Resources

About Us

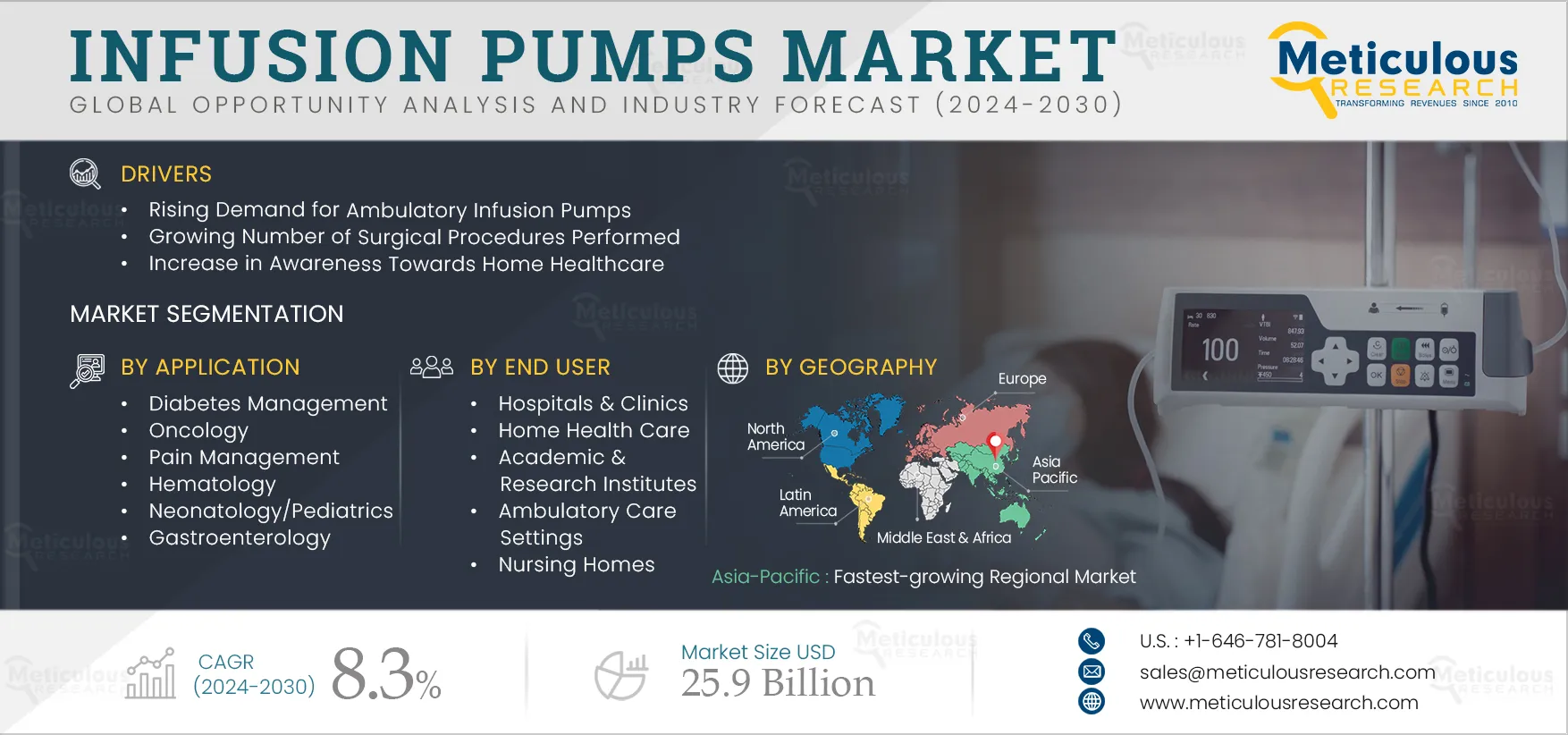

Infusion Pumps Market by Type (Volumetric, Syringe, Insulin, Ambulatory [Disposable, Chemo] Implantable), Channel (Single, Multi) Application (Oncology, Pain, Diabetes, Hematology, Pediatrics) End User (Hospital, Ambulatory Care) - Global Forecast to 2032

Report ID: MRHC - 104272 Pages: 230 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportInfusion pumps enable healthcare providers to provide easy and seamless delivery of fluids into the patient’s body without frequently being in contact with them. These solutions help healthcare professionals streamline patient medications in a controlled way, reducing the chances of errors or overdose. Moreover, advanced infusion pumps give patients the accessibility to carry out their daily tasks with ease while being on medications. Additionally, the COVID-19 pandemic triggered several end users' adoption of infusion pumps, such as hospitals, clinics, and ambulatory centers, due to their ability to provide medications to patients without contact with them.

The growth of this market is driven by the increasing demand and adoption of patient engagement solutions, efforts to enhance patient-centric care by end users, growing industry consolidation through partnerships and collaborations, government initiatives and regulatory upgradation, rising healthcare expenditure, and rising prevalence of chronic diseases coupled with the increasing geriatric population. However, patient data privacy and safety concerns may restrain the growth of this market.

Furthermore, the growing adoption of wearable and mobile-based digital healthcare solutions and emerging economies are expected to offer significant growth opportunities for players in this market. However, the lack of digital literacy, the high cost associated with deploying healthcare IT solutions, and the lack of skilled IT personnel in the healthcare industry are challenging the growth of infusion pump market.

Click here to: Get a Free Sample Copy of this report

The prevalence of chronic diseases and conditions such as cancer, diabetes, and heart disease is rising globally. According to the WHO, 41 million people die from chronic diseases each year, accounting for around 74% of all deaths globally. Growth in the geriatric population and social behaviors such as tobacco and alcohol use, physical inactivity, and unhealthy diets are major factors driving a steady increase in the number of people suffering from chronic diseases. According to the International Diabetes Federation, the global prevalence of diabetes is estimated to increase from 10.5% of the global population in 2021 to 11.3% in 2032.

Also, chronic diseases are often associated with the elderly population due to the declining bodily functions and immunity among this population segment. Aging is associated with progressive deterioration in the structure and functioning of organs. The elderly population is more prone to various chronic diseases. According to World Population Prospects, the population aged 65 and above is growing more rapidly than other age groups.

In 2019, 703 million people were in the age group of 65 years and above globally. This number is projected to reach 1.5 billion by 2050. This remarkable growth in the elderly population is driven by declining fertility rates and improvements in longevity. Infusion pumps are commonly used to manage diabetes, particularly for individuals with type 1 diabetes. Insulin pumps deliver a continuous supply of insulin, mimicking the function of the pancreas. This helps regulate blood sugar levels and allows for flexibility in insulin dosing. Insulin pump can also be programmed to deliver bolus doses before meals.

Furthermore, non-communicable diseases (NCDs), such as cancer, cardiovascular disease, diabetes, and mental illness, are becoming more prevalent. NCDs currently account for 70% of all deaths globally, with the majority recorded in low- & middle-income countries. The International Agency for Research on Cancer (IARC) estimates that globally, 1 in 5 people develop cancer during their lifetime, and 1 in 8 men and 1 in 11 women lose their lives. As per WHO estimates, the global prevalence of new cancer cases is expected to increase from 19.2 million in 2020 to 24.5 in 2032, while the global mortality from cancer is expected to increase from 9.9 million in 2020 to 12.9 million in 2032. Many cancer patients receive chemotherapy and other medications through infusion pumps. These pumps provide a steady and controlled infusion of chemotherapy drugs, reducing the risk of side effects and ensuring the patient receives the prescribed treatment regimen.

The overall scenario indicates that the rising prevalence of chronic diseases, coupled with the increasing geriatric population, is expected to increase the patient pool demanding highly innovative solutions during their diagnosis journey, further driving the growth of the infusion pumps market. Infusion pumps offer several advantages in managing chronic diseases, including precise dosing, reduced risk of human error, and the ability to customize infusion rates and schedules based on individual patient needs.

The emergence of home healthcare has enabled patients to receive hospital-like care in their homes. Infusion pumps are often used in home healthcare settings to manage chronic diseases. Patients can receive necessary treatments and medications at home, improving their quality of life and reducing hospital stays. These advantages of home care have led many countries, such as the U.S., U.K., Canada, Australia, and Israel, to implement government policies that encourage homecare health services. For instance, every regional and metropolitan hospital in Victoria, Australia, has a hospital-at-home program, and nearly 6% of all hospital bed-days are provided that way. (Source: Commonwealth Fund). Furthermore, home care is widely adopted for specific conditions such as deep venous thrombosis (DVT) and acute cellulitis.

As per the Johns Hopkins Model, the cost of at-home care was 32% less than hospital care (USD 5,081 VS. USD 7,480), and the length of stay of the patients was also reduced by nearly one-third (3.2 days VS. 4.9 days). Additionally, the home care setting was found to be more convenient for family members and patients than those offered usual hospital care.

Nearly 5.6 million children in the U.S. receive nearly 5.1 hours of medical care at home, which saves approximately USD 36 billion annually (Source: Everyday Health, Inc.). These factors have led to the increased adoption of home healthcare as a cost-effective alternative to hospital healthcare services. Additionally, the reduced need for rehospitalization, expensive & unnecessary testing, and shorter treatment times are among the major factors propelling the adoption of home-based health care in developed and developing countries.

Among the product types studied in this report, in 2025, the infusion pump accessories/consumables segment is expected to account for the largest share of the infusion pumps market. Recurrent use and repeat purchase of accessories/consumables for infusion therapy support the high share of this segment.

Among the channels studied in this report, in 2025, the multi-channel infusion pumps segment is expected to account for the largest share of the segment owing to factors such as rising demand for technologically advanced infusion pumps, precise & multiple drug delivery in case of chronic diseases, and rising awareness and demand for advanced infusion pumps in home healthcare.

Among the applications studied in this report, in 2025, the oncology segment is expected to account for the largest share of the infusion pumps market due to the increasing prevalence of cancer and rising demand for controlled dispensing of drugs in the body for chemotherapy. Additionally, portable infusion pumps can enable patients to receive chemotherapy in their homes, triggering the segment's growth.

Among the end users studied in this report, in 2025, the hospitals & clinics segment is expected to account for the largest share of the infusion pumps market. Factors such as the large volume of patients served by hospitals, the top line serving a large volume of patients, and increasing patient pool are some factors that account for the largest market share.

The increasing focus of government bodies of Asia-Pacific countries such as China, India, Singapore, and South Korea on the healthcare sector in terms of increased investment for the adoption of advanced technology, rising investments in better healthcare infrastructure, and the increasing awareness and literacy among the population. Furthermore, the growing presence of key companies is boosting the growth of this regional market.

Key Players

Some of the key infusion pump manufacturers operating in the this market are Becton, Dickinson and Company (BD), B. Braun SE (Germany), Baxter International Inc. (U.S.), Fresenius SE&Co. KGaA. (Germany), ICU Medical, Inc. (U.S.), Medtronic plc (Ireland), MOOG Inc. (U.S.), Terumo Corporation (Japan), F. Hoffmann-LA Roche Ltd (Switzerland), and Insulet Corporation (U.S.).

Infusion Pumps Market Size & Trend Analysis, by End User

Key questions answered in the report:

The Infusion Pumps Market focuses on devices that deliver fluids and medications into patients' bodies in controlled amounts, enhancing treatment precision and reducing risks of medication errors.

The Infusion Pumps Market is projected to reach $25.9 billion by 2032, driven by increasing adoption in hospitals, home healthcare, and rising chronic disease cases globally.

The Infusion Pumps Market is expected to grow at a CAGR of 8.3% from 2025 to 2032, reflecting increasing adoption due to the demand for efficient healthcare delivery systems.

The market size is projected to reach $25.9 billion by 2032, driven by rising demand for healthcare solutions and the growing geriatric population requiring chronic disease management.

Key players include BD, B. Braun SE, Baxter International, Fresenius SE&Co. KGaA, ICU Medical, Medtronic, MOOG, Terumo Corporation, Roche, and Insulet Corporation.

A key trend is the increasing demand for wearable and portable infusion pumps, particularly in home healthcare, enabling patients to manage treatments conveniently.

The market is driven by rising chronic disease prevalence, an aging population, increased home healthcare adoption, and technological advancements in infusion pump devices.

The market is segmented by product type (devices, accessories/consumables), channel (single/multi-channel pumps), application (diabetes, oncology, pain management), and end user (hospitals, home healthcare).

The global outlook is optimistic, with high growth projected in Asia-Pacific, driven by government investments in healthcare infrastructure and increasing awareness.

The market is expected to grow significantly, reaching $25.9 billion by 2032, fueled by advancements in medical devices and the need for precise medication delivery systems.

The Infusion Pumps Market is projected to grow at a CAGR of 8.3% from 2025 to 2032, driven by increasing demand for automated and portable healthcare solutions.

North America holds the largest market share, driven by advanced healthcare infrastructure, high chronic disease prevalence, and significant adoption of infusion pumps.

1. Introduction

1.1. Market Definition and Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3 Market Share Analysis

2.4. Assumptions for the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. Rising Demand for Ambulatory Infusion Pumps

4.2.2. Increasing Incidence of Chronic Diseases along with the Rapid Growth in the Geriatric Population

4.2.3. Growing Number of Surgical Procedures Performed

4.2.4. Increase in Awareness Towards Home Healthcare

4.3. Restraints

4.3.1. Frequent Product Recalls of Infusion Pumps

4.3.2. Increasing Adoption of Refurbished and Rental Infusion Pumps

4.3.3. Stringent Regulatory Requirements for New Products

4.4. Opportunities

4.4.1. Emerging Markets

4.4.2. Growing Adoption of Specialty Infusion Systems such as IOT Infusion Pumps

4.5. Challenges

4.5.1. Increasing Incidence of Medication Errors and Lack of Wireless Connectivity in Hospitals

4.6. Porter’s Five Forces Analysis

4.7. Regulatory Analysis

4.8. Case Studies/Use Cases

5. Infusion Pumps Market Size & Trend Analysis—by Product

5.1. Overview

5.2. Devices

5.2.1. By Type

5.2.1.1. Volumetric Infusion Pumps

5.2.1.2. Syringe Infusion Pumps

5.2.1.3. Insulin Infusion Pumps

5.2.1.4. Ambulatory Infusion Pumps

5.2.1.4.1. Disposable Infusion Pumps

5.2.1.4.2. Chemotherapy Infusion Pumps

5.2.1.5. Enteral Infusion Pumps

5.2.1.6. PCA Infusion Pumps

5.2.1.7. Implantable Infusion Pumps

5.2.2. By Mode

5.2.2.1. Manual Infusion Pumps

5.2.2.2. Automatic Infusion Pumps

5.3. Infusion Pump Accessories/Consumables

6. Infusion Pumps Market Size & Trend Analysis—by Channel

6.1. Overview

6.2. Single Channel Infusion Pumps

6.3. Multi-channel Infusion Pumps

7, Infusion Pumps Market Size & Trend Analysis—by Application

7.1. Overview

7.2. Diabetes Management

7.3. Oncology

7.4. Pain Management

7.5. Hematology

7.6. Neonatology/Pediatrics

7.7. Gastroenterology

8. Infusion Pumps Market Size & Trend Analysis—by End User

8.1. Overview

8.2. Hospitals & Clinics

8.3. Home Health Care

8.4. Academic & Research Institutes

8.5. Ambulatory Care Settings

8.6. Nursing Homes

9. Infusion Pumps Market Size & Trend Analysis—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. Italy

9.3.4. U.K.

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/Market Ranking (2022)

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1. Becton, Dickinson and Company (BD) (U.S.)

11.2. B. Braun SE (Germany)

11.3. Fresenius SE&Co. KGaA. (Germany)

11.4. ICU Medical, Inc. (U.S.)

11.5. Medtronic plc (Ireland)

11.6. MOOG Inc. (U.S.)

11.7. Terumo Corporation (Japan)

11.8. F. Hoffmann-LA Roche Ltd (Switzerland)

11.9. Insulet Corporation (U.S.)

11.10. Baxter International Inc. (U.S.)

(Note: SWOT analysis is provided for the top 5 companies.)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 2 Global Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 3 Global Infusion Pump Devices Market, by Country/Region, 2021–2032 (USD Million)

Table 4 Global Volumetric Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 5 Global Syringe Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 6 Global Insulin Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 7 Global Ambulatory Infusion Pumps Market, by Type, 2021–2032 (USD Million)

Table 8 Global Ambulatory Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 9 Global Disposable Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 10 Global Chemotherapy Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 11 Global Enteral Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 12 Global PCA Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 13 Global Implantable Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 14 Global Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 15 Global Infusion Pump Devices Market, by Mode, Country/Region, 2021–2032 (USD Million)

Table 16 Global Manual Infusion Pumps Market, by Channel, by Country/Region, 2021–2032 (USD Million)

Table 17 Global Automatic Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 18 Global Infusion Pump Accessories/Consumables Market, by Country/Region, 2021–2032 (USD Million)

Table 19 Global Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 20 Global Single Channel Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 21 Global Multi-channel Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 22 Global Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 23 Global Infusion Pumps Market for Diabetes Management, by Country/Region, 2021–2032 (USD Million)

Table 24 Global Infusion Pumps Market for Oncology, by Country/Region, 2021–2032 (USD Million)

Table 25 Global Infusion Pumps Market for Pain Management, by Country/Region, 2021–2032 (USD Million)

Table 26 Global Infusion Pumps Market for Hematology, by Country/Region, 2021–2032 (USD Million)

Table 27 Global Infusion Pumps Market for Neonatology/Pediatrics, by Country/Region, 2021–2032 (USD Million)

Table 28 Global Infusion Pumps Market for Gastroenterology, by Country/Region, 2021–2032 (USD Million)

Table 29 Global Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 30 Global Infusion Pumps Market for Hospitals & Clinics, by Country/Region, 2021–2032 (USD Million)

Table 31 Global Infusion Pumps Market for Home Health Care, by Country/Region, 2021–2032 (USD Million)

Table 32 Global Infusion Pumps Market for Academic & Research Institutes, by Country/Region, 2021–2032 (USD Million)

Table 33 Global Infusion Pumps Market for Ambulatory Care Settings, by Country/Region, 2021–2032 (USD Million)

Table 34 Global Infusion Pumps Market for Nursing Homes, by Country/Region, 2021–2032 (USD Million)

Table 35 Global Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 36 North America: Infusion Pumps Market, by Country, 2021–2032 (USD Million)

Table 37 North America: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 38 North America: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 39 North America: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 40 North America: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 41 North America: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 42 North America: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 43 North America: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 44 U.S.: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 45 U.S.: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 46 U.S.: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 47 U.S.: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 48 U.S.: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 49 U.S.: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 50 U.S.: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 51 Canada: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 52 Canada: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 53 Canada: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 54 Canada: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 55 Canada: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 56 Canada: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 57 Canada: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 58 Europe: Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 59 Europe: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 60 Europe: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 61 Europe: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 62 Europe: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 63 Europe: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 64 Europe: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 65 Europe: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 66 Germany: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 67 Germany: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 68 Germany: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 69 Germany: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 70 Germany: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 71 Germany: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 72 Germany: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 73 France: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 74 France: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 75 France: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 76 France: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 77 France: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 78 France: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 79 France: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 80 U.K.: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 81 U.K.: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 82 U.K.: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 83 U.K.: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 84 U.K.: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 85 U.K.: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 86 U.K.: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 87 Italy: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 88 Italy: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 89 Italy: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 90 Italy: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 91 Italy: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 92 Italy: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 93 Italy: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 94 Spain: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 95 Spain: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 96 Spain: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 97 Spain: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 98 Spain: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 99 Spain: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 100 Spain: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 101 Rest of Europe: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 102 Rest of Europe: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 103 Rest of Europe: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 104 Rest of Europe: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 105 Rest of Europe: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 106 Rest of Europe: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 107 Rest of Europe: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 108 Asia-Pacific: Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 109 Asia-Pacific: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 110 Asia-Pacific: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 111 Asia-Pacific: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 112 Asia-Pacific: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 113 Asia-Pacific: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 114 Asia-Pacific: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 115 Asia-Pacific: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 116 Japan: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 117 Japan: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 118 Japan: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 119 Japan: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 120 Japan: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 121 Japan: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 122 Japan: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 123 China: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 124 China: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 125 China: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 126 China: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 127 China: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 128 China: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 129 China: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 130 India: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 131 India: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 132 India: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 133 India: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 134 India: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 135 India: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 136 India: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 137 Rest of Asia–Pacific: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 138 Rest of Asia–Pacific: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 139 Rest of Asia–Pacific: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 140 Rest of Asia–Pacific: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 141 Rest of Asia–Pacific: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 142 Rest of Asia–Pacific: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 143 Rest of Asia–Pacific: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 144 Latin America: Infusion Pumps Market, by Country/Region, 2021–2032 (USD Million)

Table 145 Latin America: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 146 Latin America: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 147 Latin America: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 148 Latin America: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 149 Latin America: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 150 Latin America: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 151 Latin America: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 152 Brazil: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 153 Brazil: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 154 Brazil: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 155 Brazil: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 156 Brazil: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 157 Brazil: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 158 Brazil: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 159 Mexico: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 160 Mexico: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 161 Mexico: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 162 Mexico: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 163 Mexico: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 164 Mexico: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 165 Mexico: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 166 Rest of Latin America: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 167 Rest of Latin America: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 168 Rest of Latin America: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 169 Rest of Latin America: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 170 Rest of Latin America: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 171 Rest of Latin America: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 172 Rest of Latin America: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 173 Middle East & Africa: Infusion Pumps Market, by Product Type, 2021–2032 (USD Million)

Table 174 Middle East & Africa: Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 175 Middle East & Africa: Ambulatory Infusion Pump Devices Market, by Type, 2021–2032 (USD Million)

Table 176 Middle East & Africa: Infusion Pump Devices Market, by Mode, 2021–2032 (USD Million)

Table 177 Middle East & Africa: Infusion Pumps Market, by Channel, 2021–2032 (USD Million)

Table 178 Middle East & Africa: Infusion Pumps Market, by Application, 2021–2032 (USD Million)

Table 179 Middle East & Africa: Infusion Pumps Market, by End User, 2021–2032 (USD Million)

Table 180 Recent Developments, by Company, 2020–2025

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Size Estimation

Figure 7 Global Infusion Pumps Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 8 Global Infusion Pumps Market, by Channel, 2025 Vs. 2032 (USD Million)

Figure 9 Global Infusion Pumps Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 10 Global Infusion Pumps Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 11 Global Infusion Pumps Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 12 Impact Analysis: Infusion Pumps Market

Figure 13 Market Dynamics: Infusion Pumps Market

Figure 14 Global Infusion Pumps Market, by Product Type, 2025 Vs.2032 (USD Million)

Figure 15 Global Infusion Pumps Market, by Channel, 2025 Vs.2032 (USD Million)

Figure 16 Global Infusion Pumps Market, by Application, 2025 Vs.2032 (USD Million)

Figure 17 Global Infusion Pumps Market, by End User, 2025 Vs.2032 (USD Million)

Figure 18 Global Infusion Pumps Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 19 North America: Infusion Pumps Market Snapshot

Figure 20 Europe: Infusion Pumps Market Snapshot

Figure 21 Asia-Pacific: Infusion Pumps Market Snapshot

Figure 22 Latin America: Infusion Pumps Market Snapshot

Figure 23 Key Growth Strategies Adopted by Leading Players, 2020–2025

Figure 24 Global Infusion Pumps Market: Competitive Benchmarking Based on Product Type

Figure 25 Global Infusion Pumps Market: Competitive Benchmarking Based on Geography

Figure 26 Global Infusion Pumps Market: Market Share Analysis (2022)

Figure 27 Becton, Dickinson and Company (BD): Financial Overview (2022)

Figure 28 B. Braun SE: Financial Overview (2022)

Figure 29 Baxter International Inc.: Financial Overview (2022)

Figure 30 Fresenius SE&Co. KGaA.: Financial Overview (2022)

Figure 31 ICU Medical, Inc.: Financial Overview (2022)

Figure 32 Medtronic plc: Financial Overview (2022)

Figure 33 MOOG Inc.: Financial Overview (2022)

Figure 34 Terumo Corporation: Financial Overview (2022)

Figure 35 F. Hoffmann-LA Roche Ltd: Financial Overview (2022)

Figure 36 Insulet Corporation: Financial Overview (2022)

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Mar-2016

Published Date: Aug-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates