Resources

About Us

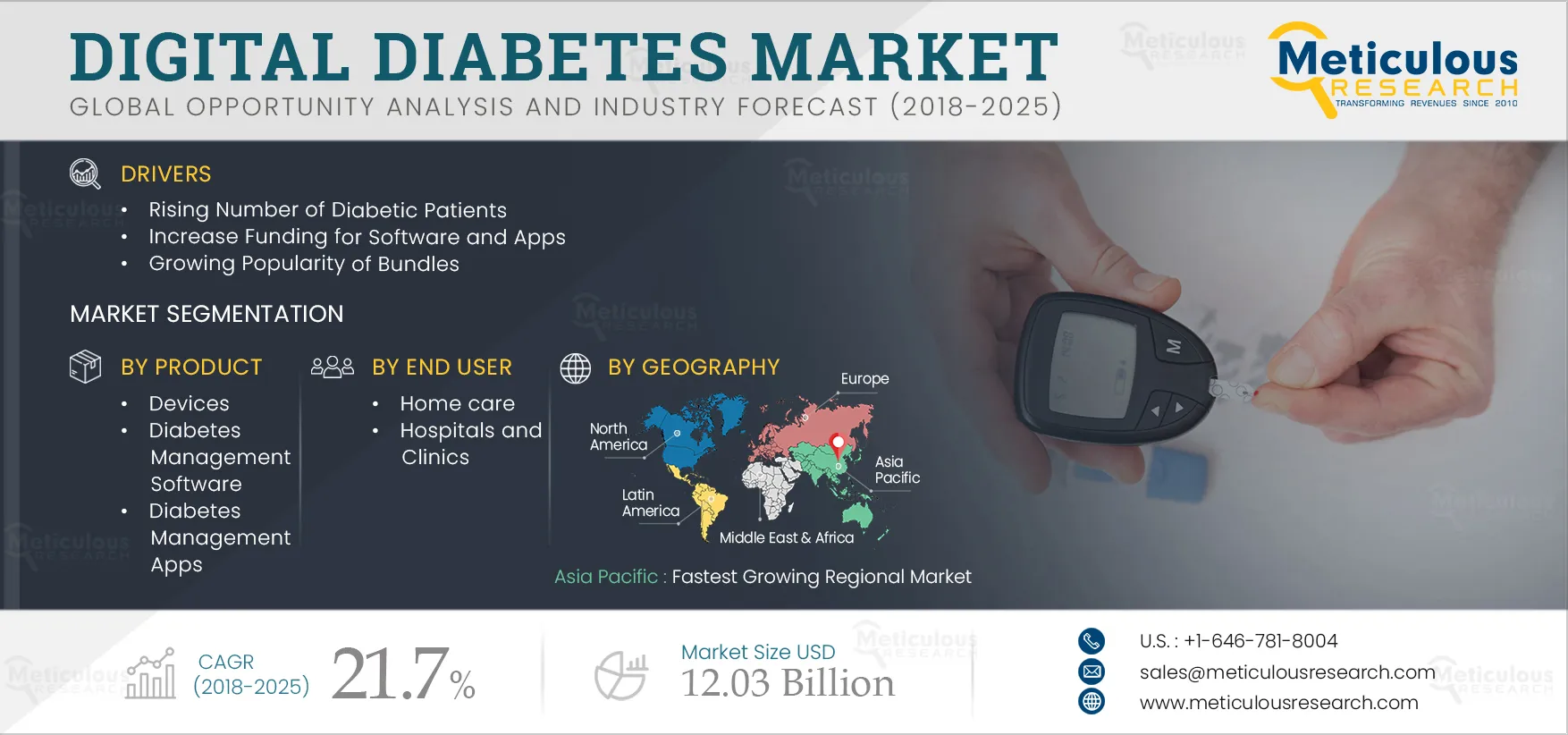

Digital Diabetes Market by Product (SMBG, CGM, Smart Insulin Pump, Smart Insulin Pens, Software, Apps), End User (Home Care, Hospitals and Clinics), and Geography - Global Forecast to 2025

Report ID: MRHC - 104245 Pages: 148 Feb-2019 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe Digital Diabetes Market is expected to grow at a CAGR of 21.7%from 2018 to 2025 to reach $12.03 billion by 2025. Factors such as rising number of diabetic patients, increasing penetration of smartphones, technological advancement in diabetes devices, and growing funding for diabetes are driving the growth of this market. However, high cost of devices and poor reimbursement scenario is expected to hinder the growth of this market in the coming years.

Rising number of diabetes fuels the growth of the global digital diabetes market

Diabetes is attaining epidemic proportions and digital health companies are fighting back with innovative solutions. Approximately, one in 11 adults across the globe has diabetes attributing to 425 million people, worldwide. As the cases of diabetes are growing so is the digital diabetes market. Over the last few years, the digital diabetes care market has substantially progressed. If these trends continue, by 2045, 693 million people aged between 18-99 years, or 629 million of people aged between 20-79 years, will have diabetes. Globally, diabetes results in $727 billion of healthcare expenditure, which corresponds to one for every eight dollars spent on healthcare. Thus, rising number of diabetic patients across the globe and increasing demand for better ways to manage the disease is expected to drive the adoption of innovative diabetes devices, software, and apps among patients over the coming years, thereby driving the growth of the digital diabetes market.

Increasing funding for diabetes management software and apps drives the market growth

In recent years, number of pharma companies and research organizations have increased funding for digital diabetes care app’s and software development. For instance,

The rising number of funding from companies and organizations is expected to drive the adoption of digital diabetes devices which in turn is expected to drive the growth of this market in coming years.

Click here to: Get Free Sample Pages of this Report

The devices segment accounted for the largest share in digital diabetes market in 2018. This market is expected to grow at a CAGR of 21.5% in the forecast period mainly attributed to growing diabetic population, increasing adoption of diabetes devices, and growing awareness about diabetes in emerging countries.

CGM systems accounted for the largest share of digital diabetes devices market, by type. Increasing adoption of CGM systems, development of advanced CGM systems, and favorable government policies in developed countries promoting adoption of CGM systems are the key factors contributing to the largest share and highest growth of this segment.

Over the past few years, the development and adoption of home care devices has increased. In addition, growing focus of companies to increase awareness about diabetes and diabetes devices & apps are further driving the adoption in home care settings. In 2018, home care segments accounted for the largest share of the global digital diabetes market.

Asia Pacific: Fastest growing regional market

Asia Pacific expected to register the fastest growth during forecast period. Several factors, such as high pool of diabetic patients, increasing healthcare expenditure, and growing focus of key players towards this region are expected to propel the growth of this market. Increasing disposable income and growing awareness on diabetes and associated diseases are further expected to drive the growth of this regional segment.

Digital Diabetes Market Key Players

The report includes competitive landscape based on extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past 3 years (2015-2018). The key players in the global digital diabetes market are Lifescan, Roche, Medtronic, Ascensia Diabetes Care, Tandem Diabetes Care, Dexcomm, SocialDiabetes, One Drop, H2 Inc., Dottli Oy, Abbott Laboratories, Ypsomed holding AG, ARKRAY Inc., and Insulet Corporation among many others.

Scope of Digital Diabetes Market Report:

Digital Diabetes Market by Product

Digital Diabetes Market by End User

Digital Diabetes Market by Geography

Key questions answered in the report:

Smart glucose meters dominated the digital diabetes market

North America favors both regional and local manufacturers that compete in multiple segments

Recent strategic developments taken place in the digital diabetes market

Published Date: Nov-2025

Published Date: Jul-2024

Published Date: Feb-2023

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates