Resources

About Us

Marine Current Turbine Market Size, Share, Forecast & Trends by Technology (Horizontal Axis, Vertical Axis, Oscillating Hydrofoil), Application (Utilities, Commercial, Industrial), and End-Use Industry - Global Forecast to 2035

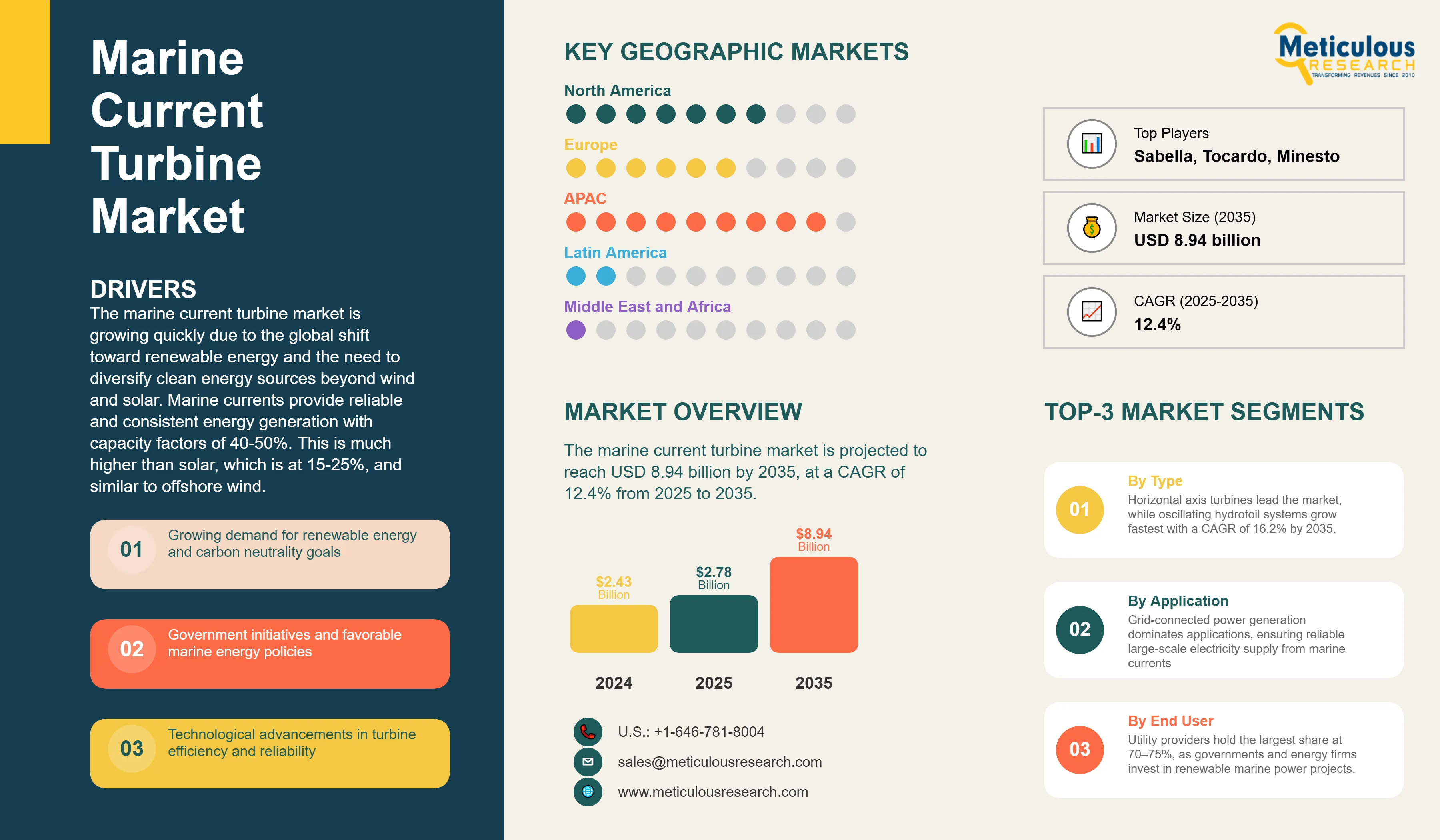

Report ID: MREP - 1041568 Pages: 320 Aug-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe marine current turbine market was worth USD 2.43 billion in 2024. The market is estimated to be valued at USD 2.78 billion in 2025 and is projected to reach USD 8.94 billion by 2035, at a CAGR of 12.4% from 2025 to 2035.

Marine Current Turbine Market - Key Highlights

|

Metric |

Value |

|

Market Value (2025) |

USD 2.78 billion |

|

Market Value (2035) |

USD 8.94 billion |

|

CAGR (2025-2035) |

12.4% |

|

Largest Technology Segment |

Horizontal Axis Turbines (55-60% share) |

|

Fastest Growing Technology |

Oscillating Hydrofoil Systems (16.2% CAGR) |

|

Leading Application |

Utilities (70-75% share) |

|

Dominant End-Use Industry |

Grid-Scale Power Generation (65-70% share) |

|

Fastest Growth Region |

Asia-Pacific (14.8% CAGR) |

|

Top Country by CAGR |

South Korea (17.2%) |

|

Market Concentration |

Top 5 players hold 35-45% share |

Marine Current Turbine Market Overview

Click here to: Get Free Sample Pages of this Report

Why is the Global Marine Current Turbine Market Growing?

The marine current turbine market is growing quickly due to the global shift toward renewable energy and the need to diversify clean energy sources beyond wind and solar. Marine currents provide reliable and consistent energy generation with capacity factors of 40-50%. This is much higher than solar, which is at 15-25%, and similar to offshore wind. Ocean currents hold immense energy potential, with global estimates indicating 400 TWh of annual electricity generation capacity from accessible tidal streams alone.

Market growth is speeding up because of government commitments to carbon neutrality. More than 70 countries are aiming for net-zero emissions by 2050. Coastal nations are investing heavily in marine renewable energy as part of their energy security plans. The UK has set aside £20 million for tidal stream projects, while France has pledged €2.5 billion for marine renewable energy development. South Korea's K-Tidal program aims to install 8.2 GW of tidal energy capacity by 2030.

Technological advances are lowering costs and improving efficiency. New blade designs that use computational fluid dynamics are achieving 45-50% energy conversion efficiency. Modular systems allow for easier installation and maintenance. Digital twin technology and AI-powered predictive maintenance are cutting operational costs by 25-30%. Grid integration technologies, such as subsea power transmission systems and energy storage solutions, are solving intermittency problems and enabling large-scale deployment.

Marine Current Turbine Market Size and Forecast

|

Metric |

Value |

|

Marine Current Turbine Market Value in (2025) |

USD 2.78 billion |

|

Marine Current Turbine Market Forecast Value in (2035 F) |

USD 8.94 billion |

|

Forecast CAGR (2025 to 2035) |

12.4% |

Market Segmentation

The marine current turbine market has been segmented based on technology type, turbine capacity, application, installation type, end-use industry, and geography. Based on technology type, the marine current turbine market is segmented into Horizontal Axis Turbines, Vertical Axis Turbines, Oscillating Hydrofoil Systems, and Others. By application, the market is segmented into Utilities, Commercial, Industrial, and Remote Communities. The marine current turbine market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Horizontal Axis Turbines Lead Marine Current Market with 55-60% Share

Horizontal axis turbines lead the marine current turbine market, holding a substantial market share of 55-60%. This dominance comes from their well-established technology, reliability, and high energy conversion efficiency. These systems usually reach 45-50% energy conversion efficiency under ideal flow conditions. Blade tip speed ratios of 4-6 allow them to extract maximum energy from tidal currents that move at 2-4 m/s.

Horizontal axis technology benefits from many years of wind turbine development. Manufacturers can use proven blade designs, gearbox systems, and generator technologies. Projects like the MeyGen in Scotland show their commercial success. The 1.5 MW turbines there produce over 21 GWh annually. Modern materials such as carbon fiber composites and corrosion-resistant alloys help ensure a lifespan of 25 years in tough marine conditions.

The technology segment keeps growing with innovations like variable pitch blade systems, direct-drive generators that remove the need for gearboxes, and floating platforms to access deeper waters beyond 40 meters. Horizontal axis systems are highly scalable. Their capacities range from 100 kW for community uses to 2-3 MW for utility-scale projects. This versatility supports various market needs and reinforces their market leadership.

Utilities Application Dominates Marine Current Turbine Market with 70-75% Share in 2025

The utilities segment makes up 70-75% of the marine current turbine market. Government renewable energy mandates and the need for large-scale power generation drive this dominance. Utility companies are setting up arrays of multiple turbines that produce 10-100 MW to meet renewable portfolio standards. For instance, the Pentland Firth development aims for an installed capacity of 398 MW.

The growth of the utilities segment is supported by feed-in tariffs and renewable energy certificates that offer financial incentives. The UK's Contracts for Difference scheme guarantees £178/MWh for tidal stream projects. In France, the rate is €240/MWh for marine energy. Utilities need systems with over 95% availability and 25-year operational lifespans. This drives demand for strong, commercial-grade turbine systems with thorough maintenance programs.

Grid integration is vital for utility applications. It calls for advanced power conditioning systems, subsea cables rated for 33-66 kV transmission, and synchronization equipment for easy grid connection. Smart grid technologies help utilities optimize the dispatch of tidal energy based on predictable current patterns. This approach maximizes system value while keeping grid stability through seasonal and daily generation cycles.

What are the Drivers, Restraints, and Key Trends of the Marine Current Turbine Market?

The marine current turbine market is expanding due to renewable energy targets, energy security concerns, technological advancements, and government support mechanisms. Additionally, predictable energy generation, environmental benefits, and coastal development initiatives improve market competitiveness.

Impact of Key Growth Drivers and Restraints on Marine Current Turbine Market

Base CAGR: 12.4%

|

Driver |

CAGR Impact |

Key Factors |

|

Renewable Energy Mandates |

+3.8% |

• Net-zero commitments |

|

Technology Advancement |

+2.9% |

• Efficiency improvements |

|

Government Support |

+2.1% |

• Feed-in tariffs |

|

Energy Security |

+1.7% |

• Import reduction |

Market Restraints

|

Restraint |

CAGR Impact |

Mitigation Trends |

|

High Capital Costs |

-2.6% |

• Modular designs |

|

Technical Complexity |

-1.8% |

• Standardized systems |

|

Environmental Permitting |

-1.3% |

• Streamlined processes |

Government Renewable Energy Policies Accelerate Market Growth

Government renewable energy policies are driving significant growth in the marine current turbine market as countries aim for carbon neutrality and energy independence. The European Union's Green Deal targets 32% renewable energy by 2030, with marine energy playing a major role for coastal member states. The UK's Net Zero Strategy allocates £1 billion for marine energy development, which includes simpler consenting processes and better grid connections for tidal projects.

Concerns about national energy security are pushing investments in local renewable resources. South Korea's New Deal includes marine energy as a key technology, with government funding backing commercial-scale tidal developments along the western coast. Japan's Basic Energy Plan focuses on ocean energy potential, aiming for 100 MW of marine energy capacity by 2030 through public-private partnerships and technology demonstration projects.

Carbon pricing is improving the economics of marine current turbines by raising fossil fuel costs. The EU Emissions Trading System price of €80-100 per tonne of CO2 makes marine energy more competitive with traditional generation. National feed-in tariffs provide long-term revenue certainty, with guaranteed prices ranging from €150 to €250 per MWh across European markets, which supports project financing and commercial development.

Regulatory frameworks are changing to support marine energy deployment. Simplified environmental impact assessments, standardized grid connection procedures, and marine spatial planning initiatives trim down development timelines and costs. International cooperation through organizations like Ocean Energy Systems promotes technology transfer and the sharing of best practices, speeding up global market growth.

Technological Innovations Drive Efficiency and Cost Reduction

Technological innovations are changing the economics of marine current turbines. They achieve this through improved efficiency, lower maintenance needs, and better reliability. Advanced computational fluid dynamics helps in designing optimized blades that attain energy conversion efficiencies of over 50%. Variable geometry systems adjust to varying current conditions. This maximizes power extraction during tidal cycles.

Next-generation materials such as carbon fiber composites and bio-inspired surface coatings resist marine fouling and corrosion. They extend operational lifespans to 25-30 years while cutting down on maintenance needs. Direct-drive permanent magnet generators remove the risk of gearbox failures, which have historically caused 60% of turbine downtime. They also enhance efficiency by 3-5% by minimizing mechanical losses.

Digital technologies are changing how we operate and maintain these systems. IoT sensors provide real-time monitoring of turbine performance, environmental conditions, and structural health. This supports predictive maintenance strategies that can reduce costs by 20-30%. Digital twin technologies improve turbine positioning and operation. Meanwhile, machine learning algorithms help predict the best maintenance schedules based on current patterns and component wear rates.

Floating platform technologies open up new deployment opportunities. They allow for installations beyond shallow nearshore areas to deep-water sites with stronger, more reliable currents. Semi-submersible and tension leg platforms enable installations in depths of 50-200 meters. This access to higher energy resources also helps lessen visual impact and navigational conflicts with existing marine activities.

Competitive Landscape

Marine current turbine market competitive environment is dominated by innovation in technology, strategic alliances, and growing commercial installations. Market leaders are spending big on R&D to enhance turbine efficiency, reliability, and affordability while creating strong project development and operation capabilities.

Industry leaders are entering strategic partnerships with utilities, engineering contractors, and government agencies to build commercial deployment more quickly. Simec Atlantis Energy, Nova Innovation, and Orbital Marine Power are creating regional partnerships to penetrate local markets while utilizing technical knowledge and project experience. Vertical integration strategies include turbine manufacturing, project development, and long-term operations in order to capture value through the entire supply chain.

Technology differentiation emphasizes turbine reliability, efficiency in converting energy, and ease of installation. Manufacturers are creating standardized products to minimize costs while providing site-specific customized solutions. Service-based business models such as turbine-as-a-service and performance guarantees offer customers lower risk and fewer surprises in costs, driving market acceptance.

Marine Current Turbine Market Growth, By Key Regions/Countries

|

Country |

CAGR |

|

South Korea |

17.2% |

|

United Kingdom |

15.8% |

|

France |

14.6% |

|

China |

13.9% |

|

Canada |

12.1% |

|

Japan |

11.8% |

|

United States |

10.5% |

The global marine current turbine market is projected to grow at a CAGR of 12.4% from 2025 through 2035, with Asia-Pacific demonstrating the highest growth driven by government renewable energy mandates and extensive coastline development opportunities. South Korea leads with 17.2% CAGR, supported by the K-Tidal program targeting 8.2 GW capacity and strong government funding for commercial demonstrations.

The United Kingdom maintains strong 15.8% growth through established tidal energy policies, successful project deployments, and advantageous tidal resources in Scotland and Wales. France follows with 14.6% CAGR, driven by €2.5 billion marine energy commitments and strategic focus on Brittany and Normandy tidal developments. China exhibits 13.9% growth through coastal industrial development and renewable energy diversification initiatives.

Canada demonstrates 12.1% growth potential through Bay of Fundy resources and federal clean energy investments, while Japan achieves 11.8% CAGR supported by island energy security initiatives and advanced marine technology development. The United States shows steady 10.5% growth driven by state renewable energy standards and federal research funding for marine energy technologies.

Country-Specific Growth Analysis

South Korea's Marine Current Turbine Market Accelerates at 17.2% CAGR (2025-2035)

South Korea's marine current turbine industry is growing phenomenally at 17.2% CAGR due to the government's Green New Deal and aggressive tidal energy development strategy. The K-Tidal program aims at 8.2 GW installed capacity by 2030, the world's most aggressive national tidal energy deployment program. Strategic sites like Uldolmok Strait and Jindo Island have outstanding tidal resources with currents over 3 m/s.

Government investment is over KRW 2 trillion (USD 1.5 billion) by 2030, funding technology development, commercial demonstration, and grid infrastructure build-out. Korea's sophisticated shipbuilding and offshore engineering technologies are solid industrial bases for marine energy production and deployment. Strategic alliances with EU technology leaders drive knowledge transfer while building in-country supply chain competence.

United Kingdom's Established Leadership Drives 15.8% CAGR Growth

The UK marine current turbine market maintains robust 15.8% CAGR growth, building upon world-leading tidal energy resources and supportive policy frameworks. Scottish waters contain an estimated 10 GW of practical tidal energy potential, with the Pentland Firth representing Europe's premier tidal energy development zone. The MeyGen project demonstrates commercial viability with 6 MW operational capacity and expansion plans to 398 MW.

Government support includes £20 million in additional funding through the Tidal Stream and Wave Power Scheme, complementing Contracts for Difference providing £178/MWh guaranteed prices. The Crown Estate's leasing round offers development rights for up to 10 GW capacity, while streamlined consenting processes reduce development timelines and costs. Strong academic and industrial research capabilities continue advancing technology development and cost reduction initiatives.

Key Players in Marine Current Turbine Market Expand Global Reach with Advanced Technology

Leading companies in the marine current turbine market are developing integrated solutions combining advanced turbine technology, project development expertise, and comprehensive operation services. Simec Atlantis Energy leads through the MeyGen project success and AR-Series turbine technology, while expanding into Asian markets through strategic partnerships and licensing agreements.

Nova Innovation focuses on smaller-scale distributed generation with 100 kW-1 MW turbine systems targeting remote communities and industrial applications. Their M100 turbine achieves 40% energy conversion efficiency while offering simplified installation and maintenance procedures. Orbital Marine Power's O2 turbine represents the world's most powerful tidal turbine at 2 MW capacity, utilizing floating platform technology for reduced installation costs and enhanced accessibility.

Verdant Power and Ocean Renewable Power Company lead North American market development through Roosevelt Island and Maine tidal projects respectively. European companies including Sabella, Tocardo, and Minesto continue technology innovation through oscillating hydrofoil and vertical axis designs targeting niche applications and specific site conditions.

Recent Developments in the Global Marine Current Turbine Market

In Q1 2025, Simec Atlantis Energy announced a major milestone with the completion of Phase 1C of the MeyGen project, bringing total installed capacity to 8.5 MW and demonstrating consistent power generation exceeding design specifications. The project achieved 98.5% availability during the quarter while generating 12 GWh of renewable electricity, validating commercial viability of tidal stream technology.

Orbital Marine Power secured €15 million in Series B funding to accelerate O2 turbine deployment and develop next-generation 3 MW floating systems. The funding round included participation from renewable energy developers and government investment funds, reflecting growing investor confidence in marine current technology commercialization prospects.

|

Item |

Value |

|

Market Size (2025) |

USD 2.78 Billion |

|

Technology Type |

Horizontal Axis, Vertical Axis, Oscillating Hydrofoil, Others |

|

Application |

Utilities, Commercial, Industrial, Remote Communities |

|

End-Use Industry |

Grid-Scale Power, Distributed Generation, Industrial Power, Island Communities |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Simec Atlantis Energy, Nova Innovation, Orbital Marine Power, Verdant Power, Ocean Renewable Power Company, Sabella, Tocardo, Minesto, OpenHydro, Marine Current Turbines Ltd., Flumill, TidalStream |

|

Additional Attributes |

Porter's Five Forces Analysis, technology readiness assessment, environmental impact analysis, competitive benchmarking, grid integration analysis, LCOE modeling, resource assessment methodology, supply chain analysis |

The global marine current turbine market is estimated to be valued at USD 2.78 billion in 2025.

The market size for marine current turbines is projected to reach USD 8.94 billion by 2035.

The marine current turbine market is expected to grow at 12.4% CAGR between 2025 and 2035.

Horizontal axis turbines command the largest share at 55-60% due to their proven reliability and superior energy conversion efficiency.

Utilities represent 70-75% of applications, driven by renewable energy mandates and grid-scale power generation requirements.

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates