Resources

About Us

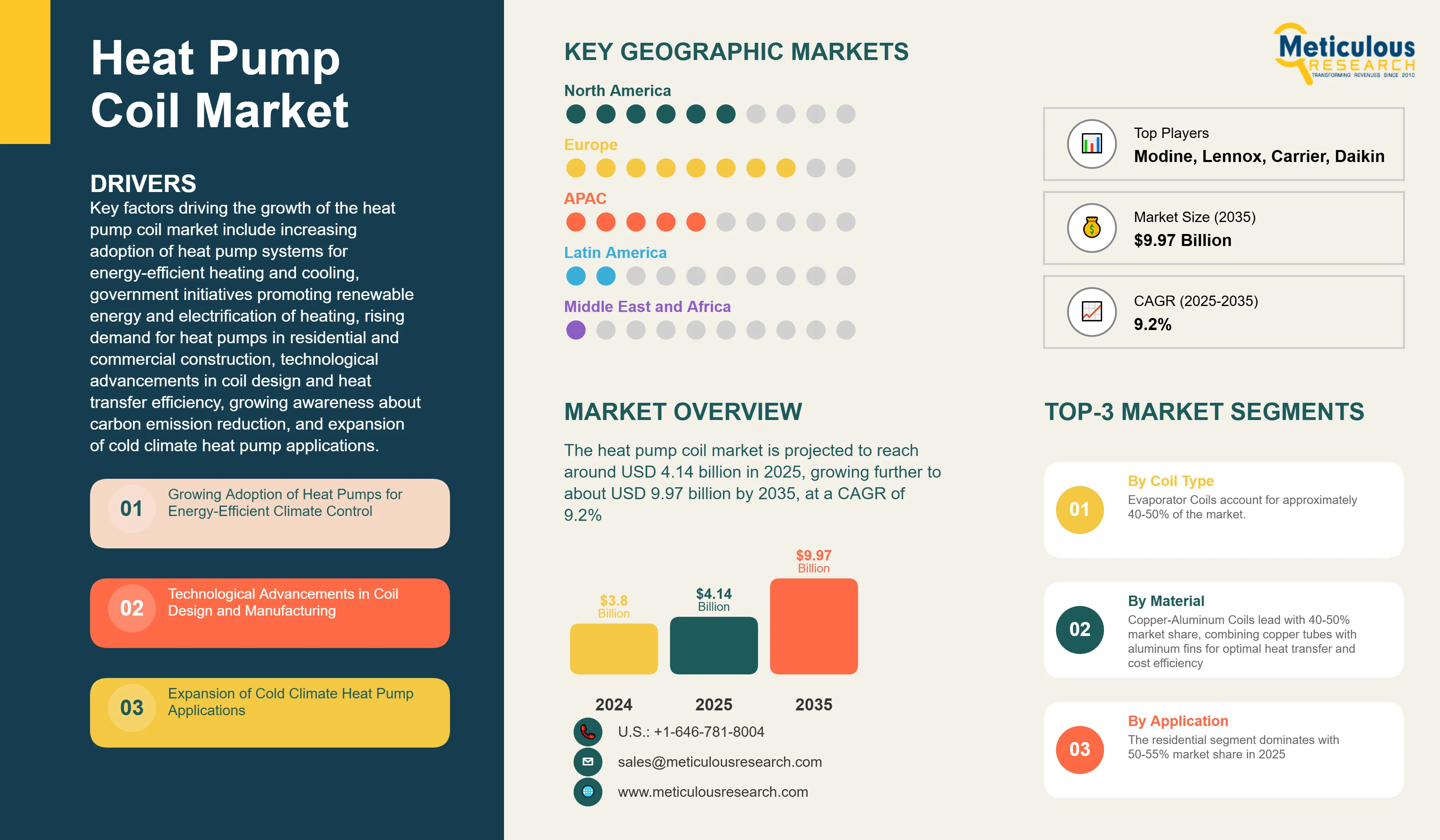

Heat Pump Coil Market Size, Share & Forecast 2025–2035: Global Trends, Growth Drivers & Regional Outlook

Report ID: MREP - 1041523 Pages: 180 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the heat pump coil market include increasing adoption of heat pump systems for energy-efficient heating and cooling, government initiatives promoting renewable energy and electrification of heating, rising demand for heat pumps in residential and commercial construction, technological advancements in coil design and heat transfer efficiency, growing awareness about carbon emission reduction, and expansion of cold climate heat pump applications. However, this growth is restrained by high initial costs of advanced coil materials and coatings, shortage of skilled technicians for installation and maintenance, competition from traditional HVAC systems in certain regions, fluctuating raw material prices particularly for copper and aluminum, and technical challenges in extreme climate conditions.

Additionally, emerging opportunities in microchannel coil technology for improved efficiency, development of corrosion-resistant coatings for coastal applications, integration with smart HVAC control systems, growing retrofit market for heat pump conversions, advancement in refrigerant-compatible coil designs for low-GWP refrigerants, and expansion in industrial process heating applications are poised to offer significant growth opportunities for market players. The adoption of all-aluminum microchannel coils and development of hybrid coil designs combining different materials are emerging as notable trends in this market.

Growing Adoption of Heat Pumps for Energy-Efficient Climate Control

The global shift toward energy-efficient heating and cooling solutions is driving significant demand for heat pump coils. Heat pumps can achieve coefficient of performance (COP) values of 3-5, meaning they produce 3-5 times more energy than they consume, making them significantly more efficient than traditional heating systems. According to the International Energy Agency (IEA), heat pump sales grew by 11% globally in 2023, with over 20 million units sold worldwide that year.

Government policies supporting building electrification and decarbonization are accelerating heat pump adoption. According to the European Union's REPowerEU plan, the EU aims to double the deployment rate of heat pumps, targeting the installation of 10 million new units between 2023 and 2027. In the United States, the Inflation Reduction Act provides up to $2,000 in tax credits for heat pump installations, driving residential market growth. These policy initiatives directly translate to increased demand for high-quality heat pump coils.

Technological Advancements in Coil Design and Manufacturing

Innovation in coil technology is enhancing heat pump performance and reliability. Microchannel aluminum coils offer up to 30% better heat transfer efficiency compared to traditional fin-and-tube designs while using 50% less refrigerant charge. Advanced manufacturing techniques like brazing and laser welding enable more compact and efficient coil designs.

The development of enhanced surface coatings is addressing durability concerns. Hydrophilic coatings improve moisture management and reduce frost formation, while anti-corrosion treatments extend coil life in harsh environments. Some manufacturers report 5-7 year warranty extensions for coils with advanced protective coatings, making heat pumps more attractive for coastal and industrial applications.

Expansion of Cold Climate Heat Pump Applications

Technological improvements have enabled heat pumps to operate efficiently in extremely cold climates, expanding the addressable market. Modern cold climate heat pumps maintain heating capacity at temperatures as low as -25°C (-13°F), opening new markets in northern regions previously dominated by fossil fuel heating.

Countries like Norway, where over 60% of households use heat pumps despite cold winters, demonstrate the technology's viability. Advanced coil designs with variable refrigerant flow and enhanced defrosting capabilities are crucial for cold climate performance. The Cold Climate Heat Pump Technology Challenge by the U.S. Department of Energy is driving innovation in this segment.

Market Segmentation Analysis

By Coil Type

Based on coil type, the heat pump coil market is segmented into evaporator coils and condenser coils. The market shows relatively balanced distribution between these segments due to their complementary nature in heat pump systems.

By Material

Based on material, the market is segmented into copper coils, aluminum coils, and copper-aluminum coils. The copper-aluminum combination dominates due to optimal cost-performance balance.

By Application

The market is segmented into residential, commercial, and industrial applications. The residential segment dominates with 50-55% market share in 2025.

Regional Analysis

Europe: Market Leader in Heat Pump Adoption

Europe dominates the global heat pump coil market with approximately 30-40% share in 2025. Nordic countries lead in per-capita installations, while France, Germany, and Italy represent the largest markets by volume. The EU's Fit for 55 package and national building renovation programs drive sustained growth.

Asia-Pacific: Fastest Growing Market

Asia-Pacific region shows the highest growth rate at 11.1% CAGR. China leads production and consumption, while Japan's Top Runner program promotes high-efficiency heat pumps. Growing markets in India and Southeast Asia driven by rising cooling demand and energy efficiency awareness.

North America: Emerging Growth Market

North America witnesses accelerating growth due to federal and state incentives. The shift from gas furnaces to heat pumps in mild climate zones and increasing adoption of cold climate heat pumps in northern states drive coil demand.

Rest of World: Developing Markets

Brazil leads in Latin America with growing commercial sector adoption. Middle Eastern countries show interest in heat pump technology for cooling applications with waste heat recovery potential.

Competitive Landscape

The heat pump coil market features a mix of specialized coil manufacturers, integrated HVAC component suppliers, and heat pump OEMs with in-house coil production. Companies compete on efficiency, durability, cost, and customization capabilities.

Leading Companies Include:

Global Coil Manufacturers:

Specialized Coil Suppliers:

Regional Leaders:

Emerging Players:

|

Particulars |

Details |

|

Market Size 2024 |

USD 3.8 billion |

|

Market Size 2025 |

USD 4.14 billion |

|

Market Size 2035 |

USD 9.97 billion |

|

CAGR (2025-2035) |

9.2% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2035 |

|

Segments Covered |

By Coil Type, Material, Application, Heat Pump Type |

|

Leading Coil Type |

Evaporator Coils (40-50% share) |

|

Leading Material |

Copper-Aluminum Coils (40-50% share) |

|

Leading Application |

Residential (50-55% share) |

|

Leading Region |

Europe (30-40% share) |

|

Fastest Growing Region |

Asia-Pacific (11.1% CAGR) |

The heat pump coil market is projected to reach USD 9.97 billion by 2035 from USD 4.14 billion in 2025, at a CAGR of 9.2% during the forecast period.

The copper-aluminum coil segment is anticipated to maintain the dominant position with approximately 40-50% market share throughout the forecast period due to optimal balance between cost, performance, and manufacturability.

The commercial segment is projected to record the highest growth rate during the forecast period, driven by increasing adoption of VRF systems and energy efficiency mandates for commercial buildings.

Key factors driving growth include growing adoption of heat pumps for energy-efficient climate control, government policies supporting building electrification, technological advancements in coil design, expansion of cold climate heat pump applications, and rising demand for heat recovery systems.

Major opportunities include microchannel coil technology advancement, development of corrosion-resistant coatings for coastal applications, integration with IoT for predictive maintenance, retrofit market for heat pump conversions, and emerging applications in industrial process heating.

Europe maintains the largest market share at 30-40% driven by aggressive decarbonization policies. Asia-Pacific shows the highest growth potential, led by China and emerging markets in Southeast Asia. North America presents significant opportunities with federal incentives driving rapid market expansion.

Published Date: Oct-2025

Published Date: Sep-2025

Published Date: Jul-2025

Published Date: May-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates