Resources

About Us

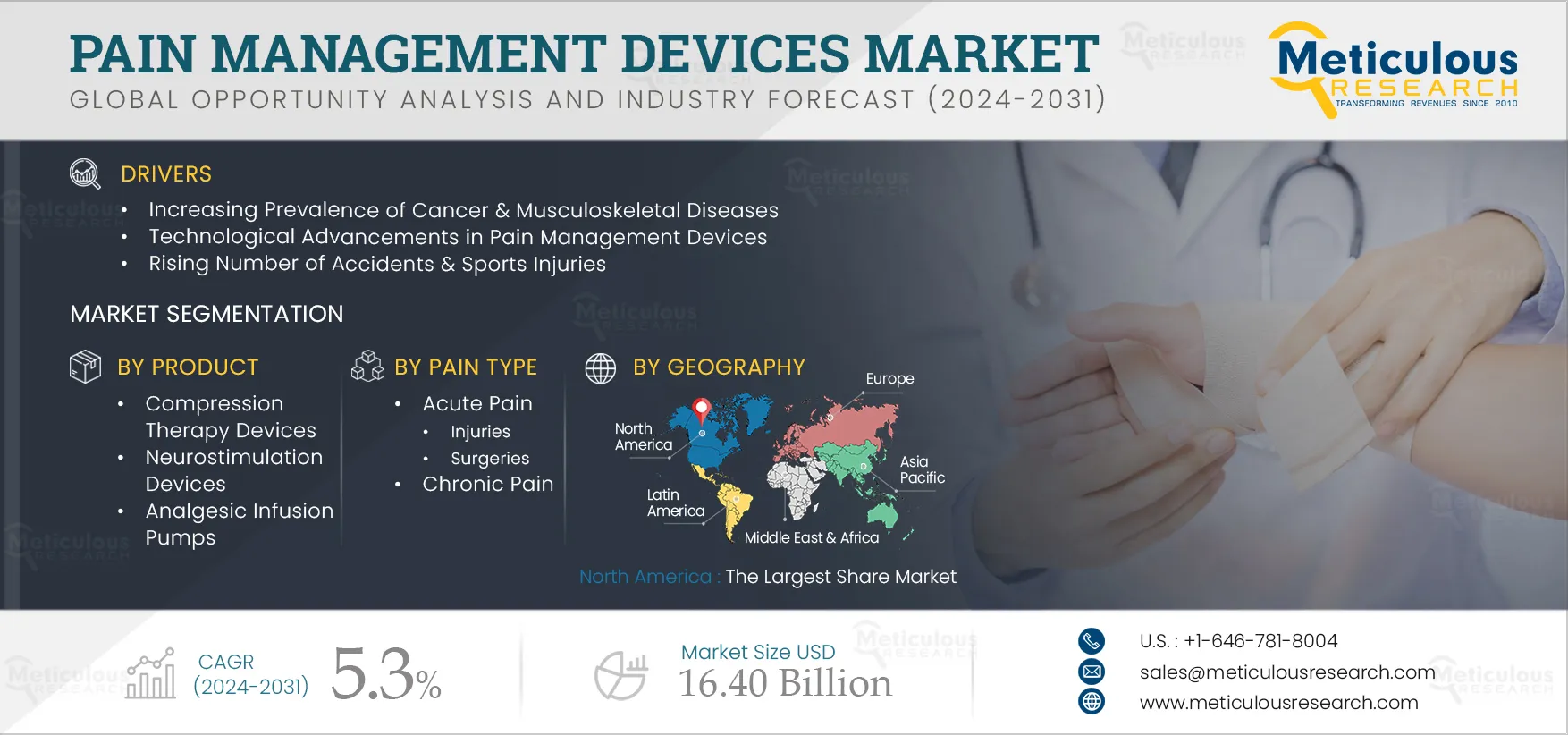

Pain Management Devices Market Size, Share, Forecast, & Trends Analysis by Product (Neurostimulation [DBS, TENS, VNS], Infusion Pump, Compression), Pain Type (Surgical, Musculoskeletal, Neuropathic, Cancer), Distribution, End User - Global Forecast to 2032

Report ID: MRHC - 1041238 Pages: 280 Jun-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the pain management devices market is primarily driven by the rising number of chronic pain cases associated with the geriatric population, the increasing number of surgical procedures, the increasing prevalence of cancer & musculoskeletal diseases, technological advancements in pain management devices, increasing healthcare expenditures, and the increasing number of sports & accident injuries.

Moreover, partnerships & collaborations by pain management device companies, the integration of digital health technologies into pain management devices, and emerging economies are expected to offer market growth opportunities.

The incidence of cancer is rising across the world. According to the World Health Organization (WHO), in 2022, 20 million people were diagnosed with cancer globally. This number is projected to reach 35 million in 2050. Moreover, according to data published by the World Health Organization (WHO) in February 2022, cancer is the most common cause of mortality. In 2020, it accounted for approximately 10 million deaths worldwide. Lung cancer, breast cancer, colon cancer, prostate cancer, and rectum cancer are some of the most common types of cancer.

Furthermore, according to the WHO, in 2022, 1.71 billion people were affected by musculoskeletal conditions, including osteoarthritis, osteoporosis, fragility fractures, and rheumatoid arthritis globally. According to the State of Musculoskeletal Health (MSK), in 2021, 20.3 million individuals in the U.K. (32% of the population) had musculoskeletal conditions such as back pain and arthritis, of which 2.8 million people were aged under 35, 10.2 million people were aged between 35–64, and 7.4 million people were aged 65 or above.

Thus, the increasing prevalence of cancer & musculoskeletal diseases is boosting the demand for pain management devices, driving the growth of this market.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Technological advancements in pain management devices have led to their increased adoption among patients. There have been significant advancements in neurostimulation devices, including Peripheral Nerve Stimulators (PNS) and Spinal Cord Stimulators (SCS). These devices send electric impulses to specific nerves that modulate pain signals and provide relief. Recent advancements have led to the introduction of more compact, implantable neurostimulation devices with increased programming possibilities that are also comfortable for patients.

Furthermore, technological advances have enhanced medicine delivery techniques for pain relief and management. Implantable drug delivery systems, such as intrathecal pumps, can quickly deliver pain drugs to the spinal cord and other specific locations, improving pain management and reducing the need for systemic opioids. These systems have longer battery life, provide better flexibility, come in smaller sizes, and offer more security features. These benefits support their adoption, driving the growth of the pain management devices market.

Wearable pain management devices are developed with a focus on portability and simplicity of operation to make them convenient for patients. These devices are small, lightweight, and mostly wireless, enabling unlimited adaptability and motion. Wearable pain management devices are popular among individuals looking for on-the-go pain treatment solutions due to their convenience.

Furthermore, technological advancements in wearable pain management devices have improved their efficacy and user experience. These devices feature smart algorithms, advanced sensors, and networking choices, enabling data tracking, real-time monitoring, and individualized treatment modifications. Integration with digital platforms and mobile apps offers useful data to patients and doctors and improves the user experience. Moreover, pain management device companies are launching wearable products to offer convenience to patients. For instance, in September 2022, UltraCare PRO (India) launched the TENS 2.0 wearable, wireless, and pocket-sized pain management device for joint, muscular, and everyday pain.

Electrical stimulation devices offer non-invasive pain management, eliminating the need for surgical procedures and medicines. Electrodes attached to the skin send electrical impulses to specific nerves and areas of discomfort. The non-invasive nature of these devices makes them an appealing choice for anyone looking for drug-free pain relief.

Furthermore, electrical stimulation devices can help with the management of various types of pain, such as musculoskeletal, surgery, and neuropathic pain. Further, electrical stimulation devices have customizable settings, allowing patients to personalize their treatment to their pain level and needs. Users can adjust the frequency, intensity, and duration of electrical impulses to alleviate pain. This capacity to personalize therapy increases user comfort and improves treatment.

Pain management device companies are focusing on partnerships & collaborations to launch advanced offerings that can help patients reduce pain and enhance their quality of life. Some of the recent partnerships & collaborations in this market are as follows:

Thus, increasing partnerships & collaborations by pain management device companies are driving the development of new and advanced products, generating market growth opportunities.

Based on product, the pain management devices market is segmented into compression therapy devices, neurostimulation devices, analgesic infusion pumps, electrotherapy devices, ablation devices, and accessories. In 2025, the compression therapy devices segment is expected to account for the largest share of 28.1% of the pain management devices market. The compression therapy devices segment is further segmented into bandages, garments, intermittent/sequential pneumatic compression pumps, and other pressure pumps. The large market share of this segment can be attributed to the increasing number of orthopedic procedures and the rising global geriatric population, which is highly susceptible to improper blood flow, edema, and vein problems like varicose veins, spider veins, and leg ulcers. Additionally, the increased demand for compression therapy garments among healthcare professionals and the general population for long-term treatment options contributes to the segment’s large market share.

Owing to the rising demand for compression therapy devices, companies operating in this market are focusing on the introduction of innovative offerings. For instance, in September 2024, AIROS Medical, Inc. (U.S.) launched the AIROS 6P sequential compression device and pants-like compression garments to treat abdominal, pelvic, and leg swelling.

Based on portability, the pain management devices market is segmented into stationary/benchtop and wearable & implantable devices. In 2025, the wearable & implantable segment is expected to account for the larger share of the pain management devices market.

The large market share of this segment can be attributed to technological advancements in wearable & implantable pain management devices and the benefits offered by these devices, such as the ability to track muscle activity, provide real-time feedback, monitor changes, and register pain and stress signals.

Based on pain type, the pain management devices market is segmented into acute pain and chronic pain. In 2025, the chronic pain segment is expected to account for the larger share of the pain management devices market. The large market share of this segment can be attributed to the increasing cases of musculoskeletal diseases. For instance, according to the Australian Institute of Health and Welfare (AIHW), chronic musculoskeletal disorders affect nearly one-third of all Australians. In 2022, nearly 3.1 million people in Australia had arthritis, 6.9 million had back problems, and 889,000 had osteoporosis.

Based on distribution channel, the pain management devices market is segmented into hospital pharmacies, retail pharmacies, and online/e-commerce platforms. In 2025, the retail pharmacies segment is expected to account for the largest share of the pain management devices market. The large market share of this segment can be attributed to the availability of a diverse selection of pain management devices, such as compression therapy devices, including bandages, garments, and intermittent/sequential pneumatic compression pumps at retail pharmacies, which enables patients to select the best pain management options depending on their specific preferences, needs, and healthcare expert recommendations.

Based on end user, the pain management devices market is segmented into hospitals & clinics, ambulatory surgical centers, physiotherapy centers, home care settings, and other end users. In 2025, the hospitals & clinics segment is expected to account for the largest share of 39.0% of the pain management devices market. The large market share of this segment can be attributed to the growing number of patient visits to hospitals & clinics for pain management and surgical procedures, the presence of highly skilled healthcare professionals, ease of access, increasing healthcare expenditures, improving hospital infrastructure in emerging economies, and the increasing adoption of pain management devices among hospitals & clinics.

However, the home care settings segment is expected to register the highest CAGR of 6.3% during the forecast period. The growth of this segment is driven by the rising demand for pain management devices in home care settings due to the growing global geriatric population with musculoskeletal and neuropathic pain.

In 2025, North America is expected to account for the largest share of 30.7% of the pain management devices market, followed by Europe and Asia-Pacific. North America’s significant market share can be attributed to the presence of major pain management device manufacturers such as Becton, Dickinson and Company (U.S.) and Boston Scientific Corporation (U.S.), increasing healthcare expenditure, the growing prevalence of cancer & musculoskeletal diseases and technological advancements in pain management devices.

However, Asia-Pacific is slated to register the highest growth rate of 6.7% during the forecast period. The growth of this regional market is driven by the rising awareness regarding pain management in countries such as China and India, increasing healthcare spending, and the growing number of accidents and sports injuries.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the pain management devices market are Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), Boston Scientific Corporation (U.S.), Johnson & Johnson Services, Inc. (U.S.), Baxter International, Inc. (U.S.), VirpaxPharmaceuticals, Inc. (U.S.), B. Braun Melsungen AG (Germany), Medtronic plc (Ireland), Rusan Pharma Ltd (India), Grünenthal GmbH (Germany), OMRON Healthcare, Inc. (U.S.), and Nevro Corp. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.3% |

|

Market Size (Value) |

$16.40 Billion by 2032 |

|

Segments Covered |

By Product

By Portability

By Pain Type

By Distribution Channel

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, Italy, U.K., Spain, Switzerland, and Rest of Europe), Asia–Pacific (India, China, Japan, Australia, South Korea, and Rest of Asia–Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories (U.S.), Becton, Dickinson and Company (U.S.), Boston Scientific Corporation (U.S.), Johnson & Johnson Services, Inc. (U.S.), Baxter International, Inc. (U.S.), VirpaxPharmaceuticals, Inc. (U.S.), B. Braun Melsungen AG (Germany), Medtronic plc (Ireland), Rusan Pharma Ltd (India), Grünenthal GmbH (Germany), OMRON Healthcare, Inc. (U.S.), and Nevro Corp. (U.S.). |

The Pain Management Devices Market offers various devices to alleviate pain from chronic conditions, surgeries, and injuries through technological innovations and therapies.

The Pain Management Devices Market is projected to grow from its current value to $16.40 Billion by 2032, reflecting significant expansion and investment in pain management technologies.

The market is forecast to grow at a CAGR of 5.3% from 2025 to 2032, driven by increasing chronic pain cases, technological advances, and rising healthcare expenditures.

The market size is projected to reach $16.40 billion by 2032, up from its current valuation, reflecting robust growth in pain management solutions and technologies.

Key players include Abbott Laboratories, Boston Scientific, Medtronic, Becton, Dickinson, Johnson & Johnson, and Grünenthal, among others, driving market innovation.

Trends include the rise of wearable pain management devices, technological advancements in neurostimulation, and increased focus on non-invasive treatments.

Drivers include the growing prevalence of cancer and musculoskeletal diseases, technological advancements, rising healthcare expenditures, and increasing sports injuries.

Segments include product types (compression therapy, neurostimulation), portability (wearable, implantable), pain types (chronic, acute), and distribution channels.

The market outlook is positive with North America leading, followed by Europe and Asia-Pacific, driven by technological advancements and increasing healthcare investments.

The market is expected to grow at a CAGR of 5.3% from 2025 to 2032, driven by technological innovations and increasing demand for effective pain management solutions.

The market is projected to grow at a CAGR of 5.3% from 2025 to 2032, reflecting strong growth driven by advancements in technology and rising pain management needs.

North America is expected to hold the largest market share of 30.7% in 2025, due to major manufacturers, high healthcare spending, and prevalent chronic conditions.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Jun-2024

Published Date: Sep-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates