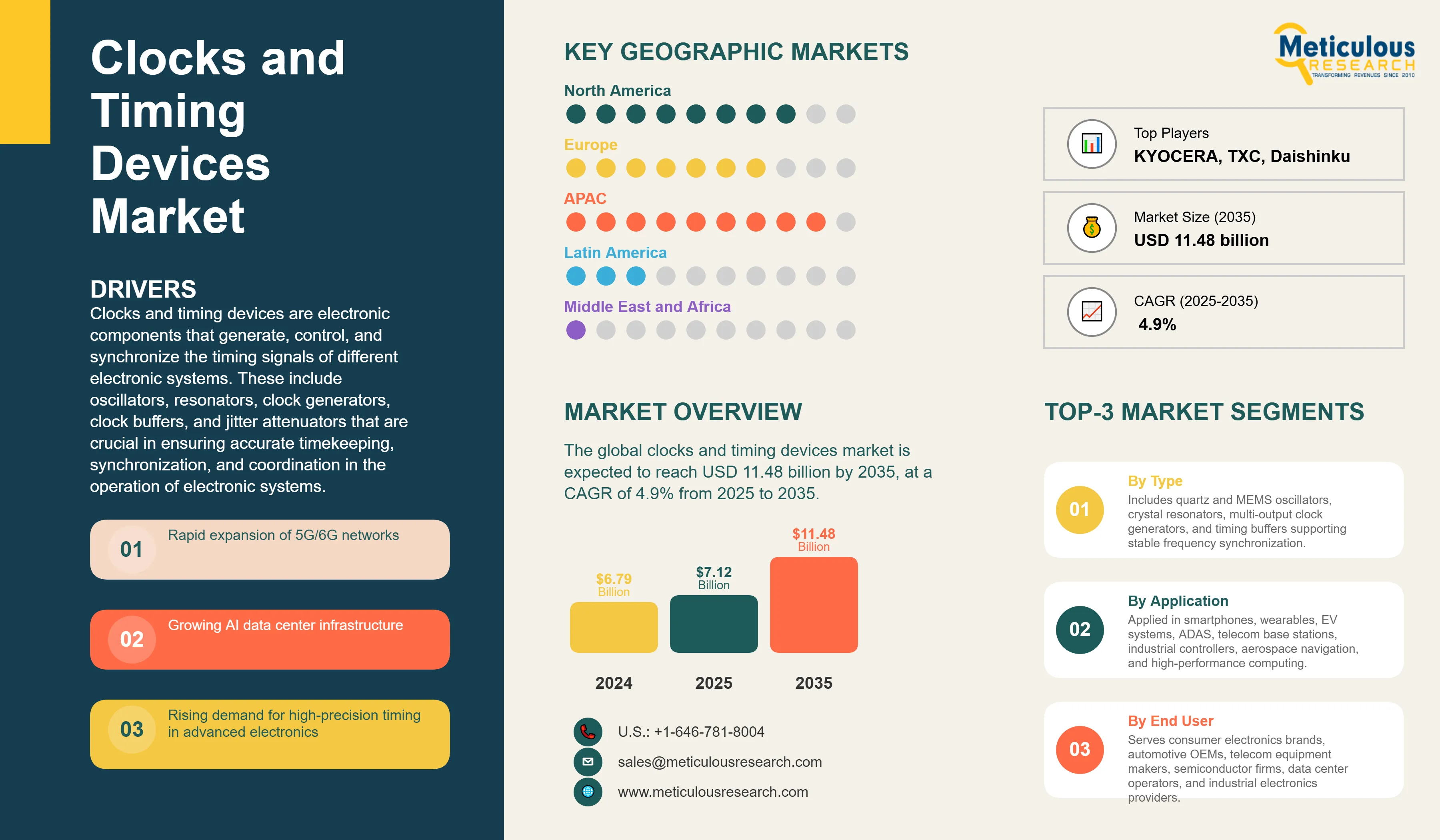

The global clocks and timing devices market is expected to reach USD 11.48 billion by 2035 from USD 7.12 billion in 2025, at a CAGR of 4.9% from 2025 to 2035.

Clocks and timing devices are electronic components that generate, control, and synchronize the timing signals of different electronic systems. These include oscillators, resonators, clock generators, clock buffers, and jitter attenuators that are crucial in ensuring accurate timekeeping, synchronization, and coordination in the operation of electronic systems. Using the principles of the piezoelectric effect in quartz crystals, MEMS resonators, and atomic properties, timing devices produce oscillations at stable frequencies that become imperative for telecommunications networks, consumer electronics, automotive systems, industrial automation, and aerospace applications.

Key Market Highlights:

- In 2025, Asia-Pacific holds the largest share of the global clocks and timing devices market due to the region's extensive electronics manufacturing capabilities, its being home to major manufacturers of timing devices such as Japan and Taiwan, and the rapid adoption of 5G infrastructure across China, South Korea, and India.

- North America is expected to witness a high CAGR from 2025 to 2035 due to rising demand for AI data center infrastructures, expansion of 5G network coverage, and growing utilization of precision timing solutions in automotive electronics.

- By product type, oscillators command the largest share of around 50-55% in 2025, due to their crucial role of providing stable clock signals for accurate communication and data processing in electronic devices.

- Crystal/quartz accounts for over 70% market share in 2025, based on technology, owing to the fact that quartz crystals are widely used in electronic equipment due to their cost-effectiveness, reliability, and consistency for providing precise timing and frequency regulation in a device.

- Based on application, the automotive segment is expected to grow at the highest CAGR during the forecast period. This is mainly attributed to the enhanced growth in the usage of advanced driver assistance systems, autonomous driving technologies, electric vehicles, and vehicle-to-everything (V2X) communication systems.

- By application, the consumer electronics segment holds the largest share of the market in 2025, driven by increasing demand for smartphones, wearables, smart home devices, and IoT applications that require precision timekeeping.

- The U.S. clocks and timing devices market is projected to grow at a CAGR of around 5.5% during the forecast period 2025 to 2035, supported by leadership in AI data center infrastructure and advanced automotive electronics.

- The massive capabilities of electronics manufacturing, the 5G infrastructure investments, and smart city initiatives will drive China to continue leading the Asia-Pacific timing devices market.

- In 2025, Japan commands a significant share of the Asia-Pacific market, supported by the headquarters of major manufacturers of timing devices, such as Seiko Epson, NDK, and Kyocera, along with sophisticated semiconductor technology development.

Overview of the Market and Insights

Click here to: Get Free Sample Pages of this Report

Clocks and timing devices form the fundamental technological infrastructure for precision synchronization across advanced technology applications. These electronic components provide the delivery of accurate time measurements and synchronization for complex systems, forming the basis of modern digital communication and the support of telecommunications networks, satellite navigation, automation, and scientific research. As technologies become increasingly interconnected and microsecond-level precision becomes relevant, timing devices evolve from basic mechanisms of timekeeping to integrated systems that enable technological advancement in nearly every electronic application.

A number of technological trends are revolutionizing the timing devices market, from the deployment of 5G/6G networks that require tight synchronization to the electrification and automation of vehicles demanding robust AEC-qualified timing solutions. Expansion of AI data centers, proliferation of IoT devices, and increasing electronic system complexity requiring real-time processing with continuous connectivity have made timing devices a critically important component in nearly all industry segments.

Market Report Summary:

|

Parameter

|

Details

|

|

Market Size Value in 2025

|

USD 7.12 Billion

|

|

Revenue Forecast in 2035

|

USD 11.48 Billion

|

|

Growth Rate

|

CAGR of 4.9% from 2025 to 2035

|

|

Base Year for Estimation

|

2024

|

|

Historical Data

|

2023–2024

|

|

Forecast Period

|

2025–2035

|

|

Quantitative Units

|

Revenue in USD Billion and CAGR from 2025 to 2035

|

|

Report Coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments Covered

|

Product Type, Technology, Application, End-User Industry, Region

|

|

Regional Scope

|

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

|

|

Countries Covered

|

U.S., Canada, Germany, U.K., France, Italy, Netherlands, China, Japan, South Korea, Taiwan, India, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa

|

|

Key Companies Profiled

|

Seiko Epson Corporation, NIHON DEMPA KOGYO CO., LTD. (NDK), KYOCERA Corporation, TXC Corporation, Daishinku Corp (KDS), SiTime Corporation, Microchip Technology Inc., Murata Manufacturing Co. Ltd., Rakon Limited, Texas Instruments Incorporated, Analog Devices Inc., Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Silicon Laboratories Inc., Abracon LLC, Diodes Incorporated, CTS Corporation, IQD Frequency Products Ltd., Crystek Corporation

|

Key Trends Shaping the Market:

·Timing devices market is primarily driven by the rapid adoption of MEMS technology. Compared to the traditional quartz solution, MEMS oscillators offer 20× better vibration immunity and up to 50% lower power consumption for superior reliability, especially when deploying into high-volume automotive, IoT, and AI servers. SiTime Corporation's Chorus family of MEMS-based clock generators for AI data centers is said to provide up to 10× higher performance compared to discrete oscillators while shrinking board area by up to 50%.

·Another transformative trend is the integration of AI and machine learning capabilities into timing solutions. The AI-enabled timing devices will automatically tune themselves within dynamic environments so that precision timing performance is maintained for these complex systems. These solutions optimize power consumption and device responsiveness, while enabling predictive maintenance and better system performance for telecommunications, automotive, and industrial applications.

·Miniaturization continues to drive innovation in these time and frequency standards; ultra-compact oscillators are now reaching 2.0 × 1.6 mm packages without compromising ±1 ppm performance. Development of chip-scale atomic clocks (CSAC) is expanding applications in GPS-denied environments, military systems, and other critical infrastructure requiring holdover when GNSS signals are unavailable or compromised.

Market Dynamics:

Driver: 5G/6G Network Deployment and Telecommunications Expansion

The telecommunications industry is one of the largest and fastest-growing application segments for timing devices. Deployment of 5G networks and anticipation of 6G technologies require very precise timing and synchronization to accommodate higher data rates, low latency, and higher network capacity. 5G networks necessitate frequency and phase alignment within 1.5 µs to avoid uplink-downlink interference, thus fueling the adoption of TCXO/OCXO and GPS-or PTP-synchronized clocks. China's mobile operators have deployed 4.71 million 5G base stations as of September 2025, supported by cumulative investments exceeding USD 180 billion from telcos since 2020, all requiring sophisticated timing synchronization systems for performance.

Driver: AI Data Center Expansion & High-Performance Computing

The demand for precision timing solutions is being driven by the rapid growth of AI data centers. AI training fabrics integrate low-jitter MEMS oscillators per network interface card to support microsecond-grade orchestration across GPU pods. A single 64T/64R massive-MIMO panel in data centers requires up to eight high-accuracy oscillators to curb spatial stream interference. Major cloud providers have invested billions in the infrastructure of data centers, with Amazon announcing USD 13 billion for expanding data centers in Australia alone, which creates a sustained demand for advanced timing solutions to facilitate synchronized operation across distributed applications.

Opportunity: Automotive Electronics and Autonomous Driving Systems

Automotive electronics are the fastest-growing vertical for timing devices, expected to expand at more than 5.5% CAGR through 2035. The move toward electric and autonomous vehicles drives the need for robust AEC-Q100 qualified timing solutions with extended temperature ranges from -40°C to +125°C and EMI resilience for sensor fusion and domain controllers. Timing devices in modern vehicles are used in engine control, ADAS systems, infotainment, battery management, and vehicle-to-everything (V2X) communication. The shift to 77-79 GHz automotive radar invites substantial opportunities for timing device makers to utilize OCXOs with sub-100 fs jitter to avoid ghost targets.

Opportunity: IoT Ecosystem Expansion and Wearable Technology

The proliferation of IoT devices across industrial, consumer, and commercial environments presents great opportunities for growth. Connected devices require highly accurate timing for synchronization, clocking, and frequency control. Wearable health monitoring devices including smartwatches and smart rings integrate timing solutions such as real-time clocks, event counters, and timers for data timestamping, health activity monitoring, and sensor readings. Ultra-low power kHz references paired with high-accuracy MHz/GHz clocks balance sleep current targets and wake-up latency for battery-powered applications.

Segment Analysis:

By Product Type:

In 2025, the oscillators segment holds the largest share of the overall timing devices market, accounting for around 50-55% of revenue. The largest share of oscillators can be attributed to their critical function of providing accurate frequency signals in an array of electronic devices and systems. The segment includes Temperature-Compensated Crystal Oscillators (TCXOs), Voltage-Controlled Crystal Oscillators (VCXOs), Oven-Controlled Crystal Oscillators (OCXOs), and MEMS oscillators. TCXOs are the dominating type within the oscillator segment since it offers the best cost-to-performance ratio for telecom equipment that requires up to ±100 ppb stability. However, MEMS oscillators segment is the fastest-growing subsegment owing to its much-improved vibration immunity and digital programmability.

The resonators segment, meanwhile, continues to advance at a stable pace, with crystal resonators (quartz crystal units) remaining an indispensable component due to their frequency determination in cost-sensitive applications. Clock generators are gradually finding acceptance in complex systems where multiple synchronized outputs are needed.

By Technology:

Crystal/quartz technology dominates the overall market in 2025, driven by decades of reliability records and mature global fabrication capabilities. Quartz crystals provide high Q-factor and superior phase noise performance and inherent frequency stability, making them indispensable for precision applications. MEMS technology, however, is expected to grow at a higher CAGR as OEMs focus on smaller footprints, high temperature shock resistance, and digital programmability.

By Application:

Consumer electronics holds the largest market share in 2025 due to the growing demand for smartphones, tablets, wearables, smart home devices, and portable electronics that require precision timekeeping for communication and other functions. However, the automotive segment is projected to be the fastest-growing because of the increasing electronic content per vehicle, EV adoption, and autonomous driving technologies.

Regional Insights:

In 2025, the Asia-Pacific region holds the largest share of the global market for timing devices. This is due to the presence of extensive electronics manufacturing capabilities, key timing device manufacturers such as Seiko Epson, NDK, Kyocera, TXC in Japan and Taiwan, combined with fast-growing regional demand for 5G and EVs.

- ·China leads this market due to massive electronics manufacturing and government-backed 5G infrastructure development.

- ·Japan's high-tech industry with its emphasis on precision and innovation in semiconductors contribute to strong market demand, while South Korea's leadership in 5G deployment drives the need for precise timing solutions.

- ·North America accounts for a considerable market share due to technological innovation related to AI data centers, telecommunications, and automotive technology. Some of the factors contributing to the increased demand for accurate timing solutions in this region include expansion in 5G networks, high demand for consumer electronics, and advancement of technologies related to autonomous driving and ADAS.

- ·Europe also represents a major market that is driven by the digital strategy of the European Union, enhancing the connectivity and infrastructure, including the deployment of 5G networks. The automotive sector, especially in Germany and France, is increasingly focusing on ADAS and autonomous vehicle technologies using high-precision timing for both navigation and safety applications.

Key Players:

The major players in the clocks and timing devices market include Seiko Epson Corporation (Japan), NIHON DEMPA KOGYO CO., LTD. (Japan), KYOCERA Corporation (Japan), TXC Corporation (Taiwan), Daishinku Corp (Japan), SiTime Corporation (U.S.), Microchip Technology Inc. (U.S.), Murata Manufacturing Co. Ltd. (Japan), Rakon Limited (New Zealand), Texas Instruments Incorporated (U.S.), Analog Devices Inc. (U.S.), Infineon Technologies AG (Germany), STMicroelectronics N.V. (Switzerland), Renesas Electronics Corporation (Japan), Silicon Laboratories Inc. (U.S.), Abracon LLC (U.S.), Diodes Incorporated (U.S.), CTS Corporation (U.S.), IQD Frequency Products Ltd. (U.K.), and Crystek Corporation (U.S.), among others.

The market remains moderately concentrated, with the top five vendors - Seiko Epson, Kyocera, NDK, SiTime, and TXC controlling global shipments. Legacy quartz manufacturers retain share through vertically integrated operations spanning crystal growth to packaged oscillators, while MEMS-focused companies like SiTime are gaining share through design wins in AI data centers and automotive applications.

Key Questions Answered