Resources

About Us

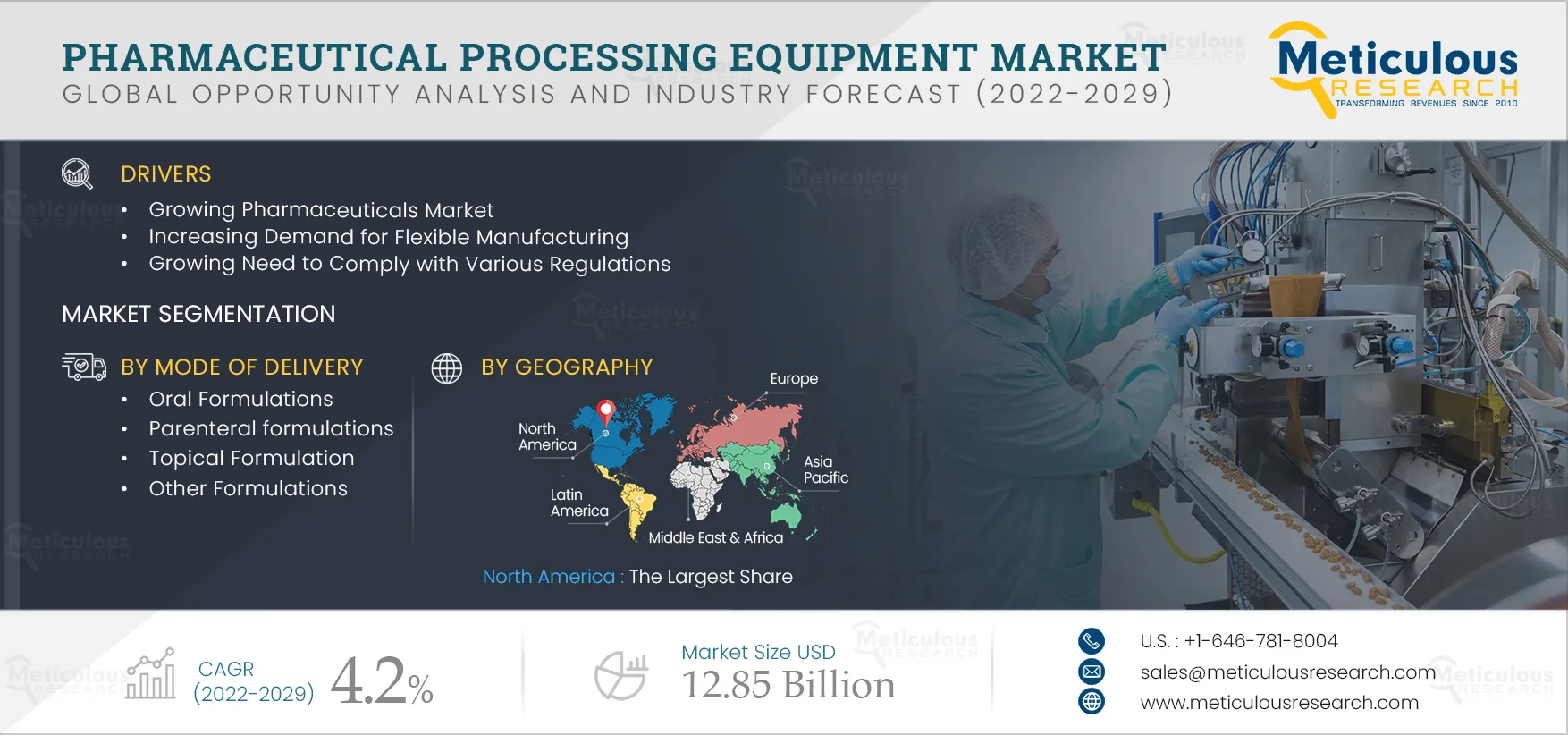

Pharmaceutical Processing Equipment Market by Mode of Delivery (Oral [OSDs {Coating, Milling}, Oral Liquid Dosages {Filtration Units}], Parenterals [SIP, CIP, Process Systems], Topicals [Agitators, Homogenizers, Colloid Mills]) - Global Forecasts to 2029

Report ID: MRHC - 104610 Pages: 400 Jun-2022 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Pharmaceutical Processing Equipment Market is projected to grow at a CAGR of 4.2% from 2022 to 2029 and is expected to reach $12.85 billion by 2029. Pharmaceutical processing includes a range of unit operations such as blending, milling, granulation, tablet pressing, coating, and filling, depending on the mode of delivery. With the growing adoption of continuous manufacturing and the rising number of novel therapies in clinical development, pharmaceutical equipment is becoming a central inflection point for developing new therapies. New types of therapies entering the clinical pipeline and orphan drug designation are driving the technological innovations in pharmaceutical processing. Apart from the technological innovations, the growing pharmaceutical market, a trend of flexible manufacturing, and rising contract manufacturing of pharmaceuticals are the factors driving the pharmaceutical processing equipment market.

Pharmaceutical manufacturing is witnessing a rapid transition. Prevalent trends in pharmaceutical manufacturing include low volume production, an increase in the pharmaceutical manufacturing process, and the growing adoption of digital and single-use technologies.

The COVID-19 pandemic has positively impacted the pharmaceutical processing equipment market. It has increased the demand for therapeutics for fighting the COVID-19 outbreak. Several pharmaceutical manufacturers are expanding their manufacturing facilities due to the significant demand for vaccines and medicines for the novel coronavirus. Pharmaceutical manufacturing is also outsourcing operations to meet the growing market demand. This strategy is expected to improve the demand for new processing equipment.

Pharmaceutical manufacturing was lagging in various countries because of the disruption created in the supply chain due to the COVID-19 pandemic. To tackle this situation, the public organizations of various countries have focused on decreasing the dependency on imports by domestic pharmaceutical manufacturing. The reshoring manufacturing opportunities would be developed in Europe, the U.S., and Japan. Additionally, the government of these countries are also likely to develop preferred access regulations mandating the local supply of essential API and drugs using available financial grants.

Growing Trend of Contract Manufacturing in the Pharmaceutical Sector

Pharmaceutical companies face challenges such as controlling manufacturing costs and navigating stringent regulatory approval processes. The high consumption of small molecules for treating different diseases, the emergence of advanced technologies in the manufacture of finished dosage formulations, patent expirations of small molecules, and the rising demand for generics support the growth of contract manufacturing in the pharmaceutical sector. Small pharmaceutical companies also lack well-equipped infrastructure, advanced technologies, and high containment capabilities to produce pharmaceuticals, due to which they prefer outsourcing manufacturing operations to keep initial investments low. As manufacturing processes are becoming increasingly complex and stringent regulations are being imposed, pharmaceutical companies are developing long-term contracts with Contract Manufacturing Organizations (CMOs).

Pricing pressures in the pharmaceutical industry have driven pharmaceutical CMOs to establish operations in India, China, Singapore, South Korea, and Malaysia. The Government of India offers soft loans to support manufacturing facilities for CMOs in India. According to the Indian Drug Manufacturers’ Association (IDMA), India has the edge over other countries in producing basic medicinal products due to the availability of cost-effective resources, WHO-GMP-approved production facilities, and rapidly developing infrastructure. The CMOs that offshore operations to India can lower production costs by 40%.

Thus, the pricing pressures prevalent in the pharmaceutical industry and increased pharmaceutical production are expected to increase the focus on contract manufacturing.

By Mode of Delivery, in 2022 Oral Formulations Segment is Estimated to Generate the Largest Proportion of Revenue in the Pharmaceutical Processing Equipment Market

Based on the mode of delivery, the pharmaceutical processing equipment market segment is divided into oral, parenteral, topical, and other modes of delivery. Oral formulations is the most preferred mode of delivery, owing to its ease in consumption, convenience, safety, and cost-effectiveness. Furthermore, patients’ compliance is higher with this mode than with other delivery modes. The oral dosage forms also offer ease in large-scale manufacturing. Thus, based on these factors, the preference for oral formulations is likely to continue to increase during the forecast period.

North America: Largest Revenue Contributing Regional Market

Reshoring of pharmaceutical manufacturing in the U.S., expansion of manufacturing facilities, and agreements between pharmaceutical companies and CMOs to increase the availability of pharmaceuticals are the key factors contributing to the largest revenue share in North America. Additionally, an increase in the government funding to develop COVID-19-related-therapies is also driving the demand for innovative technologies in pharmaceutical processing.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by leading market participants in the industry over the past three years. The market players profiled in the global pharmaceutical processing equipment market report are ACG (India), Cadmach Machinery Company Private Limited (India), GEA GROUP (Germany), Sainty Co. (China), Syntegon Technology GmbH (Germany), Freund Corporation (Japan), ACIC Pharmaceuticals Inc. (Canada), Bausch+Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG (Germany), Fette Compacting GmbH (Germany), IDEX Corporation (U.S.), Kevin Process Technologies Private Limited (India), KIKUSUI SEISAKUSHO LTD. (Japan), KORSCH AG (Germany), MAQUINARIA INDUSTRIAL DARA, SL (Spain), and Marchesini Group S.p.A. (Italy).

Scope of the Report:

Pharmaceutical Processing Equipment Market, by Mode of Delivery

Pharmaceutical Processing Equipment Market, by Geography

Key Questions Answered in the Report:

This study offers a detailed assessment of the pharmaceutical processing equipment market, including the market sizes & forecasts. Furthermore, the pharmaceutical processing equipment is divided based on the mode of delivery into oral formulations, parenteral formulations, topical formulations, and others. The market sizes and forecasts for each of these categories have also been provided across five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa

The global pharmaceutical processing equipment market is projected to reach $12.85 billion by 2029, growing at a CAGR of 4.2% during the forecast period.

Based on the mode of delivery, the oral formulation segment is expected to command the largest market share of pharmaceutical processing equipment in 2022. Key factors attributing to the market growth are the ease of drug administration, cost-effectiveness, and better bioavailability of oral dosages.

The growth of this market is attributed to technological innovations in pharmaceutical manufacturing, the growing pharmaceuticals market, rising demand for flexible manufacturing, increasing need to comply with various regulations, and the growing trend of contract manufacturing in the pharmaceutical sector. Furthermore, factors such as, emerging pharmaceutical manufacturing hotspots, growing pharmaceutical R&D spending and expanding clinical pipelines offer market growth opportunities.

The key players operating in the global pharmaceutical processing equipment market are ACG (India), Cadmach Machinery Company Private Limited (India), GEA GROUP (Germany), Sainty Co. (China), Syntegon Technology GmbH (Germany), Freund Corporation (Japan), ACIC Pharmaceuticals Inc. (Canada), Bausch+Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG (Germany), Fette Compacting GmbH (Germany), IDEX Corporation (U.S.), Kevin Process Technologies Private Limited (India), KIKUSUI SEISAKUSHO LTD. (Japan), KORSCH AG (Germany), MAQUINARIA INDUSTRIAL DARA, SL (Spain), and Marchesini Group S.p.A. (Italy).

Emerging economies such as China and India are projected to offer significant growth opportunities for the vendors in this market.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates