Resources

About Us

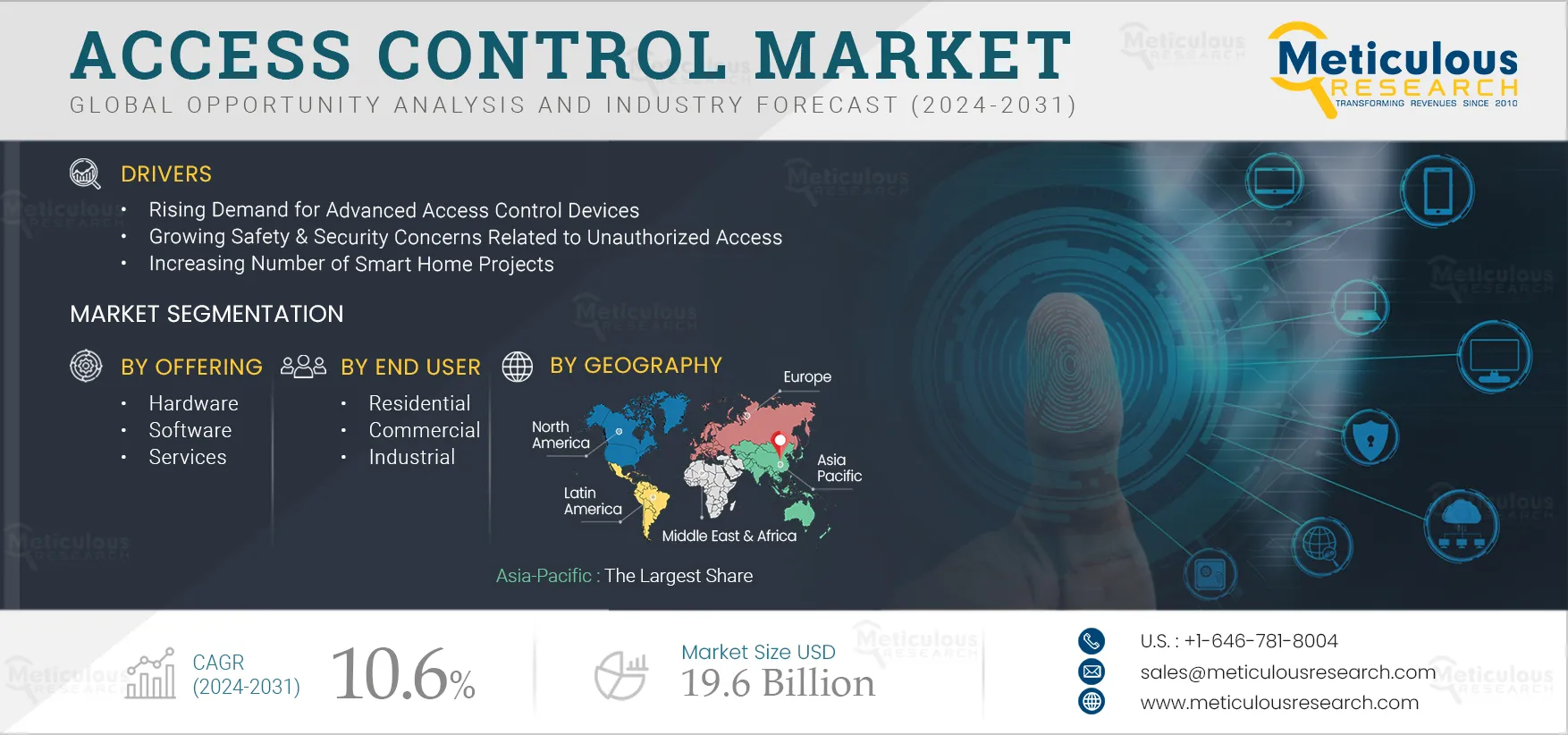

Access Control Market Size, Share, Forecast, & Trends Analysis by Offering (Hardware {Biometric Devices, Electronic Locks, Other}, Software {Cloud, On-premise}, Services), End User (Residential, Commercial {Retail, IT & Telecom, Other}, Industrial), and Geography - Global Forecast to 2031

Report ID: MRSE - 104399 Pages: 250 Jul-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe Access Control Market is expected to reach $19.6 billion by 2031, at a CAGR of 10.6% from 2024 to 2031. The growth of the access control market is driven by the rising demand for advanced access control devices, growing safety & security concerns related to unauthorized access, and the increasing number of smart home projects around the world. However, the high initial costs of deployment limit the adoption of access control systems, restraining the growth of this market.

Furthermore, organizations’ increasing preference for cloud-based access control systems and the growing use of wireless access controls are expected to generate growth opportunities for the stakeholders in the access control market. However, low awareness regarding advanced security solutions in developing countries and data security & privacy issues are major challenges in the access control market.

Additionally, the increasing adoption of Access Control as a Service (ACaaS), the growing utilization of smartphones for access control, and the increasing use of contactless biometric access control devices are prominent trends in the access control market.

Advanced access control devices incorporate cutting-edge technologies and features to enhance security and provide efficient access management. These devices go beyond traditional key-based or card-based access systems, offering improved authentication methods, flexibility, and integration capabilities. Advanced access control devices offer greater security, flexibility, and convenience in managing access to physical spaces. They are commonly used in commercial buildings, government facilities, healthcare institutions, and residential properties where effective security & access management are essential.

Access control devices such as electronic locks can be more secure than traditional locks as they require authorized credentials, such as PIN codes or access cards, for entry. Unauthorized individuals cannot pick or manipulate these locks easily. Market players are focused on product development to offer enhanced security for residential spaces. For instance, in April 2023, Allegion plc (Ireland), a leading security products and solutions provider, introduced a new brand, Zentra, focused on access solutions for multifamily properties. A single software platform unifies the brand’s offerings with integrated hardware and support services to enhance back-end efficiency for property managers and improve overall resident security. Such developments and the benefits of advanced access control devices are driving the growth of the access control market.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Access control ensures that people and assets in an organization are safe from potential internal and external threats, such as intruders. Regardless of the type and extent of the attack, physical security is critical when it comes to protecting sensitive areas, including controlling on-site third parties’ access to server rooms or data centers. The use of access control devices in commercial spaces helps protect assets, ensures safety, and provides a means for businesses to manage and monitor who enters their premises. They are a fundamental component of modern security systems for businesses of all sizes. In recent years, the risk of economically motivated attacks has increased significantly, especially for companies and organizations with cutting-edge technologies and confidential information.

According to the FBI’s Uniform Crime Reporting (UCR) Program, in 2021, there were 583,178 burglary incidents and 583,178 offenses reported in the U.S. by 11,794 law enforcement agencies that submitted National Incident-Based Reporting System (NIBRS) data and covered 69% of the country’s total population. Access control devices play a crucial role in preventing burglary incidents and enhancing security in various settings, such as homes, businesses, and institutions. These devices help restrict unauthorized access, monitor entry points, and deter potential intruders. Thus, safety & security concerns related to unauthorized access are increasing the adoption of access control devices, driving the growth of this market.

Mobile phones are revolutionizing access control in property management. The pace of mobile access adoption is increasing as solutions migrate to centralized ecosystems with cloud-connected devices, applications, and mobile identities. Mobile access credentials also provide a secure way for license key holders to access particular locations within a building. Mobile technology offers organizations benefits such as convenience of use, effectiveness, and cost savings.

In addition, key players are focusing on the development of access control solutions with mobile authentication. For instance, in February 2024, Hangzhou Hikvision Digital Technology Co., Ltd. (Hikvision) (China) launched its second-generation professional access control products that allow users to choose from a wide variety of authentication methods ranging from traditional card, fingerprint, and PIN code authentication, to more modern mobile identity checking technologies including Bluetooth, NFC, and QR codes. Such developments are expected to have a positive impact on the access control market during the forecast period.

Securing physical spaces and managing permissions has become paramount in today’s digitalized world, making access control essential for organizations. Cloud-based access control systems utilize a combination of cutting-edge hardware and software components, enabling efficient authentication, authorization, and identity management. By centralizing access control in the cloud, businesses can simplify administration, streamline operations, and ensure consistent security protocols across multiple locations.

One of the major advantages of cloud-based access control systems over physical access control systems is the additional flexibility offered. Fluctuating workforces, expanding footprints, and constant user setting changes are easy to handle with a cloud-based access control solution. Furthermore, cloud-based solutions allow for seamless integration with other security systems, such as video surveillance and intrusion detection, creating a comprehensive security ecosystem. Such benefits are driving the demand for cloud-based access control systems, generating growth opportunities for the players operating in the access control market.

Based on offering, the access control market is segmented into hardware, software, and services. In 2024, the hardware segment is expected to account for the largest share of over 56.0% of the access control market. The hardware segment comprises biometric devices, cards, electronic locks & doors, controllers, and hybrid devices. The large market share of this segment is attributed to the growing adoption of access control systems for safeguarding offices, government buildings, airports, hospitals, and military facilities, growing urbanization, and the increasing number of smart homes & apartments.

In addition, the increasing deployment of access control systems for more comprehensive and efficient security is expected to drive the growth of this segment. For instance, in February 2023, San Diego International Airport deployed Identiv’s comprehensive, end-to-end access control ecosystem, including Hirsch Velocity Software and its Velocity Vision Video Management System (VMS), under a single Graphical User Interface (GUI).

However, the services segment is projected to register the highest CAGR during the forecast period. Organizations’ growing need for visibility to diagnose and troubleshoot problems before they impact operations or end-user experiences is driving the adoption of access control services. Technical support and upgrades ensure optimum utilization of access control solutions. Additionally, the increasing deployment of access control solutions and the rising demand for both pre-deployment and post-deployment services support the growth of this segment. These services are crucial for maintaining security, privacy, and compliance within an organization. Access control services typically encompass various aspects, including authentication, authorization, auditing, and monitoring.

Based on end user, the access control market is broadly segmented into residential, commercial, and industrial end users. In 2024, the commercial segment is expected to account for the largest share of over 52.0% of the access control market. The large market share of this segment is attributed to the increasing implementation of access control systems across government facilities, the growing use of smart cards in the hospitality sector, and the increased adoption of enterprise-level access control solutions.

In addition, the increasing deployment of access control systems for office spaces to bolster the security of entrances supports the growth of this segment. In August 2023, HID Global Corporation (U.S.), the global leader in trusted identity solutions, partnered with Ghelamco Group (Belgium), an international real estate investor and developer, to standardize HID’s mobile and physical access control solutions across its prestigious projects in Warsaw, Poland.

Moreover, the commercial segment is also projected to register the highest CAGR during the forecast period. The growth of this segment is driven by market players’ growing focus on technology and product development to cater to the needs of commercial end users. For instance, in July 2023, Anviz Global Inc. (U.S.), an industry leader in professional and converged intelligent security solutions, launched its next-generation access control solutions powered by the Open Supervised Device Protocol (OSDP) for education, government, commercial real estate, retail, manufacturing, healthcare, and hospitality, among other end users, providing them with access to a comprehensive and integrated security control experience.

In 2024, Asia-Pacific is expected to account for the largest share of over 44.0% of the access control market. APAC’s large market share is attributed to the region’s rapidly developing economies, consistent technological advancements in access control solutions, increased use of access control systems at airports and railway stations, and the increasing deployment of access control systems across government agencies for tracking employee attendance.

For instance, in March 2022, IDEMIA (France), the global leader in Identity technologies, announced plans to provide biometric solutions to Singapore’s Changi Airport Terminals 1 and 2 (T1 and T2) to elevate the passenger experience, particularly in the immigration process.

Moreover, Asia-Pacific is also projected to register the highest CAGR of 11.7% during the forecast period. The growth of this regional market is driven by the rising adoption of biometric recognition technology and technological advancements in access control systems. For instance, in November 2022, NEC Corporation (Japan), a Japanese multinational information technology and electronics corporation, developed a Gateless Access Control System using Biometric Recognition that combines NEC’s face recognition technology with person re-identification technology, which matches people even if they are facing away or their bodies are occluded, to provide fast and reliable gateless entry control.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. The key players operating in the access control market are Johnson Controls International plc (Ireland), Honeywell International Inc. (U.S.), Identiv, Inc. (U.S.), Suprema Inc. (South Korea), Bosch Sicherheitssysteme GmbH (Germany), Genetec Inc. (Canada), NEC Corporation (Japan), Assa Abloy (Sweden), dormakaba International Holding AG (Switzerland), Allegion plc (Ireland), Nedap N.V. (Netherlands), Thales (France), IDEMIA (France), Axis Communications AB (Sweden), Anviz Global Inc. (U.S.) and Dahua Technology Co., Ltd (China).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

10.6% |

|

Market Size (Value) |

$19.6 Billion by 2031 |

|

Segments Covered |

By Offering

By End User

|

|

Countries Covered |

Europe (U.K., Germany, France, Italy, Spain, Switzerland, Sweden, Denmark, Norway, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Malaysia, Taiwan, and Rest of Asia-Pacific), North America (U.S. and Canada), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America) and the Middle East & Africa (UAE, Israel, and Rest of Middle East & Africa) |

|

Key Companies Profiled |

Johnson Controls International plc (Ireland), Honeywell International Inc. (U.S.), Identiv, Inc. (U.S.), Suprema Inc. (South Korea), Bosch Sicherheitssysteme GmbH (Germany), Genetec Inc. (Canada), NEC Corporation (Japan), Assa Abloy (Sweden), dormakaba International Holding AG (Switzerland), Allegion plc (Ireland), Nedap N.V. (Netherlands), Thales (France), IDEMIA (France), Axis Communications AB (Sweden), Anviz Global Inc. (U.S.) and Dahua Technology Co., Ltd (China) |

The access control market study focuses on market assessment and opportunity analysis based on the sales of access control hardware, software, and services across various regions, countries, and market segments. The study also includes a competitive analysis based on an extensive assessment of the product portfolios, geographic presence, and key growth strategies of leading players in the access control market.

The access control market is expected to reach $19.6 billion by 2031, at a CAGR of 10.6% from 2024 to 2031.

In 2024, the hardware segment is expected to account for the largest share of the access control market.

The commercial segment is expected to register the highest CAGR during the forecast period.

The growth of the access control market is driven by the rising demand for advanced access control devices, growing safety & security concerns related to unauthorized access, and the increasing number of smart home projects around the world. Furthermore, organizations’ increasing preference for cloud-based access control systems and the growing use of wireless access controls are expected to generate growth opportunities for the stakeholders in the access control market.

The key players operating in the access control market are Johnson Controls International plc (Ireland), Honeywell International Inc. (U.S.), Identiv, Inc. (U.S.), Suprema Inc. (South Korea), Bosch Sicherheitssysteme GmbH (Germany), Genetec Inc. (Canada), NEC Corporation (Japan), Assa Abloy (Sweden), dormakaba International Holding AG (Switzerland), Allegion plc (Ireland), Nedap N.V. (Netherlands), Thales (France), IDEMIA (France), Axis Communications AB (Sweden), Anviz Global Inc. (U.S.) and Dahua Technology Co., Ltd (China)

Asia-Pacific is projected to register the highest CAGR of 11.7% during the forecast period. The growth of this regional market is driven by the rising adoption of biometric recognition technology and technological advancements in access control systems.

Published Date: Sep-2025

Published Date: Jul-2025

Published Date: Oct-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates