Resources

About Us

Gravity Energy Storage Systems Market Size, Share, & Forecast by Technology (Solid Blocks, Underground Rail), Storage Capacity, Energy Conversion Efficiency, and Deployment Location - Global Forecast (2026-2036)

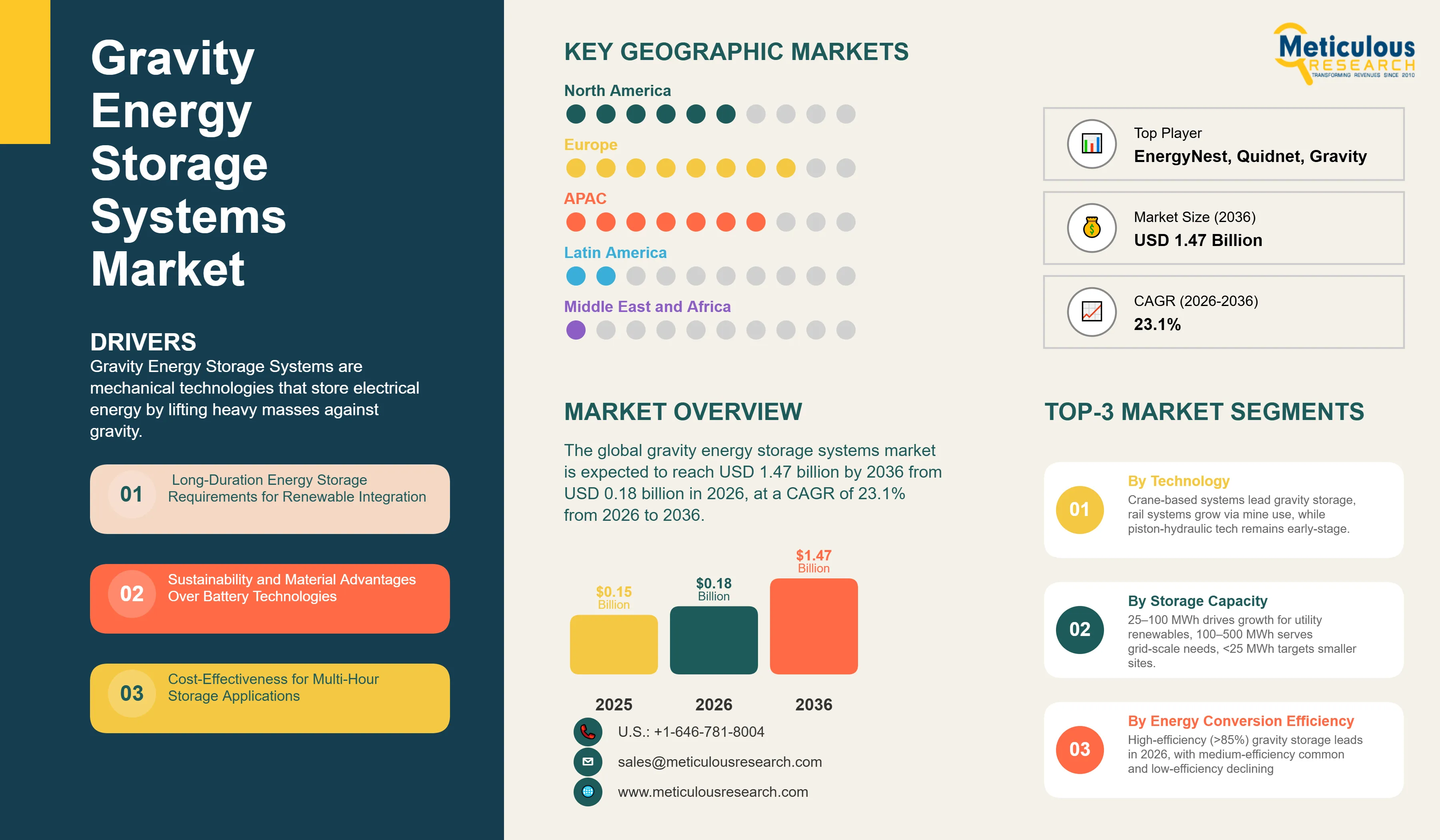

Report ID: MREP - 1041686 Pages: 269 Jan-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global gravity energy storage systems market is expected to reach USD 1.47 billion by 2036 from USD 0.18 billion in 2026, at a CAGR of 23.1% from 2026 to 2036.

Gravity Energy Storage Systems are mechanical technologies that store electrical energy by lifting heavy masses against gravity. They recover energy by lowering these masses in a controlled way, turning potential energy back into electricity through generators. These systems use different methods, such as crane-based solid block systems that stack concrete or composite blocks in towers with automated cranes, underground rail systems that move weighted railcars in vertical or inclined mine shafts, piston systems that raise and lower heavy pistons in deep shafts, and pulley and cable setups that improve mechanical advantage and energy density. By using the basic physics of gravitational potential energy (PE = mgh), these systems offer important benefits. They can store energy for long periods, from hours to days, without losing capacity. Their round-trip efficiency is typically between 75% and 90%, which is similar to pumped hydro. They can cycle indefinitely without battery-like wear, have long operational lives of over 30 to 50 years, and use affordable materials like concrete and steel instead of rare minerals. They respond quickly, supporting frequency regulation and grid services, and can scale from megawatt-hours to gigawatt-hours for various purposes, from integrating renewable energy to enhancing grid resilience.

Click here to: Get Free Sample Pages of this Report

Gravity Energy Storage Systems offer a new way to tackle the challenge of long-lasting energy storage. This is essential for using renewable energy and keeping the grid stable. Unlike chemical batteries that store energy through reactions that can degrade and need rare minerals, gravity storage uses the basic physics of lifting and lowering heavy objects. This principle, as old as clock towers and water mills, is applied on a large scale with modern materials, automation, and control systems. These systems offer significant advantages, including operational lifespans of 30 to 50 years without losing capacity, the use of abundant sustainable materials that do not depend on lithium, cobalt, or other limited battery minerals, unlimited cycling capability for daily or hourly charge-discharge without performance loss, and quick response times in seconds that enable energy trading and additional services. As renewable energy sources increase worldwide—solar and wind are expected to supply 40 to 60% of electricity by 2035 in many markets—the demand for cost-effective long-term storage solutions to manage renewable energy's variability becomes crucial. This creates market opportunities for gravity storage as an alternative or complement to batteries and pumped hydro.

Several trends are changing the gravity energy storage systems market. These include moving from pilot projects to large-scale deployments that prove the technology’s feasibility and cost-effectiveness, repurposing abandoned mine sites for low-cost deployment especially in areas with mining history, integrating gravity storage with renewable energy projects to create hybrid systems, developing modular designs that allow for capacity ranges from 10 MWh to over 1 GWh, and exploring new configurations like offshore gravity storage using ocean depths and buoyancy. The increase in renewable energy creating storage needs, along with technology advancements proving feasibility, supportive policies providing incentives, and market interest in sustainable infrastructure, has helped elevate gravity storage from a lab concept to a developing commercial technology. This shift has attracted hundreds of millions in investment and secured initial project contracts.

The gravity energy storage systems market is moving from early technology development to commercial rollout, with various technology types competing to show the best performance and cost. Leading methods are showing increasingly advanced capabilities, including automated operations that require minimal human involvement, control systems that optimize energy efficiency and grid services, structural designs that maximize energy density in compact spaces, modular setups that allow gradual deployment and expansion of capacity, and integration with renewable energy generation and grid management systems. This competition is pushing rapid innovation as developers strive to prove their technologies and gain early advantages in this emerging market.

The solid block crane-based systems developed by Energy Vault are the most recognized approach to gravity storage. They use automated cranes to stack 35-ton concrete or composite blocks into towers that can reach over 100 meters high. During charging, excess renewable energy powers electric motors that lift the blocks to the top of the tower, converting electrical energy into gravitational potential energy. When discharging, the blocks are lowered in a controlled manner, driving generators that convert potential energy back into electricity. This system achieves round-trip efficiency of 75 to 85%, quick response times under 2.8 seconds, and modular scalability, with each tower capable of providing 20 to 80 MWh of capacity. Energy Vault has secured contracts for more than 2 GWh worldwide and has completed its first commercial-scale project in China. This success demonstrates the technology's feasibility and has attracted investments from cement companies and utilities. The approach benefits from using low-cost, abundant materials, the ability to deploy on any suitable land, and a modular design that allows for capacity expansion.

Underground rail systems developed by Gravitricity and others make use of abandoned mine shafts. They employ weighted railcars or suspended masses that travel in vertical or inclined shafts reaching depths of 500 to 1,500 meters. These deep shafts enable high energy density—Gravitricity's designs can achieve 1 to 4 MWh per shaft, depending on depth—and they use existing infrastructure, significantly reducing capital costs compared to building new shafts. The UK alone has over 1,000 abandoned mine shafts that could potentially be converted, and globally, thousands of disused mines offer deployment opportunities. These systems achieve round-trip efficiency above 80 to 85%, very quick response times under 1 second for frequency response services, and the potential for hybrid setups that provide both power capacity and energy storage. Gravitricity is advancing toward commercial deployment with demonstration projects in Scotland and partnerships for mine conversions in the Czech Republic and other locations. This approach is particularly appealing in areas with a mining tradition and offers economic development opportunities for former mining communities.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 0.18 Billion |

|

Revenue Forecast in 2036 |

USD 1.47 Billion |

|

Growth Rate |

CAGR of 23.1% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments Covered |

Technology Type, Storage Capacity, Energy Conversion Efficiency, Deployment Location, Application, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Switzerland, Netherlands, China, India, Japan, Australia, South Korea, South Africa, Chile, Brazil, Saudi Arabia |

|

Key Companies Profiled |

Energy Vault Holdings Inc., Gravitricity Ltd., Gravity Power LLC, Advanced Rail Energy Storage (ARES), New Energy Let's Go B.V., Vault Energy Storage, RheEnergise Ltd., Quidnet Energy Inc., Gravity Storage GmbH, Heindl Energy GmbH, Terrament Ltd., Graviton Energy Ltd., EnergyNest AS, Adiabatic Compressed Air Energy Storage (AdiaCAES), General Compression Inc., Highview Power Storage Ltd., Storelectric Ltd., Green Gravity Energy, Edinburgh Innovations (University of Edinburgh), ETH Zurich (Research Projects) |

Driver: Long-Duration Energy Storage Requirements for Renewable Integration

As the world shifts to higher renewable energy use, there is a strong need for long-duration energy storage to manage multi-hour and day-to-night variations. Lithium-ion batteries work well for short durations (1-4 hours), but their high costs and wear make them less suitable for longer periods. Pumped hydro storage offers reliable long-duration options but has geographic limits, environmental permitting issues, and high initial costs. This opens the door for alternative long-duration storage technologies that can provide better economics or bypass the drawbacks of pumped hydro. Gravity storage systems meet this demand with their ability to store energy for hours to days, no capacity loss allowing unlimited daily use, and flexibility in location that doesn't depend on specific geography.

Driver: Sustainability and Material Advantages Over Battery Technologies

Concerns about battery supply chains, critical mineral shortages, and environmental effects create chances for storage technologies that use abundant, sustainable materials. Lithium-ion batteries need lithium, cobalt, nickel, and graphite, which have concentrated supply chains, environmental extraction issues, and geopolitical risks. In contrast, gravity storage systems use concrete, steel, and composite materials that are widely available, have well-established sustainable supply chains, and can be recycled at the end of their life. This sustainability benefit appeals to utilities and renewable energy developers who are increasingly focused on overall environmental impacts and supply chain stability. Furthermore, gravity systems last 50 years, far outpacing the 10-15 year lifespan of batteries, which improves lifecycle costs and cuts down on replacement needs.

Opportunity: Abandoned Mine Infrastructure Repurposing

Thousands of abandoned mines around the world present strong opportunities for underground gravity storage. These sites have existing vertical shafts that can significantly lower excavation costs, usually the largest capital expense. The UK alone has over 1,000 disused mines, while South Africa, Australia, Germany, Poland, the United States, and other mining regions have considerable abandoned infrastructure. Converting these mines into energy storage can boost economic growth for former mining communities, preserve industrial history, and utilize sunk infrastructure investments. Gravitricity and its partners are actively pursuing these mine conversions, with demonstration projects moving forward in Scotland and commercial talks happening in multiple countries. This repurposing opportunity could speed up deployment by cutting capital costs by 40-60% compared to new shaft construction.

Opportunity: Hybrid Energy Systems and Microgrid Applications

Gravity storage's quick response time and long cycle life make it ideal for hybrid energy systems that combine generation, storage, and possibly other storage types. Applications include renewable energy hybrid projects that provide consistent capacity, where gravity storage complements batteries. Other uses are off-grid microgrids for remote communities or industrial sites that need reliable long-duration storage, backup power for critical facilities like data centers, hospitals, and military bases requiring Multi-day storage, and frequency regulation services that utilize rapid response while offering energy storage for longer duration needs. These hybrid and specialized applications can demand premium pricing due to their reliability, creating promising early markets for gravity storage that demonstrate their capabilities and build a track record.

By Technology:

In 2026, the Solid Block Crane-Based Systems segment is expected to hold the largest share of the overall gravity energy storage systems market. This growth is fueled by Energy Vault's commercial projects and its proven concept. The scalable modular design can handle capacities from 20 MWh to over 80 MWh per tower. It also offers site flexibility, allowing deployment on any suitable land without geographic restrictions. Additionally, Energy Vault has formed strategic partnerships with major utilities and renewable developers worldwide. The company has secured over 2 GWh in contracts and completed its first commercial installation in China, showcasing both technical and commercial viability. The technology benefits from simple, proven mechanical principles like crane operation and concrete blocks. It also has the potential for automated unmanned operation, along with the ability to use recycled materials or waste products in block composition, which enhances sustainability.

The Underground Rail Systems segment is anticipated to see notable growth during the forecast period. This rise is driven by Gravitricity's technological advancements and opportunities for mine conversions. It offers high energy density achievable in deep shafts (1-4 MWh per shaft) and extremely rapid response times of under 1 second, which provide valuable frequency response services. The segment also features compelling economics, especially when using existing mine infrastructure, which dramatically reduces capital costs. It is particularly strong in regions with a mining background, including the UK, South Africa, Australia, and parts of Europe and North America. Demonstration projects are moving closer to commercial deployment as partnerships for mine conversions are established.

The Piston-Based and Hydraulic Systems segment represents earlier-stage technologies with potential benefits such as very high energy density in compact sizes. It may offer hybrid configurations that combine gravity with pumped hydro or compressed air principles. This segment has fewer moving parts compared to crane or rail systems, which could improve reliability. However, it is still further from commercial deployment than block-stacking or rail approaches.

By Storage Capacity:

In 2026, the 25-100 MWh segment is expected to experience the highest growth rate during the forecast period. This segment represents the ideal capacity for utility-scale renewable integration projects. It balances capital costs with revenue opportunities from energy arbitrage and capacity payments. This range also aligns with the typical scales of solar farms or wind projects, enabling co-located hybrid systems. Applications for this capacity range include shifting renewable energy generation from midday solar to evening peak demand, providing utility peaking capacity to defer or replace combustion turbine peaker plants, and supporting community-scale energy storage for municipal utilities or microgrids. Projects in this capacity range achieve economies of scale while being manageable in terms of development, financing, and construction.

The 100-500 MWh segment caters to larger utility applications, including regional energy storage that supports transmission systems, large renewable energy zone integration, and grid-scale peak capacity. These larger systems require either multiple gravity storage units (like multiple towers or shafts) or very large single installations. This segment is developing as technology scales and utilities become more comfortable with proven deployments.

The <25 MWh segment focuses on smaller applications including distributed energy storage for commercial or industrial facilities, small community microgrids, and specialized uses. While each system is smaller individually, this segment could represent a significant overall market if modular gravity systems can compete on cost at smaller scales.

By Energy Conversion Efficiency:

In 2026, the High-Efficiency (>85%) segment is projected to dominate the market. This segment represents optimized system designs with mechanical configurations that minimize friction losses. It includes regenerative drive systems that recover energy from mechanical components and precise control systems that operate equipment at optimal efficiency. Overall round-trip efficiency is expected to approach or exceed 85%, comparable to pumped hydro storage. High efficiency improves project economics by reducing energy losses. It also allows for competitive performance in energy arbitrage applications, where efficiency plays a key role in spread capture. Furthermore, it differentiates gravity storage from some compressed air or other mechanical storage options that have lower efficiency. Leading developers like Gravitricity claim efficiencies above 85% for optimized underground rail systems.

The Medium-Efficiency (75-85%) segment includes most first-generation commercial systems that achieve good, but not optimal, efficiency. Energy Vault's block-stacking systems reach round-trip efficiency in the 75-85% range, depending on configuration and operating conditions. While this level of efficiency is competitive for many applications, it is also acceptable for projects that prioritize other factors like sustainability, longevity, or site flexibility over maximum efficiency.

The Standard-Efficiency (<75%) segment includes earlier prototypes or simpler designs that have higher mechanical losses. As technology evolves, the market is shifting toward higher efficiency systems.

By Deployment Location:

In 2026, the Greenfield Land-Based segment is expected to hold a significant share. This segment covers new construction of gravity storage facilities on available land that does not require special geography. This includes Energy Vault's tower-based systems, which can be deployed on any reasonably flat land near transmission access. This setup allows for co-location with renewable energy projects or strategic grid locations. The segment benefits from site flexibility and the ability to optimize location for transmission access and renewable integration, without the geographic limitations faced by pumped hydro or underground systems.

The Abandoned Mine Conversion segment is projected to grow quickly. This growth is driven by the compelling economics of using existing shaft infrastructure. There is strong potential in regions with a mining background, such as the UK, South Africa, Australia, and parts of Europe and North America. This segment offers economic development benefits for former mining communities. However, it also faces challenges, such as mine safety assessments and the legal complexities of converting industrial sites. Geographic limitations are also a factor since mines may not be optimally located for grid needs. Still, capital cost advantages of 40-60% can help address these challenges.

The Purpose-Built Underground segment involves creating new shafts designed specifically for gravity storage when existing mines aren't suitable. This approach is more capital-intensive than mine conversion. However, it may be warranted in certain situations, particularly in urban areas where land costs are high or environmental considerations favor underground deployment.

In 2026, Europe is expected to hold the largest share of the global gravity energy storage systems market. This growth is driven by advancements in technology, with Energy Vault in Switzerland and Gravitricity in the UK leading the way. The region benefits from ambitious energy storage goals under the EU Green Deal and national strategies. High levels of renewable energy require long-duration storage for grid stability. There is also a lot of abandoned mine infrastructure, especially in the UK, Germany, and Poland, which provides opportunities for deployment. Additionally, supportive policies, including funding for innovation and storage requirements, are in place. The UK is at the forefront of the European market, thanks to Gravitricity's initiatives and the extensive mining history in Scotland and Wales. Energy Vault is headquartered in Switzerland, which hosts its European operations. Germany faces renewable integration needs and has mining infrastructure, particularly in former coal regions.

The Asia-Pacific region is projected to grow at the fastest rate during the forecast period. China's ambitious energy storage target of 100 GW by 2030 and its eagerness to implement new technologies drive this growth. Energy Vault's first commercial project is operational in China, with more projects already contracted. India's growth in renewable energy requires long-duration storage, and there is significant abandoned mine infrastructure in China, Australia, and India. Government backing for energy storage innovation and deployment is strong, along with a focus on energy security and reliable grids. China presents the largest opportunity due to its size, government support, and commitment to deploying gravity storage commercially. Australia has renewable energy needs and mining infrastructure. India is an emerging market with considerable potential.

North America is a growing market, influenced by the U.S. Inflation Reduction Act, which offers tax credits for energy storage. The rise of renewable energy, particularly in California, Texas, and the Great Plains, creates a demand for storage. There is also abandoned mine infrastructure in Appalachia, the Midwest, and Western states, and utilities are interested in long-duration storage alternatives to batteries. Energy Vault has secured contracts for projects in the U.S. Advanced Rail Energy Storage (ARES) is working on rail-based gravity storage in Nevada. The region benefits from access to capital, a culture of technological innovation, and utilities increasingly acknowledging the need for long-duration storage.

Major players include Energy Vault Holdings Inc. (Switzerland), Gravitricity Ltd. (UK), Gravity Power LLC (U.S.), Advanced Rail Energy Storage/ARES (U.S.), New Energy Let's Go B.V. (Netherlands), Vault Energy Storage (Australia), RheEnergise Ltd. (UK), Quidnet Energy Inc. (U.S.), Gravity Storage GmbH (Germany), Heindl Energy GmbH (Germany), Terrament Ltd. (UK), Graviton Energy Ltd. (UK), EnergyNest AS (Norway), Green Gravity Energy (Australia), and various research institutions including Edinburgh Innovations and ETH Zurich, among others.

The gravity energy storage systems market is expected to grow from USD 0.18 billion in 2026 to USD 1.47 billion by 2036.

The gravity energy storage systems market is expected to grow at a CAGR of 23.1% from 2026 to 2036.

Major players include Energy Vault Holdings, Gravitricity, Gravity Power, Advanced Rail Energy Storage (ARES), New Energy Let's Go, RheEnergise, Quidnet Energy, Gravity Storage, Heindl Energy, and Green Gravity Energy, among others.

Main factors include long-duration energy storage requirements for renewable integration, sustainability advantages using abundant materials versus batteries, abandoned mine repurposing opportunities reducing capital costs, high cycle life and longevity, and favorable policy environment including energy storage incentives.

Europe is estimated to account for the largest share in 2026 due to pioneering technology development and extensive abandoned mine infrastructure, while Asia-Pacific is expected to register the highest growth rate during 2026-2036.

Published Date: Jul-2024

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates