Resources

About Us

Europe Biopharmaceutical Processing Equipment and Consumables Market by Product Type {Filtration, Chromatography [Consumables, Equipment], Disposable Bioreactors, Cell Culture Media, Shakers, Services), Application (Vaccine, mAb, R&D), and End User - Forecast to 2032

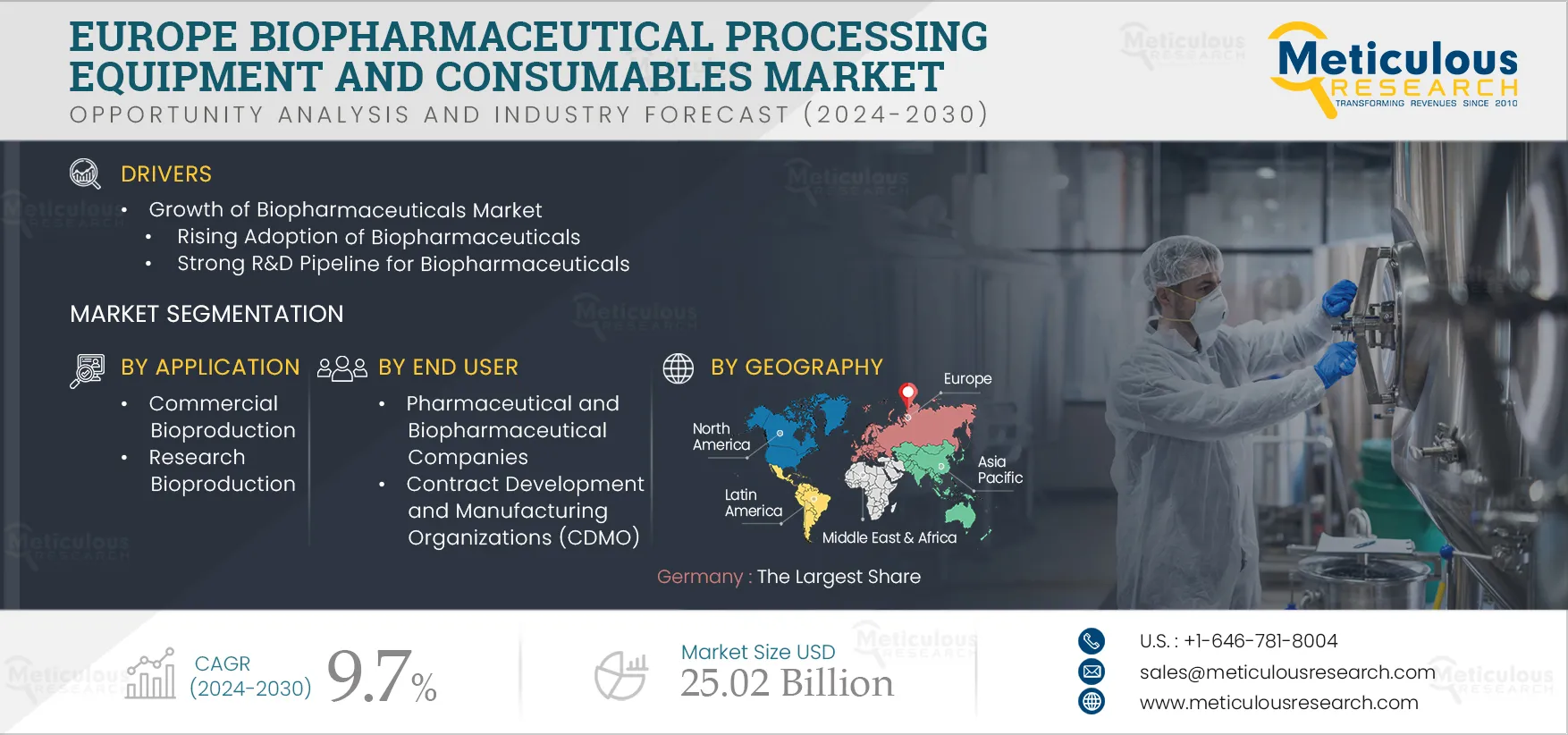

Report ID: MRHC - 104868 Pages: 150 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Biopharmaceutical Processing Equipment and Consumables Market is expected to grow at a CAGR of 9.7% from 2025 to 2032 to reach $25.02 billion by 2032. Biopharmaceutical processing involves the study of the discovery, development, and processing of complex medicines using living cells and organisms. Biopharmaceuticals include vaccines, whole blood and blood components, gene therapies, recombinant therapeutic proteins, and somatic cells.

Biopharmaceutical processing uses equipment such as filtration systems, chromatography equipment and consumables, bioreactors, cell culture systems, mixing systems, bioprocessing containers, sterilizers, centrifuges, incubators, biosafety cabinets, and other equipment like membrane adsorbers, cell disruption reagents, pipettes, syringes, vials, closures, tubing, connectors, and sensors for commercial and research-based bioproduction.

The growth of this market is driven by factors such as the growth of the biopharmaceuticals market, capacity expansions of biopharmaceutical plants, and the growing adoption of single-use bioprocessing equipment. However, biopharmaceuticals' complex development and manufacturing process restrain the market’s growth.

Furthermore, the shift towards Bioprocessing 4.0 and the rising adoption of personalized medicine are expected to offer significant market growth opportunities. The intensive capital requirements for biopharmaceutical production pose a major challenge to the market’s growth. The trends for the Europe biopharmaceutical processing equipment and consumables market are the use of disposable processing equipment for commercial production and rising focus on continuous bioprocessing.

So far, the biopharmaceutical processing industry has been dominated by stainless-steel/reusable equipment in Europe. Most biopharmaceutical manufacturing plants in the region have fixed stainless-steel bioreactors, mixers, and bioprocessing vessels. However, in the last few years, the trend has shifted towards adopting single-use/disposable equipment. This is attributed to various advantages this equipment has over conventional stainless-steel equipment, such as reduced manufacturing costs (by eliminating cleaning and cleaning validation steps).

Besides reducing the time and labor required, single-use technologies also help reduce capital costs and energy consumption, improving efficiency. Although single-use systems generate waste from incinerating and discarding plastic materials, they still leave a smaller carbon footprint than permanent steel systems. The carbon dioxide released after generating steam for water for injection (WFI) cleaning and the steam-in-place sterilization of stainless-steel vessels, piping, and other hardware are far more than the carbon dioxide produced from manufacturing and disposal of plastic single-use systems. Thus, the usage of WFI, steam, and cleaning agents is reduced significantly by incorporating single-use platforms.

Single-use systems (SUS) are used clinically for over 80% of European bioprocessing operations. However, biomanufacturers and contract manufacturing organizations (CMOs) are expected to adopt such systems more as pipeline SUS products are increasingly approved and enter commercial production.

Click here to: Get a Free Sample Copy of this Report

Growing Focus on Continuous Bioprocessing to Drive the Growth of this Market

For a long time, batch/fed-batch mode has dominated the manufacturing of biopharmaceuticals in Europe. However, it has some limitations - it requires additional instruments for feedback control and is costly operation costs compared to continuous bioprocessing. In continuous bioprocessing, the process is performed at a single location without interruption, as there is a continuous flow of raw materials in and out of the bioreactor with the processing of the intermediate or final product—in contrast to batch culture—in which specific quantity of product is produced in a discrete volume during the same cycle of manufacture, and the process is frequently segmented into many individual steps that are often performed at separate facilities.

Moreover, continuous processing produces a quality end product with no variation and offers steady-state operation, reduced equipment size, streamlined process flow, and reduced capital costs. Due to the growing demand for innovative and complex therapies and the growing competition in the European biopharmaceuticals market, biopharmaceutical manufacturers are reconsidering manufacturing methods (shifting from batch to continuous manufacturing). Although batch manufacturing is preferred, continuous manufacturing is increasingly accepted in the pharmaceutical industry due to its commercial advantages.

Among the Product Types, The Filtration Systems Segment is Expected to Account for the Largest Share of the Market in 2025

Among the product type, in 2025, the filtration systems segment is expected to account for the largest share of the Europe biopharmaceutical processing equipment and consumables market. The process of filtration is the basic requisite across all stages of bioproduction. Filtration is commonly used in biopharmaceutical processing for separating components. It is used in various downstream operations, such as clarification, filtration of intermediates, critical final filling applications, or upstream processing for sterilizing-grade filtration of cell culture media. The largest share of this segment is attributed to the frequent use of filtration at every step in bioprocessing and technological advancements in filtration technologies.

Among the Applications, The Commercial Bioproduction Segment is Projected to Grow at the Highest CAGR Over the Forecast Period

Among the applications, the commercial bioproduction segment is estimated to grow at the highest CAGR during the forecast period. Growing initiatives supporting the adoption of biopharmaceuticals, rising biopharmaceutical manufacturing outsourcing, and accelerated developments in personalized therapies are some drivers for this segment's growth. Trelleborg AB (Sweden) expanded its biopharmaceutical manufacturing capabilities to extend capabilities in the future in Europe. This is likely to enhance the demand for bioprocessing equipment and consumables for the commercial bioproduction of monoclonal antibodies (mAbs), vaccines, gene therapies, and recombinant protein-based are the factors contributing to the largest share of this segment.

Among the End Users, The Pharmaceutical and Biopharmaceutical Companies Segment is Expected to Account for the Largest Share of the Market in 2025

Among the end users, in 2025, the pharmaceutical and biopharmaceutical companies segment is expected to account for the largest share of Europe Biopharmaceutical Processing Equipment and Consumables market. The capacity expansion of biopharmaceutical manufacturers and the growing adoption of biopharmaceutical processing equipment for bioproduction is the key factor for the largest market share. The development and manufacturing of biopharmaceuticals are gaining pace. Thus, growing manufacturing by biopharmaceutical companies has driven the demand for biopharmaceutical processing equipment and consumables.

Germany: To Account for the Largest Market Share in 2025

In 2025, Germany is expected to account for the largest share of the Europe biopharmaceutical processing equipment and consumables market. The large share is primarily attributed to an increase in pharmaceutical export, government grants, and funding to biotech and biopharmaceutical companies' expansion to meet the increasing market demand. For instance, in 2021, BioNTech SE (Germany) opened a new manufacturing facility in Hamburg, Germany, which acts as a manufacturing and storage facility for BioNTech and Pfizer’s COVID-19 vaccine. In 2021, Baxter Biopharma Solutions LLC (U.S.) invested USD 100 million to expand the fill-finish capabilities of their plant in Halle/Westfalen, Germany.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that led market participants to adopt over the past three years. The key players profiled in the Europe biopharmaceutical processing equipment and consumables market report are Sartorius AG (Germany), Merck KGaA (Germany), Eppendorf AG (Germany), Solaris Biotechnology Srl (Italy), Thermo Fisher Scientific Inc. (U.S.), 3M Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Agilent Technologies, Inc (U.S.), Repligen Corporation (U.S.), and Danaher Corporation (U.S.)

Scope of the Report:

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Product Type

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Application

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by End User

Europe Biopharmaceutical Processing Equipment and Consumables Market Size & Trend Analysis, by Country

Key questions answered in the report:

This study offers a detailed assessment of the Europe biopharmaceutical processing equipment and consumables market, including the market size & forecast for various segmentation like mode of product type, application, and end user. The Europe biopharmaceutical processing equipment and consumables market studied in this report also involve the value analysis of various segments and sub-segments of biopharmaceutical processing equipment and consumables at country levels.

The Europe biopharmaceutical processing equipment and consumables market is projected to reach $25.02 billion by 2032, at a CAGR of 9.7% during the forecast period.

In 2025, the filtration systems segment is expected to account for the largest share of the Europe biopharmaceutical processing equipment and consumables market. The large market share of this segment is attributed to the frequent use of filtration at every step in bioprocessing and technological advancements in filtration technologies.

Among the applications, the commercial bioproduction segment is expected to grow at the highest CAGR over the forecast period. A large number of biopharmaceuticals in clinical development and nearing patent expirations of biologics are the key factors supporting the market growth.

The growth of this market is driven by factors growth of the biopharmaceuticals market, capacity expansions of biopharmaceutical plants, and the growing adoption of single-use bioprocessing equipment. Moreover, the shift towards Bioprocessing 4.0 and the rising adoption of personalized medicines are expected to offer significant market growth opportunities.

The key players profiled in the Europe biopharmaceutical processing equipment and consumables market report are Sartorius AG (Germany), Merck KGaA (Germany), Eppendorf AG (Germany), Solaris Biotechnology Srl (Italy), Thermo Fisher Scientific Inc. (U.S.), 3M Company (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Agilent Technologies, Inc (U.S.), Repligen Corporation (U.S.), and Danaher Corporation (U.S.)

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates