Resources

About Us

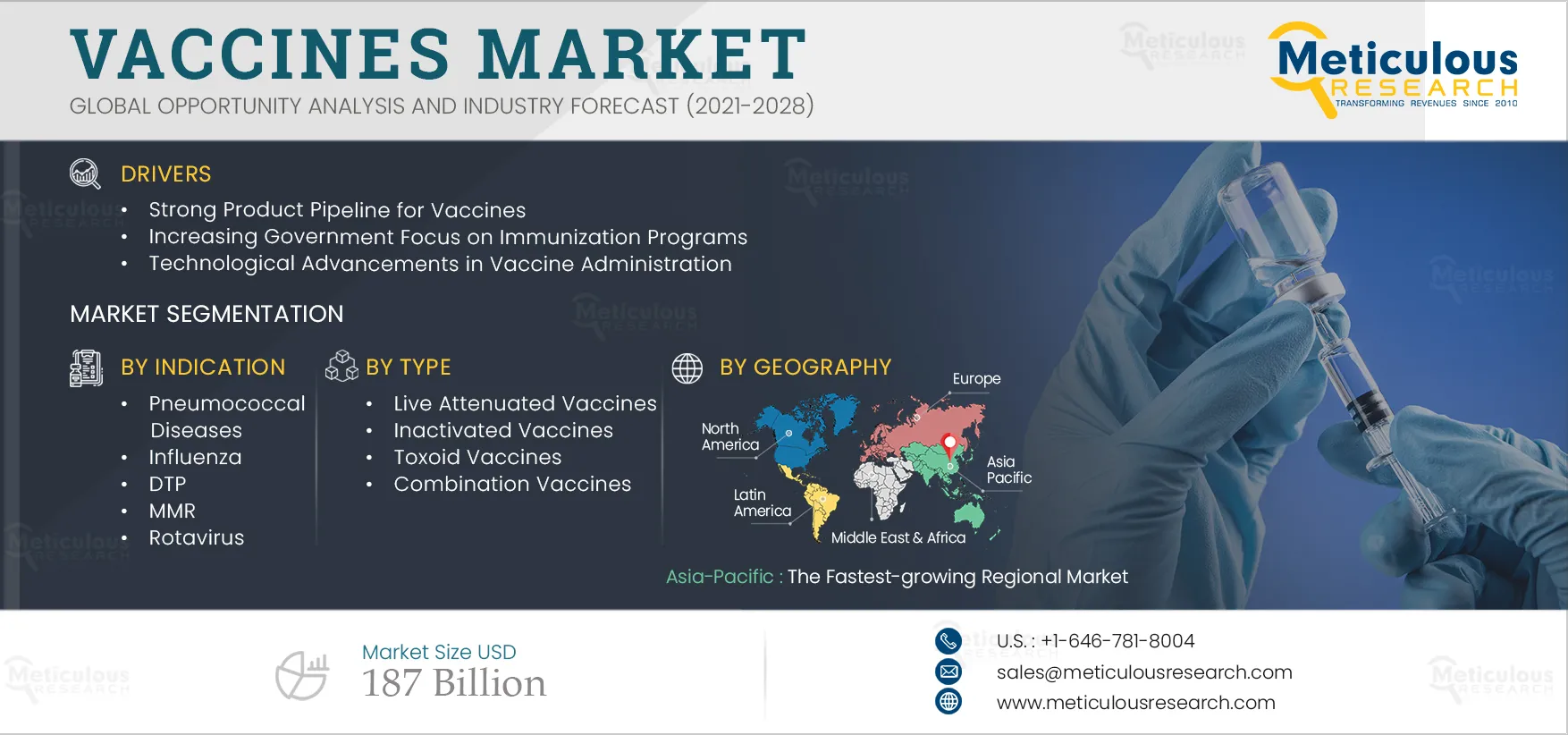

Vaccines Market Size, Share, Forecast, & Trends Analysis by Indication (Pneumococcal, Influenza, HPV, DTP, MMR, Hepatitis, COVID-19) Administration (IM, SC, Oral) Type (Inactivated, Combination) Valence (Multivalent, Monovalent) - Global Forecast to 2031

Report ID: MRHC - 104377 Pages: 270 May-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe market’s growth is majorly driven by the strong pipeline for vaccines, increasing government initiatives toward immunization, and technological advancements in the vaccine industry. Moreover, the rising prevalence of diseases, growing focus on therapeutic vaccines, and growth prospects in emerging markets are expected to offer growth opportunities for the players operating in this market.

Vaccine technology has evolved significantly during the last decade, profoundly changing the future of vaccine development. The introduction of genetic engineering has fueled many advances in vaccine development programs, leading to new products. Various virus vaccines that use the attenuated form of the virus have been developed through these methods. Also, new technologies enable the faster detection of viruses and allow for concentration levels to be kept high enough to generate an immune response.

Recent vaccine technologies are largely driven by the need to accelerate response times against emerging threats and make vaccines available for quick deployment. The increasing need to develop vaccines against difficult targets and improve delivery systems for maximum potency is also the focus of innovation in the vaccine industry. The development of synthetic vaccine candidates, genomic analysis of disease progression and vaccine response, structure-based antigen design, and nanoparticle delivery systems are some of the technological advancements in vaccine delivery.

Therefore, technological advancements are expected to drive the emergence of new and more effective vaccines for various new indications, fueling the growth of the vaccine market.

Click here to: Get Free Sample Pages of this Report

Over the last decade, the field of vaccine development has received huge support from the pharmaceutical industry as well as governments worldwide due to successful vaccination programs that helped in the eradication of infectious diseases such as chickenpox and polio globally, saving billions of dollars in healthcare expenditure. Vaccines are one of the most powerful and cost-effective health interventions available. Yet, many preventable diseases still cost millions of lives and billions of dollars every year. GlaxoSmithKline plc (U.K.), Johnson & Johnson (U.S.), Merck & Co., Inc. (U.S.), Pfizer Inc. (U.S.), Sanofi (France), Serum Institute of India Pvt. Ltd. (India), Daiichi Sankyo Co., Ltd. (Japan), and Takeda Pharmaceutical Co., Ltd. (Japan) are some of the major providers of vaccines in the global market. These companies are continuously engaged in developing new vaccines for new indications. The strong product pipelines of these companies indicate the growing demand for vaccines in the global market.

Some companies have portfolios of highly profitable vaccines and small vaccine pipelines. In such cases, the companies’ access considerations mainly depend upon pricing, registration, and supply. Other companies have limited product portfolios but larger pipelines supported by proportionally high investments in vaccine R&D. These companies are focused on ensuring the development of effective and accessible vaccines to meet global health needs.

Rising Prevalence of Diseases

The world is becoming increasingly interconnected, where cross-border travel allows diseases to spread quicker. Today, many vaccine manufacturers are focused on developing vaccines to prevent diseases of epidemic potential and improving the priority of such vaccines globally, creating market potential.

Also, the prevalence of infectious diseases is on the rise. According to the World Health Organization (WHO), infectious diseases such as tuberculosis (TB) are major causes of death worldwide. In 2022, 10.6 million people suffered from TB, and 1.3 million died from the disease, with over 80% of TB-related deaths recorded in low- and middle-income countries. Therefore, due to the rising prevalence of infectious diseases, there has been an increase in research activities to design vaccines, with a simultaneous increase in the emergence of new vaccines against infectious diseases.

By Indication: In 2024, the Pneumococcal Diseases Segment to Dominate the Vaccines Market

Based on indication, the vaccines market is segmented into pneumococcal diseases, influenza, human papillomavirus (HPV), diphtheria, tetanus, pertussis (DTP), meningococcal disease, measles, mumps, rubella (MMR), rotavirus, poliomyelitis (polio), hepatitis, COVID-19, and other indications. In 2024, the pneumococcal diseases segment is expected to account for the largest share of 13.9% of the vaccines market. The large market share of this segment can be attributed to the rising incidence of pneumococcal diseases such as pneumonia, meningitis, febrile bacteremia, otitis media, and sinusitis; the development of quality vaccines such as PPSV23; and initiatives by government and private sector organizations to prevent and control outbreaks of pneumococcal disease.

The pneumococcal disease segment is also projected to register the highest CAGR of 2.7% during the forecast period of 2024-2031. This is due to growing awareness regarding the importance of influenza vaccination and increasing clinical trial support.

By Route of Administration: In 2024, the Intramuscular (IM) Segment to Dominate the Vaccines Market

Based on route of administration, the vaccines market is segmented into intramuscular (IM), subcutaneous (SC), oral, and other route of administration. In 2024, the Intramuscular (IM) segment is expected to account for the largest share of the vaccines market. The large market share of this segment can be attributed to the ease of intramuscular administration and quick absorption of vaccines administered through the intramuscular route.

By Type: In 2024, the Subunit & Conjugate Vaccines Segment to Dominate the Vaccines Market

Based on type, the vaccines market is segmented into subunit & conjugate vaccines, inactivated vaccines, live-attenuated vaccines, toxoid vaccines, and combination vaccines. In 2024, the subunit & conjugate vaccines segment is expected to account for the largest share of the vaccines market. The large market share of this segment can be attributed to the subunit & conjugate vaccines’ long-term immunity, high safety, and stability compared to vaccines with other antigens.

By Valence: In 2024, the Multivalent Vaccines Segment to Dominate the Vaccines Market

Based on valence, the vaccines market is segmented into multivalent vaccines and monovalent vaccines. In 2024, the multivalent vaccines segment is expected to account for the larger share of 64.5% of vaccines market. The large market share of this segment is attributed to the launch of new multivalent vaccines, growing investments by key players in the R&D of multivalent vaccines, and technological advancements in multivalent vaccine production.

In 2024, North America is expected to account for the largest share of 41.2% of the vaccine market, followed by Europe and Asia-Pacific. North America’s significant market share can be attributed to several key factors, including the growing research & development, product launches, and the establishment of new facilities in the region by key players.

However, Asia-Pacific is slated to register the highest growth rate of 3.1% during the forecast period. The growth of this regional market is attributed to the increase in the emergence of infectious diseases, a large population of patients suffering from diseases, rising public awareness for vaccination, and growing support from governments towards immunization.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the vaccines market are Sanofi (France), Merck & Co., Inc. (U.S.), GlaxoSmithKline plc (U.K.), Pfizer Inc. (U.S.), Johnson & Johnson (U.S.), Daiichi Sankyo Co., Ltd. (Japan), Takeda Pharmaceutical Company Limited (Japan), CSL Limited (Australia), Emergent BioSolutions Inc. (U.S.), and AstraZeneca PLC (U.K.).

|

Particulars |

Details |

|

Number of Pages |

270 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

2.3% |

|

Market Size (Value) |

USD 71.50 billion by 2031 |

|

Segments Covered |

By Indication

By Route of Administration

By Type

By Valence

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Switzerland, Netherlands, Rest of Europe) Asia–Pacific (India, China, Japan, Australia, South Korea, Rest of Asia–Pacific), Latin America (Brazil, Mexico, Rest of Latin America), Middle East & Africa. |

|

Key Companies |

Sanofi (France), Merck & Co., Inc. (U.S.), GlaxoSmithKline plc (U.K.), Pfizer Inc. (U.S.), Johnson & Johnson (U.S.), Daiichi Sankyo Co., Ltd. (Japan), Takeda Pharmaceutical Company Limited (Japan), CSL Limited (Australia), Emergent BioSolutions Inc. (U.S.), and AstraZeneca PLC (U.K.). |

The vaccines market encompasses the industry involved in the development, production, and distribution of vaccines used to prevent or treat diseases. This market includes various types of vaccines, such as subunit, conjugate, inactivated, and live-attenuated vaccines, as well as different routes of administration like intramuscular, subcutaneous, and oral.

In 2023, the vaccines market was valued at approximately $59.55 billion.

The market is expected to grow to $71.5 billion by 2031, with an estimated value of $60.98 billion in 2024.

The market size was $59.55 billion in 2023 and is projected to be $60.98 billion in 2024.

Major companies in the vaccines market include:

Sanofi (France)

Merck & Co., Inc. (U.S.)

GlaxoSmithKline plc (U.K.)

Pfizer Inc. (U.S.)

Johnson & Johnson (U.S.)

Daiichi Sankyo Co., Ltd. (Japan)

Takeda Pharmaceutical Company Limited (Japan)

CSL Limited (Australia)

The market is experiencing growth driven by technological advancements in vaccine development, a strong product pipeline, and increasing government initiatives towards immunization.

Key drivers include:

The global outlook is positive, with North America holding the largest market share. However, Asia-Pacific is expected to exhibit the highest growth rate due to increasing disease prevalence, rising vaccination awareness, and government support.

The market is projected to grow from $60.98 billion in 2024 to $71.5 billion by 2031, indicating a steady expansion.

The market is projected to grow at a CAGR of 2.3% during the forecast period from 2024 to 2031.

North America is expected to hold the highest market share, accounting for 41.2% of the market in 2024.

Published Date: Jun-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates