Resources

About Us

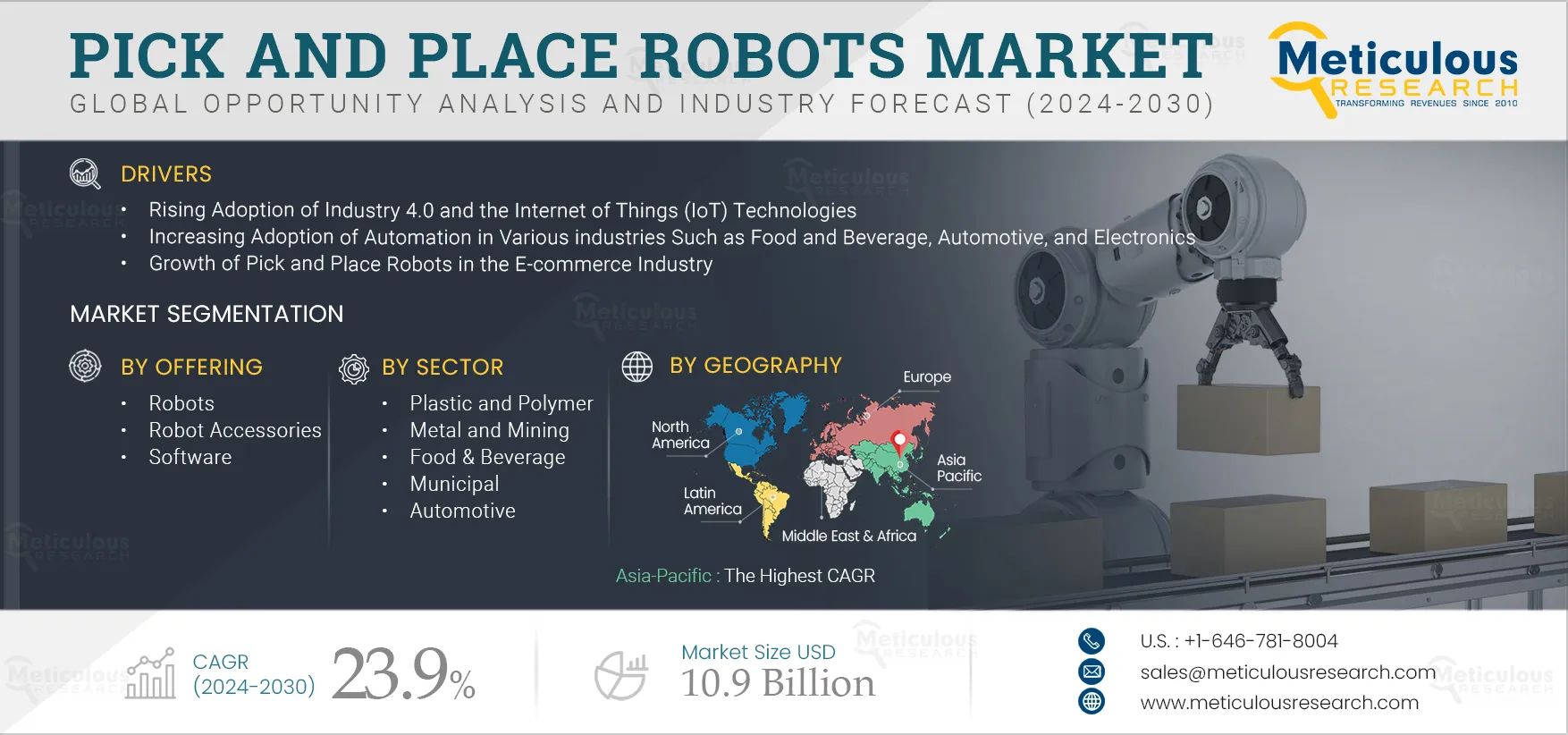

Pick and Place Robots Market by Offering (Robots, Robot Accessories, Software), Payload (Up to 15 KG, 15 KG to 30 KG, More than 30 KG), Sector (E-commerce & Logistics, Food & Beverage, Other Sectors) and Geography - Global Forecast to 2032

Report ID: MRSE - 104890 Pages: 250 Jan-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Pick and Place Robots Market is projected to reach $10.9 billion by 2032, at a CAGR of 23.9% from 2025 to 2032. The growth of this market is attributed to the rising adoption of Industry 4.0 and the Internet of Things (IoT) technologies, increasing adoption of automation in various industries such as food and beverage, automotive, and electronics, and growth of pick and place robots in the e-commerce industry. However, the high initial investment and rising safety concerns due to the growing integration of automation technologies restrain market growth. At the same time, the high labor costs in North America and Europe and the growing demand for automation in various sectors such as manufacturing, packaging, and logistics are expected to create significant opportunities for this market. However, limited flexibility to handle different sizes, shapes, or weights poses challenges to market growth.

The global pick and place robots market is segmented by offering, payload, sector, and geography. The study also evaluates industry competitors and analyzes the regional and country-level markets.

Key Players:

The key players profiled in the global pick and place robots market study include ABB Ltd (Switzerland), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Kawasaki Heavy Industries, Ltd. (Japan), Universal Robots A/S (Denmark), Techman Robot Inc. (Taiwan), Omron Corporation (Japan), Seiko Epson Corporation (Japan), Schneider Electric SE (France), Codian Robotics B.V. (Netherlands), JLS Automation (U.S.), Toshiba Infrastructure Systems & Solutions Corporation (Japan), Bastian Solutions, LLC (U.S.) and Mitsubishi Electric Corporation (Japan).

Click here to: Get a Free Sample Copy of this Report

Human labor costs include wages and wage inflation, training and non-wage benefits, compensation, insurance, payroll taxes, and auxiliary safety equipment costs, which are high in North America and Europe. On the other hand, automation costs include the cost of purchasing and installing hardware and software, operator training & wages, maintenance, and planned or unplanned stoppages due to part changeouts for flexible automation systems. Labor costs have increased exponentially across various regions due to the low availability of labor to perform critical manufacturing tasks. Pick and place robots reduce labor costs and enhance production workflows, allowing companies to increase savings. The prices of robots have significantly decreased over the last decade, whereas the cost of labor has been increasing steadily in terms of minimum wages and other paid advantages.

The increase in labor costs is attributed to government rules and regulations under which organizations must pay a minimum fixed amount to employees. Thus, industries are gradually replacing human labor with robots to cut costs and reduce errors, driving the growth of the pick and place robots market.

Based on Offering, the Robot Accessories Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on offering, the robot accessories segment is expected to register the highest CAGR during the forecast period. The growing utilization of robots has resulted in the increasing development and innovations in industrial robot accessories to enhance productivity and overcome common obstacles in a typical manufacturing environment. Robotic accessories include end effector, robotic vision, robot controller, and other accessories. End-effectors are also called EOAT (End of Arm Tooling). It can be changed according to the application performed. Robotic tool changers are integrated with robots to allow for automatic EOAT changes and for one robot to perform multiple applications within a production line. Advances in EOAT technology have led to the expansion of robotic applications and the adoption of robots in fields outside of industrial applications. Further, integrating robotic vision systems into manufacturing processes enables robots to perform tasks such as inspecting, identifying, counting, measuring, and picking and placing. Ultra-high-speed imaging and lens quality facilitate multi-operations in one process. Vision systems are used for image capture & processing, connectivity, and response.

Based on Payload, the Up to 15 KG Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on payload, the up to 15 kg segment is expected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing need for pick and place applications in the food and beverage, cosmetics, and semiconductor and electronics industries, where SCARA, Delta, and collaborative robots are extensively used. Generally, these robots can operate at a higher speed and with optional cleanroom specifications. By design, these robots suit applications with a smaller field of operation with limited floor space. In addition, the compact layout makes them relocatable in temporary or remote applications. SCARA and Delta robots are particularly used in clean and hygienic environments, such as the food and beverage industry.

Based on Sector, the Pharmaceutical and Chemistry Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on sector, the pharmaceutical and chemistry segment is expected to register the highest CAGR during the forecast period. The pharmaceutical and chemistry sector prefers pick and place robots for several reasons, such as to handle delicate and sensitive products with precision and accuracy, which is essential in the pharmaceutical industry where quality control is paramount. Additionally, these robots work with high speed and efficiency, which improves productivity while reducing costs. Also, these robots are programmed to perform various tasks, making them versatile and adaptable to changing production needs.

Pick and place robots are widely used in pharmaceutical operations to pick up pills and vials, place them in boxes, and apply labels. It is also used for tasks like sorting bottles, arranging syringes, and removing defective products during inspection. These robots help to improve consistency and accuracy, increase efficiency, and reduce human error. They also save workers from hazardous environments and repetitive tasks. The adoption of pick and place robots in the pharmaceutical and chemistry sector is gaining traction due to their high efficiency and precise operations. Pick and place robots help to increase throughput and allow existing employees to keep pace with the rising demand of the pharmaceutical and chemistry sector. Pharmaceutical manufacturers are also looking to maintain rigorous hygiene standards when automating their handling applications. To cater to this demand, several players are focusing on the development of pick and place robots to maintain hygiene standards in pharmaceutical companies. For instance, in February 2025, Fanuc Corporation (Japan) launched two additions to its SCARA pick-and-place robot range: the cleanroom-standard, pedestal-mounted SR-3iA/C three-axis and SR-6iA/C four-axis robots. Ideal for replacing manual labor in handling tasks, they also boast novel anti-contamination features, meeting the highest safety and hygiene standards in even the most challenging pharma settings. Such development of pick and place robots is expected to support segment growth.

Asia-Pacific is Slated to Register the Highest CAGR During the Forecast Period

Based on geography, the global pick and place market is segmented into Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific is projected to register the highest CAGR during the forecast period. Asia-Pacific is projected to register the highest CAGR during the forecast period. The growth of the market in Asia-Pacific is driven by the increasing demand for automation in manufacturing processes, which is driven by the need for greater efficiency, productivity, and cost savings. The growth of e-commerce and the rise of online shopping have also contributed to the demand for pick and place robots, as they help to streamline order fulfillment and reduce lead times. Additionally, the increasing adoption of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, is expected to drive the growth of the pick and place robots market in the region. These technologies can help to optimize production processes and improve quality control, which are key factors in the pharmaceutical industry. Also, the increasing focus on safety and reducing workplace injuries drives the demand for pick and place robots, as they can handle repetitive and hazardous tasks that may be difficult or unsafe for human workers.

Report Summary:

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2022 |

|

CAGR |

23.9% |

|

Estimated Market Size (Value) |

$10.9 billion by 2032 |

|

Segments Covered |

By Offering

By Payload

By Sector

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Taiwan, Rest of Asia-Pacific), Latin America, and the Middle East & Africa. |

|

Key Companies |

ABB Ltd (Switzerland), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Kawasaki Heavy Industries, Ltd. (Japan), Universal Robots A/S (Denmark), Techman Robot Inc. (Taiwan), Omron Corporation (Japan), Seiko Epson Corporation (Japan), Schneider Electric SE (France), Codian Robotics B.V. (Netherlands), JLS Automation (U.S.), Toshiba Infrastructure Systems & Solutions Corporation (Japan), Bastian Solutions, LLC (U.S.) and Mitsubishi Electric Corporation (Japan). |

Key questions answered in the report:

The global pick and place robots market is segmented by offering, payload, sector, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

The global pick and place robots market is projected to reach $ 10.9 billion by 2032, at a CAGR of 23.9% from 2025 to 2032.

In 2025, the robots segment is expected to account for the largest share of the pick and place robots market.

Based on sector, in 2025, the food and beverage segment is expected to account for the largest share of the pick and place robots market.

The growth of this market is attributed to the rising adoption of Industry 4.0 and the Internet of Things (IoT) technologies, increasing adoption of automation in various industries such as food and beverage, automotive, and electronics, and growth of pick and place robots in the e-commerce industry. At the same time, the high labor costs in North America and Europe and the growing demand for automation in various sectors such as manufacturing, packaging, and logistics are expected to create significant opportunities for this market.

The key players profiled in the global pick and place robots market study include ABB Ltd (Switzerland), Fanuc Corporation (Japan), Yaskawa Electric Corporation (Japan), KUKA AG (Germany), Kawasaki Heavy Industries, Ltd. (Japan), Universal Robots A/S (Denmark), Techman Robot Inc. (Taiwan), Omron Corporation (Japan), Seiko Epson Corporation (Japan), Schneider Electric SE (France), Codian Robotics B.V. (Netherlands), JLS Automation (U.S.), Toshiba Infrastructure Systems & Solutions Corporation (Japan), Bastian Solutions, LLC (U.S.) and Mitsubishi Electric Corporation (Japan).

Asia-Pacific is likely to offer significant opportunities due to the increasing demand for automation in manufacturing processes, which is driven by the need for greater efficiency, productivity, and cost savings. The growth of e-commerce and the rise of online shopping have also contributed to the demand for pick and place robots, as they help to streamline order fulfillment and reduce lead times. Additionally, the increasing adoption of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, is expected to drive the growth of the pick and place robots market in the region. These technologies can help to optimize production processes and improve quality control, which are key factors in the pharmaceutical industry. Also, the increasing focus on safety and reducing workplace injuries drives the demand for pick and place robots, as they can handle repetitive and hazardous tasks that may be difficult or unsafe for human workers.

Published Date: Oct-2025

Published Date: May-2025

Published Date: Nov-2024

Published Date: Jul-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates