Resources

About Us

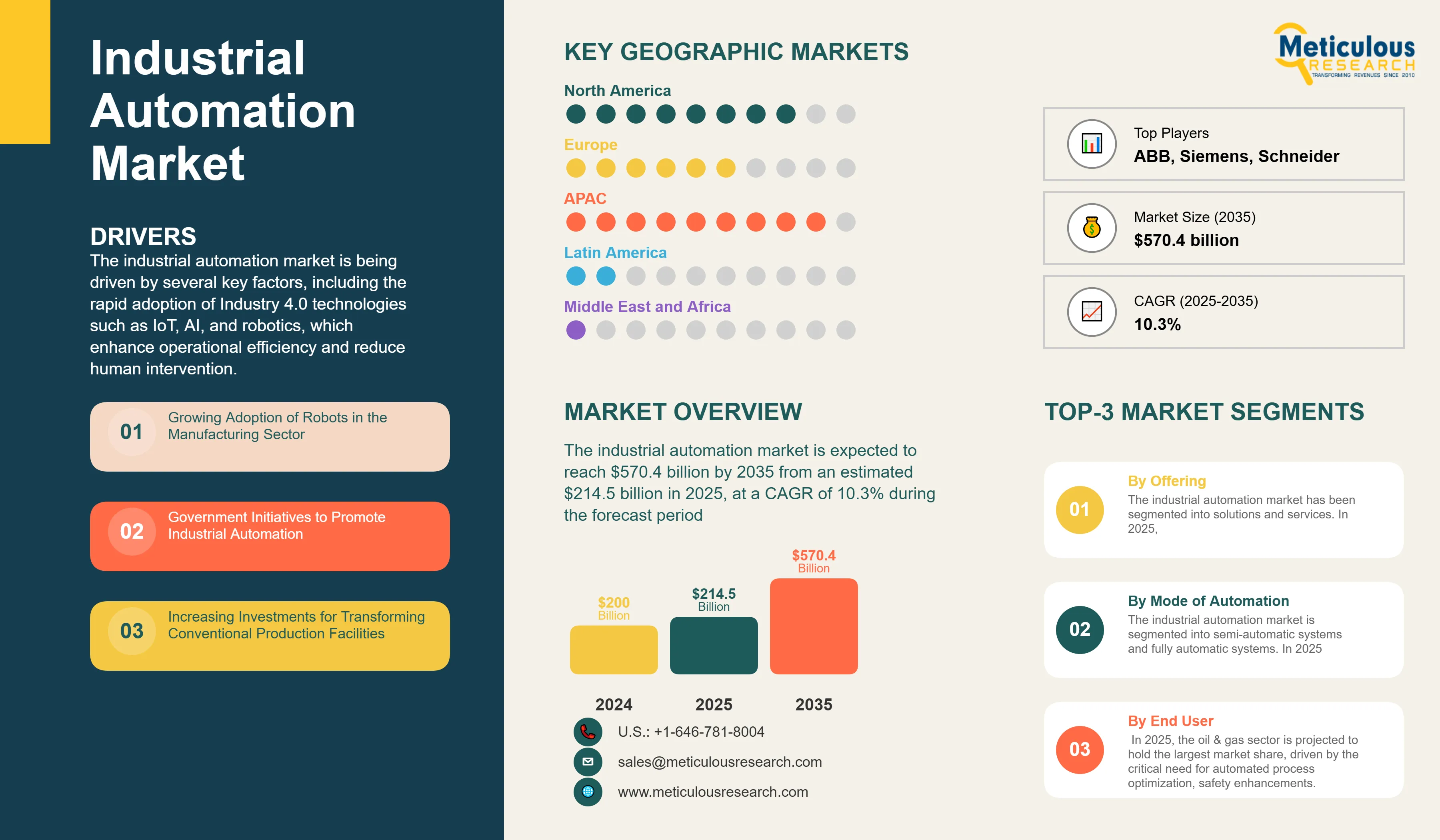

Industrial Automation Market by Offering (Solutions (Enterprise-level Controls, Plant Instrumentation, Plant-level Controls), Services), Mode of Automation, End-use Industry (Oil & Gas, Automotive, Food & Beverage), and Geography - Global Forecasts to 2035

Report ID: MRICT - 104478 Pages: 450 May-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe industrial automation market is being driven by several key factors, including the rapid adoption of Industry 4.0 technologies such as IoT, AI, and robotics, which enhance operational efficiency and reduce human intervention. Labor shortages and rising wage costs are pushing manufacturers toward automation to maintain productivity, while government initiatives like smart manufacturing policies and tax incentives further accelerate adoption. Additionally, the need for predictive maintenance and energy-efficient systems is boosting demand for automated solutions across sectors like automotive, oil & gas, and pharmaceuticals. However, the market faces restraints such as high initial investment costs, particularly for SMEs, and cybersecurity risks associated with interconnected systems. The lack of skilled labor to operate advanced automation technologies and integration challenges with legacy systems also hinder growth.

Key trends shaping the market include the rise of AI-driven predictive maintenance, collaborative robots (cobots), and 5G-enabled smart factories. The use of digital twins for simulation and optimization, along with sustainable automation solutions, is gaining traction. Opportunities abound in emerging markets like Asia-Pacific and Latin America, where industrialization and government support are fueling automation demand. The expansion of autonomous mobile robots (AMRs) in logistics and cloud-based SCADA systems presents significant growth potential. Furthermore, hyperautomation—combining RPA, AI, and IoT—is set to revolutionize end-to-end manufacturing processes, offering lucrative prospects for market players.

The adoption of Industry 4.0 and smart manufacturing is a major driver of industrial automation growth. By integrating IoT, AI, and big data analytics, factories can achieve real-time monitoring, predictive maintenance, and optimized production flows. Smart manufacturing enables self-adjusting machines, digital twins, and automated quality control, reducing downtime and waste. Companies benefit from higher productivity, lower operational costs, and improved supply chain agility. As industries shift from traditional to data-driven manufacturing, demand for automation solutions like collaborative robots (cobots) and edge computing surges. This transformation is critical for maintaining competitiveness in sectors like automotive, electronics, and pharmaceuticals, where precision and efficiency are paramount.

Government policies and financial incentives play a pivotal role in accelerating industrial automation adoption. Programs like Germany’s Industrie 4.0, China’s Made in China 2025, and the U.S. Advanced Manufacturing Partnership provide funding, tax breaks, and R&D support to encourage automation. These initiatives aim to boost productivity, reduce reliance on manual labor, and enhance global competitiveness. Emerging economies, such as India and Vietnam, also offer subsidies for smart factory upgrades to attract foreign investment. By lowering financial barriers, governments help SMEs and large manufacturers transition to automated systems, driving market expansion. Such policies ensure long-term industrial growth and technological leadership.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing the industrial automation market, enabling smarter, more adaptive manufacturing systems. AI-powered solutions enhance predictive maintenance by analyzing sensor data to forecast equipment failures before they occur, minimizing unplanned downtime. Machine learning algorithms optimize production processes by identifying inefficiencies, adjusting parameters in real time, and reducing energy consumption. Computer vision systems, driven by deep learning, perform high-speed quality inspections, detecting defects with greater accuracy than human operators. Additionally, AI facilitates autonomous decision-making in robotics and supply chain management, improving agility and responsiveness. The rise of edge AI allows for faster, localized data processing, reducing latency in critical applications. As industries increasingly adopt digital twins and generative AI for design optimization, the demand for AI-driven automation solutions continues to surge. This trend is reshaping sectors like automotive, pharmaceuticals, and electronics, where precision, speed, and reliability are paramount, positioning AI and ML as core pillars of Industry 4.0.

The Asia-Pacific and Latin America regions present significant growth opportunities for the industrial automation market, driven by rapid industrialization, rising labor costs, and increasing government support for smart manufacturing. Countries like China, India, Vietnam, Brazil, and Mexico are investing heavily in automation to enhance productivity, attract foreign investment, and compete globally. The expansion of automotive, electronics, and textile industries in these regions fuels demand for robotics, IoT-enabled systems, and AI-driven solutions. Additionally, favorable policies, tax incentives, and infrastructure development further accelerate adoption. As these emerging markets modernize their manufacturing sectors, they offer vast potential for automation vendors to expand their footprint and tap into new revenue streams.

The industrial automation market has been segmented into solutions and services. In 2025, the solutions segment is expected to dominate the industrial automation market. Solutions are further segmented into plant instrumentation, plant-level controls, and enterprise-level controls. The segment’s major share is primarily attributed to the growing adoption of ERP, SCADA, PLM, and DCS solutions to streamline production & enterprise processes in the manufacturing & industrial sectors, the rising focus on data analytics and predictive maintenance capabilities for optimizing operations, reducing downtime, and improving overall equipment effectiveness, the rising need to lower operating costs and maximize resource utilization, and the adoption of Industry 4.0 technologies.

The industrial automation market is segmented into semi-automatic systems and fully automatic systems. In 2025, the semi-automatic systems segment is expected to account for the major share of the industrial automation market. The segment’s major market share is primarily attributed to the lower costs of implementing semi-automatic systems compared to fully automatic systems, the increasing need for improved flexibility in manual and automated processes, and the growing need to monitor industrial systems and intervene promptly to avoid costly downtime and quality issues. However, the fully automatic systems segment is expected to record a higher CAGR during the analysis period.

The industrial automation market is segmented into automotive, oil & gas, food & beverage, chemicals & materials, consumer goods, semiconductors & electronics, power, pharmaceuticals & biotech, machines & tools, paper & pulp, mining & metals, aerospace & defense, and other end-use industries. In 2025, the oil & gas sector is projected to hold the largest market share, driven by the critical need for automated process optimization, safety enhancements, and predictive maintenance in upstream and downstream operations. Factors such as rising demand for remote monitoring, regulatory compliance, and cost-efficient asset management further solidify its dominance. However, the automotive industry is anticipated to be the fastest-growing segment, fueled by accelerating adoption of smart factories, robotics, and AI-driven automation to meet evolving demands for electric vehicles (EVs), autonomous driving technologies, and precision manufacturing. The shift toward Industry 4.0 and flexible production lines positions automotive as a high-growth sector in industrial automation.

Asia-Pacific (APAC) is projected to remain the largest and fastest-growing market for industrial automation, driven by rapid industrialization, government-led smart manufacturing initiatives (e.g., Made in China 2025, India’s Production-Linked Incentive Scheme), and heavy investments in automotive, electronics, and energy sectors. The region’s dominance stems from its expansive manufacturing base, cost-competitive labor transitioning to automation, and rising adoption of AI, robotics, and IoT to enhance productivity. Meanwhile, North America holds a significant share due to advanced technological infrastructure, strong R&D in autonomous systems and digital twins, and demand for automation in pharmaceuticals and aerospace. However, APAC’s growth outpaces other regions, fueled by expanding FDI, supply chain shifts, and policy support for Industry 4.0, making it both the largest and most dynamic market.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that led market participants to adopt over the past three years (2022-2025). The key players profiled in the global Industrial Automation market report are ABB Ltd (Switzerland), Rockwell Automation Inc. (U.S.), Siemens AG (Germany), Yaskawa Electric Corporation (Japan), Schneider Electric SE (France), Yokogawa Electric Corporation (Japan), KUKA AG (Germany), Emerson Electric Co. (U.S.), FANUC CORPORATION (Japan), Honeywell International Inc. (U.S.), Mitsubishi Electric Corporation (Japan), OMRON Corporation (Japan), Advantech Co., Ltd. (Taiwan), Hitachi Ltd. (Japan), and General Electric Company (U.S.).

|

Particular |

Details |

|

Number of Pages |

450 |

|

Format |

PDF and Excel |

|

Forecast Period |

2025-2035 |

|

Base Year |

2024 |

|

CAGR |

10.3% |

|

Market Size in 2025 |

$214.5 Billion |

|

Market Size in 2035 |

$570.4 Billion |

|

Segments Covered |

By Offerings

By Mode of Automation

By End-use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Netherlands, Sweden, Spain, RoE), Asia-Pacific (China, Japan, India, Singapore, South Korea, RoAPAC), Latin America (Mexico, Brazil, RoLATAM), and Middle East & Africa (UAE, South Africa, Saudi Arabia, RoMEA). |

|

Key Companies Profiled |

ABB Ltd (Switzerland), Rockwell Automation Inc. (U.S.), Siemens AG (Germany), Yaskawa Electric Corporation (Japan), Schneider Electric SE (France), Yokogawa Electric Corporation (Japan), KUKA AG (Germany), Emerson Electric Co. (U.S.), FANUC CORPORATION (Japan), Honeywell International Inc. (U.S.), Mitsubishi Electric Corporation (Japan), OMRON Corporation (Japan), Advantech Co., Ltd. (Taiwan), Hitachi Ltd. (Japan), and General Electric Company (U.S.). |

The global industrial automation market size was valued at $200.0 billion in 2024.

The market is projected to grow from $214.5 billion in 2025 to $570.4 billion by 2035.

The industrial automation market analysis indicates significant growth, reaching $570.4 billion by 2035, at a compound annual growth rate (CAGR) of 10.3% from 2025 to 2035.

The key companies operating in the industrial automation market include ABB Ltd (Switzerland), Rockwell Automation Inc. (U.S.), Siemens AG (Germany), Yaskawa Electric Corporation (Japan), Schneider Electric SE (France), Yokogawa Electric Corporation (Japan), KUKA AG (Germany), Emerson Electric Co. (U.S.), FANUC CORPORATION (Japan), Honeywell International Inc. (U.S.), Mitsubishi Electric Corporation (Japan), OMRON Corporation (Japan), Advantech Co., Ltd. (Taiwan), Hitachi Ltd. (Japan), and General Electric Company (U.S.).

Prominent market trends in the industrial automation market are AI-driven predictive maintenance, collaborative robots (cobots), and 5G-enabled smart factories.

By offering, the solution segment is forecasted to hold the largest market share; by mode of automation, the semi-automatic segment is expected to dominate the market; and by end-use industry, the oil & gas segment is poised to record the dominant position in the market.

By region, Asia-Pacific (APAC) is projected to remain the largest and fastest-growing market for industrial automation, driven by rapid industrialization, government-led smart manufacturing initiatives (e.g., Made in China 2025, India’s Production-Linked Incentive Scheme), and heavy investments in automotive, electronics, and energy sectors.

The primary drivers of the industrial automation market include industry 4.0 adoption, labor shortages, government incentives, and demand for predictive maintenance and energy efficiency.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates