Resources

About Us

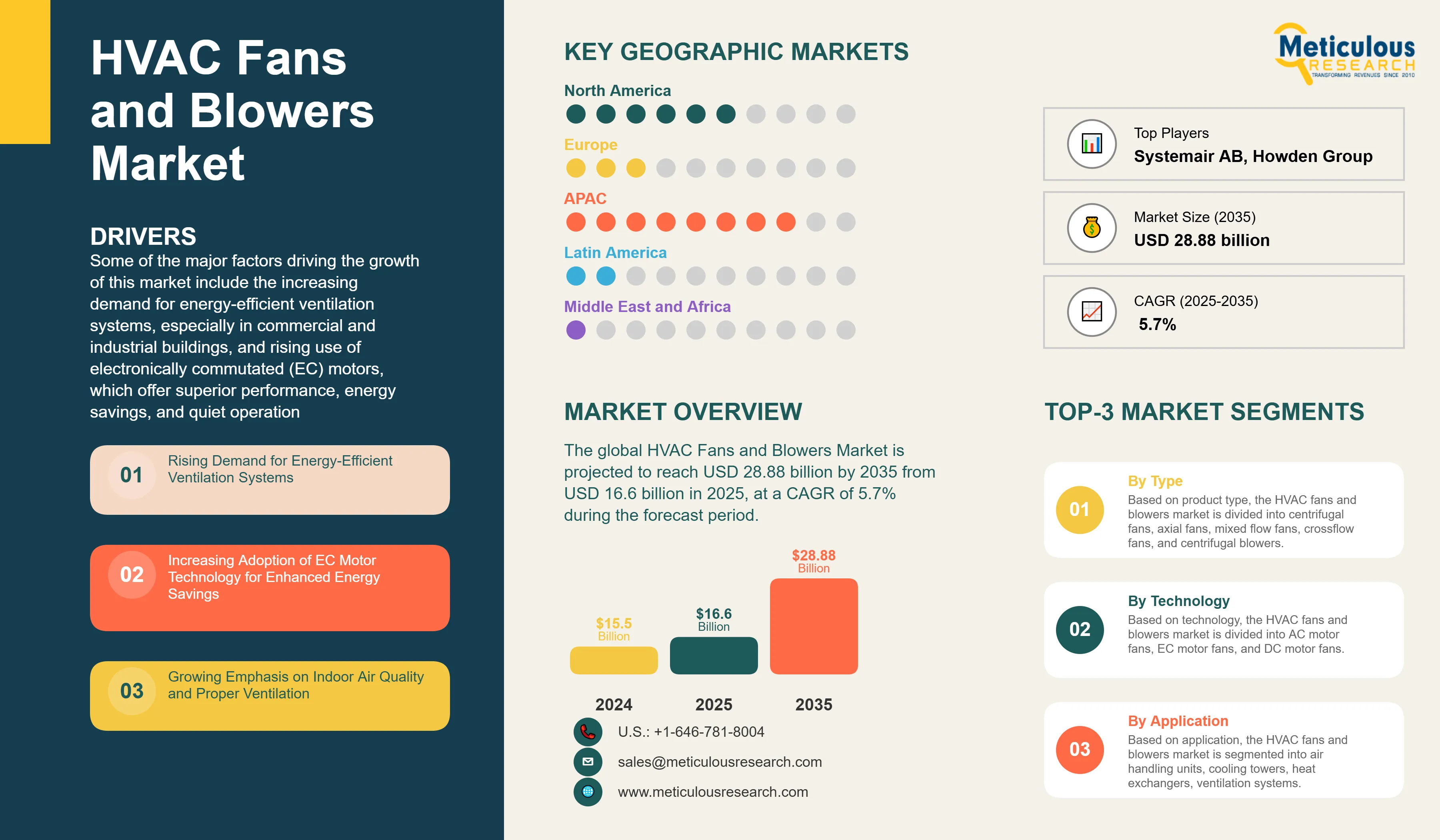

HVAC Fans and Blowers Market Size & Forecast 2025–2035 | Global Trends, Growth Drivers, EC Motor Adoption & Regional Outlook

Report ID: MREP - 1041532 Pages: 185 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportSome of the major factors driving the growth of this market include the increasing demand for energy-efficient ventilation systems, especially in commercial and industrial buildings, and rising use of electronically commutated (EC) motors, which offer superior performance, energy savings, and quiet operation. Moreover, awareness of indoor air quality and proper ventilation has grown, particularly after the COVID-19 pandemic. This has increased the emphasis on upgrading HVAC systems. In addition, global construction and infrastructure development are pushing market demand, while strict regulations are prompting the use of energy-efficient HVAC technologies.

However, high initial costs for energy-efficient fan technologies may deter some buyers. Additionally, strong price competition from low-cost manufacturers is putting pressure on profit margins. Fluctuations in raw material prices further impact profitability, and it can be technically difficult and expensive to integrate new fan technologies into existing HVAC systems.

Despite these hurdles, the market has considerable untapped potential. Rapid industrialization in emerging economies presents new growth opportunities. The adoption of smart, IoT-enabled fan systems with predictive maintenance features is leading to innovative applications, particularly in sectors like data centers, which need specialized high-performance cooling solutions.

There is also a growing interest in connecting HVAC systems with renewable energy sources and energy storage solutions. Demand for quiet, aerodynamically optimized fan designs is rising, along with the use of advanced materials such as lightweight composites and corrosion-resistant alloys.

In line with broader industry trends, digitalization and remote monitoring are becoming standard, while the use of variable frequency drives (VFDs) is improving operational efficiency. Sustainable manufacturing practices are emerging as a key focus for manufacturers aiming to meet global environmental goals.

Market Drivers

Rising Demand for Energy-Efficient Ventilation Systems

According to a Johnson Controls 2023 Energy Efficiency Indicator Survey, around 62% of building professionals reported increased investment in ventilation and IAQ solutions post-COVID. The demand for energy-efficient HVAC fans and blowers is growing significantly. This increase is due to growing awareness of reducing operational costs and focus on environmental sustainability. HVAC fans and blowers usually make up 15-25% of a building's total energy use. This makes them key targets for efficiency improvements.

Using electronically commutated (EC) motor technology in fans and blowers can cut energy use by 30-50% compared to traditional AC motors. EC motors also offer better speed control and more operational flexibility. Variable frequency drives (VFDs) and smart control systems let fans run at the best speeds based on real-time needs. This further boosts energy efficiency and lowers operating costs.

In recent years, there has been an emerging trend among building owners and facility managers toward energy-efficient fan systems due to their growing focus on receiving green building certifications, meeting energy efficiency standards, and lowering long-term operating costs. High-efficiency fans usually have a payback period of 2-4 years through energy savings. This makes them appealing investments for commercial and industrial use.

Growing Emphasis on Indoor Air Quality and Proper Ventilation

The COVID-19 pandemic has reshaped the importance placed on indoor air quality and ventilation across commercial, institutional, and residential buildings. Effective ventilation is essential for eliminating airborne contaminants, managing humidity levels, and maintaining healthy indoor environments.

Stronger ventilation needs have led to a greater demand for high-performance fans and blowers. These systems must provide higher air change rates while also being energy-efficient. Many buildings are updating their HVAC systems to comply with new ventilation standards. This includes bringing in more outdoor air and improving air filtration, which calls for more powerful and efficient fan systems.

The healthcare sector, schools, and commercial office buildings are especially focused on improving ventilation. This has increased the need for specialized fan solutions that can meet higher airflow demands while keeping noise levels down and conserving energy.

Expanding Construction Activities and Infrastructure Development

The UN‑Habitat estimates APAC countries will require construction of an additional ~230 billion m² of new housing by 2050 to meet demand in middle-income and low-income regions. Global construction activities, especially in emerging economies across Asia-Pacific, the Middle East, and Latin America, are driving strong demand for HVAC fans and blowers. New commercial complexes, industrial facilities, data centers, and residential developments need reliable ventilation systems with dependable fan and blower components.

The shift toward larger and more complex buildings, such as high-rise towers, shopping centers, airports, and manufacturing facilities, requires advanced fan systems that can manage high air volume and intricate ductwork setups. These projects often need custom-engineered solutions with specific performance features.

Infrastructure projects like tunnels, underground facilities, and transportation systems also create a need for specialized ventilation fans tailored for tough environments and essential safety applications.

Market Segmentation Analysis

By Product Type

Based on product type, the HVAC fans and blowers market is divided into centrifugal fans, axial fans, mixed flow fans, crossflow fans, and centrifugal blowers. In 2025, the centrifugal fans segment is expected to lead the market, representing about 45-50% of the total HVAC fans and blowers market. Centrifugal fans dominate due to their strong pressure generation, wide range of applications, and ability to handle different air volumes and system resistances.

On the other hand, the axial fans segment is projected to grow at the highest CAGR during the forecast period from 2025 to 2035. The growing use of axial fans in energy-efficient applications, increasing demand for compact and lightweight fan options, broader use in data center cooling, and improvements in blade design and motor integration that enhance performance and lower noise levels are some of the major drivers for the growth of this segment.

By Technology

Based on technology, the HVAC fans and blowers market is divided into AC motor fans, EC motor fans, and DC motor fans. In 2025, the AC motor fans segment is expected to hold the largest share of the market, with around a 55-60% share of the market. This is mainly due to their lower initial cost, easy availability, and established installation and maintenance practices across various applications.

However, the EC motor fans segment is projected to grow at the highest CAGR during the forecast period. This growth is driven by their better energy efficiency compared to AC motors, precise speed control, reduced maintenance needs because of their brushless design, and increasing regulatory demands for energy-efficient HVAC components.

By Pressure Range

On the basis of pressure range, the HVAC fans and blowers market is segmented into low pressure (up to 1000 Pa), medium pressure (1000-3000 Pa), and high pressure (above 3000 Pa). In 2025, the low pressure segment is expected to hold the largest share of around 50-55%, driven by widespread use in general ventilation, air handling units, and residential HVAC applications.

However, the medium pressure segment is expected to record the highest CAGR during the forecast period, driven by their increasing demand for air handling systems in commercial buildings, growing need for energy recovery ventilation, and expanding applications in industrial process ventilation that require moderate pressure capabilities.

By Application

Based on application, the HVAC fans and blowers market is segmented into air handling units, cooling towers, heat exchangers, ventilation systems, and others. In 2025, the air handling units segment is expected to dominate the overall market with around 35-40% share, driven by widespread use in commercial and institutional buildings for climate control and air quality management.

On the other hand, the cooling towers segment is projected to record the highest CAGR during the forecast period of 2025-2035. This is mainly attributed to the expanding data center construction, growing industrial cooling requirements, and increasing adoption of closed-loop cooling systems that require high-performance axial fans for heat rejection applications.

Regional Analysis

Based on geography, the HVAC fans and blowers market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, the Asia-Pacific region is expected to hold the largest share of around 40-45% of the global HVAC fans and blowers market. Rapid industrial growth, extensive construction projects, expanding manufacturing sector, and increased use of energy-efficient building technologies are some of the factors driving the growth of this regional segment.

This market is also expected to grow at the highest CAGR during the forecast period from 2025 to 2035. This growth is driven by expanding manufacturing industries that need industrial ventilation, rapid urbanization that increases commercial construction, the growth of data centers, government initiatives that promote energy efficiency, and rising awareness of the importance of indoor air quality.

North America is a mature market that emphasizes energy efficiency, building automation, and regulatory compliance. The region focuses on retrofitting existing buildings with energy-efficient fan systems and expanding data center infrastructure, which supports steady market growth.

Europe shows a strong demand for high-efficiency and environmentally friendly fan solutions. Strict energy efficiency regulations are driving the adoption of EC motor technology and advanced control systems.

Competitive Landscape

The HVAC fans and blowers market is characterized by a mix of specialized fan manufacturers, diversified industrial equipment companies, and technology-focused players competing on product innovation, energy efficiency, reliability, and technical support capabilities. Leading players operating in the global HVAC fans and blowers market are ebm-papst Group, Greenheck Fan Corporation, Systemair AB, Howden Group Ltd., Twin City Fan Companies Ltd., Soler & Palau Ventilation Group, Ziehl-Abegg SE, Continental Fan Manufacturing Inc., Johnson Controls International plc, Carrier Global Corporation, Trane Technologies plc, Aerovent Inc., New York Blower Company, Hartzell Air Movement, and Chicago Blower Corporation, among others.

These companies focus on strategies like developing energy-efficient EC motor technologies, investing in aerodynamic design improvement and computational fluid dynamics, expanding smart fan systems with IoT connectivity, forming partnerships with HVAC system integrators and building automation companies, and growing in high-growth emerging markets to strengthen their market position and expand their product offerings.

|

Particulars |

Details |

|

Number of Pages |

185 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.7% |

|

Market Size 2024 |

USD 15.5 billion |

|

Market Size 2025 |

USD 16.6 billion |

|

Market Size 2035 |

USD 28.88 billion |

|

Segments Covered |

By Product Type, Technology, Pressure Range, Application, and End Use |

|

Countries Covered |

North America (U.S., Canada, Mexico), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

The HVAC fans and blowers market is projected to reach USD 28.88 billion by 2035 from USD 16.6 billion in 2025, at a CAGR of 5.7% during the forecast period.

In 2025, the centrifugal fans segment is projected to hold the major share of the HVAC fans and blowers market, while the axial fans segment is slated to record the highest growth rate.

Key factors driving the growth include rising demand for energy-efficient ventilation systems, increasing adoption of EC motor technology, growing emphasis on indoor air quality and proper ventilation, expanding construction activities and infrastructure development, and stringent regulations promoting energy efficiency.

Asia-Pacific leads the market with the highest share and is projected to record the highest growth rate during the forecast period, offering significant opportunities for HVAC fans and blowers vendors.

Major opportunities include untapped markets in emerging economies with rapid industrialization, development of smart and IoT-enabled fan systems, expansion of data center cooling applications, integration with renewable energy systems, and rising demand for noise-reduced and aerodynamically optimized designs.

Key trends include the adoption of advanced materials, including lightweight composites, digitalization, remote monitoring capabilities, variable frequency drive integration, and sustainable manufacturing processes.

The EC motor fans segment is anticipated to record the highest growth rate during the forecast period, driven by superior energy efficiency, precise speed control capabilities, and increasing regulatory pressure for energy-efficient HVAC components.

Published Date: Oct-2025

Published Date: Sep-2025

Published Date: Jul-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates