Resources

About Us

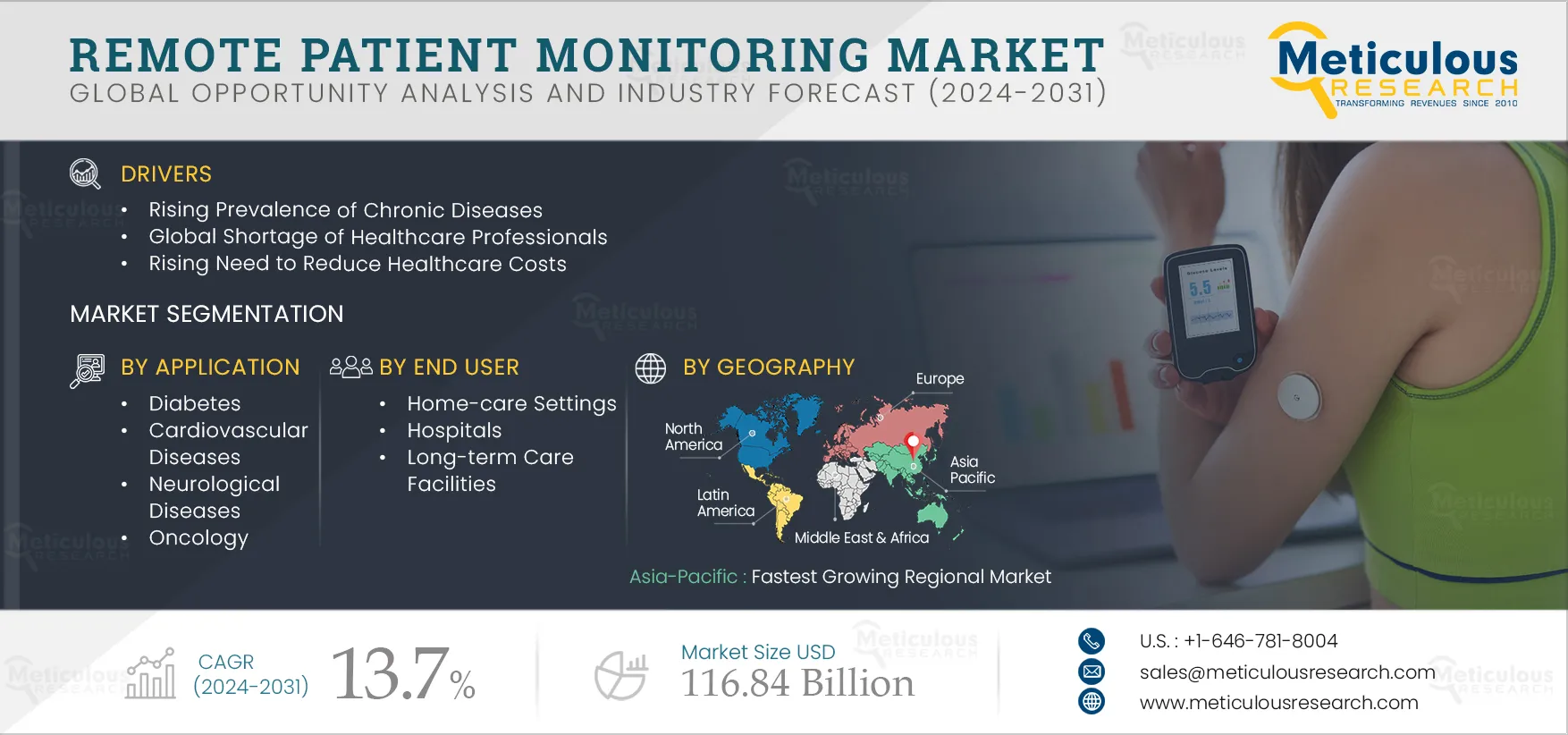

Remote Patient Monitoring Market by Product ([Blood Glucose, Respiratory, Blood Pressure, Fetal, Weight Monitoring] [Wearable, Portable, Benchtop]) Application (Diabetes, Oncology, Cardiovascular, Neurological Disorders) End User - Global Forecast to 2031

Report ID: MRHC - 104658 Pages: 247 Mar-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportRemote patient monitoring (RPM) is a sub-category of the telehealth market. It involves the use of connected medical devices to measure and monitor patient health data and transmit it to the healthcare provider. It also involves the use of software platforms to transmit the data to healthcare providers, where they can analyze the information and generate actionable insights. Healthcare professionals can intervene in disease management as necessary, either in person or virtually.

The rising prevalence of chronic diseases, shortage of healthcare professionals, growing awareness regarding the benefits of RPM, such as convenience and improved patient outcomes, rising need to reduce healthcare costs, and favorable government initiatives promoting remote patient monitoring are the factors driving the growth of the remote patient monitoring market.

Additionally, technological advancements in telehealth & remote patient monitoring, emerging economies with growing patient populations, increasing adoption of wearable devices, advancements in sensor technologies, and integration of artificial intelligence with RPM are expected to create market growth opportunities.

However, data accuracy & reliability concerns and barriers limiting the use of remote patient monitoring technologies, such as limited access and low technology literacy among patients, restrain the growth of the market. Additionally, data security & privacy concerns and increased overhead expenses due to the need for additional staff to manage the RPM system are some of the challenges impacting the market’s growth.

Remote patient monitoring involves the use of different kinds of technologies, software, services, and devices, including wearable devices such as CGM patches and wearable vital monitors. In recent years, there has been an increase in the adoption of wearable devices that allow health monitoring. These devices are cost-effective and save time.

For instance, GluCare.Health (U.A.E.), a diabetes-centered and digital therapeutics company, uses remote patient monitoring systems and devices such as continuous glucose monitoring systems and connected weighing scales to measure and collect patient data and allow healthcare professionals to connect remotely with patients whenever required. The company also has a team that regularly monitors recorded patient vials.

Besides wearable technologies, RPM is also being integrated with artificial intelligence (AI) to enhance monitoring and evaluating patients’ diagnostic requirements. Artificial intelligence-driven smart solutions, including care-assistive apps and prediction algorithms, allow for the remote evaluation of patients. For instance, Waire Health Ltd. (U.K.), a wellness and fitness service company, has developed C-Detect.

This wearable sensor device uses AI to monitor health parameters such as respiration rates, blood oxygen saturation, heart rate, core body temperature, step count, and fall detection & prediction. Thus, the growing use of artificial intelligence and virtual assistants in remote patient monitoring is driving the development of innovative RPM solutions, creating growth opportunities for the players operating in the market.

Conventionally, healthcare providers oversee patient diagnosis, health monitoring, and treatment. Healthcare providers are responsible for determining the type of screening, diagnostic, or therapeutic monitoring required to be performed on a specific patient. Additionally, patients must visit physicians for diagnosis and then schedule a follow-up appointment for further treatment and consultations.

However, increased digitalization and internet penetration have improved remote access to healthcare. There is a growing focus on enabling patients to actively participate in managing their health. Patients can now take responsibility for their healthcare due to the shift from physician-driven to consumer-driven healthcare. This trend has boosted the demand for remote patient monitoring globally.

Remote patient monitoring or health monitoring allows patients to actively participate in their health management. Patients can self-monitor their vital signs, track symptoms, and manage their conditions from the comfort of their own homes. Ever since the COVID-19 pandemic, consumers have been participating more actively in health decisions, enabling them to stay informed about their health and lead healthy lifestyles.

Remote patient monitoring has become an important part of healthcare. Earlier, individuals could receive treatment or manage health emergencies only at hospitals. However, with the increased focus on remote patient monitoring, physicians can use RPM devices to remotely manage several patients simultaneously.

Click here to: Get Free Sample Pages of this Report

Based on product, the remote patient monitoring market is segmented into monitoring devices, software, and services. In 2024, the monitoring devices segment is expected to account for the largest share of the market. The main factors contributing to the large market share of this segment are the increasing prevalence of chronic diseases, the rising awareness and utilization of telehealth and RPM technologies, the growing consumer awareness regarding the importance of monitoring chronic diseases, the rising demand for personalized healthcare, and the integration of artificial intelligence and machine learning in monitoring devices.

Furthermore, the utilization of AI in health monitoring has enabled easy and efficient detection of potential health issues. For instance, DrKrumo, Inc. (U.S.) offers AI-driven Next-Gen RPM solutions that allow healthcare providers to make informed clinical decisions from the insights created by the multicast data live streaming.

Based on application, the remote patient monitoring market is segmented into diabetes, cardiovascular diseases, neurological diseases, respiratory diseases, oncology, and other applications. In 2024, the diabetes segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the surge in the utilization of telehealth, the increased need to monitor diabetes patients, and the increasing prevalence of chronic diseases.

Furthermore, the challenge of providing continuous care due to limited medical resources has increased the adoption of RPM technologies. For instance, in 2021, the University of Mississippi Medical Center (UMMC) partnered with the North Mississippi Primary Health Care (MNPHC) to increase access to diabetes care through remote patient monitoring programs. Through this initiative, patients were provided with smart tablets to report their glucose level information to healthcare providers.

This data was accessed by the professionals using electronic health records (EHR), increasing the use of RPM technologies.

Based on end user, the remote patient monitoring market is segmented into home-care settings, hospitals, long-term care facilities, and other end users. In 2024, the home-care settings segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the growing shift towards home-care settings, the rising prevalence of chronic diseases among the elderly population, the shortage of healthcare professionals, and increasing consumer awareness regarding the monitoring of chronic conditions through RPM tools.

According to the World Health Organization (WHO), there are approximately 23, 7, and 26 doctors per 10,000 people in China, India, and Japan, respectively. Remote patient monitoring technologies provide numerous benefits in home care settings. They allow patients to access specialized healthcare services while saving on travel costs. Additionally, these technologies enable a single healthcare provider to consult with and treat multiple patients simultaneously.

Asia-Pacific is slated to register the highest CAGR in the remote patient monitoring market during the forecast period. The growth of this regional market can be attributed to growing consumer awareness, increasing personal disposable incomes, a large target population, increasing prevalence of chronic & infectious diseases, and government initiatives aimed at promoting the use of remote patient monitoring solutions.

For instance, in June 2023, the Universitas Indonesia Hospital (RSUI) (Indonesia) collaborated with Indonesia’s Ministry of Health (MOH) to launch a new digital application called RSUI Telmon AI.

This application includes telemonitoring, remote patient monitoring, and artificial intelligence capabilities. Patients can use it to consult with general practitioners and also connect their wearable devices, such as blood glucose monitors and blood pressure monitors, to allow therapeutic monitoring by their healthcare providers.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies like new product launches, mergers & acquisitions, partneships & agreements; adopted by leading market players over the past three years.

The key players profiled in the global remote patient monitoring market report are Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Boston Scientific Corporation (U.S.), Abbott Laboratories (U.S.), Siemens Healthineers AG (Germany), GE HealthCare Technologies, Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Baxter International, Inc. (U.S.), Oracle Corporation (U.S.), DexCom, Inc. (U.S.), and VitalConnect, Inc. (U.S.).

|

Particulars |

Details |

|

Page No |

247 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2024 |

|

CAGR |

13.7% |

|

Market Size (Value) |

$116.84 billion |

|

Segments Covered |

By Product

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), Latin America, and Middle East & Africa |

|

Key Companies |

Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Boston Scientific Corporation (U.S.), Abbott Laboratories (U.S.), Siemens Healthineers AG (Germany), GE HealthCare Technologies, Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Baxter International, Inc. (U.S.), Oracle Corporation (U.S.), DexCom, Inc. (U.S.), and VitalConnect, Inc. (U.S.) |

This study offers a detailed assessment of the remote patient monitoring market, including the market size & forecast for various segmentations like product, application, and end user. This report also involves the value analysis of various segments of remote patient monitoring at the regional and country levels.

The global remote patient monitoring market is projected to reach $116.84 billion by 2031, at a CAGR of 13.7% during the forecast period.

Based on product, the remote patient monitoring market is segmented into monitoring devices, software, and services. In 2024, the monitoring devices segment is expected to account for the largest share of the market. The large market share of the segment can be attributed to the increasing prevalence of chronic diseases, the rise in the elderly population, favorable regulatory scenarios, advancements in sensor technology, the rising demand for personalized healthcare, and the increasing integration of artificial intelligence in monitoring devices.

Based on application, in 2024, the diabetes segment is expected to account for the largest share of the market. The large market share of the segment can be attributed to several factors, including the widespread adoption of telehealth, the growing prevalence of diabetes, the increasing demand for continuous monitoring of diabetes patients, and the challenge of providing consistent care amid limited medical resources, which has propelled the adoption of remote patient monitoring technologies.

Factors such as the rising prevalence of chronic diseases, shortage of healthcare professionals, growing awareness regarding the benefits of RPM such as convenience and improved patient outcomes, rising need to reduce healthcare costs, and favorable government initiatives promoting remote patient monitoring are the factors driving the growth of the remote patient monitoring market.

Additionally, technological advancements in telehealth & remote patient monitoring, emerging economies with growing patient populations, increasing adoption of wearable devices, advancements in sensor technologies, and integration of artificial intelligence with RPM are expected to create market growth opportunities.

The key players operating in the global remote patient monitoring market are Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Boston Scientific Corporation (U.S.), Abbott Laboratories (U.S.), Siemens Healthineers AG (Germany), GE HealthCare Technologies, Inc. (U.S.), F. Hoffmann-La Roche AG (Switzerland), Baxter International, Inc. (U.S.), Oracle Corporation (U.S.), DexCom, Inc. (U.S.), and VitalConnect, Inc. (U.S.).

Emerging economies such as India are expected to offer significant growth opportunities for market players due to the high adoption of remote patient monitoring solutions, driven by rising healthcare expenditure, rising geriatric population, and government initiatives aimed at improving healthcare infrastructure.

1. Introduction

1.1. Market Definition And Scope

1.2. Market Ecosystem

1.3. Currency And Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection And Validation

2.2.1. Secondary Research

2.2.2. Primary Research / Interviews With Key Opinion Leaders of The Industry

2.3. Market Sizing And Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions For The Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Impact Analysis of Market Dynamics

4.2.2. Factor Analysis

4.3. Remote Patient Monitoring Market: Regulatory Analysis

4.3.1. Overview

4.3.2. North America

4.3.2.1. U.S.

4.3.2.2. Canada

4.3.3. Europe

4.3.4. Asia-Pacific

4.3.4.1. China

4.3.4.2. Japan

4.3.4.3. India

4.3.5. Latin America

4.3.6. Middle East

4.4. Pricing Analysis

4.5. Industry Trends

4.5.1. Shift From Physician-Driven to Consumer-Driven Healthcare

4.5.2. Integration of Artificial Intelligence With Remote Patient Monitoring Technologies

4.6. Porter's Five Forces Analysis

4.6.1. Bargaining Power of Buyers

4.6.2. Bargaining Power of Suppliers

4.6.3. Threat of Substitutes

4.6.4. Threat of New Entrants

4.6.5. Degree of Competition

5. Remote Patient Monitoring Market Assessment— by Product

5.1. Overview

5.2. Monitoring Devices

5.2.1. Monitoring Devices, by Functionality

5.2.1.1. Blood Glucose Monitoring Devices

5.2.1.2. Cardiac Monitoring Devices

5.2.1.3. Neurological Monitoring Devices

5.2.1.4. Respiratory Monitoring Devices

5.2.1.5. Multiparameter Monitoring Devices

5.2.1.6. Blood Pressure Monitoring Devices

5.2.1.7. Fetal And Neonatal Monitoring Devices

5.2.1.8. Weight Monitoring Devices

5.2.1.9. Other Monitoring Devices

5.2.2. Monitoring Devices, by Type

5.2.2.1. Wearable Monitoring Devices

5.2.2.2. Portable Monitoring Devices

5.2.2.3. Bench-Top Monitoring Devices

5.3. Software

5.4. Services

6. Remote Patient Monitoring Market Assessment—by Application

6.1. Overview

6.2. Diabetes

6.3. Cardiovascular Diseases

6.4. Neurological Disorders

6.5. Respiratory Diseases

6.6. Oncology

6.7. Other Applications

7. Remote Patient Monitoring Market Assessment—by End User

7.1. Overview

7.2. Home-Care Settings

7.3. Long-Term Care Facilities

7.4. Hospitals

7.5. Other End Users

8. Remote Patient Monitoring Market Assessment–by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. U.K.

8.3.3. France

8.3.4. Italy

8.3.5. Spain

8.3.6. Rest of Europe

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. Rest of Asia-Pacific

8.5. Latin America

8.6. Middle East & Africa

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

10. Company Profiles

10.1. Medtronic plc

10.2. Koninklijke Philips N.V.

10.3. Omron Corporation

10.4. Boston Scientific Corporation

10.5. Abbott Laboratories

10.6. Siemens Healthineers AG

10.7. Ge Healthcare Technologies, Inc.

10.8. F. Hoffmann-La Roche AG

10.9. Baxter International Inc.

10.10. Oracle Corporation

10.11. Dexcom, Inc.

10.12. VitalConnect, Inc.

10.13. Other Companies

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Population Aged 65 or Above, by Region, 2019 Vs. 2030 Vs. 2050 (In Million)

Table 2 Total Deaths Due to Parkinson's And Alzheimer's, by Country, 2010 Vs. 2019 Vs. 2020

Table 3 Total Deaths Due to Respiratory Disorders (Influenza, Pneumonia, COPD, Asthma), by Country, 2010 Vs. 2019 Vs. 2020

Table 4 Total Deaths Due to Circulatory System Diseases (Ischemic Heart Disease, Cerebrovascular Diseases), by Country, 2010 Vs. 2019 Vs. 2020

Table 5 Recent Technological Developments in Remote Patient Monitoring

Table 6 Physicians Per 1000 People, by Country, 2020

Table 7 Hospital Beds Per 1000 People, by Country, 2020

Table 8 Remote Patient Monitoring Devices: FDA Medical Device Classification

Table 9 China's Medical Device Classification Management System

Table 10 Saudi Arabia: Medical Device Classification System

Table 11 Remote Patient Monitoring Devices: Pricing Analysis

Table 12 Remote Patient Monitoring Services: Pricing Model

Table 13 Global Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 14 Global Remote Patient Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 15 Global Remote Patient Monitoring Devices Market, by Functionality, 2022–2031 (USD Million)

Table 16 Number of People With Diabetes, by Region (2021 Vs. 2030) (In Thousands)

Table 17 Global Blood Glucose Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 18 Some of The Examples of Wearable Cardiac Monitoring Devices

Table 19 Some of The Examples of Implantable Cardiac Monitoring Devices

Table 20 Global Cardiac Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 21 Global Neurological Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 22 Global Respiratory Monitoring Devices, by Country/Region, 2022–2031 (USD Million)

Table 23 Global Multiparameter Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 24 Global Blood Pressure Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 25 Number of Childbirths Per Year (2020 Vs. 2030)

Table 26 Global Fetal And Neonatal Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 27 Global Weight Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 28 Global Other Remote Patient Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 29 Global Remote Patient Monitoring Devices, by Type, 2022–2031 (USD Million)

Table 30 Innovative Wearable Remote Patient Monitoring Devices

Table 31 Global Wearable Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 32 Global Portable Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 33 Global Bench-Top Remote Patient Monitoring Devices Market, by Country/Region, 2022–2031 (USD Million)

Table 34 Major Features of Remote Patient Monitoring Software

Table 35 Global Remote Patient Monitoring Software Market, by Country/Region, 2022–2031 (USD Million)

Table 36 Types of Services Involved in Remote Patient Monitoring

Table 37 Trends in The Services Segment

Table 38 Global Remote Patient Monitoring Services Market, by Country/Region, 2022–2031 (USD Million)

Table 39 Global Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 40 Some of The Companies Offering Remote Patient Monitoring For Diabetes

Table 41 Global Remote Patient Monitoring Market For Diabetes, by Country/Region, 2022–2031 (USD Million)

Table 42 Some of The Companies Offering Remote Patient Monitoring For Cardiovascular Diseases

Table 43 Global Remote Patient Monitoring Market For Cardiovascular Diseases, by Country/Region, 2022–2031 (USD Million)

Table 44 Burden of Neurological Conditions (Dalys Per 100,000 Population)

Table 45 Deaths Per 100,000 Population Due to Parkinson's Disease And Alzheimer

Table 46 Some of The Companies Offering Remote Patient Monitoring For Neurological Disorders

Table 47 Global Remote Patient Monitoring Market For Neurological Disorders, by Country/Region, 2022–2031 (USD Million)

Table 48 Some of The Companies Offering Remote Patient Monitoring For Respiratory Diseases

Table 49 Global Remote Patient Monitoring Market For Respiratory Diseases, by Country/Region, 2022–2031 (USD Million)

Table 50 Some of The Companies Offering Remote Patient Monitoring For Oncology

Table 51 Global Remote Patient Monitoring Market For Cancer, by Country/Region, 2022–2031 (USD Million)

Table 52 Some of The Companies Offering Remote Patient Monitoring For Other Applications

Table 53 Global Remote Patient Monitoring Market For Other Applications, by Country/Region, 2022–2031 (USD Million)

Table 54 Global Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 55 Global Remote Patient Monitoring Market For Home-Care Settings, by Country/Region, 2022–2031 (USD Million)

Table 56 Global Remote Patient Monitoring Market For Long-Term Care Facilities, by Country/Region, 2022–2031 (USD Million)

Table 57 Global Remote Patient Monitoring Market For Hospitals, by Country/Region, 2022–2031 (USD Million)

Table 58 Global Remote Patient Monitoring Market For Other End Users, by Country/Region, 2022–2031 (USD Million)

Table 59 Global Remote Patient Monitoring Market, by Country/Region, 2022–2031 (USD Million)

Table 60 North America: Remote Patient Monitoring Market, by Country, 2022–2031 (USD Million)

Table 61 North America: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 62 North America: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 63 North America: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 64 North America: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 65 North America: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 66 U.S.: Macro Indicators & Micro Indicators

Table 67 U.S.: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 68 U.S.: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 69 U.S.: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 70 U.S.: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 71 U.S.: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 72 Canada: Macroeconomic Indicators

Table 73 Canada: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 74 Canada: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 75 Canada: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 76 Canada: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 77 Canada: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 78 Europe: Remote Patient Monitoring Market, by Country/Region, 2022–2031 (USD Million)

Table 79 Europe: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 80 Europe: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 81 Europe: Remote Patient Monitoring Market, by Type, 2022–2031 (USD Million)

Table 82 Europe: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 83 Europe: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 84 Germany: Macroeconomic Indicators

Table 85 Germany: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 86 Germany: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 87 Germany: Remote Patient Monitoring Devices, by Type, 2022–2031 (USD Million)

Table 88 Germany: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 89 Germany: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 90 U.K.: Prevalence of Various Chronic Conditions

Table 91 U.K.: Macroeconomic Indicators

Table 92 U.K.: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 93 U.K.: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 94 U.K.: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 95 U.K.: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 96 U.K.: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 97 France: Macroeconomic Indicators

Table 98 France: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 99 France: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 100 France: Remote Patient Monitoring Market, by Type, 2022–2031 (USD Million)

Table 101 France: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 102 France: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 103 Italy: Leading Causes of Deaths (2020)

Table 104 Italy: Macroeconomic Indicators

Table 105 Italy: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 106 Italy: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 107 Italy: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 108 Italy: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 109 Italy: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 110 Spain: Macroeconomic Indicators

Table 111 Spain: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 112 Spain: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 113 Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 114 Spain: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 115 Spain: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 116 Rest of Europe: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 117 Rest of Europe: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 118 Rest of Europe: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 119 Rest of Europe: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 120 Rest of Europe: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 121 Asia-Pacific: Remote Patient Monitoring Market, by Country/Region, 2022–2031 (USD Million)

Table 122 Asia-Pacific: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 123 Asia-Pacific: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 124 Asia-Pacific: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 125 Asia-Pacific: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 126 Asia-Pacific: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 127 China: Macroeconomic Indicators

Table 128 China: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 129 China: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 130 China: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 131 China: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 132 China: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 133 Japan: Macroeconomic Indicators

Table 134 Japan: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 135 Japan: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 136 Japan: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 137 Japan: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 138 Japan: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 139 India: Macroeconomic Indicators

Table 140 India: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 141 India: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 142 India: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 143 India: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 144 India: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 145 Rest of Asia-Pacific: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 146 Rest of Asia-Pacific: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 147 Rest of Asia-Pacific: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 148 Rest of Asia-Pacific: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 149 Rest of Asia-Pacific: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 150 Latin America: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 151 Latin America: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 152 Latin America: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 153 Latin America: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 154 Latin America: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 155 Middle East & Africa: Remote Patient Monitoring Market, by Product, 2022–2031 (USD Million)

Table 156 Middle East & Africa: Remote Patient Monitoring Devices Market, by Function, 2022–2031 (USD Million)

Table 157 Middle East & Africa: Remote Patient Monitoring Devices Market, by Type, 2022–2031 (USD Million)

Table 158 Middle East & Africa: Remote Patient Monitoring Market, by Application, 2022–2031 (USD Million)

Table 159 Middle East & Africa: Remote Patient Monitoring Market, by End User, 2022–2031 (USD Million)

Table 160 Recent Developments, by Company, 2020-2024

Table 161 Product Portfolio Analysis

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global Remote Patient Monitoring Market Size, by Product, 2024 Vs. 2031 (USD Million)

Figure 8 Global Remote Patient Monitoring Market Size, by Application, 2024 Vs. 2031 (USD Million)

Figure 9 Global Remote Patient Monitoring Market Size, by End User, 2024 Vs. 2031 (USD Million)

Figure 10 Remote Patient Monitoring Market, by Geography

Figure 11 Impact Analysis of Market Dynamics

Figure 12 Global Estimated Number of New Cancer Cases, 2020–2040

Figure 13 Benefits of Remote Patient Monitoring

Figure 14 Global Prevalence of Diabetes in People Aged 20-79 Years, 2011–2045

Figure 15 USFDA Regulatory Pathways For Medical Devices

Figure 16 Eu Regulatory Pathway - IVDR 2017/746

Figure 17 China: Medical Device Classification And Pre-Market Requirements For IVD Devices

Figure 18 Advantages of AI Integration in Remote Patient Monitoring

Figure 19 Porter's Five Forces Analysis

Figure 20 Global Remote Patient Monitoring Market, by Product, 2024 Vs. 2031 (USD Million)

Figure 21 Global Remote Patient Monitoring Market, by Application, 2024 Vs. 2031 (USD Million)

Figure 22 Estimated Number of Cancer Cases (2020-2040)

Figure 23 Global Remote Patient Monitoring Market, by End User, 2024 Vs. 2031 (USD Million)

Figure 24 Global Remote Patient Monitoring Market, by Geography, 2024 Vs. 2031 (USD Million)

Figure 25 North America: Remote Patient Monitoring Market Snapshot

Figure 26 Geriatric Population in Canada (2019–2050)

Figure 27 Europe: Remote Patient Monitoring Market Snapshot

Figure 28 Asia-Pacific: Remote Patient Monitoring Market Snapshot

Figure 29 China: Estimated Number of New Cancer Cases (2020–2040)

Figure 30 Japan: Percentage of Population Aged 65 And Above (2010-2030)

Figure 31 Key Growth Strategies Adopted by Leading Players, 2020-2023

Figure 32 Remote Patient Monitoring Market: Competitive Benchmarking by Region

Figure 33 Competitive Dashboard: Remote Patient Monitoring Market

Figure 34 Medtronic plc: Financial Overview (2022)

Figure 35 Koninklijke Philips N.V.: Financial Overview (2022)

Figure 36 OMRON Corporation: Financial Overview (2022)

Figure 37 Boston Scientific Corporation: Financial Overview (2022)

Figure 38 Abbott Laboratories: Financial Overview (2022)

Figure 39 Siemens Healthineers AG: Financial Overview (2022)

Figure 40 GE Healthcare Technologies, Inc.: Financial Overview (2023)

Figure 41 F. Hoffmann-La Roche AG: Financial Overview (2023)

Figure 42 Baxter International, Inc.: Financial Overview (2023)

Figure 43 Oracle Corporation: Financial Overview (2022)

Figure 44 DexCom, Inc.: Financial Overview (2023)

Published Date: Jan-2024

Published Date: Jul-2018

Published Date: Mar-2016

Published Date: Jul-2014

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates