Resources

About Us

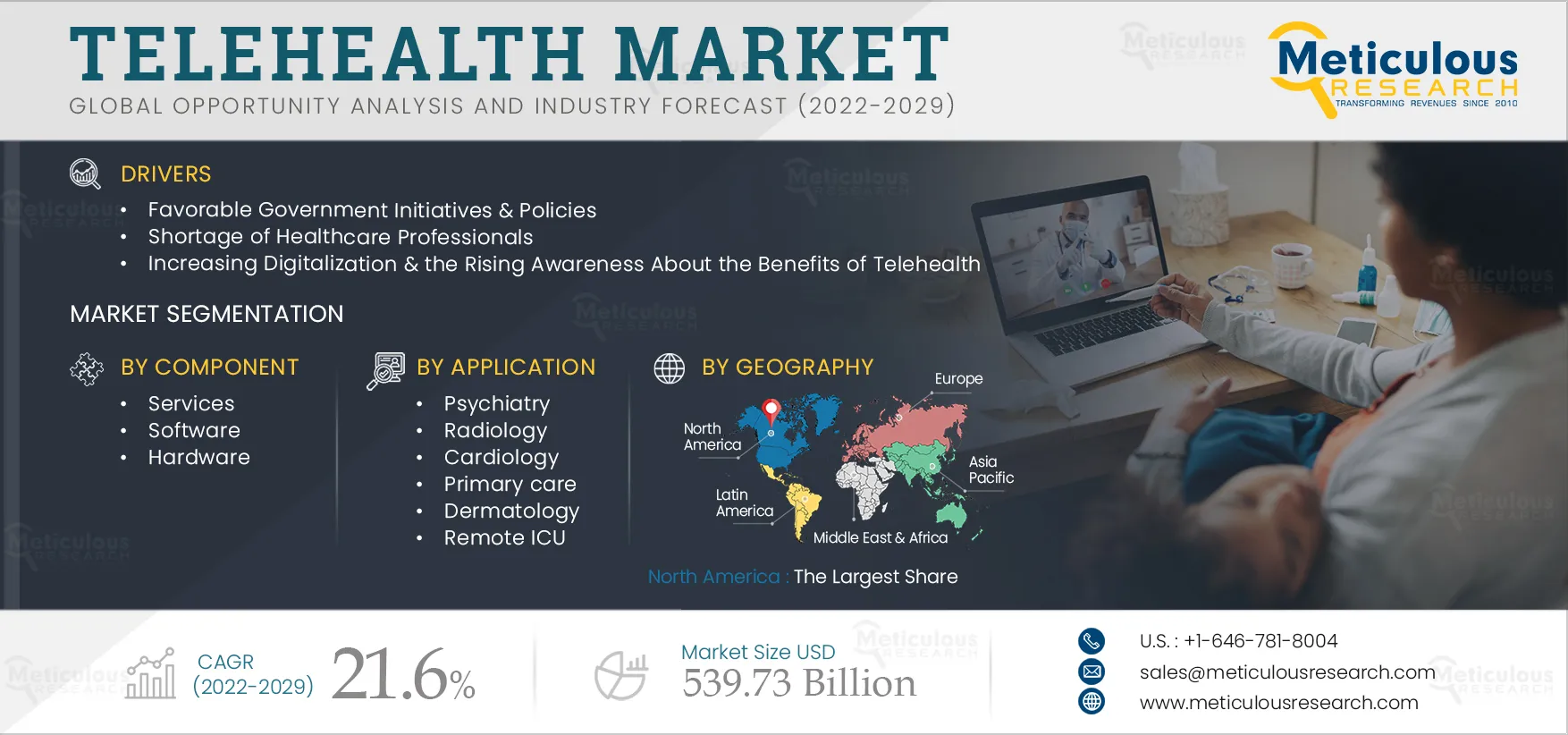

Telehealth Market by Component [Hardware (Peripheral Devices, Monitor), Software (Cloud, On-premise), Services (Real-time, Remote Monitoring)], Application (Radiology, Cardiology, Psychiatry), End User (Provider, Payer, Patient) - Global Forecast to 2029

Report ID: MRHC - 10462 Pages: 203 Dec-2022 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe Telehealth Market is expected to grow at a CAGR of 21.6% from 2022 to 2029 to reach $539.73 billion by 2029. Telehealth or teleconsultation refers to the use of digital information and communication technologies, such as computers and mobile devices, to access and manage healthcare services remotely. Teleconsultation involves delivering healthcare, health education, and health information services through remote technologies. Telehealth has several benefits, including reduced unnecessary hospitalizations, medical treatment wait times, and significant financial savings. It allows patients and physicians to engage over great distances and provide care, counseling, reminders, education, intervention, monitoring, and remote admissions. Telehealth involves videoconferencing, transmission of still images, e-health, remote monitoring of vital signs, continuing medical education, and nurse call centers. Both primary and specialized care providers benefit from teleconsultation because it allows them to broaden their reach and treat patients everywhere there is an Internet connection.

The key factors driving the global telehealth market are favorable government initiatives and reforms/policies, a shortage of healthcare professionals worldwide, and increasing awareness about the benefits of telehealth. In addition, the use of artificial intelligence and virtual assistants and the development of telerobots are expected to provide great growth opportunities for the market in the coming years.

Click here to: Get Free Sample Copy of this report

Artificial intelligence (AI) is broadening the scope of telemedicine technology to include radiology, pathology, dermatology, and psychiatry, among other fields. Artificial intelligence-driven smart solutions, including care-assistive apps and prediction algorithms, allow for more than just remotely evaluating patients' diagnostic needs. They help healthcare professionals (HCPs) reduce workloads by automatically translating prescriptions into Electronic Health Records (EHRs) and generating medical reports, particularly in times of crisis. For instance, DrFirst (U.S.), a healthcare technology start-up, has developed a patented SmartSig AI technology that accurately converts patient medication history into hospitals' and health systems' EHRs without the need for human involvement.

Healthcare professionals can use AI-enabled EHRs to increase data interoperability and improve remote patient monitoring. Furthermore, AI-based networking models can shorten the time it takes to find specialists, reducing patient waiting times. Clinicians at the Los Angeles County Department of Health Services, for instance, reduced visits to specialized care providers by more than 14,000 by introducing telemedicine examinations for diabetic retinopathy at the department’s security net facilities.

AI-enabled healthcare chatbots are also gaining traction around the world. These bots can chat with people in the virtual plane, answering their questions, educating them about sickness symptoms, and assisting them in scheduling appointments with doctors. Engagely AI (U.S.), for instance, has developed a smart telemedicine bot that assists hospitals in checking pharmaceutical inventories, suggesting alternative treatment choices, and following up with patients for routine check-ups. It also allows healthcare professionals to verify a patient's medical history, perform remote diagnoses, and create digital prescriptions.

Thus, the use of artificial intelligence and virtual assistants in telemedicine is creating growth opportunities for the players in this market.

The development of telerobots has improved telemedicine in a variety of ways. Remote patient monitoring, diagnosis, and virtual care are all made easier and more accurate with the use of telerobots. Telerobots can track patients' health in real time and warn physicians if their condition deteriorates. For instance, iRobot (U.S.) and InTouch Health (U.S.) have collaborated to build robots for remote healthcare settings such as ICUs, patient wards, and operating & procedure rooms.

Robots are also assisting doctors in setting up virtual visits with their patients, in addition to remote monitoring. For instance, VGo Communications (U.S.) has developed a two-wheeled robot that is in use at Florida Hospital (U.S.), Intermountain Healthcare (U.S.), and Children's Hospital Boston (U.S.). It allows doctors who are not in the same city as their patients to video-call them in hospitals and receive their most recent medical information. Patients can even take telerobots home with them after their hospital stay to assist with postoperative consultations and care. Thus, the development of telerobots is creating market growth opportunities.

In 2022, the services segment is expected to account for the largest share of 73% of the global telehealth market. The large share of this segment is attributed to the increasing utilization of telehealth services in remote/rural areas, shortage of physicians & specialists, increasing remote patient monitoring for chronic diseases, and growing adoption & awareness about telehealth solutions. Telehealth services are divided into teleconsultation and telemonitoring. Teleconsultation involves communication between the doctor and the patient remotely. This communication could be done via video conferencing or telephonic communication. Teleconsultation is also useful for routine drug prescriptions, medical diagnostics, and screening, or medical advice on specific situations. Telemonitoring refers to digital patient monitoring that may be used remotely with the appropriate device and software.

In 2022, Radiology and Psychiatry Applications Will Exhibit a Greater Uptake in the Telehealth Market

The radiology and psychiatry specialties have a higher uptake of telehealth products & services. The high penetration of telehealth in the radiology segment can be attributed to the shortage of radiologists, the high number of diagnostic imaging procedures performed per year, and the high prevalence of chronic diseases such as cancer. The growing uptake of telehealth in the psychiatry segment can be attributed to the shortage of primary psychiatric care and the outbreak of the COVID-19 pandemic. Telepsychiatry services have proven efficient and effective in improving access, quality, and efficiency in mental healthcare, contributing to its rapid adoption.

In 2022, the Healthcare Providers Segment is Expected to Account for the Largest Share of the Telehealth Market

In 2022, the healthcare providers segment is expected to account for the largest share of the global telehealth market. This segment's large share is attributed to factors such as the high demand for convenient healthcare, a dearth of medical professionals, advanced telehealth infrastructure in hospitals, and an increase in the focus and availability of provider-specific telehealth solutions.

U.S. to Account for the Largest Market Share in 2022

In 2022, the U.S. is expected to account for the largest share of 35% of the global telehealth market. In the U.S., the adoption of telehealth services has been on the rise over the last decade. This is due to its greater convenience to physicians and specialists. The increasing adoption of telehealth has led to healthcare payers becoming more interested in covering telehealth services. Several insurance companies, as well as certain government-funded programs, have modified their policies to include telemedicine. Since 2018, Medicaid has expanded its scope of telehealth and telemedicine services in several states. Thus, high adoption of telehealth services, high prevalence of chronic diseases, presence of top players in the country, and favorable government initiatives support the largest share of the market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the product portfolio offerings, components, applications, end users, geographic presence, and key strategic developments adopted by leading market players in the industry over the years 2019–2022. The key players profiled in the global telehealth market are Aerotel Medical Systems (1998) Ltd. (Israel), Cerner Corporation (U.S.), Medtronic Public Limited Company (Ireland), Koninklijke Philips N.V. (Netherlands), AMD Global Telemedicine, Inc. (U.S.), American Well Corporation (U.S.), Cisco Systems, Inc. (U.S.), Doctor On Demand, Inc. (U.S.), MDlive Inc. (U.S.), Siemens Healthineers AG (Germany), Teladoc Health, Inc. (U.S.), and Zipnosis, Inc. (U.S.). The major companies in the telehealth market have implemented various strategies over the years to expand their product offerings and global footprint and augment their market shares. The key strategies followed by most companies in the telehealth market were product launches & approvals, acquisitions, agreements, partnerships, and collaborations. Product launches & approvals were the most preferred growth strategies adopted by the leading players. The leading players that actively adopted this strategy include Teladoc Health, Inc. (U.S.), American Well Corporation (U.S.), Koninklijke Philips N.V. (Netherlands), Medtronic PLC (Ireland), and AMD Global Telemedicine, Inc. (U.S.).

Telehealth Market, by Component

Services

Telehealth Market, by Application

Telehealth Market, by End User

Telehealth Market, by Geography

North America

Key questions answered in the report:

The telehealth market report covers the market size & forecasts for various components, applications, end users, and geography. It also involves the value analysis of various segments and sub-segments of telehealth at the regional and country levels.

The global telehealth market is projected to reach $539.73 billion by 2029, at a CAGR of 21.6% during the forecast period of 2022–2029.

The various components are hardware, software, and services. In 2022, the services segment is expected to account for the largest share of the global telehealth market.

The rising adoption of telehealth services is due to the COVID-19 pandemic, rising global elderly population, increasing prevalence of chronic diseases, and increasing awareness about the benefits and convenience telehealth offers. Furthermore, the use of AI and virtual assistants and the development of technologies such as telerobots are some factors that provide significant growth opportunities for market players.

The lack of health standards compared to traditional health systems and patient privacy & confidentiality concerns are expected to limit the market's growth to some extent.

The key players operating in the global telehealth market are Aerotel Medical Systems (1998) Ltd. (Israel), Cerner Corporation (U.S.), Medtronic Public Limited Company (Ireland), Koninklijke Philips N.V. (Netherlands), AMD Global Telemedicine, Inc. (U.S.), American Well Corporation (U.S.), Cisco Systems, Inc. (U.S.), Doctor On Demand, Inc. (U.S.), MDlive Inc. (U.S.), Siemens Healthineers AG (Germany), Teladoc Health, Inc. (U.S.), and Zipnosis, Inc. (U.S.) among others.

China is the fastest-growing country and offers significant growth opportunities for the players operating in this market. The increasing government support and initiatives promoting the adoption of telehealth services, the increasing demand for better healthcare, and the improvement of healthcare infrastructure are supporting the market's growth.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates