Resources

About Us

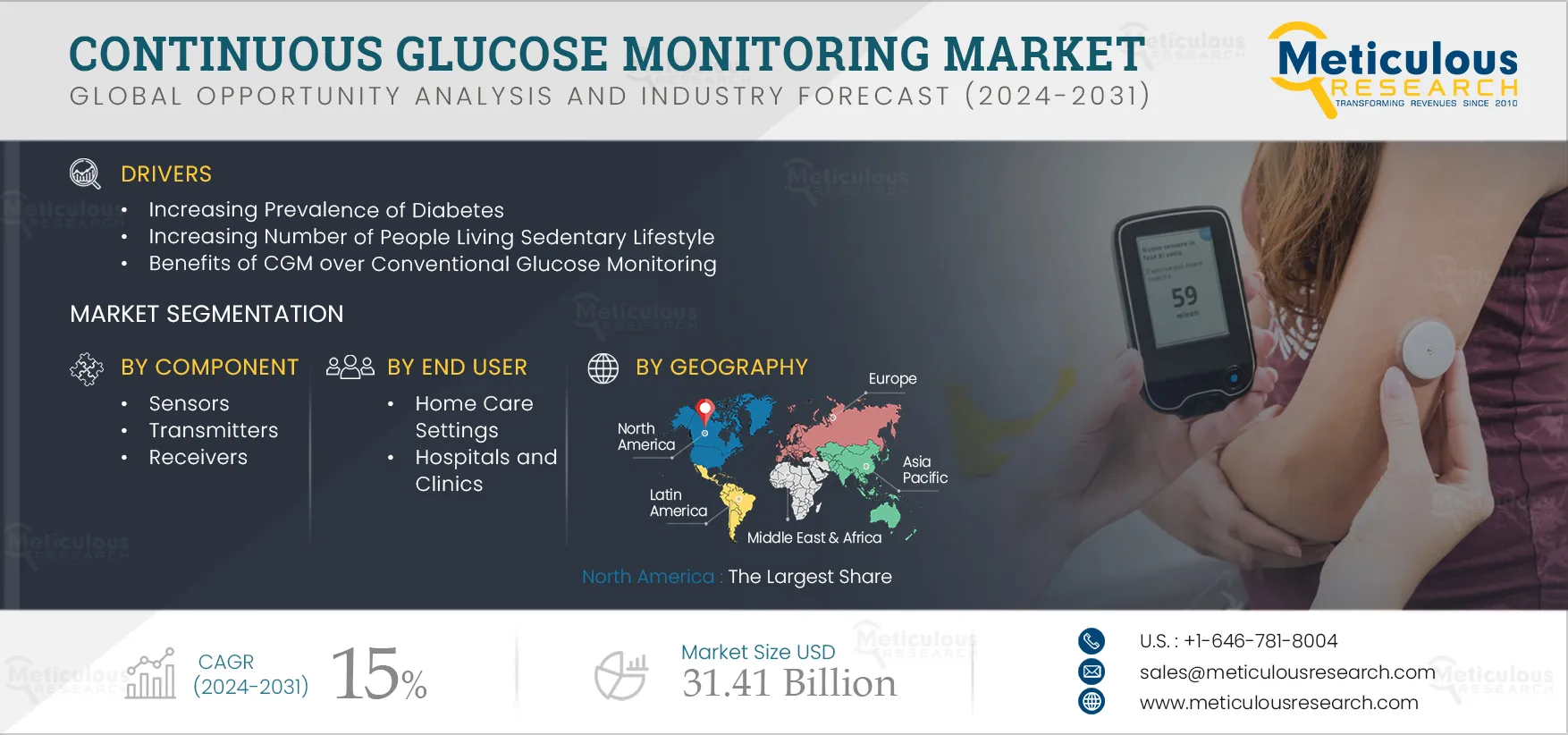

Continuous Glucose Monitoring Market Size, Share, Forecast, and Trends Analysis by Component (Sensors [Disposable, Implantable], Receivers, Transmitters), Age Group (Adults, Children), End User (Homecare, Hospitals & Clinics) - Global Forecast to 2032

Report ID: MRHC - 1041277 Pages: 150 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Continuous Glucose Monitoring Market is expected to reach $31.41 billion by 2032, at a CAGR of 15% from 2025 to 2032. The growth of this market is driven by factors such as the increasing prevalence of diabetes and the number of people living a sedentary lifestyle, the benefits of CGM over conventional glucose monitoring, and the use of CGM by athletes and fitness enthusiasts. Furthermore, technological advancements in CGM devices, a shift toward personalized care and rising health awareness, and increasing accessibility for diabetes care devices in low and middle-income countries are expected to offer growth opportunities for the players operating in the continuous glucose monitoring market.

Continuous glucose monitors help measure glucose levels in the body and send the readings to the healthcare provider through a smartphone app. Several new products have been launched in the diabetes management space in recent years; for instance, in March 2025, the U.S. Food and Drug Administration (FDA) approved DexCom, Inc.’s (U.S.) Dexcom Stelo Glucose Biosensor System. It is an over-the-counter (OTC) integrated CGM and can be used for patients aged 18 years and older. This device is suitable for people who are not on insulin and who do not have severe hypoglycemia.

Some of the risk factors of diabetes are obesity, family history, poor diet, mutations in single gene, prediabetes, sedentary lifestyle, and insulin resistance.

For instance, according to the World Health Organization (WHO), approximately 422 million people have diabetes worldwide. Continuous glucose monitoring helps patients regularly monitor their glucose levels and receive timely alerts in case of low or high glucose levels.

Click here to: Get Free Sample Pages of this Report

The rising incidence of chronic diseases enabled technological advancements in healthcare devices. One such advancement is the growing use of continuous glucose monitors. The benefits offered by CGMs over conventional devices are real-time data monitoring; provision of trend analysis to monitor glucose levels during meals, exercise, and resting periods of the patient; issue alerts in cases of extremely high or low glucose levels, enhanced diabetes management, and reduction in the use of fingerstick.

Artificial intelligence (AI) is also being integrated into CGM devices contributing to effective diabetes management. This integration leads to the optimization of treatments and helps in lifestyle management to avoid the risk of diabetes. For instance, in May 2024, January, Inc. (U.S.) launched a generative artificial intelligence (AI) supported app that can estimate and predict the glucose patterns of individuals. This app can be integrated with a CGM and can be accessed through any smartphone device to receive recommendations on calorie intake and physical activity. It also offers tips on blood glucose management and can be used by people without diabetes who are on special diets such as intermittent fasting.

The usage of smart electronic devices and the integration of AI in glucose monitoring is a recent development. Smart CGM devices predict fluctuations in glucose levels up to 60 minutes in advance and provide access to additional algorithms and insights for improved glucose management. For example, the Guardian Connect CGM System, developed by Medtronic (Ireland), allows users with diabetes to track their glucose patterns on mobile devices every 5 minutes.

AI integration in glucose monitoring devices helps reduce manual checking of blood glucose levels by predicting the sugar levels and creating a personalized plan, making diabetes management easier than with traditional devices. For instance, in March 2025, Roche launched an AI-powered diabetes management system called the 14-day Accu-Chek SmartGuide system that predicts fluctuations in glucose levels.

After the COVID-19 pandemic, there has been increased adoption of wearable technology in healthcare. The rising prevalence of diabetes and an increased need for real-time or continuous monitoring are key drivers of this increasing adoption. CGM devices have a lower turnaround time than the conventional process at the clinics, which is expensive and relies on patient-provider availability.

The adoption of wearable devices to monitor vitals has proven to be significant. Additionally, the emphasis on preventive healthcare and personalized medicine is encouraging more people to adopt CGM devices to manage their health proactively.

Technologically advanced continuous glucose monitors are gaining popularity due to the enhanced connectivity features offered by these devices. Some of the advantages offered by these devices include wireless connectivity, personalized glucose level tracking, integration with insulin pumps, and a combination of artificial intelligence and machine learning.

Another such innovation is the use of enzyme-based electrochemical sensors in CGM devices that provide accurate and reliable information to the users. Many of the minimally invasive CGM systems are enzyme-based. The wireless connectivity feature of CGMs with smartphones enables users to track their glucose levels in real time. Combining this with insulin pumps allows the adjustment of insulin levels based on glucose levels, providing a significant edge in diabetes care management.

Additionally, implantable continuous glucose monitors are also being introduced. For instance, in February 2022, Senseonics Holdings, Inc. (U.S.) received the U.S. Food and Drug Administration (FDA) approval for the Eversense® E3 version, which is an implantable CGM device and can stay in the body of a patient for approximately six months.

Based on component, the continuous glucose monitoring market is segmented into sensors, transmitters, and receivers. In 2025, the sensors segment is expected to account for the largest share of over 52.4% of the continuous glucose monitoring market. The rise in the preference for continuous glucose monitoring, along with frequent purchases of sensors, compared to receivers and transmitters, supports the large market share of this segment. Sensors require more frequent replacement compared to other components. Disposable sensors are replaced in 7 to 14 days after placement while implantable sensors can be replaced in 150-180 days.

Based on age group, the market is segmented into adults and children. In 2025, the adult segment is expected to account for a larger share of the continuous glucose monitoring market. This segment’s large market share can be attributed to the rise in the geriatric population with a high prevalence of diabetes and a sedentary lifestyle, leading to diseases such as obesity. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), in 2021, 38.4 million people of all ages had diabetes (11.6% of the population), among which 38.1 million were adults ages 18 years or older.

However, the children segment is projected to register the highest growth rate during the forecast period. Children are more likely to get diagnosed with type 1 diabetes, where the body no longer produces insulin, leading to elevated glucose levels. For instance, according to the International Diabetes Federation (IDF) Atlas 2022, in 2022, there were 1.52 million under 20 years of age, living with type 1 diabetes globally. Continuous or real-time monitoring of glucose levels can help effectively manage this condition.

Based on end user, the market is segmented into home care settings and medical facilities such as hospitals & clinics. In 2025, the home care settings segment is expected to account for a larger share of over 82.3% of the continuous glucose monitoring market. The large market share of this segment is attributed to factors such as the rising prevalence of diabetes globally, increasing health awareness among people, a shift toward preventive healthcare, and easy accessibility to CGM in developed countries. CGM technologies provide numerous benefits in home care settings. There is a growing shift toward home healthcare due to the shortage of healthcare professionals and increasing consumer awareness about the monitoring of diabetic conditions through CGM.

In 2025, North America to Dominate the Continuous Glucose Monitoring Market

In 2025, North America is expected to account for the largest share of over 42.2% of the continuous glucose monitoring market, followed by Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America’s significant market share can be attributed to the high accessibility to advanced technologies, the presence of prominent manufacturers in the region, significant investments in research & development, a robust reimbursement framework for continuous glucose monitoring devices, and supportive government initiatives aimed at raising awareness about diabetes. According to the Centers for Medicare and Medicaid Services (U.S.), in 2022, healthcare spending was 4.1 percent, reaching $4.5 trillion or $13,493 per person.

However, the market in Asia-Pacific is projected to register the highest CAGR of over 17.40% during the forecast period. The growth of this regional market is driven by factors such as improving healthcare infrastructure, rising disposable income, and increasing investments by major market players. Furthermore, economic growth, as well as technological advancements are the major reasons for market growth in this region.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and the key growth strategies adopted by them over the past three to four years. Some of the key players operating in the continuous glucose monitoring market are DexCom, Inc. (US), Abbott Laboratories (US), F. Hoffmann-La Roche Ltd (Switzerland), Medtronic PLC (Ireland), Nemaura Medical Inc. (UK), LifeScan, Inc. (US), Senseonics Holdings, Inc. (Maryland), A. Menarini Diagnostics S.r.l (Italy), Medtrum Technologies, Inc. (Shanghai.), and B. Braun SE (Germany).

|

Particulars |

Details |

|

Number of Pages |

150 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

15% |

|

Market Size (Value) |

$31.41 Billion by 2032 |

|

Segments Covered |

By Component

By Age Group

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Norway, Sweden, Denmark, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa |

|

Key Companies |

DexCom, Inc. (US), Abbott Laboratories (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Medtronic plc (Ireland), Nemaura Medical Inc. (UK), LifeScan, Inc. (US), Senseonics Holdings, Inc. (U.S.), A. Menarini Diagnostics S.r.l (Italy), Medtrum. Technologies, Inc. (Shanghai.), B. Braun SE (Germany) |

This market study covers the market sizes and forecasts of the continuous glucose monitoring market based on component, age group, end user, and geography. This market study also provides the value analysis of various segments and sub-segments of the continuous glucose monitoring market at the regional and country levels.

The continuous glucose monitoring market is projected to reach $31.41 billion by 2032, at a CAGR of 15% during the forecast period.

The sensors segment is expected to account for the largest share of the continuous glucose monitoring market in 2025. The large market share of this segment is attributed to factors such as a rise in the preference for continuous glucose monitoring coupled with frequent purchases of sensors compared to receivers and transmitters.

The growth of this market is driven by factors such as the increasing prevalence of diabetes across all age groups, the increasing number of people living sedentary lifestyles as well as the use of CGM by athletes and fitness enthusiasts. Furthermore, technological advancements in CGM devices, a shift toward personalized care along with rising health awareness, benefits offered by CGM over conventional glucose monitoring, and increasing accessibility for diabetic care devices in low- and middle-income countries are expected to provide growth opportunities for the market.

The key players profiled in the continuous glucose monitoring market report are DexCom, Inc. (US), Abbott Laboratories (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Medtronic PLC (Ireland), Nemaura Medical Inc. (U.K.), LifeScan, Inc. (U.S.), Senseonics Holdings, Inc. (U.S.), A. Menarini Diagnostics S.r.l (Italy), Medtrum Technologies, Inc. (Shanghai.), and B. Braun SE (Germany).

China, South Korea, and India are expected to offer significant growth opportunities for the vendors in the continuous glucose monitoring market during the analysis period. The rising incidence of diabetes in China and India, rising healthcare spending, and expansion of CGM manufacturing facilities are expected to drive the market’s growth in these countries.

Published Date: Jan-2025

Published Date: Mar-2024

Published Date: May-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates