Resources

About Us

Hydrogen Mass Flow Meter Market Size, Share, Forecast, & Trends Analysis by Technology (Coriolis, Thermal, Differential Pressure, Ultrasonic) Flow Rate (Low, Medium, High) Pressure Rating (Low, Medium, High, Ultra-High) End-Use (Energy, Transportation, Industrial, Oil & Gas) - Global Forecast to 2035

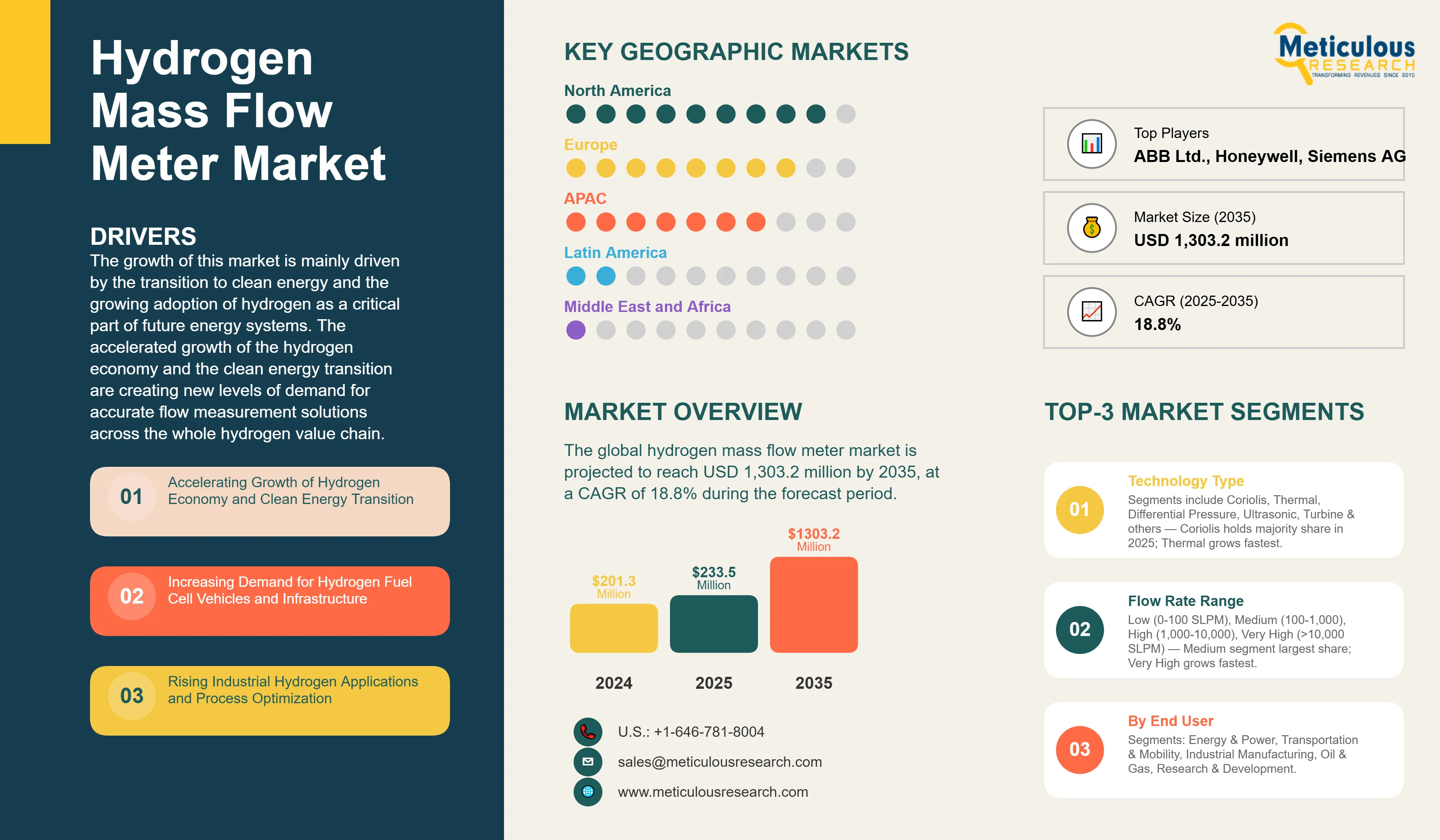

Report ID: MREP - 1041538 Pages: 246 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 2 to 4 Hours Download Free Sample ReportThe global hydrogen mass flow meter market is projected to reach USD 1,303.2 million by 2035 from USD 233.5 million in 2025, at a CAGR of 18.8% during the forecast period. The market was valued at USD 201.3 million in 2024.

The growth of this market is mainly driven by the transition to clean energy and the growing adoption of hydrogen as a critical part of future energy systems. The accelerated growth of the hydrogen economy and the clean energy transition are creating new levels of demand for accurate flow measurement solutions across the whole hydrogen value chain. Organizations around the world are beginning to characterize accurate hydrogen flow measurement as critical to optimizing processes, achieving safety compliance, and enabling the economy of hydrogen operations. Hydrogen is highly flammable and diffusive; accurate measurement helps maintain safe pressure, detect leaks early, and meet global standards (e.g., ISO 14687, ATEX).

The growing interest in hydrogen fuel cell vehicles and infrastructure is also transforming the transportation sector across the globe. Large automotive manufacturers are investing in hydrogen fuel cell vehicles, while governments are also investing in hydrogen refueling station networks. In July 2025, Toyota announced investing $139 million through a joint venture with Shudao Investment Group to build a hydrogen fuel cell manufacturing base in Chengdu, China. Also, in 2023, Toyota introduced a hydrogen fuel cell version of its Hilux pickup. This prototype uses core components from the Mirai, such as its fuel cell and hydrogen tanks, and achieves a range of nearly 400 miles. The Hilux prototype is currently undergoing testing, with small-scale production anticipated in the coming years. This evolution will require sophisticated flow measurement systems to address the critical aspects of accurately measuring high-pressure, high-volume hydrogen gas in an extremely safe and reliable manner, either in vehicles or refueling stations.

The growth in industrial hydrogen applications and process optimization activities will allow the market to diversify across traditional applications. Industrials like steel making, chemical processing, and electronics manufacturing are deploying hydrogen-based processes that require advanced flow measurement technology. As hydrogen becomes increasingly integrated into industrial processes, flow meters will be required to consistently deliver high-precision measurements while operating reliably in harsh and demanding environments.

Nevertheless, the market faces significant challenges that must be addressed. High upfront capital and installation costs often place hydrogen projects beyond the reach of smaller stakeholders. Additionally, the cost of specialized hydrogen flow measurement technologies remains premium, particularly in high-pressure and high-accuracy applications.

The technical challenge of having consistent hydrogen measurement accuracy over varied operating conditions continues to pose elusive problems for both manufacturers and end users. The low density of hydrogen and its unique flow characteristics demand advanced sensor technology and new signal processing techniques that add complexity and cost to the measurement system.

The insufficient supply of trained technicians and maintenance capacity for hydrogen flow measurement systems creates operational challenges for end users. The specialized knowledge to calibrate, maintain, and troubleshoot hydrogen-specific flow meters is still evolving within an evolving industry.

Market Drivers and Insights

Click here to: Get Free Sample Pages of this Report

Accelerating Growth of Hydrogen Economy and Clean Energy Transition

Globally, the hydrogen economy is gaining incredible momentum as countries commit to reaching net-zero emissions and transitioning to cleaner fuels as an alternative to fossil fuels. According to the International Energy Agency’s Global Hydrogen Review 2024, global hydrogen demand is projected to reach 500 million tonnes by 2050—representing a fivefold increase compared to current levels. Such growth will require sophisticated flow measurement systems to track and measure hydrogen as it moves through its lifecycle from production to end-use.

Governments are catalyzing change by significantly investing in hydrogen development. For instance, the EU’s REPowerEU initiative earmarked up to €300 billion through 2027 to accelerate hydrogen deployment and energy diversification. The U.S. is providing federal tax incentives for the development of clean hydrogen through the Inflation Reduction Act, with hydrogen producers eligible for federal production tax credits of up to USD 3/kg under Section 45V. Japan has pledged around USD 107 billion (¥15 trillion) in public–private investment over 15 years to build a comprehensive hydrogen supply chain. South Korea is executing its Hydrogen Economy Roadmap with multi‑billion‑dollar commitments toward industrial hydrogen infrastructure, fuel cell development, and regional hydrogen hubs.

The hydrogen industry is evolving from small pilot projects to large-scale commercial hydrogen businesses. For early infrastructure and system installations, basic measurement devices were sufficient; as hydrogen technology advances with commercial production and distribution, the industry must rely on certified, high-precision flow meters designed to measure large volume and pressure reliably. As the industry is migrating away from pilot projects to commercial distribution, there will be many opportunities to replace and upgrade flow meter technology across the hydrogen sector.

Increasing Demand for Hydrogen Fuel Cell Vehicles and Infrastructure

The automotive industry is increasingly shifting toward hydrogen fuel cell vehicles, driving demand for specialized flow measurement technologies. Leading manufacturers such as Toyota, Hyundai, BMW, and Mercedes-Benz are scaling up hydrogen vehicle production, while commercial vehicle makers are similarly advancing hydrogen-powered trucks, buses, and industrial equipment.

China, South Korea, and Japan are the leading countries, collectively operating over 850 hydrogen stations. China alone has more than 540 stations, with plans to expand to over 1,000 stations by 2030. Each station is a valuable hub that relies on several high-accuracy flow meters to track how much hydrogen is stored, delivered, and dispensed safely and accurately. As of the end of 2024, there were over 1,100 hydrogen refueling stations (HRS) operational worldwide, marking a significant milestone in the global hydrogen infrastructure development. This represents a 60% increase from 2021, indicating accelerating adoption of hydrogen as a clean fuel alternative (Source: Hydrogen Council). Importantly, every new station represents a significant business opportunity for flow meter suppliers.

Hydrogen adoption in heavy-duty applications, including trucks and buses, is accelerating, with refueling flow rates often exceeding 10,000 standard liters per minute (SLPM). This rise in fuel delivery demands advanced industrial flow meters capable of precise, high-volume measurements under elevated pressures, with stringent safety standards. Key sectors such as logistics companies, ports, and mining operations are actively investing in hydrogen vehicle fleets and the associated measurement infrastructure essential for reliable and efficient operations.

Table: Key Factors Impacting Global Hydrogen Mass Flow Meter Market (2025–2035)

Base CAGR: 18.8%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

||||

|

1. |

Accelerating Growth of Hydrogen Economy and Clean Energy Transition |

Major infrastructure projects begin |

Commercial-scale hydrogen economy established |

▲ +2.1% |

|

2. |

Increasing Demand for Hydrogen Fuel Cell Vehicles and Infrastructure |

Refueling network expansion |

Mass adoption of hydrogen vehicles |

▲ +1.8% |

|

3. |

Rising Industrial Hydrogen Applications and Process Optimization |

Pilot projects and early adoption |

Widespread industrial implementation |

▲ +1.5% |

|

Restraints |

||||

|

1. |

High Initial Investment and Installation Costs |

Limits adoption in smaller projects |

Economies of scale reduce impact |

▼ −1.0% |

|

2. |

Technical Challenges in Hydrogen Measurement Accuracy |

Performance limitations affect adoption |

Advanced technology resolves issues |

▼ −0.8% |

|

Opportunities |

||||

|

1. |

Development of Green Hydrogen Production Networks |

Large-scale production facilities |

Global green hydrogen infrastructure |

▲ +2.3% |

|

2. |

Integration of IoT and Smart Monitoring Technologies |

Early smart meter deployments |

Standard industry practice |

▲ +1.6% |

|

Trends |

||||

|

1. |

Advancement in Coriolis and Thermal Technologies |

Premium product differentiation |

Standard technology across segments |

▲ +0.9% |

|

Challenges |

||||

|

1. |

Long-Term Reliability in High-Pressure Environments |

Conservative adoption in critical apps |

Proven reliability enables growth |

▼ −0.3% |

Market Segmentation Analysis

By Technology Type

The hydrogen mass flow meter market is classified by technology type into Coriolis mass flow meters, thermal mass flow meters, differential pressure flow meters, ultrasonic flow meters, turbine flow meters, and others. The Coriolis mass flow meters segment is expected to hold the largest share of the overall hydrogen mass flow meter market in 2025, with around 45-50% of the total hydrogen mass flow meter market.

However, the thermal mass flow meters segment is expected to grow at the highest CAGR during the forecast period. This growth is primarily driven by the economic feasibility of thermal flow meters in high-volume applications, their superior performance across wide flow ranges, and lower pressure drop compared to alternative technologies. Additionally, thermal meters are increasingly favored in hydrogen production and storage sectors, where achieving high accuracy at minimal cost is critical.

By Flow Rate Range

The hydrogen mass flow meter market is segmented by flow rate into four categories, which include low flow rate (0-100 SLPM), medium flow rate (100-1,000 SLPM), high flow rate (1,000-10,000 SLPM), and very high flow rate (greater than 10,000 SLPM). The medium flow rate segment is expected to hold the largest share of the market in 2025, with approximately 35-40% market share. Electrolyzers and reformers in the 100–1,000 SLPM range are common in distributed hydrogen generation, fueling smaller refueling stations or industrial processes. Medium flow rates are typical for injecting hydrogen into natural gas pipelines or blending with other gases, requiring precise flow control. The growth of small to mid-scale hydrogen production, increasing hydrogen blending in natural gas pipelines, fuel cell testing activities, and the rise of compact refueling stations for light-duty vehicles and equipment are some of the major drivers for the growth of this segment.

The very high flow rate segment is expected to grow at the highest CAGR during the forecast period. The need for very high flow rate hydrogen measurement, exceeding 10,000 SLPM, is driven by large-scale industrial hydrogen production, heavy-duty vehicle refueling such as trucks and buses, and extensive hydrogen storage and distribution systems requiring rapid, accurate, and safe fuel delivery.

By Pressure Rating

Based on pressure rating, the hydrogen mass flow meter market is categorized as low pressure (up to 50 bar), medium pressure (50 - 200 bar), high pressure (200 - 700 bar), and ultra-high pressure (above 700 bar). The low-pressure segment is projected to hold the largest share in 2025, at approximately 30-40% of market share. The low-pressure segment (up to 50 bar) currently dominates because it covers a wide range of established hydrogen applications in production, research, and industrial settings where hydrogen is stored, transported, or consumed at relatively lower pressures. Electrolyzers, laboratory testing, semiconductor manufacturing, and many chemical and industrial processes operate within low-pressure environments, making this category the most commonly used today. Flow meters designed for low pressure are also more cost-effective, easier to integrate with existing systems, and sufficient for most pilot-scale hydrogen projects and small-scale distribution networks, which account for a large share of ongoing hydrogen activities.

However, the high-pressure segment (200–700 bar) is witnessing the fastest growth, driven primarily by the expansion of hydrogen mobility and refueling infrastructure. Fuel cell electric vehicles (FCEVs), buses, and heavy-duty trucks require hydrogen to be compressed and dispensed at high pressures (typically 350–700 bar) to achieve sufficient driving range and efficiency. As governments and companies scale up refueling networks and invest in hydrogen-based transportation, demand for mass flow meters capable of withstanding and accurately measuring at high pressures is rising sharply.

By End-Use Industry

The hydrogen mass flow meter market is segmented based on end-use industry: hydrogen production, hydrogen storage, energy & power generation, transportation & mobility, industrial manufacturing, oil & gas, and research & development. In 2025, the hydrogen production segment is expected to account for the largest share of the hydrogen mass flow meter market. The large share of this segment is attributed to the fact that accurate flow measurement is critical across all production pathways, whether through steam methane reforming (SMR), coal gasification, or increasingly, electrolysis. Producers must precisely monitor hydrogen output to ensure efficiency, safety, and compliance with purity and quality standards. Electrolyzer-based green hydrogen projects, in particular, rely heavily on mass flow meters for real-time monitoring of both hydrogen and oxygen flows, as well as for optimizing energy input versus hydrogen output. Since production is the foundation of the hydrogen value chain, spanning industrial-scale plants, pilot projects, and demonstration units worldwide, it naturally represents the largest share of demand for hydrogen mass flow meters today.

However, the transportation and mobility segment is witnessing the fastest growth as global hydrogen adoption shifts toward mobility applications such as fuel cell electric vehicles (FCEVs), buses, trucks, trains, and even marine and aviation trials. These applications require hydrogen to be dispensed and metered at high accuracy and under demanding pressure and flow conditions, making advanced mass flow meters indispensable in refueling stations and onboard systems.

Regional Analysis

On the basis of geography, the global hydrogen mass flow meter market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to command a share of 33% of the global hydrogen mass flow meter market. North America’s dominance stems from its early investments in hydrogen production and infrastructure, supported by substantial government funding and incentives such as the U.S. Inflation Reduction Act. The region also has a highly developed industrial base with strong adoption of hydrogen across refining, chemicals, and power applications. In addition, North American companies are leaders in fuel cell electric vehicles (particularly for heavy-duty trucks and buses), where mass flow meters play a critical role in precise hydrogen dispensing and monitoring. The presence of established players, advanced R&D capabilities, and a robust pipeline of large-scale green hydrogen projects further strengthens its position as the largest market.

However, Asia-Pacific is witnessing the fastest growth, at a CAGR of 26%, due to rapid scaling of clean hydrogen initiatives in countries such as China, Japan, South Korea, India, and Australia. These countries are aggressively pursuing hydrogen strategies to decarbonize transportation, industrial manufacturing, and power sectors, with governments setting ambitious hydrogen adoption targets. Japan and South Korea are frontrunners in hydrogen mobility, driving demand for mass flow meters in fueling stations and vehicle integration. China is investing heavily in green hydrogen production linked to renewable energy, while India and Australia are positioning themselves as global hydrogen exporters. This accelerated pace of infrastructure build-out, coupled with government-backed roadmaps and significant private sector participation, positions Asia-Pacific as the fastest-growing region in the hydrogen mass flow meter market.

Key Players in the Global Hydrogen Mass Flow Meter Market

Some of the major players that operate in the global hydrogen mass flow meter market include Emerson Electric Co. (Micro Motion) (U.S.), Endress+Hauser Group (Switzerland), ABB Ltd. (Switzerland), Yokogawa Electric Corporation (Japan), Honeywell International Inc. (U.S.), Siemens AG (Germany), Krohne Group (Germany), Bronkhorst High-Tech B.V. (Netherlands), Brooks Instrument (ITW) (U.S.), RHEONIK Messtechnik GmbH (Germany), Sierra Instruments Inc. (U.S.), Alicat Scientific Inc. (U.S.), TSI Incorporated (U.S.), Sensirion AG (Switzerland), Teledyne Hastings Instruments, (U.S.), KOBOLD Group (Germany), and Fox Thermal Instruments, Inc.(U.S.)

Each company is undergoing diverse actions to capitalize on its position in the market. Industrial automation leaders Emerson and Endress+Hauser are leveraging the advantages of their global service platforms and pre-existing customer relationships, while specialized flow meter manufacturers such as Bronkhorst and Alicat are developing more accurate, hydrogen-optimized products for research and precision.

|

Particulars |

Details |

|

Number of Pages |

246 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

18.8% |

|

Market Size 2024 |

USD 201.3 million |

|

Market Size 2025 |

USD 233.5 million |

|

Market Size 2035 |

USD 1,303.2 billion |

|

Segments Covered |

By Technology Type, Flow Rate Range, Pressure Rating, and End-Use Industry |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Netherlands, Norway, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), Latin America (Brazil, Chile, Mexico, Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

The hydrogen mass flow meter market is projected to reach USD 1,303.2 billion by 2035 from USD 180 million in 2025, at a CAGR of 18.8% during the forecast period.

In 2025, the Coriolis mass flow meters segment is projected to hold the major share of the hydrogen mass flow meter market, while the thermal mass flow meters segment is slated to record the highest growth rate due to cost-effectiveness and performance advantages in large-volume applications.

Key factors driving growth include the accelerating growth of the hydrogen economy and clean energy transition, increasing demand for hydrogen fuel cell vehicles and infrastructure, rising industrial hydrogen applications and process optimization, stringent safety and regulatory standards for hydrogen handling, and government initiatives and investment in hydrogen technologies.

North America leads the market with the highest share due to aggressive government policies and infrastructure investments, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for hydrogen mass flow meter vendors.

Major opportunities include the development of green hydrogen production and distribution networks, integration of IoT and smart monitoring technologies, expansion of hydrogen storage and transportation infrastructure, emerging applications in power-to-gas and energy storage systems, and growth in hydrogen blending for natural gas networks.

Key trends include advancement in Coriolis and thermal mass flow measurement technologies, development of explosion-proof and intrinsically safe designs, integration of digital communication protocols and data analytics, and miniaturization for portable and mobile hydrogen applications.

The transportation and mobility segment is witnessing the fastest growth as global hydrogen adoption shifts toward mobility applications such as fuel cell electric vehicles (FCEVs), buses, trucks, trains, and even marine and aviation trials. These applications require hydrogen to be dispensed and metered at high accuracy and under demanding pressure and flow conditions, making advanced mass flow meters indispensable in refueling stations and onboard systems.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Market Analysis, by Technology Type

3.2.2. Market Analysis, by Flow Rate Range

3.2.3. Market Analysis, by Pressure Rating

3.2.4. Market Analysis, by End User

3.3. Regional Analysis

3.4. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Accelerating Growth of Hydrogen Economy and Clean Energy Transition

4.2.1.2. Increasing Demand for Hydrogen Fuel Cell Vehicles and Infrastructure

4.2.1.3. Rising Industrial Hydrogen Applications and Process Optimization

4.2.1.4. Stringent Safety and Regulatory Standards for Hydrogen Handling

4.2.1.5. Government Initiatives and Investment in Hydrogen Technologies

4.2.2. Restraints

4.2.2.1. High Initial Investment and Installation Costs

4.2.2.2. Technical Challenges in Hydrogen Measurement Accuracy

4.2.2.3. Limited Availability of Skilled Technicians and Maintenance Expertise

4.2.2.4. Hydrogen Embrittlement and Material Compatibility Issues

4.2.3. Opportunities

4.2.3.1. Development of Green Hydrogen Production and Distribution Networks

4.2.3.2. Integration of IOT and Smart Monitoring Technologies

4.2.3.3. Expansion of Hydrogen Storage and Transportation Infrastructure

4.2.3.4. Emerging Applications in Power-To-Gas and Energy Storage Systems

4.2.3.5. Growth in Hydrogen Blending for Natural Gas Networks

4.2.4. Challenges

4.2.4.1. Ensuring Long-Term Reliability in High-Pressure Hydrogen Environments

4.2.4.2. Calibration and Traceability Standards for Hydrogen Flow Measurement

4.2.4.3. Cost Optimization While Maintaining Safety and Accuracy Standards

4.2.5. Trends

4.2.5.1. Advancement in Coriolis and Thermal Mass Flow Measurement Technologies

4.2.5.2. Development of Explosion-Proof and Intrinsically Safe Designs

4.2.5.3. Integration of Digital Communication Protocols and Data Analytics

4.2.5.4. Miniaturization for Portable and Mobile Hydrogen Applications

5. Hydrogen Mass Flow Meter Market Assessment - by Technology Type

5.1. Overview

5.2. Coriolis Mass Flow Meters

5.2.1. Key Insights

5.2.2. Key Players

5.2.3. Key Market Drivers

5.3. Thermal Mass Flow Meters

5.3.1. Key Insights

5.3.2. Key Players

5.3.3. Key Market Drivers

5.4. Differential Pressure Flow Meters

5.4.1. Key Insights

5.4.2. Key Players

5.4.3. Key Market Drivers

5.5. Ultrasonic Flow Meters

5.5.1. Key Insights

5.5.2. Key Players

5.5.3. Key Market Drivers

5.6. Turbine Flow Meters

5.6.1. Key Insights

5.6.2. Key Players

5.6.3. Key Market Drivers

5.7. Others (Emerging Technologies)

5.7.1. Key Insights

5.7.2. Key Players

5.7.3. Key Market Drivers

6. Hydrogen Mass Flow Meter Market Assessment - by Flow Rate Range

6.1. Overview

6.2. Low Flow Rate (0-100 SLPM)

6.2.1. Application Landscape

6.2.2. Competitive Dynamics

6.2.3. Market Drivers

6.3. Medium Flow Rate (100-1,000 SLPM)

6.3.1. Application Landscape

6.3.2. Competitive Dynamics

6.3.3. Market Drivers

6.4. High Flow Rate (1,000-10,000 SLPM)

6.4.1. Application Landscape

6.4.2. Competitive Dynamics

6.4.3. Market Drivers

6.5. Very High Flow Rate (Above 10,000 SLPM)

6.5.1. Application Landscape

6.5.2. Competitive Dynamics

6.5.3. Market Drivers

7. Hydrogen Mass Flow Meter Market Assessment - by Pressure Rating

7.1. Overview

7.2. Low Pressure (Up to 50 Bar)

7.2.1. Competitive Dynamics

7.2.2. Market Drivers

7.3. Medium Pressure (50-200 Bar)

7.3.1. Application Landscape

7.3.2. Technology Distribution

7.3.3. Competitive Dynamics

7.3.4. Market Drivers

7.3.5. Technical Considerations

7.4. High Pressure (200-700 Bar)

7.4.1. Application Landscape

7.4.2. Competitive Dynamics

7.4.3. Market Drivers

7.5. Ultra-High Pressure (Above 700 Bar)

7.5.1. Application Landscape

7.5.2. Competitive Dynamics

7.5.3. Market Drivers

8. Hydrogen Mass Flow Meter Market Assessment - by End-Use Industry

8.1. Overview

8.2. Hydrogen Production

8.2.1. Electrolysis Plants

8.2.2. Steam Methane Reforming

8.2.3. Others (Compression & Purification)

8.3. Transportation and Mobility

8.3.1. Hydrogen Refueling Stations (HRS)

8.3.2. Heavy-Duty Transportation

8.3.3. Fuel Cell Electric Vehicles (FCEVs)

8.3.4. Marine and Aviation Applications

8.4. Industrial Manufacturing

8.4.1. Chemical and Petrochemical

8.4.2. Steel and Metals

8.4.3. Electronics and Semiconductors

8.4.4. Glass Manufacturing

8.5. Hydrogen Storage and Distribution

8.6. Energy and Power Generation

8.6.1. Renewable Energy Integration

8.6.2. Grid-Scale Energy Storage

8.6.3. Backup Power Systems

8.7. Oil and Gas

8.7.1. Refining Operations

8.7.2. Hydrogen Blending

8.7.3. Process Optimization

8.8. Research and Development

8.9. Others (Power-to-X, Healthcare)

9. Hydrogen Mass Flow Meter Market Assessment - by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Netherlands

9.3.5. Norway

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. South Korea

9.4.3. China

9.4.4. India

9.4.5. Australia

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Chile

9.5.4. Rest of Latin America

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. South Africa

9.6.3. United Arab Emirates

9.6.4. Rest of Middle East & Africa

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Dashboard

10.3.1. Industry Leaders

10.3.2. Market Differentiators

10.3.3. Vanguards

10.3.4. Emerging Companies

10.4. Market Share Analysis, 2024

11. Company Profiles

11.1. Emerson Electric Co.

11.2. Endress+Hauser Group

11.3. ABB Ltd.

11.4. Yokogawa Electric Corporation

11.5. Honeywell International Inc.

11.6. Siemens AG

11.7. Krohne Group

11.8. Bronkhorst High-Tech B.V.

11.9. Brooks Instrument (ITW)

11.10. Rheonik Messtechnik GmbH & Co. KG

11.11. Kobold Messring GmbH

11.12. Fox Thermal Instruments, Inc.

11.13. Sierra Instruments Inc.

11.14. Alicat Scientific Inc.

11.15. TSI Incorporated

11.16. Sensirion AG

11.17. Teledyne Hastings Instruments

11.18. MKS Instruments Inc.

11.19. Axetris AG (Leister Group)

11.20. Fluid Components International (FCI)

11.21. Sage Metering Inc.

11.22. Kurz Instruments Inc.

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Hydrogen Mass Flow Meter Market, by Technology Type, 2023-2035 (USD Million)

Table 2 Global Coriolis Mass Flow Meters Market, by Region/Country, 2023-2035 (USD Million)

Table 3 Global Thermal Mass Flow Meters Market, by Region/Country, 2023-2035 (USD Million)

Table 4 Global Differential Pressure Flow Meters Market, by Region/Country, 2023-2035 (USD Million)

Table 5 Global Ultrasonic Flow Meters Market, by Region/Country, 2023-2035 (USD Million)

Table 6 Global Turbine Flow Meters Market, by Region/Country, 2023-2035 (USD Million)

Table 7 Global Others (Emerging Technologies) Market, by Region/Country, 2023-2035 (USD Million)

Table 8 Global Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023-2035 (USD Million)

Table 9 Global Low Flow Rate (0-100 SLPM) Market, by Region/Country, 2023-2035 (USD Million)

Table 10 Global Medium Flow Rate (100-1,000 SLPM) Market, by Region/Country, 2023-2035 (USD Million)

Table 11 Global High Flow Rate (1,000-10,000 SLPM) Market, by Region/Country, 2023-2035 (USD Million)

Table 12 Global Very High Flow Rate (Above 10,000 SLPM) Market, by Region/Country, 2023-2035 (USD Million)

Table 13 Global Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023-2035 (USD Million)

Table 14 Global Low Pressure (Up To 50 Bar) Market, by Region/Country, 2023-2035 (USD Million)

Table 15 Global Medium Pressure (50-200 Bar) Market, by Region/Country, 2023-2035 (USD Million)

Table 16 Global High Pressure (200-700 Bar) Market, by Region/Country, 2023-2035 (USD Million)

Table 17 Global Ultra-High Pressure (Above 700 Bar) Market, by Region/Country, 2023-2035 (USD Million)

Table 18 Global Hydrogen Mass Flow Meter Market, by End-Use Industry, 2023-2035 (USD Million)

Table 19 Global Hydrogen Mass Flow Meter Market for Hydrogen Production, by Region/Country, 2023-2035 (USD Million)

Table 20 Hydrogen Production: Hydrogen Mass Flow Meter Market Share by Application, 2024 (%)

Table 21 Global Hydrogen Mass Flow Meter Market for Transportation and Mobility, by Region/Country, 2023-2035 (USD Million)

Table 22 Transportation and Mobility: Hydrogen Mass Flow Meter Market Share by Application, 2024 (%)

Table 23 Global Hydrogen Mass Flow Meter Market for Industrial Manufacturing, by Region/Country, 2023-2035 (USD Million)

Table 24 Industrial Manufacturing: Hydrogen Mass Flow Meter Market Share, by Application, 2024 (%)

Table 25 Global Hydrogen Mass Flow Meter Market for Hydrogen Storage and Distribution, by Region/Country, 2023-2035 (USD Million)

Table 26 Global Hydrogen Mass Flow Meter Market for Energy and Power Generation, by Region/Country, 2023-2035 (USD Million)

Table 27 Energy and Power Generation: Hydrogen Mass Flow Meter Market Share, by Application, 2024 (%)

Table 28 Global Hydrogen Mass Flow Meter Market for Oil and Gas, by Region/Country, 2023-2035 (USD Million)

Table 29 Oil and Gas: Hydrogen Mass Flow Meter Market Share, by Application, 2024 (%)

Table 30 Global Hydrogen Mass Flow Meter Market for Research and Development, by Region/Country, 2023-2035 (USD Million)

Table 31 Global Hydrogen Mass Flow Meter Market for Others (Power-To-X, Healthcare), by Region/Country, 2023-2035 (USD Million)

Table 32 North America: Hydrogen Mass Flow Meter Market, by Country, 2023-2035 (USD Million)

Table 33 North America: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 34 North America: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 35 North America: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 36 North America: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 37 U.S.: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 38 U.S.: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 39 U.S.: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 40 U.S.: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 41 Canada: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 42 Canada: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 43 Canada: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 44 Canada: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 45 Europe: Hydrogen Mass Flow Meter Market, by Country/Region, 2023–2035 (USD Million)

Table 46 Europe: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 47 Europe: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 48 Europe: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 49 Europe: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 50 Germany: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 51 Germany: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 52 Germany: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 53 Germany: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 54 France: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 55 France: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 56 France: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 57 France: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 58 U.K.: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 59 U.K.: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 60 U.K.: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 61 U.K.: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 62 Netherlands: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 63 Netherlands: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 64 Netherlands: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 65 Netherlands: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 66 Norway: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 67 Norway: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 68 Norway: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 69 Norway: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 70 Rest of Europe: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 71 Rest of Europe: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 72 Rest of Europe: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 73 Rest of Europe: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 74 Asia-Pacific: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 75 Asia-Pacific: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 76 Asia-Pacific: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 77 Asia-Pacific: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 78 Japan: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 79 Japan: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 80 Japan: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 81 Japan: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 82 South Korea: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 83 South Korea: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 84 South Korea: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 85 South Korea: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 86 China: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 87 China: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 88 China: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 89 China: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 90 India: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 91 India: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 92 India: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 93 India: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 94 Australia: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 95 Australia: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 96 Australia: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 97 Australia: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 98 Rest of Asia-Pacific: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 99 Rest of Asia-Pacific: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 100 Rest of Asia-Pacific: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 101 Rest of Asia-Pacific: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 102 Latin America: Hydrogen Mass Flow Meter Market, by Country/Region, 2023–2035 (USD Million)

Table 103 Latin America: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 104 Latin America: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 105 Latin America: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 106 Latin America: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 107 Brazil: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 108 Brazil: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 109 Brazil: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 110 Brazil: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 111 Mexico: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 112 Mexico: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 113 Mexico: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 114 Mexico: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 115 Chile: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 116 Chile: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 117 Chile: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 118 Chile: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 119 Rest of Latin America: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 120 Rest of Latin America: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 121 Rest of Latin America: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 122 Rest of Latin America: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 123 Middle East & Africa: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 124 Middle East & Africa: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 125 Middle East & Africa: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 126 Middle East & Africa: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 127 Middle East & Africa: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 128 Saudi Arabia: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 129 Saudi Arabia: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 130 Saudi Arabia: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 131 Saudi Arabia: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 132 South Africa: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 133 South Africa: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 134 South Africa: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 135 South Africa: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 136 UAE: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 137 UAE: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 138 UAE: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 139 UAE: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 140 Rest of Middle East & Africa: Hydrogen Mass Flow Meter Market, by Technology Type, 2023–2035 (USD Million)

Table 141 Rest of Middle East & Africa: Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2023–2035 (USD Million)

Table 142 Rest of Middle East & Africa: Hydrogen Mass Flow Meter Market, by Pressure Rating, 2023–2035 (USD Million)

Table 143 Rest of Middle East & Africa: Hydrogen Mass Flow Meter Market, by End User, 2023–2035 (USD Million)

Table 144 Number of Recent Key Developments, by Company, 2022-2025

Table 145 Key Strategic Developments, by Company, 2022-2025

Table 146 Global Hydrogen Mass Flow Meter Market Share, by Company, 2024 (%)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key executives interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2025, the Coriolis Mass Flow Meters Segment is Expected to Dominate the Hydrogen Mass Flow Meter Market

Figure 8 In 2025, the Medium Flow Rate (100–1,000 SLPM) Segment is Expected to Dominate the Hydrogen Mass Flow Meter Market

Figure 9 In 2025, the Low Pressure (Up to 50 Bar) Segment is Expected to Dominate the Hydrogen Mass Flow Meter Market

Figure 10 In 2025, the Hydrogen Production Segment is Expected to Dominate the Hydrogen Mass Flow Meter Market

Figure 11 Hydrogen Mass Flow Meter Market, by Region, 2025 Vs. 2035

Figure 12 Factors Affecting Market Growth

Figure 13 Global Hydrogen Mass Flow Meter Market, by Technology Type, 2025 Vs. 2035 (USD Million)

Figure 14 Global Hydrogen Mass Flow Meter Market, by Flow Rate Range, 2025 Vs. 2035 (USD Million)

Figure 15 Global Hydrogen Mass Flow Meter Market, by Pressure Rating, 2025 Vs. 2035 (USD Million)

Figure 16 Global Hydrogen Mass Flow Meter Market, by End-Use Industry, 2025 Vs. 2035 (USD Million)

Figure 17 Global Hydrogen Mass Flow Meter Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 18 North America: Hydrogen Mass Flow Meter Market Snapshot

Figure 19 Europe: Hydrogen Mass Flow Meter Market Snapshot

Figure 20 Asia Pacific: Hydrogen Mass Flow Meter Market Snapshot

Figure 21 Latin America: Hydrogen Mass Flow Meter Market Snapshot

Figure 22 Middle East & Africa: Hydrogen Mass Flow Meter Market Snapshot

Figure 23 Key Growth Strategies Adopted by Leading Players, 2022-2025

Figure 24 Competitive Dashboard: Hydrogen Mass Flow Meter Market

Figure 25 SWOT Analysis – Emerson Electric Co.

Figure 26 SWOT Analysis – Endress+Hauser Group

Figure 27 SWOT Analysis – ABB Ltd.

Figure 28 SWOT Analysis – Yokogawa Electric Corporation

Figure 29 SWOT Analysis – Honeywell International Inc.

Figure 30 SWOT Analysis – Siemens AG

Figure 31 SWOT Analysis – Krohne Group

Figure 32 SWOT Analysis – Bronkhorst High-Tech B.V.

Figure 33 SWOT Analysis – Brooks Instrument (an ITW company)

Figure 34 SWOT Analysis – Rheonik GmbH & Co. KG

Figure 35 SWOT Analysis – Kobold Messring GmbH

Figure 36 SWOT Analysis – Fox Thermal Instruments, Inc.

Figure 37 SWOT Analysis – Sierra Instruments Inc.

Figure 38 SWOT Analysis – Alicat Scientific Inc.

Figure 39 SWOT Analysis – TSI Incorporated

Figure 40 SWOT Analysis – Sensirion AG

Figure 41 SWOT Analysis – Teledyne Hastings Instruments

Figure 42 SWOT Analysis – MKS Instruments Inc.

Figure 43 SWOT Analysis – Axetris AG

Figure 44 SWOT Analysis – Fluid Components International

Figure 45 SWOT Analysis – Sage Metering Inc.

Figure 46 SWOT Analysis – Kurz Instruments Inc.

Published Date: Oct-2025

Published Date: Oct-2025

Published Date: Jan-2026

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates