Resources

About Us

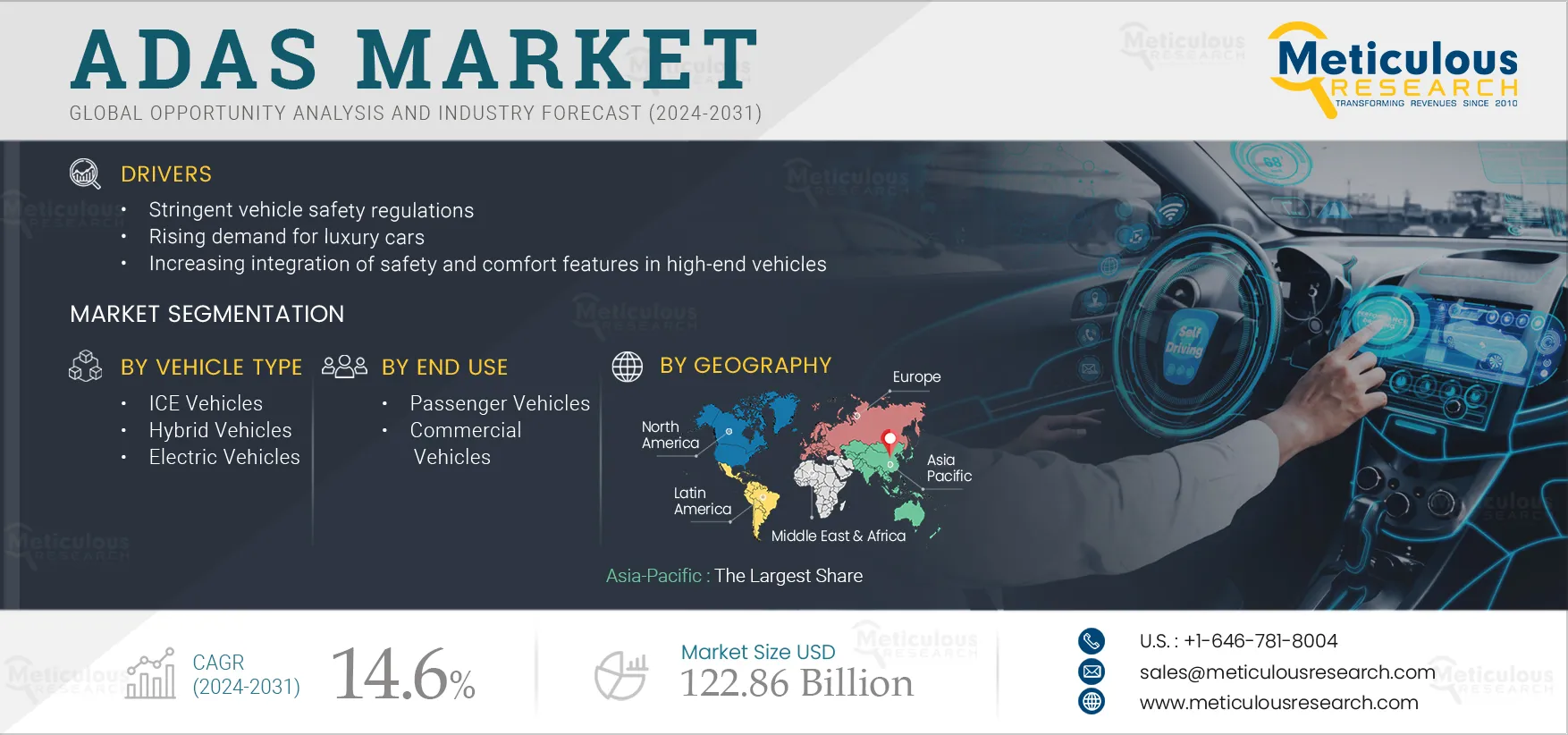

ADAS Market Size, Share, Forecast, & Trends Analysis by Type (Blind Spot Detection Systems, Automatic Emergency Braking Systems), Automation (Level 1, 2, and 3), Component (Vision Camera Systems, Sensors), Vehicle, End Use (Passenger, Commercial), and Geography - Global Forecast to 2031

Report ID: MRAUTO - 104693 Pages: 267 Jan-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the ADAS market is driven by stringent vehicle safety regulations, the rising demand for luxury cars, and the increasing integration of safety and comfort features in high-end vehicles. Moreover, the emergence of autonomous vehicles, increasing developments in the autonomous shared mobility space, and the rising adoption of electric vehicles are expected to generate market growth opportunities.

ADAS technology aims to reduce human errors that may lead to vehicle accidents. ADAS operates both actively and passively, alerting the driver of a potential collision or braking and steering the vehicle. Due to its dynamic nature, regulating ADAS is a constant challenge globally. Therefore, safety standards need to remain flexible to accommodate the evolution of ADAS technologies. For example, the regulatory environment in the U.S. has fostered innovation and growth in the field of partially and fully autonomous vehicles. However, the safety of certain ADAS technologies has not been fully evaluated. Hence, regulators are focused on ensuring that ADAS technologies integrated into cars improve vehicle safety & comfort.

Technological advancements have made autonomous vehicles a real-world possibility, with many automotive manufacturers heavily investing in developing such vehicles due to the increasing demand. Autonomous vehicles are completely driven by sensors and electronics, ensuring a complete driverless experience. ADAS technologies are crucial in such vehicles as they play a major role in enabling functions such as blind-spot monitoring, lane-keep assistance, lane-departure warning, and collision warning that can limit the rising number of accidents that occur due to human errors.

The emergence of autonomous vehicles, initiatives such as demonstration programs, and OEMs’ partnerships with sensor manufacturing companies are driving the development of new and advanced LiDAR sensors, which are important components of ADAS. Presently, more than 80 automobile companies are testing self-driving cars, and the adoption of autonomous vehicles is expected to gain traction by 2025. The sales of autonomous vehicles are expected to cross 12 million units by 2035, and by 2050, all vehicles are expected to be autonomous. According to Nissan, 55% of small businesses are expected to operate fully autonomous fleets within two decades. Thus, the emergence of autonomous vehicles is expected to generate growth opportunities for the players operating in the ADAS market.

Click here to: Get Free Sample Pages of this Report

Based on system type, the ADAS market is broadly segmented into adaptive cruise control systems, blind spot detection systems, automatic parking systems, pedestrian detection systems, traffic jam assistance systems, lane departure warning systems, tire pressure monitoring systems, automatic emergency braking systems, adaptive front-lighting systems, traffic sign recognition systems, forward collision warning systems, driver monitoring systems, and night vision systems. In 2024, the adaptive cruise control systems segment is expected to account for the largest share of 15.4% of the market. The growth of this segment is mainly attributed to the need to maintain a comfortable driving experience, supportive government regulations, and advancements in adaptive cruise control systems.

However, the blind spot detection systems segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the expanding e-commerce and logistics sector, the increasing adoption of BSD systems in vehicles, and the rising use of complementary metal oxide semiconductors (CMOS) image sensors.

Based on level of automation, the ADAS market is broadly segmented into level 1, level 2, and level 3. In 2024, the level 1 segment is expected to account for the largest share of 57.7% of the market. The growth of this segment is attributed to the growing investments in vehicle electrification, the rising demand for driver assistance systems, and the increasing number of Level 1 vehicles on the road.

However, the level 3 segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising demand for self-driving vehicles and the increasing initiatives by major market players aimed at launching advanced Level 3 autonomous cars.

Based on component, the ADAS market is broadly segmented into vision camera systems, sensors, ECU, software, and actuators. In 2024, the sensors segment is expected to account for the largest share of 49.0% of the market. However, the sensors segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising need to reduce greenhouse gas emissions and the increasing demand for sensors in hybrid powertrains.

Also, this segment is projected to register the highest CAGR during the forecast period.

Based on vehicle type, the ADAS market is broadly segmented into internal combustion engine, hybrid, and electric vehicles. In 2024, the internal combustion engine vehicles segment is expected to account for the largest share of 46.0% of the market. Internal combustion engine (ICE) vehicles are automobiles that use an internal combustion engine (ICE) to power the vehicle. ICEs are typically powered by fossil fuels such as gasoline or diesel, but they can also be powered by alternative fuels such as ethanol or compressed natural gas. ICE vehicles have been the dominant form of transportation for the past century.

However, the electric vehicles segment is projected to register the highest CAGR during the forecast period. The supportive government policies and regulations, increasing investments by leading automotive OEMs, rising environmental concerns, decreasing prices of batteries, and advancements in charging technologies are the key factors driving the growth of electric vehicles in the ADAS market.

Based on end use, the ADAS market is broadly segmented into passenger and commercial vehicles. In 2024, the passenger vehicles segment is expected to account for the larger share of 70.7% of the ADAS market. The growth of this segment is attributed to the growing awareness regarding the hazards associated with greenhouse gas emissions and environmental pollution, stringent emission norms, and demand for premium cars among consumers.

However, the commercial vehicles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicles, and the increasing adoption of electric buses and trucks.

In 2024, Asia-Pacific is expected to account for the largest share of 58.7% of the global ADAS market. In 2024, Asia-Pacific ADAS market is projected to be worth of USD 27.8 billion. The region's significant market share is attributed to the growing automotive manufacturing sector in countries such as Japan, China, India, and South Korea, supportive government regulations, and the rising popularity of Electric Vehicles (EVs).

However, Europe is expected to command the highest CAGR of the global ADAS market. The market growth in the region is attributed to the huge presence of component manufacturers, the growth of the overall automotive sector, and the high demand for sensors for automated vehicle prototypes.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the ADAS market Continental AG (Germany), Valeo SA (France), Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), and Aptiv PLC (Ireland), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Garmin Ltd. (U.S.), Infineon Technologies AG (Germany), Magna International Inc. (Canada), Mobileye B.V. (Israel), Huawei Technologies Co., Ltd. (China), Qualcomm Technologies, Inc. (U.S.), Microsoft (U.S.), and NXP Semiconductors N.V. (Netherlands).

In May 2023, Infineon (Germany) and Hon Hai Technology Group (Taiwan) signed a MoU to partner on SiC collaboration and leverage respective expertise in EV development, including smart cabin applications, advanced driver assistance systems, and autonomous driving applications.

In April 2023, Continental AG (Germany) and HERE (Netherlands) partnered with IVECO (Netherlands) to increase safety, fuel-saving, and ADAS functions in commercial vehicles.

|

Particulars |

Details |

|

Number of Pages |

267 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

14.6% |

|

Market Size (Value) |

USD 122.86 Billion by 2031 |

|

Segments Covered |

By System Type

By Level of Automation

By Component

By Vehicle Type

By End Use

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Russia, Sweden, Netherlands, Italy, Spain, Denmark, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Indonesia, Thailand, and Rest of Asia-Pacific), Latin America, and the Middle East & Africa |

|

Key Companies |

Continental AG (Germany), Valeo SA (France), Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), and Aptiv PLC (Ireland), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Garmin Ltd. (U.S.), Infineon Technologies AG (Germany), Magna International Inc. (Canada), Mobileye B.V. (Israel), Huawei Technologies Co., Ltd. (China), Qualcomm Technologies, Inc. (U.S.), Microsoft (U.S.), and NXP Semiconductors N.V. (Netherlands). |

The ADAS market study focuses on the market assessment and opportunity analysis through the sales of ADAS across different region, and countries across different market segmentation, this study is also focused on competitive analysis for ADAS based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The global ADAS market is projected to reach $122.86 billion by 2031, at a CAGR of 14.6% from 2024 to 2031.

In 2024, the adaptive cruise control systems segment is expected to account for the largest share of 15.4% of the market. The growth of this segment is mainly attributed to the need to maintain a comfortable driving experience, supportive government regulations, and advancements in adaptive cruise control systems.

The electric vehicles segment is projected to register the highest CAGR during the forecast period. The supportive government policies and regulations, increasing investments by leading automotive OEMs, rising environmental concerns, decreasing prices of batteries, and advancements in charging technologies are the key factors driving the growth of electric vehicles in the ADAS market.

The growth of the ADAS market is driven by stringent vehicle safety regulations, the rising demand for luxury cars, and the increasing integration of safety and comfort features in high-end vehicles. Moreover, the emergence of autonomous vehicles, increasing developments in the autonomous shared mobility space, and the rising adoption of electric vehicles are expected to generate market growth opportunities.

The key players operating in the ADAS market Continental AG (Germany), Valeo SA (France), Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), and Aptiv PLC (Ireland), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Garmin Ltd. (U.S.), Infineon Technologies AG (Germany), Magna International Inc. (Canada), Mobileye B.V. (Israel), Huawei Technologies Co., Ltd. (China), Qualcomm Technologies, Inc. (U.S.), Microsoft (U.S.), and NXP Semiconductors N.V. (Netherlands).

Europe is expected to command the highest CAGR of the global ADAS market. The market growth in the region is attributed to the huge presence of component manufacturers, the growth of the overall automotive sector, and the high demand for sensors for automated vehicle prototypes.

Published Date: Feb-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates