Resources

About Us

Industrial Thermal Management Market by Component (Hardware, Software, Services), Cooling Type (Air, Liquid, Hybrid), Technology (Active, Passive), Temperature Range, Application, End User, and Geography—Global Forecast to 2035

Report ID: MREP - 1041613 Pages: 245 Oct-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Industrial Thermal Management Market Size?

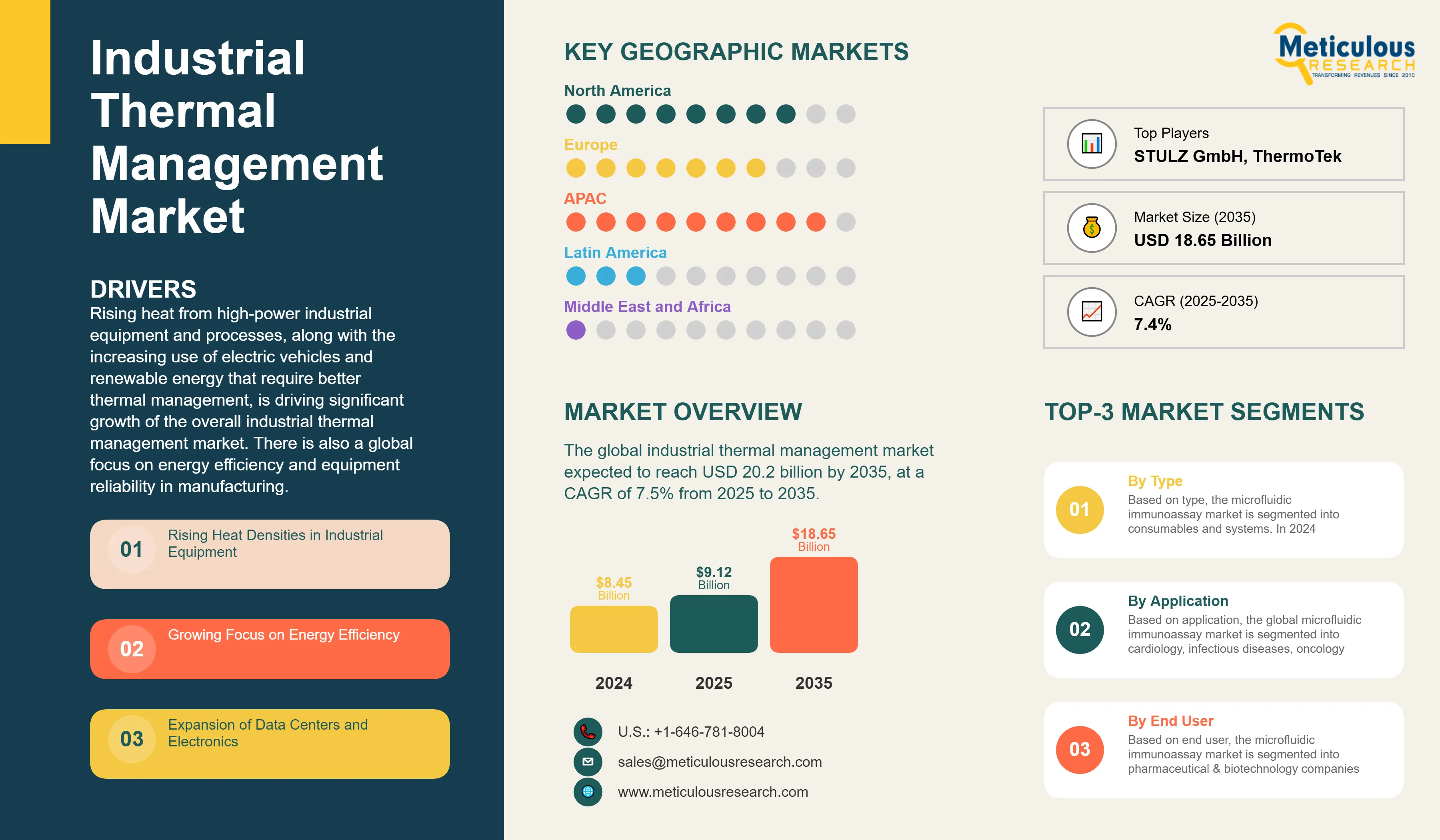

The global industrial thermal management market was valued at USD 9.1 billion in 2024. It is expected to reach USD 20.2 billion by 2035 from USD 9.8 billion in 2025, at a CAGR of 7.5% from 2025 to 2035.

Rising heat from high-power industrial equipment and processes, along with the increasing use of electric vehicles and renewable energy that require better thermal management, is driving significant growth of the overall industrial thermal management market. There is also a global focus on energy efficiency and equipment reliability in manufacturing.

Industrial Thermal Management Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The industrial thermal management market involves the design, production, and maintenance of systems that control temperature and remove heat from industrial equipment, processes, and facilities. This includes cooling technologies such as heat exchangers, chillers, cooling towers, heat pipes, thermal interface materials, and modern phase change materials, along with heating solutions to maintain accurate temperature control. Unlike standard commercial HVAC systems, these manage extreme temperatures, high heat loads, and challenging conditions, which helps protect equipment and improve process efficiency.

Market growth comes from increasing power densities in electronics and machinery, higher automation and Industry 4.0 demands for dependable thermal control, expanding data centers with significant cooling needs, tougher efficiency and emissions regulations, progress in cooling technologies and materials, and a better understanding of how thermal management impacts equipment lifespan and operational costs.

How is AI Transforming the Industrial Thermal Management Market?

AI integration is transforming industrial thermal management by allowing smarter, predictive, and autonomous control. By analyzing real-time data from thousands of sensors, AI can predict hot spots and thermal failures before they occur, helping to avoid costly equipment damage and production downtime. Machine learning adjusts cooling operations, such as fan speeds and pump flows, based on expected heat loads. This saves 20-30% energy while maintaining optimal temperatures.

AI-driven digital twins simulate thermal behavior in various scenarios, speeding up design and testing by 40%. Predictive maintenance algorithms detect wear in cooling systems early, allowing repairs to be scheduled before problems happen. By combining computer vision with thermal imaging, AI can automatically find thermal anomalies. It accurately identifies normal fluctuations and potential issues, increasing reliability by 25-35%.

What are the Key Trends in the Industrial Thermal Management Market?

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 18.65 Billion |

|

Market Size in 2025 |

USD 9.12 Billion |

|

Market Size in 2024 |

USD 8.45 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 7.4% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Component, Cooling Type, Technology, Temperature Range, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Heat Densities and Electrification Trends

A major factor driving the global industrial thermal management market is the sharp increase in heat produced by modern equipment. This is mainly due to higher power densities, quicker processing, and the widespread use of electricity. The manufacturing machines, power electronics, and automation systems can create heat fluxes above 1000 W/cm², which demands improved cooling to prevent failures. The move to electric vehicles and renewable energy fuels strong demand for thermal solutions in batteries, power converters, and charging stations.

Data centers around the world consume over 200 TWh each year, and cooling makes up 40% of that energy use. This pushes for innovation in efficient thermal management. The rise of Industrial IoT and edge computing also requires reliable cooling to keep billions of connected devices operating smoothly. As electronic components become smaller yet more powerful, new thermal challenges arise. This situation needs new materials and cooling methods. High-power applications like laser processing, induction heating, and plasma systems create additional demand for specialized thermal management solutions.

Restraint

High Implementation Costs and Technical Complexity

Despite strong demand, the industrial thermal management market faces several challenges. Modern cooling systems need large upfront investments, often costing hundreds of thousands to millions for large-scale setups. Integrating these systems with existing industrial operations can lead to expensive downtime and complicated modifications, which disrupt production. A lack of skilled technicians familiar with these technologies increases installation and maintenance costs.

Cooling systems also use 20-40% of a facility’s energy, raising ongoing operational costs. Managing different thermal loads, ensuring consistent temperatures, and preventing condensation in difficult industrial environments make system design complicated. Additionally, meeting regulations on refrigerants, noise, and environmental impact adds more complexity and cost to projects.

Opportunity

Energy Recovery and Thermal Optimization

The growing focus on energy efficiency and circular economy principles is creating great opportunities for thermal management systems that recover and reuse waste heat. Industrial processes often waste 20-50% of their energy as heat. This heat can be captured and repurposed for heating, power, or absorption cooling, which boosts overall efficiency by 15-25%. Combining thermal management with renewable sources like solar cooling and geothermal heat pumps helps lower costs and reduce carbon footprints.

Emerging smart thermal grids connect multiple facilities to share heat and balance loads, creating new business possibilities. Advanced thermal storage using phase change materials and thermochemical systems allows for shifting energy use and reducing peak demand, which cuts costs further. Government incentives that support energy efficiency and carbon reduction make these projects more attractive, leading to faster payback times.

Component Insights

Why does Hardware Dominate the Market?

The hardware segment holds the largest share of the overall industrial thermal management market with around 65-70% share in 2025. Key components such as heat exchangers, chillers, cooling towers, pumps, and fans are essential to thermal management systems and require a considerable capital investment. Since heat transfer depends on physical systems, these hardware parts must be sturdy enough to handle industrial conditions like vibration, corrosion, and extreme temperatures. With replacement cycles of 10 to 20 years, there is a steady demand for new equipment and upgrades. Improvements in materials and design constantly boost hardware performance and efficiency. Reliable hardware is vital for preventing thermal failures and avoiding costly downtime, so high-quality components often come with higher prices.

On the other hand, the software and services segment is projected to grow at the fastest CAGR through 2035. The increasing use of digital thermal management tools, such as simulation software, monitoring platforms, and predictive analytics, is raising software demand. The growing complexity of systems also increases the need for professional services in design, installation, optimization, and maintenance support.

Cooling Type Insights

How does Liquid Cooling Address High Heat Loads?

The liquid cooling segment holds nearly 45-50% share of the overall market in 2025. The growing use of liquid cooling in data centers, power electronics, and battery systems drives the growth of this segment during the forecast period.

The hybrid cooling segment is projected to grow at the fastest CAGR by combining liquid and air cooling. These systems improve efficiency by switching between cooling methods based on ambient conditions and heat loads, which helps reduce energy use.

Technology Insights

How does Active Cooling Ensure Reliable Temperature Control?

The active cooling segment leads the industrial thermal management market, holding around 70-75% share of the overall market in 2025. Its mechanical refrigeration, pumps, and fans provide precise and reliable temperature control. This control is essential for critical industrial processes, no matter the external conditions. Active cooling efficiently manages large temperature differences and heavy heat loads, making it crucial in industries such as manufacturing, power generation, and data centers.

At the same time, the phase change materials (PCM) segment is set for rapid growth. PCMs offer passive thermal storage and buffering, which help reduce peak cooling needs and improve overall efficiency. New PCM technologies feature customizable melting points and improved conductivity, expanding their industrial applications.

Temperature Range Insights

Why does 0°C to 100°C Range Dominate Applications?

The 0°C to 100°C temperature range holds the largest share of the global industrial thermal management market with around 40- 45% share, in 2025. It covers most industrial processes, electronics cooling, and HVAC needs. This range benefits from affordable, reliable cooling equipment and water-based systems that avoid the complications of specialized fluids. Energy efficiency is strong due to moderate temperature differences. This makes it ideal for manufacturing, data centers, and commercial uses, which drives significant market demand.

The -40°C segment is expected to grow at the fastest CAGR, driven by increasing needs in semiconductor manufacturing, cryogenic processing, and emerging fields like quantum computing. Refrigeration and cryogenic systems that can reach temperatures below -100°C are supporting these specialized applications.

Application Insights

Why does Electronics Cooling Lead Applications?

On the basis of application, the electronics cooling segment holds the largest share of around 30-35% in 2025. Rapid growth in electronics across industries, from telecom to automotive, creates significant cooling needs. Higher power densities in processors, power supplies, and LEDs require effective thermal management to prevent failures. As electronics become more critical and compact, improved cooling techniques are essential. The high value of equipment and costly downtime encourage investment in reliable, backup cooling solutions.

The battery thermal management segment is expected to grow at the fastest CAGR through 2035, due to the rise in electric vehicles and energy storage. Accurate temperature control is crucial for safety and performance. Improved cooling systems help extend battery life and prevent dangerous thermal runaway incidents.

End User Insights

Why does Manufacturing Sector Lead Adoption?

The manufacturing segment holds the largest share of the overall industrial thermal management market with around 25-30% share in 2025. Manufacturing facilities face various thermal challenges from production equipment, process cooling, and HVAC systems. Precise temperature control is essential for ensuring product quality, which drives the adoption of improved cooling solutions. Growing automation and smart manufacturing lead to increased heat from motors, drives, and control systems. Regulations on workplace comfort and product standards further demand effective thermal management.

The data center segment is expected to grow the fastest, driven by a surge in data demand and cloud expansion. New data centers need effective cooling to manage servers that consume megawatts of power. The rise of edge computing, which places data centers closer to users, creates a need for distributed cooling solutions across different locations.

U.S. Industrial Thermal Management Market Size and Growth 2025 to 2035

The U.S. industrial thermal management market is projected to be worth around USD 5.28 billion by 2035, growing at a CAGR of 7.5% from 2025 to 2035.

How is the Asia Pacific Industrial Thermal Management Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest share of the global industrial thermal management market in 2025 with around 35-40% share in 2025. This is primarily attributed to the vast manufacturing base in China, Japan, South Korea, and Southeast Asia. Rapid industrial growth and infrastructure development in emerging economies drive strong demand for thermal management systems.

The region leads in electronics manufacturing, from semiconductors to consumer devices, which increases the use of improved cooling technologies. Growing automotive production, particularly electric vehicles in China and Japan, creates a demand for effective battery thermal management. The rise in data center capacity to support the digital economy also boosts the need for efficient cooling solutions. Government programs that focus on energy efficiency and industrial modernization speed up system upgrades. With lower manufacturing costs and strong supply chains, Asia Pacific stays highly competitive in producing thermal management equipment.

Which Factors Support the North America Industrial Thermal Management Market Growth?

North America industrial thermal management market is expected to grow at the fastest CAGR between 2025 and 2035. This surge is mainly due to significant investments in data center infrastructure from large cloud providers looking for better cooling solutions. The reshoring of manufacturing, particularly in semiconductors and pharmaceuticals, is increasing the demand for modern thermal management systems. A strong focus on sustainability and energy efficiency is promoting the use of waste heat recovery and new cooling technologies.

The top tech companies and research institutions in the region are continuing to drive innovation in thermal management. Strict rules on refrigerants and energy efficiency are leading to upgrades and replacements of equipment. Additionally, the rise in electric vehicle production and charging networks is creating a need for advanced thermal solutions. High-tech industries such as aerospace, defense, and biotechnology also depend on precise temperature control systems, which further boosts market growth.

Value Chain Analysis

Recent Developments

Segments Covered in the Report

By Component

By Cooling Type

By Technology

By Temperature Range

By Application

By End User

By Region

The industrial thermal management market is expected to grow from USD 9.8 billion in 2025 to USD 20.2 billion by 2035.

The industrial thermal management market is expected to grow at a CAGR of around 7.5% from 2025 to 2035.

The major players in the industrial thermal management market include Johnson Controls International plc, Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Vertiv Holdings Co., Rittal GmbH & Co. KG, Airedale International, Boyd Corporation, Advanced Cooling Technologies Inc., Lytron Inc., Laird Thermal Systems, Delta Electronics Inc., Asetek A/S, CoolIT Systems Inc., Motivair Corporation, Nortek Air Solutions, STULZ GmbH, Swegon Group AB, ThermoTek Inc., and Aqua Cooling Solutions.

The driving factors of the industrial thermal management market are increasing heat generation from high-power industrial equipment, growing adoption of electric vehicles and renewable energy systems, and rising focus on energy efficiency and equipment reliability in manufacturing operations globally.

Asia Pacific region will lead the global industrial thermal management market during the forecast period 2025 to 2035.

Published Date: Sep-2025

Published Date: Jul-2024

Published Date: May-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates