Resources

About Us

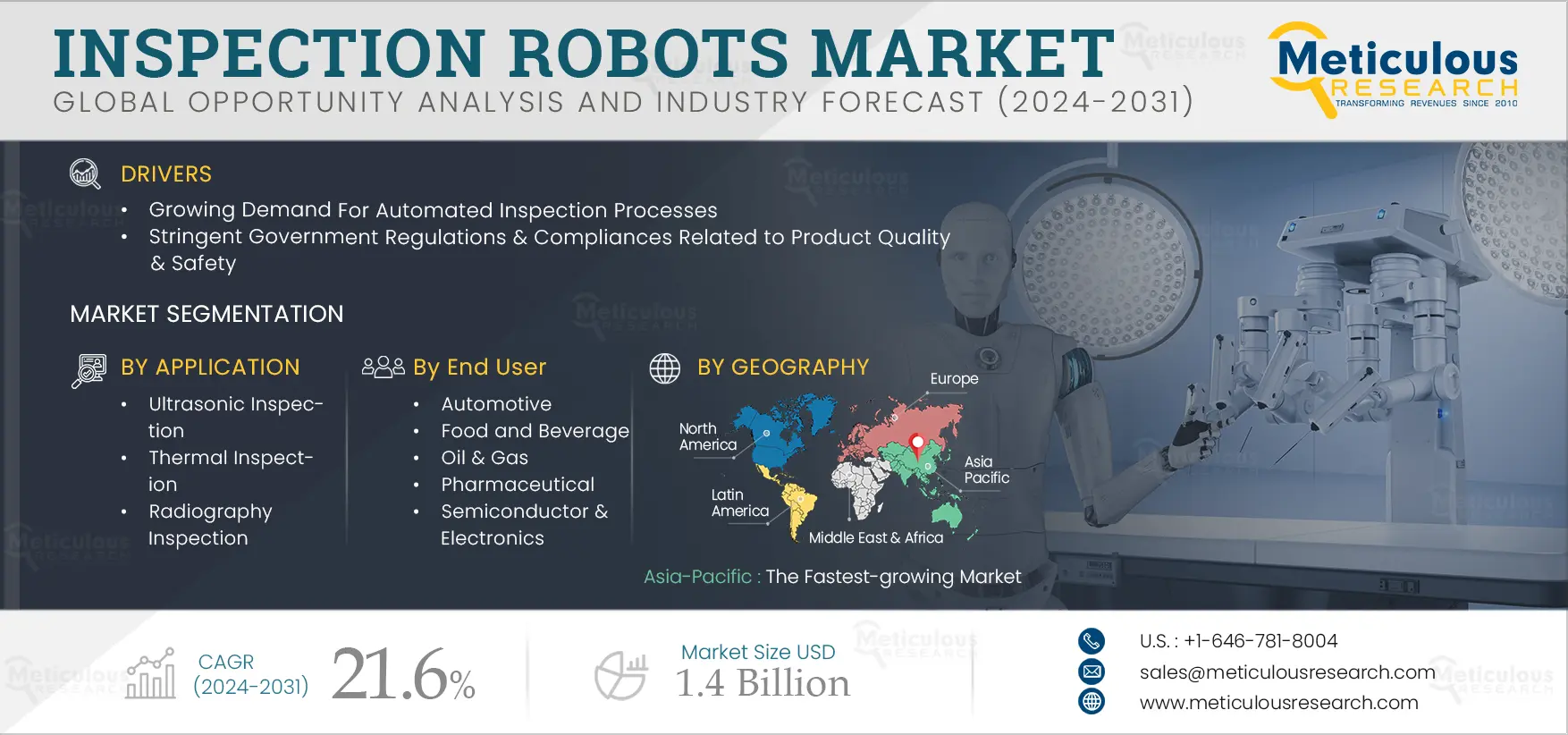

Inspection Robots Market Size, Share, Forecast, & Trends Analysis by Type (Stationary, Mobile), Application (Visual, Ultrasonic, Photogrammetry, Laser Scanning, Thermal, Quality Inspection), End User (End Use Industry, Inspection Services) and Geography - Global Forecast to 2031

Report ID: MRSE - 104830 Pages: 209 Nov-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportKey factors driving the growth of this market include the growing demand for automated inspection processes, stringent government regulations & compliances related to product quality & safety, and the increasing adoption of Industry 4.0 technologies. Furthermore, technological advancements in inspection robots are expected to generate market growth opportunities.

Automated inspection processes involve the use of advanced technologies to perform quality checks and detect defects with minimal human intervention. Automated systems are employed to ensure the quality and integrity of components and assemblies. Automated inspection processes help in the early identification of flaws in the production process, reducing rework and ensuring compliance with strict industry standards. In industries such as automotive manufacturing, these systems are used for dimensional measurement, surface defect detection, and assembly verification. In the electronics industry, automated inspection processes help ensure PCB (Printed Circuit Board) quality and component placement accuracy. In the pharmaceutical and food & beverage industries, these processes help detect contaminants, ensuring product integrity and compliance with regulatory standards.

Companies operating in the inspection robots market are focusing on partnerships to develop advanced inspection technologies capable of performing complex inspections rapidly and accurately to improve production efficiency, reduce operational costs, and enhance product quality. For instance, in November 2023, GMV Innovating Solutions S.L. (Spain) partnered with ANYbotics AG (Switzerland) to offer high-level availability, reliability, and efficiency in automated inspections with autonomous robots. The partnership was aimed at automating the way companies manage their inspection operations and providing improved effectiveness and optimized resource utilization in industrial environments. Such developments, coupled with the shift toward smart manufacturing and automation, are driving the growth of the inspection robots market.

Click here to: Get a Free Sample Copy of this report

Click here to: Get a Free Sample Copy of this report

Regulations and compliance include stringent standards and guidelines imposed by regulatory bodies to ensure that products meet specified quality, safety, and efficacy criteria. Major regulations related to product quality and safety include FDA Regulations, GMP (Good Manufacturing Practices), ISO Standards, HACCP (Hazard Analysis and Critical Control Points), EPA Regulations, OSHA Standards, CPSC Regulations, and CE Marking. FDA Regulations help ensure the safety and quality of food products, drugs, medical devices, cosmetics, and tobacco products. GMP guidelines provide standards for the manufacturing, testing, and quality assurance of pharmaceuticals, food products, cosmetics, and medical devices to ensure consistent product quality and safety. ISO Standards, including ISO 9001, ISO 13485, and ISO 22000 help ensure product quality, safety, and reliability. The HACCP approach helps identify and control potential food safety hazards.

Inspection robots help companies comply with regulations related to product quality and safety. These robots utilize advanced technologies such as AI and machine learning, LIDAR and 3D mapping, ultrasonic and infrared sensors, machine vision, and precision sensors to thoroughly inspect products during manufacturing and packaging processes. These benefits, coupled with the growing consumer demand for safe and high-quality products, drive the growth of the inspection robots market.

Technological advancements in inspection robots are anticipated to generate significant growth opportunities for market stakeholders. With continuous improvements in artificial intelligence, machine learning, and sensor technologies, inspection robots are becoming more capable of performing complex tasks requiring precision, such as real-time data analysis, anomaly detection, and predictive maintenance. These capabilities are crucial for industries seeking to automate and streamline their inspection processes, reducing human error, and improving operational efficiency.

Enhanced mobility, adaptability, and durability are also making inspection robots more versatile and suitable for diverse industrial environments, from confined spaces to high-risk areas. These improvements are expanding the potential applications of inspection robots, particularly in sectors such as oil & gas, manufacturing, and power generation, where safety, reliability, and uptime are critical. By automating inspections in challenging environments, these robots not only enhance safety but also reduce the need for costly manual checks, which supports their industry-wide adoption. Such developments indicate industry players’ rising focus on investing in advanced inspection technologies, which is expected to create significant market growth opportunities during the forecast period.

Based on type, the global inspection robots market is segmented into stationary robots and mobile robots. In 2024, the stationary robots segment is anticipated to dominate the inspection robots market. Stationary robots are fixed robotic systems that play a crucial role in inspection and monitoring across various industries. Stationary robots are designed to operate from a specific location, making them ideal for tasks that require constant oversight or detailed examination of particular areas or objects. These robots are equipped with advanced sensors, cameras, and analytical tools and can perform a variety of functions. The benefits of stationary robots include improved efficiency, accuracy, and reliability. By automating routine inspection tasks, they minimize human error and reduce labor costs, allowing personnel to focus on more complex duties. Their ability to provide real-time data also supports proactive maintenance strategies, ultimately leading to enhanced operational effectiveness and safety in various applications. As technology advances, the capabilities and applications of stationary robots continue to expand, making them indispensable in modern inspection processes.

In manufacturing environments, they are often utilized for quality control, inspecting products for defects, and ensuring they meet stringent standards. Also, stationary robots play a vital role in the pharmaceutical industry, enhancing efficiency, accuracy, and safety in various processes. These fixed robotic systems are primarily utilized for tasks such as inspection, packaging, and monitoring of pharmaceutical products. Thus, stationary robots streamline industrial processes, provide real-time data for decision-making, and significantly contribute to cost savings and operational efficiency.

In 2024, Asia-Pacific is expected to account for the largest share of 63.2% of the global inspection robots market. The growth of this market can be attributed to the increasing adoption of automation and advanced technologies, the presence of leading companies operating in this market, and the easy availability of their forthcoming products and services. Furthermore, technologically advanced countries, such as China, Japan, South Korea, Taiwan, and India, are expected to offer significant market growth opportunities in the coming years.

Additionally, the market in Asia-Pacific is projected to register the highest CAGR of 22.3% during the forecast period.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market players over the past three years (2021-2024).

The key players profiled in the inspection robots market report are ABB Ltd (Sweden), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Kawasaki Heavy Industries, Ltd. (Japan), Denso Corporation (Japan), Seiko Epson Corporation (Japan), Universal Robots A/S (Denmark), Waygate Technologies (Germany), Eddyfi Technologies (Canada), ANYbotics AG (Switzerland), Hangzhou Shenhao Technology Co., Ltd. (China), Robotnik Automation S.L. (Spain), PetroBot Technologies Private Limited (India), Systemantics India Pvt. Ltd. (India), SMP Robotics Systems Corp. (U.S.), and Energy Robotics GmbH (Germany).

|

Particulars |

Details |

|

Number of Pages |

209 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

21.6% |

|

Market Size (Value) |

USD 5.6 Billion by 2031 |

|

Segments Covered |

By Type

By Application

By End User

|

|

Countries Covered |

Asia-Pacific (China, Japan, India, Australia, South Korea, Taiwan, Rest of Asia-Pacific), North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Switzerland, Sweden, Rest of Europe), Latin America (Mexico, Brazil, Argentina, Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, Israel, Rest of Middle East & Africa) |

|

Key Companies |

ABB Ltd (Sweden), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Kawasaki Heavy Industries, Ltd. (Japan), Denso Corporation (Japan), Seiko Epson Corporation (Japan), Universal Robots A/S (Denmark), Waygate Technologies (Germany), Eddyfi Technologies (Canada), ANYbotics AG (Switzerland), Hangzhou Shenhao Technology Co., Ltd. (China), Robotnik Automation S.L. (Spain), PetroBot Technologies Private Limited (India), Systemantics India Pvt. Ltd. (India), SMP Robotics Systems Corp. (U.S.), and Energy Robotics GmbH (Germany) |

The inspection robots market size was valued at $1.2 billion in 2023.

The market is projected to grow from $1.4 billion in 2024 to $5.6 billion by 2031.

The inspection robots market analysis indicates substantial growth, with projections indicating that the market will reach $5.6 billion by 2031 at a compound annual growth rate (CAGR) of 21.6% from 2024 to 2031.

The key companies operating in this market ABB Ltd (Sweden), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Mitsubishi Heavy Industries, Ltd. (Japan), Kawasaki Heavy Industries, Ltd. (Japan), Denso Corporation (Japan), Seiko Epson Corporation (Japan), Universal Robots A/S (Denmark), Waygate Technologies (Germany), Eddyfi Technologies (Canada), ANYbotics AG (Switzerland), Hangzhou Shenhao Technology Co., Ltd. (China), Robotnik Automation S.L. (Spain), PetroBot Technologies Private Limited (India), Systemantics India Pvt. Ltd. (India), SMP Robotics Systems Corp. (U.S.), and Energy Robotics GmbH (Germany).

By type, the stationary robots segment is forecasted to hold the largest market share during 2024-2031.

By , the ultrasonic inspection segment is expected to dominate the market during 2024-2031.

By , the industry segment is expected to dominate the market during 2024-2031.

By Geography, Asia-Pacific is anticipated to hold the largest market share during 2024-2031.

By geography, Asia-Pacific holds the largest share of the inspection robots market in 2024. Moreover, the market in Asia-Pacific is projected to register the highest growth rate during the forecast period, driven by the increasing adoption of automation and advanced technologies, the presence of leading companies operating in this market, and the easy availability of their forthcoming products and services.

Key factors driving the growth of this market include the growing demand for automated inspection processes, stringent government regulations & compliances related to product quality & safety, and the increasing adoption of Industry 4.0 technologies.

Published Date: May-2025

Published Date: Feb-2025

Published Date: Jul-2024

Published Date: May-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates