Resources

About Us

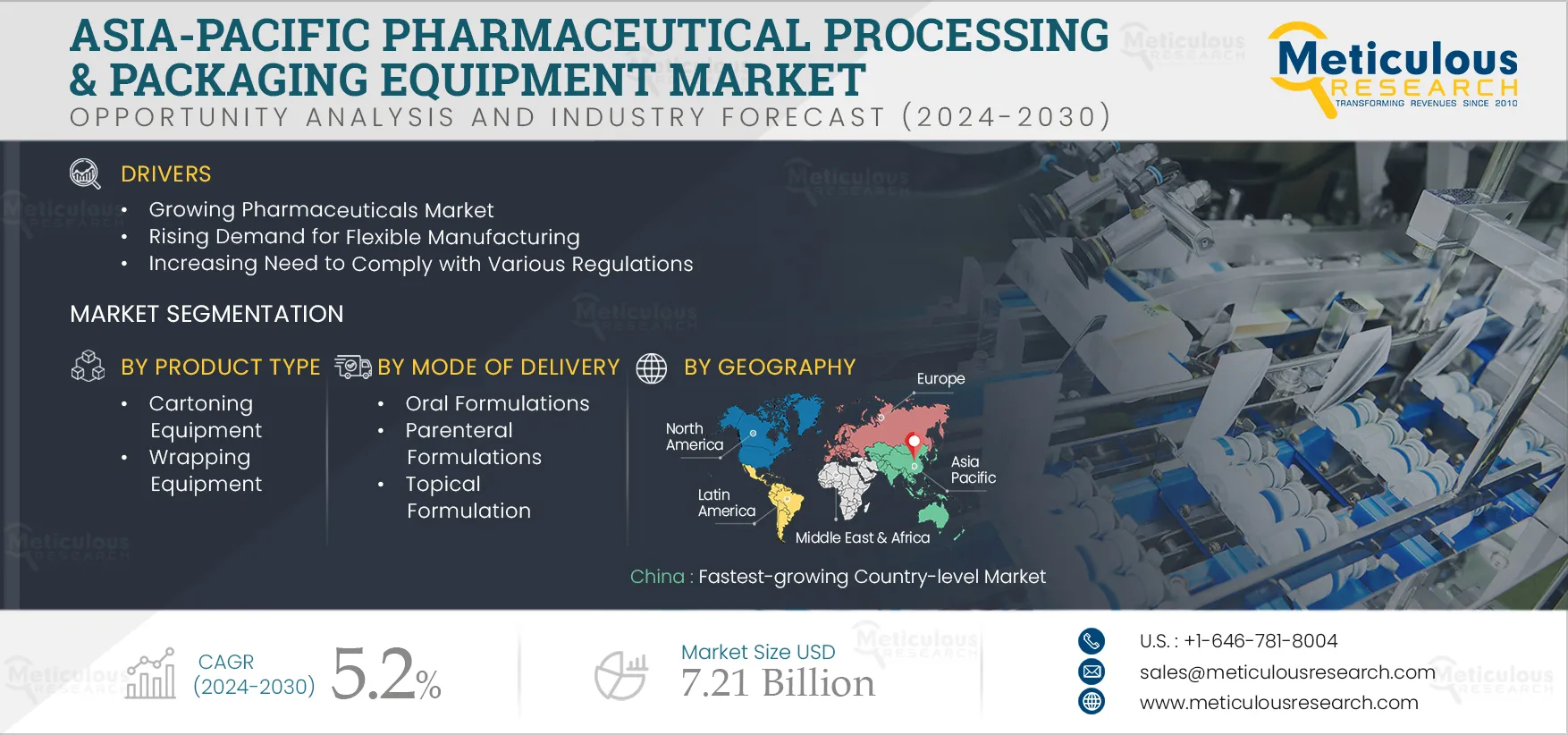

Asia-Pacific Pharmaceutical Processing and Packaging Equipment Market by Mode of Delivery (Oral [Solid, Liquid], Parenteral, Topical), Secondary (Cartoning, Labelling, Serialization, Wrapping) and Tertiary (Palletizing, De-Palletizing) - Forecast to 2032

Report ID: MRHC - 104931 Pages: 220 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Pharmaceutical Processing and Packaging Equipment Market is projected to reach $7.21 billion by 2032, at a CAGR of 5.2% from 2025 to 2032. Pharmaceutical processing & packaging equipment plays a crucial role in ensuring the quality and safety of pharmaceutical products. These machines are designed to meet strict industry standards and regulations, ensuring that the drugs produced are safe, effective, and high-quality. Packaging equipment provides protective barriers that safeguard the integrity of drugs during storage, transportation, and distribution.

The growth of the Asia-Pacific pharmaceutical processing & packaging equipment market is driven by several factors, such as the growing pharmaceutical market, rising demand for flexible manufacturing, increasing need to comply with various regulations and the trend of contract manufacturing in the pharmaceutical sector. Factors such as emerging pharmaceutical manufacturing hotspots and growing pharmaceutical R&D spending are opportunities that would help grow the market. Changing market demands in the constantly evolving pharmaceutical space could be a challenge for the pharmaceutical processing & packaging equipment market. However, the preference for refurbished equipment restrains the growth of the market.

Click here to: Get Free Sample Pages of this Report

Rising Demand for Flexible Manufacturing Drives the Asia-Pacific Pharmaceutical Processing & Packaging Equipment

Recent pharmaceutical trends support the development of specialized products for small groups of patients. Regulatory agencies support this trend by expediting drug approvals. Further, the increasing focus of pharmaceutical companies on cost control coupled with unpredictable demand for pharmaceuticals has created a need for more agile and flexible pharmaceutical manufacturing facilities. The emergence of continuous manufacturing and single-use technologies has supported the development of flexible manufacturing facilities, allowing for pharmaceutical processing and packaging innovation.

Fast-track drug approval programs and the need for operational flexibility among pharmaceutical companies and CMOs further support adopting flexible manufacturing processes. Orphan drug development is gaining traction due to its incentivization by regulatory authorities, accelerated drug approvals, and the exclusivity of molecules. Orphan drug developers focus on shortening the clinical development phase, wherein processes involving chemistry, manufacturing, control development, scale-up, validation, tech transfer, and stability testing must be completed rapidly after securing initial regulatory approval. Moreover, orphan drug development programs contribute to the increased adoption of orphan drugs. Similar to the U.S. Orphan Drug Act, Asian countries have been implementing a framework of such rules to accelerate the registration approval of new drugs to treat rare diseases. Orphan Drug Legislation is used in countries such as Japan, South Korea, and Taiwan. Such factors have increased the demand for flexible manufacturing in the pharmaceutical sector.

Thus, the increasing preference for specialized therapies among patients has boosted the adoption of flexible manufacturing practices involving single-use systems, continuous manufacturing systems, and modular facilities.

The rising Geriatric Population Drives the Demand for Pharmaceutical Processing & Packaging Equipment

Growth in the aging population and the rapid increase in the burden of chronic and infectious diseases have increased the demand for pharmaceuticals. According to a report by United Nations, the population in Asia will reach up to 4.9 billion in 2032 from 4.4 billion in 2015. Also, according to the Asian Development Bank, by 2050, one in four people in Asia-Pacific will be over 60 years of age. Consistent growth in the aging population is increasing the burden of chronic diseases. Common conditions affecting the geriatric population include osteoarthritis, diabetes, heart diseases, chronic obstructive pulmonary disorders, depression, and dementia. The rising prevalence of these conditions is increasing the demand for pharmaceuticals, thereby driving the pharmaceutical processing and packaging equipment market.

Chronic diseases are a leading cause of disability, illness, and death globally, with cardiovascular diseases, cancer, diabetes, and chronic obstructive pulmonary diseases (COPD) being the most common chronic disorders. Cancer is the leading cause of death globally. According to GLOBOCAN, in Asia, the new cancer cases will reach 7,768,608 cases in 2032 from 5,509,098 cases in 2020 for the age group of 60 to 85+ years of age. Thus, the growing burden of chronic diseases has increased the consumption of pharmaceuticals, positively impacting the demand for pharmaceutical processing and packaging equipment.

Key Findings of the Asia-Pacific Pharmaceutical Processing & Packaging Equipment Market Study

In 2025, the Oral Formulations Segment is Expected to Dominate the Asia-Pacific Pharmaceutical Processing & Packaging Equipment Market

Among the modes of drug delivery, in 2025, the oral formulations segment is expected to account for the largest share of the Asia-Pacific pharmaceutical processing & packaging equipment market. Oral formulations include oral solid dosages and oral liquid dosages. Factors contributing to the segment’s largest share include patients' high preference for oral formulations due to their advantages, including ease of administration, high patient compliance, non-painful and better safety, lowest variability, and accurate dosing.

In 2025, the Cartoning Equipment Segment is Expected to Dominate the Asia-Pacific Secondary Packaging Equipment Market

Among the types of secondary packaging equipment, in 2025, the cartoning equipment segment is expected to account for the largest share of the Asia-Pacific pharmaceutical processing and packaging equipment market. Cartoning equipment packs primarily packaged pharmaceuticals to provide extra protection. It helps protect the products during shipment in a very cost-effective & efficient way. Regulatory agencies, such as China Food and Drug Administration (CFDA), also recommend using secondary packaging of pharmaceuticals, such as cartons, to protect the medicines from moisture, light, or any possible contaminants. Hence, cartons are considered an ideal secondary packaging for product handling, increasing their utilization thereby contributing to the segment’s largest share. Some of the other regulatory bodies in Asia-Pacific include the National Agency of Drug and Food Control (NADFC) in Indonesia, the Drug Administrative Department of Vietnam (DAV), and the Health Science Authority (HSA) Singapore, among others.

In 2025, the Case Packaging Equipment Segment is Expected to Dominate the Asia-Pacific End-of-Line Packaging Equipment Market

Among the types of end-of-line packaging equipment, in 2025, the case packaging equipment segment is expected to account for the largest share of the Asia-Pacific pharmaceutical processing and packaging equipment market. Factors such as the importance of case packaging in bulk packaging, supply chain efficiency, automation benefits, versatility, and the high volume of production and expansions of supply chains contribute to the segment’s largest share.

China: Fastest-growing Country-level Market

Based on geography, China is slated to record the highest growth rate during the forecast period. The growth of this market is mainly driven by the growing aging population in the country and government initiatives for improving domestic manufacturing.

Key Players

The key players profiled in the pharmaceutical processing & packaging equipment market report are JEKSON VISION (India), Kevin Process Technologies Pvt. Ltd. (India), KIKUSUI SEISAKUSHO LTD. (Japan), Wenzhou Trustar Machinery Technology Co., Ltd (China), Sainty Co (China), ACG (India), Cadmach Machinery Co. Pvt. Ltd (India), Freund Corporation (Japan), Truking Technology Limited (China), Shibuya Corporation (Japan), and M.A.R. S.p.A. Macchine Automatiche Riempitrici (Italy).

The report includes a competitive landscape based on an extensive market assessment based on the mode of delivery, product types of secondary packaging equipment and end-of-line packaging equipment, and geography. The report also provides insights into the geographic presence of major market players and their key growth strategies in the last three to four years.

Scope of the Report:

Asia-Pacific Pharmaceutical Processing and Primary Packaging Equipment Market, by Mode of Delivery

Asia-Pacific Pharmaceutical Secondary Packaging Equipment Market, by Product Type

Asia-Pacific Pharmaceutical End-of-Line Packaging Equipment Market, by Product Type

Asia-Pacific Pharmaceutical Processing and Packaging Equipment Market, by Country

Key questions answered in the report:

This market study covers the market sizes & forecasts of the Asia-Pacific pharmaceutical processing & packaging equipment market based on mode of delivery, product types of secondary packaging equipment and end-of-line packaging equipment, and geography. This market study also provides the value analysis of various segments and subsegments of the Asia-Pacific pharmaceutical processing & packaging equipment market at regional and country levels.

The Asia-Pacific pharmaceutical processing & packaging equipment market is projected to reach $7.21 billion by 2032, at a CAGR of 5.2% during the forecast period.

The oral formulations segment is expected to account for the largest share of the market in 2025. Factors such as ease of administration, high patient compliance, and non-invasive & accurate dosing support the largest share of this segment.

The growth of the Asia-Pacific pharmaceutical processing & packaging equipment market is driven by several factors, such as the growing pharmaceutical market, rising demand for flexible manufacturing, increasing need to comply with various regulations, and the growing trend of contract manufacturing in the pharmaceutical sector. Factors such as emerging pharmaceutical manufacturing hotspots and growing pharmaceutical R&D spending are some opportunities that would help grow the market. Changing market demands in the constantly evolving pharmaceutical space could be a challenge for the pharmaceutical processing & packaging equipment market. However, the preference for refurbished equipment restrains the growth of the market.

The key players profiled in the Asia-Pacific pharmaceutical processing & packaging equipment market report are JEKSON VISION (India), Kevin Process Technologies Pvt. Ltd. (India), KIKUSUI SEISAKUSHO LTD. (Japan), Wenzhou Trustar Machinery Technology Co., Ltd (China), Sainty Co (China), ACG (India), Cadmach Machinery Co. Pvt. Ltd (India), Freund Corporation (Japan), Truking Technology Limited (China), Shibuya Corporation (Japan), and M.A.R. S.p.A. Macchine Automatiche Riempitrici (Italy).

Emerging economies from Asia-Pacific, such as China and India, are projected to offer significant growth opportunities for vendors operating in this market. This growth is mainly due to the highest population number in Asia, which leads to an increased customer pool and an increased number of manufacturers across Asia-Pacific.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates