Resources

About Us

HVAC Controls Market Size, Share, Trends & Forecast by Component (Sensors, Controllers, Thermostats), System Type, Technology, Implementation, End-Use, and Region – Global Outlook 2025–2035

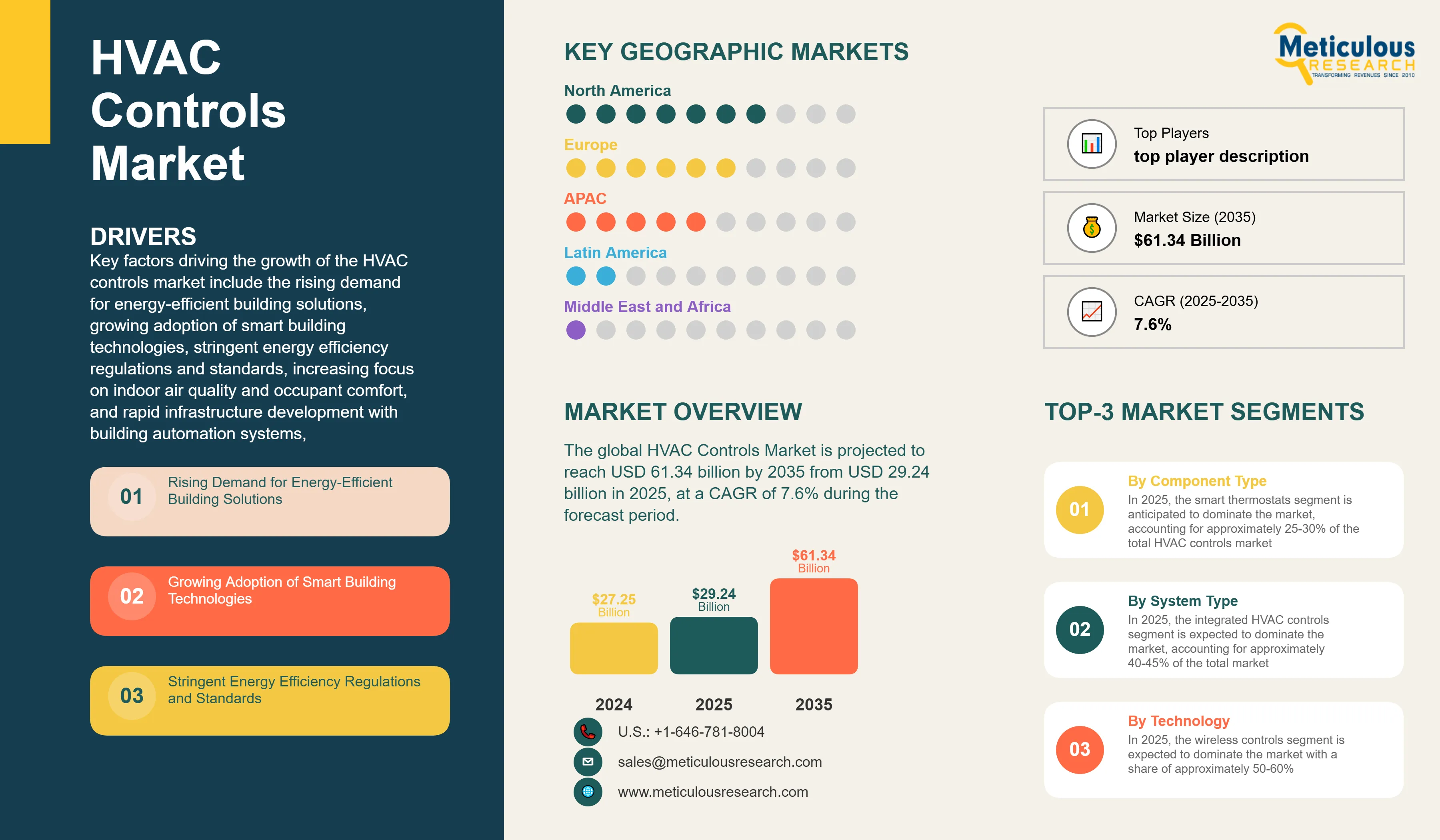

Report ID: MRSE - 1041528 Pages: 185 Jul-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the HVAC controls market include the rising demand for energy-efficient building solutions, growing adoption of smart building technologies, stringent energy efficiency regulations and standards, increasing focus on indoor air quality and occupant comfort, and rapid infrastructure development with building automation systems. However, this growth is restrained by high initial investment and installation costs, complexity of integration with legacy systems, lack of skilled technicians and training programs, and cybersecurity concerns in connected systems.

Additionally, untapped opportunities in emerging markets with rapid urbanization, IoT and AI integration in HVAC systems, expansion of the retrofit market for existing buildings, and development of wireless and battery-free solutions are poised to offer significant growth opportunities for market players. The adoption of cloud-based HVAC management platforms, wireless communication and remote monitoring capabilities, integration with building management systems, and advanced analytics with predictive maintenance are emerging as notable trends in this market.

Rising Demand for Energy-Efficient Building Solutions

The demand for advanced HVAC controls is experiencing unprecedented growth due to increasing awareness about energy consumption and operational cost optimization in buildings. Modern buildings consume approximately 40% of global energy, with HVAC systems accounting for 50-60% of a building's total energy consumption. This has led to heightened focus on intelligent control systems that can optimize energy usage while maintaining occupant comfort.

HVAC controls enable precise temperature management, zone-based conditioning, and adaptive control strategies that can reduce energy consumption by 20-30% compared to traditional systems. The integration of advanced algorithms, machine learning capabilities, and real-time monitoring allows these systems to automatically adjust operations based on occupancy patterns, weather conditions, and energy pricing, delivering significant cost savings and environmental benefits.

Growing Adoption of Smart Building Technologies

The convergence of IoT, artificial intelligence, and cloud computing is driving the transformation of traditional buildings into intelligent, connected environments. Smart HVAC controls serve as critical components in this ecosystem, enabling seamless integration with other building systems including lighting, security, and fire safety systems.

The smart building market is experiencing robust growth, with increasing adoption of building automation systems (BAS) and building management systems (BMS) that require sophisticated HVAC control solutions. These systems provide centralized monitoring and control capabilities, enabling facility managers to optimize operations, reduce maintenance costs, and enhance occupant experience through personalized comfort settings.

Stringent Energy Efficiency Regulations and Standards

Government regulations and energy efficiency standards are becoming increasingly stringent worldwide, driving demand for advanced HVAC control systems. Building codes such as ASHRAE 90.1, IECC, and EU Energy Performance of Buildings Directive mandate specific energy efficiency requirements that necessitate the use of intelligent control systems.

Green building certifications including LEED, BREEAM, and WELL Building Standard require comprehensive HVAC control strategies for optimal energy performance and indoor environmental quality. These standards often mandate advanced control features such as demand-controlled ventilation, occupancy-based controls, and integration with renewable energy sources, creating strong market demand for sophisticated control solutions.

Market Segmentation Analysis

By Component Type

Based on component type, the HVAC controls market is segmented into thermostats, sensors, controllers, actuators, control panels, and others. In 2025, the smart thermostats segment is anticipated to dominate the market, accounting for approximately 25-30% of the total HVAC controls market. The dominance of smart thermostats is attributed to their widespread adoption in residential and commercial applications, advanced connectivity features, and integration with smart home ecosystems.

However, the sensors segment is projected to record the highest CAGR of 8.7% during the forecast period of 2025-2035. This exceptional growth is driven by the increasing deployment of IoT-enabled sensors for temperature, humidity, pressure, and air quality monitoring, growing demand for precise environmental control, and the integration of artificial intelligence for predictive analytics and automated system optimization.

The controllers segment is also experiencing robust growth due to the increasing complexity of HVAC systems and the need for centralized control and monitoring capabilities across multiple zones and applications.

By System Type

Based on system type, the HVAC controls market is segmented into heating controls, ventilation controls, air conditioning controls, and integrated HVAC controls. In 2025, the integrated HVAC controls segment is expected to dominate the market, accounting for approximately 40-45% of the total market share. This dominance is attributed to the growing preference for comprehensive building automation solutions that provide unified control over all HVAC functions.

The integrated HVAC controls segment is anticipated to record the highest growth rate during the forecast period, driven by increasing adoption of smart building technologies, demand for centralized control systems, and the benefits of integrated solutions including reduced installation costs, simplified maintenance, and improved system interoperability.

By Technology

Based on technology, the HVAC controls market is segmented into wired controls, wireless controls, and pneumatic controls. In 2025, the wireless controls segment is expected to dominate the market with a share of approximately 50-60%, driven by the advantages of wireless communication including easy installation, reduced wiring costs, and flexibility in system design and expansion.

The wireless controls segment is projected to record the highest CAGR of 8.2% during the forecast period of 2025-2035, driven by advancing wireless communication technologies, increasing adoption of IoT-enabled devices, and the growing preference for retrofitting existing buildings with smart control systems without extensive rewiring.

By End-Use Application

Based on end-use application, the HVAC controls market is segmented into residential, commercial, and industrial applications. In 2025, the commercial segment is anticipated to dominate the market with a share of approximately 50-55%, driven by office buildings, retail establishments, healthcare facilities, educational institutions, and hospitality venues prioritizing energy efficiency, occupant comfort, and operational optimization.

The residential segment is projected to record the highest CAGR of 8.1% during the forecast period of 2025-2035, driven by increasing consumer awareness of energy efficiency benefits, rising adoption of smart home technologies, growing disposable incomes, and the availability of user-friendly control solutions for residential applications.

Regional Analysis

Based on geography, the HVAC controls market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is anticipated to account for the major share of around 30-40% of the HVAC controls market, reflecting the region's mature building automation market, stringent energy efficiency regulations, high adoption of smart building technologies, and strong emphasis on sustainability and operational cost optimization.

The market in Asia-Pacific is slated to record the highest CAGR of 8.5% during the forecast period of 2025–2035. This growth is fueled by rapid urbanization, increasing construction activities, rising disposable incomes, growing awareness of energy efficiency, and government initiatives promoting smart city development. China and India are leading regional growth, while developed markets like Japan and South Korea focus on advanced automation technologies and energy-efficient solutions.

Europe represents a sophisticated market emphasizing sustainability and energy efficiency, with stringent EU regulations driving demand for advanced HVAC control systems. The region leads in developing innovative control technologies and sustainable building practices, with strong adoption of integrated building automation solutions.

Competitive Landscape

The HVAC controls market is characterized by a mix of diversified industrial conglomerates, specialized automation companies, and technology-focused players competing on product innovation, system integration capabilities, technical support, and cost-effectiveness. Leading players in the global HVAC controls market include Honeywell International Inc., Johnson Controls International plc, Schneider Electric SE, Siemens AG, Emerson Electric Co., Carrier Global Corporation, Trane Technologies plc, Danfoss A/S, Belimo Holding AG, Delta Controls Corporation, Distech Controls Inc., KMC Controls Inc., Nest Labs Inc. (Google), Ecobee Inc., Daikin Industries Ltd., LG Electronics, Mitsubishi Electric Corporation, Bosch Thermotechnology, Lennox International Inc., Azbil Corporation, Jackson Systems, Eaton Corporation plc, Fr. Sauter AG., among others.

These companies are focusing on strategies such as investments in IoT and AI technologies, development of cloud-based control platforms, partnerships with building automation system integrators, expansion of wireless and battery-free solutions, and mergers and acquisitions to strengthen their market position and expand their product portfolios.

|

Particulars |

Details |

|

Number of Pages |

185 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

7.6% |

|

Market Size 2024 |

USD 27.25 billion |

|

Market Size 2025 |

USD 29.24 billion |

|

Market Size 2035 |

USD 61.34 billion |

|

Segments Covered |

By Component Type, System Type, Technology, Implementation, End-Use Application |

|

Countries Covered |

North America (U.S., Canada, Mexico), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

The HVAC controls market is projected to reach USD 61.34 billion by 2035 from USD 29.24 billion in 2025, at a CAGR of 7.6% during the forecast period.

In 2025, the smart thermostats segment is projected to hold the major share of the HVAC controls market, while the sensors segment is slated to record the highest growth rate.

Key factors driving the growth include rising demand for energy-efficient building solutions, growing adoption of smart building technologies, stringent energy efficiency regulations and standards, increasing focus on indoor air quality and occupant comfort, and rapid infrastructure development with building automation systems.

North America leads the market with the highest share, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for HVAC controls vendors.

Major opportunities include untapped markets in emerging economies with rapid urbanization, IoT and AI integration in HVAC systems, expansion of the retrofit market for existing buildings, and development of wireless and battery-free solutions.

Key trends include cloud-based HVAC management platforms, wireless communication and remote monitoring capabilities, integration with building management systems, and advanced analytics with predictive maintenance capabilities.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates