Resources

About Us

Cleanroom HVAC Market by Filter Type (HEPA, ULPA), System Type (Recirculating, Single Pass), Component (AHU, FFU, Laminar Flow), Cleanroom Class (ISO 1-9), Application, End User, and Geography—Global Forecast to 2035

Report ID: MREP - 1041607 Pages: 215 Oct-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Cleanroom HVAC Market Size?

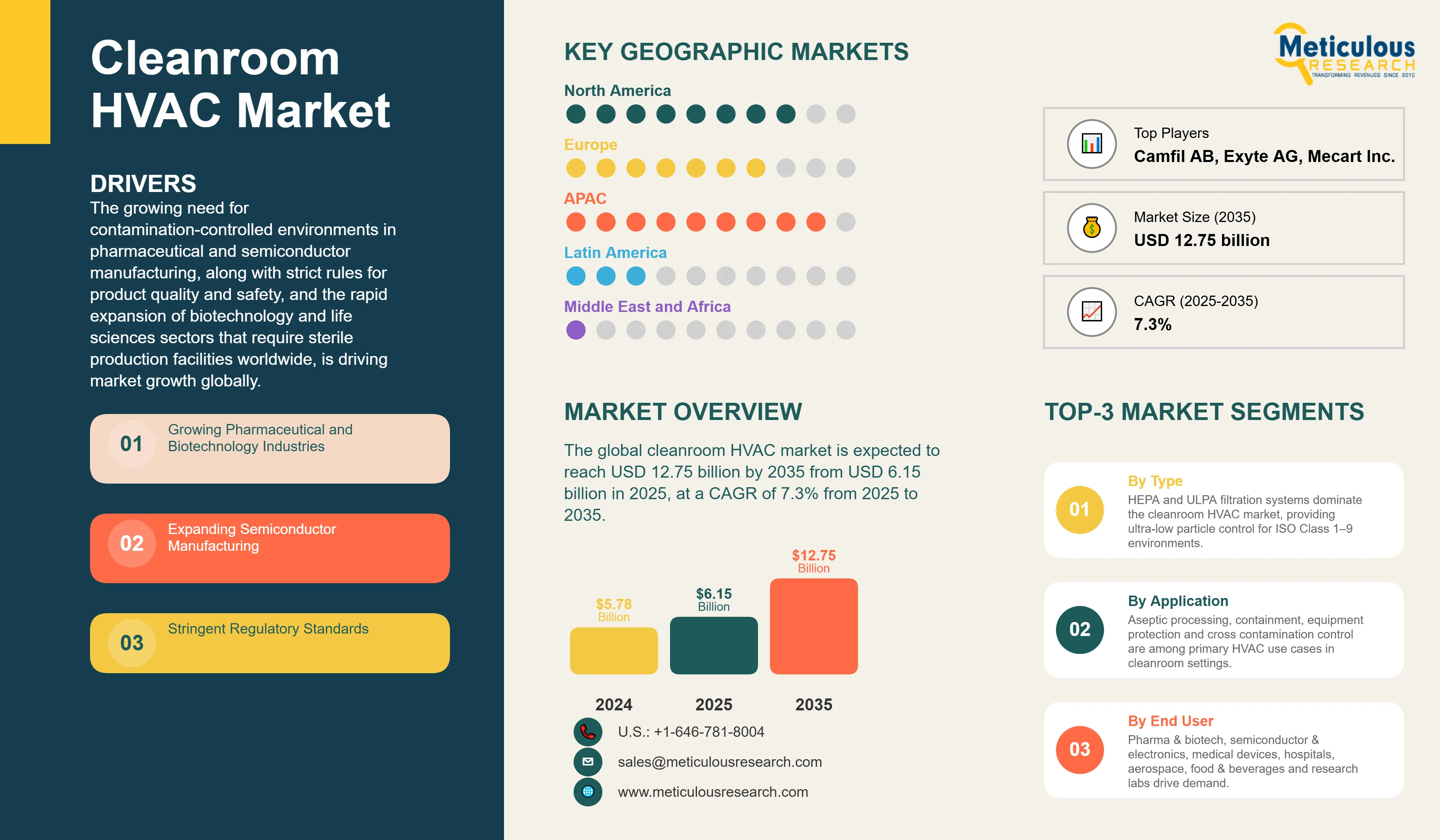

The global cleanroom HVAC market was valued at USD 5.78 billion in 2024 and is expected to reach USD 12.75 billion by 2035 from USD 6.15 billion in 2025, at a CAGR of 7.3% from 2025 to 2035.

The growing need for contamination-controlled environments in pharmaceutical and semiconductor manufacturing, along with strict rules for product quality and safety, and the rapid expansion of biotechnology and life sciences sectors that require sterile production facilities worldwide, is driving market growth globally.

Cleanroom HVAC Market Key Takeaways

Click here to: Get Free Sample Pages of this Report

The cleanroom HVAC market involves designing, manufacturing, installing, and maintaining specialized heating, ventilation, and air conditioning systems. These systems create and uphold controlled environments with specific levels of airborne particles, temperature, humidity, and pressure. They include high-efficiency particulate air (HEPA) and ultra-low particulate air (ULPA) filters, precise airflow controls, and advanced monitoring systems to reach cleanliness levels from ISO Class 1 to ISO Class 9.

The cleanroom HVAC market is driven by the growing pharmaceutical and biopharmaceutical sectors needing sterile environments, increased demand in semiconductor production for ultra-clean conditions, rising concerns about healthcare-associated infections that lead to more hospitals adopting cleanrooms, technological improvements in energy-efficient filtration and airflow management, and stricter regulatory standards for good manufacturing practices (GMP) in various industries.

What are the Key Trends in the Cleanroom HVAC Market?

Market Scope

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 12.75 Billion |

|

Market Size in 2025 |

USD 6.15 Billion |

|

Market Size in 2024 |

USD 5.78 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 7.3% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Filter Type, System Type, Component, Cleanroom Class, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Pharmaceutical and Biotechnology Industry Expansion

A key reason for the growth of the cleanroom HVAC market is the rapid rise of the pharmaceutical and biotechnology sectors. This is especially true for biologics, cell and gene therapies, and personalized medicine, which require strict contamination control. The global biologics market is expected to hit $500 billion by 2030. It needs sterile manufacturing environments with ISO Class 5 or better conditions for aseptic processing.

The COVID-19 pandemic emphasized the urgent need for vaccine production capacity, leading to increased investments in new cleanroom facilities around the world. Regulatory requirements, including the FDA's current Good Manufacturing Practice (cGMP) and EU GMP Annex 1, set specific HVAC performance standards for pharmaceutical cleanrooms.

The move toward continuous manufacturing and single-use technologies in biopharmaceuticals creates new HVAC needs for flexible, modular facilities. A growing focus on preventing drug shortages and ensuring supply chain stability is pushing the expansion of pharmaceutical manufacturing capacity, especially in developed markets that want to lessen their reliance on imports.

Opportunity

Emerging Markets and Advanced Manufacturing

The growth of pharmaceutical and electronics manufacturing in emerging markets offers strong opportunities for cleanroom HVAC systems as countries improve their local production capabilities. Government programs encouraging local pharmaceutical production in India, China, Brazil, and some African countries create a need for GMP-compliant cleanroom facilities. The rise of new therapies like CAR-T cells, gene editing, and regenerative medicine requires specialized cleanroom environments with specific HVAC needs.

Increased investments in semiconductor manufacturing, driven by chip shortages and local supply chains, require very clean environments with specialized HVAC systems. The legalization and regulation of the cannabis industry in various areas also creates a new need for controlled environment cultivation and processing facilities.

The development of sustainable cleanroom technologies, such as energy recovery, renewable energy use, and low-GWP refrigerants, appeals to organizations that prioritize environmental responsibility.

Filter Type Insights

Why do HEPA Filters Dominate the Market?

The HEPA filters segment holds the largest share of around 65% of the overall cleanroom HVAC market in 2025. HEPA filters remove 99.97% of particles that are 0.3 microns or larger, meeting the needs of many cleanroom applications including pharmaceutical manufacturing, electronics assembly, and healthcare facilities.

The common availability of HEPA filters and their established performance standards (EN 1822, IEST-RP-CC001) ensure consistent quality and compliance with regulations. HEPA filtration strikes a good balance between achieving cleanliness and keeping operational costs low for ISO Class 5-8 cleanrooms, which make up most installations.

However, the ULPA filters segment is expected to grow at the fastest CAGR through 2035. A rising need for ISO Class 1-4 cleanrooms, especially in semiconductor manufacturing and nanotechnology, drives the use of ULPA filters, which remove 99.999% of particles that are 0.12 microns or larger. Advanced pharmaceutical applications, such as sterile injectables and cell therapies, increasingly require ULPA filtration in critical areas.

System Type Insights

How do Recirculating Air Systems Support Cleanroom Operations?

The recirculating air systems segment holds the largest market share at nearly 70% in 2025. Recirculating systems, which reuse filtered air, can cut energy use by 30-50% compared to single-pass systems, leading to substantial savings in operating costs. These systems maintain stable temperature and humidity with recirculated air, which enhances process control and product quality in manufacturing. Recirculating designs meet required air change rates (20-600 per hour) more cost-effectively by filtering and returning room air instead of conditioning outdoor air.

The unidirectional flow systems segment is expected to grow the fastest in the coming years. Critical manufacturing processes that need ISO Class 1-5 environments drive the use of unidirectional (laminar) flow systems, which provide steady and contamination-free airflow. The growing demand for unidirectional flow in advanced semiconductor fabrication and aseptic pharmaceutical processing aims to protect products.

End User Insights

Why do Pharmaceutical & Biotechnology Lead Market Demand?

Based on end user, the pharmaceutical and biotechnology segment commands the largest share of around 40% of the overall cleanroom HVAC market in 2025. Strict rules for drug manufacturing, including FDA 21 CFR Part 211 and EU GMP, require controlled environments with validated HVAC systems. The complexity of producing biological drugs, which needs multiple cleanroom areas with different classifications, drives the need for advanced HVAC setups.

The growth of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) further drives the need for cleanroom capacity. The push for personalized medicine and small-batch production requires flexible cleanroom designs with improved HVAC features. Regular inspections and quality audits lead to ongoing investments in cleanroom HVAC maintenance and upgrades.

However, the medical devices segment is expected to experience the fastest growth during the coming years. The increasing complexity of medical devices, such as implantables, drug-device combinations, and diagnostic equipment, heightens the need for cleanrooms.

U.S. Cleanroom HVAC Market Size and Growth 2025 to 2035

The U.S. cleanroom HVAC market is projected to be worth around USD 3.92 billion by 2035, growing at a CAGR of 7.8% from 2025 to 2035.

How is the Asia Pacific Cleanroom HVAC Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest share of 40-45% of the global cleanroom HVAC market in 2025. This is primarily attributed to its vast semiconductor manufacturing capacity in Taiwan, South Korea, China, and Japan. These countries need advanced cleanroom HVAC systems for chip production.

Rapid growth in the pharmaceutical industry in India and China, fueled by domestic demand and export opportunities, creates significant needs for cleanroom infrastructure. Government programs like "Make in India" for pharmaceuticals and China's plans for developing the biomedical industry promote investments in cleanroom facilities.

The region's role as the global electronics manufacturing hub requires many cleanroom facilities for producing and assembling components. Lower construction and operational costs than those in Western markets attract multinational companies looking to set up cleanroom facilities. The growing biotechnology sectors in Singapore, South Korea, and China focus on biosimilars and innovative therapies, which increases demand for cleanrooms.

Which Factors Support the North America Cleanroom HVAC Market Growth?

North America is set to experience the fastest growth rate from 2025 to 2035. This growth comes from significant investments in biopharmaceutical manufacturing, including cell and gene therapies that need specialized cleanroom environments.

Reshoring initiatives for pharmaceutical and semiconductor manufacturing, which gained urgency due to supply chain issues highlighted by COVID-19, are increasing the demand for cleanroom facilities.

A strong regulatory system and enforcement from the FDA lead to ongoing updates and maintenance of cleanroom HVAC systems. The presence of top pharmaceutical, biotechnology, and medical device companies spurs innovation in cleanroom technology.

Government support through the CHIPS Act for semiconductor manufacturing and BARDA for pharmaceutical readiness aids the development of cleanroom infrastructure. Leading research facilities in universities and national labs need state-of-the-art cleanroom HVAC systems for nanotechnology and life sciences research.

Value Chain Analysis

Key Players:

Recent Developments

Segments Covered in the Report

By Filter Type

By System Type

By Component

By Cleanroom Class

By Application

By End User

By Region

The cleanroom HVAC market is expected to increase from USD 6.15 billion in 2025 to USD 12.75 billion by 2035.

The cleanroom HVAC market is expected to grow at a CAGR of 7.3% from 2025 to 2035.

The major players in the cleanroom HVAC market include Camfil AB, AAF International (Daikin Industries), Trane Technologies plc, Carrier Global Corporation, M+W Group, Exyte AG, Clean Air Technology Inc., Terra Universal Inc., Mecart Inc., Ardmac Ltd., Nicomac Clean Rooms, Airtech Japan Ltd., Suzhou Pharma Machinery Co. Ltd., Weiss Technik, ABN Cleanroom Technology, E.J. Pleune Company, Clean Rooms International Inc., Atmos-Tech Industries, Swiftwall Inc., and PBSC Cleanrooms.

The driving factors of the cleanroom HVAC market are increasing demand for contamination-controlled environments in pharmaceutical and semiconductor manufacturing, stringent regulatory requirements for product quality and safety, and rapid growth in biotechnology and life sciences sectors requiring sterile production facilities globally.

Asia Pacific region will lead the global cleanroom HVAC market during the forecast period 2025 to 2035.

Published Date: Sep-2025

Published Date: Jul-2025

Published Date: Jul-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates