Resources

About Us

Marine HVAC Systems Market Size, Share & Forecast (2025–2035): Global Trends, Energy Efficiency, Vessel Modernization & Regional Outlook

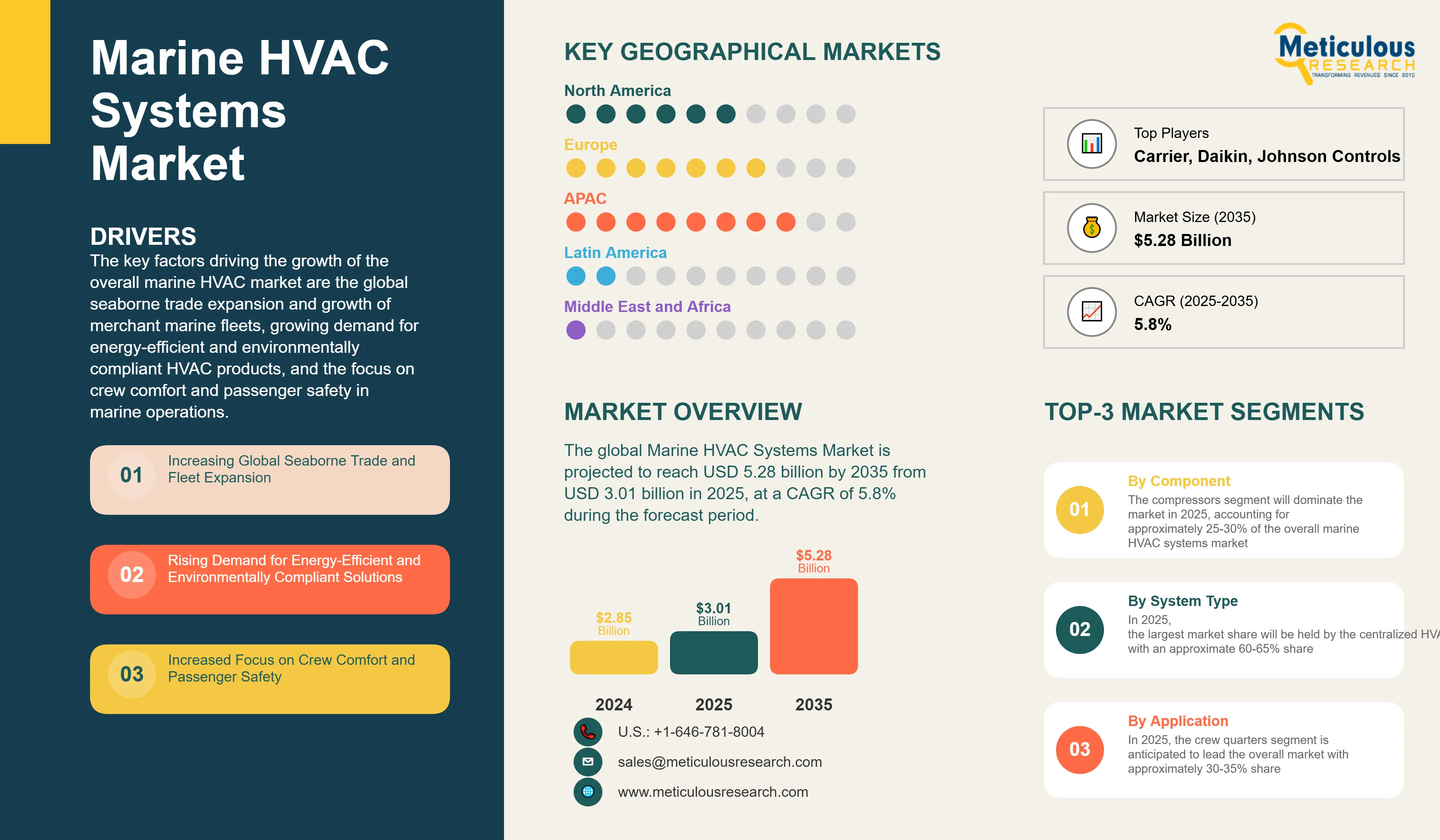

Report ID: MREP - 1041536 Pages: 285 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe key factors driving the growth of the overall marine HVAC market are the global seaborne trade expansion and growth of merchant marine fleets, growing demand for energy-efficient and environmentally compliant HVAC products, and the focus on crew comfort and passenger safety in marine operations. Additionally, enforcement of tight international maritime policies for emissions control and energy efficiency have spurred the market's growth. Further, the modernization of aging fleets of vessels and growth in offshore renewable energy projects are fueling demand for advanced marine HVAC technologies.

However, high upfront installation costs and demanding integration requirements could discourage some shipowners, especially for retrofit purposes. Also, the cyclic nature of the shipping business and volatility of freight rates introduce uncertainty into capital expenditure projects. Technical difficulty in designing HVAC systems to withstand extreme marine environments, such as salt corrosion and space limitations, presents engineering challenges, while keeping up with changing international maritime regulations entails ongoing technology refreshes.

In spite of these challenges, the market holds significant untapped potential. The surge in cruise travel and luxury yacht markets offers high-end opportunities for sophisticated climate control technologies. Offshore wind farms and floating production platforms expansion bring with them demand for custom HVAC systems adapted to the harsh marine environments. There is also increased demand for incorporating renewable energy resources and heat recovery systems to enhance overall vessel energy efficiency.

The new trends in smart ship technology and predictive maintenance through IoT are transforming the market scenario. There is increasing demand for light and compact HVAC designs to maximize vessel space efficiency, as well as technological developments in variable refrigerant flow (VRF) systems and magnetic bearings. Air purification and filtration systems are incorporated as a norm, while hybrid and electric propulsion ships are opening up opportunities for integrated energy management systems.

Following the trend of the wider industry, the emphasis on decarbonization and alternative fuels is driving demand for HVAC systems tailored to LNG, hydrogen, and ammonia-fueled ships. Suppliers are creating corrosion-resistant materials and using environmentally friendly manufacturing processes to address changing environmental requirements.

Market Drivers

Increasing Global Seaborne Trade and Fleet Expansion

Global seaborne trade is projected to grow at around 2.4%–3.4% per annum through 2030, based on forecasts from maritime trade analysts like UNCTAD and Clarkson Research. This growth is expected to support demand for new shipbuilding and fleet renewal, particularly expanding container shipping, bulk carrier, and specialized vessel fleets. Currently, the world’s merchant fleet comprises more than 98,000 ships, with approximately 2,500 to 3,000 new vessels delivered annually, fueling steady demand for marine HVAC systems across vessel types.

Advanced climate control systems are needed for modern ships to preserve cargo integrity, keep the crew safe, and meet international comfort levels. Increased container ship and bulk carrier size demands higher-powered and more efficient HVAC systems with greater capability to cool larger enclosed spaces while conserving energy.

The move towards larger, more fuel-efficient ships has added complexity to HVAC requirements, with systems having to deal with multiple climate zones, changing load conditions, and built-in air quality management. Such sophisticated systems usually cost 8-12% of overall shipbuilding expenditure but are essential for operational effectiveness and regulatory compliance.

Emerging trends in autonomous and semi-autonomous shipping also are driving demand for HVAC systems with more remote monitoring features and lower maintenance needs as human intervention becomes increasingly less feasible over longer journeys.

Rising Demand for Energy-Efficient and Environmentally Compliant Solutions

The IMO Energy Efficiency Design Index (EEDI) regulations and the future Carbon Intensity Indicator (CII) requirements are compelling shipowners to spend on energy-efficient HVAC technologies. In line with DNV GL's Maritime Forecast to 2050, ships constructed after 2025 need to be 30% more energy efficient than the 2008 baselines.

Heat recovery ventilation systems and variable frequency drive (VFD) technology are able to decrease HVAC energy usage by 25-40% when compared with traditional systems. The use of magnetic bearing chillers and heat pump technologies is being used as standard in new vessel designs to achieve efficiency targets and minimize maintenance needs.

Installation of the IMO sulfur cap regime has raised the focus on alternative fuels, and there is a demand for HVAC systems designed for LNG, methanol, and hydrogen-fueled ships. Alternative fuel systems have specialized ventilation and gas detection features, which are enhancing innovation in the design of marine HVAC.

Energy management systems that link HVAC controls to overall vessel power management are becoming necessary for meeting new efficiency regulations and optimizing operational expenses in a volatile fuel price environment.

Increased Focus on Crew Comfort and Passenger Safety

The Maritime Labour Convention (MLC) 2006 and related amendments set strict standards for crew accommodations such as temperature, air quality, and noise levels. These standards must be complied with for certification of the vessel and access to ports, and therefore competent HVAC systems are a regulatory requirement rather than a choice.

The post-COVID-19 recovery and growth of the cruise industry have increased interest in air quality control and ventilation systems with the ability to create healthy indoor spaces. HVAC systems in contemporary cruise ships need to support up to 6,000 passengers while still enjoying personal cabin climate control and optimizing energy usage.

Improved air filtration and purification technologies have become minimum requirements based on health and safety issues experienced during the pandemic. HEPA filtration and UV-C sterilization technology are becoming more integrated in marine HVAC designs to maintain air quality standards.

The expanding luxury yacht market, worth more than USD 8 billion each year, requires high-end HVAC solutions offering individual zone control, whispering silence operation, and integration with advanced vessel management systems.

Table: Key Factors Impacting Global Marine HVAC Systems Market (2025–2035)

Base CAGR: 5.8%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

||||

|

1. |

Increasing Global Seaborne Trade & Fleet Expansion |

Strong demand from new vessel construction |

Sustained growth as global trade expands |

▲ +0.5% |

|

2. |

Rising Demand for Energy-Efficient Solutions |

Gradual adoption driven by EEDI/CII regulations |

Accelerated by stricter efficiency mandates |

▲ +0.6% |

|

3. |

Growing Cruise Tourism & Passenger Vessel Market |

Recovery-driven retrofits and upgrades |

Expansion of global cruise capacity |

▲ +0.4% |

|

Restraints |

||||

|

1. |

High Initial Installation & Integration Costs |

Delays in retrofit projects; budget constraints |

Long-term barrier in cost-sensitive segments |

▼ −0.4% |

|

2. |

Cyclical Nature of Shipping Industry |

Volatile newbuild orders affect market demand |

Economic cycles impact long-term growth |

▼ −0.2% |

|

Opportunities |

||||

|

1. |

Offshore Wind & Renewable Energy Platforms |

Growing offshore infrastructure investments |

Major growth driver for specialized marine HVAC |

▲ +0.7% |

|

2. |

Smart Ship Technologies & IoT Integration |

Early adoption in premium vessel segments |

Standard across all vessel types by 2030+ |

▲ +0.7% |

|

Trends |

||||

|

1. |

Modular & Compact System Designs |

Space optimization becomes priority |

Standard design approach for new vessels |

▲ +0.4% |

|

2. |

Heat Recovery & Waste Heat Utilization |

Growing interest in energy optimization |

Essential for regulatory compliance |

▲ +0.4% |

|

Challenges |

||||

|

1. |

Compliance with Evolving IMO Regulations |

Increased development costs and complexity |

Ongoing challenge requiring continuous innovation |

▼ −0.2% |

|

2. |

Skilled Technician Shortage |

Installation and maintenance challenges |

Training programs and automation reduce impact |

~ Neutral |

Market Segmentation Analysis

By Component

By component, the marine HVAC systems market is segmented into compressors, condensers, evaporators, expansion valves, controls and sensors, ductwork and ventilation components, and others. The compressors segment will dominate the market in 2025, accounting for approximately 25-30% of the overall marine HVAC systems market. Compressors are dominant because they play a pivotal role in system performance, have a higher frequency of replacements, and technologically drive toward variable speed and magnetic bearing designs.

Conversely, the controls and sensors segment is likely to expand at the highest CAGR in the forecast period 2025-2035. The increasing use of smart ship technologies, expanding adoption of IoT-based monitoring systems, requirement for predictive maintenance functionality, and growing focus on energy optimization with advanced control techniques are key drivers for the expansion of this segment.

By System Type

On the basis of system type, the market for marine HVAC systems is categorized into centralized HVAC systems, decentralized HVAC systems, and hybrid HVAC systems. In 2025, the largest market share will be held by the centralized HVAC systems segment, with an approximate 60-65% share. This is primarily because of their cost savings on large vessels, proven design practices, and optimal utilization of space for high-capacity applications.

Nevertheless, the hybrid HVAC systems segment is expected to develop with the highest CAGR over the forecast period. This is owing to their capability to maximize energy efficiency by utilizing zone-based control, increased redundancy and system reliability, adaptability to accommodate dynamic load conditions, and minimized environmental effect via integrated heat recovery systems.

By Vessel Type

Based on vessel type, the marine HVAC systems market is classified into commercial vessels (container ships, bulk carriers, tankers, general cargo), passenger vessels (cruise ships, ferries, luxury yachts), offshore vessels (supply vessels, drilling rigs, production platforms), naval vessels, and others. In 2025, the commercial vessels segment will account for the largest share of approximately 45-50%, given the vast global merchant fleet size and ongoing newbuild activity.

However, the offshore vessels segment is anticipated to witness the highest CAGR over the forecast period due to increasing offshore wind power projects, increased demand for floating production storage and offloading (FPSO) units, heightened deep-water exploration activities, and specialized HVAC requirements for severe offshore environments.

By Application

On the basis of application, the marine HVAC systems market has been divided into crew quarters, passenger spaces, cargo compartments, engine spaces, bridge and control spaces, and galley/food service spaces. In 2025, the crew quarters segment is anticipated to lead the overall market with approximately 30-35% share owing to obligatory adherence to Maritime Labour Convention regulations and high frequencies of crew accommodation spaces in every vessel type.

Conversely, the passenger areas segment is anticipated to achieve the maximum CAGR between the forecast period of 2025-2035. This is largely driven by cruise tourism recovery and growth, a greater focus on passenger comfort and experience, an expanding luxury yacht market, and higher air quality standards post-health and safety issues.

Regional Analysis

By geography, the market for marine HVAC systems is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In 2025, the Asia-Pacific region will account for the highest share of approximately 40-45% of the worldwide marine HVAC systems market. The region's leadership in shipbuilding, widespread merchant fleet activity, increasing offshore energy projects, and growing cruise tourism in Southeast Asia are among the main market growth drivers.

This region is also anticipated to increase at the highest CAGR of the forecasting period from 2025-2035. The reason behind this growth is the increase in shipbuilding capacity in China and South Korea, investments in offshore wind power projects, regional trade and shipping activity, government support for green shipping technologies, and the increasing demand for LNG carriers and niche ships.

Europe is also exhibiting high demand for environmentally sustainable and energy-efficient marine HVAC systems. Environmental regulations, offshore wind energy leadership, and the location of influential cruise operators are fueling uptake of advanced HVAC technology and sustainable design approaches.

Key Players in the Global Marine HVAC Market

Major companies leading the global marine HVAC market include Carrier Corporation, Daikin Industries, Johnson Controls International plc, Heinen & Hopman Engineering B.V., Bronswerk Marine Inc., Drews Marine GmbH, Mitsubishi Electric Corporation, Dometic Group AB (including Marine Air Systems), Novenco Marine & Offshore A/S, GEA Group, Horn International AS, Teknotherm Marine AS, Brownswerk Marine Inc., AF Group ASA, Webasto SE, Thermo King Corporation, Climma Marine Air Conditioning, Veco S.p.A., Frigomar Srl, Aqua-Air Manufacturing, Nauticool Ltd., HFL Marine Air Conditioning, Marinaire LLC, Condaria Srl, and YORK Marine Systems. These companies together contribute significantly to innovation, energy-efficient solutions, and comprehensive product offerings that serve a wide range of vessel types and marine HVAC needs worldwide.

|

Particulars |

Details |

|

Number of Pages |

285 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.8% |

|

Market Size 2024 |

USD 2.85 billion |

|

Market Size 2025 |

USD 3.01 billion |

|

Market Size 2035 |

USD 5.28 billion |

|

Segments Covered |

By Component, System Type, Vessel Type, Application, and Technology |

|

Countries Covered |

North America (U.S., Canada, Mexico), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Norway, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Singapore, Australia, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa) |

The global marine HVAC systems market is projected to reach USD 5.28 billion by 2035 from USD 3.01 billion in 2025, at a CAGR of 5.8% during the forecast period. The market was valued at USD 2.85 billion in 2024.

In 2025, the compressors segment is projected to hold the major share of the marine HVAC systems market, while the controls and sensors segment is slated to record the highest growth rate.

Key factors driving the growth include increasing global seaborne trade and fleet expansion, rising demand for energy-efficient and environmentally compliant solutions, growing emphasis on crew comfort and passenger safety, expansion of offshore renewable energy projects, and implementation of stringent IMO regulations for emissions control.

Asia-Pacific leads the market with the highest share and is projected to record the highest growth rate during the forecast period, offering significant opportunities for marine HVAC systems vendors.

Major opportunities include expansion of offshore wind energy platforms, development of smart ship technologies and IoT integration, growth in alternative fuel vessels requiring specialized HVAC solutions, modular and compact system designs for space optimization, and enhanced air quality systems for passenger vessels.

Key trends include adoption of heat recovery and waste heat utilization systems, integration of advanced air filtration and purification technologies, development of magnetic bearing and variable speed compressor technologies, implementation of predictive maintenance through IoT sensors, and focus on lightweight and corrosion-resistant materials.

The hybrid HVAC systems segment is anticipated to record the highest growth rate during the forecast period, driven by energy optimization capabilities, improved system redundancy, flexible load handling, and integrated heat recovery features.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Marine HVAC Systems Market, by Component

3.2.2. Marine HVAC Systems Market, by System Type

3.2.3. Marine HVAC Systems Market, by Vessel Type

3.2.4. Marine HVAC Systems Market, by Application

3.2.5. Marine HVAC Systems Market, by Technology

3.2.6. Marine HVAC Systems Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Increasing Global Seaborne Trade and Fleet Expansion

4.2.1.2. Rising Demand for Energy-Efficient and Environmentally Compliant Solutions

4.2.1.3. Growing Emphasis on Crew Comfort and Passenger Safety

4.2.1.4. Expansion of Offshore Renewable Energy Projects

4.2.1.5. Implementation of Stringent IMO Regulations for Emissions Control

4.2.2. Restraints

4.2.2.1. High Initial Installation and Integration Costs

4.2.2.2. Cyclical Nature of Shipping Industry and Economic Volatility

4.2.2.3. Technical Complexity of Marine Environment Integration

4.2.2.4. Space and Weight Constraints in Vessel Design

4.2.3. Opportunities

4.2.3.1. Development of Smart Ship Technologies and IoT Integration

4.2.3.2. Growth in Offshore Wind Energy and Floating Platforms

4.2.3.3. Alternative Fuel Vessels and Specialized HVAC Requirements

4.2.3.4. Modular and Pre-fabricated HVAC System Solutions

4.2.3.5. Enhanced Air Quality and Filtration System Integration

4.2.4. Trends

4.2.4.1. Adoption of Heat Recovery and Waste Heat Utilization Systems

4.2.4.2. Integration of Advanced Control Systems and Automation

4.2.4.3. Development of Magnetic Bearing and Variable Speed Technologies

4.2.4.4. Implementation of Predictive Maintenance through IoT Sensors

4.2.5. Challenges

4.2.5.1. Compliance with Evolving International Maritime Regulations

4.2.5.2. Corrosion Resistance in Harsh Marine Environments

4.2.5.3. Skilled Technician Shortage for Installation and Maintenance

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Marine HVAC Systems Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy Efficient HVAC Technologies and Heat Recovery Systems

4.4.1.2. Reduced Carbon Footprint through Optimized System Design

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Development of Eco-Friendly Refrigerants and Materials

4.4.2.2. Manufacturer-led Sustainability Initiatives in Marine HVAC Design

4.4.3. Market Opportunities Created by Sustainability Focus

4.4.3.1. Integration with Renewable Energy Sources and Energy Storage

4.4.3.2. Challenges in Sustainable Material Sourcing and Recycling

5. Marine HVAC Systems Market Assessment—By Component

5.1. Overview

5.2. Compressors

5.3. Condensers

5.4. Evaporators

5.5. Expansion Valves

5.6. Controls and Sensors

5.7. Ductwork and Ventilation Components

5.8. Others

6. Marine HVAC Systems Market Assessment—By System Type

6.1. Overview

6.2. Centralized HVAC Systems

6.3. Decentralized HVAC Systems

6.4. Hybrid HVAC Systems

7. Marine HVAC Systems Market Assessment—By Vessel Type

7.1. Overview

7.2. Commercial Vessels

7.2.1. Container Ships

7.2.2. Bulk Carriers

7.2.3. Tankers

7.2.4. General Cargo Ships

7.3. Passenger Vessels

7.3.1. Cruise Ships

7.3.2. Ferries

7.3.3. Luxury Yachts

7.4. Offshore Vessels

7.4.1. Supply Vessels

7.4.2. Drilling Rigs

7.4.3. Production Platforms

7.4.4. FPSO Units

7.5. Naval Vessels

7.6. Others

8. Marine HVAC Systems Market Assessment—By Application

8.1. Overview

8.2. Crew Quarters

8.3. Passenger Areas

8.4. Cargo Holds

8.5. Engine Rooms

8.6. Bridge and Control Rooms

8.7. Galley/Food Service Areas

8.8. Others

9. Marine HVAC Systems Market Assessment—By Technology

9.1. Overview

9.2. Variable Refrigerant Flow (VRF) Systems

9.3. Heat Pump Technology

9.4. Magnetic Bearing Chillers

9.5. Heat Recovery Systems

9.6. Traditional Vapor Compression Systems

9.7. Others

10. Marine HVAC Systems Market Assessment—By Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.3.6. Netherlands

10.3.7. Norway

10.3.8. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. South Korea

10.4.4. India

10.4.5. Singapore

10.4.6. Australia

10.4.7. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. United Arab Emirates (UAE)

10.6.2. Saudi Arabia

10.6.3. Qatar

10.6.4. South Africa

10.6.5. Rest of Middle East & Africa (RoMEA)

11. Competitive Landscape

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Contemporary Stalwarts

11.5. Market Share/Ranking Analysis, by the Key Players, 2024

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

12.1. Carrier Corporation

12.2. Daikin Industries, Ltd.

12.3. Johnson Controls International plc

12.4. Heinen & Hopman Engineering B.V.

12.5. Bronswerk Marine Inc.

12.6. Drews Marine GmbH

12.7. Mitsubishi Electric Corporation

12.8. Dometic Group AB (including Marine Air Systems)

12.9. Novenco Marine & Offshore A/S

12.10. GEA Group

12.11. Horn International AS

12.12. Teknotherm Marine AS

12.13. Brownswerk Marine Inc.

12.14. AF Group ASA

12.15. Webasto SE

12.16. Thermo King Corporation

12.17. Climma Marine Air Conditioning

12.18. Veco S.p.A.

12.19. Frigomar Srl

12.20. Aqua-Air Manufacturing

12.21. Nauticool Ltd.

12.22. HFL Marine Air Conditioning

12.23. Marinaire LLC

12.24. Condaria Srl

12.25. YORK Marine Systems

12.26. Others

13. Appendix

13.1. Available Customization

13.2. Related Reports

LIST OF TABLES

Table 1. Global Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 2. Global Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 3. Global Condensers Market, by Country/Region, 2025–2035 (USD Million)

Table 4. Global Evaporators Market, by Country/Region, 2025–2035 (USD Million)

Table 5. Global Expansion Valves Market, by Country/Region, 2025–2035 (USD Million)

Table 6. Global Controls and Sensors Market, by Country/Region, 2025–2035 (USD Million)

Table 7. Global Ductwork and Ventilation Components Market, by Country/Region, 2025–2035 (USD Million)

Table 8. Global Other Components Market, by Country/Region, 2025–2035 (USD Million)

Table 9. Global Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 10. Global Centralized HVAC Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 11. Global Decentralized HVAC Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 12. Global Hybrid HVAC Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 13. Global Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 14. Global HVAC Market for Commercial Vessels, by Type, 2025–2035 (USD Million)

Table 15. Global HVAC Market for Container Ships, by Country/Region, 2025–2035 (USD Million)

Table 16. Global HVAC Market for Bulk Carriers, by Country/Region, 2025–2035 (USD Million)

Table 17. Global HVAC Market for Tankers, by Country/Region, 2025–2035 (USD Million)

Table 18. Global HVAC Market for General Cargo Ships, by Country/Region, 2025–2035 (USD Million)

Table 19. Global HVAC Market for Passenger Vessels, by Type, 2025–2035 (USD Million)

Table 20. Global HVAC Market for Cruise Ships, by Country/Region, 2025–2035 (USD Million)

Table 21. Global HVAC Market for Ferries, by Country/Region, 2025–2035 (USD Million)

Table 22. Global HVAC Market for Luxury Yachts, by Country/Region, 2025–2035 (USD Million)

Table 23. Global HVAC Market for Offshore Vessels, by Type, 2025–2035 (USD Million)

Table 24. Global HVAC Market for Supply Vessels, by Country/Region, 2025–2035 (USD Million)

Table 25. Global HVAC Market for Drilling Rigs, by Country/Region, 2025–2035 (USD Million)

Table 26. Global HVAC Market for Production Platforms, by Country/Region, 2025–2035 (USD Million)

Table 27. Global HVAC Market for FPSO Units, by Country/Region, 2025–2035 (USD Million)

Table 28. Global HVAC Market for Naval Vessels, by Country/Region, 2025–2035 (USD Million)

Table 29. Global HVAC Market for Other Vessel Types, by Country/Region, 2025–2035 (USD Million)

Table 30. Global Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 31. Global HVAC Market for Crew Quarters, by Country/Region, 2025–2035 (USD Million)

Table 32. Global HVAC Market for Passenger Areas, by Country/Region, 2025–2035 (USD Million)

Table 33. Global HVAC Market for Cargo Holds, by Country/Region, 2025–2035 (USD Million)

Table 34. Global HVAC Market for Engine Rooms, by Country/Region, 2025–2035 (USD Million)

Table 35. Global HVAC Market for Bridge and Control Rooms, by Country/Region, 2025–2035 (USD Million)

Table 36. Global HVAC Market for Galley/Food Service Areas, by Country/Region, 2025–2035 (USD Million)

Table 37. Global HVAC Market for Other Applications, by Country/Region, 2025–2035 (USD Million)

Table 38. Global Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 39. Global Variable Refrigerant Flow (VRF) Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 40. Global Heat Pump Technology Market, by Country/Region, 2025–2035 (USD Million)

Table 41. Global Magnetic Bearing Chillers Market, by Country/Region, 2025–2035 (USD Million)

Table 42. Global Heat Recovery Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 43. Global Traditional Vapor Compression Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 44. Global Others Market, by Country/Region, 2025–2035 (USD Million)

Table 45. North America: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 46. North America: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 47. North America: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 48. North America: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 49. North America: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 50. North America: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 51. North America: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 52. North America: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 53. U.S.: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 54. U.S.: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 55. U.S.: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 56. U.S.: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 57. U.S.: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 58. U.S.: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 59. U.S.: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 60. U.S.: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 61. Canada: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 62. Canada: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 63. Canada: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 64. Canada: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 65. Canada: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 66. Canada: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 67. Canada: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 68. Canada: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 69. Mexico: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 70. Mexico: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 71. Mexico: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 72. Mexico: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 73. Mexico: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 74. Mexico: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 75. Mexico: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 76. Mexico: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 77. Europe: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 78. Europe: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 79. Europe: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 80. Europe: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 81. Europe: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 82. Europe: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 83. Europe: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 84. Europe: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 85. Germany: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 86. Germany: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 87. Germany: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 88. Germany: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 89. Germany: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 90. Germany: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 91. Germany: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 92. Germany: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 93. France: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 94. France: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 95. France: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 96. France: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 97. France: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 98. France: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 99. France: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 100. France: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 101. U.K.: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 102. U.K.: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 103. U.K.: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 104. U.K.: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 105. U.K.: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 106. U.K.: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 107. U.K.: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 108. U.K.: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 109. Italy: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 110. Italy: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 111. Italy: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 112. Italy: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 113. Italy: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 114. Italy: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 115. Italy: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 116. Italy: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 117. Spain: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 118. Spain: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 119. Spain: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 120. Spain: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 121. Spain: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 122. Spain: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 123. Spain: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 124. Spain: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 125. Netherlands: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 126. Netherlands: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 127. Netherlands: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 128. Netherlands: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 129. Netherlands: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 130. Netherlands: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 131. Netherlands: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 132. Netherlands: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 133. Norway: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 134. Norway: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 135. Norway: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 136. Norway: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 137. Norway: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 138. Norway: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 139. Norway: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 140. Norway: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 141. Rest of Europe: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 142. Rest of Europe: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 143. Rest of Europe: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 144. Rest of Europe: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 145. Rest of Europe: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 146. Rest of Europe: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 147. Rest of Europe: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 148. Rest of Europe: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 149. Asia-Pacific: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 150. Asia-Pacific: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 151. Asia-Pacific: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 152. Asia-Pacific: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 153. Asia-Pacific: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 154. Asia-Pacific: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 155. Asia-Pacific: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 156. Asia-Pacific: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 157. China: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 158. China: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 159. China: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 160. China: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 161. China: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 162. China: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 163. China: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 164. China: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 165. Japan: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 166. Japan: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 167. Japan: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 168. Japan: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 169. Japan: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 170. Japan: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 171. Japan: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 172. Japan: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 173. South Korea: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 174. South Korea: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 175. South Korea: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 176. South Korea: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 177. South Korea: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 178. South Korea: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 179. South Korea: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 180. South Korea: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 181. India: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 182. India: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 183. India: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 184. India: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 185. India: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 186. India: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 187. India: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 188. India: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 189. Singapore: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 190. Singapore: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 191. Singapore: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 192. Singapore: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 193. Singapore: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 194. Singapore: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 195. Singapore: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 196. Singapore: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 197. Australia: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 198. Australia: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 199. Australia: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 200. Australia: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 201. Australia: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 202. Australia: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 203. Australia: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 204. Australia: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 205. Rest of Asia-Pacific: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 206. Rest of Asia-Pacific: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 207. Rest of Asia-Pacific: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 208. Rest of Asia-Pacific: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 209. Rest of Asia-Pacific: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 210. Rest of Asia-Pacific: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 211. Rest of Asia-Pacific: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 212. Rest of Asia-Pacific: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 213. Latin America: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 214. Latin America: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 215. Latin America: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 216. Latin America: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 217. Latin America: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 218. Latin America: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 219. Latin America: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 220. Latin America: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 221. Brazil: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 222. Brazil: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 223. Brazil: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 224. Brazil: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 225. Brazil: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 226. Brazil: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 227. Brazil: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 228. Brazil: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 229. Argentina: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 230. Argentina: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 231. Argentina: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 232. Argentina: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 233. Argentina: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 234. Argentina: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 235. Argentina: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 236. Argentina: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 237. Rest of Latin America: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 238. Rest of Latin America: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 239. Rest of Latin America: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 240. Rest of Latin America: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 241. Rest of Latin America: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 242. Rest of Latin America: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 243. Rest of Latin America: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 244. Rest of Latin America: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 245. Middle East & Africa: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 246. Middle East & Africa: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 247. Middle East & Africa: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 248. Middle East & Africa: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 249. Middle East & Africa: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 250. Middle East & Africa: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 251. Middle East & Africa: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 252. Middle East & Africa: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 253. United Arab Emirates: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 254. United Arab Emirates: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 255. United Arab Emirates: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 256. United Arab Emirates: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 257. United Arab Emirates: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 258. United Arab Emirates: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 259. United Arab Emirates: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 260. United Arab Emirates: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 261. Saudi Arabia: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 262. Saudi Arabia: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 263. Saudi Arabia: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 264. Saudi Arabia: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 265. Saudi Arabia: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 266. Saudi Arabia: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 267. Saudi Arabia: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 268. Saudi Arabia: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 269. Qatar: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 270. Qatar: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 271. Qatar: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 272. Qatar: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 273. Qatar: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 274. Qatar: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 275. Qatar: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 276. Qatar: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 277. South Africa: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 278. South Africa: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 279. South Africa: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 280. South Africa: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 281. South Africa: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 282. South Africa: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 283. South Africa: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 284. South Africa: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

Table 285. Rest of Middle East & Africa: Marine HVAC Systems Market, by Component, 2025–2035 (USD Million)

Table 286. Rest of Middle East & Africa: Marine HVAC Systems Market, by System Type, 2025–2035 (USD Million)

Table 287. Rest of Middle East & Africa: Marine HVAC Systems Market, by Vessel Type, 2025–2035 (USD Million)

Table 288. Rest of Middle East & Africa: Commercial Vessels Market, by Type, 2025–2035 (USD Million)

Table 289. Rest of Middle East & Africa: Passenger Vessels Market, by Type, 2025–2035 (USD Million)

Table 290. Rest of Middle East & Africa: Offshore Vessels Market, by Type, 2025–2035 (USD Million)

Table 291. Rest of Middle East & Africa: Marine HVAC Systems Market, by Application, 2025–2035 (USD Million)

Table 292. Rest of Middle East & Africa: Marine HVAC Systems Market, by Technology, 2025–2035 (USD Million)

LIST OF FIGURES

Figure 1. Research Process

Figure 2. Secondary Sources Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Compressors segment to Account for the Largest Share

Figure 8. In 2025, the Centralized HVAC Systems to Account for the Largest Share

Figure 9. In 2025, the Commercial Vessels to Account for the Largest Share

Figure 10. In 2025, the Crew Quarters to Account for the Largest Share

Figure 11. In 2025, the Traditional Vapor Compression Systems to Account for the Largest Share

Figure 12. Asia-Pacific to be the Fastest-growing Regional Market

Figure 13. Impact Analysis of Market Dynamics

Figure 14. Global Marine HVAC Systems Market: Porter's Five Forces Analysis

Figure 15. Global Marine HVAC Systems Market, by Component, 2025 Vs. 2035 (USD Million)

Figure 16. Global Marine HVAC Systems Market, by System Type, 2025 Vs. 2035 (USD Million)

Figure 17. Global Marine HVAC Systems Market, by Vessel Type, 2025 Vs. 2035 (USD Million)

Figure 18. Global Marine HVAC Systems Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 19. Global Marine HVAC Systems Market, by Technology, 2025 Vs. 2035 (USD Million)

Figure 20. Global Marine HVAC Systems Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 21. North America: Marine HVAC Systems Market Snapshot (2025)

Figure 22. Europe: Marine HVAC Systems Market Snapshot (2025)

Figure 23. Asia-Pacific: Marine HVAC Systems Market Snapshot (2025)

Figure 24. Latin America: Marine HVAC Systems Market Snapshot (2025)

Figure 25. Middle East & Africa: Marine HVAC Systems Market Snapshot (2025)

Figure 26. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 27. Global Marine HVAC Systems Market Competitive Benchmarking, by Component

Figure 28. Competitive Dashboard: Global Marine HVAC Systems Market

Figure 29. Global Marine HVAC Systems Market Share/Ranking, by Key Player, 2024 (%)

Figure 30. Carrier Corporation: Financial Overview (2024)

Figure 31. Johnson Controls International: Financial Overview (2024)

Figure 32. Daikin Industries Ltd.: Financial Overview (2024)

Figure 33. Ingersoll Rand Inc.: Financial Overview (2024)

Figure 34. Danfoss A/S: Financial Overview (2024)

Figure 35. Wärtsilä Corporation: Financial Overview (2024)

Figure 36. MAN Energy Solutions: Financial Overview (2024)

Figure 37. Heinen & Hopman: Financial Overview (2024)

Figure 38. Marine Air Systems: Financial Overview (2024)

Figure 39. Tekmar Group: Financial Overview (2024)

Figure 40. Novenco Marine & Offshore A/S: Financial Overview (2024)

Figure 41. Lindab Group: Financial Overview (2024)

Figure 42. Munters Group AB: Financial Overview (2024)

Figure 43. NIBE Group: Financial Overview (2024)

Figure 44. Gree Electric Appliances Inc.: Financial Overview (2024)

Published Date: Aug-2025

Published Date: Jul-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates