Resources

About Us

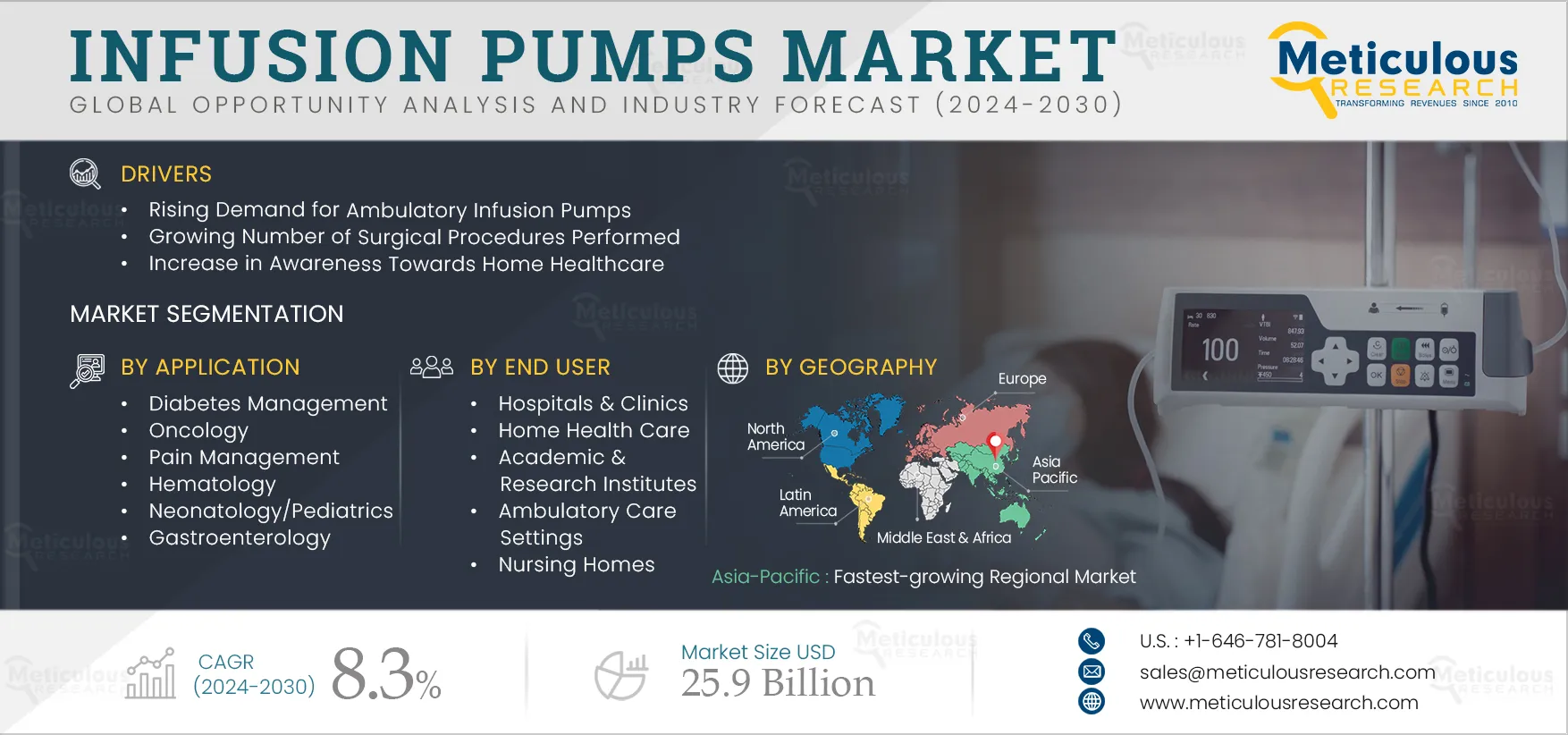

Infusion Pumps Market by Type (Volumetric, Syringe, Insulin, Ambulatory [Disposable, Chemo] Implantable), Channel (Single, Multi) Application (Oncology, Pain, Diabetes, Hematology, Pediatrics) End User (Hospital, Ambulatory Care) - Global Forecast to 2032

Report ID: MRHC - 104272 Pages: 230 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportInfusion pumps enable healthcare providers to provide easy and seamless delivery of fluids into the patient’s body without frequently being in contact with them. These solutions help healthcare professionals streamline patient medications in a controlled way, reducing the chances of errors or overdose. Moreover, advanced infusion pumps give patients the accessibility to carry out their daily tasks with ease while being on medications. Additionally, the COVID-19 pandemic triggered several end users' adoption of infusion pumps, such as hospitals, clinics, and ambulatory centers, due to their ability to provide medications to patients without contact with them.

The growth of this market is driven by the increasing demand and adoption of patient engagement solutions, efforts to enhance patient-centric care by end users, growing industry consolidation through partnerships and collaborations, government initiatives and regulatory upgradation, rising healthcare expenditure, and rising prevalence of chronic diseases coupled with the increasing geriatric population. However, patient data privacy and safety concerns may restrain the growth of this market.

Furthermore, the growing adoption of wearable and mobile-based digital healthcare solutions and emerging economies are expected to offer significant growth opportunities for players in this market. However, the lack of digital literacy, the high cost associated with deploying healthcare IT solutions, and the lack of skilled IT personnel in the healthcare industry are challenging the growth of infusion pump market.

Click here to: Get a Free Sample Copy of this report

The prevalence of chronic diseases and conditions such as cancer, diabetes, and heart disease is rising globally. According to the WHO, 41 million people die from chronic diseases each year, accounting for around 74% of all deaths globally. Growth in the geriatric population and social behaviors such as tobacco and alcohol use, physical inactivity, and unhealthy diets are major factors driving a steady increase in the number of people suffering from chronic diseases. According to the International Diabetes Federation, the global prevalence of diabetes is estimated to increase from 10.5% of the global population in 2021 to 11.3% in 2032.

Also, chronic diseases are often associated with the elderly population due to the declining bodily functions and immunity among this population segment. Aging is associated with progressive deterioration in the structure and functioning of organs. The elderly population is more prone to various chronic diseases. According to World Population Prospects, the population aged 65 and above is growing more rapidly than other age groups.

In 2019, 703 million people were in the age group of 65 years and above globally. This number is projected to reach 1.5 billion by 2050. This remarkable growth in the elderly population is driven by declining fertility rates and improvements in longevity. Infusion pumps are commonly used to manage diabetes, particularly for individuals with type 1 diabetes. Insulin pumps deliver a continuous supply of insulin, mimicking the function of the pancreas. This helps regulate blood sugar levels and allows for flexibility in insulin dosing. Insulin pump can also be programmed to deliver bolus doses before meals.

Furthermore, non-communicable diseases (NCDs), such as cancer, cardiovascular disease, diabetes, and mental illness, are becoming more prevalent. NCDs currently account for 70% of all deaths globally, with the majority recorded in low- & middle-income countries. The International Agency for Research on Cancer (IARC) estimates that globally, 1 in 5 people develop cancer during their lifetime, and 1 in 8 men and 1 in 11 women lose their lives. As per WHO estimates, the global prevalence of new cancer cases is expected to increase from 19.2 million in 2020 to 24.5 in 2032, while the global mortality from cancer is expected to increase from 9.9 million in 2020 to 12.9 million in 2032. Many cancer patients receive chemotherapy and other medications through infusion pumps. These pumps provide a steady and controlled infusion of chemotherapy drugs, reducing the risk of side effects and ensuring the patient receives the prescribed treatment regimen.

The overall scenario indicates that the rising prevalence of chronic diseases, coupled with the increasing geriatric population, is expected to increase the patient pool demanding highly innovative solutions during their diagnosis journey, further driving the growth of the infusion pumps market. Infusion pumps offer several advantages in managing chronic diseases, including precise dosing, reduced risk of human error, and the ability to customize infusion rates and schedules based on individual patient needs.

The emergence of home healthcare has enabled patients to receive hospital-like care in their homes. Infusion pumps are often used in home healthcare settings to manage chronic diseases. Patients can receive necessary treatments and medications at home, improving their quality of life and reducing hospital stays. These advantages of home care have led many countries, such as the U.S., U.K., Canada, Australia, and Israel, to implement government policies that encourage homecare health services. For instance, every regional and metropolitan hospital in Victoria, Australia, has a hospital-at-home program, and nearly 6% of all hospital bed-days are provided that way. (Source: Commonwealth Fund). Furthermore, home care is widely adopted for specific conditions such as deep venous thrombosis (DVT) and acute cellulitis.

As per the Johns Hopkins Model, the cost of at-home care was 32% less than hospital care (USD 5,081 VS. USD 7,480), and the length of stay of the patients was also reduced by nearly one-third (3.2 days VS. 4.9 days). Additionally, the home care setting was found to be more convenient for family members and patients than those offered usual hospital care.

Nearly 5.6 million children in the U.S. receive nearly 5.1 hours of medical care at home, which saves approximately USD 36 billion annually (Source: Everyday Health, Inc.). These factors have led to the increased adoption of home healthcare as a cost-effective alternative to hospital healthcare services. Additionally, the reduced need for rehospitalization, expensive & unnecessary testing, and shorter treatment times are among the major factors propelling the adoption of home-based health care in developed and developing countries.

Among the product types studied in this report, in 2025, the infusion pump accessories/consumables segment is expected to account for the largest share of the infusion pumps market. Recurrent use and repeat purchase of accessories/consumables for infusion therapy support the high share of this segment.

Among the channels studied in this report, in 2025, the multi-channel infusion pumps segment is expected to account for the largest share of the segment owing to factors such as rising demand for technologically advanced infusion pumps, precise & multiple drug delivery in case of chronic diseases, and rising awareness and demand for advanced infusion pumps in home healthcare.

Among the applications studied in this report, in 2025, the oncology segment is expected to account for the largest share of the infusion pumps market due to the increasing prevalence of cancer and rising demand for controlled dispensing of drugs in the body for chemotherapy. Additionally, portable infusion pumps can enable patients to receive chemotherapy in their homes, triggering the segment's growth.

Among the end users studied in this report, in 2025, the hospitals & clinics segment is expected to account for the largest share of the infusion pumps market. Factors such as the large volume of patients served by hospitals, the top line serving a large volume of patients, and increasing patient pool are some factors that account for the largest market share.

The increasing focus of government bodies of Asia-Pacific countries such as China, India, Singapore, and South Korea on the healthcare sector in terms of increased investment for the adoption of advanced technology, rising investments in better healthcare infrastructure, and the increasing awareness and literacy among the population. Furthermore, the growing presence of key companies is boosting the growth of this regional market.

Key Players

Some of the key infusion pump manufacturers operating in the this market are Becton, Dickinson and Company (BD), B. Braun SE (Germany), Baxter International Inc. (U.S.), Fresenius SE&Co. KGaA. (Germany), ICU Medical, Inc. (U.S.), Medtronic plc (Ireland), MOOG Inc. (U.S.), Terumo Corporation (Japan), F. Hoffmann-LA Roche Ltd (Switzerland), and Insulet Corporation (U.S.).

Infusion Pumps Market Size & Trend Analysis, by End User

Key questions answered in the report:

The Infusion Pumps Market focuses on devices that deliver fluids and medications into patients' bodies in controlled amounts, enhancing treatment precision and reducing risks of medication errors.

The Infusion Pumps Market is projected to reach $25.9 billion by 2032, driven by increasing adoption in hospitals, home healthcare, and rising chronic disease cases globally.

The Infusion Pumps Market is expected to grow at a CAGR of 8.3% from 2025 to 2032, reflecting increasing adoption due to the demand for efficient healthcare delivery systems.

The market size is projected to reach $25.9 billion by 2032, driven by rising demand for healthcare solutions and the growing geriatric population requiring chronic disease management.

Key players include BD, B. Braun SE, Baxter International, Fresenius SE&Co. KGaA, ICU Medical, Medtronic, MOOG, Terumo Corporation, Roche, and Insulet Corporation.

A key trend is the increasing demand for wearable and portable infusion pumps, particularly in home healthcare, enabling patients to manage treatments conveniently.

The market is driven by rising chronic disease prevalence, an aging population, increased home healthcare adoption, and technological advancements in infusion pump devices.

The market is segmented by product type (devices, accessories/consumables), channel (single/multi-channel pumps), application (diabetes, oncology, pain management), and end user (hospitals, home healthcare).

The global outlook is optimistic, with high growth projected in Asia-Pacific, driven by government investments in healthcare infrastructure and increasing awareness.

The market is expected to grow significantly, reaching $25.9 billion by 2032, fueled by advancements in medical devices and the need for precise medication delivery systems.

The Infusion Pumps Market is projected to grow at a CAGR of 8.3% from 2025 to 2032, driven by increasing demand for automated and portable healthcare solutions.

North America holds the largest market share, driven by advanced healthcare infrastructure, high chronic disease prevalence, and significant adoption of infusion pumps.

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Mar-2016

Published Date: Aug-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates