Resources

About Us

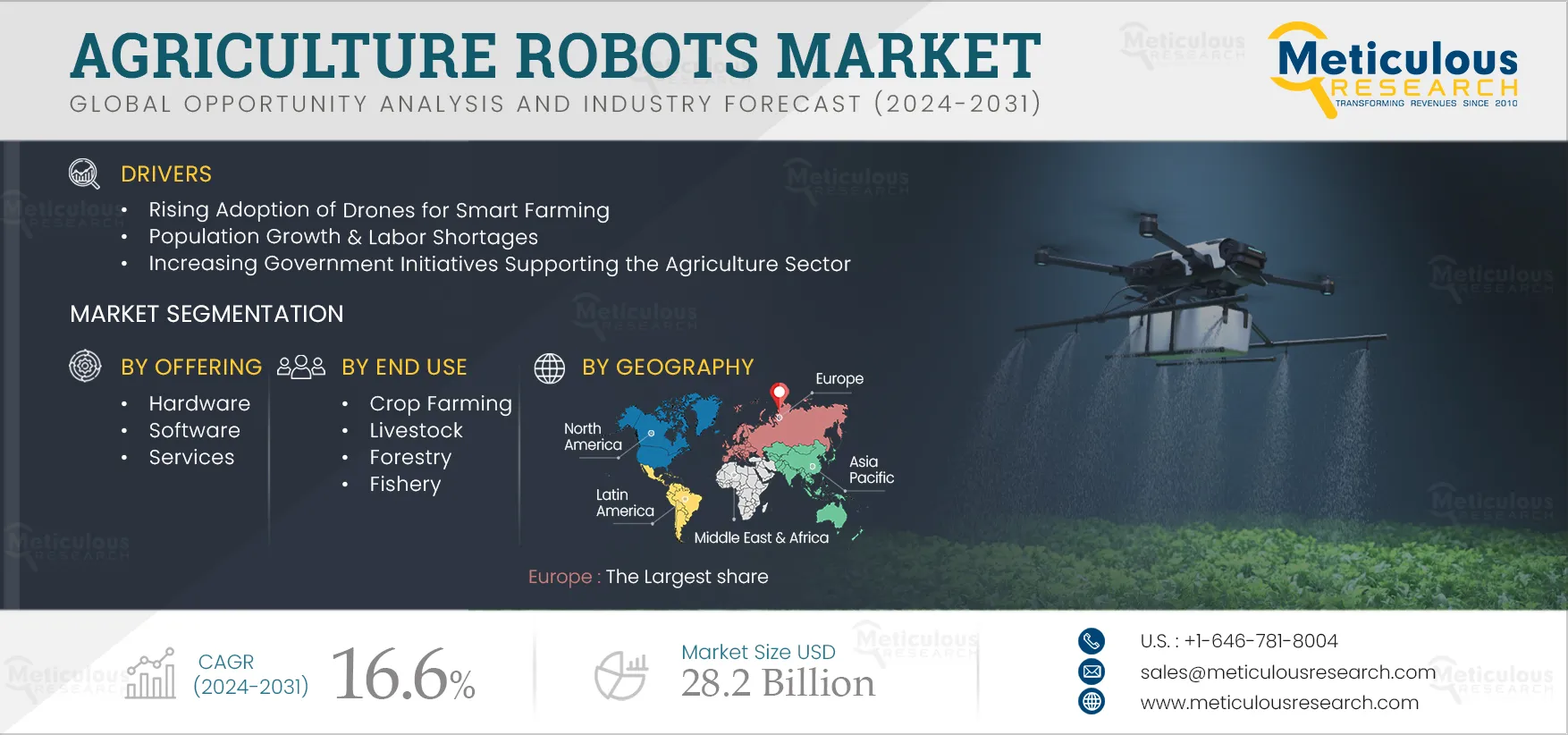

Agriculture Robots Market by Offering (Hardware, Software), Deployment (Indoor, Outdoor), Automation Type (Automated, Semi-automated), and End Use (Crop Farming, Livestock, Forestry, Fishery), and Geography - Global Forecast to 2031

Report ID: MRSE - 104933 Pages: 335 Jul-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market is attributed to the rising adoption of drones for smart farming, population growth & labor shortages, and increasing government initiatives supporting the agriculture sector. Moreover, the increasing integration of artificial intelligence into agricultural robots is expected to offer growth opportunities for the players operating in this market.

According to data published by the United Nations, by 2050, the world population is expected to reach 9.8 billion, with the world population increasing roughly by 83 million every year. Global production of food, feed, and fiber will need to increase by 70% by 2050 to meet the demands of this growing population. The demand for food is expected to increase by 59–98% by 2050.

The agriculture sector is facing labor shortages. According to the U.K. Parliament, labor shortages are affecting the food and farming sectors, as farmers are unable to hire seasonal workers for food harvesting and other applications. Thus, the rising population is driving the demand for improved food products, and labor shortages are encouraging farmers to adopt agricultural robots to increase crop production and profitability. These factors are expected to support market growth in the coming years.

Click here to: Get Free Sample Pages of this Report

Government bodies in developing countries have started creating awareness programs, reforming policies, and forming tie-ups with the private sector to encourage the adoption of robotic solutions and promote smart farming. For instance, in December 2022, the Department for Environment, Food & Rural Affairs (U.K.) partnered with UK Research and Innovation (UKRI) to provide USD 13.2 million (EUR 12.5 million) for funding agriculture and horticulture automation and robotics to boost productivity, reduce labor demand, and create more sustainable farming practices. Also, in August 2022, India’s Ministry of Agriculture & Farmers’ Welfare announced various initiatives, including the National e-Governance Plan in Agriculture (NeGP-A), wherein funds are being provided to facilitate the use of modern technologies such as Artificial Intelligence (AI), Machine Learning (ML), robotics, drones, data analytics, and blockchain to encourage digital agriculture in the country. Such government initiatives are driving the adoption of agricultural robots among farmers, Boosting the growth of this market.

Adopting agriculture robots benefits farmers through higher efficiency, profitability and productivity and reduced labor requirements. However, incorporating comprehensive solutions is often not feasible for most farmers across the globe due to various reasons, with high costs and lack of knowledge holding most of the weightage. These factors have restricted the growth of the agriculture robots market considerably. However, agro-tech companies and agricultural robot manufacturers have started providing robots-as-a-service solutions for agricultural processes to help farmers tackle such issues.

Leading industry players have started providing end-to-end solutions for farm owners and land managers, along with analytical help and precise guidance regarding various agricultural processes, helping farmers focus on operations rather than system technicalities.

Furthermore, robots-as-a-service solutions help farmers reduce capital and operational expenditures and reap the benefits of robotics technology at only a fraction of the cost. This market trend is gaining momentum in the U.S. and other Western countries. However, the trend is not as prominent in developing economies. Companies struggle to propagate this trend in cost-driven economies, particularly in Asia-Pacific. The trend is expected to grow globally over the next few years.

With the consistently increasing adoption of agricultural robots, agro-tech companies are now integrating disruptive technologies, such as artificial intelligence, into their offerings. Industry experts believe that pairing AI with robots can pave the way for sustainable agricultural processes and mitigate the ill effects of agriculture on the environment. Some of the most common agricultural applications of AI-enabled robots are precision farming, drone operations, livestock management, and pesticide application. Companies are exploring new solutions to make AI integration more sustainable and cost-effective for farmers and the environment, creating market growth opportunities.

Based on offering, the agriculture robots market is segmented into hardware, software, and services. In 2024, the hardware segment is expected to account for the largest share of above 88% of the agriculture robots market. The large market share of this segment is attributed to the increasing adoption of livestock management robots, rapid automation of agricultural processes, growing population, and shortage of labor. Several organizations are focusing on providing robot hardware to overcome the labor shortage issue across the globe. For instance, in February 2023, MetoMotion (Israel) launched an AI robot for picking tomatoes to help farmers solve the labor shortage problem of fruit and vegetable pickers. Moreover, this segment is also projected to register the highest CAGR during the period.

Based on deployment, the agriculture robots market is segmented into indoor and outdoor. In 2024, the outdoor segment is expected to account for the larger share of above 89% of the agriculture robots market. The large market share of this segment is attributed to the growing population, shortage of labor, and increasing need to monitor weather and climatic changes for outdoor farming. Organizations provide agriculture robots and software for mapping, navigation, and monitoring crops. For instance, in October 2022, Clearpath Robotics Inc. (Canada) launched OutdoorNav Navigation Software, an autonomous navigation software platform, to provide GPS-based navigation and mapping purposes in outdoor farming. Moreover, this segment is also projected to register the highest CAGR during the period.

Based on automation type, the agriculture robots market is segmented into automated and semi-automated. In 2024, the automated segment is expected to account for the larger share of above 81% of the agriculture robots market. The large market share of this segment is attributed to the integration of a variety of technologies in robots, such as digitalization, automation, and artificial intelligence, which plays a major role in crop production, livestock management, fishery, and forestry applications. Several organizations are focusing on providing fully automated robots for agricultural applications. For instance, in February 2022, Naio Technologies (France) launched Orio, an autonomous agriculture robot designed for large vegetable production, high-precision seeding & fertilizing, and monitoring the crops. Moreover, this segment is also projected to register the highest CAGR during the period.

Based on end use, the agriculture robots market is segmented into crop farming, livestock, forestry, and fishery. In 2024, the crop farming segment is expected to account for the largest share of above 56% of the agriculture robots market. The large market share of this segment is attributed to the rising labor cost, increasing population growth, and increasing need to improve the quality and productivity of yield. Several companies have started focusing on new strategic developments in autonomous platforms to offer new features to automate farming processes. For instance, in June 2022, AGCO Corporation (U.S.) partnered with Apex.AI, Inc. (U.S.) to add new capabilities to its autonomous farming robot, “Fendt Xaver,” by incorporating the Apex.OS software development kit to implement safety-critical applications to detect objects and prevent collision during the agricultural process.

However, the livestock segment is projected to register the highest CAGR during the period. The growth of this segment is driven by the increasing need for livestock monitoring and disease detection, labor shortage, and the rising cattle population with increasing dairy farms. In December 2022, DeLaval (Sweden) launched OptiDuo, a feed-pushing robot to constantly refresh the feed to provide stable rumen and produce more milk.

In 2024, Europe is expected to account for the largest share of above 34% of the agriculture robots market. The market growth in Europe is driven by innovation in the European agri-tech industry, rising pressure on the food supply chain, rising adoption of precision farming, and government initiatives in the region to increase the implementation of advanced technology in agriculture. Government and agriculture stakeholders in this region are showing interest in enhancing the business structure of the agriculture sector by investing heavily in the implementation of robotics and automation in the European agriculture sector. For instance, in January 2021, the European Union offered USD 9.3 million (EUR 7.9 million) funding for the Robs4Crops project to accelerate the shift toward the large-scale implementation of robotics and automation in European farming. This project started in January 2021 and will run for four years.

However, Asia-Pacific is projected to record the highest CAGR of above 18.8% during the forecast period. The region’s growth is attributed to the increasing adoption of smart devices for agriculture, rising demand for enhanced food quality, growing adoption of precision farming & government initiatives, and the growing number of start-ups in the region. Countries like China, India, and Japan have adopted agriculture robots to automate agricultural processes, transforming agriculture earnings with increased profitability.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the agriculture robots market are Yanmar Holdings Co., Ltd. (Japan), AgEagle Aerial Systems Inc. (U.S.), Lely International N.V. (Netherlands), BouMatic (U.S.), DJI (China), Deere & Company (U.S.), XAG Co., Ltd. (China), Clearpath Robotics Inc. (Canada), Naio Technologies (France), Robotics Plus Limited (New Zealand), GEA Group Aktiengesellschaft (Germany), DeLaval (Sweden), and Small Robot Company (U.K.).

|

Particulars |

Details |

|

Number of Pages |

335 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

16.6% |

|

Market Size (Value) |

USD 28.2 Billion by 2031 |

|

CAGR (Volume) |

8.6% |

|

Market Size (Volume) |

30,41,634 thousand units by 2031 |

|

Segments Covered |

By Offering

By Deployment

By Automation Type

By End Use

|

|

Countries Covered |

Europe (Germany, Netherlands, U.K., Russia, France, Italy, Spain, Sweden, Rest of Europe), Asia-Pacific (China, Japan, India, Australia & New Zealand, Indonesia, Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (Saudi Arabia, Israel, South Africa, Rest of the Middle East & Africa) |

|

Key Companies |

Yanmar Holdings Co., Ltd. (Japan), AgEagle Aerial Systems Inc. (U.S.), Lely International N.V. (Netherlands), BouMatic (U.S.), DJI (China), Deere & Company (U.S.), XAG Co., Ltd. (China), Clearpath Robotics Inc. (Canada), Naio Technologies (France), Robotics Plus Limited (New Zealand), GEA Group Aktiengesellschaft (Germany), DeLaval (Sweden), and Small Robot Company (U.K.) |

The agriculture robots market study focuses on market assessment and opportunity analysis through the sales of agriculture robots across different regions and countries across different market segmentations. This study is also focused on competitive analysis for agriculture robots based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The agriculture robots market is projected to reach $28.2 billion by 2031, at a CAGR of 16.6% during the forecast period

In 2024, the hardware segment is expected to account for the largest share of above 88% of the agriculture robots market.

Based on end use, the livestock segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the rising adoption of drones for smart farming, population growth & labor shortages, and increasing government initiatives supporting the agriculture sector. Moreover, the increasing integration of artificial intelligence into agricultural robots is expected to offer growth opportunities for the players operating in this market.

The key players operating in the agriculture robots market are Yanmar Holdings Co., Ltd. (Japan), AgEagle Aerial Systems Inc. (U.S.), Lely International N.V. (Netherlands), BouMatic (U.S.), DJI (China), Deere & Company (U.S.), XAG Co., Ltd. (China), Clearpath Robotics Inc. (Canada), Naio Technologies (France), Robotics Plus Limited (New Zealand), GEA Group Aktiengesellschaft (Germany), DeLaval (Sweden), and Small Robot Company (U.K.).

Asia-Pacific is projected to register the highest CAGR of above 18.8% during the forecast period.

Published Date: May-2025

Published Date: Nov-2024

Published Date: May-2024

Published Date: Jan-2025

Published Date: May-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates