Resources

About Us

Ductless Heat Pumps Market Size, Share, Forecast & Trends by Type (Mini-Split, VRF Systems) Application (Residential, Commercial, Industrial) Capacity (Up to 10 kW, 10 to 100 kW, Above 100 kW) Refrigerant (R410A, R32, R290) - Global Forecast to 2035

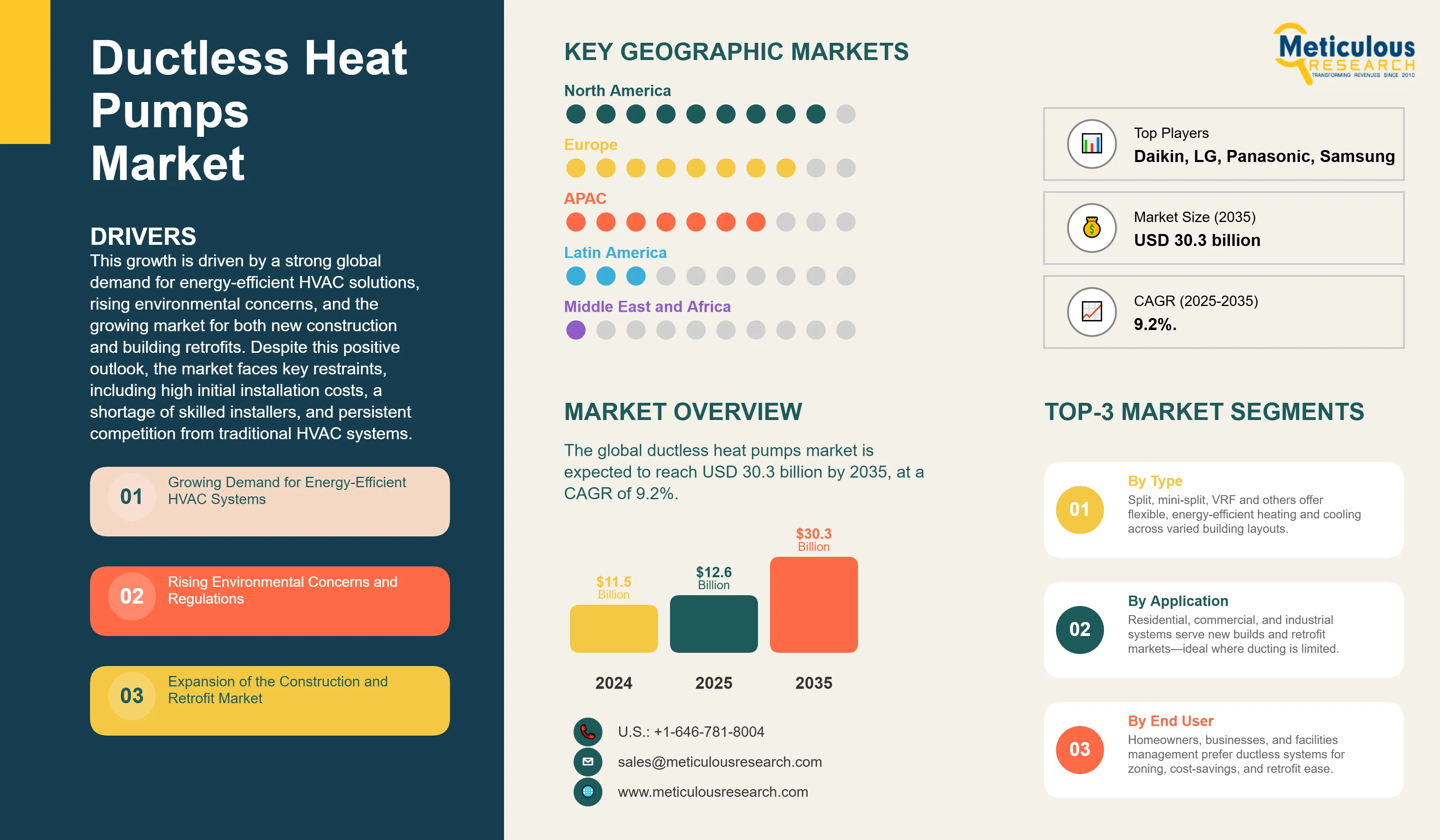

Report ID: MREP - 1041585 Pages: 207 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global ductless heat pumps market was valued at USD 11.5 billion in 2024. The market is expected to reach USD 30.3 billion by 2035 from USD 12.6 billion in 2025, at a CAGR of 9.2%. This growth is driven by a strong global demand for energy-efficient HVAC solutions, rising environmental concerns, and the growing market for both new construction and building retrofits. Despite this positive outlook, the market faces key restraints, including high initial installation costs, a shortage of skilled installers, and persistent competition from traditional HVAC systems.

Competitive Scenario of Ductless Heat Pumps Market and Insights

Click here to: Get Free Sample Pages of this Report

The global ductless heat pump market is highly competitive, with a mix of major international players and regional specialists vying for market share. Leading companies like Daikin, Mitsubishi Electric, and LG Electronics dominate the market, capitalizing on their wide range of products, strong brand recognition, and a commitment to innovation, such as developing more energy-efficient systems and incorporating smart home technology. However, competition goes beyond product performance, with companies also forming strategic partnerships to strengthen their positions.

Recent Developments in the Ductless Heat Pumps Market

LG Expands Global HVAC Training Network to Address Skilled Labor Shortage

In May 2025, LG Electronics announced a significant expansion of its global HVAC training network to support its growing business and tackle the skilled labor shortage in the HVAC industry. By the end of 2025, LG plans to run 70 HVAC academies around the world, an increase from 65 earlier in the year. These academies collectively train about 37,000 HVAC professionals each year in key areas like system design, installation, maintenance, troubleshooting, and safety.

LG has recently opened and improved training facilities in important markets such as Thailand (Bangkok), China (Shenzhen and Tianjin), Indonesia (Jakarta), and France (Lyon and Paris). These academies offer localized, hands-on training programs designed to meet the specific needs of regional industries and professionals. Certifications given at several locations are nationally recognized, helping to boost the technical skills of local HVAC workers.

Trane Technologies Innovations Focus on Sustainability, Cybersecurity, and New Products

In April 2025, Trane Technologies moved forward with its switch to low-GWP refrigerants by using R-454B in its residential HVAC products, including popular residential heat pumps. This refrigerant has about 78% lower global warming potential than its predecessor R-410A. It demonstrates the company’s focus on sustainability and goals for reducing emissions, such as the Gigaton Challenge.

In addition, in Q1 2025, Trane received new cybersecurity certifications for its control systems. This improved product security comes amid growing digitalization. The company also introduced new Modular Self-Contained units, which are part of its updated residential product lineup focused on higher efficiency and sustainability.

Trane began its gradual switch to R-454B in 2024, starting with its 15 SEER2 heat pump systems. These systems meet federal safety standards and help improve energy efficiency. This transition shows Trane’s leadership in the industry's move toward eco-friendly technologies. It is supported by successful field trials, including compliance with the U.S. Department of Energy’s Cold Climate Heat Pump Challenge.

Key Market Drivers

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Growing Demand for Energy-Efficient HVAC Systems |

Energy cost savings and consumer awareness |

Efficiency becomes the standard |

▲ +2.5% |

|

2. Rising Environmental Concerns and Regulations |

Government incentives and new mandates boost sales |

Decarbonization targets make heat pumps the default solution |

▲ +2.0% |

|

|

3. Expansion of the Construction and Retrofit Market |

Rapid adoption in home renovations |

Widespread replacement of traditional HVAC systems |

▲ +1.5% |

|

|

Restraints |

1. High Initial Installation Costs |

Price-sensitive consumers |

Costs decrease due to economies of scale |

▼ −1.0% |

|

2. Shortage of Skilled Installers |

Installation backlogs and higher labor |

Industry training programs and simplified systems |

▼ −0.5% |

|

|

Opportunities |

1. Integration with Smart Home Technology |

Early adopters and tech-focused consumers |

Smart, connected systems become standard features |

▲ +0.5% |

|

2. Growing Adoption in Emerging Economies |

Market entry and initial growth |

Massive population and rising incomes fuel |

▲ +1.0% |

|

|

Trends |

1. Electrification and Decarbonization |

Government policies and energy-saving |

Global energy transition fully establishes heat pumps |

▲ +2.1% |

|

Challenges |

1. High Initial Cost and Affordability |

Price remains a significant barrier |

Declining costs and rising subsidies |

▼ −1.0% |

Regional Analysis

Government Policy Support and Energy Efficiency Standards Drive Ductless Heat Pumps Market in North America

The North America ductless heat pump market is experiencing substantial growth, driven largely by a growing focus on energy efficiency and robust government support. Federal and state incentives, particularly through the U.S. Inflation Reduction Act (IRA), are making these systems more accessible to consumers by offering significant rebates and tax credits. This helps offset the higher initial costs of installation. The region's varied climate, including colder areas, plays a crucial role in this growth, as advancements in technology have led to the development of high-performance cold-climate heat pumps (CCHPs) that work efficiently even in sub-freezing temperatures. Additionally, the IRA further supports this shift with its Energy Efficient Home Improvement Credit (Section 25C), offering federal tax credits of up to USD 2,000 annually for the installation of qualifying heat pumps, covering up to 30% of the total cost.

The High-Efficiency Electric Home Rebate Act (HEEHRA) component of the IRA also provides direct rebates, offering up to USD 8,000 for low-income households and USD 4,000 for moderate-income households installing ENERGY STAR-certified heat pumps. Moreover, the U.S. Department of Energy’s Cold Climate Heat Pump Technology Challenge, in partnership with manufacturers and Natural Resources Canada, has been essential in proving the performance of CCHPs.

Manufacturing Hub and Urbanization Fuel Dominance of Ductless Heat Pumps Market in the Asia Pacific Region

The Asia-Pacific region is the largest and fastest-growing market for ductless heat pumps, driven by rapid economic growth, increasing urbanization, and rising disposable incomes. As economies in China, India, and Southeast Asia continue to expand at a fast pace, there has been a significant surge in demand for modern infrastructure. This growth extends beyond residential buildings to commercial spaces, with new malls, office buildings, and other commercial developments emerging rapidly in urban areas.

Technological advancements in heat pump systems are also playing a key role in this expansion. Leading manufacturers like Daikin, Mitsubishi Electric, and LG Electronics have a strong foothold in the region, continuously innovating their products. Moreover, the rise of Internet of Things (IoT) has introduced features like smartphone control, energy usage tracking, and integration with smart home systems. These innovations enhance user experience while optimizing energy savings, making ductless heat pumps an even more appealing option for both consumers and businesses. As a result, the APAC ductless heat pump market is projected to grow at a rapid pace over the forecast period.

China’s Urbanization and Manufacturing Prowess Fuel Global Dominance in Ductless Heat Pumps

China shows strong growth potential in the ductless heat pumps market. This growth comes from its leading manufacturing capabilities, supportive government environmental policies, and increasing domestic demand for energy-efficient appliances.

As the world’s largest heat pump manufacturer, China enjoys significant cost benefits and technical know-how. This expertise helps both with local adoption and international exports. A solid domestic supply chain and economies of scale make ductless heat pumps widely available and affordable in both urban and rural areas.

Top Chinese companies like Midea Group and Gree Electric Appliances lead the way in innovation. They are integrating ductless heat pumps as standard features in new residential and commercial buildings across the country. Government policies that support energy efficiency subsidies and building electrification programs help speed up market growth. Extensive distribution networks through appliance retailers and e-commerce platforms also ensure wide market coverage.

Rapid urbanization increases the demand for space-saving, energy-efficient HVAC solutions in crowded cities, which boosts the use of ductless heat pumps. Together, these factors position China as an important player in shaping the global ductless heat pump market over the coming years.

Germany's Decarbonization Mandate and Subsidies Spur Growth in Ductless Heat Pumps

Germany is Europe’s largest ductless heat pump market. It has strong government policies and excellent manufacturing skills in energy-efficient heating technologies. The Federal Climate Protection Act and other regulations require a significant shift from fossil fuel boilers to heat pump systems. These efforts are part of broader goals to cut greenhouse gas emissions by 65% by 2030 and achieve carbon neutrality by 2045.

Government programs like the Building Energy Act (GEG) and the Federal Funding for Efficient Buildings (BEG) offer substantial subsidies, covering much of the initial investment costs for consumers. This support has greatly increased heat pump adoption rates. Germany’s top manufacturers, such as Vaillant, Viessmann, and Bosch Thermotechnology, lead the world in cold-climate heat pump technologies. They focus on inverter-driven compressors, low-global warming potential refrigerants, and smart controls suited for Central Europe’s climate.

Rapid urban development, strict emission standards, and ongoing public support for sustainable heating solutions make Germany a key player in the transition from fossil fuels in the European market. This favorable regulatory and policy environment, along with consumer incentives and innovative European manufacturers, will keep driving the growth of ductless heat pumps in residential and commercial buildings in the near future.

Segmental Analysis

Split Systems Dominate the Ductless Heat Pumps Market

On the basis of type, Split Systems hold the dominant share of the overall ductless heat pumps market in 2025. These systems, consisting of a single outdoor unit connected to one or more indoor units, have become the leading technology in the HVAC market, thanks to their versatility, cost-effectiveness, and energy efficiency. Their ability to provide zoned comfort, allowing different rooms or areas to be controlled independently, drives their demand, especially in larger homes with multiple rooms or in commercial settings such as offices and retail stores, where different temperature preferences are common.

In addition to their versatility, split systems are known for their energy efficiency. Inverter-driven split systems are up to 30-55% more energy-efficient than traditional HVAC systems with fixed-speed compressors. This efficiency makes them especially appealing in areas with high energy costs or where sustainability is a priority. With growing global awareness of climate change and environmental sustainability, consumers are increasingly prioritizing energy-efficient solutions, which in turn is driving the adoption of split systems.

Residential Segment Fuel Surge in Ductless Heat Pumps Demand

The residential sector is the largest segment for ductless heat pumps, driven by a rising demand for energy-efficient, quiet, and versatile heating and cooling solutions. These systems offer several benefits, particularly energy savings, thanks to the use of inverter technology, which adjusts the compressor speed for better efficiency. The ability to control temperatures in individual rooms, known as zoning, provides customized comfort while minimizing energy waste, making it especially appealing to homeowners. Ductless heat pumps are also easier to install compared to traditional HVAC systems, as they don’t require extensive ductwork, making them an ideal choice for retrofitting existing homes. With rising energy costs and increasing environmental awareness, ductless heat pumps are gaining popularity as a cost-effective and efficient climate control solution.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 12.6 billion |

|

Revenue forecast in 2035 |

USD 30.3 billion |

|

CAGR (2025-2035) |

9.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Type (Mini-Split Heat Pumps, VRF Systems, Other Types) Application (Residential, Commercial, Industrial) Capacity (Up to 10 kW, 10 to 100 kW, above 100 kW) Refrigerant (R410A, R32, R290, Other Refrigerants), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Daikin, Mitsubishi Electric, Fujitsu General, Carrier Global, LG Electronics, Panasonic, Samsung, Trane Technologies, Johnson Controls, Rheem Manufacturing, Gree Electric Appliances, Midea Group, Lennox International, Hitachi, |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The ductless heat pumps market is estimated to be USD 12.6 billion in 2025 and grow at a CAGR of 9.2% to reach USD 30.3 billion by 2035.

In 2024, the ductless heat pumps market was estimated at USD 11.5 billion, with projections to reach USD 12.6 billion in 2025.

Daikin, Mitsubishi Electric, Fujitsu General, Carrier Global, LG Electronics, Panasonic, Samsung, Trane Technologies, Rheem Manufacturing, Gree Electric Appliances, Midea Group, and Lennox International, Hitachi, are the major companies operating in the market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, split systems accounted for the largest market share of the ductless heat pumps market.

Published Date: Oct-2025

Published Date: Jul-2025

Published Date: Jul-2025

Published Date: May-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates