Resources

About Us

Solar-Powered Cold Chain Units Market by Type (Refrigerated Trucks, Refrigerated Containers, Cold Storage), Technology (PV-Battery, PV-PCM, Hybrid), Temperature Range, Capacity, End User, and Geography - Global Forecast to 2035

Report ID: MREP - 1041596 Pages: 210 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Solar-Powered Cold Chain Units Market Size?

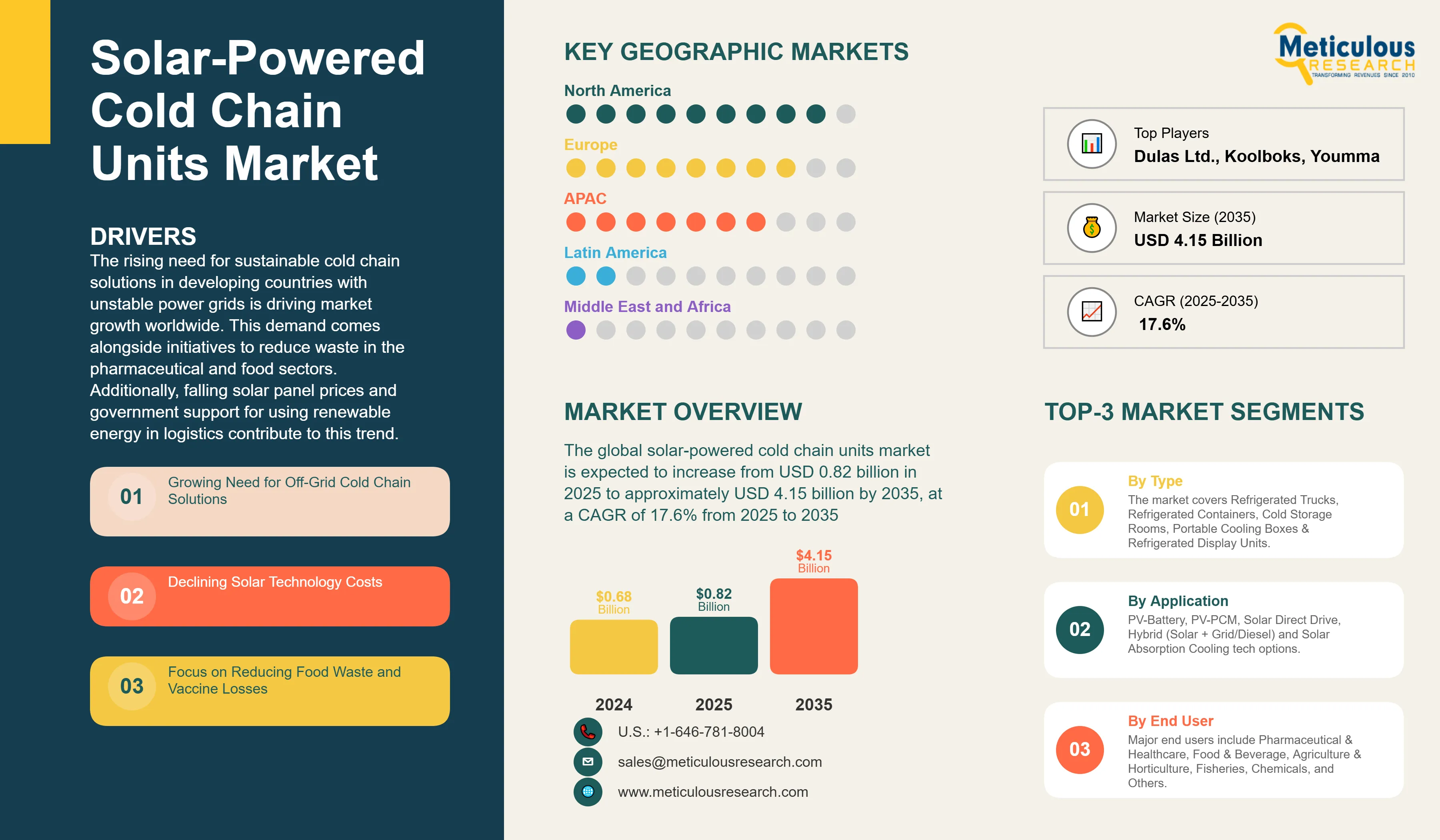

The global solar-powered cold chain units market was valued at USD 0.68 billion in 2024 and is expected to increase from USD 0.82 billion in 2025 to approximately USD 4.15 billion by 2035, at a CAGR of 17.6% from 2025 to 2035. The rising need for sustainable cold chain solutions in developing countries with unstable power grids is driving market growth worldwide. This demand comes alongside initiatives to reduce waste in the pharmaceutical and food sectors. Additionally, falling solar panel prices and government support for using renewable energy in logistics contribute to this trend.

Highlights: Solar-Powered Cold Chain Units Market

Click here to: Get Free Sample Pages of this Report

The solar-powered cold chain units market involves designing, manufacturing, and deploying refrigeration and cooling systems that use solar energy to keep supply chains at the right temperature. These units include solar-powered refrigerated trucks, containers, cold storage rooms, and portable cooling boxes that use solar panels, batteries, and good insulation to maintain specific temperature ranges without depending on grid electricity or diesel generators. Unlike traditional cold chain equipment, solar-powered units provide energy independence, lower operational costs, have zero emissions during use, and can function in off-grid areas. The market is growing due to the rising need for vaccine distribution in remote locations, an increased focus on reducing food waste in developing countries, greater awareness of reducing carbon footprints in logistics, strict regulations on diesel emissions, and the expanding pharmaceutical and agricultural sectors that need dependable cold chain infrastructure.

How is AI Transforming the Solar-Powered Cold Chain Units Market?

Artificial intelligence is changing the market for solar-powered cold chain units. It allows for better temperature control, optimizes energy use based on weather forecasts and load needs, offers real-time monitoring and alerts for temperature changes, and improves route planning for mobile units. AI algorithms look at past data and weather trends to forecast solar energy availability and adjust cooling cycles. This helps maintain a steady temperature while extending battery life.

Machine learning models help with preventive maintenance by spotting when solar panels, batteries, and cooling parts are not performing well. This reduces downtime and increases the life of the equipment. AI analytics give insights into usage patterns. This helps operators make the best use of capacity and find ways to improve energy efficiency. As a result, solar-powered cold chain solutions become more reliable and cost-effective for important applications.

What are the Key Trends in the Solar-Powered Cold Chain Units Market?

Market Scope

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 4.15 Billion |

|

Market Size in 2025 |

USD 0.82 Billion |

|

Market Size in 2024 |

USD 0.68 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 17.6% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

Africa & Middle East |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Technology, Temperature Range, Capacity, End User, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Last-Mile Vaccine Distribution in Developing Countries

A key factor driving the growth of the solar-powered cold chain units market is the urgent need for dependable vaccine storage and distribution in developing countries that lack reliable electricity. The COVID-19 pandemic showed how crucial it is to keep mRNA vaccines at ultra-cold temperatures. Routine immunization programs also need consistent storage between 2-8°C for traditional vaccines. Solar-powered cold chain units allow healthcare workers to serve remote communities without relying on unstable electricity grids or costly diesel generators. Organizations like WHO, UNICEF, and GAVI are actively supporting and funding the use of solar cold chain equipment in Africa, Asia, and Latin America, resulting in significant market demand. This technology can maintain accurate temperature control while operating independently. It plays a vital role in ensuring universal immunization coverage and reducing vaccine waste in areas with limited resources.

Restraint

High Initial Investment and Technical Complexity

Despite growing demand, the market for solar-powered cold chain units faces challenges from high upfront costs compared to traditional refrigeration systems and technical complexity that requires specialized maintenance. Solar panels, batteries, insulation, and control systems greatly increase the initial investment; this is usually 2 to 3 times higher than diesel-powered options. Proper sizing based on solar irradiation patterns, cooling load calculations, and battery capacity planning often demands technical know-how that is often absent in target markets. Battery replacement costs every 3 to 5 years add to the total ownership costs, and dust buildup on solar panels in dry areas reduces efficiency without regular cleaning. These issues create barriers to adoption, especially for small operators and organizations with limited budgets.

Opportunity

Agricultural Post-Harvest Management

The growing use of solar-powered cold chain units in agricultural post-harvest management offers a great chance for market growth. Developing countries lose 30-40% of their agricultural produce because of poor cold storage systems, leading to billions in economic losses each year. Solar-powered cold storage helps farmers keep produce fresh, extend its shelf life, and get better prices by avoiding rushed sales. This technology is especially useful for high-value crops like fruits, vegetables, dairy, and flowers, which need quick cooling right after harvest. Government support for farmer producer organizations and agricultural value chains, along with a focus on increasing farmer incomes, encourages the use of decentralized solar cold storage at farms and collection centers. This opens up new market opportunities beyond traditional pharmaceutical uses.

Type Insights

Why are Refrigerated Containers Preferred in Solar-Powered Cold Chain?

The refrigerated containers segment holds the largest market share of around 40-45% in 2025. Refrigerated containers are versatile for both transportation and stationary storage, making them ideal for various cold chain needs. Their standard sizes allow easy integration with current logistics systems, and roof-mounted solar panels supply enough power to maintain the necessary temperatures. The modular design can scale from small 10-foot containers for local distribution to 40-foot containers for bulk storage, meeting different customer needs. These units are especially popular for pharmaceutical distribution, agricultural collection centers, and temporary cold storage at events or during disaster relief efforts.

The cold storage rooms segment is expected to grow at the fastest CAGR through 2035. The increasing demand for walk-in cold rooms powered by solar energy in rural health centers, agricultural packhouses, and small-scale food processing drives this growth. These installations take advantage of larger solar array capacity and thermal mass, providing more stable temperature control and better energy efficiency compared to mobile units.

Technology Insights

How do PV-Battery Systems Support Market Growth?

The PV-battery systems segment holds the largest market share of around 50-55% in 2025. Photovoltaic panels paired with battery storage offer a simple and reliable way to power refrigeration with solar energy. This technology provides complete energy independence, making it perfect for off-grid areas where grid access is limited or unreliable. Modern lithium-ion batteries offer better energy density, longer cycle life, and improved performance in high temperatures compared to traditional lead-acid batteries. The falling prices of solar panels and batteries, along with better charge controllers and inverters, are making PV-battery systems more cost-effective than diesel-powered options.

The hybrid (solar + grid/diesel) segment is expected to grow at the fastest CAGR during the forecast period. Hybrid systems offer operational flexibility by mixing solar power with backup energy sources, ensuring that cold chain maintenance continues without interruption during long cloudy days or peak demand. This technology is attractive to operators who need reliable solutions for high-value products while still making significant fuel savings and reducing emissions through solar use.

Temperature Range Insights

How does the 2°C to 8°C Range Dominate the Market?

The 2°C to 8°C segment holds the largest market share at nearly 40-45% in 2025. This temperature range is crucial for storing most vaccines, biological samples, pharmaceuticals, and fresh produce. It represents the biggest application area for cold chain equipment. The moderate cooling needs allow for efficient operation using solar power since the temperature difference from the surroundings is manageable even in tropical climates. WHO prequalification standards for solar direct-drive vaccine refrigerators in this range have set performance guidelines and sped up their use in immunization programs worldwide.

The -20°C to -30°C segment is expected to grow the fastest during the coming years. Rising demand for ultra-low temperature storage for advanced biologics, mRNA vaccines, and frozen food products drives this growth. Improvements in solar-powered cascade refrigeration systems and better insulation materials make ultra-low temperature applications more practical with renewable energy.

Capacity Insights

Why are 100-500 Liter Units Most Popular?

The 100-500 liters segment holds the largest market share at nearly 30-35% in 2025. This capacity range offers an optimal balance between portability and storage volume. It is suitable for district hospitals, primary health centers, and small-scale agricultural applications. Units in this range can be powered by reasonably sized solar arrays of 200 to 500W while providing enough storage for weekly vaccine supplies or daily harvests from small farms. The size allows for installation in facilities with limited space while maintaining energy efficiency through the right surface area to volume ratios.

The segment above 5000 liters is expected to grow the fastest during the coming years. Large-capacity solar cold storage rooms and containers are becoming popular among agricultural cooperatives, food processing hubs, and central medical stores. The economies of scale in solar system sizing and the growing need for community-level cold storage infrastructure are driving the adoption of larger units.

End User Insights

Why has the Pharmaceutical Sector Found Maximum Application?

The pharmaceutical and healthcare segment holds the largest market share, nearly 30-40%, in 2025. The strict temperature control needs of the pharmaceutical industry and the commitment to provide life-saving medicines and vaccines to underserved populations push the use of solar-powered cold chain solutions. The sector benefits from support from international funding, WHO prequalification programs, and government immunization programs that encourage solar refrigeration for vaccine storage. The high value of products and the serious risks caused by temperature fluctuations make investing in reliable solar-powered systems with strong monitoring features worthwhile.

The agriculture and horticulture segment is likely to experience the fastest growth rate in the near future. The growing emphasis on reducing post-harvest losses, boosting farmer incomes, and meeting export quality standards encourages quick adoption of agricultural applications. Government subsidies for solar cold storage, rising demand for quality produce from organized retail, and investments in shared infrastructure by farmer producer organizations all contribute to this segment's growth.

Distribution Channel Insights

Why are Direct Sales Preferred?

The direct sales segment has the largest market share, around 50-60%, in 2025. Direct sales through manufacturers and authorized distributors offer technical support, customization options, and after-sales service that are essential for solar-powered cold chain equipment. Customers prefer direct interaction for proper system sizing, installation supervision, and training on operation and maintenance. Government tenders and institutional purchases for healthcare and agricultural programs usually follow direct procurement processes, which helps the segment maintain its dominance.

The rental and leasing services segment is expected to have the fastest growth rate during the foreseeable future. Pay-per-use and cooling-as-a-service models lower upfront investment barriers and shift technical risks to service providers. This approach is especially attractive to smallholder farmers and small businesses, as it allows them to access solar cold chain solutions without the need for capital investment or maintenance responsibilities.

U.S. Solar-Powered Cold Chain Units Market Size and Growth 2025 to 2035

The U.S. solar-powered cold chain units market is expected to grow at a CAGR of 17.1% from 2025 to 2035.

How is the Asia Pacific Solar-Powered Cold Chain Units Market Growing Dominantly Across the Globe?

Asia Pacific has the largest market share of around 35-40% in 2025. This dominance comes from large rural populations needing cold chain access, significant agricultural production requiring post-harvest management, and government efforts to encourage renewable energy use. India’s major investments in solar cold storage for agriculture, along with subsidies under the PM-KUSUM scheme and the Agriculture Infrastructure Fund, fuel regional growth. China’s ability to manufacture solar panels and refrigeration parts offers cost benefits. Southeast Asian countries like Indonesia, the Philippines, and Vietnam are setting up solar cold chain units for island communities and remote areas. The high levels of solar energy available, especially in South Asia, ensure better system performance and quicker returns on investment compared to other regions.

Which Factors Support the Africa & Middle East Solar-Powered Cold Chain Units Market Growth?

Africa and the Middle East are expected to have the fastest growth rate from 2025 to 2035. This growth is due to large off-grid populations needing vaccine cold chains, abundant solar resources with high sunlight levels throughout the year, and international funding for healthcare infrastructure. African countries are quickly rolling out solar direct-drive refrigerators for immunization programs, with support from GAVI, the World Bank, and bilateral aid agencies. The Middle East is investing in solar-powered agricultural cold chains, especially in countries like Saudi Arabia, the UAE, and Egypt, as they focus on economic diversification and food security. Mobile money and pay-as-you-go financing models, which started in Africa, make solar cold chain equipment affordable for small-scale users, helping the market grow in previously underserved areas.

Value Chain Analysis

Key Players:

Segments Covered in the Report

By Type

By Technology

By Temperature Range

By Capacity

By End User

By Distribution Channel

By Region

The solar-powered cold chain units market is expected to increase from USD 0.68 billion in 2024 to USD 4.15 billion by 2035.

The solar-powered cold chain units market is expected to grow at a CAGR of 17.6% from 2025 to 2035.

The major players in the solar-powered cold chain units market include B Medical Systems S.à r.l., Dulas Ltd., Sure Chill Company Ltd., Dometic Group AB, Sundanzer (Groupe Lagazel), Godrej & Boyce Manufacturing Company Limited, Haier Biomedical, Zero Appliances Pty Ltd., Coolex (InSPIRE), Gricd SAS, Vestfrost Solutions, MOON Technology, Solar Cooling Technologies, Eco Solar Cool, Koolboks, Youmma, Promethean Power Systems, Blue Star Limited, Carrier Global Corporation, and Daikin Industries Ltd.

The driving factors of the solar-powered cold chain units market are the increasing demand for sustainable cold chain solutions in developing countries with unreliable grid infrastructure, growing pharmaceutical and food waste reduction initiatives, declining solar panel costs, and government support for renewable energy adoption in logistics.

Asia Pacific region will lead the global solar-powered cold chain units market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Type

3.3. Market Analysis, By Technology

3.4. Market Analysis, By Temperature Range

3.5. Market Analysis, By Capacity

3.6. Market Analysis, By End User

3.7. Market Analysis, By Distribution Channel

3.8. Market Analysis, By Geography

3.9. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Solar-Powered Cold Chain Units Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Growing Need for Off-Grid Cold Chain Solutions

4.2.2. Declining Solar Technology Costs

4.2.3. Focus on Reducing Food Waste and Vaccine Losses

4.3. Global Solar-Powered Cold Chain Units Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Initial Capital Investment

4.3.2. Technical Complexity and Maintenance Requirements

4.4. Global Solar-Powered Cold Chain Units Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Agricultural Value Chain Development

4.4.2. Expansion of Healthcare Access in Remote Areas

4.5. Global Solar-Powered Cold Chain Units Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Weather Dependency and Energy Storage Limitations

4.5.2. Competition from Grid-Based Solutions

4.6. Global Solar-Powered Cold Chain Units Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Integration of IoT and Remote Monitoring

4.6.2. Development of PCM-Based Thermal Storage

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Sustainability on the Global Solar-Powered Cold Chain Units Market

5.1. Introduction to Sustainable Cold Chain Solutions

5.2. Carbon Footprint Reduction Through Solar Adoption

5.3. Environmental Impact of Refrigerants and Materials

5.4. Life Cycle Assessment of Solar Cold Chain Equipment

5.5. Circular Economy and Equipment Recycling

5.6. Regulatory Framework for Sustainable Cooling

5.7. Corporate Sustainability Goals and Cold Chain

5.8. Impact on Market Growth and Investment Trends

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

7. Global Solar-Powered Cold Chain Units Market, By Type

7.1. Introduction

7.2. Refrigerated Trucks

7.3. Refrigerated Containers

7.4. Cold Storage Rooms

7.5. Portable Cooling Boxes

7.6. Refrigerated Display Units

8. Global Solar-Powered Cold Chain Units Market, By Technology

8.1. Introduction

8.2. PV-Battery Systems

8.2.1. Lead-Acid Battery Systems

8.2.2. Lithium-Ion Battery Systems

8.3. PV-PCM (Phase Change Material) Systems

8.4. Solar Direct Drive (SDD)

8.5. Hybrid (Solar + Grid/Diesel)

8.6. Solar Absorption Cooling

9. Global Solar-Powered Cold Chain Units Market, By Temperature Range

9.1. Introduction

9.2. Above 8°C (Cooling)

9.3. 2°C to 8°C (Chilling)

9.4. -5°C to -20°C (Freezing)

9.5. -20°C to -30°C (Deep Freezing)

9.6. Below -30°C (Ultra-Low)

10. Global Solar-Powered Cold Chain Units Market, By Capacity

10.1. Introduction

10.2. Below 100 Liters

10.3. 100-500 Liters

10.4. 500-1000 Liters

10.5. 1000-5000 Liters

10.6. Above 5000 Liters

11. Global Solar-Powered Cold Chain Units Market, By End User

11.1. Introduction

11.2. Pharmaceutical & Healthcare

11.2.1. Vaccines & Biologics

11.2.2. Blood & Blood Products

11.2.3. Medical Supplies

11.3. Food & Beverage

11.3.1. Dairy Products

11.3.2. Meat & Seafood

11.3.3. Fruits & Vegetables

11.3.4. Processed Foods

11.4. Agriculture & Horticulture

11.5. Fisheries & Marine Products

11.6. Chemicals

11.7. Others

12. Global Solar-Powered Cold Chain Units Market, By Distribution Channel

12.1. Introduction

12.2. Direct Sales

12.3. Distributors & Dealers

12.4. Rental/Leasing Services

12.5. Online Sales

13. Solar-Powered Cold Chain Units Market, By Geography

13.1. Introduction

13.2. Asia-Pacific

13.2.1. India

13.2.2. China

13.2.3. Indonesia

13.2.4. Philippines

13.2.5. Thailand

13.2.6. Vietnam

13.2.7. Rest of Asia-Pacific

13.3. Africa & Middle East

13.3.1. Nigeria

13.3.2. Kenya

13.3.3. Ethiopia

13.3.4. South Africa

13.3.5. Saudi Arabia

13.3.6. UAE

13.3.7. Egypt

13.3.8. Rest of Africa & Middle East

13.4. North America

13.4.1. U.S.

13.4.2. Canada

13.4.3. Mexico

13.5. Europe

13.5.1. Germany

13.5.2. France

13.5.3. U.K.

13.5.4. Italy

13.5.5. Spain

13.5.6. Netherlands

13.5.7. Rest of Europe

13.6. Latin America

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Colombia

13.6.4. Rest of Latin America

14. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

14.1. B Medical Systems S.à r.l.

14.2. Dulas Ltd.

14.3. Sure Chill Company Ltd.

14.4. Dometic Group AB

14.5. Sundanzer (Groupe Lagazel)

14.6. Godrej & Boyce Manufacturing Company Limited

14.7. Haier Biomedical

14.8. Zero Appliances Pty Ltd.

14.9. Coolex (InSPIRE)

14.10. Gricd SAS

14.11. Vestfrost Solutions

14.12. MOON Technology

14.13. Solar Cooling Technologies

14.14. Eco Solar Cool

14.15. Koolboks

14.16. Youmma

14.17. Promethean Power Systems

14.18. Blue Star Limited

14.19. Carrier Global Corporation

14.20. Daikin Industries Ltd.

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Sep-2025

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates