Resources

About Us

Rooftop HVAC Units Market by Type (Single Package, Split System), Capacity (Below 10 Tons, 10-30 Tons, Above 30 Tons), Technology (Conventional, VRF, Heat Pump), Application, End User, and Geography—Global Forecast to 2035

Report ID: MREP - 1041597 Pages: 210 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Rooftop HVAC Units Market Size?

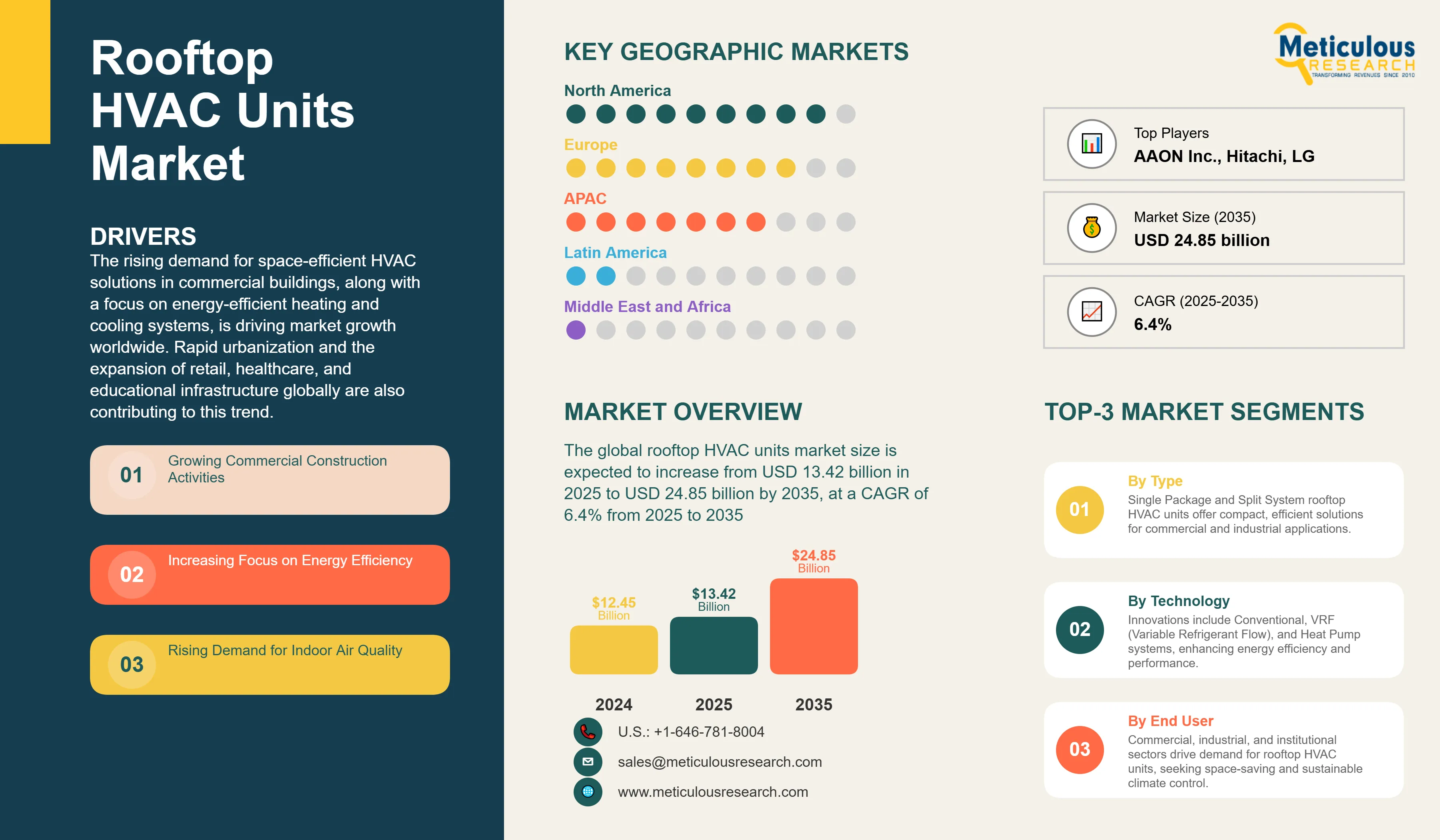

The global rooftop HVAC units market size was valued at USD 12.45 billion in 2024 and is expected to increase from USD 13.42 billion in 2025 to USD 24.85 billion by 2035, at a CAGR of 6.4% from 2025 to 2035. The rising demand for space-efficient HVAC solutions in commercial buildings, along with a focus on energy-efficient heating and cooling systems, is driving market growth worldwide. Rapid urbanization and the expansion of retail, healthcare, and educational infrastructure globally are also contributing to this trend.

Rooftop HVAC Units Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The rooftop HVAC units market includes the design, manufacturing, installation, and servicing of heating, ventilation, and air conditioning systems placed on building rooftops for commercial and industrial use. These self-contained units house all key HVAC components, such as compressors, condensers, evaporators, fans, and controls in weatherproof enclosures. This setup removes the need for indoor mechanical rooms and maximizes usable floor space.

Rooftop units differ from traditional split systems. They allow for easier installation, centralized maintenance access, less noise inside buildings, and flexible zoning options. The market growth stems from rising commercial construction projects, the need to replace old HVAC systems, strict energy efficiency regulations, an increased demand for better indoor air quality, and advancements in variable refrigerant flow systems, smart controls, and eco-friendly refrigerants in retail, office, healthcare, educational, and industrial facilities worldwide.

How is AI Transforming the Rooftop HVAC Units Market?

Artificial intelligence rooftop HVAC units allow for predictive maintenance, improve energy use with machine learning, provide fault detection and diagnostics, and support automatic climate control based on occupancy and weather. AI systems look at real-time data to spot inefficiencies, predict when parts might fail, and adjust settings for the best performance and energy savings. Machine learning models evaluate past usage patterns, outdoor conditions, and building features to create comfort profiles while reducing energy use. AI helps with load balancing among multiple rooftop units, smart economizer control for free cooling, and automatic scheduling based on occupancy predictions. This cuts operational costs by 20-30%, boosts occupant comfort, and extends the life of equipment by optimizing operation.

What are the Key Trends in the Rooftop HVAC Units Market?

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 24.85 Billion |

|

Market Size in 2025 |

USD 13.42 Billion |

|

Market Size in 2024 |

USD 12.45 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 6.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Capacity, Technology, Application, End User, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Commercial Construction and Retrofitting Activities

A major factor driving the growth of the rooftop HVAC units market is the strong increase in commercial construction around the world. This is especially true in emerging economies where urbanization and economic development are happening quickly. The construction of retail spaces, office buildings, warehouses, healthcare facilities, and educational institutions requires efficient HVAC solutions. These systems need to maximize usable indoor space while ensuring reliable climate control.

Additionally, many existing rooftop units are aging, usually around 15 to 20 years old. This situation offers significant opportunities for replacement as building owners aim to improve energy efficiency, lower maintenance costs, and meet updated building codes. Government incentives for energy-efficient upgrades, like tax credits and utility rebates, also speed up the replacement process. The growing trend of adapting industrial buildings for commercial use drives demand for rooftop units that can be installed easily without major structural changes.

Restraint

High Installation and Maintenance Costs

Despite increasing demand, the rooftop HVAC units market encounters obstacles due to high initial investment costs and ongoing maintenance issues. Installation expenses include the equipment itself as well as structural reinforcement, crane services for placing units on the roof, electrical upgrades, and ductwork changes; this often adds up to 2-3 times the cost of the unit. Units on rooftops face harsh weather, which demands strong weatherproofing and more frequent maintenance than indoor systems. Maintenance on rooftops can be difficult, raising service costs and safety concerns; this requires technicians to have special training and equipment. Larger rooftop units can weigh too much for the roof load capacity of older buildings, leading to costly structural upgrades. These challenges can make it hard for adoption, especially for small building owners with limited budgets.

Opportunity

Energy-Efficient and Sustainable HVAC Solutions

The growing focus on sustainability and net-zero building goals offers profitable chances for rooftop HVAC units with high-efficiency parts, renewable energy options, and low-GWP refrigerants. Heat pump rooftop units that heat and cool through electric power support electrification aims and remove the need for natural gas. Connecting with rooftop solar panels for direct energy supply or thermal storage systems for load shifting adds more value. The rising demand for LEED and ENERGY STAR certified buildings encourages the use of high-efficiency rooftop units that help achieve certification points. Smart grid integration features that allow for demand response participation provide extra income for building owners and help maintain grid stability. This creates market opportunities for manufacturers offering sustainable solutions.

Type Insights

Why are Single Package Units Preferred for Rooftop Applications?

The single package units segment holds the largest market share, around 75% in 2025. Single package units include all HVAC components in one weatherproof enclosure. This setup allows for easier installation, shorter refrigerant piping, and fewer roof penetrations compared to split systems. These self-contained units do not need indoor mechanical space, which maximizes the leasable area in commercial buildings. The factory-installed design ensures quality control, cuts down on installation time and labor costs, and makes maintenance easy because all components are accessible from the rooftop. Single package units are especially popular in retail stores, restaurants, and small office buildings, where indoor space is limited and standardized solutions meet comfort needs.

The split system units segment is expected to see the fastest growth during the next several years. The increasing use of VRF split systems for rooftop applications is driving this segment. These systems offer better energy efficiency, allow for control in individual zones, and operate more quietly by placing noisy components on the roof, separate from the indoor air handlers.

Technology Insights

How do Conventional Rooftop Units Maintain Market Leadership?

The conventional rooftop units segment holds the largest market share, around 50-55% in 2025. Conventional constant-speed units with staged compressors offer a cost-effective solution for standard commercial applications. They are reliable and easy to maintain. These units use familiar technology that HVAC technicians can service easily, ensuring that parts and expertise are widely available. Although they are less efficient than newer options, conventional units meet basic comfort needs at lower initial costs. This makes them appealing to budget-conscious buyers and suitable for applications with moderate runtime hours. The large number of installed conventional units also boosts replacement demand since building owners tend to prefer similar technology that works with existing setups.

The heat pump rooftop units segment is expected to grow at the fastest CAGR through 2035. There is a growing focus on electrification and reducing carbon emissions, which boosts the adoption of heat pump technology. This technology eliminates natural gas use while providing efficient heating and cooling. Advanced heat pumps with cold climate capabilities create new opportunities in northern regions that previously relied on gas heating.

Capacity Insights

How does the 10-30 Tons Segment Dominate the Market?

The 10-30 tons segment accounts for 45-50% share of the overall market in 2025. This capacity range serves most commercial buildings, including retail stores, restaurants, bank branches, and small office buildings. These units strike a good balance between capacity and efficiency for typical commercial loads. They also fit within standard electrical service capabilities. The 10-30 ton range allows for modular setups, where multiple units provide redundancy and control for medium-sized buildings. Standardization in this range helps manufacturers achieve economies of scale and competitive prices.

The segment above 30 tons is expected to grow the fastest in the coming years. Rising demand from large commercial facilities, data centers, and industrial applications needing significant cooling capacity drives this growth. Improvements in high-capacity scroll and screw compressors enhance the efficiency and reliability of large rooftop units.

Application Insights

Why do Commercial Applications Drive Market Demand?

The commercial segment holds the largest share of 70% of the overall rooftop HVAC units market in 2025. Commercial buildings, including retail stores, offices, hotels, hospitals, and schools, depend heavily on rooftop units for space-efficient HVAC solutions. This approach keeps valuable indoor space available for revenue-generating activities. The commercial sector focuses on occupant comfort, indoor air quality, and operational efficiency, which drives a continuous demand for new installations and replacements. Shorter replacement cycles in commercial applications result from higher runtime hours and changing efficiency standards, creating steady market demand. The variety of commercial building types and sizes allows for a wide array of rooftop unit configurations and capacities.

The industrial segment is expected to grow at the fastest CAGR during the forecast period. Increased use in warehouses, distribution centers, and manufacturing facilities drives this growth. The expansion of e-commerce and the return of manufacturing create a need for climate-controlled industrial spaces. Modern rooftop units with precise temperature and humidity control meet the requirements of industrial processes.

End User Insights

Why have Retail & Shopping Centers Found Maximum Application?

The retail and shopping centers segment holds the largest market share, nearly 25-30%, in 2025. Retail environments need reliable HVAC systems to ensure comfortable shopping conditions. This comfort encourages customers to spend more time in stores and boosts sales. Rooftop units provide ideal solutions for retail spaces. They preserve sales floor area, offer flexible zoning for different store sections, and allow individual tenant control in multi-tenant properties. The modular design of rooftop units makes it easy to adjust capacity as retail spaces change or are repurposed. The high visibility of energy costs in retail operations leads to the adoption of efficient rooftop units that lower operational expenses while keeping comfort levels high.

The data centers segment is expected to grow the fastest during the foreseeable period. The rapid increase in data center construction and higher heat densities from high-performance computing drive the need for specialized rooftop units. These units require precise temperature and humidity control, high sensible heat ratios, and redundant setups to meet mission-critical cooling needs.

Distribution Channel Insights

Why are Direct Sales Dominant in the Market?

The direct sales segment is expected to hold the largest market share of 60-65% in 2025. Direct sales through manufacturers' sales teams and authorized representatives provide the technical knowledge needed for proper equipment selection, system design, and application engineering. Commercial HVAC projects often require customization, value-engineering, and coordination with mechanical contractors that benefit from direct manufacturer involvement. Having direct relationships allows for better project support, warranty management, and access to technical resources. Large commercial projects and national accounts prefer direct purchasing relationships to get volume pricing, standardization across portfolios, and dedicated support services.

However, the online sales segment is projected to witness the fastest growth rate during the upcoming years. The shift towards digital in HVAC distribution enables online selection tools, configurators, and e-commerce platforms that make purchasing easier for standard rooftop units. Online channels lower transaction costs and improve access for smaller contractors and end-users.

U.S. Rooftop HVAC Units Market Size and Growth 2025 to 2035

The U.S. rooftop HVAC units market is projected to be worth around USD 8.92 billion by 2035, growing at a CAGR of 6.3% from 2025 to 2035.

How is the North America Rooftop HVAC Units Market Growing Dominantly Across the Globe?

North America holds the largest market share of around 40-45% of the global rooftop HVAC units market in 2025. This is mainly attributed to the widespread use of rooftop units as the standard HVAC solution for commercial buildings. This trend is driven by a lot of low-rise commercial construction and a preference for packaged equipment. The established replacement market, with millions of rooftop units reaching the end of their life, creates steady demand. Strict energy codes, such as ASHRAE 90.1 and Title 24 in California, encourage the use of high-efficiency units.

Major manufacturers like Trane Technologies, Carrier, Johnson Controls, Lennox, and Rheem have extensive distribution networks that ensure product availability and service support. Features such as economizers, demand-controlled ventilation, and energy recovery are common in North American markets, which supports premium pricing and overall market value.

Which Factors Support the Asia Pacific Rooftop HVAC Units Market Growth?

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2035. This growth is primarily attributed to the rapid urbanization and the development of commercial infrastructure in China, India, Southeast Asia, and other emerging markets. The rising popularity of organized retail, modern warehousing, and international building standards increases the demand for rooftop HVAC solutions. Higher disposable incomes and expectations for comfort in tropical climates create a strong need for cooling, which rooftop units in commercial spaces can effectively meet.

Government programs that promote energy efficiency and green buildings, like China's carbon neutrality goals and India's Energy Conservation Building Code, support the adoption of improved rooftop units. Local manufacturing capabilities and competitive pricing also help expand the market, while technology transfers from global manufacturers enhance product quality and efficiency.

Value Chain Analysis

Recent Developments

Segments Covered in the Report

By Type

By Capacity

By Technology

By Application

By End User

By Distribution Channel

By Region

The rooftop HVAC units market is expected to increase from USD 12.45 billion in 2024 to USD 24.85 billion by 2035.

The rooftop HVAC units market is expected to grow at a CAGR of 6.4% from 2025 to 2035.

The major players in the rooftop HVAC units market include Trane Technologies plc, Carrier Global Corporation, Johnson Controls International plc, Daikin Industries Ltd., Lennox International Inc., Rheem Manufacturing Company, Goodman Manufacturing (Daikin), Nortek Global HVAC, AAON Inc., Mitsubishi Electric Corporation, LG Electronics Inc., Samsung Electronics Co. Ltd., Gree Electric Appliances Inc., Midea Group Co. Ltd., Hitachi Ltd., Fujitsu General Limited, Bosch Thermotechnology (Robert Bosch GmbH), Toshiba Corporation, Panasonic Corporation, and York (Johnson Controls).

The driving factors of the rooftop HVAC units market are the increasing demand for space-efficient HVAC solutions in commercial buildings, growing emphasis on energy-efficient cooling and heating systems, rapid urbanization, and expansion of retail, healthcare, and educational infrastructure globally.

North America region will lead the global rooftop HVAC units market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Type

3.3. Market Analysis, By Capacity

3.4. Market Analysis, By Technology

3.5. Market Analysis, By Application

3.6. Market Analysis, By End User

3.7. Market Analysis, By Distribution Channel

3.8. Market Analysis, By Geography

3.9. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Rooftop HVAC Units Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Growing Commercial Construction Activities

4.2.2. Increasing Focus on Energy Efficiency

4.2.3. Rising Demand for Indoor Air Quality

4.3. Global Rooftop HVAC Units Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Installation and Maintenance Costs

4.3.2. Structural Limitations of Existing Buildings

4.4. Global Rooftop HVAC Units Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Heat Pump Technology Adoption

4.4.2. Smart Building Integration

4.5. Global Rooftop HVAC Units Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Skilled Technician Shortage

4.5.2. Refrigerant Transition Requirements

4.6. Global Rooftop HVAC Units Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Variable Refrigerant Flow Technology

4.6.2. IoT and Predictive Maintenance

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Sustainability on the Global Rooftop HVAC Units Market

5.1. Introduction to Sustainable HVAC Solutions

5.2. Low-GWP Refrigerant Transition

5.3. Energy Efficiency Standards and Regulations

5.4. Renewable Energy Integration

5.5. Life Cycle Assessment and Circular Economy

5.6. Green Building Certifications Impact

5.7. Corporate Sustainability Goals

5.8. Impact on Market Growth and Technology Development

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

7. Global Rooftop HVAC Units Market, By Type

7.1. Introduction

7.2. Single Package Units

7.3. Split System Units

8. Global Rooftop HVAC Units Market, By Capacity

8.1. Introduction

8.2. Below 10 Tons

8.3. 10-30 Tons

8.4. 30-50 Tons

8.5. 50-100 Tons

8.6. Above 100 Tons

9. Global Rooftop HVAC Units Market, By Technology

9.1. Introduction

9.2. Conventional Rooftop Units

9.2.1. Constant Air Volume (CAV)

9.2.2. Variable Air Volume (VAV)

9.3. Variable Refrigerant Flow (VRF) Units

9.4. Heat Pump Rooftop Units

9.4.1. Air Source Heat Pumps

9.4.2. Dual Fuel Heat Pumps

9.5. Evaporative Cooling Units

9.6. Hybrid Systems

10. Global Rooftop HVAC Units Market, By Application

10.1. Introduction

10.2. Commercial

10.2.1. New Construction

10.2.2. Retrofit & Replacement

10.3. Industrial

10.3.1. Process Cooling

10.3.2. Comfort Cooling

11. Global Rooftop HVAC Units Market, By End User

11.1. Introduction

11.2. Retail & Shopping Centers

11.3. Office Buildings

11.4. Healthcare Facilities

11.5. Educational Institutions

11.6. Hospitality

11.7. Data Centers

11.8. Warehouses & Distribution Centers

11.9. Manufacturing Facilities

11.10. Government Buildings

11.11. Others

12. Global Rooftop HVAC Units Market, By Distribution Channel

12.1. Introduction

12.2. Direct Sales

12.3. Distributors & Dealers

12.4. Online Sales

12.5. Contractors & Installers

13. Rooftop HVAC Units Market, By Geography

13.1. Introduction

13.2. North America

13.2.1. U.S.

13.2.2. Canada

13.2.3. Mexico

13.3. Asia-Pacific

13.3.1. China

13.3.2. Japan

13.3.3. India

13.3.4. South Korea

13.3.5. Australia

13.3.6. Southeast Asia

13.3.7. Rest of Asia-Pacific

13.4. Europe

13.4.1. Germany

13.4.2. U.K.

13.4.3. France

13.4.4. Italy

13.4.5. Spain

13.4.6. Netherlands

13.4.7. Rest of Europe

13.5. Latin America

13.5.1. Brazil

13.5.2. Argentina

13.5.3. Chile

13.5.4. Rest of Latin America

13.6. Middle East & Africa

13.6.1. UAE

13.6.2. Saudi Arabia

13.6.3. South Africa

13.6.4. Rest of Middle East & Africa

14. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

14.1. Trane Technologies plc

14.2. Carrier Global Corporation

14.3. Johnson Controls International plc

14.4. Daikin Industries Ltd.

14.5. Lennox International Inc.

14.6. Rheem Manufacturing Company

14.7. Goodman Manufacturing (Daikin)

14.8. Nortek Global HVAC

14.9. AAON Inc.

14.10. Mitsubishi Electric Corporation

14.11. LG Electronics Inc.

14.12. Samsung Electronics Co. Ltd.

14.13. Gree Electric Appliances Inc.

14.14. Midea Group Co. Ltd.

14.15. Hitachi Ltd.

14.16. Fujitsu General Limited

14.17. Bosch Thermotechnology (Robert Bosch GmbH)

14.18. Toshiba Corporation

14.19. Panasonic Corporation

14.20. York (Johnson Controls)

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Oct-2025

Published Date: Jul-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates