Resources

About Us

Europe Biopharmaceutical Processing Equipment and Consumables Market by Product Type {Filtration, Chromatography [Consumables, Equipment], Disposable Bioreactors, Cell Culture Media, Shakers, Services), Application (Vaccine, mAb, R&D), and End User - Forecast to 2032

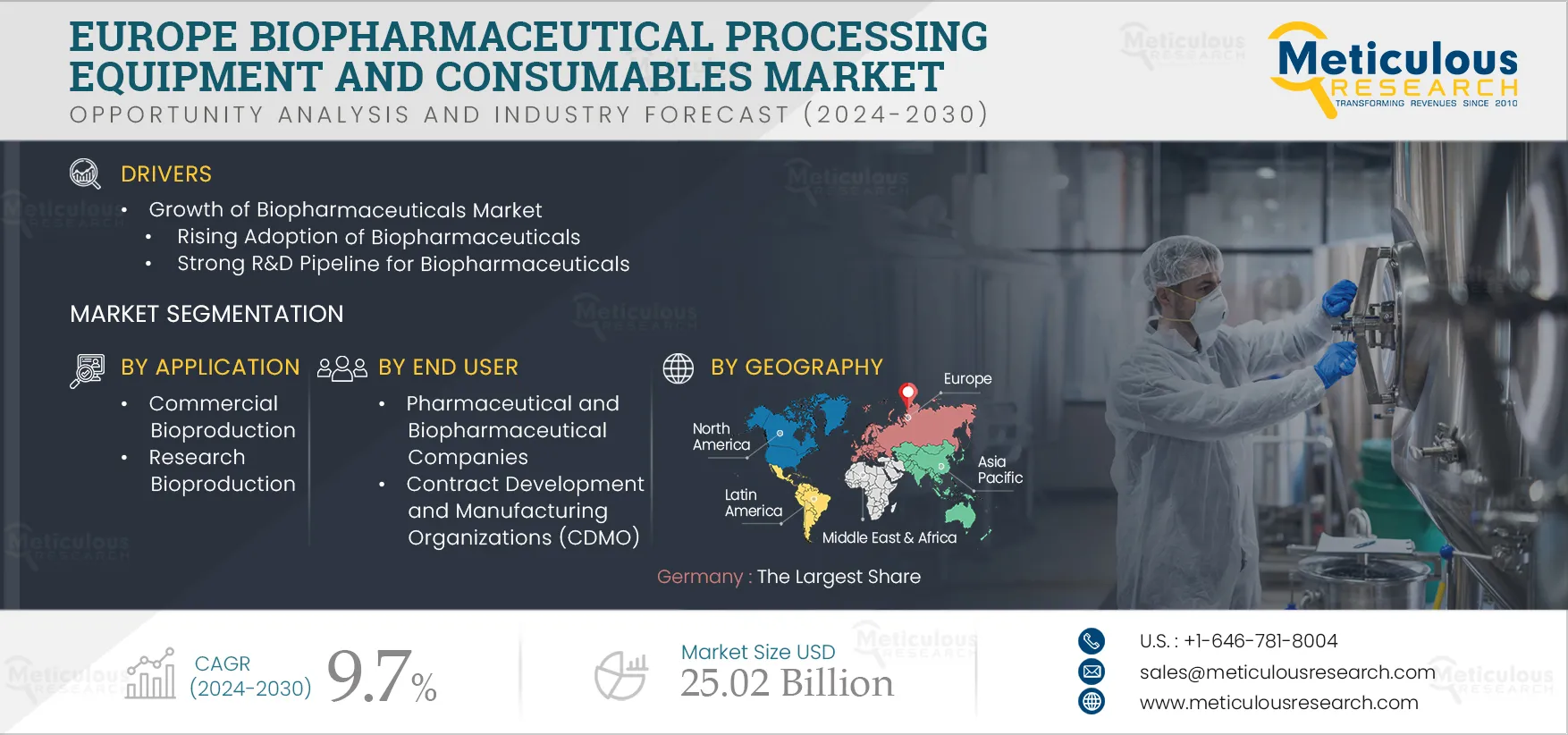

Report ID: MRHC - 104868 Pages: 150 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Biopharmaceutical Processing Equipment and Consumables Market is expected to grow at a CAGR of 9.7% from 2025 to 2032 to reach $25.02 billion by 2032. Biopharmaceutical processing involves the study of the discovery, development, and processing of complex medicines using living cells and organisms. Biopharmaceuticals include vaccines, whole blood and blood components, gene therapies, recombinant therapeutic proteins, and somatic cells.

Biopharmaceutical processing uses equipment such as filtration systems, chromatography equipment and consumables, bioreactors, cell culture systems, mixing systems, bioprocessing containers, sterilizers, centrifuges, incubators, biosafety cabinets, and other equipment like membrane adsorbers, cell disruption reagents, pipettes, syringes, vials, closures, tubing, connectors, and sensors for commercial and research-based bioproduction.

The growth of this market is driven by factors such as the growth of the biopharmaceuticals market, capacity expansions of biopharmaceutical plants, and the growing adoption of single-use bioprocessing equipment. However, biopharmaceuticals' complex development and manufacturing process restrain the market’s growth.

Furthermore, the shift towards Bioprocessing 4.0 and the rising adoption of personalized medicine are expected to offer significant market growth opportunities. The intensive capital requirements for biopharmaceutical production pose a major challenge to the market’s growth. The trends for the Europe biopharmaceutical processing equipment and consumables market are the use of disposable processing equipment for commercial production and rising focus on continuous bioprocessing.

So far, the biopharmaceutical processing industry has been dominated by stainless-steel/reusable equipment in Europe. Most biopharmaceutical manufacturing plants in the region have fixed stainless-steel bioreactors, mixers, and bioprocessing vessels. However, in the last few years, the trend has shifted towards adopting single-use/disposable equipment. This is attributed to various advantages this equipment has over conventional stainless-steel equipment, such as reduced manufacturing costs (by eliminating cleaning and cleaning validation steps).

Besides reducing the time and labor required, single-use technologies also help reduce capital costs and energy consumption, improving efficiency. Although single-use systems generate waste from incinerating and discarding plastic materials, they still leave a smaller carbon footprint than permanent steel systems. The carbon dioxide released after generating steam for water for injection (WFI) cleaning and the steam-in-place sterilization of stainless-steel vessels, piping, and other hardware are far more than the carbon dioxide produced from manufacturing and disposal of plastic single-use systems. Thus, the usage of WFI, steam, and cleaning agents is reduced significantly by incorporating single-use platforms.

Single-use systems (SUS) are used clinically for over 80% of European bioprocessing operations. However, biomanufacturers and contract manufacturing organizations (CMOs) are expected to adopt such systems more as pipeline SUS products are increasingly approved and enter commercial production.

Click here to: Get a Free Sample Copy of this Report

Growing Focus on Continuous Bioprocessing to Drive the Growth of this Market

For a long time, batch/fed-batch mode has dominated the manufacturing of biopharmaceuticals in Europe. However, it has some limitations - it requires additional instruments for feedback control and is costly operation costs compared to continuous bioprocessing. In continuous bioprocessing, the process is performed at a single location without interruption, as there is a continuous flow of raw materials in and out of the bioreactor with the processing of the intermediate or final product—in contrast to batch culture—in which specific quantity of product is produced in a discrete volume during the same cycle of manufacture, and the process is frequently segmented into many individual steps that are often performed at separate facilities.

Moreover, continuous processing produces a quality end product with no variation and offers steady-state operation, reduced equipment size, streamlined process flow, and reduced capital costs. Due to the growing demand for innovative and complex therapies and the growing competition in the European biopharmaceuticals market, biopharmaceutical manufacturers are reconsidering manufacturing methods (shifting from batch to continuous manufacturing). Although batch manufacturing is preferred, continuous manufacturing is increasingly accepted in the pharmaceutical industry due to its commercial advantages.

Among the Product Types, The Filtration Systems Segment is Expected to Account for the Largest Share of the Market in 2025

Among the product type, in 2025, the filtration systems segment is expected to account for the largest share of the Europe biopharmaceutical processing equipment and consumables market. The process of filtration is the basic requisite across all stages of bioproduction. Filtration is commonly used in biopharmaceutical processing for separating components. It is used in various downstream operations, such as clarification, filtration of intermediates, critical final filling applications, or upstream processing for sterilizing-grade filtration of cell culture media. The largest share of this segment is attributed to the frequent use of filtration at every step in bioprocessing and technological advancements in filtration technologies.

Among the Applications, The Commercial Bioproduction Segment is Projected to Grow at the Highest CAGR Over the Forecast Period

Among the applications, the commercial bioproduction segment is estimated to grow at the highest CAGR during the forecast period. Growing initiatives supporting the adoption of biopharmaceuticals, rising biopharmaceutical manufacturing outsourcing, and accelerated developments in personalized therapies are some drivers for this segment's growth. Trelleborg AB (Sweden) expanded its biopharmaceutical manufacturing capabilities to extend capabilities in the future in Europe. This is likely to enhance the demand for bioprocessing equipment and consumables for the commercial bioproduction of monoclonal antibodies (mAbs), vaccines, gene therapies, and recombinant protein-based are the factors contributing to the largest share of this segment.

Among the End Users, The Pharmaceutical and Biopharmaceutical Companies Segment is Expected to Account for the Largest Share of the Market in 2025

Among the end users, in 2025, the pharmaceutical and biopharmaceutical companies segment is expected to account for the largest share of Europe Biopharmaceutical Processing Equipment and Consumables market. The capacity expansion of biopharmaceutical manufacturers and the growing adoption of biopharmaceutical processing equipment for bioproduction is the key factor for the largest market share. The development and manufacturing of biopharmaceuticals are gaining pace. Thus, growing manufacturing by biopharmaceutical companies has driven the demand for biopharmaceutical processing equipment and consumables.

Germany: To Account for the Largest Market Share in 2025

In 2025, Germany is expected to account for the largest share of the Europe biopharmaceutical processing equipment and consumables market. The large share is primarily attributed to an increase in pharmaceutical export, government grants, and funding to biotech and biopharmaceutical companies' expansion to meet the increasing market demand. For instance, in 2021, BioNTech SE (Germany) opened a new manufacturing facility in Hamburg, Germany, which acts as a manufacturing and storage facility for BioNTech and Pfizer’s COVID-19 vaccine. In 2021, Baxter Biopharma Solutions LLC (U.S.) invested USD 100 million to expand the fill-finish capabilities of their plant in Halle/Westfalen, Germany.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that led market participants to adopt over the past three years. The key players profiled in the Europe biopharmaceutical processing equipment and consumables market report are Sartorius AG (Germany), Merck KGaA (Germany), Eppendorf AG (Germany), Solaris Biotechnology Srl (Italy), Thermo Fisher Scientific Inc. (U.S.), 3M Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Agilent Technologies, Inc (U.S.), Repligen Corporation (U.S.), and Danaher Corporation (U.S.)

Scope of the Report:

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Product Type

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Application

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by End User

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Country

Key questions answered in the report:

This study offers a detailed assessment of the Europe biopharmaceutical processing equipment and consumables market, including the market size & forecast for various segmentation like mode of product type, application, and end user. The Europe biopharmaceutical processing equipment and consumables market studied in this report also involve the value analysis of various segments and sub-segments of biopharmaceutical processing equipment and consumables at country levels.

The Europe biopharmaceutical processing equipment and consumables market is projected to reach $25.02 billion by 2032, at a CAGR of 9.7% during the forecast period.

In 2025, the filtration systems segment is expected to account for the largest share of the Europe biopharmaceutical processing equipment and consumables market. The large market share of this segment is attributed to the frequent use of filtration at every step in bioprocessing and technological advancements in filtration technologies.

Among the applications, the commercial bioproduction segment is expected to grow at the highest CAGR over the forecast period. A large number of biopharmaceuticals in clinical development and nearing patent expirations of biologics are the key factors supporting the market growth.

The growth of this market is driven by factors growth of the biopharmaceuticals market, capacity expansions of biopharmaceutical plants, and the growing adoption of single-use bioprocessing equipment. Moreover, the shift towards Bioprocessing 4.0 and the rising adoption of personalized medicines are expected to offer significant market growth opportunities.

The key players profiled in the Europe biopharmaceutical processing equipment and consumables market report are Sartorius AG (Germany), Merck KGaA (Germany), Eppendorf AG (Germany), Solaris Biotechnology Srl (Italy), Thermo Fisher Scientific Inc. (U.S.), 3M Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Agilent Technologies, Inc (U.S.), Repligen Corporation (U.S.), and Danaher Corporation (U.S.)

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Factors Affecting Market Growth

4.1. Overview

4.2. Drivers

4.2.1. Growth of Biopharmaceuticals Market

4.2.1.1. Rising Adoption of Biopharmaceuticals

4.2.1.2. Strong R&D Pipeline for Biopharmaceuticals

4.2.1.3. Government Initiatives

4.3. Restraints

4.3.1. Complex Development and Manufacturing Process of Biopharmaceuticals

4.4. Opportunities

4.4.1. Shift Towards Bioprocessing 4.0

4.4.2. The Rising Adoption of Personalized Medicines

4.5. Challenges

4.5.1. Intensive Capital Requirements for Biopharmaceuticals Production

4.5.2. Data Security and Privacy Concerns

4.6. Market Trends

4.6.1. Use of Disposable Processing Equipment for Commercial Production

4.6.2. Rising Focus on Continuous Bioprocessing

4.7. Regulatory Analysis

4.8. Porter’s Five Forces Analysis

4.9. Pricing Analysis

4.10. Factor Analysis

5. Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Product Type

5.1. Overview

5.2. Filtration Systems

5.3. Chromatography Equipment and Consumables

5.3.1. Chromatography Consumables

5.3.2. Chromatography Equipment

5.4. Bioreactors

5.4.1. Reusable Bioreactors

5.4.2. Disposable/Single-use Bioreactors

5.5. Cell Culture Products

5.5.1. Cell Culture media

5.5.1.1. Cell Culture Media, by Physical Form

5.5.1.1.1. Dry Powder Media

5.5.1.1.2. Liquid Media

5.5.1.2. Cell Culture Media, by Type

5.5.1.2.1. Off-the-shelf Media

5.5.1.2.2. Custom Media

5.5.1.3. Cell Culture Media, by Source

5.5.1.3.1. Chemically Defined Media

5.5.1.3.2. Natural Media

5.5.2. Reagents and Supplements

5.5.3. Cells and Cell Lines

5.5.4. Cell Culture Serum

5.6. Bioprocessing Containers (BPC)

5.7. Sterilizers

5.8. Mixers/Mixing Systems

5.9. Incubators

5.10. Centrifuges

5.11. Shakers

5.12. Biosafety Cabinets

5.13. Other Consumables and Accessories

5.14. Services

6. Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Application

6.1. Overview

6.2. Commercial Bioproduction

6.2.1. Monoclonal Antibody Production

6.2.2. Therapeutic Protein Production

6.2.3. Vaccine Production

6.2.4. Cell and Gene Therapy

6.3. Research Bioproduction

7. Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by End User

7.1. Overview

7.2. Pharmaceutical and Biopharmaceutical Companies

7.3. Contract Development and Manufacturing Organizations (CDMOs)

7.4. Academia and Research Institutes

8. Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Country

8.1. Overview

8.2. Germany

8.3. France

8.4. U.K.

8.5. Italy

8.6. Switzerland

8.7. Spain

8.8. Ireland

8.9. Denmark

8.10. Belgium

8.11. Rest of Europe

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Vendor Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

9.5. Market Share Analysis /Market Rankings (2022)

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

10.1. Sartorius AG

10.2. Merck KGaA

10.3. Eppendorf AG

10.4. Solaris Biotechnology Srl

10.5. Thermo Fisher Scientific Inc.

10.6. 3M Company

10.7. Bio-Rad Laboratories, Inc.

10.8. Agilent Technologies, Inc

10.9. Repligen Corporation

10.10. Danaher Corporation

(Note: SWOT analysis is provided for leading 5 companies.)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 2 Europe Filtration Systems Market, by Country, 2021–2032 (USD Million)

Table 3 Europe Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 4 Europe Chromatography Equipment and Consumables Market, by Country, 2021–2032 (USD Million)

Table 5 Europe Chromatography Consumables Market, by Country, 2021–2032 (USD Million)

Table 6 Europe Chromatography Equipment Market, by Country, 2021–2032 (USD Million)

Table 7 Europe Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 8 Europe Bioreactors Market, by Country, 2021–2032 (USD Million)

Table 9 Europe Single-use Bioreactors Market, by Country, 2021–2032 (USD Million)

Table 10 Europe Reusable Bioreactors Market, by Country, 2021–2032 (USD Million)

Table 11 Europe Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 12 Europe Cell Culture Products Market, by Country, 2021–2032 (USD Million)

Table 13 Europe Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 14 Europe Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 15 Europe Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 16 Europe Cell Culture Media Market, by Country, 2021–2032 (USD Million)

Table 17 Europe Dry Powder Cell Culture Media Market, by Country, 2021–2032 (USD Million)

Table 18 Europe Liquid Cell Culture Media Market, by Country, 2021–2032 (USD Million)

Table 19 Europe off-the-shelf Cell Culture Media Market, by Country, 2021–2032 (USD Million)

Table 20 Europe Custom Cell Culture Media Market, by Country, 2021–2032 (USD Million)

Table 21 Europe Chemically Defined Cell Culture Media Market, by Country, 2021–2032 (USD Million)

Table 22 Europe Natural Media Market, by Country, 2021–2032 (USD Million)

Table 23 Europe Cell Culture Reagents and Supplements Market, by Country, 2021–2032 (USD Million)

Table 24 Europe Cells and Cell Lines Market, by Country, 2021–2032 (USD Million)

Table 25 Europe Cell Culture Serum Market, by Country, 2021–2032 (USD Million)

Table 26 Europe Bioprocessing Containers Market, by Country, 2021–2032 (USD Million)

Table 27 Europe Sterilizers Market, by Country, 2021–2032 (USD Million)

Table 28 Europe Mixers/Mixing Systems Market, by Country, 2021–2032 (USD Million)

Table 29 Europe Incubators Market, by Country, 2021–2032 (USD Million)

Table 30 Europe Centrifuges Market, by Country, 2021–2032 (USD Million)

Table 31 Europe Shakers Market, by Country, 2021–2032 (USD Million)

Table 32 Europe Biosafety Cabinets Market, by Country, 2021–2032 (USD Million)

Table 33 Europe Other Consumables and Accessories Market, by Country, 2021–2032 (USD Million)

Table 34 Europe Bioprocessing Services Market, by Country, 2021–2032 (USD Million)

Table 35 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 36 Europe Commercial Biopharmaceutical Processing Equipment and Consumables Market, by Application Type, 2021–2032 (USD Million)

Table 37 Europe Commercial Biopharmaceutical Processing Equipment and Consumables Market, by Country, 2021–2032 (USD Million)

Table 38 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Monoclonal Antibody Production, by Country, 2021–2032 (USD Million)

Table 39 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Therapeutic Protein Production, by Country, 2021–2032 (USD Million)

Table 40 Europe Biopharmaceutical Processing Equipment Market Size for Vaccine Production, by Country, 2021–2032 (USD Million)

Table 41 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Cell and Gene Therapy, by Country, 2021–2032 (USD Million)

Table 42 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Research Bioproduction, by Country, 2021–2032 (USD Million)

Table 43 Europe Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 44 Europe Biopharmaceutical Processing Equipment and Consumables Market for Pharmaceutical and Biopharmaceutical Companies, by Country, 2021–2032 (USD Million)

Table 45 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Contract Development and Manufacturing Organizations (CDMOs), by Country, 2021–2032 (USD Million)

Table 46 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Academia and Research Institutes, by Country, 2021–2032 (USD Million)

Table 47 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Country, 2021–2032 (USD Million)

Table 48 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 49 Europe Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 50 Europe Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 51 Europe Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 52 Europe Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 53 Europe Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 54 Europe Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 55 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 56 Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 57 Europe Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 58 Germany: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 59 Germany: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 60 Germany: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 61 Germany: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 62 Germany: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 63 Germany: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 64 Germany: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 65 Germany: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 66 Germany: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 67 Germany: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 68 France: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 69 France: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 70 France: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 71 France: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 72 France: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 73 France: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 74 France: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 75 France: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (US

Table 76 France: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 77 France: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 78 U.K.: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 79 U.K.: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 80 U.K.: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 81 U.K.: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 82 U.K.: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 83 U.K.: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 84 U.K.: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 85 U.K.: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 86 U.K.: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 87 U.K.: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 88 Italy: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 89 Italy: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 90 Italy: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 91 Italy: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 92 Italy: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 93 Italy: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 94 Italy: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 95 Italy: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 96 1Italy: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 97 Italy: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 98 Switzerland: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 99 Switzerland: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 100 Switzerland: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 101 Switzerland: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 102 Switzerland: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 103 Switzerland: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 104 Switzerland: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 105 Switzerland: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 106 Switzerland: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 107 Switzerland: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 108 Spain: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 109 Spain: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 110 Spain: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 111 Spain: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 112 Spain: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 113 Spain: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 114 Spain: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 115 Spain: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 116 Spain: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 117 Spain: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 118 Ireland: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 119 Ireland: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 120 Ireland: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 121 Ireland: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 122 Ireland: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 123 Ireland: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 124 Ireland: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 125 Ireland: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 126 Ireland: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 127 Ireland: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 128 Denmark: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 129 Denmark: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 130 Denmark: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 131 Denmark: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 132 Denmark: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 133 Denmark: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 134 Denmark: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 135 Denmark: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 136 Denmark: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 137 Denmark: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 138 Belgium: Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 139 Belgium: Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 140 Belgium: Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 141 Belgium: Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 142 Belgium: Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 143 Belgium: Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 144 Belgium: Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 145 Belgium: Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 146 Belgium: Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 147 Belgium: Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 148 Rest of Europe Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2021–2032 (USD Million)

Table 149 Rest of Europe Chromatography Equipment and Consumables Market, by Type, 2021–2032 (USD Million)

Table 150 Rest of Europe Bioreactors Market, by Type, 2021–2032 (USD Million)

Table 151 Rest of Europe Cell Culture Products Market, by Type, 2021–2032 (USD Million)

Table 152 Rest of Europe Cell Culture Media Market, by Physical Form, 2021–2032 (USD Million)

Table 153 Rest of Europe Cell Culture Media Market, by Type, 2021–2032 (USD Million)

Table 154 Rest of Europe Cell Culture Media Market, by Source, 2021–2032 (USD Million)

Table 155 Rest of Europe Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2021–2032 (USD Million)

Table 156 Rest of Europe Biopharmaceutical Processing Equipment and Consumables Market Size for Commercial Bioproduction, by Type, 2021–2032 (USD Million)

Table 157 Rest of Europe Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2021–2032 (USD Million)

Table 158 Recent Developments, by Company, 2020–2025

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation

Figure 7 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2025–2032 (USD Million)

Figure 8 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2025–2032 (USD Million)

Figure 9 Europe Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2025–2032 (USD Million)

Figure 10 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Country 2025–2032 (USD Million)

Figure 11 Impact Analysis: Europe Biopharmaceutical Processing Equipment and Consumables Market Size Market

Figure 12 Market Dynamics: Europe Biopharmaceutical Processing Equipment and Consumables Market Size Market

Figure 13 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Product Type, 2025–2032 (USD Million)

Figure 14 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Application, 2025–2032 (USD Million)

Figure 15 Europe Biopharmaceutical Processing Equipment and Consumables Market, by End User, 2025–2032 (USD Million)

Figure 16 Europe Biopharmaceutical Processing Equipment and Consumables Market, by Country, 2025–2032 (USD Million)

Figure 17 Europe Biopharmaceutical Processing Equipment and Consumables Market Snapshot

Figure 18 Key Growth Strategies Adopted by Leading Players (2020–2025)

Figure 19 Europe Biopharmaceutical Processing Equipment and Consumables Market: Vendor Dashboard

Figure 20 Europe Biopharmaceutical Processing Equipment and Consumables Market: Competitive Benchmarking, by Product Type

Figure 21 Market Share Analysis: Europe Biopharmaceutical Processing Equipment and Consumables Market (2022)

Figure 22 Thermo Fisher Scientific Inc.: Financial Overview (2022)

Figure 23 3M Company: Financial Overview (2022)

Figure 24 Bio-Rad Laboratories, Inc.: Financial Overview (2022)

Figure 25 Danaher Corporation: Financial Overview (2022)

Figure 26 Agilent Technologies, Inc.: Financial Overview (2022)

Figure 27 Repligen Corporation: Financial Overview (2022)

Figure 28 Sartorius AG: Financial Overview (2022)

Figure 29 Merck KGaA: Financial Overview (2022)

Figure 30 Eppendorf AG: Financial Overview (2022)

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates