Resources

About Us

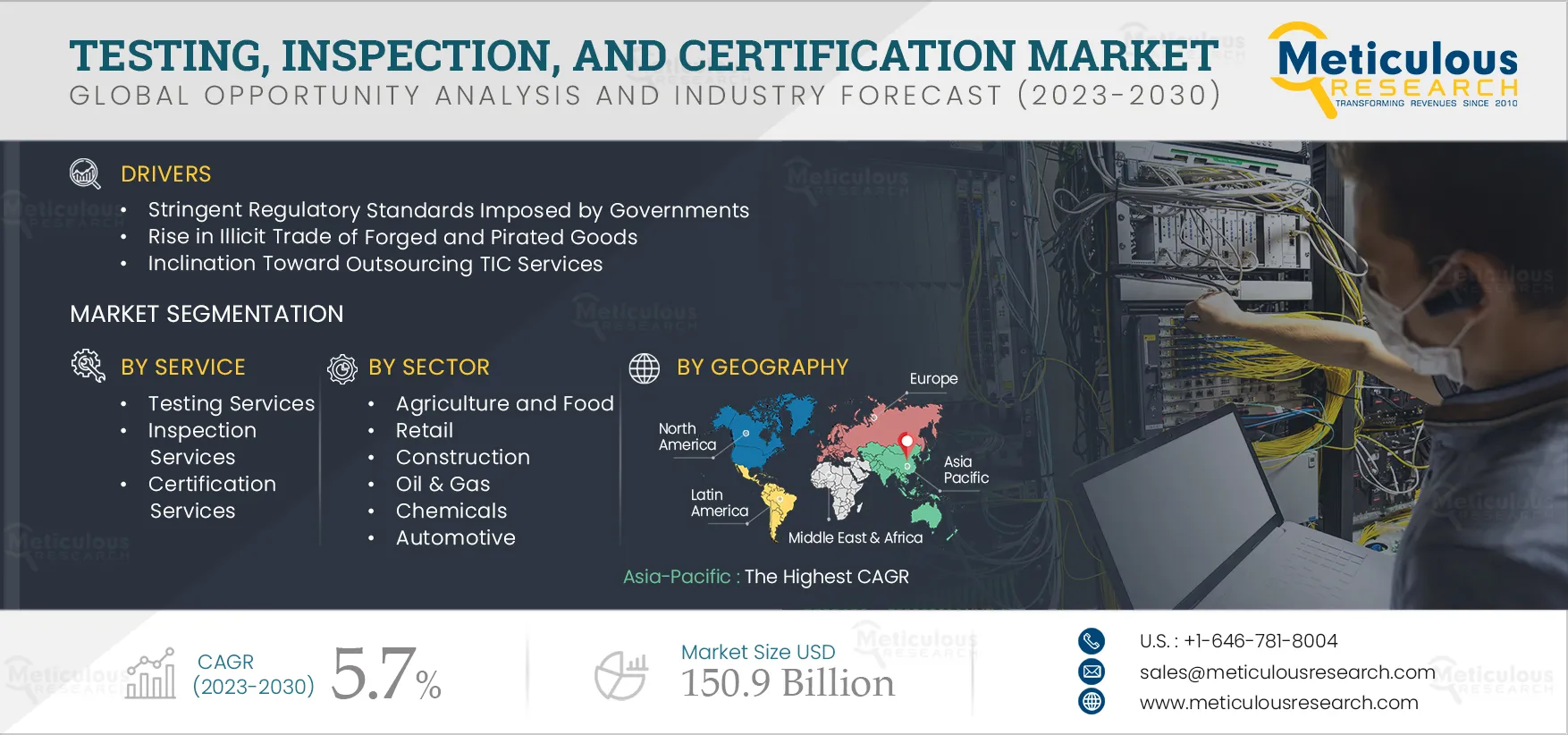

Testing, Inspection, and Certification Market by Service (Testing Services, Inspection Services, Certification Services), Sector (Agriculture and Food, Retail, Automotive, Construction) - Global Forecast to 2030

Report ID: MRSE - 104455 Pages: 200 Mar-2023 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of the testing, inspection, and certification market is driven by the rise in the illicit trade of forged and pirated goods and the inclination toward outsourcing TIC services. However, dynamic international regulatory standards across regions may restrain the market's growth.

Furthermore, the surge in consumer awareness toward product safety and purity is expected to offer significant growth opportunities for the testing, inspection, and certification market. However, a lack of testing facilities and skilled resources may hinder the growth of this market.

Consumer awareness plays a vital role in implementing products' quality and safety through various means, including social media, labeling, and nutritional facts. Modern-day consumers are progressively becoming aware of food-related issues, such as contaminants, allergens, physiological reactions, and effects of processed and stored food. The rising number of health-conscious consumers and increasing awareness about healthy and safe food products fuel the demand for TIC services in the food & beverage industry. Stringent regulations imposed by the government for food quality and safety concerns draw the attention of major players in the TIC market to formulate new and effective food testing and certification standards. Some of the most prominent TIC services offered by major players are food allergen testing, nutrition label testing, ISO 22000 Food Safety Management Certification, BSI Catering Food Safety Certification, Food Contaminant Testing, and Food Microbiology Testing, among others.

Drastically changing food habits, fast lifestyle, and the consistent surge in foodborne diseases have encouraged the government to introduce various regulations on food safety and its quality to reduce the number of deaths and illnesses caused. Organizations have dedicated themselves to implementing safety testing services based on framed government guidelines to address such safety concerns. Increasing standards and regulations on validation and verification services, consumer demand for certification, stringent regulations imposed by the government for food certifications, and extensive industry standards are significantly creating growth opportunities for the TIC market.

Click here to: Get Free Sample Pages of this Report

In 2023, the Testing Services Segment is Expected to Dominate the Testing, Inspection, And Certification Market

Based on service, in 2023, the testing services segment is expected to account for the largest share of the testing, inspection, and certification market. The large market share of this segment is majorly attributed to the presence of different product standards across different regions, vast product diversity, demand for high-quality products, and strong recommendations from regulatory authorities to ensure safety.

Based on sector, in 2023, the agriculture and food segment is expected to account for the largest share of the testing, inspection, and certification market. The consistent growth in the agritech sector, growing demand for organic and processed food, and the increasing need to ensure quality and improve food production are supporting the large market share of this segment.

Asia-Pacific to Register the Highest CAGR During the Forecast Period

Asia-Pacific is slated to register the highest CAGR during the forecast period. This market is expected to witness rapid growth during the forecast period due to the strict regulatory standards imposed by governments, growing consumer awareness towards quality and environmental safety, and the rise in the illicit trade of forged & pirated goods.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by major market players in the last three to four years. The key players profiled in the testing, inspection, and certification market study are SGS S.A. (Switzerland), Bureau Veritas S.A. (France), Intertek Group Plc. (U.K.), TÜV SÜD (Germany), Dekra SE (Germany), TÜV Rheinland Ag Group (Germany), APPLUS+ (Spain), Eurofins Scientific SE (U.S.), British Standards Institution (BSI) (U.K.), TÜV Lloyd’s Register Group Limited (U.K.), Mistras Group, Inc. (U.S.), DNV GL (Norway), Element Materials Technology Ltd. (U.K.), ALS Ltd. (Australia), and UL LLC (U.S.).

Scope of the Report:

Testing, Inspection, and Certification Market Assessment, by Service

Testing, Inspection, and Certification Market Assessment, by Sector

Testing, Inspection, and Certification Market Assessment, by Geography

Key questions answered in the report:

The global testing, inspection, and certification market is projected to reach $150.9 billion by 2030, at a CAGR of 5.7% during the forecast period.

The growth of the testing, inspection, and certification market is driven by the strict regulatory standards imposed by governments, the rise in the illicit trade of forged and pirated goods, and the inclination toward outsourcing TIC services.

Furthermore, the surge in consumer awareness toward product safety and purity is expected to offer significant growth opportunities for the testing, inspection, and certification market.

The key players operating in the global testing, inspection, and certification market are SGS S.A. (Switzerland), Bureau Veritas S.A. (France), Intertek Group Plc. (U.K.), TÜV SÜD (Germany), Dekra SE (Germany), TÜV Rheinland Ag Group (Germany), APPLUS+ (Spain), Eurofins Scientific SE (U.S.), British Standards Institution (BSI) (U.K.), TÜV Lloyd’s Register Group Limited (U.K.), Mistras Group, Inc. (U.S.), DNV GL (Norway), Element Materials Technology Ltd. (U.K.), ALS Ltd. (Australia), and UL LLC (U.S.).

Currently, Europe dominates the global testing, inspection, and certification market. However, Asia-Pacific is projected to register the highest CAGR during the forecast period.

Based on service, the certification services segment is expected to register the highest CAGR during the forecast period. The growth of this segment is expected to be driven by the growing significance of product credibility, government encouragement to promote product certification, dynamic standards by international standardization institutions, and growing awareness towards social and environmental responsibility.

Based on sector, the healthcare segment is expected to register the highest CAGR during the forecast period. The growth of this segment is mainly driven by the growing medical device industries, the increasing complexity of medical devices, and the stringent government regulations and standards across healthcare organizations.

Published Date: Feb-2025

Published Date: Nov-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates