Resources

About Us

Space Domain Awareness (SDA) Sensors & Software Market: Size, Share, & Forecast by Sensor Type (Ground-Based Radar, Space-Based Optical), Data Fusion, and Threat Detection Capabilities: 2025-2035

Report ID: MRSE - 1041678 Pages: 200 Jan-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Space Domain Awareness (SDA) Sensors & Software Market Size?

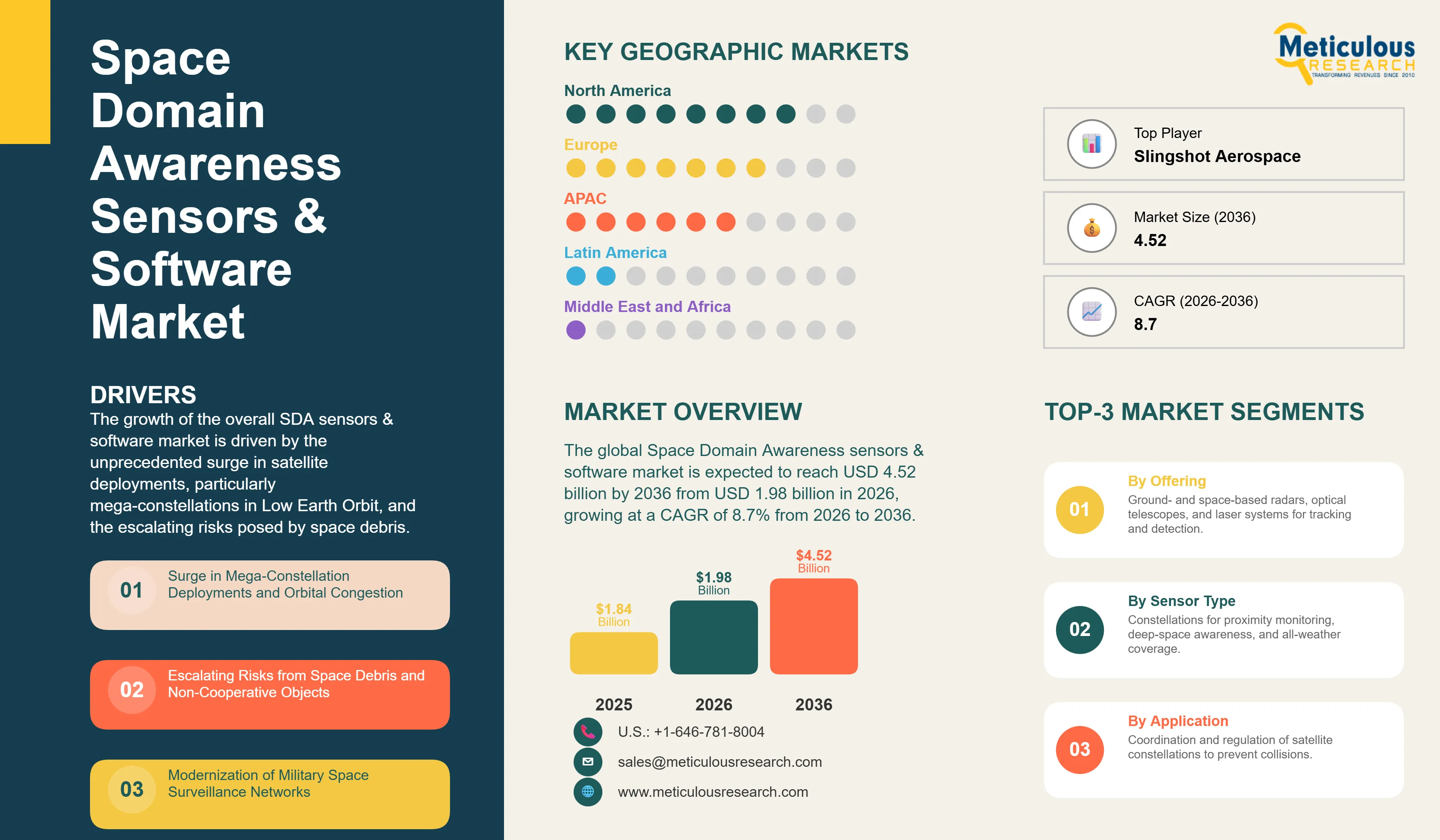

The global Space Domain Awareness (SDA) sensors & software market was valued at USD 1.84 billion in 2025. The market is expected to reach approximately USD 4.52 billion by 2036 from USD 1.98 billion in 2026, growing at a CAGR of 8.7% from 2026 to 2036. The growth of the overall SDA sensors & software market is driven by the unprecedented surge in satellite deployments, particularly mega-constellations in Low Earth Orbit (LEO), and the escalating risks posed by space debris. As space becomes increasingly congested and contested, the need for high-fidelity tracking, characterization, and predictive analytics has become essential for ensuring the safety and sustainability of orbital assets. The rapid expansion of commercial space traffic management (STM) services, coupled with the modernization of military space surveillance networks and the emergence of space-based sensing constellations, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Space Domain Awareness (SDA) sensors and software are critical systems used to detect, track, and characterize objects in Earth’s orbit. While traditional Space Situational Awareness (SSA) focused on cataloging objects, SDA emphasizes understanding the “intent” and “status” of objects, particularly in a contested environment. The market is defined by high-precision technologies such as Active Electronically Scanned Array (AESA) radars, electro-optical telescopes, and space-based optical sensors, which provide the raw data necessary for orbital intelligence. These systems are indispensable for satellite operators and defense agencies seeking to optimize mission safety and maintain strategic superiority in the space domain.

The market includes a diverse range of configurations, ranging from globally distributed ground-based radar networks for LEO monitoring to sophisticated space-based constellations designed for “all-regime” awareness from LEO to Cislunar space. These systems are increasingly integrated with advanced AI and machine learning platforms to provide services such as real-time maneuver detection, automated conjunction assessment, and predictive threat analysis. The ability to provide stable, high-fidelity data while minimizing latency has made advanced SDA sensors and software the technology of choice for an industry where orbital safety and national security are paramount.

The global space sector is pushing hard to modernize aging surveillance infrastructure, aiming to meet the challenges of a “New Space” era characterized by thousands of active satellites. This drive has increased the adoption of commercial SDA data, with advanced radar networks helping to stabilize the tracking of small debris. At the same time, the rapid growth in military space operations is increasing the need for high-precision battle management software.

What are the Key Trends in the Space Domain Awareness (SDA) Sensors & Software Market?

Proliferation of Commercial Radar Networks and Software-Defined Sensing

Manufacturers and service providers are rapidly shifting toward commercial radar networks, moving beyond government-owned legacy systems toward smarter, software-defined sensing architectures. LeoLabs’ latest modular radar sites deliver unprecedented revisit rates for LEO objects, while Slingshot Aerospace’s recent global expansions have integrated diverse sensor data into unified orbital intelligence platforms. The real game-changer comes with “smart” scheduling systems featuring AI-optimized beam management, like LeoLabs’ dynamic priority models that maintain peak tracking accuracy even as the number of active satellites fluctuates wildly. These advancements make high-fidelity SDA practical and cost-effective for everyone from commercial constellation operators to national space agencies chasing orbital safety and lower operational footprints.

Innovation in Space-Based Sensing and AI-Driven Analytics

Innovation in space-based sensing and AI-driven analytics is rapidly driving the SDA market, as the need for “all-weather” and “all-regime” coverage scales up. Equipment suppliers are now designing space-based optical constellations specifically for high-resolution proximity monitoring and threat characterization, with tight control over data fusion and latency to meet stringent operational specifications. This often involves advanced on-orbit processing and edge computing capable of handling massive data volumes without excessive downlink bottlenecks.

At the same time, growing focus on space sustainability is pushing manufacturers to develop SDA solutions tailored to debris mitigation and active debris removal (ADR) missions. These systems help identify and track non-cooperative objects, providing the precise orbital state vectors needed for rendezvous and proximity operations (RPO). By combining high-sensitivity sensors with precisely controlled analytical stages, these new designs support both commercial space traffic management and national security missions, strengthening the resilience and resource security of the broader space value chain.

The global SDA sensors & software market was valued at USD 1.84 billion in 2025. The market is expected to reach approximately USD 4.62 billion by 2036 from USD 2.01 billion in 2026, growing at a CAGR of 8.7% from 2026 to 2036.

|

Parameters |

Details |

|

Market Size by 2036 |

USD 4.52 Billion |

|

Market Size in 2026 |

USD 1.98 Billion |

|

Market Size in 2025 |

USD 1.84 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 8.7% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Offering, Sensor Type, Orbit, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Mega-Constellation Deployments and Orbital Congestion

A key driver of the SDA sensors & software market is the rapid movement of the global space industry toward mega-constellations and intensified orbital activity. Global initiatives to provide worldwide broadband and Earth observation have created significant incentives for the adoption of advanced SDA technologies. The expansion of SpaceX’s Starlink, Amazon’s Project Kuiper, and China’s Guowang constellation drive operators toward scalable solutions that commercial SDA networks can uniquely provide. It is estimated that as the number of active satellites rises through 2036, the need for automated collision avoidance increases significantly; therefore, SDA sensors and software, with their ability to provide high-precision tracking and maneuver detection, are considered a crucial enabler of modern space strategies.

Opportunity: Commercial Space Traffic Management (STM) and Cislunar Awareness

The rapid growth of commercial space traffic management and the expansion of activities into Cislunar space provide great opportunities for the SDA sensors & software market. Indeed, the global surge in lunar exploration and deep-space missions has created a compelling demand for systems that can monitor activity beyond traditional GEO orbits. These applications require high sensitivity, long-range detection, and the ability to handle complex orbital dynamics, all attributes that are met with advanced SDA sensors and software. The Cislunar SDA market is set to expand significantly through 2036, with space-based sensing poised for an expanding share as operators seek to secure lunar supply chains. Furthermore, the increasing demand for “SDA-as-a-Service” is stimulating demand for modular, cloud-based software systems that provide data independence and resilience.

Offering Insights

Why Do Sensors (Hardware) Dominate the Market?

The sensors (hardware) segment accounts for around 65-70% of the overall SDA sensors & software market in 2026. This is mainly attributed to the primary use of this technology in data collection and object detection across a wide range of orbital regimes. These systems offer the foundational capability to generate the raw observations needed for any SDA mission. The defense and commercial sectors alone consume the vast majority of sensor production, with major projects in North America and Europe demonstrating the technology’s capability to handle high-volume tracking.

However, the software & services segment is expected to grow at the fastest CAGR during the forecast period, driven by the growing utility-scale projects in automated collision avoidance, AI-driven threat characterization, and battle management. The ability to derive actionable intelligence from massive sensor datasets makes software highly attractive for modern space users.

Sensor Type Insights

How Do Ground-Based Sensors Lead the Market?

Based on sensor type, the ground-based sensors segment holds the largest share of the overall market in 2026, accounting for around 70-75% of the overall market. From large-scale phased array radars to globally distributed optical telescope networks, the use of ground-based technology is central to maintaining the global space object catalog. Current large-scale projects are increasingly specifying advanced AESA radars for their superior tracking capacity and all-weather operational capability compared to traditional mechanical radars.

The space-based sensors segment continues to find critical applications in missions where ground-based visibility is limited or where high-resolution proximity monitoring is required. However, the shift toward persistent, “always-on” awareness is pushing the requirement for space-based constellations that allow operators to maintain custody of high-interest objects regardless of terrestrial weather or geographic constraints.

Regional Insights

How is North America Maintaining Dominance in the Global SDA Sensors & Software Market?

North America holds the largest share of the global SDA sensors & software market in 2026. The largest share of this region is primarily attributed to the massive presence of the U.S. Space Force and the world’s most advanced space surveillance infrastructure. The U.S. alone accounts for more than 50% of global SDA investment, with its position as a leading hub for commercial space innovation driving sustained growth. The presence of leading manufacturers like Lockheed Martin and Northrop Grumman, along with commercial pioneers like LeoLabs and Slingshot Aerospace, provides a robust market for both military-grade and commercial SDA solutions.

Which Factors Support Asia Pacific and Europe Market Growth?

Asia Pacific and Europe together account for around 30 to 35% of the global SDA sensors & software market. The growth of these markets is mainly driven by the need for independent space surveillance capabilities and the implementation of regional space safety mandates. The demand for SDA systems in Asia Pacific is mainly due to large-scale national space programs in China and India and the presence of innovators like Digantara.

In Europe, the leadership in space sustainability policies and the push for “Strategic Autonomy” are driving the adoption of high-efficiency SDA sensors. Countries like France, Germany, and the UK are at the forefront, with significant focus on integrating commercial SDA data into national defense architectures.

The companies such as Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies, Inc., and BAE Systems plc lead the global SDA sensors & software market with a comprehensive range of high-precision radar and optical solutions, particularly for large-scale military and national security applications. Meanwhile, players including LeoLabs, Inc., Slingshot Aerospace, Inc., ExoAnalytic Solutions, Inc., and NorthStar Earth & Space focus on specialized commercial radar networks, AI-driven analytics platforms, and space-based optical sensing targeting the commercial satellite and STM sectors. Emerging manufacturers and integrated players such as Digantara, Kayhan Space, and HEO are strengthening the market through innovations in space-based sensors and automated collision avoidance systems.

The SDA sensors & software market is expected to grow at a CAGR of 8.7% from 2026 to 2036.

The major players include Lockheed Martin Corporation, Northrop Grumman Corporation, LeoLabs, Inc., Slingshot Aerospace, Inc., and ExoAnalytic Solutions, Inc., among others.

The main factors include the surge in mega-constellation deployments, orbital congestion, and the escalating risks from space debris.

North America will lead the global SDA sensors & software market in terms of market share, while Asia Pacific is expected to witness the fastest growth during the forecast period 2026 to 2036.

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Jan-2024

Published Date: Apr-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates