Resources

About Us

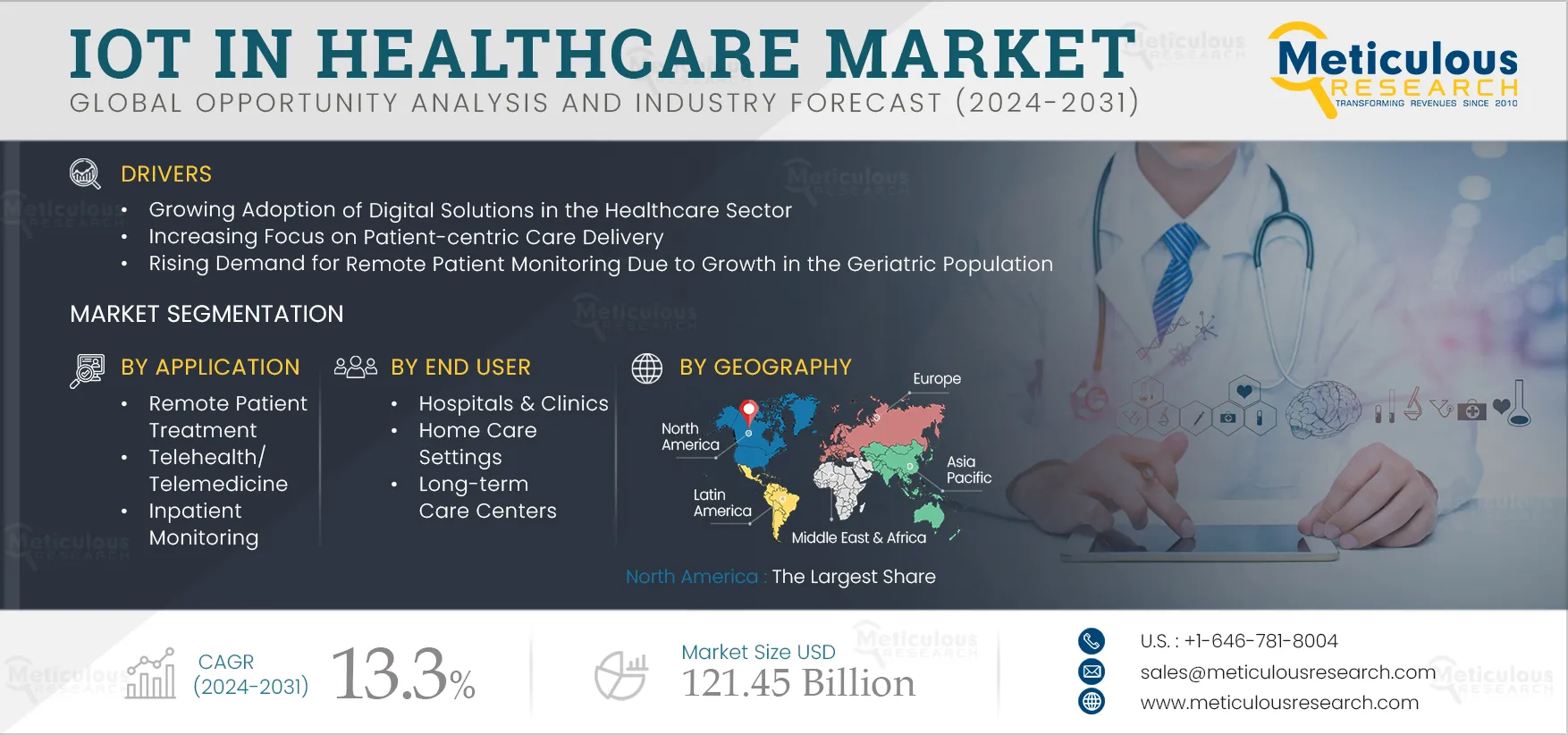

IoT in Healthcare Market Size, Share, Forecast, & Trends Analysis by Offering (Monitoring Devices (Glucose, Cardiac, Respiratory, Blood Pressure, Neuro) Pacemaker, ICD, Insulin Pump) Application (Telehealth, In-Patient) End User - Global Forecast to 2031

Report ID: MRHC - 104244 Pages: 291 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportKey factors driving the growth of this market include the widespread adoption of digital healthcare technologies, an increasing emphasis on patient-centered care, and increasing digital health initiatives globally. Moreover, the widespread adoption of telehealth solutions and the increasing utilization of IoT for early & accurate disease diagnosis and treatment is anticipated to create market growth opportunities.

A patient-centric approach fosters collaboration between doctors, patients, and their families to make decisions that align with patients' needs, preferences, and desires. Healthcare delivery is increasingly shifting from institutional-focused models to patient-focused ones. This transition drives the adoption of technologies that facilitate interactions between healthcare providers and patients, enabling the collection of crucial health information for informed treatment decisions.

Patient-centric care extends to both diagnosis and treatment provided by hospitals. This approach facilitates the customization of care plans and the development of personalized medicine. Additionally, this approach takes into account patients' overall well-being, including factors such as genetics, metabolism, immune system, and biomarkers. IoT plays a significant role in delivering patient-centered care by enabling the collection and processing of vast amounts of data, which is essential for personalized healthcare.

Click here to: Get Free Sample Pages of this Report

Advanced connectivity options, such as Bluetooth, Wi-Fi, and cellular networks, have enhanced the way sensor data is transmitted and shared. Enhanced connectivity enables real-time data transfer from sensors to smartphones, tablets, or healthcare providers’ systems, allowing for immediate analysis and response. For instance, the Dexcom G6 Continuous Glucose Monitoring (CGM) system wirelessly transmits glucose data to compatible smart devices, providing users and healthcare providers with real-time glucose readings and trend information. This seamless connectivity empowers users to make informed decisions about managing diabetes while enabling healthcare providers to offer timely guidance and support.

These advancements in sensor technologies have not only improved the accuracy and comfort of measuring body vitals but have also allowed users and healthcare providers to make more informed decisions. Advances in these technologies are shaping the future of personalized healthcare and enhancing overall health and well-being.

Connected medical devices, such as smart contact lenses, are increasingly utilized for vision correction and ocular health monitoring. These innovative lenses, equipped with microelectronics and sensors, enable continuous tracking of intraocular pressure, glucose levels, and other critical eye parameters. This technology provides valuable insights for the early detection and management of conditions like glaucoma and diabetes-related eye complications. For instance, in 2023, researchers at the University of California, Berkeley, developed a smart contact lens capable of monitoring glucose levels in tears, which could become a valuable tool for individuals with diabetes.

With connectivity features such as Bluetooth and NFC, these lenses effortlessly transmit data to smartphones or healthcare providers, facilitating effective eye health management. The integration of smart contact lenses with IoT technology holds significant promise for improving vision care outcomes, enhancing patient comfort, and advancing teleophthalmology for remote diagnosis and monitoring.

Telehealth utilizes communication technologies and digital information to manage and access remote healthcare services. Many countries are increasingly incorporating telehealth and telemedicine into their healthcare infrastructures. IoT-based solutions, including connected medical devices, enable healthcare providers and patients to monitor health progress through automated records of vital signs and other health indicators. Governments worldwide are also promoting the use of telehealth technologies. For instance, in February 2020, the CDC issued guidelines encouraging healthcare providers to adopt telehealth services to prevent the spread of COVID-19. Additionally, factors such as the shortage of healthcare providers, the increasing elderly population, the increasing burden of chronic diseases, and advancements in healthcare technology present significant opportunities for market growth.

Based on offering, the market is segmented into IoT medical devices and services. In 2024, the IoT medical devices segment is anticipated to hold the major share of 84.2% of the IoT in healthcare market. This segment’s major market share is due to the benefits offered by IoT-enabled medical devices. These devices collect data and generate reports by uploading information to cloud databases in real time. This process simplifies trend analysis and early detection of warning signs, thereby enhancing diagnostic accuracy. Access to comprehensive patient data facilitates more effective collaboration among healthcare professionals, ensuring timely and appropriate care.

Moreover, the IoT medical devices segment is anticipated to register the highest compound annual growth rate (CAGR) of 13.8% during the forecast period of 2024 to 2031. This segment’s growth is due to the rising prevalence of chronic diseases, the increasing adoption of IoMT medical devices, ongoing technological advancements, and a growing emphasis on self-monitoring among patients.

Based on application, the market is segmented into remote patient treatment, inpatient treatment, telehealth, and other applications. In 2024, the remote patient treatment segment is anticipated to hold the major share of 52.5% of the global IoT in healthcare market. This segment’s major market share is due to the growing preference for home healthcare, rising awareness of the benefits of remote patient monitoring, the rise in the geriatric population, increased adoption of connected medical devices, and a shortage of healthcare professionals.

Moreover, the remote patient treatment segment is anticipated to register the highest compound annual growth rate (CAGR) of 14.6% during the forecast period of 2024 to 2031. This segment’s growth is due to the cost-effectiveness of remote patient treatment, which reduces the need for hospital visits and inpatient care, and supportive policies aimed at promoting the adoption of telehealth and remote monitoring.

Based on connectivity, the market is segmented into Bluetooth, Wi-Fi, cellular, and other connectivity. In 2024, the Bluetooth segment is anticipated to hold the major share of the global IoT in healthcare market. This segment’s major market share is due to the benefits offered by Bluetooth connectivity, such as real-time tracking, low power consumption, and compatibility with a range of medical devices.

However, the Wi-Fi segment is anticipated to register the highest compound annual growth rate (CAGR) during the forecast period of 2024 to 2031. This segment's growth is driven by the benefits offered by Wi-Fi-enabled medical devices, such as rapid and efficient data transfer, real-time access to medical imaging and patient information, and seamless integration with existing hospital systems. Wi-Fi enhances data processing by enabling doctors and nurses to efficiently access and share digital images and data from medical imaging devices such as MRI, ultrasound, CT, and radiography. Previously, managing and transferring large files was challenging and time-consuming. With Wi-Fi-enabled imaging equipment, file transfers are significantly faster, allowing for rapid and secure exchange of large data sets. These benefits are expected to drive the increased adoption of Wi-Fi-enabled IoT medical devices during the forecast period,

Based on end user, the market is segmented into long-term care centers, hospitals & clinics, home care settings, and other end users. In 2024, the home care settings segment is anticipated to hold the major share of the global IoT in healthcare market. This segment’s major market share is due to the increasing demand for accessible and convenient healthcare services, the growing adoption of home healthcare services as a cost-effective alternative to hospital care, and the increase in the aging population, leading to a higher prevalence of chronic diseases.

Moreover, the home care settings segment is anticipated to register the highest compound annual growth rate (CAGR) during the forecast period of 2024 to 2031. This segment’s growth is due to the significant cost savings offered by home care compared to hospital-based care, the increase in the aging population that requires long-term management of chronic conditions, technological advancements in IoT-enabled wearable devices and home monitoring systems, and the need to alleviate the burden on healthcare facilities by providing care in home settings.

In 2024, North America is expected to account for the largest share of 42.6% of the IoT in healthcare market. North America’s major market share is due to its well-established healthcare sector, high consumer demand for wearable health monitoring devices, strong government support and investments in healthcare IT, widespread use of electronic health records, and the presence of prominent market players.

However, the market in Asia-Pacific is anticipated to register the highest compound annual growth rate (CAGR) of 15.7% during the forecast period. The growth of this regional market is driven by the rapid expansion of healthcare infrastructure due to increased investments in emerging economies, government initiatives and funding aimed at advancing digital health technologies, and the growing adoption of telehealth services.

The report offers a competitive landscape based on an extensive assessment of the leading players’ offerings and geographic presence and key growth strategies adopted by them over the past three to four years. Some of the prominent companies operating in the IoT in healthcare market are Medtronic plc (U.K.), GE HealthCare Technologies Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers AG (Germany), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Honeywell Life Care Solutions (U.S.), BIOTRONIK SE & Co. KG (Germany), AgaMatrix, Inc. (U.S.), Securitas Healthcare, LLC. (U.S.), AliveCor, Inc. (U.S.), iHealth Labs, Inc. (U.S.), Johnson & Johnson (U.S.), Baxter International Inc. (U.S.), and OMRON Healthcare, Inc. (U.S.).

|

Particulars |

Details |

|

No of Pages |

291 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

13.3% |

|

Market Size (Value) |

$121.45 billion by 2031 |

|

Segments Covered |

By Offering

By Application

By Connectivity

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Austria, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America, and the Middle East & Africa |

|

Key Companies |

Medtronic plc (U.K.), GE HealthCare Technologies Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers AG (Germany), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Honeywell Life Care Solutions (U.S.), BIOTRONIK SE & Co. KG (Germany), AgaMatrix, Inc. (U.S.), Securitas Healthcare, LLC. (U.S.), AliveCor, Inc. (U.S.), iHealth Labs, Inc. (U.S.), Johnson & Johnson (U.S.), Baxter International Inc. (U.S.), and OMRON Healthcare, Inc. (U.S.). |

This study covers the market size and forecasts for various IoT-enabled medical devices and services offered by key companies.

The IoT in healthcare market is anticipated to reach $121.45 billion by 2031, at a CAGR of 13.3% during the forecast period.

In 2024, the IoT medical devices segment is anticipated to hold the major share of the IoT in healthcare market.

In 2024, the remote patient treatment segment is anticipated to hold the major share of the IoT in healthcare market.

In 2024, the Bluetooth segment is anticipated to hold the major share of the IoT in healthcare market.

In 2024, the home-care settings segment is anticipated to hold the major share of the IoT in healthcare market.

In 2024, North America is anticipated to hold the major share of the IoT in healthcare market.

Key factors driving the growth of this market include the widespread adoption of digital healthcare technologies, an increasing emphasis on patient-centered care, and increasing digital health initiatives globally. Moreover, the widespread adoption of telehealth solutions and the increasing utilization of IoT for early & accurate disease diagnosis and treatment is anticipated to create market growth opportunities.

Some of the major companies operating in the IoT in healthcare market are Medtronic plc (U.K.), GE HealthCare Technologies Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers AG (Germany), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Honeywell Life Care Solutions (U.S.), BIOTRONIK SE & Co. KG (Germany), AgaMatrix, Inc. (U.S.), Securitas Healthcare, LLC. (U.S.), AliveCor, Inc. (U.S.), iHealth Labs, Inc. (U.S.), Johnson & Johnson (U.S.), Baxter International Inc. (U.S.), and OMRON Healthcare, Inc. (U.S.).

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Mar-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates