Resources

About Us

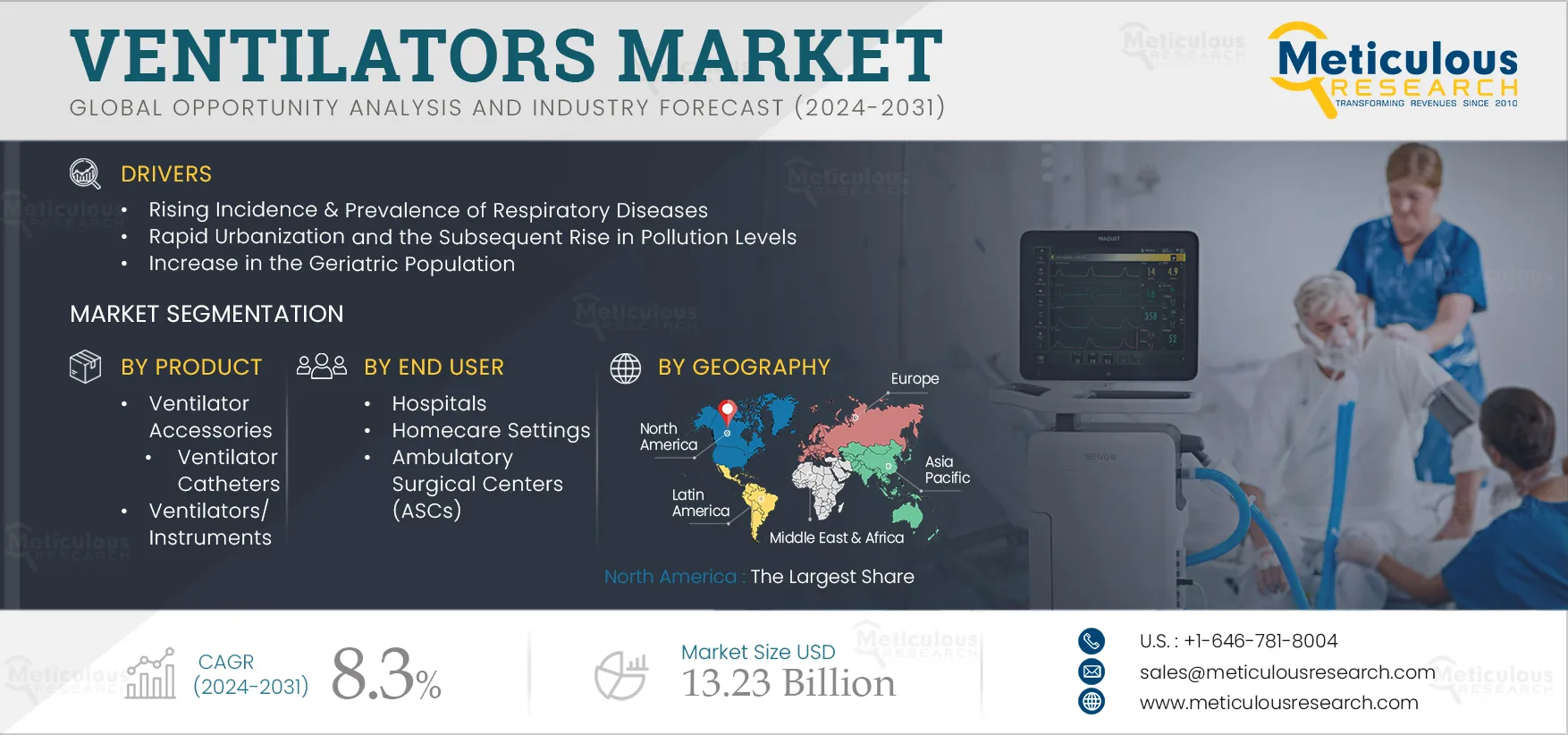

Ventilators Market Size, Share, Forecast, & Trends Analysis by Product (Instrument, Catheter, Mask, Tube) Mobility (Intensive Care, Portable) Interface (Invasive, Non-invasive) Age Group Mode (Volume, Pressure) End User – Global Forecast to 2031

Report ID: MRHC - 104395 Pages: 230 Sep-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of the ventilators market is driven by factors such as the increasing number of intensive care units (ICUs) and the corresponding rise in the demand for related equipment & systems, the rising incidence & prevalence of respiratory diseases, rapid urbanization and the consequent rise in pollution levels, the increase in the geriatric population, and the rising incidence of preterm births.

Furthermore, the increasing demand for home care therapeutic devices and the expansion of healthcare infrastructure across emerging economies in Asia-Pacific and Latin America are expected to create market growth opportunities.

The intensive care unit (ICU) is a specialized facility where critically ill patients receive intensive medical care. The strength of healthcare systems globally is often assessed based on the availability of hospital beds and critical care beds, including those in the ICU. This availability determines the accessibility of healthcare services for the population. Currently, access to healthcare services, particularly intensive care, varies significantly worldwide. The number of ICU beds per 10,000 population differs across regions. For example, in Europe, ICU bed numbers range from 0.42 per 10,000 population in Portugal to 2.92 per 10,000 population in Germany, with an average of 1.15 ICU beds per 10,000 population across Europe. Globally, the U.S. has the highest number of ICU beds, with 3.42 beds per 10,000 population—nearly ten times that of China (0.36) and three times that of Italy (1.25).

Equipment utilized in ICUs ranges from basic tools like blood pressure monitors to highly specialized machinery such as dialysis machines. Key components of critical care infrastructure include ventilators, infusion pumps, IV pole mounts, bedside electronic and manual patient monitoring devices, resuscitation equipment, and various catheters and intubation devices. Therefore, a rise in the overall number of ICU beds subsequently increases demand for associated devices like ventilators.

Click here to: Get Free Sample Pages of this Report

Over the past several decades, the share of the global urban population has significantly increased. This rising urbanization often leads to deforestation for residential and industrial development. The resultant deforestation, combined with higher emissions from various industries and increased vehicle use in urban areas, contributes to numerous environmental issues, including air pollution. As urbanization continues, air pollution levels tend to rise, which adversely affects human health, particularly the respiratory system. Increased exposure to air pollutants is linked to higher incidences of respiratory diseases. For instance, according to the American Lung Association (ALA), in 2022, 11.7 million people, or 4.6% of adults, reported being diagnosed with chronic obstructive pulmonary disease (COPD), chronic bronchitis, or emphysema. Thus, the rising levels of air pollution driven by urbanization have increased the incidence and prevalence of respiratory diseases, thereby driving the demand for ventilators.

According to the WHO, preterm birth is defined as the birth of babies before 37 complete weeks of pregnancy. Over the past several decades, the rates of preterm birth have been rising in many countries. According to the CDC, in 2022, preterm birth affected approximately one in every ten infants born in the U.S. Globally, premature births are the leading cause of death among children under five years old.

Preterm infants are more susceptible to respiratory problems as their lungs are underdeveloped and may not function properly. As a result, preterm babies are at risk for serious complications such as Respiratory Distress Syndrome (RDS), sleep apnea, anemia, bronchopulmonary dysplasia (BPD), persistent pulmonary hypertension of the newborn (PPHN), and pneumonia. Among these, bronchopulmonary dysplasia (BPD) is the most common complication in premature infants and often requires ventilatory support.

The rising incidence of preterm births and associated complications, including respiratory distress syndrome, bronchopulmonary dysplasia, and sleep apnea, is driving the demand for neonatal ventilators worldwide.

The increase in the geriatric population and the rise in life expectancy have increased the global demand for home care services. Additionally, government initiatives aimed at reducing healthcare costs by transitioning certain treatments to non-hospital settings have further fueled the growth of the home care therapy market. As a result, there has been a substantial increase in the demand for home care devices. Moreover, advancements in technology have redirected attention towards alternative treatment approaches, like home healthcare, which are both cost-effective and efficient.

Amid the increased demand for ventilators prompted by the outbreak of the COVID-19 pandemic, the U.S. FDA implemented a reinforcement policy in March 2020 to increase the availability of ventilators and respiratory devices, including their accessories. The FDA categorized ventilators based on their suitability for facility or home use. According to regulations outlined in 21 CFR 868.5895, ventilators supporting continuous ventilation with minimal assistance can be utilized in home settings. These regulatory measures are expected to drive the growth of the ventilators market for home care settings, presenting growth opportunities for companies operating in this market.

Emerging economies in the Asia-Pacific and Latin America regions are witnessing significant improvements in healthcare infrastructure due to increasing healthcare expenditure and rising demand for better healthcare services. For instance, the Indian government is implementing various initiatives to address these needs. In 2018, the Ministry of Health and Family Welfare of India introduced the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY), a centrally sponsored health assurance scheme. By July 2021, 160.9 million beneficiary cards had been issued under this program.

In China, the government has been implementing reforms to reduce the burden on public hospitals by encouraging the development and use of private hospitals. Moreover, in Brazil, the National Health Mission (NHM) was established to improve healthcare delivery in both urban and rural areas, with a focus on strengthening health infrastructure.

Based on product, the market is segmented into ventilator accessories and ventilators/instruments. The ventilator accessories segment is anticipated to hold the largest share of 36.8% of the ventilators market in 2024. This significant share can be attributed to the rising awareness regarding hospital hygiene practices and the extensive utilization of ventilator accessories such as catheters, masks, endotracheal tubes, sensors, nebulizers, humidifiers, oxygen and CO2 measurement devices, circuit sets, and valve sets. The high demand for these accessories has prompted market players to expand their product offerings. For instance, in May 2021, Olympus Corporation (Japan) obtained 510(k) clearance for its Airway Mobilescopes, including the MAF-TM2, MAF-GM2, and MAF-DM2 models, designed for a range of upper and lower airway management procedures. These flexible mobile scopes feature a video camera at the tip, facilitating enhanced visualization during procedures. Anesthesiologists and pulmonologists can utilize these devices to deliver critical and intensive care.

Based on mobility, the intensive care ventilators segment is anticipated to hold the largest share of 76.2% of the ventilators market in 2024. This significant share can be attributed to the increasing installation of ventilators in ICUs, the availability of reimbursements for ventilation solutions and respiratory treatment procedures, a surge in patient admissions in CCUs driven by the rising prevalence of chronic & respiratory infectious diseases, and the rising incidence of preterm births worldwide.

Based on interface, the invasive ventilators segment is anticipated to hold the largest share of the ventilators market in 2024. This significant share can be attributed to the extensive use of invasive ventilators in ICUs for patients with neurological disorders, chronic respiratory and infectious diseases, and sleep disorders.

Based on age group, the adult & pediatric segment is anticipated to hold the largest share of the ventilators market in 2024. This significant share can be attributed to the increased adoption of ventilation support among the elderly population, their increased vulnerability to chronic and infectious diseases such as COPD and lung infections, and the increased tobacco use among this demographic. Furthermore, the high rates of hospital admissions further drive the need for critical care equipment, such as ventilators. For instance, according to the American Hospital Association (AHA), in 2022, a total of 33,679,935 admissions were recorded across all U.S. hospitals. Similarly, National Health Service (NHS) England recorded approximately 237,951 adult critical care admissions in 2022. These high admission rates necessitate the utilization of critical care equipment like ventilators, thereby contributing to the market’s growth.

Based on mode, the volume mode ventilation segment is anticipated to hold the largest share of the ventilators market in 2024. This significant share can be attributed to the widespread adoption of volume-controlled ventilators in intensive care units due to their advantages, including precise minute ventilation and consistent tidal volume delivery. Volume Controlled Ventilation (VCV) has traditionally been the standard mode of controlled ventilation in anesthesia. Some of the companies that provide volume mode ventilators are GE HealthCare Technologies, Inc. (U.S.), Hamilton Company (U.S.), Medtronic plc (Ireland), and Drägerwerk AG & Co. KGaA (Germany).

Based on end user, the hospitals segment is anticipated to hold the largest share of the ventilators market in 2024. This significant share can be attributed to the considerable number of patients afflicted with respiratory illnesses, the presence of skilled medical practitioners in hospitals, and the accessibility to advanced healthcare facilities equipped with state-of-the-art medical devices.

In 2024, North America is anticipated to hold the largest share of 55.7% of the ventilators market. North America’s large market share is attributed to the region's robust healthcare infrastructure, the increasing incidence of chronic and infectious diseases, the presence of leading market players, and the widespread adoption of cutting-edge medical technologies.

However, the market in Asia-Pacific is anticipated to record the highest CAGR of 18.7% during the forecast period. This growth is driven by the increasing prevalence of respiratory diseases, growing investments in the healthcare sector, and ongoing innovations in ventilation technology. For instance, in November 2023, China’s National Health Commission reported a rise in respiratory diseases, particularly among children. Additionally, in November 2021, Shenzhen Comen Medical Instruments Co., Ltd. (China) introduced the Comen V1 transport ventilator at the Medica Trade Fair in Germany. This ventilator is easy to use, compact in design, and portable, making it suitable for use outside hospital settings.

The report provides a competitive analysis through a comprehensive assessment of leading players' product portfolios, geographic presence, and key growth strategies adopted over the past 3–4 years. Major players operating in the ventilators market include Schiller AG (Switzerland), Hamilton Medical AG (Switzerland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies, Inc. (U.S.), Medtronic plc (Ireland), Getinge AB (Sweden), ResMed Inc. (U.S.), Zoll Medical Corporation (U.S.), Drägerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare Limited (New Zealand), and VYAIRE MEDICAL, INC. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

230 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

8.3% |

|

Market Size (Value) |

USD 13.23 Billion by 2031 |

|

Segments Covered |

By Product

By Mobility

By Interface

By Age Group

By Mode

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, Singapore, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (U.A.E., Saudi Arabia, South Africa, and Rest of Middle East & Africa) |

|

Key Companies |

Schiller AG (Switzerland), Hamilton Medical AG (Switzerland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies, Inc. (U.S.), Medtronic plc (Ireland), Getinge AB (Sweden), ResMed Inc. (U.S.), Zoll Medical Corporation (U.S.), Drägerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare Limited (New Zealand), and VYAIRE MEDICAL, INC. (U.S.) |

This market study covers the market sizes & forecasts of the ventilators based on product, mobility, interface, age group, mode, end user, and geography. It also provides the value analysis of various segments and sub-segments of the global ventilators market at country levels.

The ventilators market is projected to reach $13.23 billion by 2031, at a CAGR of 8.3% during the forecast period.

The ventilator accessories segment is expected to hold the largest share of the market in 2024.

The intensive care ventilators segment is expected to hold the largest share of the market in 2024.

The growth of the ventilators market is driven by factors such as the increasing number of intensive care units (ICUs) and the corresponding rise in the demand for related equipment & systems, the rising incidence & prevalence of respiratory diseases, rapid urbanization and the consequent rise in pollution levels, the increase in the geriatric population, and the rising incidence of preterm births.

Furthermore, the increasing demand for home care therapeutic devices and the expansion of healthcare infrastructure across emerging economies in Asia-Pacific and Latin America are expected to create market growth opportunities.

Some of the major players operating in the ventilators market are Schiller AG (Switzerland), Hamilton Medical AG (Switzerland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies, Inc. (U.S.), Medtronic plc (Ireland), Getinge AB (Sweden), ResMed Inc. (U.S.), Zoll Medical Corporation (U.S.), Drägerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare Limited (New Zealand), and VYAIRE MEDICAL, INC. (U.S.).

Countries like China, Brazil, and India are expected to offer significant growth opportunities for the vendors in this market during the analysis period.

Published Date: Feb-2023

Published Date: Jun-2023

Published Date: Jan-2025

Published Date: Mar-2016

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates