Resources

About Us

Mobile Cobots Market by Payload Capacity (Below 5kg, 5-10kg, 10-20kg, Above 20kg), Component (Hardware, Software, Services), Application (Material Handling, Assembly, Pick and Place, Machine Tending), End User, and Geography – Global Forecast to 2035

Report ID: MRSE - 1041621 Pages: 210 Oct-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Mobile Cobots Market Size?

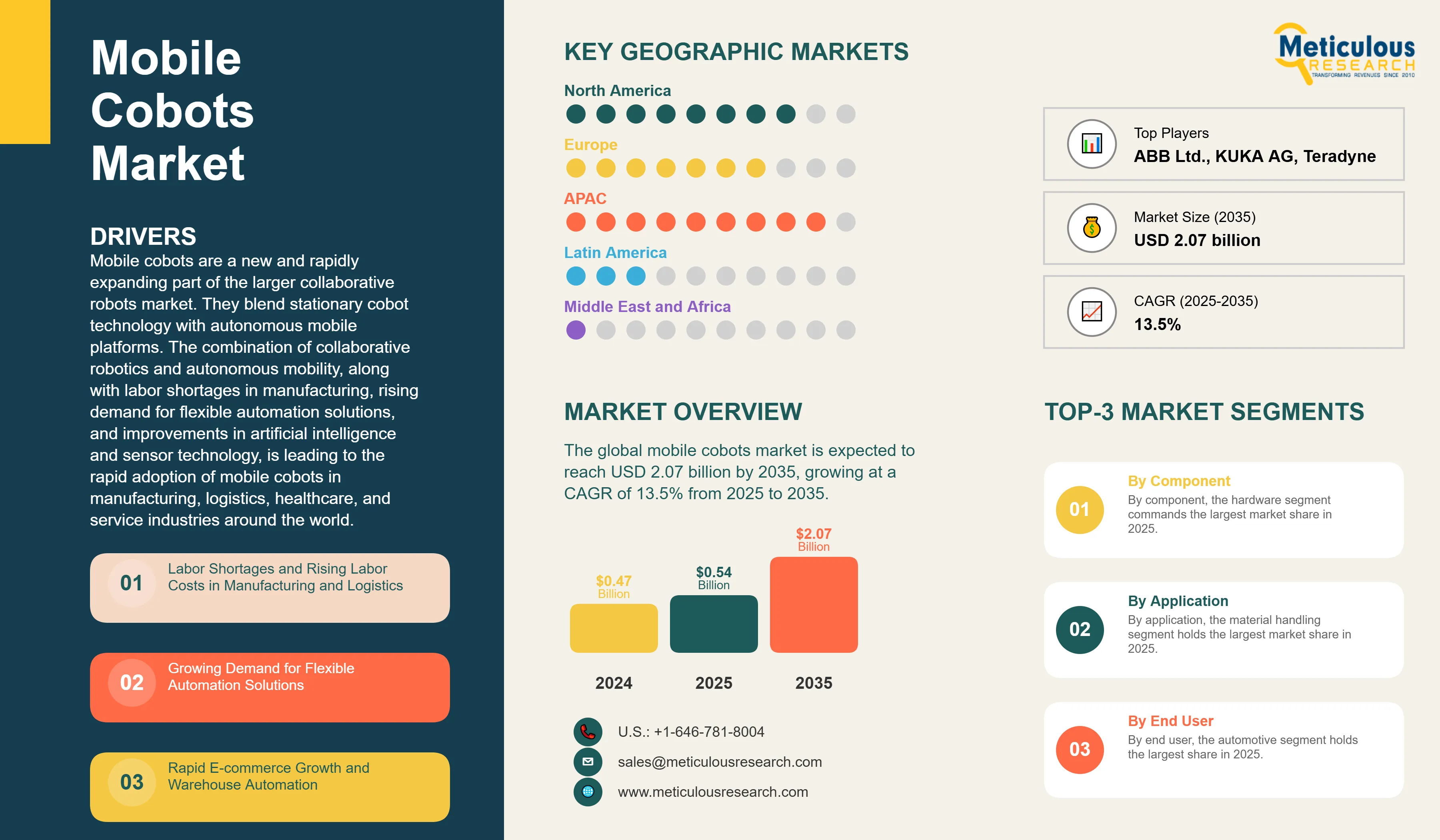

The global mobile cobots market was valued at USD 0.47 billion in 2024. This market is expected to reach USD 2.07 billion by 2035 from USD 0.54 billion in 2025, growing at a CAGR of 13.5% from 2025 to 2035. Mobile cobots are a new and rapidly expanding part of the larger collaborative robots market. They blend stationary cobot technology with autonomous mobile platforms. The combination of collaborative robotics and autonomous mobility, along with labor shortages in manufacturing, rising demand for flexible automation solutions, and improvements in artificial intelligence and sensor technology, is leading to the rapid adoption of mobile cobots in manufacturing, logistics, healthcare, and service industries around the world.

Market Highlights: Mobile Cobots

Click here to: Get Free Sample Pages of this Report

The mobile cobots market includes the design, development, manufacturing, and deployment of integrated robotic systems that combine collaborative robot arms with autonomous mobile platforms. These systems blend the safety and human-interaction capabilities of collaborative robots with the mobility and navigation intelligence of autonomous mobile robots. This creates flexible automation solutions that can move around facilities while carrying out tasks.

Mobile cobots consist of a collaborative robotic arm mounted on an autonomous mobile base. This base is equipped with sensors, navigation systems, batteries, and control electronics. The systems use technologies like LiDAR, vision systems, simultaneous localization and mapping, artificial intelligence, and machine learning for navigation and task execution.

The overall growth of the mobile cobots market is driven by the demand for flexible manufacturing systems, labor shortages in key industries, rising labor costs, the move toward mass customization and small-batch production, advancements in AI and sensor technologies, lower hardware costs, and the growing adoption of Industry 4.0 principles in manufacturing, warehousing, healthcare, retail, and hospitality sectors.

How is Artificial Intelligence Transforming the Mobile Cobots Market?

Artificial intelligence is transforming the mobile cobots market by enabling self-directed decision-making, flexible behavior, and smart task performance. These features set them apart from traditional fixed cobots and simple AMRs. AI-enabled perception systems help mobile cobots understand complex environments, recognize objects, spot obstacles, and navigate spaces that change dynamically without needing pre-made maps. Machine learning helps these systems improve their path planning, boost task efficiency over time, and handle differences in workflows and environments. Computer vision, combined with deep learning, allows for capabilities like object recognition, pose estimation, defect detection, and quality inspection without requiring extensive coding.

Natural language processing makes it easier for humans to interact with robots, using voice commands and conversational tools. AI-driven predictive maintenance looks at operational data to predict equipment failures and schedule maintenance ahead of time, reducing downtime. Reinforcement learning helps mobile cobots discover the best ways to handle tasks through practice, speeding up the process for taking on new jobs.

What are the Key Trends in the Mobile Cobots Market?

Fleet management and orchestration: A major trend in the mobile cobots market is the development of advanced fleet management and orchestration platforms that coordinate multiple mobile cobots and other automated systems within integrated workflows. Manufacturers are creating cloud-based software solutions that improve task allocation, traffic management, battery charging schedules, and resource use across fleets of mobile cobots and AMRs. These platforms use artificial intelligence to assign tasks dynamically based on system availability, location, capability, and priority. This maximizes operational efficiency. Integration with warehouse management systems, manufacturing execution systems, and enterprise resource planning systems allows seamless coordination between mobile cobots and broader facility operations. This supports the shift toward fully autonomous smart factories and warehouses. This trend is crucial for justifying the higher investment in mobile cobots compared to fixed cobots by showing better utilization rates and operational flexibility.

Modular and reconfigurable designs: Another key trend driving market growth is the shift toward modular, reconfigurable mobile cobot platforms. These allow users to customize systems for specific applications by selecting different robotic arms, grippers, sensors, and accessories. Manufacturers are developing standardized interfaces and mounting systems that make it easy to swap collaborative robot arms from different suppliers, switch out end-effectors for various tasks, and use modular sensor packages. This approach lowers the total cost of ownership by allowing a single mobile platform to handle multiple applications through reconfiguration. It eliminates the need for dedicated systems for each task. The trend supports quick redeployment as production needs change and lets users start with basic configurations, adding capabilities as requirements evolve. This makes the investment in premium mobile cobots more appealing than buying multiple fixed cobots for different locations.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 2.07 Billion |

|

Market Size in 2025 |

USD 0.54 Billion |

|

Market Size in 2024 |

USD 0.47 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 13.5% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Payload Capacity, Component, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Labor Shortages and Rising Labor Costs in Manufacturing and Logistics

A key factor driving the growth of the mobile cobots market is the severe labor shortage affecting manufacturing, warehousing, and logistics industries worldwide. This issue is worsened by rising labor costs in both developed and developing countries. The United States Bureau of Labor Statistics notes ongoing unfilled positions in manufacturing and warehousing. In Europe, Japan, and South Korea, an aging population reduces the available workforce. The COVID-19 pandemic made these issues worse by exposing weaknesses in supply chains and increasing demand for automation solutions that lessen reliance on manual labor.

Mobile cobots handle labor challenges better than fixed cobots. They automate repetitive and physically demanding tasks, such as transporting materials, tending machines, loading and unloading parts, and fulfilling orders across various locations with a single system. They can work safely alongside human workers. This technology helps manufacturers and logistics operators maintain productivity despite workforce limitations. It also allows human workers to focus on higher-value tasks that require creativity, problem-solving, and complex decision-making.

Government programs in countries like China, Germany, Singapore, and the U.S. offer grants, tax incentives, and subsidies for adopting automation. These efforts create a supportive environment for using mobile cobots as companies look for maximum flexibility in their collaborative robots.

Opportunity

E-commerce Growth and Warehouse Automation Demand

The rapid growth of e-commerce and the changes in warehousing and fulfillment operations present a significant opportunity for the mobile cobots market. Global e-commerce sales continue to grow at double-digit annual rates, leading to a strong demand for warehouse space and fulfillment capacity. The shift to omnichannel retail, expectations for same-day delivery, and wider product offerings create operational challenges that traditional manual processes and fixed automation find hard to manage efficiently.

Mobile cobots perform well in warehouse settings by flexibly handling various tasks. These include supporting goods-to-person picking, replenishing inventory, sorting products, assisting with packing, and conducting quality checks. They can move smoothly between storage areas, picking stations, and shipping zones. Unlike fixed cobots, which need several units placed in different spots, or standalone AMRs that cannot manipulate objects, mobile cobots provide better versatility and use of space.

These systems adjust easily to seasonal changes in demand, variations in product types, and new warehouse layouts without needing costly infrastructure changes. Major e-commerce companies, third-party logistics providers, and retail distribution centers are investing heavily in automation to maintain service levels while keeping labor costs in check. This creates a fast-growing market for mobile cobots specifically designed for intralogistics applications, which have a clear return on investment in these high-volume, fast-paced environments where mobility is essential.

Payload Capacity Insights

Why are 5-10kg Mobile Cobots Most Widely Adopted?

The 5-10kg payload capacity segment holds the largest share of around 35-40% of the overall mobile cobots market in 2025. This range represents the right balance between capability, cost, and versatility for most manufacturing and logistics applications that need mobile manipulation. Systems in this category can handle typical industrial parts, assemblies, small packages, and tools while keeping compact designs and reasonable energy use. They also offer good price points compared to the value they provide through mobility. This payload capacity is suitable for electronics manufacturing, automotive component handling, medical device assembly, food and beverage packaging, and light-to-medium warehouse operations. These operations often need to move parts and packages to different locations.

The payload capacity above 20kg is expected to grow at the fastest CAGR through 2035. Growth in this heavy-payload segment is fueled by increasing applications in automotive manufacturing, aerospace assembly, metal fabrication, and heavy industrial production. These areas often require handling larger parts, assemblies, and materials across multiple locations.

Component Insights

How does Hardware Dominate the Mobile Cobots Market?

The hardware segment holds the largest share of the overall mobile cobots market in 2025. This dominance comes from the high costs of the physical parts that make up mobile cobot systems, such as the robot arm, mobile base, sensors, batteries, computing hardware, and mechanical interfaces. Major robot manufacturers like ABB Ltd., Universal Robots, FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Kawasaki Heavy Industries provide robotic arms with joint torque sensors, force-limiting features, and safety controls that support safe collaboration between humans and robots. Companies that make autonomous mobile platforms, including Mobile Industrial Robots, Omron Corporation, Clearpath Robotics, and Fetch Robotics, produce mobile bases that come with LiDAR sensors, 3D cameras, IMU sensors, wheel encoders, and navigation computers.

The hardware segment benefits from ongoing tech improvements that boost performance, but the costs of components are decreasing more slowly than software. However, the software segment is expected to grow at the fastest CAGR through 2035. This growth is fueled by the increasing complexity and value of navigation systems, fleet management tools, AI-based perception algorithms, and programming tools that enhance the use and return on investment of mobile cobot hardware.

Application Insights

How does Material Handling Drive Mobile Cobot Adoption?

Based on application, the material handling segment commands the largest market share in 2025. Material handling is the most straightforward and valuable application of mobile cobots. It takes advantage of their ability to combine movement and manipulation to transport materials, components, and products within facilities. Various applications include delivering raw materials to production lines, moving work-in-process between manufacturing stations, transporting finished goods to quality inspection or packaging areas, delivering tools and fixtures, and restocking supplies at assembly workstations. This segment covers manufacturing, warehousing, healthcare, and hospitality industries, with successful deployments proving their reliability and value.

On the other hand, the quality inspection segment is projected to grow at the fastest CAGR during the forecast period. Quality inspection applications are gaining traction as mobile cobots with advanced vision systems, measurement sensors, and AI-powered defect detection algorithms offer flexible and automated quality control in production and logistics..

End User Insights

Why does the Automotive Industry Lead Mobile Cobot Adoption?

On the basis of end user, the automotive industry commands the largest share of about 25-30% of the overall mobile cobots market in 2025. This is mainly because it has complex manufacturing processes that need flexible material handling and assembly support across large production facilities. Intense competition also pushes the industry to improve efficiency constantly. Major car manufacturers, like Toyota Motor Corporation, Volkswagen Group, General Motors, Ford Motor Company, BMW Group, Hyundai Motor Group, and Stellantis, are using mobile cobots for tasks such as delivering components to assembly lines, tending machines during CNC operations, inspecting quality, and providing flexible assembly help at different workstations.

The e-commerce and logistics segment is expected to grow at the fastest CAGR through 2035. The growth of e-commerce has created a massive demand for warehouse automation solutions that offer the flexibility and scalability mobile cobots provide, especially compared to fixed automation. Leading e-commerce companies, including Amazon, Alibaba, JD.com, and major third-party logistics providers, are investing billions in automation to manage higher order volumes and faster delivery times. Mobile cobots help with several warehouse tasks, including assisting with picking goods, counting inventory, sorting products, packaging help, and processing returns in dynamic warehouse environments where fixed cobots struggle to adapt to changing layouts and workflows.

U.S. Mobile Cobots Market Size and Growth 2025 to 2035

The U.S. mobile cobots market is projected to grow at a CAGR of 14.3% from 2025 to 2035.

How is Asia Pacific Dominating the Mobile Cobots Market Globally?

Asia Pacific region holds the largest share of 35-40% of the global mobile cobots market in 2025.

China leads the global deployment of mobile cobots. The country promotes initiatives like Made in China 2025 and the 14th Five-Year Plan, which emphasize intelligent manufacturing and offer substantial subsidies for robotics adoption. Major Chinese manufacturers, such as SAIC Motor, Geely, BYD, Midea Group, and Haier, are deploying mobile cobots in automotive, electronics, and appliance production facilities where their mobility advantages justify the high investment.

Japan’s expertise in robotics technology also plays a key role. Companies like FANUC Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, and Omron Corporation are developing advanced mobile cobot solutions. Japan is both a major market and supplier of technology. The extensive adoption of collaborative robots in the country provides a strong foundation for the growth of mobile cobots as manufacturers seek more flexibility.

South Korea is focusing on smart factories. Government programs back this initiative, with major companies like Samsung, Hyundai, and LG pushing for advanced automation, including mobile cobots.

India's growing manufacturing sector benefits from the Make in India initiative. There is rising demand for flexible automation in automotive and electronics production.

Southeast Asian countries, like Thailand, Vietnam, and Indonesia, are adopting mobile cobots as manufacturing increasingly moves to these lower-cost locations. Labor shortages are emerging, and companies are seeking competitive advantages through advanced automation.

Which Factors Support the North America Mobile Cobots Market Growth?

North America is expected to witness the fastest CAGR of 14.3% from 2025 to 2035. This is mainly due to the significant labor shortages in manufacturing and logistics in this region. There is also a lot of activity in e-commerce and warehouse automation. Mobile cobots offer clear benefits over fixed alternatives. Additionally, strong venture capital and corporate investment in robotics technology are fueling this growth.

The U.S. warehouse automation market is growing rapidly as e-commerce becomes more widespread. Major retailers are investing in logistics to compete with Amazon, which creates a strong demand for flexible automation solutions. Mobile cobots can adjust to changing requirements. Efforts to bring manufacturing back to the U.S. and nearshoring trends are driven by concerns about supply chain resilience, leading to new automated production capacity across North America.

Leading technology companies such as Tesla and Apple, as well as many aerospace and defense contractors, are using mobile cobots to tackle specialized manufacturing challenges where mobility is beneficial. The region has a developed robotics ecosystem, including system integrators, application developers, and service providers that support deployment and ongoing operations. Pioneers of collaborative robots, like Rethink Robotics, and leaders in mobile robotics, such as Clearpath Robotics and Fetch Robotics, began in North America. This has fostered technology leadership and a deep understanding of mobile cobot value.

Recent Developments

Segments Covered in the Report

By Payload Capacity

By Component

By Application

By End User

By Region

The mobile cobots market is expected to grow from USD 0.54 billion in 2025 to USD 2.07 billion by 2035.

The mobile cobots market is expected to grow at a CAGR of 13.5% from 2025 to 2035.

Mobile cobots combine collaborative robot arms with autonomous mobile platforms, enabling them to move freely throughout facilities and perform manipulation tasks at multiple locations. This mobility provides significant flexibility advantages over fixed collaborative robots but comes with higher upfront costs.

The major players in the mobile cobots market include Mobile Industrial Robots A/S, Omron Corporation (Omron Mobile Robots), ABB Ltd., KUKA AG (KUKA Mobile Robotics), FANUC Corporation, Universal Robots A/S, Yaskawa Electric Corporation (Yaskawa Motoman), Kawasaki Heavy Industries Ltd., Teradyne Inc. (Universal Robots & Mobile Industrial Robots), Clearpath Robotics Inc., Fetch Robotics Inc. (Zebra Technologies), IAM Robotics LLC, Otto Motors (Rockwell Automation), inVia Robotics Inc., ForwardX Robotics, Geek+ Technology Co. Ltd., Hikrobot (Hikvision), SIASUN Robot & Automation Co. Ltd., Youibot Robotics, and Gaussian Robotics among others.

The main factors driving the mobile cobots market include acute labor shortages and rising labor costs in manufacturing and logistics industries, increasing demand for flexible automation solutions that can serve multiple locations, rapid growth of e-commerce requiring warehouse automation, technological advancements in AI and sensor systems enabling autonomous navigation and manipulation, and the need for automation solutions that provide superior utilization compared to multiple fixed collaborative robots.

Asia Pacific region will lead the global mobile cobots market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Payload Capacity

3.3. Market Analysis, By Component

3.4. Market Analysis, By Application

3.5. Market Analysis, By End User

3.6. Market Analysis, By Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Mobile Cobots Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Labor Shortages and Rising Labor Costs in Manufacturing and Logistics

4.2.2. Growing Demand for Flexible Automation Solutions

4.2.3. Rapid E-commerce Growth and Warehouse Automation

4.3. Global Mobile Cobots Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Initial Investment Compared to Fixed Cobots

4.3.2. Technical Challenges in Navigation and Manipulation Coordination

4.4. Global Mobile Cobots Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. E-commerce Growth and Warehouse Automation Demand

4.4.2. Manufacturing Reshoring and Supply Chain Localization

4.5. Global Mobile Cobots Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Standardization and Interoperability Issues

4.5.2. Safety Certification and Regulatory Compliance

4.6. Global Mobile Cobots Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Fleet Management and Orchestration

4.6.2. Modular and Reconfigurable Designs

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Industry 4.0 on the Global Mobile Cobots Market

5.1. Introduction to Industry 4.0 and Smart Manufacturing

5.2. IoT Integration and Connected Robotics

5.3. Digital Twin Technology and Simulation

5.4. Cloud Computing and Edge Processing

5.5. Big Data Analytics and Operational Intelligence

5.6. Cyber-Physical Systems Integration

5.7. Human-Robot Collaboration Evolution

5.8. Impact on Market Growth and Investment Trends

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

7. Global Mobile Cobots Market, By Payload Capacity

7.1. Introduction

7.2. Below 5kg

7.3. 5–10kg

7.4. 10–20kg

7.5. 20–50kg

7.6. Above 50kg

8. Global Mobile Cobots Market, By Component

8.1. Introduction

8.2. Hardware

8.2.1. Collaborative Robot Arm

8.2.2. Autonomous Mobile Platform

8.2.3. Sensors (LiDAR, Vision Systems, IMU, Others)

8.2.4. End-Effectors and Grippers

8.2.5. Control Systems and Electronics

8.2.6. Batteries and Power Systems

8.2.7. Others

8.3. Software

8.4. Services

9. Global Mobile Cobots Market, By Application

9.1. Introduction

9.2. Material Handling

9.3. Assembly

9.4. Pick and Place

9.5. Machine Tending

9.6. Quality Inspection

9.7. Welding and Joining

9.8. Packaging and Palletizing

9.9. Other Applications

10. Global Mobile Cobots Market, By End User

10.1. Introduction

10.2. Automotive

10.3. Electronics and Semiconductors

10.4. E-commerce and Logistics

10.5. Food and Beverage

10.6. Pharmaceuticals and Healthcare

10.7. Aerospace and Defense

10.8. Metal and Machinery

10.9. Plastics and Rubber

10.10. Consumer Goods

10.11. Retail

10.12. Others

11. Mobile Cobots Market, By Geography

11.1. Introduction

11.2. Asia-Pacific

11.2.1. China

11.2.2. Japan

11.2.3. South Korea

11.2.4. India

11.2.5. Taiwan

11.2.6. Southeast Asia

11.2.7. Rest of Asia-Pacific

11.3. North America

11.3.1. U.S.

11.3.2. Canada

11.4. Europe

11.4.1. Germany

11.4.2. France

11.4.3. U.K.

11.4.4. Italy

11.4.5. Spain

11.4.6. Nordics

11.4.7. Rest of Europe

11.5. Latin America

11.5.1. Brazil

11.5.2. Argentina

11.5.3. Mexico

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. UAE

11.6.2. Saudi Arabia

11.6.3. South Africa

11.6.4. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

12.1. Mobile Industrial Robots A/S

12.2. Omron Corporation

12.3. ABB Ltd.

12.4. KUKA AG

12.5. FANUC Corporation

12.6. Universal Robots A/S

12.7. Yaskawa Electric Corporation

12.8. Kawasaki Heavy Industries Ltd.

12.9. Teradyne Inc.

12.10. Clearpath Robotics Inc.

12.11. Fetch Robotics Inc. (Zebra Technologies)

12.12. IAM Robotics LLC

12.13. Otto Motors (Rockwell Automation)

12.14. inVia Robotics Inc.

12.15. ForwardX Robotics

12.16. Geek+ Technology Co. Ltd.

12.17. Hikrobot (Hikvision)

12.18. SIASUN Robot & Automation Co. Ltd.

12.19. Youibot Robotics

12.20. Gaussian Robotics

12.21. Others

13. Appendix

13.1. Questionnaire

13.2. Available Customization

Published Date: Jan-2026

Published Date: Nov-2024

Published Date: Jul-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates