Resources

About Us

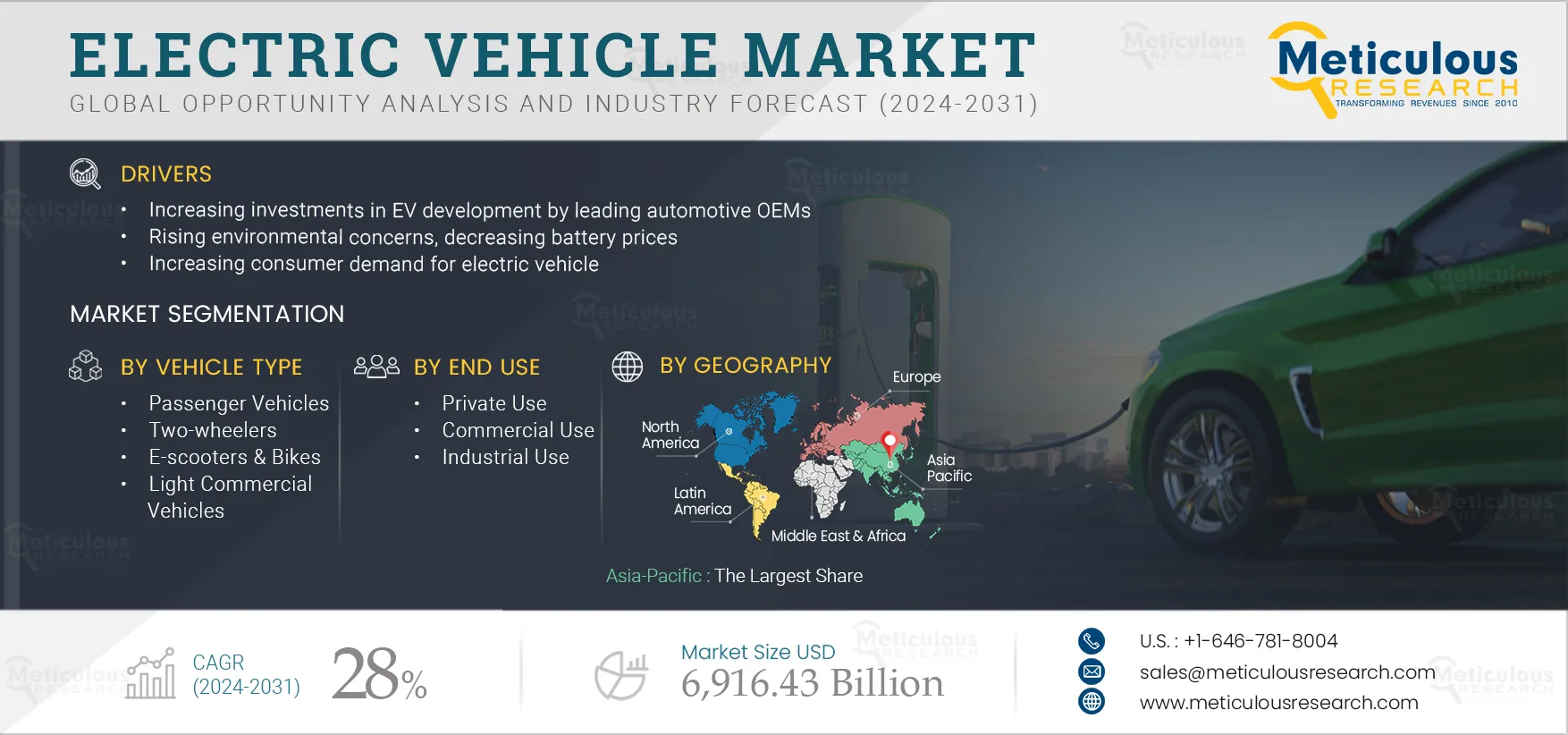

Electric Vehicle Market Size, Share, Forecast, & Trends Analysis by Vehicle Type (Passenger Vehicles, LCVs, HCVs, Two-wheelers, e-Scooters & Bikes), Propulsion Type (BEV, HEV), End Use (Private, Commercial, Industrial), Power Output, Charging Standard, and Geography - Global Forecast to 2031

Report ID: MRAUTO - 104485 Pages: 265 Jan-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe Electric Vehicle Market is expected to reach $ 6,916.43 billion by 2031, at a CAGR of 28% from 2024–2031. By volume, this market is expected to reach 446.54 million units by 2031, at a CAGR of 20.5% from 2024–2031. The growth of the global electric vehicle market is driven by factors such as supportive government policies and regulations, increasing investments in EV development by leading automotive OEMs, rising environmental concerns, decreasing battery prices, and the increasing consumer demand for electric vehicle. The growing adoption of autonomous electric vehicle and the increasing focus on electric mobility in emerging economies are expected to generate growth opportunities for the stakeholders in this market.

However, the high purchasing costs of electric vehicle and the lack of charging infrastructure in developing countries are expected to obstruct the growth of this market to some extent. The range anxiety among consumers and the low cold weather performance of electric vehicle are major challenges for market growth. Additionally, shared mobility, smart EV charging stations, wireless EV charging, and solar-powered EV charging stations are prominent trends in the global electric vehicle market.

Governments around the world are implementing policies and regulations to support EV adoption. Financial incentives, such as tax credits and rebates, are being offered to encourage consumers to purchase electric vehicle. These incentives are helping reduce the upfront costs of electric vehicle, making them more affordable for consumers. For instance, in July 2022, the Government of Chhattisgarh (India) announced an electric vehicle (EV) policy to help create robust EV charging infrastructure in the Indian state of Chhattisgarh, accelerate the transition from Internal Combustion Engine (ICE) vehicle to electric vehicle, and incentivize EV manufacturing. Many companies in the automotive industry are leveraging government policies and regulations and investing heavily in the development and production of electric vehicle as a part of their commitment to creating a more sustainable and environment-friendly future. The U.S. federal government under the Biden administration has shown a strong commitment to promoting EV adoption. For instance, in 2021, the U.S. federal government announced tax credits on the purchase of electric vehicle. Also, there were discussions about potentially expanding and extending these tax credits to further incentivize EV adoption.

Click here to: Get Free Sample Pages of this Report

The global automotive industry is gradually transitioning from fossil fuel-based vehicle to electric vehicle. Technological advancements and increasing investments in EV development by automotive OEMs, coupled with decreasing battery prices, are driving the growth of this market. In 2022, the Chinese government set targets requiring fixed parking spaces in newly built residential communities to have charging facilities and meet charging station installation requirements to make residential charging more accessible. Leading automotive companies are investing significantly in EV development to meet the increasing demand for electric vehicle.

Smart charging stations are another key trend in the electric vehicle market. The demand for smart EV charging solutions is driven by the growing popularity of electric vehicle and the need for more efficient and sustainable charging infrastructure. As the EV market continues to expand, smart charging stations are expected to play a crucial role in facilitating widespread EV adoption, supporting grid integration, and enabling a smarter and greener transportation ecosystem.

Shared Mobility

Shared mobility, which refers to using shared transportation services instead of individually owned vehicle, is another prominent trend in the electric vehicle market. The concept has gained popularity in recent years due to various factors, including technological advancements, changing consumer preferences, and the need for more sustainable transportation options. Shared mobility includes ride-hailing services and car-sharing, bike-sharing, and scooter-sharing programs.

The adoption of electric mobility in emerging economies is driven by various factors. There are still challenges that need to be addressed, including regulatory barriers, technological limitations, and public perception. As technology continues to evolve and improve, Autonomous Electric Vehicle (AEVs) are likely to become increasingly popular. The increasing adoption of electric mobility in emerging economies can positively impact the environment, energy security, and economic development. New EV market entrant countries are creating favourable conditions to support electric mobility. Countries such as South Africa, Kenya, Rwanda, Egypt, Vietnam, and Malaysia offer incentives, including tax benefits and cuts in customs duties for EVs and EV components. Some countries have also introduced targets for the transport sector. Various partnerships are accelerating the transition to electric mobility, such as the electric mobility project launched through a collaboration between Enel X, BYD Chile, and Metbus, a public transport operator in Chile, where 483 electric buses will be supplied with more than 120 charging points at terminals.

Based on vehicle type, the global electric vehicle market is segmented into passenger vehicle, light commercial vehicle, heavy commercial vehicle, two-wheelers, and e-scooters & bikes. In 2024, the passenger vehicle segment is expected to account for the largest share of 76.2% of the global electric vehicle market. The large share of this segment is attributed to increasing favorable government policies and subsidies for promoting the adoption of electric vehicle, growing awareness regarding the role of electric vehicle in reducing emissions, increasing fuel prices, and proactive participation by automotive OEMs in producing electric passenger vehicle.

However, the light commercial segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to the growing awareness regarding the role of electric vehicle in reducing emissions, the increase in demand for electric vehicle to reduce fleet emissions, and stringent government rules and regulations towards vehicle emissions.

Based on power output, the global electric vehicle market is segmented into less than 100 kW, 100 kW to 250 kW, and more than 250 kW. In 2024, the less than 100 kW segment is expected to account for the largest share of 67.0% of the global electric vehicle market. The large share of this segment is attributed to the increasing adoption of electric scooters and mopeds, increasing investments by government authorities in the development of EV charging infrastructure, and favorable policies, incentives, and subsidies introduced by several state governments.

Moreover, the less than 100 kW segment is expected to grow at the highest CAGR during the forecast period. The high growth of this segment is attributed to the increasing adoption of electric scooters and mopeds, increasing investments by government authorities in the development of EV charging infrastructure, and favorable policies, incentives, and subsidies introduced by several state governments.

Based on propulsion type, the global electric vehicle market is segmented into hybrid electric vehicle and battery electric vehicle. In 2024, the battery electric vehicle segment is expected to account for the largest share of 64.9% of the global electric vehicle market. The large share of this segment is attributed to stringent emission standards, rising demand for increased fuel efficiency, growing demand for zero-emission vehicle, and increasing adoption of battery electric vehicle as private vehicle, autonomous delivery vehicle, industrial vehicle, and public transport.

Moreover, the battery electric vehicle segment is expected to grow at the highest CAGR during the forecast period. Innovations in electric vehicles, such as improvements in power and torque, are creating new opportunities for utilizing battery electric vehicle (BEV) in diverse environments. In addition, increasing initiatives by local government bodies and automotive players for developing BEVs, the proliferation of fast & ultra-fast charging technologies, and increasing acceptance due to reduced noise & vibrations with no emissions drive the BEVs market.

Based on end use, the global electric vehicle market is segmented into private, commercial, and industrial use. In 2024, the private use segment is expected to account for the largest share of 63.9% of the global electric vehicle. The growth of the segment is attributed to the growing awareness regarding the hazards associated with greenhouse gas emissions and environmental pollution, stringent emission norms, and demand for premium EVs among consumers. Also, supportive government incentives to promote the sales and manufacturing of EVs, tax rebates, and the decline in battery costs are further driving the adoption of EVs among consumers for private use.

However, the commercial use segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicle, and the increasing adoption of electric buses and trucks.

Several manufacturers and suppliers in countries including Spain, the U.S., France, and Japan are focused on improving battery and charging technology efficiency for commercial EVs. China is by far the forerunner when it comes to making e-buses. For instance, in September 2021, Tata Motors announced the commercial launch of the ‘XPRES T EV’ for fleet customers with FAME subsidy pricing. The XPRES-T EV will come with an optimal battery size and a captive fast charging solution, ensuring outstandingly low ownership cost in addition to safety and passenger comfort, making it a comprehensive and attractive proposition for fleet owners and operators.

In 2024, Asia-Pacific is expected to account for the largest share of 59.6% of the global electric vehicle market. Asia-Pacific electric vehicle market is estimated to be worth USD 733.44 billion in 2024. In recent years, the electric vehicle (EV) market has grown rapidly in the Asia Pacific region. China, Japan, and South Korea are providing subsidies and tax incentives and implementing regulations to support the development and adoption of EVs and reduce greenhouse gas emissions and air pollution.

However, Europe is expected to become the fastest growing region in the global electric vehicle market by 2031. The high growth of the electric vehicle market in the European region is majorly attributed to the consistent developments in making stringent emission regulations by the European Union and increasing focus on reducing the number of conventional cars. Norway leads the way for electric mobility adoption in Europe. According to the European Automobile Manufacturers Association (ACEA) report, In June, new registrations of battery-electric cars in the EU increased by a significant 66.2%, reaching 158,252 units. Battery-electric cars are the third most popular choice among new car buyers, overtaking diesel cars. Most EU markets recorded impressive double- and triple-digit percentage gains, including the largest, such as the Netherlands (+90.1%), Germany (+64.4%), and France (+52.0%).

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the electric vehicle market are Tesla, Inc. (U.S.), BMW AG (Germany), BYD Company Ltd. (China), Volkswagen AG (Germany), Hyundai Motor Company (South Korea), Volvo Group (Sweden), Mercedes-Benz Group AG (Germany), Ford Motor Company (U.S.), Honda Motor Co., Ltd. (Japan), General Motor Company (U.S.), Nissan Motor Co., Ltd. (Japan), Tata Motors Limited (India), Alcraft Motor Company Ltd. (U.K.), Zero Electric Vehicle Inc. (U.S.), and Faraday & Future Inc. (U.S.).

Electric Vehicle Industry Overview: Latest Developments from Key Industry Players

In September 2022, BYD Company Ltd. (China) partnered with the Los Olivos Elementary School District to bring a BYD Type A electric school bus. Students in Santa Barbara County and create the first U.S. school district to have a 100% zero-emission fleet of school buses.

|

Particulars |

Details |

|

Number of Pages |

265 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Units) |

20.5% |

|

Market Size (Units) |

446.54 Million Units by 2031 |

|

CAGR (Value) |

28% |

|

Market Size (Value) |

USD 6,916.43 Billion by 2031 |

|

Segments Covered |

By Vehicle Type

By Power Output

By Propulsion Type

By End Use

|

|

Countries Covered |

Asia-Pacific (China, India, Japan, South Korea, Singapore, Thailand, Rest of Asia-Pacific), Europe (Germany, France, U.K., Norway, Sweden, Netherlands, Italy, Spain, Switzerland, Denmark, Rest Of Europe), North America (U.S., Canada), Latin America, Middle East & Africa |

|

Key Companies |

Tesla, Inc. (U.S.), BMW AG (Germany), BYD Company Ltd. (China), Volkswagen AG (Germany), Hyundai Motor Company (South Korea), Volvo Group (Sweden), Mercedes-Benz Group AG (Germany), Ford Motor Company (U.S.), Honda Motor Co., Ltd. (Japan), General Motor Company (U.S.), Nissan Motor Co., Ltd. (Japan), Tata Motors Limited (India), Alcraft Motor Company Ltd. (U.K.), Zero Electric Vehicle Inc. (U.S.), and Faraday & Future Inc. (U.S.) |

The electric vehicle market study focuses on the market assessment and opportunity analysis through the sales of electric vehicle across different region, and countries, this study is also focused on competitive analysis for electric vehicle based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Electric Vehicle Market is expected to reach $ 6,916.43 billion by 2031, at a CAGR of 28% from 2024–2031. By volume, this market is expected to reach 446.54 million units by 2031, at a CAGR of 20.5% from 2024–2031.

In 2024, the passenger vehicle segment is expected to hold the largest share in electric vehicle market.

Commercial use segment is expected to register highest CAGR during the forecast period.

The growth of the global electric vehicle market is driven by factors such as supportive government policies and regulations, increasing investments in EV development by leading automotive OEMs, rising environmental concerns, decreasing battery prices, and the increasing consumer demand for electric vehicle. The growing adoption of autonomous electric vehicle and the increasing focus on electric mobility in emerging economies are expected to generate growth opportunities for the stakeholders in this market.

Key players operating in the electric vehicle market are Tesla, Inc. (U.S.), BMW AG (Germany), BYD Company Ltd. (China), Volkswagen AG (Germany), Hyundai Motor Company (South Korea), Volvo Group (Sweden), Mercedes-Benz Group AG (Germany), Ford Motor Company (U.S.), Honda Motor Co., Ltd. (Japan), General Motor Company (U.S.), Nissan Motor Co., Ltd. (Japan), Tata Motors Limited (India), Alcraft Motor Company Ltd. (U.K.), Zero Electric Vehicle Inc. (U.S.), and Faraday & Future Inc. (U.S.).

Europe is expected to record a higher CAGR during the forecast period.

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates