Resources

About Us

Low-NOx Burners Market by Type (Ultra Low-NOx, Low-NOx, Conventional), Fuel Type (Natural Gas, Oil, Dual Fuel), Technology (Staged Combustion, Flue Gas Recirculation), Capacity, Application, End User, and Geography—Global Forecast to 2035

Report ID: MREP - 1041603 Pages: 198 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Low-NOx Burners Market Size?

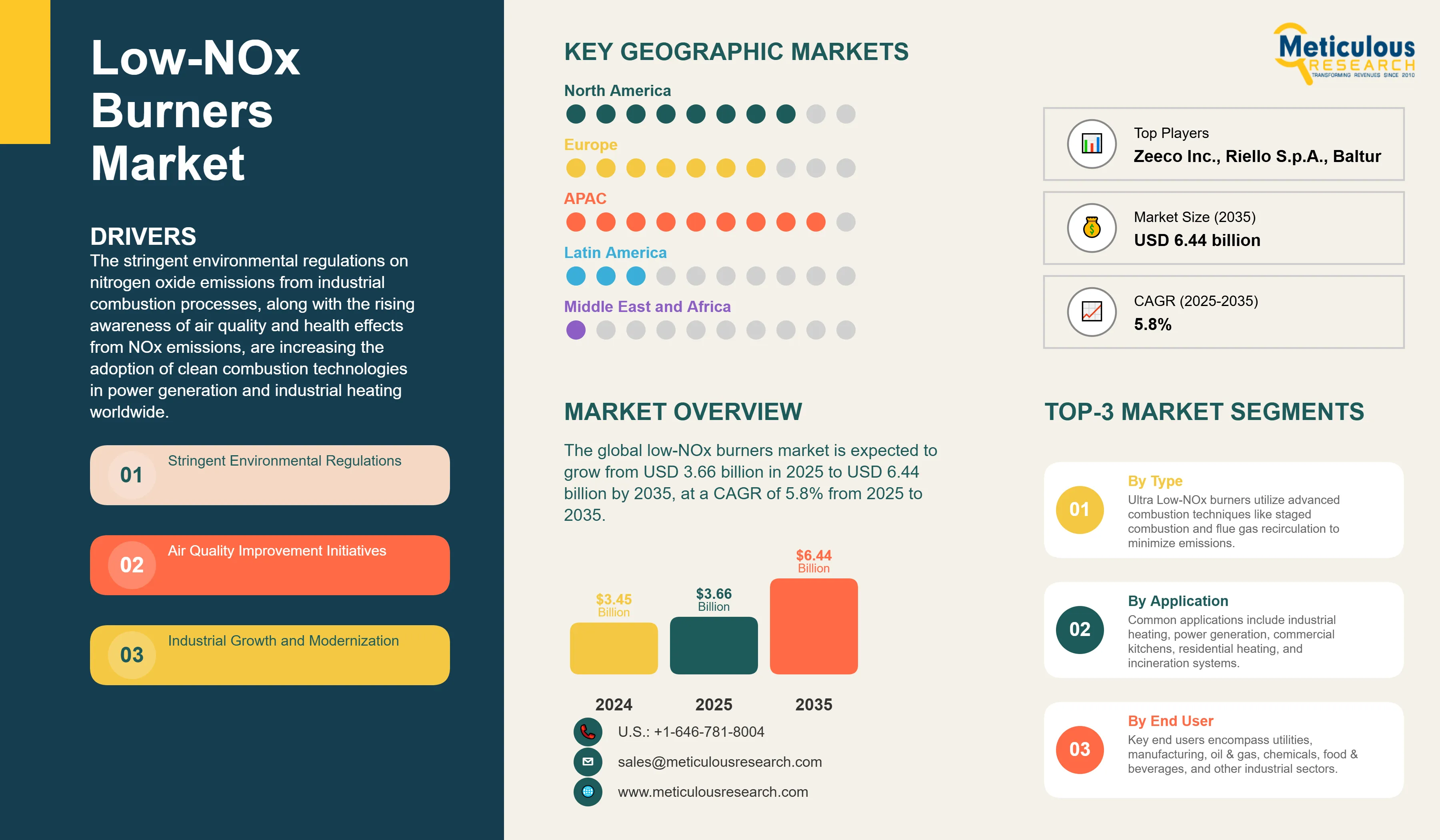

The global low-NOx burners market was valued at USD 3.45 billion in 2024 and is expected to grow from USD 3.66 billion in 2025 to USD 6.44 billion by 2035, at a CAGR of 5.8% from 2025 to 2035. The stringent environmental regulations on nitrogen oxide emissions from industrial combustion processes, along with the rising awareness of air quality and health effects from NOx emissions, are increasing the adoption of clean combustion technologies in power generation and industrial heating worldwide.

Low-NOx Burners Market Key Highlights

Click here to: Get Free Sample Pages of this Report

The low-NOx burners market includes the design, manufacturing, installation, and servicing of combustion systems that minimize nitrogen oxide emissions during fuel burning in industrial and commercial settings. These burners use improved combustion methods like staged combustion, flue gas recirculation, premixing, and lean burn technologies to lower peak flame temperatures and oxygen levels, which helps reduce thermal NOx formation.

Unlike standard burners that focus on efficiency and heat output, low-NOx burners find a balance between cutting emissions and maintaining combustion efficiency with precise air-fuel mixing and flame control methods. This market is influenced by stricter environmental regulations, such as EPA standards in the US and the Industrial Emissions Directive in Europe. It also responds to increased concerns about ground-level ozone and smog from NOx emissions, the rising need for cleaner combustion in cities with air quality challenges, technological progress that allows for ultra-low emissions without losing efficiency, and the growth of industrial activities in developing countries that are adopting modern emission standards.

How is AI Transforming the Low-NOx Burners Market?

Artificial intelligence integration in low-NOx burner systems improves combustion optimization, monitors emissions in real time, adapts control strategies, and manages regulatory compliance. AI algorithms analyze data from various sensors that track temperature, pressure, oxygen levels, and emissions. This analysis continuously refines air-fuel ratios and staging patterns, potentially cutting NOx emissions by another 15-40% beyond what traditional low-NOx designs achieve.

Machine learning models predict the best operating parameters for different load conditions and fuel types. This helps keep emissions low during system operation. AI-driven predictive maintenance spots early signs of burner wear and performance issues that might increase emissions. This allows for timely maintenance before exceeding regulatory limits.

Digital twin technology builds virtual models of combustion systems. These models simulate and optimize burner performance for specific applications. This process can reduce commissioning time by about 30% and ensures consistent low-emission performance over the equipment’s lifespan. This AI approach results in better combustion efficiency, lower maintenance costs, and improved compliance with strict emissions regulations.

What are the Key Trends in the Low-NOx Burners Market?

Hydrogen and alternative fuel compatibility: A significant trend in the low-NOx burners market is the development of burners that can run on hydrogen, ammonia, and other carbon-free fuels as industries move toward net-zero emissions. Manufacturers are making flexible burners that can handle different hydrogen-natural gas blends. This addresses hydrogen’s unique combustion traits, such as higher flame speeds and elevated flame temperatures. These advancements support global efforts to reduce carbon emissions while keeping NOx emissions low. This requires new combustion technologies to manage the increased challenges related to NOx formation that come with hydrogen combustion.

IoT integration and remote monitoring: Another major trend fueling growth of this market is the use of IoT sensors and cloud-based monitoring platforms. These tools allow for real-time emission tracking, remote optimization, and predictive maintenance. Connected burners continuously send operational data to centralized systems. This helps facility managers keep an eye on emissions across various sites, maintain compliance, and improve burner performance remotely. This digital shift supports condition-based maintenance, lowers operational costs, and provides recorded proof of compliance with regulations.

The global low-NOx burners market was valued at USD 3.45 billion in 2024 and is expected to grow from USD 3.66 billion in 2025 to USD 6.44 billion by 2035, at a CAGR of 5.8% from 2025 to 2035.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 6.44 Billion |

|

Market Size in 2025 |

USD 3.66 Billion |

|

Market Size in 2024 |

USD 3.45 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 5.8% |

|

Dominating Region |

Asia Pacific |

|

Fastest Growing Region |

North America |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Fuel Type, Technology, Capacity, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent Environmental Regulations and Air Quality Standards

A major reason for the growth of the low-NOx burners market is the rise of stricter emission rules worldwide. Regulatory agencies are setting lower NOx limits for industrial combustion sources. The US EPA's NOx SIP Call and state regulations, such as California's South Coast Air Quality Management District, require emissions to drop below 9 ppm for specific applications. The European Union's Medium Combustion Plant Directive and Industrial Emissions Directive set tough NOx limits from 50-200 mg/Nm³, depending on the fuel type and plant size.

China's ultra-low emission standards for power plants and industrial boilers, which mandate NOx levels below 50 mg/m³, also create significant retrofit opportunities. Non-compliance penalties, including fines, operational restrictions, and shutdowns, make investing in low-NOx burners crucial for business survival. The rising number of non-attainment areas for ozone standards broadens the regions that need low-NOx technology. Additionally, growing public awareness about the harmful effects of NOx pollution on respiratory health increases the demand for cleaner industrial practices.

Restraint

High Capital Investment and Operational Complexity

Despite regulatory drivers, the low-NOx burners market faces challenges from high upfront costs, which can be 30-50% more than conventional burners. This deters adoption among industries that are sensitive to costs. Retrofit installations involve extra expenses for combustion air systems, control upgrades, and possible boiler modifications to fit low-NOx technology. Maintaining optimal low-NOx performance while ensuring stable combustion and efficiency is complicated. It needs skilled operators and sophisticated control systems. Some low-NOx technologies cut thermal efficiency by 1-3%, which further raises fuel use and operating costs over the lifespan of the equipment.

Opportunity

Energy Transition and Industrial Decarbonization

The global shift toward cleaner fuels and reducing industrial carbon emissions offers great opportunities for next-generation low-NOx burners that work with hydrogen, biogas, and synthetic fuels. Government incentives and carbon pricing make low-emission technologies more economically attractive, creating opportunities for modern burner systems.

The increasing use of combined heat and power systems and district heating networks also needs efficient, low-emission combustion solutions. In developing countries, the growth of natural gas infrastructure as a replacement for coal and oil provides opportunities for new low-NOx installations. Interestingly, the shift toward electrification in some areas raises the demand for high-efficiency, low-emission backup and peak-shaving combustion systems. Combining low-NOx burners with carbon capture technologies and heat recovery systems offers effective ways to reduce emissions, appealing to industries that prioritize sustainability.

Type Insights

Why do Low-NOx Burners (30-50 ppm) Dominate the Market?

The low-NOx burners (30-50 ppm) segment holds the largest share of 40-45% of the overall low-NOx burners market in 2025. This emission range meets most current regulatory requirements while keeping costs reasonable and operations simple compared to ultra-low-NOx options. Low-NOx burners in this range use proven technologies like staged air/fuel combustion and external flue gas recirculation. These features provide reliable performance across different loads.

The 30-50 ppm range offers the best balance between reducing emissions and maintaining thermal efficiency, which helps minimize fuel consumption penalties. The wide availability of products and service support in this category ensures competitive pricing and lowers operational risks. These burners fit various applications, from industrial boilers to process heaters, without needing extensive system changes.

Fuel Type Insights

How does Natural Gas Support Low-NOx Combustion?

The natural gas segment commands the largest market share of 50-55% of the global low-NOx burners market in 2025. Natural gas burns cleanly, producing lower carbon content and no fuel-bound nitrogen. This makes it ideal for achieving low NOx emissions when compared to oil or coal. The widespread availability of natural gas infrastructure in developed markets, along with expanding pipeline networks in developing regions, supports its market dominance. The growing use of natural gas for power generation and industrial heating, driven by the shift from coal to gas, further boosts the demand for low-NOx burners.

However, the hydrogen and hydrogen-blend segment is expected to grow at the fastest CAGR during the forecast period. Decarbonization efforts that promote hydrogen use in industrial combustion create a need for specialized low-NOx burners that can handle hydrogen's unique combustion properties. The development of hydrogen-ready burners that can operate on natural gas and hydrogen blends supports this gradual shift in energy sources.

Technology Insights

How does Staged Combustion Reduce NOx Formation?

Based on technology, the staged combustion segment holds the largest market share, nearly 40%, in 2025. This technology separates fuel and air into multiple zones, which effectively lowers peak flame temperatures and reduces NOx formation while keeping combustion stable. Its ability to retrofit without major boiler changes makes it a popular choice for compliance upgrades. Staged combustion also offers good turndown ratios and the ability to follow load changes, which are essential for applications with variable demand. The reliability of staged combustion systems and the extensive operational experience with them lower the risks for industrial users. Additionally, their simpler design compared to premix systems means less maintenance and lower training needs.

Capacity Insights

Why does the 10-50 MMBtu/hr Range Lead the Market?

The 10-50 MMBtu/hr segment commands the largest share of around 30-35% of the overall low-NOx burners market in 2025. This capacity range supports most industrial and commercial boilers, process heaters, and thermal oxidizers. It represents the largest installed base that needs low-NOx upgrades. Medium-capacity burners in this range take advantage of standard designs and manufacturing efficiencies, which lower costs while keeping performance high. The 10-50 MMBtu/hr range fits various applications, from food processing to chemical manufacturing, generating strong market demand.

Application Insights

Why do Boilers Represent the Primary Application?

Based on application, the boilers segment accounts for around 40-45% share of the market in 2025. Industrial and commercial boilers represent the largest installed base of combustion equipment that needs low-NOx technology to meet regulations. Boilers play a critical role in facility operations, and high usage rates justify investment in low-NOx upgrades to maintain operation. Packaged boiler manufacturers are increasingly adding low-NOx burners as standard equipment to comply with emission requirements in various areas. Since boilers have a long operational life of 20 to 30 years, there will be ongoing demand for retrofits as emission regulations become stricter. The wide range of boiler applications, from steam generation to hot water heating across all industries, broadens the market potential.

However, the process heaters segment is projected to grow at the fastest CAGR through 2035. Stringent emission standards for petroleum refineries and petrochemical plants are driving the rapid adoption of low-NOx technology in process heaters.

End User Insights

Why does Power Generation Lead End User Adoption?

The power generation segment holds the largest market share at around 30% in 2025. Power plants must meet strict emission regulations and ongoing monitoring requirements, which drive the use of low-NOx burners. The size of power generation facilities and the visibility of their emissions create pressure for emission reductions from both regulators and the public. The shift from coal to natural gas power generation further opens up opportunities for new low-NOx installations.

The chemical and petrochemical segment is expected to grow at the fastest CAGR through 2035. Complex process needs and high-temperature applications in chemical manufacturing increase demand for specialized low-NOx solutions. Environmental regulations that target volatile organic compounds and hazardous air pollutants from chemical plants include strict NOx limits, which speed up the adoption of new technology.

U.S. Low-NOx Burners Market Size and Growth 2025 to 2035

The U.S. low-NOx burners market is projected to be worth around USD 1.87 billion by 2035, growing at a CAGR of 6.3% from 2025 to 2035.

How is the Asia Pacific Low-NOx Burners Market Growing Dominantly Across the Globe?

Asia Pacific holds the largest share of 35-40% of the global low-NOx burners market in 2025. This is primarily attributed to the rapid industrial growth in China, India, and Southeast Asian countries. This growth creates new demand for combustion equipment that meets modern emission standards.

China's strict air pollution control measures, including ultra-low emission standards for industrial boilers and power plants, fuel huge retrofit and replacement markets. The large number of existing industrial boilers and furnaces in the region need upgrades to comply with stricter regulations, which keeps demand steady. Increasing awareness of air quality issues and their impacts on public health in crowded Asian cities drive regulatory enforcement and technology adoption.

Which Factors Support the North America Low-NOx Burners Market Growth?

The North America low-NOx burners market is expected to grow at the fastest CAGR from 2025 to 2035. This growth is mainly due to strict federal and state emission rules, which include some of the lowest NOx limits in non-attainment areas. The region also has a lot of aging industrial equipment that needs to be replaced or updated to meet current standards, creating significant market opportunities.

The abundance of natural gas from shale resources makes gas-fired low-NOx burners a cost-effective choice compared to other technologies. Companies are committing to sustainability, and ESG reporting requirements encourage the use of ultra-low emission technologies beyond the minimum regulatory standards. The presence of top burner manufacturers and strong research and development capabilities supports the creation of next-generation technologies, including designs compatible with hydrogen. State-level climate policies and carbon pricing mechanisms also further improve the financial outlook for high-efficiency, low-emission combustion systems.

Value Chain Analysis

Recent Developments

Segments Covered in the Report

By Type

By Fuel Type

By Technology

By Capacity

By Application

By End User

By Region

The low-NOx burners market is expected to increase from USD 3.66 billion in 2025 to USD 6.44 billion by 2035.

The low-NOx burners market is expected to grow at a CAGR of 5.8% from 2025 to 2035.

The major players in the low-NOx burners market include Honeywell International Inc., John Zink Hamworthy Combustion, Zeeco Inc., Babcock & Wilcox Company, Mitsubishi Power Ltd., SAACKE GmbH, Alzeta Corporation, Cleaver-Brooks Inc., Riello S.p.A., Weishaupt Group, Baltur S.p.A., Oilon Group, Webster Combustion, Power Flame Inc., Selas Heat Technology, Fives Group, ICI Caldaie S.p.A., Limpsfield Combustion Engineering, Forbes Marshall, and Wesman Group.

The driving factors of the low-NOx burners market are increasing stringent environmental regulations limiting nitrogen oxide emissions, growing awareness about air quality and health impacts of NOx emissions, and rising adoption of clean combustion technologies in power generation and industrial heating applications globally.

Asia Pacific region will lead the global low-NOx burners market during the forecast period 2025 to 2035.

Published Date: Sep-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates