Resources

About Us

Industrial Chillers Market Size, Share, Forecast, & Trends Analysis by Cooling Type (Air-cooled Chillers, Water-cooled Chillers), Compressor Type (Scroll Chillers, Absorption Chillers), Capacity, End User (Chemical & Petrochemical, Pharmaceuticals) and Geography - Global Forecast to 2035

Report ID: MRSE - 1041332 Pages: 277 Jan-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportIndustrial Chillers Market Size & Forecast

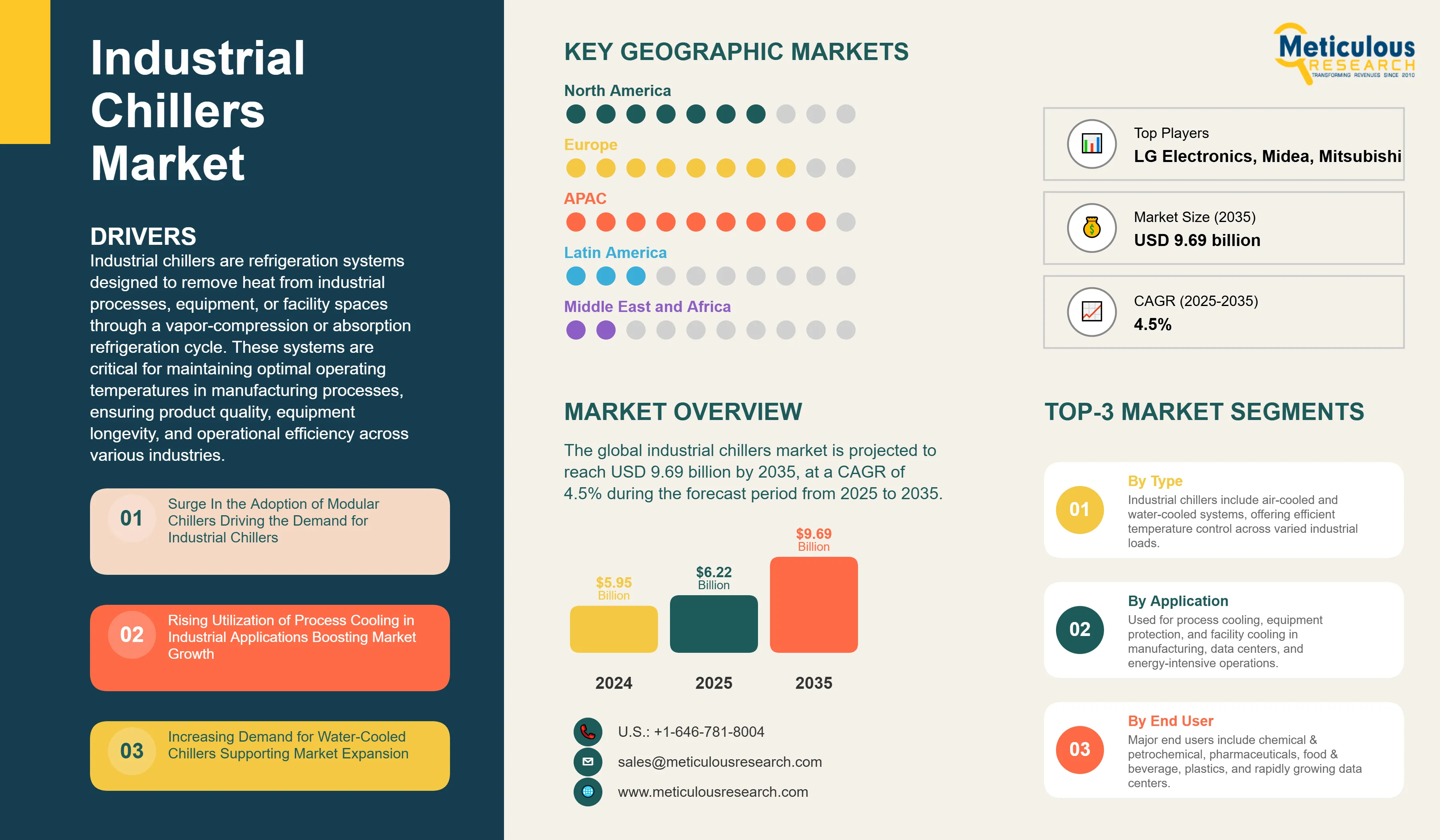

The global industrial chillers market is projected to reach USD 9.69 billion by 2035 from an estimated USD 6.22 billion in 2025, at a CAGR of 4.5% during the forecast period from 2025 to 2035.

Industrial chillers are refrigeration systems designed to remove heat from industrial processes, equipment, or facility spaces through a vapor-compression or absorption refrigeration cycle. These systems are critical for maintaining optimal operating temperatures in manufacturing processes, ensuring product quality, equipment longevity, and operational efficiency across various industries. Industrial chillers can be classified based on cooling method (air-cooled or water-cooled), compressor type (scroll, screw, centrifugal, or reciprocating), and capacity range.

Key drivers of this market include the surge in adoption of modular chillers, rising utilization of process cooling in industrial applications, and increasing demand for water-cooled chillers. The technology is essential for industries such as plastics manufacturing, pharmaceuticals, food and beverage processing, chemical production, and data centers, where precise temperature control is mandatory for operational success. According to the U.S. Department of Energy, industrial cooling systems consume nearly 16% of total electricity consumption in the manufacturing sector, highlighting the critical role these systems play in energy consumption and cost management.

The global datasphere is projected to grow from 33 zettabytes in 2018 to 175 zettabytes by 2025, representing a CAGR of 61%, necessitating expanded data center capacity and correspondingly sophisticated cooling infrastructure. This explosive growth in cloud computing, AI workloads, hyperscale facilities, and digital transformation initiatives is creating unprecedented demand for high-efficiency cooling systems. Additionally, the integration of renewable energy sources with absorption chillers, the development of low-GWP (global warming potential) refrigerants, and advancements in IoT-enabled smart chillers are transforming the market landscape.

With the growing focus on energy-efficient cooling solutions, rising adoption of eco-friendly refrigerants, expansion of industrial activities in emerging economies, and increasing investments in data center infrastructure, the industrial chillers market is expected to expand significantly, driven by the need for sustainable cooling, operational efficiency, and regulatory compliance in an increasingly energy-conscious industrial environment.

Click here to: Get Free Sample Pages of this Report

Surge in the Adoption of Modular Chillers

The global modular chillers market has witnessed significant growth in recent years, driven by the increasing demand for flexible, scalable, and energy-efficient cooling solutions across commercial and industrial sectors. The growth is primarily attributed to the rising recognition of the benefits of energy-efficient systems and the negative impacts of fossil fuel use, along with advancements in energy-saving technologies.

Modular chillers offer several advantages over traditional chiller systems, including scalability, flexibility, and ease of installation. These chillers allow building managers to adjust cooling capacity according to occupancy and usage patterns, thereby optimizing energy consumption. The modular design facilitates easy maintenance and reduces downtime, ensuring consistent performance. Additionally, the ability to integrate with smart building management systems enables precise control over temperature settings, further enhancing energy efficiency and reducing operational costs.

The commercial segment dominates the modular chillers industry in 2025, driven by increasing demand from office buildings, shopping malls, hotels, and hospitals. The industrial segment is projected to expand due to rising manufacturing activities and the need for precise temperature control in processes like pharmaceuticals, food processing, and chemicals. Major players such as Daikin Industries, Johnson Controls, Carrier Corporation, and Trane Technologies are investing in next-generation modular chillers with advanced features including variable speed drive (VSD) technology, heat recovery systems, and IoT-enabled smart controls.

Asia-Pacific dominated the modular chillers market during the forecast period. Rapid urbanization, infrastructure development, and growing demand for energy-efficient cooling solutions are driving significant growth in the region. Countries such as China, India, and Southeast Asia are witnessing significant investments in commercial construction, data centers, and manufacturing infrastructure, creating strong demand for scalable and reliable cooling systems. The surge in adoption of modular chillers is expected to drive the growth of the industrial chillers market.

Rising Utilization of Process Cooling in Industrial Applications

The industrial cooling systems market has witnessed substantial growth, driven by the increasing need for effective temperature management across various industrial sectors, including manufacturing, food processing, pharmaceuticals, and energy production. Process cooling is essential for numerous industrial applications where precise temperature control is crucial for product quality, equipment protection, and operational efficiency.

Industries such as chemicals, pharmaceuticals, food and beverages, plastics, and automotive manufacturing rely heavily on industrial chillers for process cooling applications. In the chemical industry, chillers are used to remove heat from exothermic reactions and maintain optimal temperatures for various processes. The pharmaceutical sector requires stringent temperature control for manufacturing and storage of sensitive drugs, particularly biologics and vaccines.

The food and beverage industry represents one of the fastest-growing segments for industrial cooling systems, anticipated to grow at around 9% CAGR between 2025 and 2035. The increasing consumer demand for fresh food and the emphasis on food safety have resulted in manufacturers prioritizing the deployment of advanced cooling technologies. Chillers are extensively used in food processing for applications such as cooling of cooked products, maintaining fermentation temperatures in breweries, and preserving product quality throughout the production process.

The pharmaceutical segment is expected to witness the highest CAGR during the forecast period, driven by the growing need for precise temperature control in the manufacturing, storage, and transportation of pharmaceutical products. The rapid expansion of the pharmaceutical industry in emerging markets, coupled with the increasing focus on biotechnology, is propelling the demand for high-performance and energy-efficient cooling solutions. The rising utilization of process cooling in industrial applications is expected to drive the growth of the industrial chillers market.

Increasing Demand for Water-Cooled Chillers

Water-cooled chillers are experiencing significant demand across various industries due to their superior energy efficiency and ability to handle large thermal loads with precision temperature control. The global water-cooled chillers market size is projected to reach USD 5.2 billion by 2035 from USD 3.6 billion in 2025, at a CAGR of 3.9% during the forecast period. Water-cooled chillers typically consume less energy than air-cooled systems, resulting in significant cost savings, particularly for facilities with high cooling demands.

The capability of water-cooled chillers to handle large thermal loads makes them ideal for sectors such as manufacturing, data centers, and pharmaceuticals, where consistent performance is crucial. Water-cooled chillers offer higher heat transfer efficiency compared to air-based systems and are capable of handling greater thermal loads with relatively compact equipment. The water-cooling segment dominated the industrial cooling systems market in 2024, capturing over 57% of the market share, driven by its widespread application across high-load industrial processes that require efficient heat dissipation.

In the data center industry, water-cooled chillers account for the majority of the market share in 2025, reflecting their continued preference in energy-intensive operations. Data center operators increasingly prefer water-cooled systems due to their superior efficiency and scalability for large-scale deployments. Recent developments in water-cooled chiller technology include low-GWP refrigerants and advanced controls. Daikin Applied Americas launched the enhanced Navigator WWV screw chiller with R-513A, featuring heat recovery and superior efficiency. Johnson Controls provides modular YCWE-E scroll chillers for flexible capacities, with recent liquid cooling focus. These developments boost adoption amid datasphere expansion.

Growing Need for Absorption Chillers

Absorption chillers are emerging as a significant growth opportunity in the industrial chillers market, driven by the increasing global emphasis on energy efficiency, sustainable cooling solutions, and the integration of renewable energy sources in HVAC systems. Absorption chillers utilize waste heat, steam, hot water, or renewable thermal energy as the primary energy source to drive the refrigeration process, offering significant energy savings and environmental benefits.

The waste heat recovery systems utilizing absorption chillers are gaining significant popularity. Absorption chillers provide an efficient way to leverage low-grade waste heat in industrial processes for useful applications like space cooling. Industries with abundant waste heat from exothermic processes, such as chemicals, petrochemicals, power generation, and manufacturing, are prime adopters of absorption chillers.

The integration of renewable energy sources, such as solar thermal and geothermal, with absorption chillers is creating new market opportunities. Since 2020, renewable energy integration with absorption chillers has significantly reduced operational costs, largely due to their environmental and economic benefits. The North American market is estimated to hold the largest share of the global absorption chillers market in 2025, driven by the adoption of energy-efficient and renewable cooling solutions and federal incentives like the U.S. Inflation Reduction Act. Double-stage absorption chillers are anticipated to dominate the market, reflecting their superior efficiency and cost-effectiveness.

Recent developments feature Trane's Magnetic Bearing and Ascend air-cooled chillers for data centers and modular CDUs. Johnson Controls launched liquid cooling solutions supporting AI/data center expansion. Such efficiency-focused innovations create growth opportunities for industrial chiller manufacturers supporting the rapidly expanding data center and AI infrastructure sectors.

Industrial Chillers Market Analysis: Top Market Opportunities

By Cooling Type: The Water-Cooled Chillers Segment Dominated the Industrial Chillers Market in 2025

Based on cooling type, the industrial chillers market is segmented into water-cooled chillers and air-cooled chillers. In 2025, the water-cooled chillers segment accounted for the largest share of 57.3% of the global industrial chillers market. The large share of this segment is primarily attributed to the increasing demand for energy-efficient cooling systems, the growing adoption of water-cooled chillers in the chemicals and petrochemicals industries, and the rising need for water-cooled chillers in large-scale data centers and pharmaceutical manufacturing facilities.

Furthermore, the advantages offered by water-cooled chillers such as high energy efficiency, superior heat transfer capabilities, longer lifespan, improved cooling performance, and enhanced temperature control are key factors contributing to the significant market share of this segment.

However, the air-cooled chillers segment is projected to record the highest CAGR of 5.4% during the forecast period. The growth is mainly driven by the compact design and ease of installation of air-cooled chillers, the rising demand from small and medium-sized industrial facilities, and the increasing adoption in regions with limited water availability or stringent water usage regulations. Additionally, the lower initial investment costs and reduced maintenance requirements of air-cooled chillers make them an attractive option for retrofitting projects and decentralized cooling applications.

By Compressor Type: The Screw Chillers Segment Dominated the Industrial Chillers Market in 2025

Based on compressor type, the industrial chillers market is segmented into screw chillers, centrifugal chillers, scroll chillers, absorption chillers, reciprocating chillers, and other compressor types. In 2025, the screw chillers segment accounted for the largest share of 31.2% of the global industrial chillers market. The segment's significant market share is primarily attributed to the broad capacity coverage and load-following reliability offered by screw compressors, their widespread adoption in chemical, plastics, and medium-sized industrial installations, and their ability to provide continuous operation at high thermal loads.

According to industry reports, screw compressors have remained the workhorse for industrial process cooling applications due to their excellent part-load efficiency and operational reliability.

However, the absorption chillers segment is projected to record the fastest CAGR during the forecast period due to a combination of energy efficiency drivers, sustainability goals, and the ability to utilize waste heat or renewable thermal energy sources. Unlike mechanical chillers that rely on electricity-driven compressors, absorption chillers operate on thermal energy—such as waste heat from industrial processes, steam, hot water, or even solar thermal energy. Growing global emphasis on carbon reduction, green building standards, and the adoption of low-GWP technologies is accelerating interest in non-electric and eco-friendly cooling systems.

By Capacity: The 101-500kW Segment Dominated the Industrial Chillers Market in 2025

Based on capacity, the industrial chillers market is segmented into <50kW, 51-100kW, 101-500kW, 501-1,000kW, and >1,001kW. In 2025, the 101-500kW segment accounted for the largest share of 36.2% of the global industrial chillers market. The 101-500 kW capacity range dominates because it represents the most versatile and widely used cooling range across major industrial and commercial applications.

This capacity band is ideal for medium to large-scale manufacturing operations—including plastics processing, food and beverage production, pharmaceuticals, chemicals, metalworking, and data centers—which require consistent and reliable cooling to support continuous production lines. Chillers in this range offer an optimal balance between cooling power, energy efficiency, and capital cost, making them suitable for facilities that need more capacity than small chillers can provide but cannot justify the cost or footprint of ultra-large systems.

However, the 51-100 kW segment is projected to witness the fastest growth due to the global rise in small and medium-sized manufacturing units (SMEs) and the increasing adoption of compact, energy-efficient cooling systems. This capacity range is particularly attractive for industries with moderate but growing cooling requirements—such as small plastics processors, regional food manufacturers, packaging units, electronics assembly plants, and laboratory or pilot-scale pharmaceutical facilities.

By Refrigerant Type: The R-410A Segment Dominated the Industrial Chillers Market in 2025

Based on refrigerant type, the industrial chillers market is segmented into R-410A, R-134a, Ammonia (NH₃), R-1234ze, R-513A, Carbon Dioxide (CO₂), and Other Refrigerants. In 2025, the R-410A segment accounted for the largest share of 18% of the global industrial chillers market. The segment's large market share is primarily attributed to its strong historical adoption, high cooling efficiency, and proven performance across a wide range of industrial and commercial applications.

It became the industry's preferred replacement for R-22 in many regions due to its superior thermodynamic properties, higher heat-transfer efficiency, and ability to operate at higher pressures. R-410A chillers are widely available, cost-effective, and backed by a well-established supply chain of components, compressors, and service expertise.

However, the R-1234ze segment is projected to record the highest CAGR of 10.6% during the forecast period. The growth is mainly due to the global shift toward low-GWP, environmentally sustainable refrigerants driven by stricter climate regulations. With a GWP of less than 1, R-1234ze is one of the most eco-friendly HFO refrigerants available, making it highly attractive for companies seeking to comply with HFC phasedown requirements under the Kigali Amendment, European F-Gas Regulation, and sustainability targets.

By Sales Channel: The Direct to End User Segment Dominated the Industrial Chillers Market in 2025

Based on sales channel, the industrial chillers market is segmented into direct to end user, EPC & contractors, installers/system integrators, distributors/dealers, and OEM (built-in supply). In 2025, the direct to end user segment accounted for the largest share of 37.8% of the industrial chillers market. This segment dominates because large industrial customers prefer buying directly from manufacturers to secure customized solutions, higher reliability, and strong after-sales support.

Many industries—such as plastics, chemicals, pharmaceuticals, and food processing—have specific process cooling needs, making direct engagement essential for tailored system design, performance guarantees, and integration into existing operations. Direct purchase also streamlines pricing, service contracts, and maintenance arrangements.

However, the OEM (built-in supply) segment is growing rapidly due to the increasing integration of chillers directly into industrial machinery and packaged systems. As industries shift toward modular, automated, and compact equipment designs, machinery manufacturers are embedding chillers to offer turnkey, plug-and-play solutions that simplify installation and improve overall efficiency.

By End User: The Chemical & Petrochemical Segment Dominated the Industrial Chillers Market in 2025

Based on end user, the industrial chillers market is segmented into chemical & petrochemical, pharmaceuticals, food & beverage, plastic processing, data centers, metal finishing, steel processing, medical, and others. In 2025, the chemical & petrochemical segment accounted for the largest share of 25.0% of the industrial chillers market. This segment dominates because it has the highest and most continuous demand for process cooling across large-scale production operations.

Chemical reactions, polymerization, distillation, and refining processes generate significant heat and require precise, uninterrupted temperature control to ensure product quality, safety, and operational stability. Industrial chillers are essential for maintaining controlled process temperatures, cooling reactors, protecting sensitive catalysts, and managing exothermic reactions.

However, the data centers segment is witnessing the fastest growth, at a CAGR of 7.1%, due to the explosive global expansion of cloud computing, AI workloads, hyperscale facilities, and digital transformation initiatives. As data centers become larger and more compute-intensive, thermal loads are rising sharply, increasing demand for high-efficiency, precision cooling systems. The shift toward high-density server racks, liquid cooling technologies, and edge data centers further accelerates the need for advanced chilling solutions.

Asia-Pacific Dominated the Industrial Chillers Market in 2025

Based on geography, the global industrial chillers market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific accounted for the largest share of 41.4% of the global industrial chillers market. Moreover, Asia-Pacific is projected to reach USD 4,217.2 million by 2035, at a CAGR of 5.1% during the forecast period.

The large market share of Asia-Pacific is attributed to rapid industrialization, urbanization, and increased demand for cooling solutions across China, India, Japan, and Southeast Asian nations. The manufacturing expansion, data center construction, and infrastructure development in the region create significant demand for process cooling systems. Leading global manufacturers, including Daikin and Mitsubishi Electric, have established regional production facilities to meet this demand, while domestic players such as Midea and Gree have also ramped up manufacturing capabilities.

However, the Middle East & Africa is expected to register the fastest CAGR of 4.6% during the forecast period. The rapid growth is driven by extreme climate conditions, mega-projects including NEOM and district cooling expansion, and Vision 2030 initiatives. The region's focus on sustainable development and energy efficiency is accelerating the adoption of advanced cooling technologies. North America remains a technology leader, focusing on data center applications, biotech facilities, and retrofit opportunities, with the U.S. representing the dominant national market.

Key Companies

Major companies in the global industrial chillers market have implemented various strategies to expand their product offerings and augment their market shares. The key strategies followed by most companies include partnerships, agreements & collaborations, product launches & enhancements, and expansions. Product launches and enhancements accounted for a major share of strategic developments from key players.

Some of the prominent players operating in the global industrial chillers market include DAIKIN INDUSTRIES, Ltd. (Japan), Carrier Global Corporation (U.S.), Trane Technologies plc (Ireland), Johnson Controls Inc. (Ireland), Mitsubishi Electric Corporation (Japan), Midea Group Co., Ltd. (China), LG Electronics (South Korea), Smardt Chiller Group Inc. (Canada), Drake Refrigeration Inc. (U.S.), Chillmax Technologies Pvt Ltd. (India), Reynold India Private Limited (India), Senho Machinery Shenzhen Co. Ltd. (China), Kirloskar Chillers Pvt Ltd. (India), Envisys Technologies Private Limited (India), and Atlas Copco Group (Sweden).

Industrial Chillers Market Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

297 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.5% |

|

Market Size (Value) in 2025 |

USD 6.22 Billion |

|

Market Size (Value) in 2035 |

USD 9.69 Billion |

|

Segments Covered |

By Cooling Type

By Compressor Type

By Capacity

By Refrigerant Type

By Sales Channel

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa) |

|

Key Companies |

DAIKIN INDUSTRIES, Ltd. (Japan), Carrier Global Corporation (U.S.), Trane Technologies plc (Ireland), Johnson Controls Inc. (Ireland), Mitsubishi Electric Corporation (Japan), Midea Group Co., Ltd. (China), LG Electronics (South Korea), Smardt Chiller Group Inc. (Canada), Drake Refrigeration Inc. (U.S.), Chillmax Technologies Pvt Ltd. (India), Reynold India Private Limited (India), Senho Machinery Shenzhen Co. Ltd. (China), Kirloskar Chillers Pvt Ltd. (India), Envisys Technologies Private Limited (India), and Atlas Copco Group (Sweden) |

The global industrial chillers market size is projected to reach USD 6.21 billion in 2025.

The market is projected to grow from USD 6.21 billion in 2025 to USD 9.69 billion by 2035, at a CAGR of 4.5%.

The industrial chillers market analysis indicates substantial growth, with projections indicating the market will reach USD 9.69 billion by 2035, at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2035.

The key companies operating in this market include DAIKIN INDUSTRIES, Ltd. (Japan), Carrier Global Corporation (U.S.), Trane Technologies plc (Ireland), Johnson Controls Inc. (Ireland), Mitsubishi Electric Corporation (Japan), Midea Group Co., Ltd. (China), LG Electronics (South Korea), Smardt Chiller Group Inc. (Canada), and others.

Growing demand for air-cooled chillers in data centers, rising focus on smart and connected chillers, and increasing adoption of low-GWP refrigerants are prominent trends in the industrial chillers market.

By cooling type, the water-cooled chillers segment is forecasted to hold the largest market share during 2025-2035; by compressor type, the screw chillers segment is dominated; by capacity, the 101-500kW segment held the largest share; by refrigerant type, the R-410A segment dominated; by sales channel, the direct to end user segment held the largest share; by end user, the chemical & petrochemical segment dominated; and by geography, Asia-Pacific held the largest share of the market in 2025.

By region, Asia-Pacific held the largest share of the industrial chillers market in 2025. The large share is attributed to rapid industrialization, urbanization, and increased demand for cooling solutions across China, India, Japan, and Southeast Asian nations. However, the Middle East & Africa is expected to register the highest growth rate during the forecast period, driven by extreme climate conditions and mega-projects.

Key drivers include the surge in adoption of modular chillers, rising utilization of process cooling in industrial applications, and increasing demand for water-cooled chillers. These factors are collectively driving the adoption of industrial chiller technologies across various end-user industries.

Published Date: Nov-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates