Resources

About Us

Heat Pump Coil Market Size, Share & Forecast 2025–2035: Global Trends, Growth Drivers & Regional Outlook

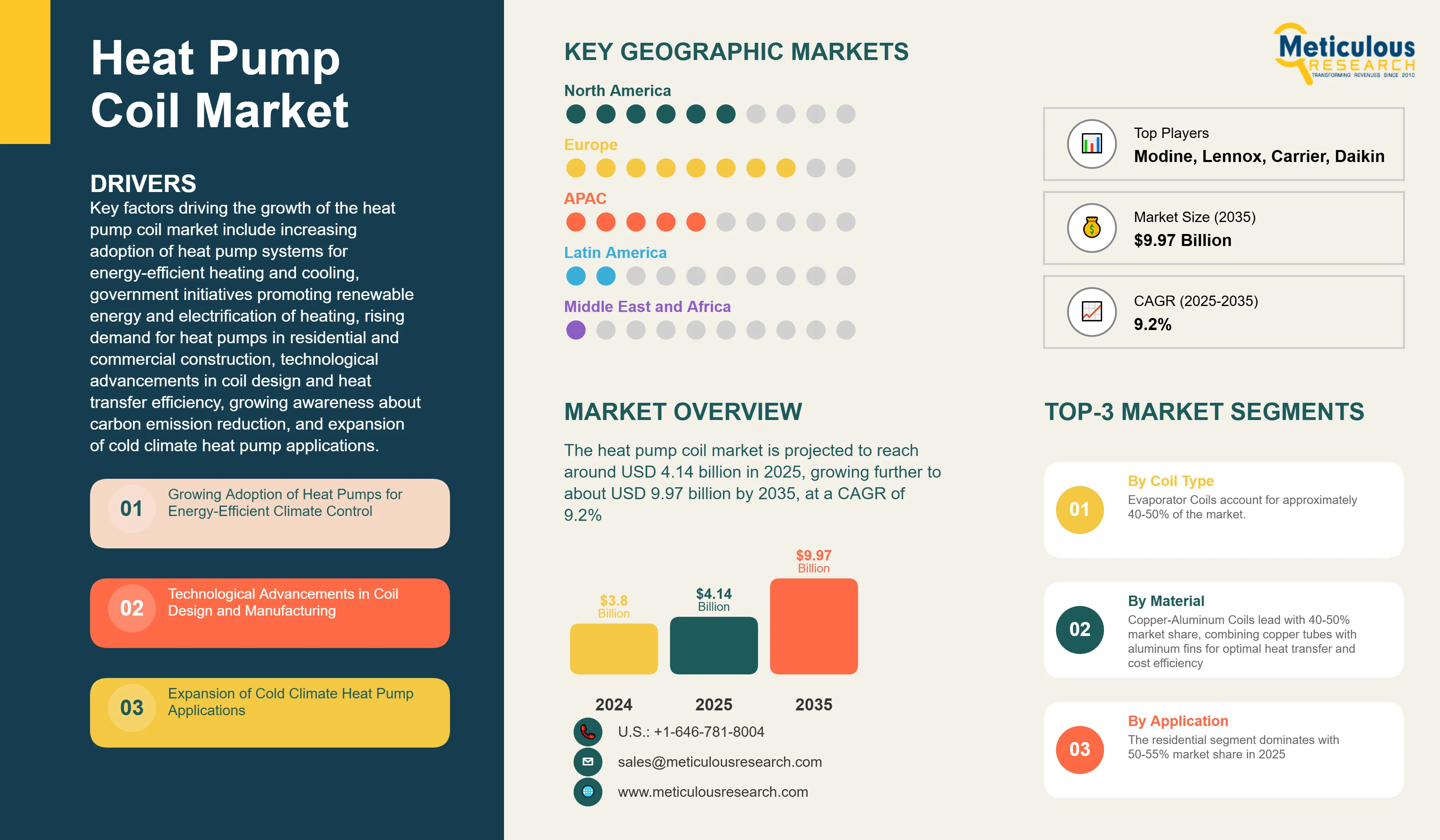

Report ID: MREP - 1041523 Pages: 180 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the heat pump coil market include increasing adoption of heat pump systems for energy-efficient heating and cooling, government initiatives promoting renewable energy and electrification of heating, rising demand for heat pumps in residential and commercial construction, technological advancements in coil design and heat transfer efficiency, growing awareness about carbon emission reduction, and expansion of cold climate heat pump applications. However, this growth is restrained by high initial costs of advanced coil materials and coatings, shortage of skilled technicians for installation and maintenance, competition from traditional HVAC systems in certain regions, fluctuating raw material prices particularly for copper and aluminum, and technical challenges in extreme climate conditions.

Additionally, emerging opportunities in microchannel coil technology for improved efficiency, development of corrosion-resistant coatings for coastal applications, integration with smart HVAC control systems, growing retrofit market for heat pump conversions, advancement in refrigerant-compatible coil designs for low-GWP refrigerants, and expansion in industrial process heating applications are poised to offer significant growth opportunities for market players. The adoption of all-aluminum microchannel coils and development of hybrid coil designs combining different materials are emerging as notable trends in this market.

Growing Adoption of Heat Pumps for Energy-Efficient Climate Control

The global shift toward energy-efficient heating and cooling solutions is driving significant demand for heat pump coils. Heat pumps can achieve coefficient of performance (COP) values of 3-5, meaning they produce 3-5 times more energy than they consume, making them significantly more efficient than traditional heating systems. According to the International Energy Agency (IEA), heat pump sales grew by 11% globally in 2023, with over 20 million units sold worldwide that year.

Government policies supporting building electrification and decarbonization are accelerating heat pump adoption. According to the European Union's REPowerEU plan, the EU aims to double the deployment rate of heat pumps, targeting the installation of 10 million new units between 2023 and 2027. In the United States, the Inflation Reduction Act provides up to $2,000 in tax credits for heat pump installations, driving residential market growth. These policy initiatives directly translate to increased demand for high-quality heat pump coils.

Technological Advancements in Coil Design and Manufacturing

Innovation in coil technology is enhancing heat pump performance and reliability. Microchannel aluminum coils offer up to 30% better heat transfer efficiency compared to traditional fin-and-tube designs while using 50% less refrigerant charge. Advanced manufacturing techniques like brazing and laser welding enable more compact and efficient coil designs.

The development of enhanced surface coatings is addressing durability concerns. Hydrophilic coatings improve moisture management and reduce frost formation, while anti-corrosion treatments extend coil life in harsh environments. Some manufacturers report 5-7 year warranty extensions for coils with advanced protective coatings, making heat pumps more attractive for coastal and industrial applications.

Expansion of Cold Climate Heat Pump Applications

Technological improvements have enabled heat pumps to operate efficiently in extremely cold climates, expanding the addressable market. Modern cold climate heat pumps maintain heating capacity at temperatures as low as -25°C (-13°F), opening new markets in northern regions previously dominated by fossil fuel heating.

Countries like Norway, where over 60% of households use heat pumps despite cold winters, demonstrate the technology's viability. Advanced coil designs with variable refrigerant flow and enhanced defrosting capabilities are crucial for cold climate performance. The Cold Climate Heat Pump Technology Challenge by the U.S. Department of Energy is driving innovation in this segment.

Market Segmentation Analysis

By Coil Type

Based on coil type, the heat pump coil market is segmented into evaporator coils and condenser coils. The market shows relatively balanced distribution between these segments due to their complementary nature in heat pump systems.

By Material

Based on material, the market is segmented into copper coils, aluminum coils, and copper-aluminum coils. The copper-aluminum combination dominates due to optimal cost-performance balance.

By Application

The market is segmented into residential, commercial, and industrial applications. The residential segment dominates with 50-55% market share in 2025.

Regional Analysis

Europe: Market Leader in Heat Pump Adoption

Europe dominates the global heat pump coil market with approximately 30-40% share in 2025. Nordic countries lead in per-capita installations, while France, Germany, and Italy represent the largest markets by volume. The EU's Fit for 55 package and national building renovation programs drive sustained growth.

Asia-Pacific: Fastest Growing Market

Asia-Pacific region shows the highest growth rate at 11.1% CAGR. China leads production and consumption, while Japan's Top Runner program promotes high-efficiency heat pumps. Growing markets in India and Southeast Asia driven by rising cooling demand and energy efficiency awareness.

North America: Emerging Growth Market

North America witnesses accelerating growth due to federal and state incentives. The shift from gas furnaces to heat pumps in mild climate zones and increasing adoption of cold climate heat pumps in northern states drive coil demand.

Rest of World: Developing Markets

Brazil leads in Latin America with growing commercial sector adoption. Middle Eastern countries show interest in heat pump technology for cooling applications with waste heat recovery potential.

Competitive Landscape

The heat pump coil market features a mix of specialized coil manufacturers, integrated HVAC component suppliers, and heat pump OEMs with in-house coil production. Companies compete on efficiency, durability, cost, and customization capabilities.

Leading Companies Include:

Global Coil Manufacturers:

Specialized Coil Suppliers:

Regional Leaders:

Emerging Players:

|

Particulars |

Details |

|

Market Size 2024 |

USD 3.8 billion |

|

Market Size 2025 |

USD 4.14 billion |

|

Market Size 2035 |

USD 9.97 billion |

|

CAGR (2025-2035) |

9.2% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2035 |

|

Segments Covered |

By Coil Type, Material, Application, Heat Pump Type |

|

Leading Coil Type |

Evaporator Coils (40-50% share) |

|

Leading Material |

Copper-Aluminum Coils (40-50% share) |

|

Leading Application |

Residential (50-55% share) |

|

Leading Region |

Europe (30-40% share) |

|

Fastest Growing Region |

Asia-Pacific (11.1% CAGR) |

The heat pump coil market is projected to reach USD 9.97 billion by 2035 from USD 4.14 billion in 2025, at a CAGR of 9.2% during the forecast period.

The copper-aluminum coil segment is anticipated to maintain the dominant position with approximately 40-50% market share throughout the forecast period due to optimal balance between cost, performance, and manufacturability.

The commercial segment is projected to record the highest growth rate during the forecast period, driven by increasing adoption of VRF systems and energy efficiency mandates for commercial buildings.

Key factors driving growth include growing adoption of heat pumps for energy-efficient climate control, government policies supporting building electrification, technological advancements in coil design, expansion of cold climate heat pump applications, and rising demand for heat recovery systems.

Major opportunities include microchannel coil technology advancement, development of corrosion-resistant coatings for coastal applications, integration with IoT for predictive maintenance, retrofit market for heat pump conversions, and emerging applications in industrial process heating.

Europe maintains the largest market share at 30-40% driven by aggressive decarbonization policies. Asia-Pacific shows the highest growth potential, led by China and emerging markets in Southeast Asia. North America presents significant opportunities with federal incentives driving rapid market expansion.

1. Introduction

1.1. Market Definition & Scope

1.2. Heat Pump Coil Market Ecosystem

1.3. Currency and Units

1.4. Key Stakeholders in Heat Pump Coil Value Chain

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Heat Pump Coil Market Analysis: by Coil Type

3.2.2. Heat Pump Coil Market Analysis: by Material

3.2.3. Heat Pump Coil Market Analysis: by Application

3.2.4. Heat Pump Coil Market Analysis: by Heat Pump Type

3.3. Heat Pump Coil Market, by Regional Analysis

3.4. Competitive Landscape & Market Competitors

4. Industry Insights

4.1. Overview

4.2. Heat Pump Coil Technology Overview

4.2.1. Fin-and-Tube vs. Microchannel Coil Comparison

4.2.2. Heat Transfer Enhancement Technologies

4.2.3. Coil Coating and Surface Treatment Technologies

4.3. Value Chain Analysis

4.3.1. Overview

4.3.2. Raw Material Suppliers (Copper, Aluminum)

4.3.3. Coil Manufacturers and Fabricators

4.3.3.1. Key Heat Pump Coil Manufacturers, by Scale

4.3.3.1.1. Local and Regional Coil Manufacturers

4.3.3.1.2. National HVAC Component Suppliers

4.3.3.1.3. International Heat Exchange Specialists

4.3.3.1.4. Integrated Heat Pump OEMs

4.3.4. Technology Development and Testing Facilities

4.3.5. Distribution Channels and HVAC Wholesalers

4.3.6. Heat Pump Manufacturers and System Integrators

4.3.7. Installation and Service Contractors

4.4. Impact of Refrigerant Transition on Coil Design

4.4.1. Low-GWP Refrigerant Compatibility Requirements

4.4.2. Pressure and Temperature Considerations

4.4.3. Material Compatibility and Corrosion Resistance

4.4.4. Coil Optimization for A2L Refrigerants

4.5. Porter's Five Forces Analysis

4.5.1. Bargaining Power of Raw Material Suppliers

4.5.2. Bargaining Power of Heat Pump Manufacturers

4.5.3. Threat of Alternative Heat Exchange Technologies

4.5.4. Threat of New Market Entrants

4.5.5. Degree of Competition Among Coil Manufacturers

5. Market Insights

5.1. Overview

5.2. Factors Affecting Market Growth

5.2.1. Drivers

5.2.1.1. Growing Adoption of Heat Pumps for Energy-Efficient Climate Control

5.2.1.2. Government Policies Supporting Building Electrification

5.2.1.3. Technological Advancements in Coil Design and Manufacturing

5.2.1.4. Expansion of Cold Climate Heat Pump Applications

5.2.1.5. Rising Demand for Heat Recovery and Simultaneous Heating/Cooling

5.2.1.6. Growth in Data Center Cooling Applications

5.2.1.7. Increasing Focus on Indoor Air Quality

5.2.1.8. Development of High-Temperature Industrial Heat Pumps

5.2.2. Restraints

5.2.2.1. High Initial Costs of Advanced Coil Technologies

5.2.2.2. Skilled Labor Shortage for Installation and Maintenance

5.2.2.3. Raw Material Price Volatility

5.2.2.4. Competition from Traditional HVAC Systems

5.2.2.5. Technical Challenges in Extreme Climate Conditions

5.2.3. Opportunities

5.2.3.1. Microchannel Coil Technology Advancement

5.2.3.2. Development of Corrosion-Resistant Coatings

5.2.3.3. Integration with IoT and Predictive Maintenance

5.2.3.4. Retrofit Market for Heat Pump Conversions

5.2.3.5. Emerging Markets in Developing Countries

5.3. Trends

5.3.1. All-Aluminum Microchannel Coil Adoption

5.3.2. Hybrid Coil Designs for Optimized Performance

5.3.3. Additive Manufacturing for Complex Coil Geometries

5.4. Standards and Regulations

5.4.1. Heat Exchanger Performance Standards

5.4.2. Pressure Vessel and Safety Regulations

5.4.2.1. North America (ASME, UL, AHRI Standards)

5.4.2.2. Europe (PED, EN Standards, Ecodesign Requirements)

5.4.2.3. Asia-Pacific (JIS, GB Standards, BIS)

5.4.2.4. International Standards (ISO, IEC)

5.5. Impact of Sustainability on Heat Pump Coil Market

5.5.1. Recyclability and End-of-Life Considerations

5.5.2. Manufacturing Process Energy Efficiency

5.5.3. Refrigerant Charge Reduction Initiatives

5.5.4. Life Cycle Assessment Requirements

6. Heat Pump Coil Market Assessment - by Coil Type

6.1. Overview

6.2. Evaporator Coils

6.2.1. A-Shape Coils

6.2.2. N-Shape/Z-Shape Coils

6.2.3. Slab/Horizontal Coils

6.2.4. Custom Configuration Coils

6.3. Condenser Coils

6.3.1. Air-Cooled Condenser Coils

6.3.2. Water-Cooled Condenser Coils

6.3.3. Evaporative Condenser Coils

7. Heat Pump Coil Market Assessment - by Material

7.1. Overview

7.2. Copper-Aluminum Coils

7.2.1. Copper Tube/Aluminum Fin

7.2.2. Rifled Copper Tube Designs

7.3. All-Aluminum Coils

7.3.1. Round Tube Plate Fin (RTPF)

7.3.2. Microchannel Aluminum Coils

7.3.3. Aluminum Tube/Aluminum Fin

7.4. All-Copper Coils

7.4.1. Copper Tube/Copper Fin

7.4.2. Enhanced Copper Surface Designs

7.5. Specialty Material Coils

7.5.1. Stainless Steel Coils

7.5.2. Titanium Coils

7.5.3. Coated/Treated Coils

8. Heat Pump Coil Market Assessment - by Application

8.1. Overview

8.2. Residential Applications

8.2.1. Single-Family Homes

8.2.1.1. Ducted Split Systems

8.2.1.2. Ductless Mini-Split Systems

8.2.1.3. Packaged Heat Pumps

8.2.2. Multi-Family Residential

8.2.2.1. Individual Unit Systems

8.2.2.2. Central Plant Systems

8.2.3. Manufactured/Mobile Homes

8.3. Commercial Applications

8.3.1. Light Commercial Buildings

8.3.1.1. Small Office Buildings

8.3.1.2. Retail Stores

8.3.1.3. Restaurants

8.3.2. Large Commercial Buildings

8.3.2.1. Office Complexes

8.3.2.2. Hotels and Hospitality

8.3.2.3. Healthcare Facilities

8.3.2.4. Educational Institutions

8.3.3. Variable Refrigerant Flow (VRF) Systems

8.4. Industrial Applications

8.4.1. Process Heating and Cooling

8.4.2. Warehouse and Distribution Centers

8.4.3. Data Centers

8.4.4. Manufacturing Facilities

8.4.5. Agricultural Applications

9. Heat Pump Coil Market Assessment - by Heat Pump Type

9.1. Overview

9.2. Air-Source Heat Pumps

9.2.1. Standard Efficiency Heat Pumps

9.2.2. High Efficiency Heat Pumps

9.2.3. Cold Climate Heat Pumps

9.2.4. Variable Speed Heat Pumps

9.3. Water-Source Heat Pumps

9.3.1. Ground-Source (Geothermal) Heat Pumps

9.3.2. Water Loop Heat Pumps

9.3.3. Surface Water Heat Pumps

9.4. Hybrid Heat Pumps

9.4.1. Dual Fuel Heat Pumps

9.4.2. Solar-Assisted Heat Pumps

9.5. Specialty Heat Pumps

9.5.1. CO2 Heat Pumps

9.5.2. Absorption Heat Pumps

9.5.3. High-Temperature Heat Pumps

10. Heat Pump Coil Market Assessment - by Geography

10.1. Overview

10.2. North America

10.2.1. United States

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. United Kingdom

10.3.4. Italy

10.3.5. Netherlands

10.3.6. Sweden

10.3.7. Norway

10.3.8. Poland

10.3.9. Spain

10.3.10. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. South Korea

10.4.4. India

10.4.5. Australia

10.4.6. New Zealand

10.4.7. Southeast Asia

10.4.7.1. Thailand

10.4.7.2. Malaysia

10.4.7.3. Singapore

10.4.7.4. Indonesia

10.4.8. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Chile

10.5.5. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. UAE

10.6.2. Saudi Arabia

10.6.3. South Africa

10.6.4. Turkey

10.6.5. Israel

10.6.6. Rest of Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies in Heat Pump Coil Market

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Global Technology Leaders

11.4.2. Regional Coil Specialists

11.4.3. Innovation Leaders

11.4.4. Cost-Competitive Players

11.5. Market Share Analysis of Key Players, 2024

12. Company Profiles

12.1. Company Profiles

12.1.1. Modine Manufacturing Company (USA)

12.1.2. Lennox International Inc. (USA)

12.1.3. Johnson Controls International (USA)

12.1.4. Carrier Global Corporation (USA)

12.1.5. Daikin Industries, Ltd. (Japan)

12.1.6. EVAPCO Inc. (USA)

12.1.7. Colmac Coil Manufacturing (USA)

12.1.8. Super Radiator Coils (USA)

12.1.9. Luvata (Finland)

12.1.10. Shanghai Shenglin M&E Technology Co., Ltd. (China)

12.1.11. Kelvion Holdings GmbH (Germany)

12.1.12. Stefani S.p.A. (Italy)

12.1.13. Roller Group (Italy)

12.1.14. Blue Star Limited (India)

12.1.15. Thermokey S.p.A. (Italy)

12.1.16. Kaltra (Germany)

12.1.17. Coilmaster Corporation (USA)

12.1.18. Capital Coil & Air (USA)

12.1.19. HC Coils Limited (UK)

12.1.20. Goodman Manufacturing Company (USA)

12.1.21. Others

(Note: SWOT Analysis of Top 5 Heat Pump Coil Companies Will Be Provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

13.3. Heat Transfer and HVAC Industry Standards

13.4. Glossary of Heat Pump Coil Terms

List of Tables

Table 1 Global Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 2 Global Evaporator Coils Market, by Country, 2023-2035 (USD Million)

Table 3 Global Condenser Coils Market, by Country, 2023-2035 (USD Million)

Table 4 Global Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 5 Global Copper-Aluminum Coils Market, by Country, 2023-2035 (USD Million)

Table 6 Global All-Aluminum Coils Market, by Country, 2023-2035 (USD Million)

Table 7 Global All-Copper Coils Market, by Country, 2023-2035 (USD Million)

Table 8 Global Specialty Material Coils Market, by Country, 2023-2035 (USD Million)

Table 9 Global Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 10 Global Heat Pump Coil Market for Residential Applications, by Country, 2023-2035 (USD Million)

Table 11 Global Heat Pump Coil Market for Commercial Applications, by Country, 2023-2035 (USD Million)

Table 12 Global Heat Pump Coil Market for Industrial Applications, by Country, 2023-2035 (USD Million)

Table 13 Global Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 14 Global Heat Pump Coil Market for Air-Source Heat Pumps, by Country, 2023-2035 (USD Million)

Table 15 Global Heat Pump Coil Market for Water-Source Heat Pumps, by Country, 2023-2035 (USD Million)

Table 16 Global Heat Pump Coil Market for Hybrid Heat Pumps, by Country, 2023-2035 (USD Million)

Table 17 Global Heat Pump Coil Market for Specialty Heat Pumps, by Country, 2023-2035 (USD Million)

Table 18 Global Heat Pump Coil Market, by Region, 2023-2035 (USD Million)

Table 19 North America: Heat Pump Coil Market, by Country, 2023-2035 (USD Million)

Table 20 North America: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 21 North America: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 22 North America: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 23 North America: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 24 U.S.: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 25 U.S.: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 26 U.S.: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 27 U.S.: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 28 Canada: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 29 Canada: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 30 Canada: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 31 Canada: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 32 Mexico: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 33 Mexico: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 34 Mexico: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 35 Mexico: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 36 Europe: Heat Pump Coil Market, by Country/Region, 2023-2035 (USD Million)

Table 37 Europe: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 38 Europe: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 39 Europe: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 40 Europe: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 41 Germany: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 42 Germany: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 43 Germany: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 44 Germany: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 45 France: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 46 France: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 47 France: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 48 France: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 49 United Kingdom: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 50 United Kingdom: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 51 United Kingdom: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 52 United Kingdom: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 53 Italy: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 54 Italy: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 55 Italy: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 56 Italy: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 57 Netherlands: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 58 Netherlands: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 59 Netherlands: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 60 Netherlands: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 61 Sweden: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 62 Sweden: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 63 Sweden: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 64 Sweden: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 65 Norway: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 66 Norway: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 67 Norway: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 68 Norway: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 69 Poland: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 70 Poland: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 71 Poland: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 72 Poland: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 73 Spain: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 74 Spain: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 75 Spain: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 76 Spain: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 77 Rest of Europe: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 78 Rest of Europe: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 79 Rest of Europe: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 80 Rest of Europe: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 81 Asia-Pacific: Heat Pump Coil Market, by Country/Region, 2023-2035 (USD Million)

Table 82 Asia-Pacific: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 83 Asia-Pacific: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 84 Asia-Pacific: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 85 Asia-Pacific: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 86 China: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 87 China: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 88 China: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 89 China: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 90 Japan: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 91 Japan: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 92 Japan: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 93 Japan: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 94 South Korea: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 95 South Korea: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 96 South Korea: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 97 South Korea: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 98 India: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 99 India: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 100 India: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 101 India: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 102 Australia: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 103 Australia: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 104 Australia: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 105 Australia: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 106 New Zealand: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 107 New Zealand: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 108 New Zealand: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 109 New Zealand: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 110 Southeast Asia: Heat Pump Coil Market, by Country, 2023-2035 (USD Million)

Table 111 Southeast Asia: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 112 Southeast Asia: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 113 Southeast Asia: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 114 Southeast Asia: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 115 Rest of Asia-Pacific: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 116 Rest of Asia-Pacific: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 117 Rest of Asia-Pacific: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 118 Rest of Asia-Pacific: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 119 Latin America: Heat Pump Coil Market, by Country/Region, 2023-2035 (USD Million)

Table 120 Latin America: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 121 Latin America: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 122 Latin America: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 123 Latin America: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 124 Brazil: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 125 Brazil: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 126 Brazil: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 127 Brazil: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 128 Mexico: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 129 Mexico: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 130 Mexico: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 131 Mexico: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 132 Argentina: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 133 Argentina: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 134 Argentina: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 135 Argentina: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 136 Chile: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 137 Chile: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 138 Chile: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 139 Chile: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 140 Rest of Latin America: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 141 Rest of Latin America: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 142 Rest of Latin America: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 143 Rest of Latin America: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 144 Middle East & Africa: Heat Pump Coil Market, by Country/Region, 2023-2035 (USD Million)

Table 145 Middle East & Africa: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 146 Middle East & Africa: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 147 Middle East & Africa: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 148 Middle East & Africa: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 149 UAE: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 150 UAE: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 151 UAE: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 152 UAE: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 153 Saudi Arabia: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 154 Saudi Arabia: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 155 Saudi Arabia: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 156 Saudi Arabia: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 157 South Africa: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 158 South Africa: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 159 South Africa: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 160 South Africa: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 161 Turkey: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 162 Turkey: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 163 Turkey: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 164 Turkey: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 165 Israel: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 166 Israel: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 167 Israel: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 168 Israel: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

Table 169 Rest of Middle East & Africa: Heat Pump Coil Market, by Coil Type, 2023-2035 (USD Million)

Table 170 Rest of Middle East & Africa: Heat Pump Coil Market, by Material, 2023-2035 (USD Million)

Table 171 Rest of Middle East & Africa: Heat Pump Coil Market, by Application, 2023-2035 (USD Million)

Table 172 Rest of Middle East & Africa: Heat Pump Coil Market, by Heat Pump Type, 2023-2035 (USD Million)

List of Figures

Figure 1 Research Process for Heat Pump Coil Market

Figure 2 Secondary Sources Referenced for Heat Pump Coil Study

Figure 3 Primary Research Techniques for Heat Pump Coil Market Analysis

Figure 4 Key Executives Interviewed in Heat Pump Coil Industry

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach for Heat Pump Coil

Figure 7 In 2025, the Evaporator Coils Segment to Show Balanced Share with Condenser Coils

Figure 8 In 2025, the Copper-Aluminum Segment to Show Largest Material Share

Figure 9 In 2025, the Residential Segment to Lead Application Market

Figure 10 In 2025, the Air-Source Heat Pumps to Dominate Heat Pump Type Market

Figure 11 Europe and Asia-Pacific Lead the Heat Pump Coil Market Growth

Figure 12 Benefits of Advanced Coil Designs on Heat Pump Efficiency and Performance

Figure 13 Heat Pump Coil Manufacturing Process Flow and Quality Standards

Figure 14 Heat Pump Coil Market: Value Chain Analysis

Figure 15 Heat Pump Coil Market: Porter's Five Forces Analysis

Figure 16 Impact Analysis of Heat Pump Coil Market Dynamics

Figure 17 Fin-and-Tube vs. Microchannel: Performance and Cost Comparison

Figure 18 Global Heat Pump Coil Market, by Coil Type, 2025 Vs. 2035 (USD Million)

Figure 19 Global Heat Pump Coil Market, by Material, 2025 Vs. 2035 (USD Million)

Figure 20 Global Heat Pump Coil Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 21 Global Heat Pump Coil Market, by Heat Pump Type, 2025 Vs. 2035 (USD Million)

Figure 22 Heat Pump Coil: Raw Material to OEM Integration Flow

Figure 23 Heat Pump Coil: Manufacturing to Installation Supply Chain

Figure 24 Impact of Refrigerant Transition on Coil Design and Materials

Figure 25 Global Heat Pump Coil Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 26 North America: Heat Pump Coil Market Snapshot (2025)

Figure 27 Europe: Heat Pump Coil Market Snapshot (2025)

Figure 28 Asia-Pacific: Heat Pump Coil Market Snapshot (2025)

Figure 29 Latin America: Heat Pump Coil Market Snapshot (2025)

Figure 30 Middle East & Africa: Heat Pump Coil Market Snapshot (2025)

Figure 31 Key Growth Strategies Adopted by Leading Heat Pump Coil Players (2022-2025)

Figure 32 Global Heat Pump Coil Market Competitive Benchmarking, by Material Type

Figure 33 Competitive Dashboard: Global Heat Pump Coil Market

Figure 34 Global Heat Pump Coil Market Share of Key Players, 2024

Figure 35 Modine Manufacturing Company: Financial Overview (2024)

Figure 36 Lennox International Inc.: Financial Overview (2024)

Figure 37 Johnson Controls International: Financial Overview (2024)

Figure 38 Carrier Global Corporation: Financial Overview (2024)

Figure 39 Traditional vs. Microchannel Coil Technology: Performance Comparison (2024)

Figure 40 Heat Pump Coil Technology Development Timeline and Market Impact

Figure 41 Heat Pump Coil Market: Sustainability and Circular Economy Impact Analysis

Published Date: Oct-2025

Published Date: Sep-2025

Published Date: Jul-2025

Published Date: May-2025

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates