Resources

About Us

Collaborative Robots Market by Type (Power and Force Limiting, Safety Monitored Stop, Speed and Separation, Hand Guiding), Component, Payload, Application, End Use Industry, & Geography - Global Forecast to 2035

Report ID: MRSE - 104313 Pages: 210 May-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThis report examines the global market for collaborative robots, focusing on how solution providers are responding to the rising labor costs, shortage of skilled workers, and the growing need for flexible automation solutions worldwide. It offers a strategic evaluation of market dynamics, forecasts growth through 2035, and assesses competitive positioning at both global and regional/country levels.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

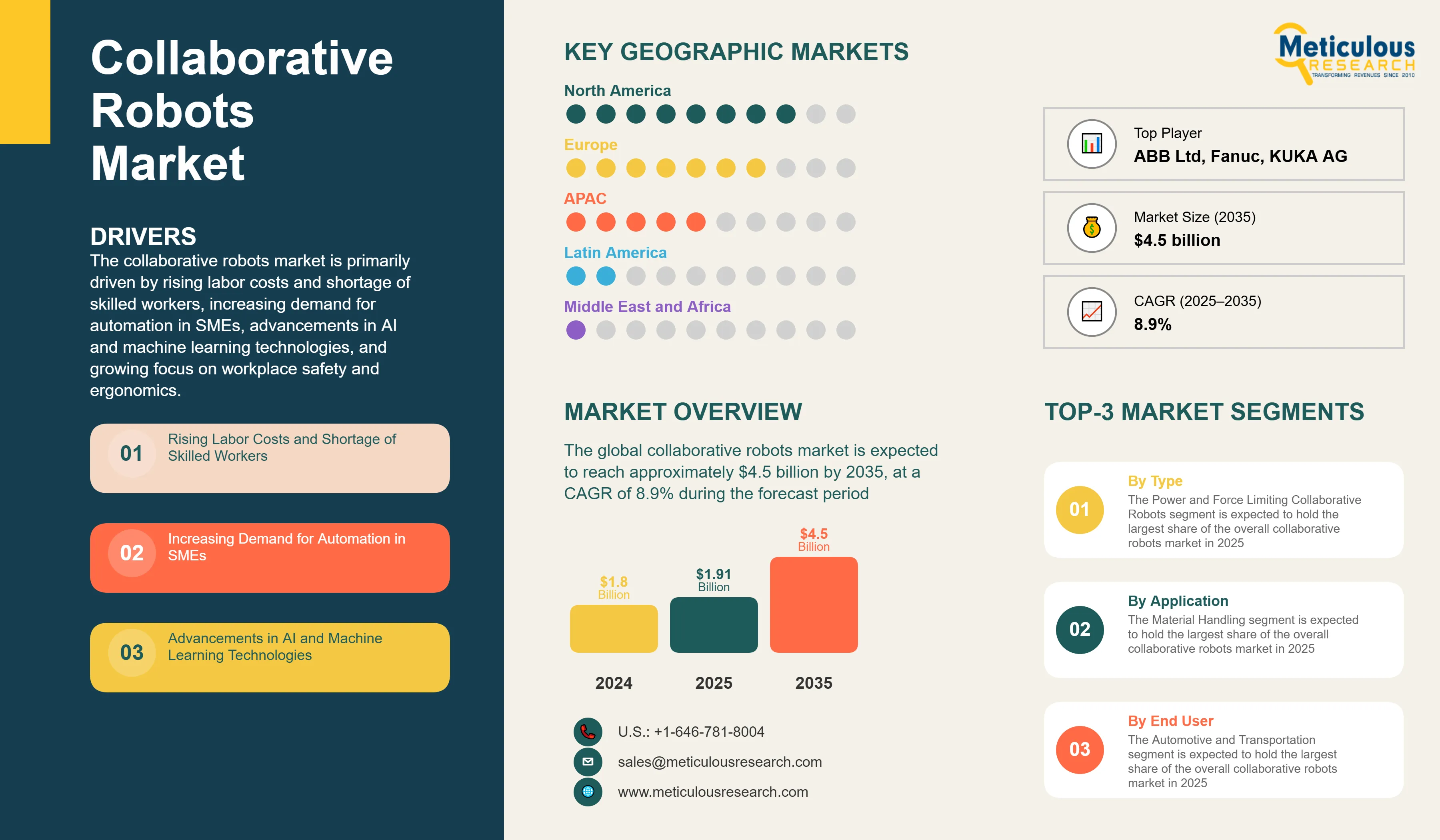

The collaborative robots market is primarily driven by rising labor costs and shortage of skilled workers, increasing demand for automation in SMEs, advancements in AI and machine learning technologies, and growing focus on workplace safety and ergonomics. The shift towards vision-guided and AI-enabled collaborative robots and cloud-based robot programming and management are reshaping the industry, while multi-arm and dual-arm collaborative systems and integration with augmented reality (AR) for training are gaining significant traction. Additionally, integration with IoT and Industry 4.0 technologies and growing applications in healthcare and life sciences are further driving market growth, especially in developed markets with advanced manufacturing infrastructure.

Key Challenges

Although the collaborative robots market holds substantial growth potential, it encounters several challenges such as high initial investment and integration costs, limited payload capacity compared to traditional robots, and slower operating speed requirements for safety. Furthermore, hurdles like safety standards and regulatory compliance across various countries, lack of standardization in safety protocols, and cybersecurity concerns in connected robotics pose significant barriers that could hinder market adoption in different parts of the world.

Growth Opportunities

The collaborative robots market presents numerous avenues for high growth. Emerging markets offer substantial expansion opportunities for market players looking to reach new customer bases. Integration with IoT and Industry 4.0 technologies provides another key opportunity, enhancing the connectivity and intelligence of robotic systems. Moreover, the development of mobile collaborative robots and growing applications in healthcare and life sciences are generating new revenue streams for solution providers as organizations seek efficient alternatives to traditional automation methods.

Market Segmentation Highlights

By Type

The Power and Force Limiting Collaborative Robots segment is expected to hold the largest share of the overall collaborative robots market in 2025, due to its inherent safety features and growing adoption in manufacturing facilities across the globe. However, the Hand Guiding Collaborative Robots segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand for intuitive programming, ease of use, and the push for operator-friendly automation solutions.

By Component

The Hardware segment is expected to dominate the overall collaborative robots market in 2025, primarily due to the essential role of robotic arms, EOAT devices, drives, controllers, and sensors in collaborative robotics systems. However, the Software segment is expected to grow at the fastest CAGR through the forecast period, driven by increasing demand for advanced programming platforms, AI integration, and cloud-based robot management solutions.

By Payload

The Up to 5 Kg Payload segment is expected to hold the largest share of the overall collaborative robots market in 2025, due to the high demand for light-duty applications in electronics assembly and precision manufacturing. However, the More than 10 Kg Payload segment is expected to experience the fastest growth rate during the forecast period, driven by expanding applications in automotive manufacturing, heavy machinery, and material handling operations.

By Application

The Material Handling segment is expected to hold the largest share of the overall collaborative robots market in 2025, due to the widespread adoption of cobots for palletizing, depalletizing, and pick-and-place operations across industries. However, the Machine Tending segment is expected to experience the fastest growth rate during the forecast period, driven by increasing automation of CNC machines, injection molding, and other manufacturing equipment.

By End Use Industry

The Automotive and Transportation segment is expected to hold the largest share of the overall collaborative robots market in 2025, due to the high volume of automation applications and early adoption of collaborative robotics technologies. However, the Healthcare segment is expected to experience the fastest growth rate during the forecast period, driven by expanding applications in laboratory automation, pharmaceutical manufacturing, and medical device assembly.

By Geography

North America is expected to hold the largest share of the global collaborative robots market in 2025, driven by advanced manufacturing infrastructure, high labor costs, strong adoption of innovative technologies, and significant investments in industrial automation. Additionally, favorable regulatory environment and high awareness about workplace safety contribute significantly to market dominance. Europe follows as the second-largest market, bolstered by strong manufacturing sectors and increasing focus on Industry 4.0 initiatives. However, Asia-Pacific is witnessing the fastest growth rate during the forecast period, primarily driven by expanding manufacturing facilities, rising labor costs, growing awareness about automation benefits, and the advantages collaborative robots offer in improving productivity and safety.

Competitive Landscape

The global collaborative robots market is characterized by a diverse competitive environment, comprising established industrial automation companies, specialized robotics manufacturers, technology solution providers, and innovative startups, each adopting unique approaches to advancing collaborative robotics technologies.

Within this landscape, solution providers are segmented into industry leaders, market differentiators, vanguards, and emerging companies, with each group implementing distinct strategies to sustain their competitive edge. Leading companies are prioritizing integrated solutions that merge cutting-edge robotics technologies with comprehensive automation platforms, while also addressing manufacturing challenges specific to various industries.

The key players operating in the global collaborative robots market are Universal Robots A/S, Rethink Robots GmbH, ABB Ltd, Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Robert Bosch Manufacturing Solutions GmbH, Stäubli International AG, F&P Robotics AG, TechMan Robot Inc., Precise Automation, Inc., Doosan Robotics Inc., MABI Robotic AG, Energid Technologies Corporation, and AUBO Robotics USA among others.

|

Particulars |

Details |

|

Number of Pages |

210 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

8.9% |

|

Market Size (Value) in 2025 |

USD 1.91 Billion |

|

Market Size (Value) in 2035 |

USD 4.5 Billion |

|

Segments Covered |

Market Assessment, by Type

Market Assessment, by Component

Market Assessment, by Payload

Market Assessment, by Application

Market Assessment, by End Use Industry

|

|

Countries Covered |

North America (U.S., Canada), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), Europe (Germany, U.K., France, Italy, Spain, Rest of Europe), Latin America, Middle East & Africa |

|

Key Companies |

Universal Robots A/S, Rethink Robots GmbH, ABB Ltd, Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Robert Bosch Manufacturing Solutions GmbH, Stäubli International AG, F&P Robotics AG, TechMan Robot Inc., Precise Automation, Inc., Doosan Robotics Inc., MABI Robotic AG, Energid Technologies Corporation, AUBO Robotics USA |

The global collaborative robots market was valued at $1.8 billion in 2024. This market is expected to reach approximately $4.5 billion by 2035, growing from an estimated $1.91billion in 2025, at a CAGR of 8.9% during the forecast period of 2025–2035.

The global collaborative robots market is expected to grow at a CAGR of 8.9% during the forecast period of 2025–2035.

The global collaborative robots market is expected to reach approximately $4.5 billion by 2035, growing from an estimated $1.91 billion in 2025, at a CAGR of 8.9% during the forecast period of 2025–2035.

The key companies operating in this market include Universal Robots A/S, Rethink Robots GmbH, ABB Ltd, Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Robert Bosch Manufacturing Solutions GmbH, Stäubli International AG, F&P Robotics AG, and others.

Major trends shaping the market include vision-guided and AI-enabled collaborative robots, cloud-based robot programming and management, multi-arm and dual-arm collaborative systems, and integration with augmented reality (AR) for training.

• In 2025, the Power and Force Limiting Collaborative Robots segment is expected to dominate the overall collaborative robots market by type

• Based on component, the Hardware segment is expected to hold the largest share of the overall market in 2025

• Based on payload, the Up to 5 Kg Payload segment is expected to hold the largest share of the overall market in 2025

• Based on application, the Material Handling segment is expected to hold the largest share of the overall market in 2025

• Based on end use industry, the Automotive and Transportation segment is expected to hold the largest share of the global market in 2025

North America is expected to hold the largest share of the global collaborative robots market in 2025, driven by advanced manufacturing infrastructure, high labor costs, and significant investments in industrial automation. Asia-Pacific is witnessing the fastest growth rate during the forecast period.

The growth of this market is driven by rising labor costs and shortage of skilled workers, increasing demand for automation in SMEs, advancements in AI and machine learning technologies, and growing focus on workplace safety and ergonomics.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Collaborative Robots Market, by Type

3.2.2. Collaborative Robots Market, by Component

3.2.3. Collaborative Robots Market, by Payload

3.2.4. Collaborative Robots Market, by Application

3.2.5. Collaborative Robots Market, by End Use Industry

3.2.6. Collaborative Robots Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Labor Costs and Shortage of Skilled Workers

4.2.1.2. Increasing Demand for Automation in SMEs

4.2.1.3. Advancements in AI and Machine Learning Technologies

4.2.1.4. Growing Focus on Workplace Safety and Ergonomics

4.2.1.5. Flexibility and Easy Programming Requirements

4.2.2. Restraints

4.2.2.1. High Initial Investment and Integration Costs

4.2.2.2. Limited Payload Capacity Compared to Traditional Robots

4.2.2.3. Slower Operating Speed Requirements for Safety

4.2.2.4. Lack of Standardization in Safety Protocols

4.2.3. Opportunities

4.2.3.1. Expansion in Emerging Markets

4.2.3.2. Integration with IoT and Industry 4.0 Technologies

4.2.3.3. Growing Applications in Healthcare and Life Sciences

4.2.3.4. Development of Mobile Collaborative Robots

4.2.4. Trends

4.2.4.1. Vision-Guided and AI-Enabled Collaborative Robots

4.2.4.2. Cloud-Based Robot Programming and Management

4.2.4.3. Multi-Arm and Dual-Arm Collaborative Systems

4.2.4.4. Integration with Augmented Reality (AR) for Training

4.2.5. Challenges

4.2.5.1. Safety Standards and Regulatory Compliance

4.2.5.2. Integration with Legacy Manufacturing Systems

4.2.5.3. Cybersecurity Concerns in Connected Robotics

4.2.5.4. Return on Investment (ROI) Justification

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on the Collaborative Robots Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy-Efficient Robotic Systems

4.4.1.2. Sustainable Manufacturing Processes

4.4.1.3. Recyclable Materials and Components

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Green Manufacturing Initiatives

4.4.2.2. Energy Consumption Optimization

4.4.3. Opportunities from Sustainability Focus

4.4.3.1. Development of Eco-Friendly Collaborative Robots

4.4.3.2. Challenges in Sustainable Robot Manufacturing

5. Collaborative Robots Market Assessment—by Type

5.1. Overview

5.2. Power and Force Limiting Collaborative Robots

5.3. Safety Monitored Stop Collaborative Robots

5.4. Speed and Separation Collaborative Robots

5.5. Hand Guiding Collaborative Robots

6. Collaborative Robots Market Assessment—by Component

6.1. Overview

6.2. Hardware

6.2.1. Robotic Arms

6.2.2. End of Arm Tooling (EOAT) Devices

6.2.2.1. Welding Torches

6.2.2.2. Grippers

6.2.2.3. Vacuum Cups

6.2.2.4. Clamps

6.2.2.5. Tool Changers

6.2.2.6. Vision Systems

6.2.2.7. Feeder Systems

6.2.2.8. Other EOAT Devices

6.2.3. Drives

6.2.4. Controllers

6.2.5. Sensors

6.3. Software

7. Collaborative Robots Market Assessment—by Payload

7.1. Overview

7.2. Up to 5 Kg Payload

7.3. 5 Kg to 10 Kg Payload

7.4. More than 10 Kg Payload

8. Collaborative Robots Market Assessment—by Application

8.1. Overview

8.2. Material Handling

8.2.1. Palletizing & Depalletizing

8.2.2. Stacking

8.2.3. Grain Elevating

8.2.4. Bucket Elevating

8.3. Welding & Soldering

8.3.1. Resistance Spot Welding

8.3.2. Arc Welding

8.3.3. Laser Welding

8.3.4. Plasma Welding

8.3.5. Ultrasonic Welding

8.3.6. Other Welding Applications

8.4. Assembling and Disassembling

8.5. Machine Tending

8.5.1. Grinding

8.5.2. Drilling

8.5.3. Milling and Turning

8.5.4. Injection Molding

8.5.5. Other Applications

8.6. Dispensing

8.7. Processing

8.8. Inspection

8.8.1. Laser Inspection

8.8.2. Dimensional Checks

8.8.3. Vision Systems

8.8.4. Flow Tests

8.8.5. Leak Tests

8.9. Other Applications

9. Collaborative Robots Market Assessment—by End-use Industry

9.1. Overview

9.2. Automotive and Transportation

9.3. Electrical & Electronics

9.4. Metal & Machinery

9.5. Plastic & Chemicals

9.6. Oil & Gas

9.7. Food & Beverage

9.8. Aerospace & Defense

9.9. Biotechnology

9.10. Healthcare

9.11. Other End-use Industries

10. Collaborative Robots Market Assessment—by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Asia-Pacific

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. South Korea

10.3.5. Rest of Asia-Pacific

10.4. Europe

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Latin America

10.6. Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies

11.2.1. Market Differentiators

11.2.2. Synergy Analysis: Major Deals & Strategic Alliances

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Emerging Companies

11.5. Market Share Analysis/Market Ranking by the Key Players

12. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

12.1. Universal Robots A/S

12.2. Rethink Robots GmbH

12.3. ABB Ltd

12.4. Fanuc Corporation

12.5. KUKA AG

12.6. Yaskawa Electric Corporation

12.7. Kawasaki Heavy Industries, Ltd.

12.8. Robert Bosch Manufacturing Solutions GmbH

12.9. Stäubli International AG

12.10. F&P Robotics AG

12.11. TechMan Robot Inc.

12.12. Precise Automation, Inc.

12.13. Doosan Robotics Inc.

12.14. MABI Robotic AG

12.15. Energid Technologies Corporation

12.16. AUBO Robotics USA

13. Appendix

13.1. Available Customization

13.2. Related Reports

List of Tables

Table 1 Currency Conversion Rates (2020–2024)

Table 2 Global Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 3 Global Power and Force Limiting Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 4 Global Safety Monitored Stop Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 5 Global Speed and Separation Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 6 Global Hand Guiding Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 7 Global Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 8 Global Collaborative Robots Hardware Market, by Type, 2023–2035 (USD Million)

Table 9 Global Collaborative Robotic Arms Market, by Country/Region, 2023–2035 (USD Million)

Table 10 Global Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 11 Global Collaborative Robots Market for Welding Torches, by Country/Region, 2023–2035 (USD Million)

Table 12 Global Collaborative Robots Market for Welding Torches, by Country/Region, 2023–2035 (USD Million)

Table 13 Global Collaborative Robots Market for Grippers, by Country/Region, 2023–2035 (USD Million)

Table 14 Global Collaborative Robots Market for Vacuum Cups, by Country/Region, 2023–2035 (USD Million)

Table 15 Global Collaborative Robots Market for Clamps, by Country/Region, 2023–2035 (USD Million)

Table 16 Global Collaborative Robots Market for Tool Changers, by Country/Region, 2023–2035 (USD Million)

Table 17 Global Collaborative Robots Market for Vision Systems, by Country/Region, 2023–2035 (USD Million)

Table 18 Global Collaborative Robots Market for Feeder Systems, by Country/Region, 2023–2035 (USD Million)

Table 19 Global Collaborative Robots Market for Other EOAT Devices, by Country/Region, 2023–2035 (USD Million)

Table 20 Global Collaborative Robots Drives Market, by Country/Region, 2023–2035 (USD Million)

Table 21 Global Collaborative Robots Controllers Market, by Country/Region, 2023–2035 (USD Million)

Table 22 Global Collaborative Robots Sensors Market, by Country/Region, 2023–2035 (USD Million)

Table 23 Global Collaborative Robots Software Market, by Country/Region, 2023–2035 (USD Million)

Table 24 Global Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 25 Global Collaborative Robots Market for Up to 5 Kg Payload, by Country/Region, 2023–2035 (USD Million)

Table 26 Global Collaborative Robots Market for 5 Kg to 10 Kg Payload, by Country/Region, 2023–2035 (USD Million)

Table 27 Global Collaborative Robots Market for More than 10 Kg Payload, by Country/Region, 2023–2035 (USD Million)

Table 28 Global Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 29 Global Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 30 Global Collaborative Robots Market for Material Handling, by Country/Region, 2023–2035 (USD Million)

Table 31 Global Material Handling Collaborative Robots Market for Palletizing & Depalletizing, by Country/Region, 2023–2035 (USD Million)

Table 32 Global Material Handling Collaborative Robots Market for Stacking, by Country/Region, 2023–2035 (USD Million)

Table 33 Global Material Handling Collaborative Robots Market for Grain Elevating, by Country/Region, 2023–2035 (USD Million)

Table 34 Global Material Handling Collaborative Robots Market for Bucket Elevating, by Country/Region, 2023–2035 (USD Million)

Table 35 Global Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 36 Global Collaborative Robots Market for Welding & Soldering, by Country/Region, 2023–2035 (USD Million)

Table 37 Global Welding & Soldering Collaborative Robots Market for Resistance Spot Welding, by Country/Region, 2023–2035 (USD Million)

Table 38 Global Welding & Soldering Collaborative Robots Market for Arc Welding, by Country/Region, 2023–2035 (USD Million)

Table 39 Global Welding & Soldering Collaborative Robots Market for Laser Welding, by Country/Region, 2023–2035 (USD Million)

Table 40 Global Welding & Soldering Collaborative Robots Market for Plasma Welding, by Country/Region, 2023–2035 (USD Million)

Table 41 Global Welding & Soldering Collaborative Robots Market for Ultrasonic Welding, by Country/Region, 2023–2035 (USD Million)

Table 42 Global Welding & Soldering Collaborative Robots Market for Other Welding Applications, by Country/Region, 2023–2035 (USD Million)

Table 43 Global Collaborative Robots Market for Assembling and Disassembling, by Country/Region, 2023–2035 (USD Million)

Table 44 Global Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 45 Global Collaborative Robots Market for Machine Tending, by Country/Region, 2023–2035 (USD Million)

Table 46 Global Machine Tending Collaborative Robots Market for Grinding, by Country/Region, 2023–2035 (USD Million)

Table 47 Global Machine Tending Collaborative Robots Market for Drilling, by Country/Region, 2023–2035 (USD Million)

Table 48 Global Machine Tending Collaborative Robots Market for Milling and Turning, by Country/Region, 2023–2035 (USD Million)

Table 49 Global Machine Tending Collaborative Robots Market for Injection Molding, by Country/Region, 2023–2035 (USD Million)

Table 50 Global Machine Tending Collaborative Robots Market for Other Applications, by Country/Region, 2023–2035 (USD Million)

Table 51 Global Collaborative Robots Market for Dispensing, by Country/Region, 2023–2035 (USD Million)

Table 52 Global Collaborative Robots Market for Processing, by Country/Region, 2023–2035 (USD Million)

Table 53 Global Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 54 Global Collaborative Robots Market for Inspection, by Country/Region, 2023–2035 (USD Million)

Table 55 Global Inspection Collaborative Robots Market for Laser Inspection, by Country/Region, 2023–2035 (USD Million)

Table 56 Global Inspection Collaborative Robots Market for Dimensional Checks, by Country/Region, 2023–2035 (USD Million)

Table 57 Global Inspection Collaborative Robots Market for Vision Systems, by Country/Region, 2023–2035 (USD Million)

Table 58 Global Inspection Collaborative Robots Market for Flow Tests, by Country/Region, 2023–2035 (USD Million)

Table 59 Global Inspection Collaborative Robots Market for Leak Tests, by Country/Region, 2023–2035 (USD Million)

Table 60 Global Collaborative Robots Market for Other Applications, by Country/Region, 2023–2035 (USD Million)

Table 61 Global Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 62 Global Collaborative Robots Market for Automotive and Transportation, by Country/Region, 2023–2035 (USD Million)

Table 63 Global Collaborative Robots Market for Electrical & Electronics, by Country/Region, 2023–2035 (USD Million)

Table 64 Global Collaborative Robots Market for Metal & Machinery, by Country/Region, 2023–2035 (USD Million)

Table 65 Global Collaborative Robots Market for Plastic & Chemicals, by Country/Region, 2023–2035 (USD Million)

Table 66 Global Collaborative Robots Market for Oil & Gas, by Country/Region, 2023–2035 (USD Million)

Table 67 Global Collaborative Robots Market for Food & Beverage, by Country/Region, 2023–2035 (USD Million)

Table 68 Global Collaborative Robots Market for Aerospace & Defense, by Country/Region, 2023–2035 (USD Million)

Table 69 Global Collaborative Robots Market for Biotechnology, by Country/Region, 2023–2035 (USD Million)

Table 70 Global Collaborative Robots Market for Healthcare, by Country/Region, 2023–2035 (USD Million)

Table 71 Global Collaborative Robots Market for Other End-use Industries, by Country/Region, 2023–2035 (USD Million)

Table 72 Global Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 73 Asia-Pacific: Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 74 Asia-Pacific: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 75 Asia-Pacific: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 76 Asia-Pacific: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 77 Asia-Pacific: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 78 Asia-Pacific: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 79 Asia-Pacific: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 80 Asia-Pacific: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 81 Asia-Pacific: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 82 Asia-Pacific: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 83 Asia-Pacific: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 84 China: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 85 China: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 86 China: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 87 China: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 88 China: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 89 China: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 90 China: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 91 China: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 92 China: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 93 China: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 94 Japan: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 95 Japan: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 96 Japan: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 97 Japan: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 98 Japan: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 99 Japan: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 100 Japan: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 101 Japan: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 102 Japan: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 103 Japan: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 104 India: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 105 India: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 106 India: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 107 India: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 108 India: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 109 India: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 110 India: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 111 India: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 112 India: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 113 India: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 114 South Korea: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 115 South Korea: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 116 South Korea: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 117 South Korea: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 118 South Korea: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 119 South Korea: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 120 South Korea: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 121 South Korea: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 122 South Korea: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 123 South Korea: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 124 Rest of Asia-Pacific: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 125 Rest of Asia-Pacific: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 126 Rest of Asia-Pacific: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 127 Rest of Asia-Pacific: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 128 Rest of Asia-Pacific: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 129 Rest of Asia-Pacific: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 130 Rest of Asia-Pacific: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 131 Rest of Asia-Pacific: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 132 Rest of Asia-Pacific: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 133 Rest of Asia-Pacific: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 134 Europe: Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 135 Europe: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 136 Europe: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 137 Europe: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 138 Europe: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 139 Europe: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 140 Europe: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 141 Europe: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 142 Europe: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 143 Europe: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 144 Europe: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 145 Germany: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 146 Germany: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 147 Germany: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 148 Germany: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 149 Germany: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 150 Germany: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 151 Germany: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 152 Germany: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 153 Germany: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 154 Germany: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 155 U.K.: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 156 U.K.: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 157 U.K.: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 158 U.K.: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 159 U.K.: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 160 U.K.: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 161 U.K.: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 162 U.K.: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 163 U.K.: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 164 U.K.: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 165 France: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 166 France: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 167 France: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 168 France: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 169 France: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 170 France: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 171 France: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 172 France: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 173 France: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 174 France: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 175 Italy: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 176 Italy: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 177 Italy: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 178 Italy: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 179 Italy: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 180 Italy: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 181 Italy: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 182 Italy: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 183 Italy: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 184 Italy: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 185 Spain: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 186 Spain: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 187 Spain: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 188 Spain: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 189 Spain: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 190 Spain: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 191 Spain: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 192 Spain: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 193 Spain: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 194 Spain: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 195 Rest of Europe: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 196 Rest of Europe: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 197 Rest of Europe: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 198 Rest of Europe: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 199 Rest of Europe: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 200 Rest of Europe: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 201 Rest of Europe: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 202 Rest of Europe: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 203 Rest of Europe: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 204 Rest of Europe: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 205 North America: Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 206 North America: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 207 North America: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 208 North America: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 209 North America: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 210 North America: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 211 North America: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 212 North America: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 213 North America: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 214 North America: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 215 North America: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 216 U.S.: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 217 U.S.: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 218 U.S.: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 219 U.S.: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 220 U.S.: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 221 U.S.: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 222 U.S.: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 223 U.S.: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 224 U.S.: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 225 U.S.: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 226 Canada: Collaborative Robots Market, by Type, 2023–2035 (USD Million)

Table 227 Canada: Collaborative Robots Market, by Component, 2023–2035 (USD Million)

Table 228 Canada: Collaborative Robots Market for End of Arm Tooling (EOAT) Devices, by Type, 2023–2035 (USD Million)

Table 229 Canada: Collaborative Robots Market, by Payload, 2023–2035 (USD Million)

Table 230 Canada: Collaborative Robots Market, by Application, 2023–2035 (USD Million)

Table 231 Canada: Collaborative Robots Market for Material Handling, by Type, 2023–2035 (USD Million)

Table 232 Canada: Collaborative Robots Market for Welding & Soldering, by Type, 2023–2035 (USD Million)

Table 233 Canada: Collaborative Robots Market for Machine Tending, by Type, 2023–2035 (USD Million)

Table 234 Canada: Collaborative Robots Market for Inspection, by Type, 2023–2035 (USD Million)

Table 235 Canada: Collaborative Robots Market, by End-use Industry, 2023–2035 (USD Million)

Table 236 Latin America: Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

Table 237 Middle East & Africa: Collaborative Robots Market, by Country/Region, 2023–2035 (USD Million)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Sizing and Growth Forecast Approaches

Figure 7 Key Insights

Figure 8 Global Collaborative Robots Market, by Type, 2025 Vs. 2035 (USD Million)

Figure 9 Global Collaborative Robots Market, by Component, 2025 Vs. 2035 (USD Million)

Figure 10 Global Collaborative Robots Market, by Payload, 2025 Vs. 2035 (USD Million)

Figure 11 Global Collaborative Robots Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 12 Global Collaborative Robots Market, by End-use Industry, 2025 Vs. 2035 (USD Million)

Figure 13 Global Collaborative Robots Market, by Geography

Figure 14 Factors Affecting Market Growth

Figure 15 Global Collaborative Robots Market, by Type, 2025 Vs. 2035 (USD Million)

Figure 16 Global Collaborative Robots Market, by Component, 2025 Vs. 2035 (USD Million)

Figure 17 Global Collaborative Robots Market, by Payload, 2025 Vs. 2035 (USD Million)

Figure 18 Global Collaborative Robots Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 19 Global Collaborative Robots Market, by End-use Industry, 2025 Vs. 2035 (USD Million)

Figure 20 Global Collaborative Robots Market, by Country/Region, 2025 Vs. 2035 (USD Million)

Figure 21 Geographic Snapshot: Collaborative Robots Market in Asia-Pacific

Figure 22 Geographic Snapshot: Collaborative Robots Market in North America

Figure 23 Geographic Snapshot: Collaborative Robots Market in Europe

Figure 24 Growth Strategies Adopted by the Key Players (2022–2025)

Figure 25 Competitive Dashboard: Collaborative Robots Market

Figure 26 Vendor Market Positioning Analysis (2022–2025)

Figure 27 ABB Ltd: Financial Overview (2022-2024)

Figure 28 Yaskawa Electric Corporation: Financial Overview (2022-2024)

Figure 29 Kawasaki Heavy Industries, Ltd.: Financial Overview (2022-2024)

Figure 30 Doosan Robotics Inc.: Financial Overview (2022-2024)

Published Date: Oct-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates