Resources

About Us

Transcriptomics Market by Product & Services (Consumables, Instruments, Software & Services), Technology (Next-Generation Sequencing, PCR-based Technologies), Application (Drug Discovery & Development, Clinical Diagnostic), and End User - Global Forecast to 2035

Report ID: MRHC - 1041636 Pages: 357 Dec-2025 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportTranscriptomics Market Size & Forecast

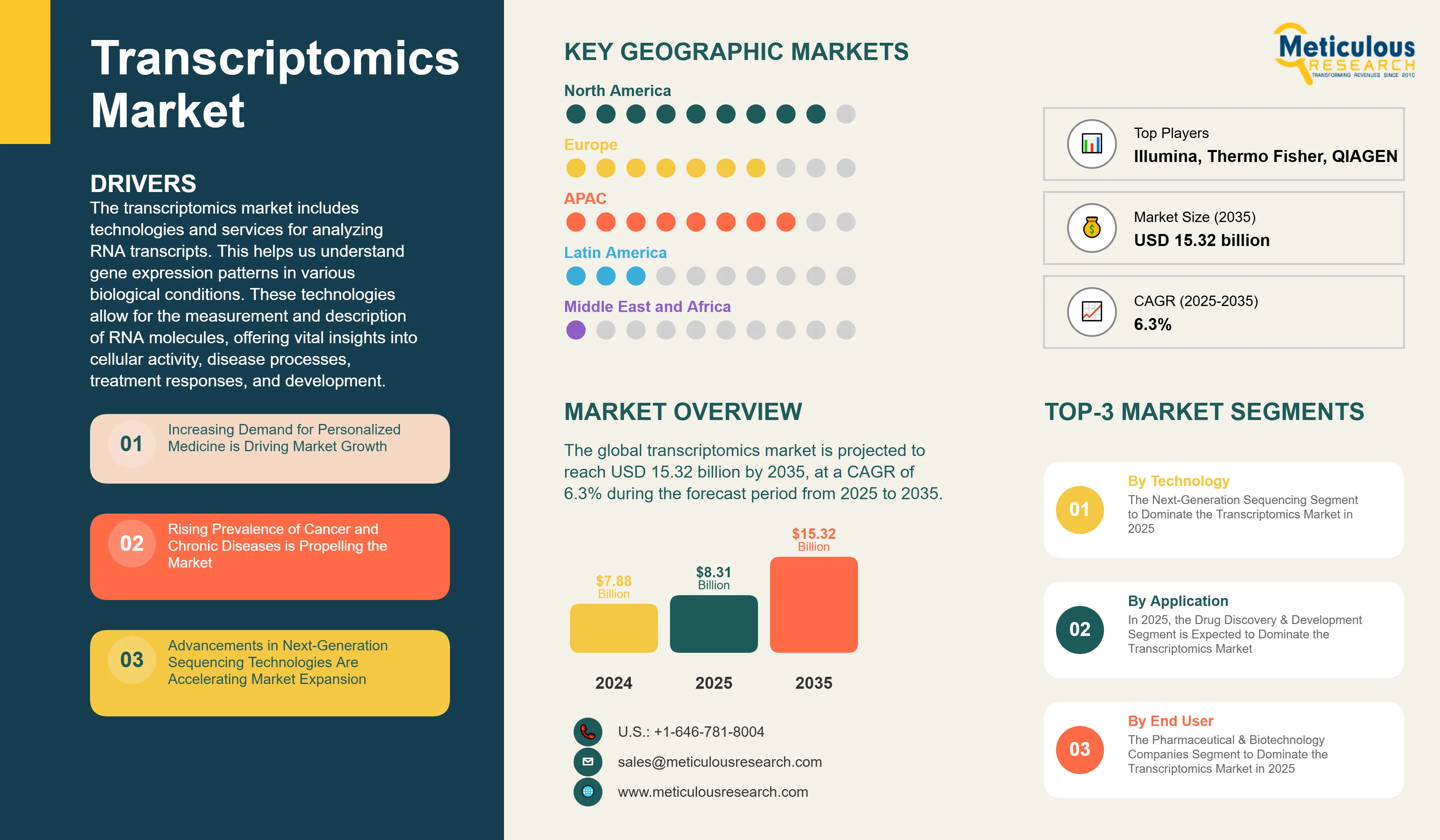

The global transcriptomics market was valued at USD 7.88 billion in 2024. This market is projected to reach USD 15.32 billion by 2035 from an estimated USD 8.31 billion in 2025, at a CAGR of 6.3% during the forecast period from 2025 to 2035.

The transcriptomics market includes technologies and services for analyzing RNA transcripts. This helps us understand gene expression patterns in various biological conditions. These technologies allow for the measurement and description of RNA molecules, offering vital insights into cellular activity, disease processes, treatment responses, and development.

Key factors driving this market include rapid improvements in next-generation sequencing (NGS) technologies, a growing demand for personalized medicine, an increase in cancer and chronic diseases, and more uses in drug discovery and development. As sequencing costs decrease and accuracy and throughput improve, transcriptomic analysis has become more available to research institutions and clinical labs. Moreover, the integration of single-cell and spatial transcriptomics workflows, the rise of multi-omics projects, and more government funding for genomics research are speeding up market growth.

The rise of clinical transcriptomics, particularly RNA-based diagnostics for cancer, infectious diseases, and genetic disorders, is creating new opportunities. Pharmaceutical and biotechnology companies are increasingly using transcriptome-driven insights in early-stage research and development to speed up treatment development, enhance candidate selection, and enable biomarker-driven patient grouping.

With the growing focus on precision medicine, AI-based data analysis, and spatial transcriptomics applications, the transcriptomics market is set to grow significantly. This growth is driven by the need for molecular characterization, treatment improvement, and personalized healthcare solutions in a complex disease landscape.

Key Findings

Click here to: Get Free Sample Pages of this Report

Increasing Demand for Personalized Medicine

The growing demand for personalized medicine is reshaping the transcriptomics market. It is driving a shift toward treatment plans that focus on specific patients based on their molecular profiles. Personalized medicine aims to adjust medical care to match each patient’s unique traits. Transcriptomics is vital in this process, as it provides insights into how gene expression patterns differ among individuals. The Personalized Medicine Coalition reports that there are over 300 FDA-approved personalized medicines available today across various therapeutic areas, such as oncology, cardiovascular diseases, and infectious diseases. Transcriptomic analysis helps clinicians identify specific gene expression patterns linked to disease subtypes, treatment responses, and patient outcomes. This information assists in choosing the most suitable treatments. In oncology, transcriptomic profiling sorts tumors into molecular subtypes, predicts how they will respond to treatment, and finds potential therapeutic targets. Analyzing RNA expression patterns enables more accurate diagnosis and better treatment choices, improving patient outcomes and lowering healthcare costs related to ineffective treatments.

The use of transcriptomics in clinical decision-making is increasing rapidly. Healthcare providers are adopting transcriptomic tests more frequently for cancer diagnosis, prognosis, and treatment choices. Several diagnostic tests based on transcriptomics have gained clinical approval, such as gene expression panels for breast cancer prognosis and lung cancer diagnosis. These tests allow oncologists to make informed decisions about treatment intensity and drug selection based on the specific characteristics of each tumor. The rising adoption of personalized medicine and the expanding use of transcriptomics are driving the demand for transcriptomic technologies and services, fueling market growth.

Rising Prevalence of Cancer and Chronic Diseases

The increasing global incidence of cancer and chronic diseases is significantly driving growth in the transcriptomics market. Cancer is one of the top causes of death worldwide, and transcriptomic analysis has become a crucial tool in cancer research, diagnosis, and treatment. The World Health Organization reports that cancer causes nearly 10 million deaths each year, with the global cancer burden expected to reach about 28.4 million new cases by 2040.

Transcriptomic technologies are widely used in cancer research. They help researchers understand tumor biology, identify biomarkers, and create targeted therapies. RNA sequencing allows scientists to analyze changes in gene expression in cancer cells, highlight driver mutations, and find new therapeutic targets. This technology proves especially useful for examining tumor diversity, grasping treatment resistance, and tracking disease progression.

In addition to cancer, transcriptomics is finding more applications in chronic diseases like cardiovascular diseases, diabetes, neurodegenerative disorders, and autoimmune conditions. The CDC states that chronic diseases account for 7 in 10 deaths in the U.S., with around 60% of adults living with at least one chronic disease. Transcriptomic analysis aids researchers in understanding the molecular mechanisms behind these conditions and finding potential treatment options.

The rising disease burden is leading to greater investment in transcriptomic research and the use of transcriptomic technologies in clinical labs. Pharmaceutical companies rely heavily on transcriptomics in drug development to identify disease biomarkers, confirm therapeutic targets, and evaluate drug effectiveness. The growing rates of cancer and chronic diseases, along with an increasing recognition of transcriptomics as a valuable tool for understanding these illnesses and developing treatments, are driving market growth.

Transcriptomics Market Opportunity

Integration of Artificial Intelligence and Machine Learning in Data Analysis

The integration of artificial intelligence and machine learning technologies into transcriptomic data analysis offers a significant opportunity for market growth. These computational methods tackle key challenges in transcriptomic analysis. They improve accuracy, help discover complex patterns, and speed up the translation of transcriptomic research into clinical applications.

Transcriptomic studies produce large amounts of complex data, with subtle patterns and relationships that are hard to find using traditional statistical methods. AI and machine learning algorithms are effective at analyzing high-dimensional data, identifying patterns, and making predictions based on these complex datasets. Machine learning methods are applied in various aspects of transcriptomic analysis. They assist with quality control to spot low-quality samples and technical errors. They are also used for differential expression analysis to better identify genes with significant biological changes and for pathway analysis to enhance understanding of biological processes.

One especially promising use is utilizing machine learning for biomarker discovery and predictive modeling. Machine learning algorithms can sift through transcriptomic data from large patient groups to pinpoint gene expression signatures that forecast disease outcomes, treatment responses, or disease development risk. These predictive models can outperform traditional methods, especially for complex diseases that involve multiple genes and pathways.

Deep learning shows particular promise in transcriptomics. Deep neural networks can learn intricate representations of transcriptomic data, potentially capturing subtle patterns that simpler methods overlook. Researchers apply deep learning to predict gene expression from DNA sequences, identify regulatory elements, and classify cell types from single-cell transcriptomic data. The use of AI and machine learning also enables the analysis of multi-modal datasets that combine transcriptomics with other molecular data, clinical information, and imaging data.

Several companies are developing AI-powered bioinformatics platforms specifically for transcriptomic analysis. These platforms offer automated workflows, sophisticated analytics, and user-friendly interfaces that make advanced machine learning techniques available to researchers who lack extensive computational skills. The pharmaceutical industry is especially keen on AI and machine learning applications for transcriptomics to speed up drug discovery by identifying therapeutic targets, predicting drug responses, and stratifying patients for clinical trials.

Transcriptomics Market Analysis: Top Market Opportunities

By Product & Services: The Consumables Segment to Dominate the Transcriptomics Market in 2025

Based on product & services, the transcriptomics market is segmented into consumables, instruments, and software & services. In 2025, the consumables segment is expected to account for the largest share of ~51% of the transcriptomics market. The large share of this segment is attributed to the recurring and high-volume nature of consumable usage across RNA-based workflows. Transcriptomic studies—whether bulk RNA-seq, single-cell RNA sequencing, spatial transcriptomics, or PCR-based assays—require continuous consumption of reagents, RNA extraction kits, library preparation kits, sequencing reagents, and PCR consumables. Unlike instruments, which involve one-time capital investment, consumables generate repeat purchases for every sample processed, making them a key revenue driver for vendors.

The rising adoption of NGS-based RNA-seq, single-cell transcriptomics, and high-throughput sequencing is significantly increasing reagent consumption per experiment. Additionally, advancements in library preparation chemistries, automation-compatible reagent kits, and specialized consumables for low-input and single-cell samples are expanding usage across both research and clinical settings.

Moreover, this segment is also poised to record a higher CAGR of 7.2% during the forecast period of 2025–2035, driven by the growth of sequencing service providers and decentralized transcriptomics testing, further accelerating consumable demand.

By Technology: The Next-Generation Sequencing Segment to Dominate the Transcriptomics Market in 2025

Based on technology, the transcriptomics market is segmented into next-generation sequencing (NGS), microarrays, PCR-based technologies, and other technologies. In 2025, the next-generation sequencing segment is expected to account for the largest share of ~71% of the transcriptomics market. The large share of this segment is attributed to the comprehensive transcriptome coverage provided by NGS technologies, continuous decline in sequencing costs making NGS accessible to more laboratories, superior ability to detect novel transcripts and splice variants compared to other technologies, and growing adoption of single-cell and spatial transcriptomics applications exclusively enabled by sequencing approaches.

Moreover, the next-generation sequencing segment is also expected to register the highest CAGR of 7.3% during the forecast period. The rapid growth is driven by technological innovations improving sequencing accuracy and throughput, expanding applications in precision medicine and clinical diagnostics, increasing investments in genomics infrastructure by pharmaceutical and biotechnology companies, and growing preference for hypothesis-free discovery approaches enabled by comprehensive sequencing.

By Application: In 2025, the Drug Discovery & Development Segment to Dominate the Transcriptomics Market

Based on application, the transcriptomics market is segmented into drug discovery & development, clinical diagnostics, personalized medicine, agricultural & animal research, and other applications. In 2025, the drug discovery & development segment is expected to account for the largest share of ~35% of the transcriptomics market. The large share is attributed to extensive use of transcriptomics throughout pharmaceutical development pipelines, growing investments in biologics and precision medicine requiring molecular characterization, increasing adoption of target-based drug discovery approaches, and expanding applications in biomarker discovery for patient stratification.

However, the personalized medicine segment is expected to register the highest CAGR of 8.0% during the forecast period. The rapid growth is driven by increasing need for precise, patient-specific insights beyond traditional genetic testing. Transcriptomic profiling enables real-time measurement of gene expression, helping clinicians understand disease pathways, drug response, and treatment resistance at individual levels. The rapid adoption of RNA-based biomarkers in oncology, immunology, and rare diseases is accelerating demand for RNA-seq and single-cell transcriptomic tools. As healthcare systems integrate precision medicine programs, transcriptomics is becoming essential for guiding targeted therapies, monitoring therapeutic efficacy, and enabling truly individualized clinical decision-making.

By End User: The Pharmaceutical & Biotechnology Companies Segment to Dominate the Transcriptomics Market in 2025

Based on end user, the transcriptomics market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, clinical diagnostic laboratories, contract research organizations (CROs), and other end users. In 2025, the pharmaceutical & biotechnology companies segment is expected to account for the largest share of ~40% of the transcriptomics market. The large share is attributed to extensive use of transcriptomics throughout drug discovery and development pipelines, growing investments in precision medicine initiatives requiring molecular profiling, increasing adoption of transcriptomics in clinical trials for patient stratification, and ongoing development of RNA-based therapeutics necessitating comprehensive transcriptomic characterization.

Along with pharmaceutical & biotechnology companies, the contract research organizations (CROs) segment is also expected to register the highest CAGR of 7.1% during the forecast period, as pharmaceutical, biotechnology, and academic institutions increasingly outsource RNA-seq, single-cell sequencing, spatial transcriptomics, and data analysis to specialized service providers. The complexity, high cost, and technical expertise required for advanced transcriptomic workflows make outsourcing an attractive option for organizations seeking speed, scalability, and cost efficiency. CROs offer end-to-end solutions—from sample preparation and sequencing to bioinformatics interpretation—enabling faster drug discovery, biomarker identification, and translational research.

Geographical Analysis

North America Dominates the Transcriptomics Market in 2025

Based on geography, the global transcriptomics market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of ~40% of the global transcriptomics market. The large market share of North America is attributed to the strong presence of leading biotechnology and pharmaceutical companies, well-established genomics research infrastructure, high adoption of advanced sequencing technologies, substantial government and private funding for genomics research, and early adoption of transcriptomic diagnostics in clinical practice. The region benefits from major research institutions, comprehensive healthcare systems, and significant investments from the National Institutes of Health and private funding organizations in genomics and precision medicine initiatives.

However, Asia-Pacific is expected to register the highest CAGR during the forecast period. The rapid growth is driven by increasing investments in genomics research infrastructure, growing pharmaceutical and biotechnology sectors in countries like China and India, rising healthcare expenditure and improving access to advanced diagnostics, expanding academic research collaborations with Western institutions, and government initiatives supporting precision medicine and genomics programs. Countries such as China have made substantial investments in genomics infrastructure and launched large-scale population genomics programs, positioning the region as a rapidly growing market for transcriptomic technologies.

Key Companies

Major companies in the global transcriptomics market have implemented various strategies to expand their product offerings and augment their market shares. The key strategies followed by most companies include product launches and enhancements, collaborations, partnerships, agreements, and others (funding, mergers, and expansion). Product launches and enhancements accounted for a major share of strategic developments from key players between 2023 and 2025, followed by partnerships, agreements, and collaborations.

Some of the prominent players operating in the global transcriptomics market include Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), QIAGEN N.V. (Netherlands), Bio-Rad Laboratories, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), 10x Genomics, Inc. (U.S.), Takara Bio Inc. (Japan), Oxford Nanopore Technologies Ltd. (U.K.), Pacific Biosciences of California, Inc. (U.S.), Merck KGaA (Germany), Bruker Corporation (U.S.), PerkinElmer, Inc. (U.S.), Fluidigm Corporation (U.S.), and Promega Corporation (U.S.).

Transcriptomics Market Industry Overview: Latest Developments from Key Industry Players

|

Particulars |

Details |

|

Number of Pages |

357 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.3% |

|

Market Size (Value) in 2025 |

USD 8.31 Billion |

|

Market Size (Value) in 2035 |

USD 15.32 Billion |

|

Segments Covered |

By Product & Services

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, South Africa, UAE) |

|

Key Companies |

Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), QIAGEN N.V. (Netherlands), Bio-Rad Laboratories, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), 10x Genomics, Inc. (U.S.), Takara Bio Inc. (Japan), Oxford Nanopore Technologies Ltd. (U.K.), Pacific Biosciences of California, Inc. (U.S.), Merck KGaA (Germany), Bruker Corporation (U.S.), PerkinElmer, Inc. (U.S.), Fluidigm Corporation (U.S.), and Promega Corporation (U.S.). |

The global transcriptomics market size is projected to reach USD 8.31 billion in 2025.

The market is projected to grow from USD 8.31 billion in 2025 to USD 15.32 billion by 2035, at a CAGR of 6.3%.

The transcriptomics market analysis indicates substantial growth, with projections indicating the market will reach USD 15.31 billion by 2035, at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2035.

The key companies operating in this market include Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), QIAGEN N.V. (Netherlands), Bio-Rad Laboratories, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), 10x Genomics, Inc. (U.S.), Takara Bio Inc. (Japan), Oxford Nanopore Technologies Ltd. (U.K.), Pacific Biosciences of California, Inc. (U.S.), Merck KGaA (Germany), Bruker Corporation (U.S.), PerkinElmer, Inc. (U.S.), Fluidigm Corporation (U.S.), and Promega Corporation (U.S.).

Single-cell transcriptomics revolutionizing biological research, long-read sequencing technologies enhancing transcriptome characterization, and integration of AI and machine learning in data analysis are prominent trends in the transcriptomics market.

By product & services, the consumables segment is forecasted to hold the largest market share during 2025-2035; by technology, the next-generation sequencing segment is expected to dominate the market during 2025-2035; by application, the drug discovery & development segment is expected to hold the largest share during 2025-2035; by end user, the pharmaceutical & biotechnology companies segment is expected to dominate during 2025-2035; and by geography, North America is expected to hold the largest share of the market during 2025-2035.

By region, North America is expected to hold the largest share of the transcriptomics market in 2025. The large share is attributed to the strong presence of leading biotechnology and pharmaceutical companies, well-established genomics research infrastructure, high adoption of advanced sequencing technologies, substantial government and private funding for genomics research, and early adoption of transcriptomic diagnostics in clinical practice. However, Asia-Pacific is expected to register the highest growth rate during the forecast period, driven by increasing investments in genomics research infrastructure and growing pharmaceutical and biotechnology sectors in countries like China and India.

Key drivers include increasing demand for personalized medicine, rising prevalence of cancer and chronic diseases, advancements in next-generation sequencing technologies, growing applications in drug discovery and development, and increasing government funding and investments in genomics research. These factors are collectively driving the adoption of transcriptomic technologies across research and clinical applications.

Published Date: Jan-2024

Published Date: Jan-2024

Published Date: Jan-2026

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates