Resources

About Us

Africa IVD Market Size, Share, Forecast, & Trends Analysis by Offering, Technology (Immunoassay, PoC, Molecular Diagnostics, Coagulation) Application (Infectious Diseases, Diabetes, Oncology) Diagnostic Approach (Lab, OTC, PoCT) End User- Forecast to 2032

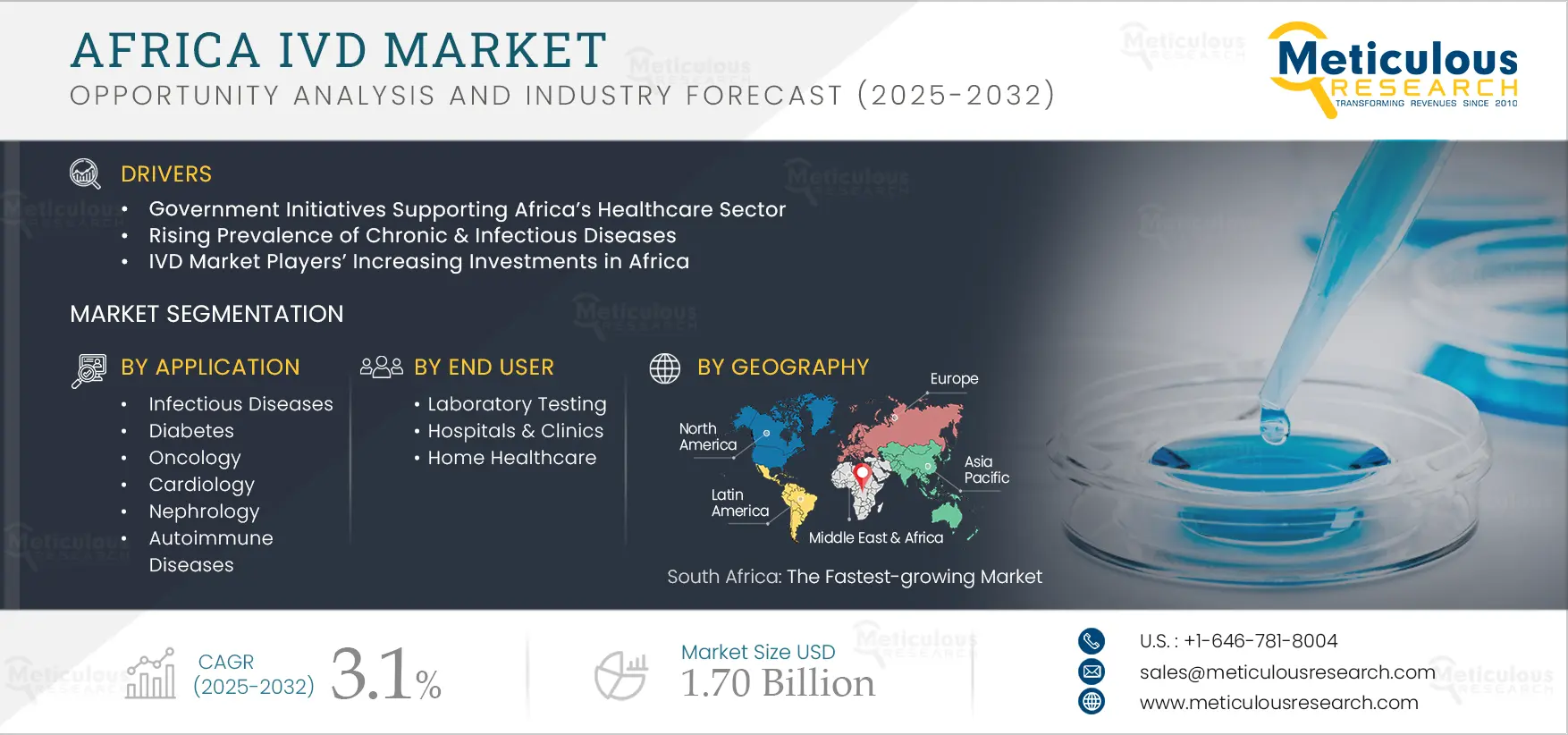

Report ID: MRHC - 104731 Pages: 242 Apr-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe Africa IVD market was valued at $1.33 billion in 2024. This market is expected to reach $1.70 billion by 2032 from an estimated $1.37 billion in 2025, at a CAGR of 3.1% during the forecast period of 2025–2032. The Africa IVD market expenditure and the rising prevalence of chronic & infectious diseases, IVD market players’ increasing investments in Africa, the growing demand for Point-of-care (POC) & rapid diagnostics, the rising geriatric population, government initiatives supporting Africa's healthcare sector, rising healthcare expenditure, and increasing R&D expenditure.

Moreover, increasing awareness regarding the importance of early diagnosis, advances in genomics & proteomics, and the increasing adoption of personalized medicine are expected to generate growth opportunities for the players operating in the Africa IVD market.

Chronic diseases such as cancer, diabetes, and cardiovascular diseases are gradually becoming the major causes of mortality in Africa. According to the WHO, in 2022, 24 million adults in Africa had diabetes, and this number is expected to reach 55 million by 2045. Chronic diseases have endangered the health and lives of millions of Africans, accounting for more than one-third of all deaths in the region.

Moreover, frequent endemic disease outbreaks in African countries also contribute to the high demand for IVD products. For instance, according to the United Nations Africa Renewal digital magazine published in July 2022, the risk of outbreaks caused by zoonotic pathogens such as the Ebola & monkeypox viruses that originate in animals and infect humans is on the rise. There has been a 63.0% increase in the number of zoonotic disease outbreaks in Africa during 2012–2022 compared to 2001–2011 (Source: WHO). Also, in July 2022, the Ministry of Health of the Democratic Republic of the Congo declared the end of the 14th Ebola outbreak since 1976. Thus, the rising disease prevalence has boosted the demand for IVD products in Africa.

Click here to: Get Free Sample Pages of this Report

Governments in Africa are undertaking initiatives to expand and modernize Africa’s healthcare sector largely in collaboration with developed countries and global organizations. Africa’s healthcare sector is witnessing a consistent expansion due to frequent infectious disease outbreaks, technological advancements, and the rising need for the early diagnosis of chronic diseases. For instance, in March 2024, three health Team Europe Initiatives (TEIs) were launched during the European Union (EU) – African Union (AU) Partnership on Global Health for Equitable Access event in Brussels. The TEIs aim to strengthen health security, support public health institutes in Africa, and boost digital health. The collaboration between the Africa CDC and ECDC, which started in 2021, will receive USD 145.5 million (EUR 123 million) from the EU budget during 2022–2027.

In addition, governments in Africa have been collaborating with international organizations and agencies to tackle the burden of diseases and develop & support health facilities. For instance, in June 2022, the U.S. Embassy in Nairobi (Kenya) announced the approval of USD 345 million in funding through the United States President’s Emergency Plan for an AIDS Relief program (PEPFAR) to support Kenya’s HIV response. These funds were used to support critical solutions required to maintain epidemic control in Kenya. Such initiatives supporting Africa’s healthcare sector are boosting the demand for IVD products in Africa.

Africa’s healthcare sector has not yet matured completely. Leading global players in the IVD market have recognized the potential in Africa and are strategically expanding their presence and product offerings in the region. These companies are actively investing in African countries either directly or through partnerships, which is expected to boost the growth of the IVD market in the region. For instance, in September 2023, Genrui Biotech Co., Ltd. (China) announced the opening of its first overseas IVD reagent factory in Tanzania. The factory will support the local IVD industry and strengthen the company’s presence in the region. Also, in December 2021, Helios Investment Partners LLP (U.K.), a private equity firm with operations in Africa, completed the acquisition of a majority stake in MedTech Group companies in Morocco. The MedTech Group operates in the medical devices, in vitro diagnostics, and pharmaceuticals segments and comprises four companies, including Techniques Sciences Santé (Morocco), also known as T2S. Helios acquired stakes in T2S to expand its network and capabilities across various African countries.

With the surge in chronic disease cases, people in Africa have become more aware of the importance of early detection and treatment. Cases of diabetes, cancer, and cardiovascular diseases are rising in the region. The number of deaths is also increasing due to the low diagnosis rate. Only 46% of people with diabetes in Africa are aware of their condition, and the situation is similar in the case of other chronic diseases. The biggest problem in diabetes care is the lack of diagnosis, as, without proper diagnosis, diabetes becomes a silent killer.

However, increasing efforts of public & private health workers and international organizations, along with government initiatives, have increased public awareness regarding various diseases and the importance of early diagnosis in choosing effective treatments. For instance, by launching the Africa Collaborative Initiative to Advance Diagnostics, the African Society for Laboratory Medicine (ASLM) and the Africa Centers for Disease Control and Prevention have joined forces to overcome current obstacles in advancing the diagnostic agenda in Africa.

Based on offering, the Africa IVD market is segmented into reagents & kits, instruments, and software & services. In 2024, the kits & reagents segment is expected to account for the largest share of 83.1% of the Africa IVD market. The large market share of this segment is attributed to the recurring use of assays & kits in the detection of various chronic diseases, the commercial availability of a diverse range of reagents & consumables for the diagnosis of various diseases, and the increase in the volume of testing for infectious diseases such as COVID-19 and influenza.

Similarly, the kits & reagents segment is projected to witness the highest growth rate of 3.3% during the forecast period of 2024–2031. The growth of this segment is driven by the emerging threats of infectious diseases such as malaria, tuberculosis, and other neglected tropical diseases, increasing test volumes for infectious diseases, and favorable initiatives to improve diagnosis, treatment, and healthcare access.

In Africa, chronic illnesses caused by infectious diseases, premature deaths, and loss of productivity are hampering the region's economic growth. Infectious diseases account for over 227 million years of health life lost and an annual productivity loss of over USD 800 billion. Furthermore, of the estimated 10 million deaths per annum due to infectious diseases, the majority of them occur in Africa. This high burden, along with the growing adoption of point-of-care testing, is favored by the use of test kits to obtain rapid results, driving the segment growth.

Based on technology, the Africa IVD market is segmented into immunoassay/immunochemistry, whole blood glucose monitoring, molecular diagnostics, point-of-care diagnostics, biochemistry/clinical chemistry, microbiology, hematology, coagulation & hemostasis, and other IVD technologies. In 2024, the immunoassay/immunochemistry segment is expected to account for the largest share of 34.5% of the Africa IVD market. The segment’s large share is attributed to the benefits of immunoassay technologies, such as efficient, convenient, and accurate research tools for the detection and quantitation of targets, continuous development of new biomarkers, and cost-effectiveness, coupled with the growing adoption of automated platforms for ELISA.

However, the molecular diagnostics segment is expected to grow at the highest CAGR of 3.8% during the forecast period of 2024-2031. The segment’s growth is attributed to the high prevalence of infectious diseases, the increasing penetration of advanced molecular diagnostic tests, higher accuracy offered by molecular diagnostics compared to other techniques, and favorable initiatives to enhance molecular detection capabilities in the region.

In April 2024, the Africa Centres for Disease Control and Prevention (Africa CDC) launched two projects, namely the Integrated Genomic Surveillance and Data Sharing Platform (IGS) and Integrated Genomic Surveillance for Outbreak Detection (DETECT), co-funded by the European Union. These initiatives are expected to strengthen the Africa Pathogen Genomics Initiative (Africa PGI 2.0), enhancing the member states’ capacity for the molecular detection of outbreaks, timely data sharing across Africa, and AMR genomic surveillance.

Based on application, the Africa IVD market is segmented into infectious diseases, diabetes, oncology, cardiology, nephrology, autoimmune diseases, and other applications. In 2024, the infectious diseases segment is expected to account for the largest share of the Africa IVD market. This segment’s large market share can be attributed to the high prevalence of infectious diseases like COVID-19, dengue, and HIV in the region, increasing awareness about diagnostic testing, and the growing availability of low-cost rapid test kits.

However, the cardiology segment is expected to grow at the highest CAGR during the forecast period of 2024 to 2031. The growing cardiac disease burden, coupled with advancements in cardiac disease diagnostic testing and the growing awareness of point-of-care and rapid cardiac tests among healthcare providers, including physicians and cardiologists, is expected to drive the segment’s growth.

Based on diagnostic approach, the Africa IVD market is categorized into laboratory testing, point-of-care testing, and OTC/self-testing. In 2024, the laboratory testing segment is expected to account for the largest share of the Africa IVD market. The large market share of this segment is attributed to the availability of several IVD tests and the higher accuracy of laboratory testing. In Africa, the laboratory testing landscape is evolving. Investments in diagnostic tests are primarily directed toward larger markets such as Egypt, Nigeria, and South Africa. According to the Prosper Africa Healthcare Report 2023, Egypt secured USD 109 million across three deals for diagnostic services. Similarly, Nigeria saw a deal value of USD 36 million through four deals.

However, the point-of-care testing segment is expected to grow at a faster CAGR during the forecast period. The segment’s growth can be attributed to the affordability, ease of use, and rapid results offered by the POCT, high burden of hepatitis, syphilis, and HIV coupled with POCT as the preferred option for testing these diseases, and favorable initiatives to expand the access of POCT in the region.

Efforts to enhance patient care are underway, with African countries and key players working to expand access to POCT. For example, in February 2022, Siemens Healthineers partnered with UNICEF to optimize POCT networks in Africa.

Based on end user, the Africa IVD market is segmented into diagnostic laboratories, hospitals & clinics, home healthcare, and other end users, which include nursing homes, academic & research institutes, ambulatory care centers, and transfusion laboratories. In 2024, the hospitals & clinics segment is expected to account for the largest share of the Africa IVD market. The largest share of the segment is attributed to the increase in the number of hospitals & clinics, the rising patient population, the increasing prevalence of infectious diseases, and the rise in funding for the expansion of hospital infrastructure.

Similarly, the hospitals & clinics segment is expected to grow at the highest CAGR during the forecast period of 2024 to 2031. With the frequent outbreaks of infectious diseases and the increasing prevalence of chronic diseases, the number of hospital visits is expected to increase, which is expected to support the segment's growth in the future. African countries are also significantly investing in hospital infrastructure to treat patients from across the world. For instance, in February 2024, Roha Medical Campus, backed by U.S. investors, invested USD 400 million to open a hospital complex, which is expected to be operational in 2025. Such initiatives, coupled with the rising prevalence of diseases, growing number of hospitals, and rising demand for diagnostic testing, drive the segment growth.

Based on geography, the Africa IVD market is segmented into South Africa, Algeria, Nigeria, Kenya, Morocco, Tunisia, Tanzania, Egypt, Côte d’Ivoire, Cameroon, and the Rest of Africa. In 2024, South Africa is expected to account for the largest share of 30.4% of the Africa IVD market. The high prevalence of chronic and infectious diseases coupled with good access to healthcare and high healthcare expenditure in South Africa compared to other countries of Africa drives the market.

Similarly, growing healthcare expenditure, growing availability due to partnerships and collaborations between diagnostic test providers and distributors, favorable government initiatives, and growing healthcare infrastructure and access in South Africa drive market growth. The market in South Africa is expected to grow at the highest CAGR of 3.9% during the forecast period of 2024 to 2031.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. The key players operating in the Africa IVD market are Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), bioMérieux SA (France), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), QIAGEN N.V. (Netherlands), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc., (U.S.), Illumina, Inc. (U.S.), and Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China).

|

Particular |

Details |

|

Page No |

242 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2023 |

|

CAGR |

3.1% |

|

Market Size (Value) |

$1.70 billion by 2032 |

|

Segments Covered |

By Offering

By Technology

By Application

By Diagnostic Approach

By End User

|

|

Countries Covered |

South Africa, Algeria, Nigeria, Kenya, Morocco, Tunisia, Tanzania, Egypt, Côte d’Ivoire, Cameroon, and the Rest of Africa |

|

Key Companies |

Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), bioMérieux SA (France), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), QIAGEN N.V. (Netherlands), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc., (U.S.), Illumina, Inc. (U.S.), and Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China). |

The Africa IVD market covers the market sizes & forecasts by offering, technology, application, diagnostic approach, and end user. The Africa IVD market studied in this report involves the value analysis of various segments and sub-segments of the Africa IVD market at regional and country levels.

The Africa IVD market is projected to reach $1.65 billion by 2031, at a CAGR of 3.1% during the forecast period.

In 2024, the reagents & kits segment is expected to account for the largest share of the Africa IVD market.

In 2024, the immunoassay/immunochemistry segment is expected to account for the largest share of the Africa IVD market.

In 2024, the infectious diseases segment is expected to account for the largest share of the Africa IVD market.

The Africa IVD market is driven by the rising prevalence of chronic & infectious diseases, IVD market players’ increasing investments in Africa, the growing demand for Point-of-care (POC) & rapid diagnostics, the rising geriatric population, government initiatives supporting Africa's healthcare sector, rising healthcare expenditure, and increasing R&D expenditure.

Moreover, increasing awareness regarding the importance of early diagnosis, advances in genomics & proteomics, and the increasing adoption of personalized medicine are expected to generate growth opportunities for the players operating in the Africa IVD market.

The key players operating in the Africa IVD market are Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), bioMérieux SA (France), Danaher Corporation (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), QIAGEN N.V. (Netherlands), Siemens Healthineers AG (Germany), Thermo Fisher Scientific Inc. (U.S.), Bio-Rad Laboratories, Inc., (U.S.), Illumina, Inc. (U.S.), and Shenzhen Mindray Bio-Medical Electronics Co., Ltd (China).

South Africa is projected to offer significant growth opportunities for the vendors in this market due to growing healthcare expenditure, growing availability due to partnerships & collaborations between diagnostic test providers & distributors, favorable government initiatives, and growing healthcare infrastructure & access in South Africa.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions For the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Government Initiatives Supporting Africa’s Healthcare Sector

4.2.1.2. Rising Prevalence of Chronic & Infectious Diseases

4.2.1.3. IVD Market Players’ Increasing Investments in Africa

4.2.2. Restraints

4.2.2.1. High Prices of Advanced IVD Products

4.2.3. Opportunities

4.2.3.1. Increasing Awareness Regarding the Importance of Early Diagnosis

4.2.4. Challenges

4.2.4.1. Uneven Access to Healthcare

4.2.4.2. Shortage of Trained Healthcare Professionals

4.2.5. Regulatory Analysis

4.2.5.1. Regulation of In Vitro Diagnostics

4.2.5.2. Harmonization of Regulations for Diagnostic Devices

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Buyers

4.3.2. Bargaining Power of Suppliers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Pricing Analysis

5. Africa IVD Market Assessment – by Offering

5.1. Overview

5.2. Reagents & Kits

5.3. Instruments

5.4. Software & Services

6. Africa IVD Market Assessment – by Technology

6.1. Overview

6.2. Immunoassay/Immunochemistry

6.3. Molecular Diagnostics

6.4. Point-Of-Care Diagnostics

6.5. Biochemistry/Clinical Chemistry

6.6. Whole Blood Glucose Monitoring

6.7. Hematology

6.8. Microbiology

6.9. Coagulation & Hemostasis

6.10. Other IVD Technologies

7. Africa IVD Market Assessment—by Application

7.1. Overview

7.2. Infectious Diseases

7.3. Oncology

7.4. Cardiology

7.5. Diabetes

7.6. Nephrology

7.7. Autoimmune Disorders

7.8. Other Applications

8. Africa IVD Market Assessment– by Diagnostic Approach

8.1. Overview

8.2. Laboratory Testing

8.3. OTC/Self-Testing

8.4. Point-Of-Care Testing

9. Africa IVD Market Assessment — by End User

9.1. Overview

9.2. Hospitals & Clinics

9.3. Diagnostic Laboratories

9.4. Home Healthcare

9.5. Other End Users

10. Africa IVD Market Assessment—by Geography

10.1. Overview

10.2. South Africa

10.3. Egypt

10.4. Algeria

10.5. Nigeria

10.6. Morocco

10.7. Kenya

10.8. Tunisia

10.9. Côte D’Ivoire

10.10. Tanzania

10.11. Cameroon

10.12. Rest of Africa

11. Competition Analysis

11.1. Introduction

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Emerging Companies

11.5. Major IVD Distributors in Africa, by Country

11.5.1. IVD Distributors In South Africa

11.5.2. IVD Distributors in Egypt

11.5.3. IVD Distributors in Algeria

11.5.4. IVD Distributors in Nigeria

11.5.5. IVD Distributors in Morocco

11.5.6. IVD Distributors in Kenya

11.5.7. IVD Distributors in Tunisia

11.5.8. IVD Distributors in Tanzania

11.5.9. IVD Distributors in Rest of Africa

11.6. Market Share Analysis (2023)

12. Company Profiles

12.1. F. Hoffmann-La Roche Ltd.

12.2. Abbott Laboratories

12.3. Danaher Corporation

12.4. Becton, Dickinson and Company

12.5. Biomérieux SA

12.6. Siemens Healthineers AG (A Subsidiary of Siemens AG)

12.7. Qiagen N.V.

12.8. Thermo Fisher Scientific, Inc.

12.9. Bio-Rad Laboratories, Inc.

12.10. Illumina, Inc.

12.11. Shenzhen Mindray Bio-Medical Electronics Co., Ltd

13. Appendix

13.1. Available Customization

List of Tables

Table 1 Africa: Rural Population as A Percentage of The Total Population, by Country, 2022

Table 2 Risk Classification Categories For In Vitro Diagnostic Products

Table 3 Regulation of In Vitro Diagnostics in Africa

Table 4 Examples of IVD Classification Among GHTF Founding Members

Table 5 Africa IVD Market, by Offering, 2022–2031 (USD Million)

Table 6 Africa IVD Reagents & Kits Market, by Country/Region, 2022–2031 (USD Million)

Table 7 Africa IVD Instruments Market, by Country/Region, 2022–2031 (USD Million)

Table 8 Africa IVD Software & Services Market, by Country/Region, 2022–2031 (USD Million)

Table 9 Africa IVD Market, by Technology, 2022–2031 (USD Million)

Table 10 Africa IVD Market for Immunoassay/Immunochemistry, by Country/Region, 2022–2031 (USD Million)

Table 11 Africa IVD Market for Molecular Diagnostics, by Country/Region, 2022–2031 (USD Million)

Table 12 Africa IVD Market for Point-Of-Care Diagnostics, by Country/Region, 2022–2031 (USD Million)

Table 13 Africa IVD Market for Biochemistry/Clinical Chemistry, by Country/Region, 2022–2031 (USD Million)

Table 14 Africa Whole Blood Glucose Monitoring Market Share Analysis (2023)

Table 15 Africa IVD Market for Whole Blood Glucose Monitoring, by Country/Region, 2022–2031 (USD Million)

Table 16 Africa IVD Market for Hematology, by Country/Region, 2022–2031 (USD Million)

Table 17 Africa Microbiology Market Share Analysis (2023)

Table 18 Africa IVD Market for Microbiology, by Country/Region, 2022–2031(USD Million)

Table 19 Africa Coagulation & Hemostasis Market Share Analysis (2023)

Table 20 Africa IVD Market for Coagulation & Hemostasis, by Country/Region, 2022–2031 (USD Million)

Table 21 Africa IVD Market for Other IVD Technologies, by Country/Region, 2022–2031 (USD Million)

Table 22 Africa IVD Market, by Application, 2022–2031 (USD Million)

Table 23 Africa IVD Market for Infectious Diseases, by Country/Region, 2022–2031 (USD Million)

Table 24 Africa: Cancer Burden, by Country, 2022 Vs. 2030

Table 25 Africa IVD Market for Oncology, by Country/Region, 2022–2031 (USD Million)

Table 26 Africa IVD Market for Cardiology, by Country/Region, 2022–2031 (USD Million)

Table 27 Africa: Diabetes Cases, by Country (2021 Vs. 2030)

Table 28 Africa IVD Market for Diabetes, by Country/Region, 2022–2031 (USD Million)

Table 29 Africa IVD Market for Nephrology, by Country/Region, 2022–2031 (USD Million)

Table 30 Africa IVD Market for Autoimmune Disorders, by Country/Region, 2022–2031 (USD Million)

Table 31 Africa IVD Market for Other Applications, by Country/Region, 2022–2031 (USD Million)

Table 32 Africa IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 33 Africa IVD Market for Laboratory Testing, by Country/Region, 2022–2031 (USD Million)

Table 34 Africa IVD Market For OTC/Self-Testing, by Country/Region, 2022–2031 (USD Million)

Table 35 Africa IVD Market for Point-Of-Care Testing, by Country/Region, 2022–2031 (USD Million)

Table 36 Africa In Vitro Diagnostics Market, by End User, 2022–2031 (USD Million)

Table 37 Africa In Vitro Diagnostics Market for Hospitals & Clinics, by Country/Region, 2022-2031 (USD Million)

Table 38 Africa In Vitro Diagnostics Market for Diagnostic Laboratories, By Country/Region, 2022-2031 (USD Million)

Table 39 Africa In Vitro Diagnostics Market for Home Healthcare, by Country/Region, 2022-2031 (USD Million)

Table 40 Africa In Vitro Diagnostics Market for Other End Users, by Country/Region, 2022-2031 (USD Million)

Table 41 Africa: HIV And AIDS Statistics (2021)

Table 42 Health Expenditure (% of GDP), 2018–2021

Table 43 Africa: Social and Economic Indicators, by Country

Table 44 Africa IVD Market, by Country/Region, 2022–2031 (USD Million)

Table 45 South Africa: IVD Market, by Offering, 2022–2031 (USD Million)

Table 46 South Africa: IVD Market, by Technology, 2022–2031 (USD Million)

Table 47 South Africa: IVD Market, by Application, 2022–2031 (USD Million)

Table 48 South Africa: IVD Market, by Diagnostic Approach, 2021–2030 (USD Million)

Table 49 South Africa: IVD Market, by End User, 2022–2031 (USD Million)

Table 50 Egypt: IVD Market, by Offering, 2022–2031 (USD Million)

Table 51 Egypt: IVD Market, by Technology, 2022–2031 (USD Million)

Table 52 Egypt: IVD Market, by Application, 2022–2031 (USD Million)

Table 53 Egypt: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 54 Egypt: IVD Market, by End User, 2022–2031 (USD Million)

Table 55 Algeria: IVD Market, by Offering, 2022–2031 (USD Million)

Table 56 Algeria: IVD Market, by Technology, 2022–2031 (USD Million)

Table 57 Algeria: IVD Market, by Application, 2022–2031 (USD Million)

Table 58 Algeria: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 59 Algeria: IVD Market, by End User, 2022–2031 (USD Million)

Table 60 Nigeria: IVD Market, by Offering, 2022–2031 (USD Million)

Table 61 Nigeria: IVD Market, by Technology, 2022–2031 (USD Million)

Table 62 Nigeria: IVD Market, by Application, 2022–2031 (USD Million)

Table 63 Nigeria: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 64 Nigeria: IVD Market, by End User, 2022–2031 (USD Million)

Table 65 Morocco: IVD Market, by Offering, 2022–2031 (USD Million)

Table 66 Morocco: IVD Market, by Technology, 2022–2031 (USD Million)

Table 67 Morocco: IVD Market, by Application, 2022–2031 (USD Million)

Table 68 Morocco: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 69 Morocco: IVD Market, by End User, 2022–2031 (USD Million)

Table 70 Kenya: IVD Market, by Offering, 2022–2031 (USD Million)

Table 71 Kenya: IVD Market, by Technology, 2022–2031 (USD Million)

Table 72 Kenya: IVD Market, by Application, 2022–2031 (USD Million)

Table 73 Kenya: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 74 Kenya: IVD Market, by End User, 2022–2031 (USD Million)

Table 75 Tunisia: IVD Market, by Offering, 2022–2031 (USD Million)

Table 76 Tunisia: IVD Market, by Technology, 2022–2031 (USD Million)

Table 77 Tunisia: IVD Market, by Application, 2022–2031 (USD Million)

Table 78 Tunisia: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 79 Tunisia: IVD Market, by End User, 2022–2031 (USD Million)

Table 80 Côte D’Ivoire: IVD Market, by Offering, 2022–2031 (USD Million)

Table 81 Côte D’Ivoire: IVD Market, by Technology, 2022–2031 (USD Million)

Table 82 Côte D’Ivoire: IVD Market, by Application, 2022–2031 (USD Million)

Table 83 Côte D’Ivoire: IVD Market, by Diagnostic Approach, 2021–2030 (USD Million)

Table 84 Côte D’Ivoire: IVD Market, by End User, 2022–2031 (USD Million)

Table 85 Tanzania: IVD Market, by Offering, 2022–2031 (USD Million)

Table 86 Tanzania: IVD Market, by Technology, 2022–2031 (USD Million)

Table 87 Tanzania: IVD Market, by Application, 2022–2031 (USD Million)

Table 88 Tanzania: IVD Market, by Diagnostic Approach, 2022–2031 (USD Million)

Table 89 Tanzania: IVD Market, by End User, 2022–2031 (USD Million)

Table 90 Cameroon: IVD Market, by Offering, 2022–2031 (USD Million)

Table 91 Cameroon: IVD Market, by Technology, 2022–2031 (USD Million)

Table 92 Cameroon: IVD Market, by Application, 2022–2031 (USD Million)

Table 93 Cameroon: IVD Market, by Diagnostic Approach, 2021–2030 (USD Million)

Table 94 Cameroon: IVD Market, by End User, 2022–2031 (USD Million)

Table 95 Prevalence of Diseases in The Rest of Africa

Table 96 Rest of Africa: IVD Market, by Offering, 2022–2031 (USD Million)

Table 97 Rest of Africa: IVD Market, by Technology, 2022–2031 (USD Million)

Table 98 Rest of Africa: IVD Market, by Application, 2022–2031 (USD Million)

Table 99 Rest of Africa: IVD Market, by Diagnostic Approach, 2021–2030 (USD Million)

Table 100 Rest of Africa: IVD Market, by End User, 2022–2031 (USD Million)

Table 101 Recent Developments, by Company, 2020–2024

Table 102 List of IVD Distributors In South Africa

Table 103 List of IVD Distributors in Egypt

Table 104 List of IVD Distributors in Algeria

Table 105 List of IVD Distributors in Nigeria

Table 106 List of IVD Distributors in Morocco

Table 107 List of IVD Distributors in Kenya

Table 108 List of IVD Distributors in Tunisia

Table 109 List of IVD Distributors in Tanzania

Table 110 List of IVD Distributors in the Rest of Africa

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Size Estimation

Figure 7 Africa IVD Market, by Offering, 2024 Vs. 2031 (USD Million)

Figure 8 Africa IVD Market, by Technology, 2024 Vs. 2031 (USD Million)

Figure 9 Africa IVD Market, by Application, 2024 Vs. 2031 (USD Million)

Figure 10 Africa IVD Market, by Diagnostic Approach, 2024 Vs. 2031 (USD Million)

Figure 11 Africa IVD Market, by End User, 2024 Vs. 2031 (USD Million)

Figure 12 Africa IVD Market, by Country/Region, 2024 Vs. 2031 (USD Million)

Figure 13 Africa IVD Market: Impact Analysis of Market Dynamics

Figure 14 Porter’s Five Forces Analysis

Figure 15 Africa IVD Market, by Offering, 2024 Vs. 2031 (USD Million)

Figure 16 Africa IVD Market, by Technology, 2024 Vs. 2031 (USD Million)

Figure 17 Africa Immunoassay/Immunochemistry Market Share Analysis (2023)

Figure 18 Africa Molecular Diagnostics Market Share Analysis (2023)

Figure 19 Africa PoC Testing Market Share Analysis (2023)

Figure 20 Africa Biochemistry/Clinical Chemistry Market Share Analysis (2023)

Figure 21 Africa Hematology Market Share Analysis (2023)

Figure 22 Africa: Adult Population (20–79 Years) With Diabetes, 2021-2045 (In Million)

Figure 23 Africa IVD Market, by Application, 2024 Vs. 2031 (USD Million)

Figure 24 Number of HIV Cases & HIV/Aids Deaths in Africa (2021)

Figure 25 Africa IVD Market, by Diagnostic Approach, 2024 Vs. 2031 (USD Million)

Figure 26 Africa In Vitro Diagnostics Market, by End User, 2024 Vs. 2031 (USD Million)

Figure 27 Africa: Number of People (Aged 20–79 Years) With Diabetes (In Millions), 2021–2045

Figure 28 Africa IVD Market, Snapshot

Figure 29 South Africa: Number of People (All Ages) Living with HIV (2010–2020) (In Millions)

Figure 30 South Africa: Number of People with Diabetes (In Thousands), 2000–2045

Figure 31 Algeria: Population Aged 65 And Above (2017–2022)

Figure 32 Algeria: People Aged 20-79 Years Who Has Diabetes (2011–2045) (In Thousands)

Figure 33 Nigeria: Number of PMI-Supported Health Facilities (2016–2020)

Figure 34 Morocco: Number of New Cancer Cases: 2020-2030

Figure 35 Share of People Living in Urban Areas: 2015–2020

Figure 36 Public Expenditure on Healthcare as Percent of Total Healthcare Expenditure: 2015–2021

Figure 37 Tanzania: Number of People with HIV (2010–2020) (In Millions)

Figure 38 Tanzania: Number of Adults (20–79 Years) With Diabetes (2011–2045)

Figure 39 Malaria Cases Reported in Senegal (2019-2021)

Figure 40 Key Growth Strategies Adopted by Leading Players, 2021–2024

Figure 41 Africa IVD Market: Competitive Benchmarking, by Offering

Figure 42 Africa IVD Market: Competitive Benchmarking, by Country

Figure 43 Competitive Dashboard: Africa IVD Market

Figure 44 Africa IVD Market Share Analysis (2023)

Figure 45 F. Hoffmann-La Roche Ltd.: Financial Overview (2023)

Figure 46 Abbott Laboratories: Financial Overview (2023)

Figure 47 Danaher Corporation: Financial Overview (2023)

Figure 48 Becton, Dickinson and Company: Financial Overview (2023)

Figure 49 Biomérieux SA: Financial Overview (2023)

Figure 50 Siemens Healthineers AG: Financial Overview (2023)

Figure 51 Qiagen N.V.: Financial Overview (2023)

Figure 52 Thermo Fisher Scientific, Inc.: Financial Overview (2023)

Figure 53 Bio-Rad Laboratories, Inc.: Financial Overview (2023)

Figure 54 Illumina, Inc.: Financial Overview (2023)

Figure 55 Shenzhen Mindray Bio-Medical Electronics Co., Ltd: Financial Overview (2022)

Published Date: Jun-2025

Published Date: Apr-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates