Resources

About Us

Industrial Evaporator & Crystallizer Market by Type (Evaporators, Crystallizers), Technology (MVR, TVR, MEE), Application (Chemicals, Food & Beverage, Pharma, Energy & Utilities, Mining) – Global Forecast to 2036

Report ID: MRSE - 1041677 Pages: 205 Jan-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Industrial Evaporator & Crystallizer Market Size?

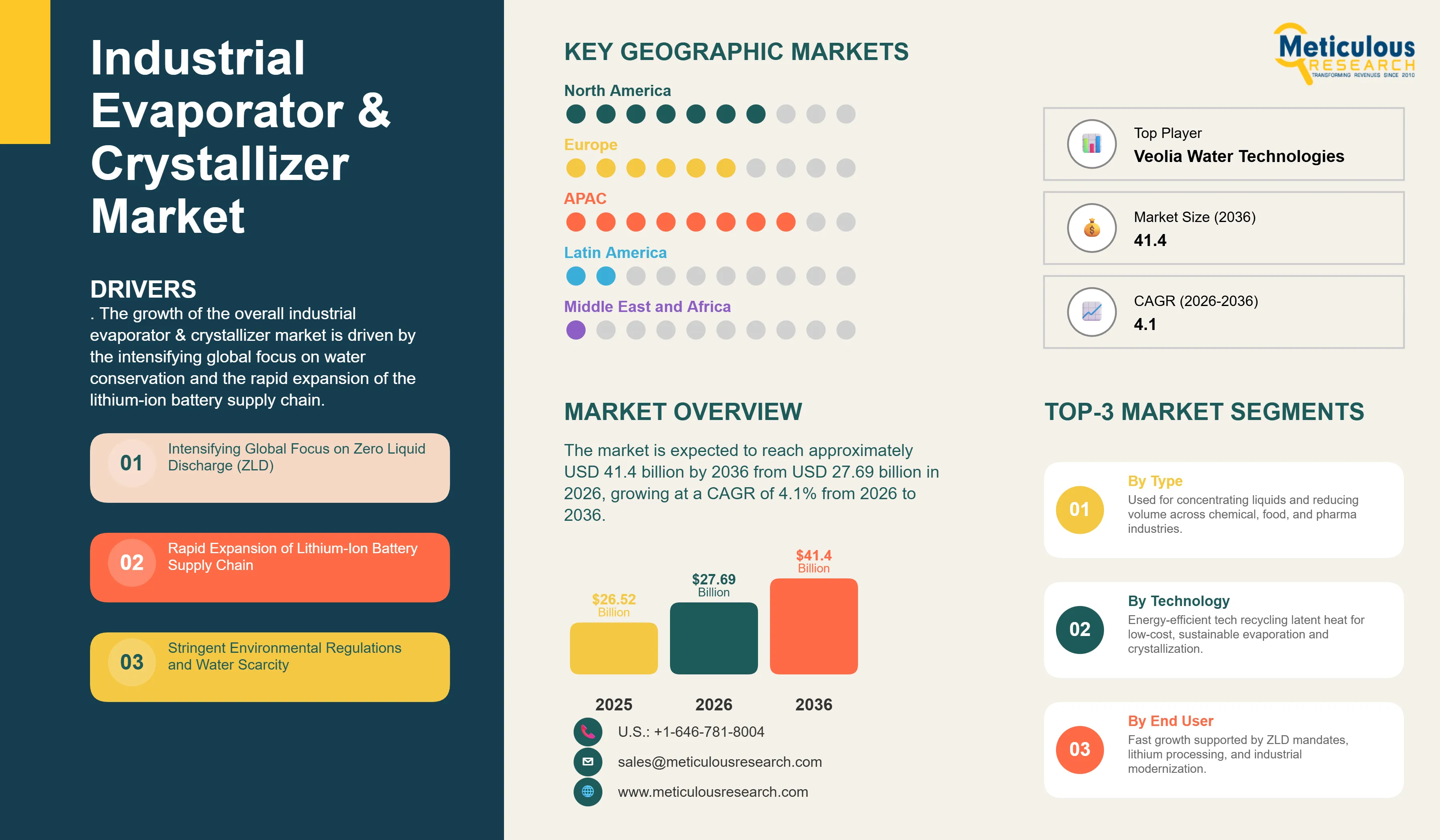

The global industrial evaporator & crystallizer market was valued at USD 26.52 billion in 2025. The market is expected to reach approximately USD 41.4 billion by 2036 from USD 27.69 billion in 2026, growing at a CAGR of 4.1% from 2026 to 2036. The growth of the overall industrial evaporator & crystallizer market is driven by the intensifying global focus on water conservation and the rapid expansion of the lithium-ion battery supply chain. As industries seek to achieve Zero Liquid Discharge (ZLD) and recover valuable resources from wastewater streams, evaporation and crystallization technologies have become essential for industrial liquid waste management and chemical processing. The rapid expansion of the pharmaceutical and food & beverage sectors, coupled with the increasing need for high-purity chemical production and sustainable desalination solutions, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Industrial evaporators and crystallizers are critical process engineering systems used to separate liquids from solids through thermal energy. Evaporators focus on concentrating solutions by boiling off solvents, while crystallizers are designed to precipitate solid crystals from a saturated solution. The market is defined by high-efficiency technologies such as Mechanical Vapor Recompression (MVR) and Thermal Vapor Recompression (TVR), which significantly reduce energy consumption by recycling latent heat. These systems are indispensable for industries seeking to optimize their total cost of ownership (TCO) and meet corporate sustainability targets.

The market includes a diverse range of configurations, ranging from compact skid-mounted units for small-scale pharmaceutical production to massive multi-effect installations for utility-grade wastewater treatment and lithium extraction. These systems are increasingly integrated with advanced automation and digital monitoring platforms to provide services such as real-time concentration control and predictive maintenance. The ability to provide stable, high-purity product recovery while minimizing waste has made advanced evaporators and crystallizers the technology of choice for industries where resource efficiency and environmental compliance are paramount.

The global industrial sector is pushing hard to modernize aging infrastructure, aiming to meet net-zero emission and water-neutral targets. This drive has increased the adoption of ZLD systems, with advanced MVR evaporators helping to stabilize plant water consumption. At the same time, the rapid growth in the lithium processing and battery recycling markets is increasing the need for high-precision crystallization.

What are the Key Trends in the Industrial Evaporator & Crystallizer Market?

Proliferation of MVR Technology and Energy-Efficient Designs

Manufacturers across industries are rapidly shifting to Mechanical Vapor Recompression (MVR) technology, moving well beyond old-school multi-effect steam systems toward smarter electrical vapor compression setups. GEA's latest MVR evaporators deliver up to 90% energy savings over conventional designs, while Alfa Laval's recent European dairy installations slashed steam use by 85% in zero-liquid discharge operations. The real game-changer comes with "smart" MVR systems featuring dynamic load balancing like SPX Flow's adaptive compressors that maintain peak efficiency even when feed rates or concentrations fluctuate wildly. These advancements make high-efficiency evaporation practical and cost-effective for everyone from food processors to chemical plants chasing energy savings and lower carbon footprints.

Innovation in Lithium Extraction and Battery-Grade Crystallization

Innovation in lithium extraction and battery-grade crystallization is rapidly driving the industrial evaporator and crystallizer market, as the electric vehicle and energy storage sectors scale up. Equipment suppliers are now designing crystallization trains specifically for high-purity lithium carbonate and lithium hydroxide, with tight control over crystal size distribution, impurities, and moisture content to meet stringent battery-grade specifications. This often involves advanced Draft Tube Baffle (DTB) and Forced Circulation (FC) crystallizers capable of handling highly scaling brines and complex chemistries without excessive fouling or downtime.

At the same time, growing focus on circular economy principles is pushing manufacturers to develop evaporation and crystallization solutions tailored to lithium-ion battery recycling. These systems help recover lithium, nickel, cobalt, and other dissolved salts from leach solutions, concentrating and crystallizing them into reusable intermediates instead of waste. By combining high-efficiency evaporation with precisely controlled crystallization stages, these new designs support both primary lithium production and closed-loop recycling, strengthening the sustainability and resource security of the broader battery value chain.

The global industrial evaporator & crystallizer market was valued at USD 26.52 billion in 2025. The market is expected to reach approximately USD 41.4 billion by 2036 from USD 27.69 billion in 2026, growing at a CAGR of 4.1% from 2026 to 2036.

|

Parameters |

Details |

|

Market Size by 2036 |

USD 41.4 Billion |

|

Market Size in 2026 |

USD 27.69 Billion |

|

Market Size in 2025 |

USD 26.52 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 4.1% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Technology, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Zero Liquid Discharge (ZLD) Mandates and Water Scarcity

A key driver of the industrial evaporator & crystallizer market is the rapid movement of the global industry toward Zero Liquid Discharge (ZLD) and water stewardship. Global regulations requiring the elimination of industrial liquid waste have created significant incentives for the adoption of evaporation and crystallization technologies. The Clean Water Act in the U.S., the EU Water Framework Directive, and China’s "Action Plan for Prevention and Control of Water Pollution" drive manufacturers toward scalable solutions that ZLD systems can uniquely provide. It is estimated that as water prices rise and discharge permits become more restrictive through 2036, the need for onsite water recovery increases significantly; therefore, evaporators and crystallizers, with their ability to recover up to 95-99% of process water, are considered a crucial enabler of modern industrial strategies.

Opportunity: Decarbonization of Chemical Processing and Resource Recovery

The rapid growth of sustainable chemical processing and resource recovery provides great opportunities for the industrial evaporator & crystallizer market. Indeed, the global surge in circular economy initiatives has created a compelling demand for systems that can recover valuable byproducts from waste streams. These applications require high reliability, long operational life, and the ability to handle corrosive or fouling-prone fluids, all attributes that are met with advanced evaporators and crystallizers. The resource recovery market is set to expand significantly through 2036, with crystallization poised for an expanding share as operators seek to monetize waste streams. Furthermore, the increasing demand for high-purity ingredients in the food and pharma sectors is stimulating demand for modular, hygienic evaporator systems that provide energy independence and resilience.

Type Insights

Why Do Evaporators Dominate the Market?

The evaporators segment accounts for around 70-75% of the overall industrial evaporator & crystallizer market in 2026. This is mainly attributed to the primary use of this technology in volume reduction and concentration across a wide range of industries. These systems offer the most efficient way to manage bulk liquid shifts and provide concentrated products. The chemical and food sectors alone consume the vast majority of evaporator production, with major projects in Asia Pacific and North America demonstrating the technology's capability to handle high-volume processing.

However, the crystallizers segment is expected to grow at the fastest CAGR during the forecast period, driven by the growing utility-scale projects in lithium extraction, pharmaceutical purification, and ZLD solid recovery. The ability to produce high-value solid products from concentrated brines makes crystallizers highly attractive for modern industrial users.

Technology Insights

How Does MVR Technology Lead the Market?

Based on technology, the Mechanical Vapor Recompression (MVR) segment holds the largest share of the overall market in 2026, accounting for around 55-60% of the overall market. From large-scale wastewater treatment to high-efficiency chemical concentration, the use of MVR technology is central to modernizing industrial infrastructure. Current large-scale projects are increasingly specifying MVR for its superior energy efficiency and lower operational costs compared to traditional multi-effect evaporation (MEE).

The Thermal Vapor Recompression (TVR) and Multi-Effect Evaporation (MEE) segments continue to find critical applications in industries where low-cost steam is readily available or where specific process requirements favor traditional thermal designs. However, the shift toward electrification and decarbonization is pushing the requirement for standardized MVR systems that allow businesses to scale their processing capacity while minimizing their carbon footprint.

Regional Insights

How is Asia Pacific Maintaining Dominance in the Global Industrial Evaporator & Crystallizer Market?

Asia Pacific holds the largest share of the global industrial evaporator & crystallizer market in 2026. The largest share of this region is primarily attributed to the massive industrialization and the presence of the world's largest chemical and pharmaceutical manufacturing hubs, particularly in China and India. China alone accounts for more than 40% of global evaporator consumption, with its position as a leading hub for electronics and automotive manufacturing driving sustained growth. The presence of leading manufacturers and a well-developed industrial supply chain provides a robust market for both standard and high-efficiency evaporation solutions.

Which Factors Support North America and Europe Market Growth?

North America and Europe together account for around 35 to 40% of the global industrial evaporator & crystallizer market. The growth of these markets is mainly driven by the need for energy-efficient modernization and the implementation of stringent environmental mandates. The demand for ZLD systems in North America is mainly due to its large-scale industrial automation projects and the presence of innovators like Veolia Water Technologies and SPX FLOW.

In Europe, the leadership in sustainable industrial policies and the push for water neutrality are driving the adoption of high-efficiency evaporators. Countries like Germany, France, and the UK are at the forefront, with significant focus on integrating smart evaporators into digital factory environments.

The companies such as GEA Group, Veolia Water Technologies, SPX FLOW (Anhydro), and Sulzer Ltd lead the global industrial evaporator & crystallizer market with a comprehensive range of evaporation and crystallization solutions, particularly for large-scale industrial and ZLD applications. Meanwhile, players including ANDRITZ Group, Alfa Laval, Sumitomo Heavy Industries, and Suez Water Technologies focus on specialized falling film, forced circulation, and plate systems targeting the chemical, food, and pharmaceutical sectors. Emerging manufacturers and integrated players such as Zhejiang VNOR, Swenson Technology, and Ebner GmbH are strengthening the market through innovations in MVR technology and smart monitoring systems.

The industrial evaporator & crystallizer market is expected to grow from USD 27.69 billion in 2026 to USD 41.4 billion by 2036.

The industrial evaporator & crystallizer market is expected to grow at a CAGR of 4.1% from 2026 to 2036.

The major players include GEA Group, Veolia Water Technologies, SPX FLOW, Sulzer Ltd, and ANDRITZ Group, among others.

The main factors include Zero Liquid Discharge (ZLD) mandates, water scarcity, and the rapid expansion of the lithium-ion battery supply chain.

Asia Pacific will lead the global industrial evaporator & crystallizer market in terms of market share, while North America is expected to witness the fastest growth during the forecast period 2026 to 2036.

Published Date: Jan-2026

Published Date: Nov-2024

Published Date: Jan-2023

Published Date: Apr-2022

Published Date: Jul-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates