Resources

About Us

Renewable Energy Forecasting Software Market (Solar, Wind): Size, Share, & Forecast by Forecasting Horizon (Short-Term, Long-Term), AI/ML Integration, and Grid Impact Mitigation – Global Forecast (2026-2036)

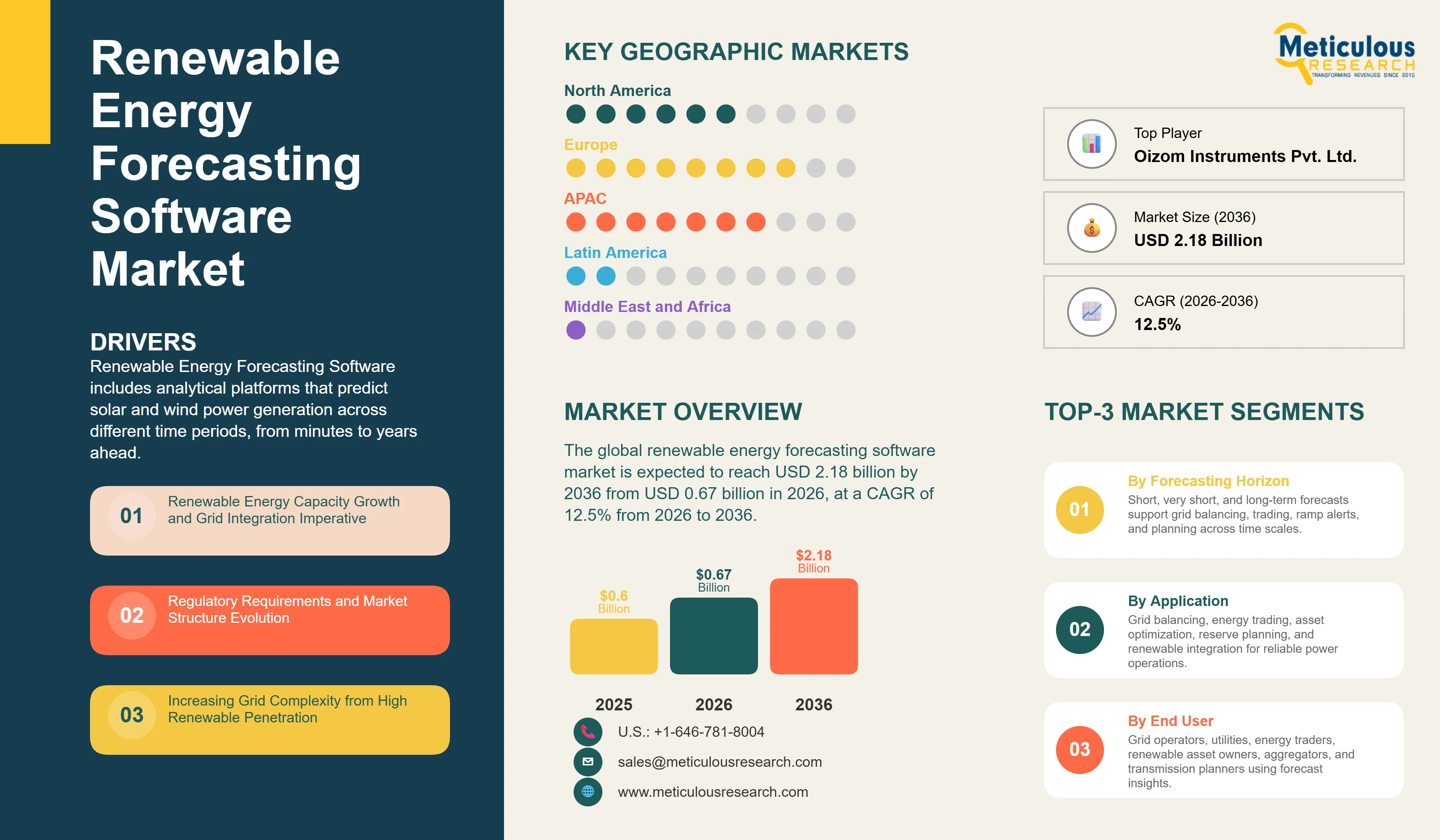

Report ID: MREP - 1041687 Pages: 256 Jan-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global renewable energy forecasting software market is expected to reach USD 2.18 billion by 2036 from USD 0.67 billion in 2026, at a CAGR of 12.5% from 2026 to 2036.

Renewable Energy Forecasting Software includes analytical platforms that predict solar and wind power generation across different time periods, from minutes to years ahead. These platforms use sophisticated algorithms that combine numerical weather prediction models, historical generation data, satellite images, ground sensor data, machine learning techniques, and forecasting methods. They provide both probabilistic and deterministic forecasts that support grid operations, energy trading, asset management, and renewable integration.

These specialized systems use artificial intelligence and deep learning for recognizing patterns and improving over time. They feature high-resolution weather modeling that accounts for local terrain and microclimate effects. Nowcasting techniques offer sub-hourly forecasts for real-time operations. Uncertainty quantification gives confidence intervals and probability distributions. Ramp event prediction identifies quick changes in generation, and they integrate with energy management systems, trading platforms, and grid operators to enable automated decision-making and participation in the market.

By providing reliable renewable generation forecasts, these platforms support essential tasks. Grid operators can balance supply and demand with variable generation. Energy traders can optimize their market positions and manage risks. Renewable asset operators can maximize revenue through better bidding and scheduling. Utilities can manage reserve needs and conventional generation dispatch. Transmission planners can ensure there is enough capacity for renewable integration.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Renewable Energy Forecasting Software is essential for successfully integrating variable renewable generation into electric power systems. This software addresses the key challenge that solar and wind output varies with weather conditions, which system operators cannot control directly. These advanced platforms convert weather data and historical generation patterns into useful forecasts, aiding operational, commercial, and planning decisions throughout the energy value chain. As the use of renewables grows worldwide, with wind and solar expected to contribute over 40% of global electricity by 2030, accurate forecasting shifts from simply improving operations to becoming essential grid infrastructure. This helps prevent imbalances, lowers integration costs, and allows for greater renewable integration while keeping reliability and economic efficiency.

Several major trends are changing the renewable energy forecasting software market. These include the use of artificial intelligence and deep learning, which improve accuracy by 20-30% compared to traditional statistical methods. The increase in distributed solar requires detailed, localized forecasts at an unprecedented scale. The development of ensemble and probabilistic forecasting offers uncertainty quantification for better risk management. Integrating forecasting with automated trading and dispatch systems allows for autonomous operations. Additionally, the market is expanding beyond generation forecasting to include comprehensive platforms that manage grid impacts, optimize storage, and coordinate flexibility. The combination of growing renewable capacity, mature AI technology, increased data from sensors and satellites, more complex grids due to high renewable usage, and evolving market structures necessitates sophisticated forecasting, elevating it from a niche service to a strategic tool for successful renewable integration.

The renewable energy forecasting software market is quickly evolving towards more accurate, detailed, and intelligent platforms using artificial intelligence and extensive data sources. Modern forecasting systems have advanced features, such as deep learning neural networks that understand complex weather-generation relationships from large datasets, satellite imagery for high-resolution cloud tracking in solar forecasting, ensemble forecasting that merges multiple models and data sources for better accuracy and uncertainty assessment, ramp forecasting that detects rapid generation changes needing grid operator response, hybrid physical-statistical models that combine weather physics with machine learning, and automated model selection that identifies the best algorithms based on forecast conditions.

Artificial intelligence and machine learning are changing renewable forecasting from being mostly based on physics to data-driven methods that find complex patterns and improve continuously. AI-powered forecasting uses convolutional neural networks to analyze satellite images for cloud movement and predict solar irradiance. It also employs recurrent neural networks and long short-term memory (LSTM) models to capture weather pattern dependencies over time. Ensemble learning combines different AI models for increased robustness. Transfer learning involves using models trained on large datasets in areas with less data. Reinforcement learning optimizes forecasting systems for specific operational goals. Leading implementations report accuracy gains of 20-30% compared to traditional methods, especially in short-term forecasting (0-6 hours) and ramp event prediction, where AI excels in identifying patterns.

Distributed solar forecasting is becoming a vital capability as behind-the-meter solar increases, generating grid management challenges from aggregated yet localized generation. Unlike utility-scale solar, which is concentrated at known locations, distributed solar consists of millions of rooftop installations. Forecasting the total output from these installations for distribution grid management is necessary but forecasting individual sites is impractical. Advanced forecasting platforms tackle this issue using probabilistic upscaling methods that estimate aggregate output from sample measurements and modeling, satellite-derived irradiance for grid-level generation estimates, and smart meter data analytics that infer solar production from net load patterns. Ensemble methods that combine physical models with machine learning from various data sources are also used. This capability is increasingly crucial for distribution utilities as rooftop solar penetration surpasses 20-30% in some areas.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 0.67 Billion |

|

Revenue Forecast in 2036 |

USD 2.18 Billion |

|

Growth Rate |

CAGR of 12.5% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments Covered |

Forecasting Horizon, AI/ML Integration, Renewable Energy Type, Application, Deployment Model, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Spain, Italy, Denmark, Netherlands, China, India, Japan, Australia, South Korea, Brazil, Chile, Mexico, South Africa, UAE |

|

Key Companies Profiled |

Vaisala Inc., DNV GL (Energy Systems), AWS Truepower (UL), Meteomatics AG, IBM Corporation (The Weather Company), DTN LLC, Weprog ApS, Energy & Meteo Systems GmbH, 3TIER (Vaisala), ENFOR A/S, Oizom Instruments Pvt. Ltd., Prescient Weather Ltd., Clean Power Research LLC, SolarAnywhere (Clean Power Research), Reuniwatt, Steadysun, SkySol, Lunarc Inc., Versorium Energy LLC, Energy Exemplar |

Driver: Renewable Energy Capacity Growth and Grid Integration Imperative

The rapid global growth of wind and solar capacity creates a strong need for forecasting capabilities. These capabilities help in integrating renewable energy while ensuring grid reliability and economics. Global renewable capacity surpassed 3,300 GW in 2023, with projections predicting over 8,000 GW by 2030. This growth is fueled by climate commitments, lower costs, and energy security goals. However, this surge in renewables brings challenges for grid management. Generation varies, requiring conventional generators or storage to balance minute-by-minute fluctuations. Accurate forecasts can reduce costly reserves. High levels of renewable energy raise concerns about grid stability due to less system inertia and synchronous generation. Precise forecasting is necessary to maintain frequency and voltage stability. Market efficiency requires accurate forecasts to allow renewable generators to actively participate in electricity markets and avoid penalties for forecast errors. Every percentage point improvement in forecast accuracy can provide significant economic benefits, estimated at $1-5 million each year per 1,000 MW of renewable capacity. This happens through lower balancing costs, better market revenues, and optimized operations.

Driver: Regulatory Requirements and Market Structure Evolution

Changes in electricity market structures and regulatory requirements are making renewable generation forecasting essential for market participation and grid operations. Many areas now require renewable generators to provide generation forecasts that meet certain accuracy standards. Financial penalties are imposed for significant deviations, discouraging poor forecasting while rewarding accuracy. Grid operators increasingly demand forecasts from renewable generators for operational planning, including day-ahead unit commitment, intraday balancing, and real-time dispatch. Ancillary service markets are evolving to buy flexibility and reserves based on forecast uncertainty, creating economic incentives to improve forecasting. These regulatory and market changes have shifted forecasting from a voluntary operational tool to a mandatory requirement for connecting to the grid and participating in the market. This shift has increased the demand for forecasting software and services.

Opportunity: AI and Machine Learning Technology Advancement

The rapid progress in AI and machine learning offers new chances for forecasting vendors to stand out through better accuracy and capabilities. Deep learning algorithms have shown significant improvements in accuracy compared to traditional statistical and physical models, especially for short-term forecasts where pattern recognition is beneficial. The growing availability of training data from expanding renewable fleets, weather satellites, and sensor networks supports more advanced AI models that require large datasets. Cloud computing and specialized AI hardware make it feasible to use sophisticated machine learning for operational forecasting that needs quick computations. Companies that develop unique AI algorithms, access special data sources, or create specialized models for specific applications can charge premium prices and gain market share. This AI advantage is self-reinforcing; more data leads to better models, which attract more customers who generate even more data.

Opportunity: Distributed and Behind-the-Meter Solar Forecasting

The growth of distributed solar creates new forecasting needs and market opportunities that differ from utility-scale forecasting. Global distributed solar capacity now exceeds 300 GW and is expanding faster than utility-scale solar in many markets. This growth leads to grid management challenges that require forecasting but lacks the site-specific measurements available for utility installations. Distribution utilities need aggregate forecasts for grid management but cannot practically forecast millions of individual rooftops. This gap creates a demand for specialized distributed solar forecasting that uses satellite irradiance, smart meter data analytics, and probabilistic upscaling methods. Opportunities exist for distribution utility services forecasting total distributed solar in their area, community solar and virtual power plant operators needing portfolio forecasts, and retailers or aggregators managing distributed solar portfolios for energy procurement and risk management.

By Forecasting Horizon:

In 2026, the Short-Term Forecasting (0-72 hours) segment is expected to hold the largest share of the renewable energy forecasting software market. This segment is crucial for grid operations, energy trading, and day-ahead market participation. Short-term forecasts support day-ahead unit commitment and market bidding, typically needing generation forecasts 12-36 hours ahead. They also aid intraday market optimization and re-bidding with forecasts hours ahead, as well as real-time dispatch and balancing, which require forecasts minutes to hours ahead. Reserve requirement determination relies on short-term forecast uncertainty. Accuracy is essential for short-term horizons since forecast errors directly impact operational costs and market revenues. This drives investment in improved forecasting capabilities like AI models, high-resolution weather data, and quick forecast updates.

The Very Short-Term and Nowcasting (0-6 hours) sub-segment is growing quickly. It provides forecasts for real-time grid balancing, intraday trading, and ramp management. Nowcasting uses specialized techniques such as satellite-based cloud tracking for solar forecasting, ground-based sky imaging for localized predictions, statistical persistence models that leverage recent observations, and AI pattern recognition. This segment is crucial for grids with high renewable penetration that need frequent balancing actions.

The Long-Term Forecasting (>72 hours to seasons/years) segment supports planning applications. This includes generation capacity planning, transmission investment decisions, energy procurement and risk management, and maintenance scheduling. Long-term forecasts focus on seasonal patterns, climate trends, and statistical distributions instead of precise hourly predictions. They use different methods to meet distinct customer needs that differ from operational short-term forecasting.

By AI/ML Integration:

In 2026, the Advanced AI-Powered Forecasting segment is projected to experience the highest growth rate. This is due to improvements in accuracy compared to traditional statistical and numerical weather prediction methods, the ability to learn continuously from growing historical data, automated model optimization that reduces manual tuning, and the capacity to find complex patterns in high-dimensional data that physics-based models miss. AI-powered systems use deep learning neural networks, ensemble machine learning, and hybrid approaches that combine AI with physical models, achieving accuracy improvements of 15-30% in many cases. This segment commands higher prices due to its performance and attracts significant R&D investments from forecasting vendors.

The Traditional Statistical and NWP-Based Forecasting segment maintains a strong market presence. It offers proven reliability, transparent model physics that are important for grid operator acceptance, lower data and computational needs than complex AI models, and established vendor relationships. Many applications use hybrid approaches that combine numerical weather prediction (NWP) models for meteorological forecasting with statistical post-processing. This achieves good performance while remaining interpretable and stable.

The Ensemble and Hybrid Forecasting segment combines multiple methods, including AI, statistical models, and physical models. This represents a growing best practice that takes advantage of the strengths of different techniques, while also providing robust uncertainty quantification through ensemble spread.

By Renewable Energy Type:

In 2026, the Wind Forecasting segment is expected to make up the largest share of the overall market. This reflects the larger installed base of wind capacity globally (over 1,000 GW) compared to solar and the higher complexity of wind forecasting due to three-dimensional atmospheric dynamics, terrain effects, and spatial variability. Wind forecasting requires advanced numerical weather prediction models, mesoscale atmospheric modeling, and wind farm-specific power curve modeling. Applications include onshore and offshore wind, with offshore posing unique difficulties due to the marine atmosphere and limited observation data.

The Solar Forecasting segment is anticipated to grow at the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by rapid solar capacity expansion expected to surpass wind by 2030, the increase of distributed solar that requires specialized forecasting approaches, and the improvement in satellite and sky imaging technologies that enhance solar-specific capabilities. Solar forecasting faces unique challenges like cloud dynamics that cause rapid changes in irradiance, the conversion of irradiance to power affected by panel characteristics and temperature, and the need for aggregate forecasting of thousands or millions of distributed installations.

The Hybrid Wind-Solar Forecasting segment is emerging as projects increasingly combine wind and solar generation. This necessitates coordinated forecasting that considers the relationships and complementarity between resources for effective portfolio management.

By Application:

In 2026, the Grid Operations and Balancing segment is expected to hold the largest share. It serves grid operators, transmission system operators, and balancing authorities that need forecasts for unit commitment, economic dispatch, reserve determination, and real-time balancing. This segment focuses on forecast accuracy, reliability, and integration with energy management systems. It often requires certified forecasts that meet regulatory standards.

The Energy Trading and Market Participation segment is growing quickly. It serves renewable asset owners, energy traders, and retailers needing forecasts for day-ahead and intraday market bidding, portfolio optimization, and risk management. This segment prioritizes probabilistic forecasts that measure uncertainty for trading optimization. It values quick forecast updates that facilitate intraday trading.

The Asset Performance and Operations segment serves renewable asset owners and operators. They need forecasts for maintenance scheduling, performance monitoring, and revenue forecasting. This supports operational planning and helps identify underperforming assets through forecast-versus-actual analysis.

Regional Insights:

In 2026, Europe is expected to hold the largest share of the global renewable energy forecasting software market. This is due to high wind and solar adoption rates in countries like Denmark, Germany, and Spain, where more than 40 to 60% of electricity comes from renewable sources. The region has detailed policies that require precise forecasting. Many European markets have mandatory forecasting for participation. Europe also has established renewable energy markets with well-developed trading and balancing systems, along with leading forecasting vendors and research institutions. Germany is at the forefront of this market due to its Energiewende renewable transition and significant wind and solar integration, which creates complex forecasting needs. Denmark is a global leader in wind integration that demands advanced forecasting. Spain and Italy also have considerable solar capacity that requires effective forecasting solutions.

Asia-Pacific is anticipated to experience the highest growth rate during this period. China's vast renewable capacity exceeds 700 GW of wind and 400 GW of solar, with ongoing aggressive expansion. India aims for a renewable capacity of 500 GW. Rapid renewable deployment poses grid integration challenges that call for forecasting solutions. Government initiatives for smart grids are boosting the adoption of forecasting technology. Additionally, there is a growing domestic forecasting vendor ecosystem, especially in China. China presents the biggest opportunity with its unmatched renewable scale and government policies that support smart grid technologies. Australia's high level of distributed solar creates specific forecasting needs. Japan and South Korea are also developing renewable capacity that requires forecasting capabilities.

North America represents a significant market due to its large wind capacity, particularly in the U.S. Great Plains and Texas. Solar deployment is also increasing, especially in California, the Southwest, and Texas. ISO/RTO forecasting is necessary for market participation. The region has sophisticated electricity markets that value precise forecasting and is home to leading forecasting technology companies. The U.S. dominates the regional market with its diverse renewable resources and complex market structures. Canada boasts important wind and growing solar capacity that need forecasting. Mexico's expansion in renewables opens up new opportunities.

Major players include Vaisala Inc. (Finland), DNV GL Energy Systems (Norway), AWS Truepower/UL (U.S.), Meteomatics AG (Switzerland), IBM Corporation/The Weather Company (U.S.), DTN LLC (U.S.), Weprog ApS (Denmark), Energy & Meteo Systems GmbH (Germany), 3TIER/Vaisala (U.S./Finland), ENFOR A/S (Denmark), Oizom Instruments Pvt. Ltd. (India), Prescient Weather Ltd. (UK), Clean Power Research/SolarAnywhere (U.S.), Reuniwatt (France), Steadysun (France), SkySol (Germany), Lunarc Inc. (U.S.), Versorium Energy LLC (U.S.), and Energy Exemplar (Australia), among others.

The global renewable energy forecasting software market is expected to reach USD 2.18 billion by 2036 from USD 0.67 billion in 2026, at a CAGR of 12.5% from 2026 to 2036.

The renewable energy forecasting software market is expected to grow at a CAGR of 12.5% from 2026 to 2036.

The major players include Vaisala Inc., DNV GL (Energy Systems), AWS Truepower (UL), Meteomatics AG, IBM Corporation (The Weather Company), DTN LLC, Weprog ApS, Energy & Meteo Systems GmbH, 3TIER (Vaisala), ENFOR A/S, Oizom Instruments Pvt. Ltd., Prescient Weather Ltd., Clean Power Research LLC, SolarAnywhere (Clean Power Research), Reuniwatt, Steadysun, SkySol, Lunarc Inc., Versorium Energy LLC, Energy Exemplar

The main factors driving the market include surging adoption of renewable energy sources (wind, solar) and the critical need to manage their inherent intermittency and volatility

In 2026, Europe is estimated to account for the largest share of the global renewable energy forecasting software market, driven by highest wind and solar penetration rates globally with countries like Denmark, Germany, and Spain exceeding 40-60% renewable electricity, sophisticated renewable integration policies requiring accurate forecasting, mandatory forecasting requirements for market participation in most European markets, mature renewable energy markets with advanced trading and balancing mechanisms, and presence of leading forecasting vendors and research institutions.

Published Date: May-2025

Published Date: Jul-2024

Published Date: Jun-2023

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates