Resources

About Us

Rotary Heat Pump Compressor Market Size, Share & Forecast 2025-2035 | Growth Analysis by Product Type, Compressor Design, Refrigerant Type, Application, End-User & Geography

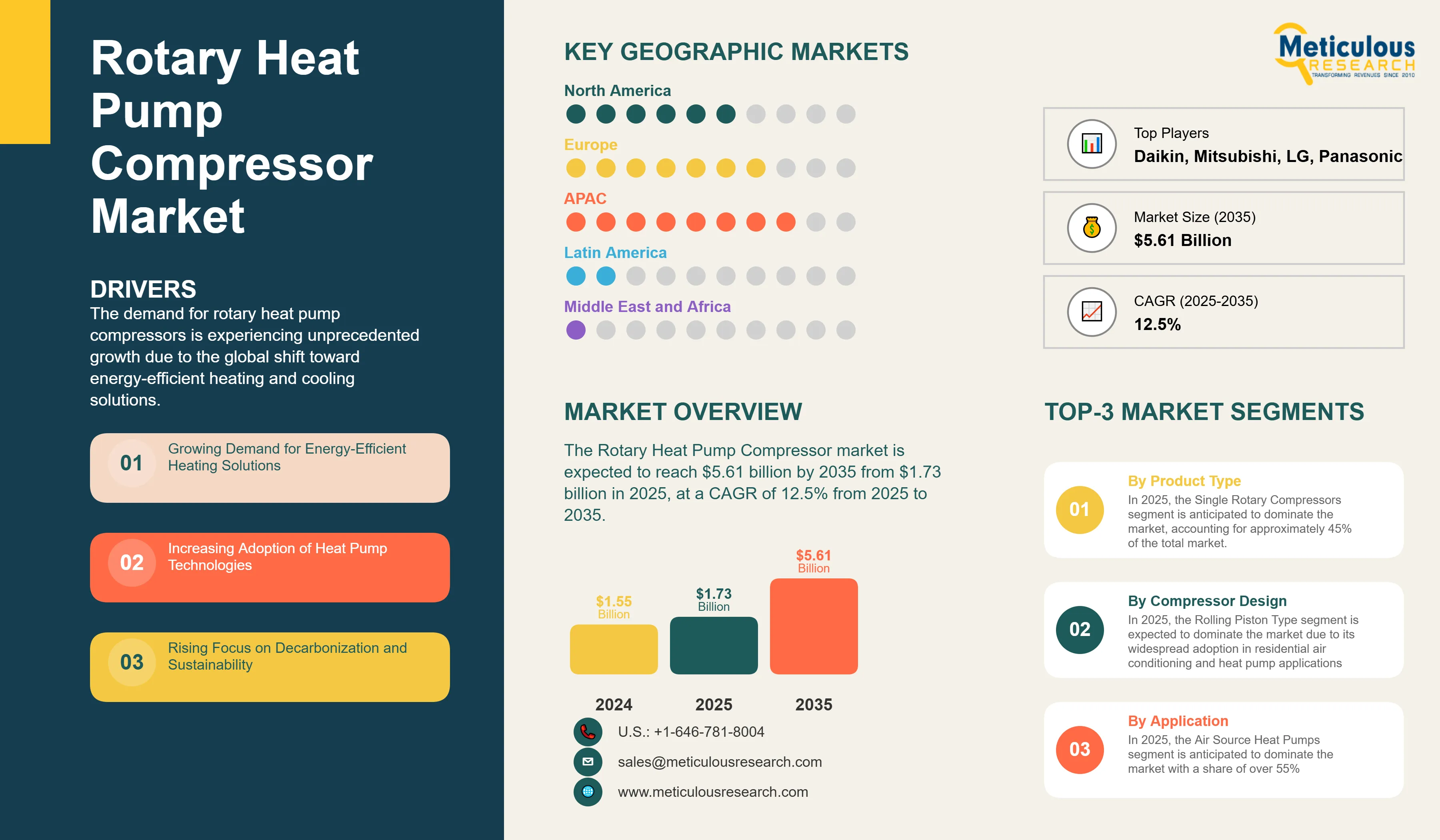

Report ID: MREP - 1041521 Pages: 220 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the overall rotary heat pump compressor market include the growing demand for energy-efficient heating solutions, increasing adoption of heat pump technologies, rising focus on decarbonization and sustainability, government incentives and regulatory support, technological advancements in compressor design, and growing HVAC market and infrastructure development. However, this growth is restrained by high initial investment and installation costs, limited awareness in emerging markets, performance limitations in extreme weather conditions, and competition from alternative compressor technologies.

Additionally, emerging opportunities in expansion of emerging markets, integration with smart home technologies, development of low-GWP refrigerant compressors, and growing industrial heat recovery applications are poised to offer significant growth opportunities for market players. The adoption of variable speed and inverter technologies and integration of IoT and digital monitoring systems are emerging as notable trends in this market.

Growing Demand for Energy-Efficient Heating Solutions

The demand for rotary heat pump compressors is experiencing unprecedented growth due to the global shift toward energy-efficient heating and cooling solutions. Modern consumers and businesses are increasingly adopting heat pump technologies to reduce energy consumption and operational costs, driving demand for sophisticated compressor systems with higher efficiency ratings and advanced functionality. The rotary heat pump compressor market benefits from this trend as HVAC manufacturers seek compressors that can deliver superior energy performance while maintaining reliability and durability.

The rise of smart buildings and sustainable construction practices, coupled with increasing awareness of environmental impact, is driving this trend. Advanced rotary compressor solutions, featuring variable speed technology, precision motor control, and optimized refrigerant handling, appeal to equipment manufacturers who prioritize energy efficiency and environmental sustainability while meeting performance requirements.

The energy efficiency revolution has gained significant momentum in recent years, with HVAC manufacturers demanding sophisticated compressor solutions that can accommodate varying load conditions, support advanced control systems, and maintain cost-effectiveness for residential and commercial applications.

Increasing Adoption of Heat Pump Technologies

Rotary heat pump compressors offer enhanced efficiency compared to traditional heating systems due to their ability to extract heat from ambient air, ground, or water sources, providing both heating and cooling capabilities in a single system. The heat pump adoption process, which includes replacing conventional heating systems with electric heat pumps, results in significant energy savings and reduced carbon emissions. Research suggests that modern rotary compressor-based heat pumps may provide 200-400% efficiency due to their heat transfer capabilities rather than direct fuel combustion.

Rotary heat pump compressors are regarded as critical enablers due to their role in supporting residential comfort systems, commercial HVAC installations, and industrial heat recovery applications. Modern rotary compressor solutions maintain operational efficiency across wide temperature ranges while providing reliable performance, making them particularly attractive to HVAC manufacturers, system integrators, and end-users seeking sustainable heating solutions.

The growing body of research supporting heat pump technology benefits, combined with the regulatory push for electrification and carbon reduction, has led to increased adoption among manufacturers seeking to meet evolving energy efficiency standards and consumer expectations.

Rising Focus on Decarbonization and Sustainability

In recent decades, the global energy landscape has undergone continuous transformation toward sustainable solutions, with heat pump technology representing a key component of decarbonization strategies. This trend was further accelerated during recent years with notable investments in renewable energy integration and building electrification initiatives. The rotary heat pump compressor segment is experiencing faster growth as equipment manufacturers increasingly require efficient, reliable compressor solutions for air source, ground source, and water source heat pump applications.

The sustainability market is being driven by increasing regulatory pressure for carbon reduction, growing corporate sustainability commitments, rising consumer awareness of environmental impact, and expanding government incentive programs. Rotary heat pump compressors, being recognized as essential components for high-efficiency heat pump systems, are positioned to capture a significant share of this growing market.

Furthermore, HVAC equipment manufacturers and system designers are increasingly emphasizing advanced rotary compressor solutions due to their performance advantages and ability to support next-generation heat pump requirements, further driving demand for specialized compressor technologies.

Market Segmentation Analysis

By Product Type

Based on product type, the rotary heat pump compressor market is segmented into Single Rotary Compressors, Twin Rotary Compressors, Multi-Stage Rotary Compressors, and Specialty Rotary Compressors. In 2025, the Single Rotary Compressors segment is anticipated to dominate the market, accounting for approximately 45% of the total rotary heat pump compressor market. The dominance of single rotary compressors is attributed to their cost-effectiveness, wide application range, and suitability for residential and light commercial applications.

However, the Twin Rotary Compressors segment is projected to record the highest CAGR during the forecast period of 2025-2035. This exceptional growth is driven by increasing demand for higher capacity heat pump systems, growing adoption in commercial applications, and superior vibration characteristics compared to single rotary designs.

By Compressor Design

The rotary heat pump compressor market is segmented into Rolling Piston Type, Rotary Vane Type, Swing Vane Type, and Others. In 2025, the Rolling Piston Type segment is expected to dominate the market due to its widespread adoption in residential air conditioning and heat pump applications, proven reliability, and cost-effectiveness.

However, the Rotary Vane Type segment is anticipated to record significant growth during the forecast period, driven by increasing demand for higher efficiency compressors, growing adoption in commercial applications, and technological advancements in vane design and materials.

By Application

Based on application, the rotary heat pump compressor market is segmented into Air Source Heat Pumps, Ground Source Heat Pumps, Water Source Heat Pumps, Heat Pump Water Heaters, Heat Pump Dryers, Commercial Chillers and Heat Pumps, and Others. In 2025, the Air Source Heat Pumps segment is anticipated to dominate the market with a share of over 55%, reflecting the large global air source heat pump market and lower installation costs compared to ground source systems.

The Ground Source Heat Pumps segment is projected to record the highest CAGR of 15.8% during the forecast period of 2025-2035, driven by increasing awareness of geothermal energy benefits, growing adoption in commercial buildings, expanding government incentive programs, and technological advancements reducing installation costs.

By End-User

The rotary heat pump compressor market is segmented into Residential, Commercial, and Industrial end-users. The Residential segment accounts for over 60% of the market in 2025, attributed to the large global residential building stock, increasing consumer awareness of energy efficiency, and growing adoption of heat pump systems for home heating and cooling.

The Commercial segment shows strong growth driven by building electrification initiatives, corporate sustainability commitments, and HVAC system upgrades, while the Industrial segment benefits from the growing trend of industrial heat recovery applications.

Regional Analysis

Based on geography, the rotary heat pump compressor market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is anticipated to account for the major share of over 45% of the rotary heat pump compressor market, reflecting the region's established HVAC manufacturing ecosystem, large residential market, and presence of major compressor manufacturers.

The market in Asia-Pacific is slated to record a strong CAGR of 14.2% during the forecast period of 2025-2035. This growth is fueled by continued urbanization, increasing disposable income, growing awareness of energy efficiency, and supportive government policies promoting heat pump adoption. For rotary heat pump compressors specifically, Asia-Pacific's leadership is further strengthened by the concentration of major HVAC manufacturers, established supply chains, and growing domestic demand.

Europe follows as the second-largest market, driven by aggressive decarbonization targets, strong regulatory support for heat pumps, growing replacement of fossil fuel heating systems, and increasing focus on building energy efficiency. The region's emphasis on sustainability and advanced environmental regulations contributes significantly to market growth.

North America represents a significant market driven by building electrification initiatives, growing awareness of heat pump benefits, increasing utility incentive programs, and expanding heat pump adoption in cold climate regions.

Competitive Landscape

The rotary heat pump compressor market is characterized by a mix of large multinational corporations, specialized compressor manufacturers, and regional players. Leading players in the global rotary heat pump compressor market include Daikin Industries, Ltd., Mitsubishi Electric Corporation, LG Electronics Inc., Panasonic Corporation, Samsung Electronics Co., Ltd., Danfoss A/S, Midea Group Co., Ltd., Hitachi, Ltd., Toshiba Corporation, Emerson Electric Co., Copeland (Emerson Climate Technologies), Tecumseh Products Company, Bristol Compressors International, Bitzer SE, Johnson Controls International plc, Carrier Global Corporation, GMCC & Welling (Midea Group), Highly Electric Appliances Co., Ltd., Kulthorn Kirby Public Company Limited, Rechi Precision Co., Ltd., Secop GmbH, Embraco (Nidec Corporation), among others. These companies are focusing on strategies such as advanced compressor technology development, capacity expansion in key markets, automation and digitalization implementation, sustainability initiatives, and strategic partnerships with heat pump manufacturers to strengthen their market position.

|

Particulars |

Details |

|

Number of Pages |

220 |

|

Forecast Period |

2025-2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

12.5% |

|

Market Size 2024 |

USD 1.55 billion |

|

Market Size 2025 |

USD 1.73 billion |

|

Market Size 2035 |

USD 5.61 billion |

|

Segments Covered |

By Product Type, Compressor Design, Refrigerant Type, Application, End-User |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Nordic Countries, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Chile, Rest of Latin America), and Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

The rotary heat pump compressor market is projected to reach USD 5.61 billion by 2035 from USD 1.73 billion in 2025, at a CAGR of 12.5% during the forecast period.

In 2025, the Single Rotary Compressors segment is projected to hold the major share of the rotary heat pump compressor market.

The Ground Source Heat Pumps segment is slated to record the highest growth rate during the forecast period of 2025-2035.

Key factors driving the growth include growing demand for energy-efficient heating solutions, increasing adoption of heat pump technologies, rising focus on decarbonization and sustainability, government incentives and regulatory support, technological advancements in compressor design, and growing HVAC market and infrastructure development.

Major opportunities include expansion in emerging markets, integration with smart home technologies, development of low-GWP refrigerant compressors, growing industrial heat recovery applications, and adoption of variable speed and inverter technologies.

Asia-Pacific leads the market with the highest share, while all regions are projected to show strong growth, with particular opportunities in emerging markets and regions focusing on building electrification and decarbonization initiatives.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Rotary Heat Pump Compressor Market, by Product Type

3.2.2. Rotary Heat Pump Compressor Market, by Compressor Design

3.2.3. Rotary Heat Pump Compressor Market, by Refrigerant Type

3.2.4. Rotary Heat Pump Compressor Market, by Application

3.2.5. Rotary Heat Pump Compressor Market, by End User

3.2.6. Rotary Heat Pump Compressor Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Demand for Energy-Efficient Heating Solutions

4.2.1.2. Increasing Adoption of Heat Pump Technologies

4.2.1.3. Rising Focus on Decarbonization and Sustainability

4.2.1.4. Government Incentives and Regulatory Support

4.2.1.5. Technological Advancements in Compressor Design

4.2.1.6. Growing HVAC Market and Infrastructure Development

4.2.2. Restraints

4.2.2.1. High Initial Investment and Installation Costs

4.2.2.2. Limited Awareness in Emerging Markets

4.2.2.3. Performance Limitations in Extreme Weather Conditions

4.2.2.4. Competition from Alternative Compressor Technologies

4.2.3. Opportunities

4.2.3.1. Expansion in Emerging Markets

4.2.3.2. Integration with Smart Home Technologies

4.2.3.3. Development of Low-GWP Refrigerant Compressors

4.2.3.4. Growing Industrial Heat Recovery Applications

4.2.4. Trends

4.2.4.1. Adoption of Variable Speed and Inverter Technologies

4.2.4.2. Integration of IoT and Digital Monitoring Systems

4.2.4.3. Development of Compact and Lightweight Designs

4.2.4.4. Focus on Noise Reduction Technologies

4.2.5. Challenges

4.2.5.1. Standardization Across Different Heat Pump Systems

4.2.5.2. Refrigerant Transition and Regulatory Compliance

4.2.5.3. Supply Chain Disruptions and Material Costs

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Rotary Heat Pump Compressor Market

4.4.1. Environmental Sustainability Factors

4.4.2. Energy-Efficient Compressor Technologies

4.4.3. Sustainable Manufacturing Practices

4.4.4. Market Response to Sustainability Demands

4.4.5. Regulatory Compliance and Green Initiatives

4.4.6. Manufacturer-led Sustainability Programs

4.4.7. Market Opportunities Created by Sustainability Focus

4.4.8. Eco-friendly Refrigerant Development

4.4.9. Challenges in Sustainable Manufacturing

5. Rotary Heat Pump Compressor Market Assessment—By Product Type

5.1. Overview

5.2. Single Rotary Compressors

5.2.1. Fixed Speed Single Rotary Compressors

5.2.2. Variable Speed Single Rotary Compressors

5.3. Twin Rotary Compressors

5.3.1. Fixed Speed Twin Rotary Compressors

5.3.2. Variable Speed Twin Rotary Compressors

5.4. Multi-Stage Rotary Compressors

5.5. Specialty Rotary Compressors

5.5.1. High-Temperature Rotary Compressors

5.5.2. Low-Temperature Rotary Compressors

6. Rotary Heat Pump Compressor Market Assessment—By Compressor Design

6.1. Overview

6.2. Rolling Piston Type

6.3. Rotary Vane Type

6.4. Swing Vane Type

6.5. Others

7. Rotary Heat Pump Compressor Market Assessment—By Refrigerant Type

7.1. Overview

7.2. R-22 (HCFC-22)

7.3. R-410A

7.4. R-32

7.5. R-290 (Propane)

7.6. R-134a

7.7. R-407C

7.8. Others

8. Rotary Heat Pump Compressor Market Assessment—By Application

8.1. Overview

8.2. Air Source Heat Pumps

8.2.1. Air-to-Air Heat Pumps

8.2.2. Air-to-Water Heat Pumps

8.3. Ground Source Heat Pumps

8.3.1. Ground-to-Air Heat Pumps

8.3.2. Ground-to-Water Heat Pumps

8.4. Water Source Heat Pumps

8.4.1. Water-to-Air Heat Pumps

8.4.2. Water-to-Water Heat Pumps

8.5. Heat Pump Water Heaters

8.6. Heat Pump Dryers

8.7. Commercial Chillers and Heat Pumps

8.8. Others

9. Rotary Heat Pump Compressor Market Assessment—By End User

9.1. Overview

9.2. Residential

9.2.1. Single-Family Homes

9.2.2. Multi-Family Housing

9.2.3. Apartments and Condominiums

9.3. Commercial

9.3.1. Office Buildings

9.3.2. Retail Establishments

9.3.3. Hotels and Hospitality

9.3.4. Educational Institutions

9.3.5. Healthcare Facilities

9.4. Industrial

9.4.1. Manufacturing Plants

9.4.2. Data Centers

9.4.3. Food Processing Facilities

9.4.4. Chemical and Pharmaceutical

9.5. Others

10. Rotary Heat Pump Compressor Market Assessment—By Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Spain

10.3.6. Netherlands

10.3.7. Nordic Countries

10.3.7.1. Norway

10.3.7.2. Sweden

10.3.7.3. Denmark

10.3.7.4. Finland

10.3.8. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. Australia

10.4.6. Thailand

10.4.7. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Chile

10.5.4. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. Saudi Arabia

10.6.2. United Arab Emirates (UAE)

10.6.3. South Africa

10.6.4. Rest of Middle East & Africa (RoMEA)

11. Competitive Landscape

11.1. Overview

11.2. Key Growth Strategies

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Industry Leaders

11.4.2. Market Differentiators

11.4.3. Vanguards

11.4.4. Contemporary Stalwarts

11.5. Market Share/Ranking Analysis, by the Key Players, 2025

12. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. Daikin Industries, Ltd.

12.2. Mitsubishi Electric Corporation

12.3. LG Electronics Inc.

12.4. Panasonic Corporation

12.5. Samsung Electronics Co., Ltd.

12.6. Danfoss A/S

12.7. Midea Group Co., Ltd.

12.8. Hitachi, Ltd.

12.9. Toshiba Corporation

12.10. Emerson Electric Co.

12.11. Copeland (Emerson Climate Technologies)

12.12. Tecumseh Products Company

12.13. Bristol Compressors International

12.14. Bitzer SE

12.15. Johnson Controls International plc

12.16. Carrier Global Corporation

12.17. GMCC & Welling (Midea Group)

12.18. Highly Electric Appliances Co., Ltd.

12.19. Kulthorn Kirby Public Company Limited

12.20. Rechi Precision Co., Ltd.

12.21. Secop GmbH

12.22. Embraco (Nidec Corporation)

13. Appendix

13.1. Available Customization

13.2. Related Reports

LIST OF TABLES

Table 1. Global Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 2. Global Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 3. Global Fixed Speed Single Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 4. Global Variable Speed Single Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 5. Global Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 6. Global Fixed Speed Twin Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 7. Global Variable Speed Twin Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 8. Global Multi-Stage Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 9. Global Specialty Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 10. Global High-Temperature Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 11. Global Low-Temperature Rotary Compressors Market, by Country/Region, 2025–2035 (USD Million)

Table 12. Global Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 13. Global Rolling Piston Type Market, by Country/Region, 2025–2035 (USD Million)

Table 14. Global Rotary Vane Type Market, by Country/Region, 2025–2035 (USD Million)

Table 15. Global Swing Vane Type Market, by Country/Region, 2025–2035 (USD Million)

Table 16. Global Other Compressor Designs Market, by Country/Region, 2025–2035 (USD Million)

Table 17. Global Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 18. Global R-22 (HCFC-22) Market, by Country/Region, 2025–2035 (USD Million)

Table 19. Global R-410A Market, by Country/Region, 2025–2035 (USD Million)

Table 20. Global R-32 Market, by Country/Region, 2025–2035 (USD Million)

Table 21. Global R-290 (Propane) Market, by Country/Region, 2025–2035 (USD Million)

Table 22. Global R-134a Market, by Country/Region, 2025–2035 (USD Million)

Table 23. Global R-407C Market, by Country/Region, 2025–2035 (USD Million)

Table 24. Global Other Refrigerants Market, by Country/Region, 2025–2035 (USD Million)

Table 25. Global Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 26. Global Air Source Heat Pumps Market, by Type, 2025–2035 (USD Million)

Table 27. Global Air-to-Air Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 28. Global Air-to-Water Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 29. Global Ground Source Heat Pumps Market, by Type, 2025–2035 (USD Million)

Table 30. Global Ground-to-Air Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 31. Global Ground-to-Water Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 32. Global Water Source Heat Pumps Market, by Type, 2025–2035 (USD Million)

Table 33. Global Water-to-Air Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 34. Global Water-to-Water Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 35. Global Heat Pump Water Heaters Market, by Country/Region, 2025–2035 (USD Million)

Table 36. Global Heat Pump Dryers Market, by Country/Region, 2025–2035 (USD Million)

Table 37. Global Commercial Chillers and Heat Pumps Market, by Country/Region, 2025–2035 (USD Million)

Table 38. Global Other Applications Market, by Country/Region, 2025–2035 (USD Million)

Table 39. Global Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 40. Global Residential Market, by Type, 2025–2035 (USD Million)

Table 41. Global Single-Family Homes Market, by Country/Region, 2025–2035 (USD Million)

Table 42. Global Multi-Family Housing Market, by Country/Region, 2025–2035 (USD Million)

Table 43. Global Apartments and Condominiums Market, by Country/Region, 2025–2035 (USD Million)

Table 44. Global Commercial Market, by Type, 2025–2035 (USD Million)

Table 45. Global Office Buildings Market, by Country/Region, 2025–2035 (USD Million)

Table 46. Global Retail Establishments Market, by Country/Region, 2025–2035 (USD Million)

Table 47. Global Hotels and Hospitality Market, by Country/Region, 2025–2035 (USD Million)

Table 48. Global Educational Institutions Market, by Country/Region, 2025–2035 (USD Million)

Table 49. Global Healthcare Facilities Market, by Country/Region, 2025–2035 (USD Million)

Table 50. Global Industrial Market, by Type, 2025–2035 (USD Million)

Table 51. Global Manufacturing Plants Market, by Country/Region, 2025–2035 (USD Million)

Table 52. Global Data Centers Market, by Country/Region, 2025–2035 (USD Million)

Table 53. Global Food Processing Facilities Market, by Country/Region, 2025–2035 (USD Million)

Table 54. Global Chemical and Pharmaceutical Market, by Country/Region, 2025–2035 (USD Million)

Table 55. Global Other End Users Market, by Country/Region, 2025–2035 (USD Million)

Table 56. North America: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 57. North America: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 58. North America: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 59. North America: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 60. North America: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 61. North America: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 62. North America: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 63. U.S.: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 64. U.S.: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 65. U.S.: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 66. U.S.: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 67. U.S.: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 68. U.S.: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 69. U.S.: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 70. Canada: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 71. Canada: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 72. Canada: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 73. Canada: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 74. Canada: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 75. Canada: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 76. Canada: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 77. Europe: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 78. Europe: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 79. Europe: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 80. Europe: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 81. Europe: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 82. Europe: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 83. Europe: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 84. Germany: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 85. Germany: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 86. Germany: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 87. Germany: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 88. Germany: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 89. Germany: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 90. Germany: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 91. France: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 92. France: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 93. France: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 94. France: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 95. France: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 96. France: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 97. France: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 98. U.K.: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 99. U.K.: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 100. U.K.: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 101. U.K.: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 102. U.K.: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 103. U.K.: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 104. U.K.: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 105. Italy: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 106. Italy: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 107. Italy: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 108. Italy: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 109. Italy: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 110. Italy: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 111. Italy: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 112. Spain: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 113. Spain: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 114. Spain: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 115. Spain: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 116. Spain: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 117. Spain: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 118. Spain: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 119. Netherlands: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 120. Netherlands: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 121. Netherlands: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 122. Netherlands: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 123. Netherlands: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 124. Netherlands: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 125. Netherlands: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 126. Nordic Countries: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 127. Nordic Countries: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 128. Nordic Countries: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 129. Nordic Countries: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 130. Nordic Countries: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 131. Nordic Countries: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 132. Nordic Countries: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 133. Norway: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 134. Sweden: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 135. Denmark: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 136. Finland: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 137. Rest of Europe: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 138. Rest of Europe: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 139. Rest of Europe: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 140. Rest of Europe: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 141. Rest of Europe: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 142. Rest of Europe: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 143. Rest of Europe: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 144. Asia-Pacific: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 145. Asia-Pacific: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 146. Asia-Pacific: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 147. Asia-Pacific: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 148. Asia-Pacific: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 149. Asia-Pacific: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 150. Asia-Pacific: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 151. China: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 152. China: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 153. China: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 154. China: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 155. China: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 156. China: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 157. China: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 158. Japan: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 159. Japan: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 160. Japan: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 161. Japan: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 162. Japan: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 163. Japan: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 164. Japan: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 165. India: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 166. India: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 167. India: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 168. India: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 169. India: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 170. India: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 171. India: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 172. South Korea: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 173. South Korea: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 174. South Korea: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 175. South Korea: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 176. South Korea: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 177. South Korea: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 178. South Korea: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 179. Australia: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 180. Australia: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 181. Australia: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 182. Australia: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 183. Australia: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 184. Australia: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 185. Australia: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 186. Thailand: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 187. Thailand: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 188. Thailand: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 189. Thailand: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 190. Thailand: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 191. Thailand: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 192. Thailand: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 193. Rest of APAC: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 194. Rest of APAC: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 195. Rest of APAC: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 196. Rest of APAC: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 197. Rest of APAC: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 198. Rest of APAC: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 199. Rest of APAC: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 200. Latin America: Rotary Heat Pump Compressor Market, by Country, 2025–2035 (USD Million)

Table 201. Latin America: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 202. Latin America: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 203. Latin America: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 204. Latin America: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 205. Latin America: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 206. Latin America: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 207. Latin America: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 208. Brazil: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 209. Brazil: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 210. Brazil: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 211. Brazil: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 212. Brazil: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 213. Brazil: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 214. Brazil: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 215. Mexico: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 216. Mexico: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 217. Mexico: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 218. Mexico: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 219. Mexico: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 220. Mexico: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 221. Mexico: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 222. Chile: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 223. Chile: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 224. Chile: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 225. Chile: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 226. Chile: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 227. Chile: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 228. Chile: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 229. Rest of Latin America: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 230. Rest of Latin America: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 231. Rest of Latin America: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 232. Rest of Latin America: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 233. Rest of Latin America: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 234. Rest of Latin America: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 235. Rest of Latin America: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 236. Middle East and Africa: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 237. Middle East and Africa: Rotary Heat Pump Compressor Market, by Country, 2025–2035 (USD Million)

Table 238. Middle East and Africa: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 239. Middle East and Africa: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 240. Middle East and Africa: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 241. Middle East and Africa: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 242. Middle East and Africa: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 243. Middle East and Africa: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 244. Saudi Arabia: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 245. Saudi Arabia: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 246. Saudi Arabia: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 247. Saudi Arabia: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 248. Saudi Arabia: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 249. Saudi Arabia: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 250. Saudi Arabia: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 251. UAE: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 252. UAE: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 253. UAE: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 254. UAE: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 255. UAE: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 256. UAE: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 257. UAE: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 258. South Africa: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 259. South Africa: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 260. South Africa: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 261. South Africa: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 262. South Africa: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 263. South Africa: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 264. South Africa: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

Table 265. Rest of Middle East and Africa: Rotary Heat Pump Compressor Market, by Product Type, 2025–2035 (USD Million)

Table 266. Rest of Middle East and Africa: Single Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 267. Rest of Middle East and Africa: Twin Rotary Compressors Market, by Type, 2025–2035 (USD Million)

Table 268. Rest of Middle East and Africa: Rotary Heat Pump Compressor Market, by Compressor Design, 2025–2035 (USD Million)

Table 269. Rest of Middle East and Africa: Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025–2035 (USD Million)

Table 270. Rest of Middle East and Africa: Rotary Heat Pump Compressor Market, by Application, 2025–2035 (USD Million)

Table 271. Rest of Middle East and Africa: Rotary Heat Pump Compressor Market, by End User, 2025–2035 (USD Million)

LIST OF FIGURES

1. Research Process

2. Secondary Components Referenced for This Study

3. Primary Research Techniques

4. Key Executives Interviewed

5. Breakdown of Primary Interviews (Supply Side & Demand Side)

6. Market Sizing and Growth Forecast Approach

7. In 2025, the Single Rotary Compressors segment to Account for the Largest Share

8. In 2025, the Rolling Piston Type to Account for the Largest Share

9. In 2025, the R-410A segment to Account for the Largest Share

10. In 2025, the Rotary Heat Pump Compressor Market for Air Source Heat Pumps to Account for the Largest Share

11. In 2025, the Residential segment to Account for the Largest Share

12. Asia-Pacific to be the Fastest-growing Regional Market

13. Impact Analysis of Market Dynamics

14. Global Rotary Heat Pump Compressor Market: Porter's Five Forces Analysis

15. Global Rotary Heat Pump Compressor Market, by Product Type, 2025 Vs. 2035 (USD Million)

16. Global Rotary Heat Pump Compressor Market, by Compressor Design, 2025 Vs. 2035 (USD Million)

17. Global Rotary Heat Pump Compressor Market, by Refrigerant Type, 2025 Vs. 2035 (USD Million)

18. Global Rotary Heat Pump Compressor Market, by Application, 2025 Vs. 2035 (USD Million)

19. Global Rotary Heat Pump Compressor Market, by End User, 2025 Vs. 2035 (USD Million)

20. Global Rotary Heat Pump Compressor Market, by Region, 2025 Vs. 2035 (USD Million)

21. North America: Rotary Heat Pump Compressor Market Snapshot (2025)

22. Europe: Rotary Heat Pump Compressor Market Snapshot (2025)

23. Asia-Pacific: Rotary Heat Pump Compressor Market Snapshot (2025)

24. Latin America: Rotary Heat Pump Compressor Market Snapshot (2025)

25. Middle East and Africa: Rotary Heat Pump Compressor Market Snapshot (2025)

26. Key Growth Strategies Adopted by Leading Players (2022–2025)

27. Global Rotary Heat Pump Compressor Market Competitive Benchmarking, by Product Type

28. Competitive Dashboard: Global Rotary Heat Pump Compressor Market

29. Global Rotary Heat Pump Compressor Market Share/Ranking, by Key Player, 2025 (%)

30. Daikin Industries, Ltd.: Financial Overview (2024)

31. Mitsubishi Electric Corporation: Financial Overview (2024)

32. LG Electronics Inc.: Financial Overview (2024)

33. Panasonic Corporation: Financial Overview (2024)

34. Samsung Electronics Co., Ltd.: Financial Overview (2024)

35. Danfoss A/S: Financial Overview (2024)

36. Midea Group Co., Ltd.: Financial Overview (2024)

37. Hitachi, Ltd.: Financial Overview (2024)

38. Toshiba Corporation: Financial Overview (2024)

39. Emerson Electric Co.: Financial Overview (2024)

Published Date: Jan-2026

Published Date: Jan-2026

Published Date: Oct-2025

Published Date: Sep-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates