Resources

About Us

Portable and Personal HVAC Cooling Devices Market Size, Share & Forecast 2025-2035 | Growth Analysis by Product Type, Technology, Application & Region

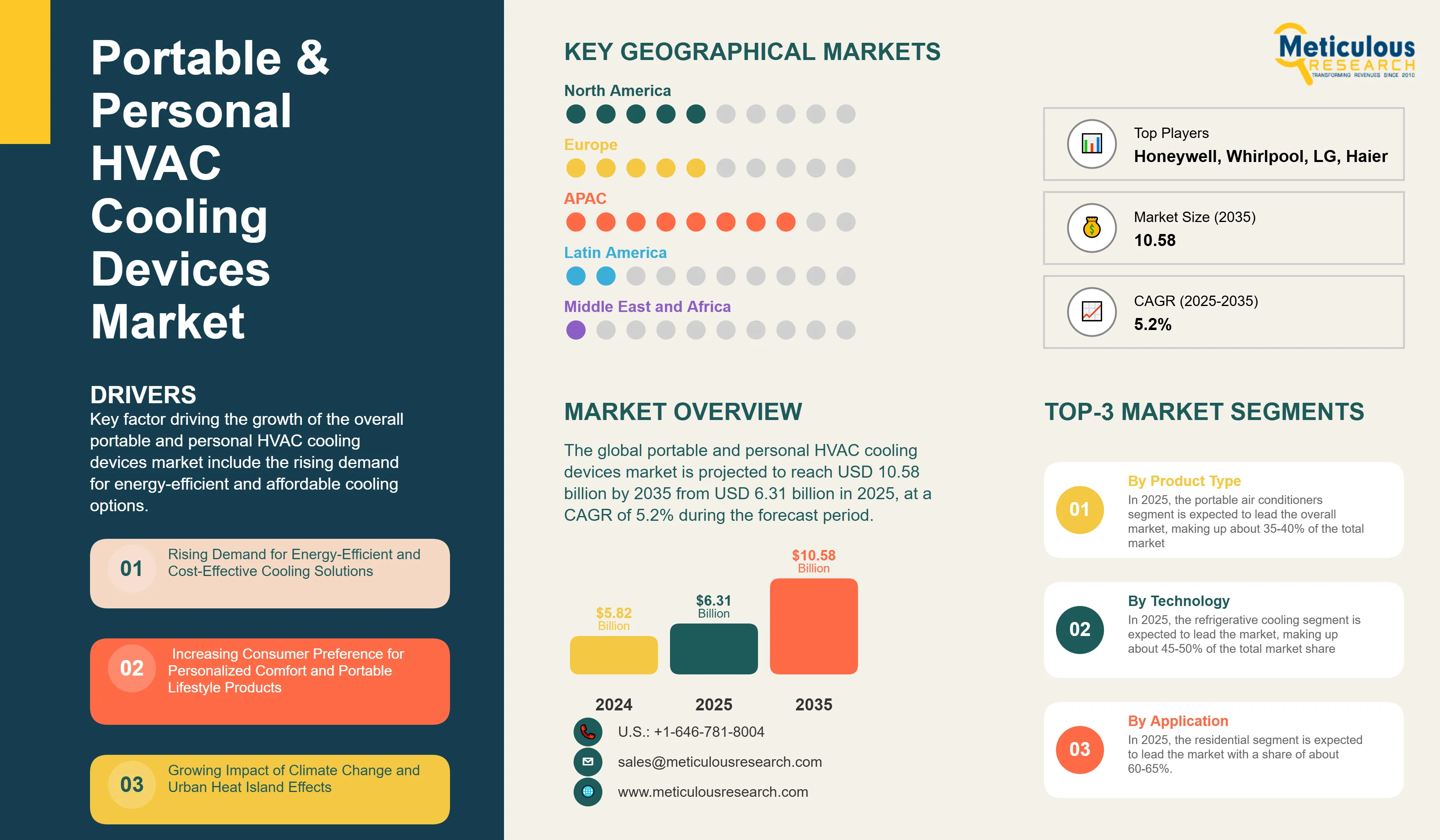

Report ID: MREP - 1041529 Pages: 172 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportKey factor driving the growth of the overall portable and personal HVAC cooling devices market include the rising demand for energy-efficient and affordable cooling options. Consumers increasingly prefer personalized comfort and products that fit a portable lifestyle. The adoption of remote work and flexible workspaces is also growing. Additionally, rising temperatures from climate change and urban heat island effects, along with more outdoor activities and events, contribute to this trend. However, this growth faces challenges. The cooling capacity of portable devices is limited compared to traditional HVAC systems. In some applications, the costs per unit are higher. Certain product categories also raise noise concerns. Seasonal demand fluctuations impact year-round sales.

There are untapped opportunities in emerging markets with growing middle-class populations. The development of smart, IoT-enabled portable cooling devices is on the rise. Battery-powered and solar-powered cooling solutions are expanding. There is also a push for sustainable and eco-friendly refrigerants. Furthermore, demand for outdoor cooling solutions in hospitality and event management is increasing.

Notable trends in this market include the use of advanced evaporative cooling technologies, wireless connectivity with smartphone integration, compact designs, and multi-functional devices that combine cooling with air purification.

Market Drivers

Rising Demand for Energy-Efficient and Cost-Effective Cooling Solutions

The demand for portable and personal HVAC cooling devices is growing significantly. This rise is due to consumers becoming more aware of energy consumption and ways to save on utility costs. Traditional central air conditioning systems can take up 50-70% of residential energy bills during peak cooling seasons. As a result, consumers are looking for more efficient cooling options.

Portable cooling devices provide zone-based cooling, letting users cool specific areas or personal spaces rather than entire buildings. This focused method can cut energy use by 30-40% compared to central systems when cooling individual rooms or workspaces. Modern portable cooling devices use technology like inverter compressors, variable speed fans, and smart temperature controls. These features help manage energy use while keeping comfort levels high.

The cost savings go beyond just energy. Portable devices do not require expensive ductwork installation, permanent changes to buildings, or professional HVAC maintenance. This makes them especially appealing for renters, small businesses, and temporary cooling needs.

Increasing Consumer Preference for Personalized Comfort and Portable Lifestyle Products

The shift toward personalized comfort solutions is driving significant growth in the portable cooling device market. Consumers increasingly seek products that fit their individual preferences and mobile lifestyles, whether they are working from home, traveling, or enjoying time outdoors.

Personal cooling devices allow users to create customized comfort zones tailored to their specific temperature needs, without impacting others in shared spaces. This trend in personalization is especially strong among younger demographics who value flexibility and individual control over their environment.

The rise of remote work and flexible workspace arrangements has created new demand for portable cooling solutions that provide comfort in home offices, co-working spaces, and temporary work locations. Additionally, the growing interest in outdoor activities, glamping, RV travel, and outdoor events has broadened the market for portable cooling devices beyond traditional indoor uses.

Growing Impact of Climate Change and Urban Heat Island Effects

Rising global temperatures and the increasing frequency of heat waves are causing significant changes in cooling demand. Many regions are experiencing longer and more intense cooling seasons, with record-breaking temperatures becoming more common. This has raised awareness of the health and productivity effects of too much heat exposure.

Urban heat island effects in crowded areas create temperature differences of 5 to 10°F compared to surrounding areas, increasing cooling needs in cities. Portable cooling devices offer flexible options for managing these temperature changes and creating comfortable microclimates in affected areas.

The growing recognition of heat-related health risks, especially for vulnerable groups like the elderly and those with chronic health conditions, is driving the need for accessible and affordable cooling solutions. Portable devices provide a crucial safety net for individuals who may not have central air conditioning or who need extra cooling in certain situations.

Market Segmentation Analysis

By Product Type

Based on product type, the portable and personal HVAC cooling devices market includes personal air coolers, portable air conditioners, evaporative coolers, tower fans, desk fans, wearable cooling devices, and others. In 2025, the portable air conditioners segment is expected to lead the overall market, making up about 35-40% of the total portable and personal HVAC cooling devices market. This leadership comes from their strong cooling performance, wide range of uses, and the growing affordability of compact refrigerative cooling technologies.

However, the personal air coolers segment is set to show the highest growth rate, with a CAGR of 6.9% during the forecast period from 2025 to 2035. This significant growth is driven by rising consumer demand for energy-efficient cooling options, increased use of evaporative cooling technology in dry areas, growing awareness of environmental advantages, and the creation of compact, visually appealing personal cooling devices with improved features.

The wearable cooling devices segment is also growing quickly due to advances in miniaturization, better battery technology, and more applications in outdoor work, sports, and recreational activities.

By Technology

Based on technology, the portable and personal HVAC cooling devices market is divided into evaporative cooling, refrigerative cooling, thermoelectric cooling, and hybrid cooling systems. In 2025, the refrigerative cooling segment is expected to lead the market, making up about 45-50% of the total market share. This is due to the better cooling performance of refrigerative systems, their effectiveness in humid climates, and consumers' familiarity with traditional air conditioning.

The evaporative cooling segment is likely to experience the highest growth rate during the forecast period. This growth is driven by increasing awareness of environmental issues, lower energy use compared to refrigerative systems, effectiveness in dry climates, and the rising use of sustainable cooling technologies that rely on water evaporation instead of chemical refrigerants.

By Application

Based on application, the portable and personal HVAC cooling devices market is divided into residential, commercial, and outdoor/recreational uses. In 2025, the residential segment is expected to lead the market with a share of about 60-65%. The rising use of portable cooling solutions in homes, apartments, dormitories, and other residential places is one of the major drivers for the growth of this segment.

The outdoor/recreational segment is likely to have the highest growth rate of 7.2% during the forecast period from 2025 to 2035. This growth is driven by the rising trend of outdoor lifestyles, the growing popularity of camping and RV travel, the expansion of outdoor dining and entertainment spaces, the rising need for temporary cooling solutions at events and festivals, and the increasing awareness of health risks related to heat during outdoor activities.

By Distribution Channel

Based on distribution channels, the portable and personal HVAC cooling devices market is divided into online retail and offline retail. In 2025, the online retail segment is expected to lead the market with a share of about 55-60%. This growth is due to the convenience of online shopping, a wide range of products, competitive prices, and the ease of comparing features and customer reviews.

The online retail segment is also predicted to see the highest growth rate during the forecast period. This is driven by more people shopping online, direct-to-consumer marketing strategies from manufacturers, increasing comfort among consumers with buying appliances online, and the rise of online marketplaces and specialty cooling device retailers.

Regional Analysis

Based on geography, the market for portable and personal HVAC cooling devices is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. In 2025, Asia-Pacific is expected to hold the largest share, about 40-45% of the market. This is due to the region's large population, rapid urbanization, rising middle-class incomes, and growing awareness of personal comfort solutions.

The market in Asia-Pacific is projected to have the highest growth rate of 6.2% during the forecast period from 2025 to 2035. This growth results from rising temperatures, impacts of climate change, increasing disposable incomes in emerging economies, trends toward urban living and apartment living, more people adopting portable products, and an expanding e-commerce infrastructure. China and India are leading this regional growth, while developed markets like Japan and South Korea focus on integrating advanced technology and offering premium products.

North America is a mature market with strong demand for energy-efficient and technologically advanced cooling solutions. The region's focus on smart home integration, outdoor activities, and sustainable cooling technologies supports steady market growth.

Europe shows a sophisticated demand for eco-friendly and energy-efficient cooling solutions. Strict environmental regulations push innovation in sustainable cooling technologies and the use of eco-friendly refrigerants.

Competitive Landscape

The market for portable and personal HVAC cooling devices includes a range of established home appliance manufacturers, specialized cooling device firms, and new tech startups. They compete based on product innovation, energy efficiency, design, and price. Key players in this market are Honeywell International Inc., Whirlpool Corporation, LG Electronics Inc., Haier Group Corporation, Midea Group Co. Ltd., Frigidaire (Electrolux), Black+Decker Inc., Dyson Ltd., Lasko Products LLC, Holmes Products Corp., Evapolar Inc., Arctic Air LLC, Personal Cooling Systems Inc., Zero Breeze Inc., and IcyBreeze LLC, among others.

These companies focus on several strategies to strengthen their market position and grow their customer base. They are developing smart and IoT-enabled cooling devices. They are also investing in energy-efficient technologies and expanding battery-powered and solar-powered product lines. Additionally, they are forming partnerships with e-commerce platforms and retailers while innovating their product designs to emphasize portability, aesthetics, and multi-functionality.

|

Particulars |

Details |

|

Number of Pages |

172 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.2% |

|

Market Size 2024 |

USD 5.82 billion |

|

Market Size 2025 |

USD 5.47 billion |

|

Market Size 2035 |

USD 10.58 billion |

|

Segments Covered |

By Product Type, Technology, Application, Distribution Channel |

|

Countries Covered |

North America (U.S., Canada, Mexico), Europe (Germany, France, U.K., Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) |

The portable and personal HVAC cooling devices market is projected to reach USD 10.58 billion by 2035 from USD 6.31 billion in 2025, at a CAGR of 5.2% during the forecast period.

In 2025, the portable air conditioners segment is projected to hold the major share of the portable and personal HVAC cooling devices market, while the personal air coolers segment is slated to record the highest growth rate.

Key factors driving the growth include rising demand for energy-efficient and cost-effective cooling solutions, increasing consumer preference for personalized comfort and portable lifestyle products, growing adoption of remote work and flexible workspace arrangements, rising temperatures due to climate change, and expanding outdoor recreational activities.

Asia-Pacific leads the market with the highest share and is projected to record the highest growth rate during the forecast period, offering significant opportunities for portable and personal HVAC cooling device vendors.

Major opportunities include untapped markets in emerging economies with growing middle-class populations, development of smart and IoT-enabled portable cooling devices, expansion of battery-powered and solar-powered cooling solutions, and rising demand for outdoor cooling solutions in hospitality and event management.

Key trends include the adoption of advanced evaporative cooling technologies, wireless connectivity and smartphone integration, compact and aesthetically pleasing designs, and multi-functional devices combining cooling with air purification capabilities.

The evaporative cooling segment is anticipated to record the highest growth rate during the forecast period, driven by increasing environmental consciousness, lower energy consumption, and growing adoption of sustainable cooling technologies.

This comprehensive report provides essential market intelligence, competitive analysis, and strategic insights for industry stakeholders, investors, and decision-makers seeking to capitalize on the expanding portable and personal HVAC cooling devices market opportunities.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Portable and Personal HVAC Cooling Devices Market, by Product Type

3.2.2. Portable and Personal HVAC Cooling Devices Market, by Technology

3.2.3. Portable and Personal HVAC Cooling Devices Market, by Application

3.2.4. Portable and Personal HVAC Cooling Devices Market, by Distribution Channel

3.2.5. Portable and Personal HVAC Cooling Devices Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Demand for Energy-Efficient and Cost-Effective Cooling Solutions

4.2.1.2. Increasing Consumer Preference for Personalized Comfort and Portable Lifestyle Products

4.2.1.3. Growing Adoption of Remote Work and Flexible Workspace Arrangements

4.2.1.4. Rising Temperatures Due to Climate Change and Urban Heat Island Effects

4.2.1.5. Expanding Outdoor Recreational Activities and Events

4.2.2. Restraints

4.2.2.1. Limited Cooling Capacity Compared to Traditional HVAC Systems

4.2.2.2. Higher Per-Unit Cooling Costs in Some Applications

4.2.2.3. Noise Concerns in Certain Product Categories

4.2.2.4. Seasonal Demand Fluctuations Affecting Year-Round Sales

4.2.3. Opportunities

4.2.3.1. Untapped Markets in Emerging Economies with Growing Middle-Class Populations

4.2.3.2. Development of Smart and IoT-Enabled Portable Cooling Devices

4.2.3.3. Expansion of Battery-Powered and Solar-Powered Cooling Solutions

4.2.3.4. Integration with Sustainable and Eco-Friendly Refrigerants

4.2.3.5. Rising Demand for Outdoor Cooling Solutions in Hospitality and Event Management

4.2.4. Trends

4.2.4.1. Advanced Evaporative Cooling Technologies

4.2.4.2. Wireless Connectivity and Smartphone Integration

4.2.4.3. Compact and Aesthetically Pleasing Designs

4.2.4.4. Multi-Functional Devices Combining Cooling with Air Purification

4.2.5. Challenges

4.2.5.1. Competition from Traditional HVAC Systems and Central Air Conditioning

4.2.5.2. Consumer Education About Product Capabilities and Limitations

4.2.5.3. Regulatory Compliance Across Different Markets

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Portable and Personal HVAC Cooling Devices Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy Efficient Cooling Technologies

4.4.1.2. Eco-Friendly Refrigerants and Natural Cooling Methods

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Development of Solar-Powered and Battery-Operated Devices

4.4.2.2. Manufacturer-led Sustainable Design Initiatives

4.4.3. Market Opportunities Created by Sustainability Focus

4.4.3.1. Circular Economy and Product Lifecycle Management

4.4.3.2. Challenges in Sustainable Material Sourcing

5. Portable and Personal HVAC Cooling Devices Market Assessment—By Product Type

5.1. Overview

5.2. Personal Air Coolers

5.3. Portable Air Conditioners

5.4. Evaporative Coolers

5.5. Tower Fans

5.6. Desk Fans

5.7. Wearable Cooling Devices

5.8. Others

6. Portable and Personal HVAC Cooling Devices Market Assessment—By Technology

6.1. Overview

6.2. Evaporative Cooling

6.3. Refrigerative Cooling

6.4. Thermoelectric Cooling

6.5. Hybrid Cooling Systems

7. Portable and Personal HVAC Cooling Devices Market Assessment—By Application

7.1. Overview

7.2. Residential

7.3. Commercial

7.4. Outdoor/Recreational

8. Portable and Personal HVAC Cooling Devices Market Assessment—By Distribution Channel

8.1. Overview

8.2. Online Retail

8.3. Offline Retail

9. Portable and Personal HVAC Cooling Devices Market Assessment—By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Netherlands

9.3.7. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Rest of Latin America (RoLATAM)

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. United Arab Emirates (UAE)

9.6.3. South Africa

9.6.4. Rest of Middle East & Africa (RoMEA)

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Contemporary Stalwarts

10.5. Market Share/Ranking Analysis, by the Key Players, 2024

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

11.1. Honeywell International Inc.

11.2. Whirlpool Corporation

11.3. LG Electronics Inc.

11.4. Haier Group Corporation

11.5. Midea Group Co. Ltd.

11.6. Frigidaire (Electrolux AB)

11.7. Black+Decker Inc.

11.8. Dyson Ltd.

11.9. Lasko Products LLC

11.10. Holmes Products Corp.

11.11. Evapolar Inc.

11.12. Arctic Air LLC

11.13. Personal Cooling Systems Inc.

11.14. Zero Breeze Inc.

11.15. IcyBreeze LLC

12. Appendix

12.1. Available Customization

12.2. Related Reports

LIST OF TABLES

Table 1. Global Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 2. Global Personal Air Coolers Market, by Country/Region, 2025–2035 (USD Million)

Table 3. Global Portable Air Conditioners Market, by Country/Region, 2025–2035 (USD Million)

Table 4. Global Evaporative Coolers Market, by Country/Region, 2025–2035 (USD Million)

Table 5. Global Tower Fans Market, by Country/Region, 2025–2035 (USD Million)

Table 6. Global Desk Fans Market, by Country/Region, 2025–2035 (USD Million)

Table 7. Global Wearable Cooling Devices Market, by Country/Region, 2025–2035 (USD Million)

Table 8. Global Other Portable and Personal HVAC Cooling Devices, by Country/Region, 2025–2035 (USD Million)

Table 9. Global Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 10. Global Evaporative Cooling Market, by Country/Region, 2025–2035 (USD Million)

Table 11. Global Refrigerative Cooling Market, by Country/Region, 2025–2035 (USD Million)

Table 12. Global Thermoelectric Cooling Market, by Country/Region, 2025–2035 (USD Million)

Table 13. Global Hybrid Cooling Systems Market, by Country/Region, 2025–2035 (USD Million)

Table 14. Global Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 15. Global Portable and Personal HVAC Cooling Devices Market for Residential, by Country/Region, 2025–2035 (USD Million)

Table 16. Global Portable and Personal HVAC Cooling Devices Market for Commercial, by Country/Region, 2025–2035 (USD Million)

Table 17. Global Portable and Personal HVAC Cooling Devices Market for Outdoor/Recreational, by Country/Region, 2025–2035 (USD Million)

Table 18. Global Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 19. Global Portable and Personal HVAC Cooling Devices Market Through Online Retail, by Country/Region, 2025–2035 (USD Million)

Table 20. Global Portable and Personal HVAC Cooling Devices Market Through Offline Retail, by Country/Region, 2025–2035 (USD Million)

Table 21. North America: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 22. North America: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 23. North America: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 24. North America: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 25. U.S.: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 26. U.S.: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 27. U.S.: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 28. U.S.: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 29. Canada: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 30. Canada: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 31. Canada: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 32. Canada: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 33. Mexico: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 34. Mexico: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 35. Mexico: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 36. Mexico: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 37. Europe: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 38. Europe: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 39. Europe: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 40. Europe: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 41. Germany: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 42. Germany: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 43. Germany: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 44. Germany: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 45. France: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 46. France: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 47. France: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 48. France: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 49. U.K.: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 50. U.K.: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 51. U.K.: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 52. U.K.: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 53. Italy: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 54. Italy: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 55. Italy: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 56. Italy: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 57. Spain: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 58. Spain: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 59. Spain: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 60. Spain: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 61. Netherlands: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 62. Netherlands: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 63. Netherlands: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 64. Netherlands: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 65. Rest of Europe: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 66. Rest of Europe: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 67. Rest of Europe: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 68. Rest of Europe: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 69. Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 70. Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 71. Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 72. Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 73. China: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 74. China: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 75. China: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 76. China: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 77. Japan: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 78. Japan: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 79. Japan: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 80. Japan: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 81. India: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 82. India: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 83. India: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 84. India: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 85. South Korea: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 86. South Korea: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 87. South Korea: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 88. South Korea: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 89. Australia: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 90. Australia: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 91. Australia: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 92. Australia: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 93. Rest of Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 94. Rest of Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 95. Rest of Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 96. Rest of Asia-Pacific: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 97. Latin America: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 98. Latin America: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 99. Latin America: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 100. Latin America: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 101. Brazil: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 102. Brazil: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 103. Brazil: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 104. Brazil: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 105. Argentina: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 106. Argentina: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 107. Argentina: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 108. Argentina: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 109. Rest of Latin America: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 110. Rest of Latin America: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 111. Rest of Latin America: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 112. Rest of Latin America: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 113. Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 114. Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 115. Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 116. Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 117. Saudi Arabia: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 118. Saudi Arabia: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 119. Saudi Arabia: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 120. Saudi Arabia: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 121. United Arab Emirates: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 122. United Arab Emirates: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 123. United Arab Emirates: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 124. United Arab Emirates: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 125. South Africa: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 126. South Africa: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 127. South Africa: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 128. South Africa: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

Table 129. Rest of Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025–2035 (USD Million)

Table 130. Rest of Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Technology, 2025–2035 (USD Million)

Table 131. Rest of Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Application, 2025–2035 (USD Million)

Table 132. Rest of Middle East & Africa: Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025–2035 (USD Million)

LIST OF FIGURES

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Portable Air Conditioners segment to Account for the Largest Share

Figure 8. In 2025, the Refrigerative Cooling to Account for the Largest Share

Figure 9. In 2025, the Portable and Personal HVAC Cooling Devices Market for Residential sector to Account for the Largest Share

Figure 10. In 2025, the Online Retail to Account for the Largest Share

Figure 11. Asia-Pacific to be the Fastest-growing Regional Market

Figure 12. Impact Analysis of Market Dynamics

Figure 13. Global Portable and Personal HVAC Cooling Devices Market: Porter's Five Forces Analysis

Figure 14. Global Portable and Personal HVAC Cooling Devices Market, by Product Type, 2025 Vs. 2035 (USD Million)

Figure 15. Global Portable and Personal HVAC Cooling Devices Market, by Technology, 2025 Vs. 2035 (USD Million)

Figure 16. Global Portable and Personal HVAC Cooling Devices Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 17. Global Portable and Personal HVAC Cooling Devices Market, by Distribution Channel, 2025 Vs. 2035 (USD Million)

Figure 18. Global Portable and Personal HVAC Cooling Devices Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 19. North America: Portable and Personal HVAC Cooling Devices Market Snapshot (2025)

Figure 20. Europe: Portable and Personal HVAC Cooling Devices Market Snapshot (2025)

Figure 21. Asia-Pacific: Portable and Personal HVAC Cooling Devices Market Snapshot (2025)

Figure 22. Latin America: Portable and Personal HVAC Cooling Devices Market Snapshot (2025)

Figure 23. Middle East & Africa: Portable and Personal HVAC Cooling Devices Market Snapshot (2025)

Figure 24. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 25. Global Portable and Personal HVAC Cooling Devices Market Competitive Benchmarking, by Product Type

Figure 26. Competitive Dashboard: Global Portable and Personal HVAC Cooling Devices Market

Figure 27. Global Portable and Personal HVAC Cooling Devices Market Share/Ranking, by Key Player, 2024 (%)

Figure 28. Honeywell International Inc.: Financial Overview (2024)

Figure 29. Whirlpool Corporation: Financial Overview (2024)

Figure 30. LG Electronics Inc.: Financial Overview (2024)

Figure 31. Haier Group Corp[]1w/oration: Financial Overview (2024)

Figure 32. Midea Group Co. Ltd.: Financial Overview (2024)

Figure 33. Frigidaire (Electrolux AB): Financial Overview (2024)

Figure 34. Black+Decker Inc.: Financial Overview (2024)

Figure 35. Dyson Ltd.: Financial Overview (2024)

Published Date: Jul-2025

Published Date: Jul-2025

Published Date: Oct-2025

Published Date: Jul-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates