Resources

About Us

Offshore Wind Turbine Installation Vessels Market Size, Share, & Forecast by Vessel Type (Jack-Up, Floater, Crane Vessels), Crane Capacity (tonnes), Deck Space, and Water Depth Capability- Global Forecasts (2026-2036)

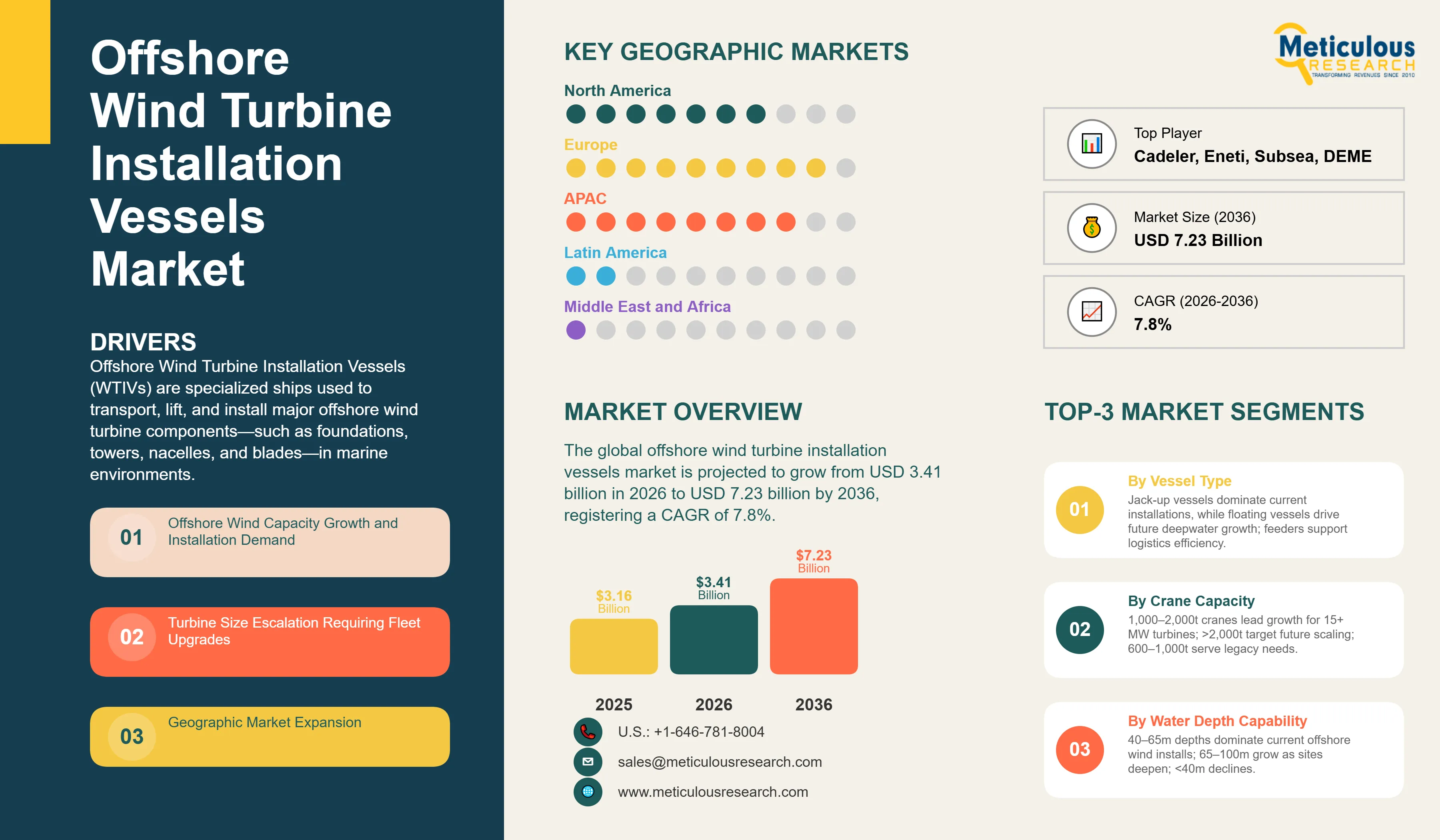

Report ID: MREP - 1041692 Pages: 291 Jan-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global offshore wind turbine installation vessels market is expected to reach USD 7.23 billion by 2036 from USD 3.41 billion in 2026, at a CAGR of 7.8% from 2026 to 2036.

Offshore Wind Turbine Installation Vessels (WTIVs) are specialized maritime vessels designed and equipped to transport, lift, and install large offshore wind turbine components including foundations, transition pieces, towers, nacelles, and rotor blades in marine environments. These sophisticated vessels incorporate advanced capabilities including heavy-lift crane systems with capacities exceeding 1,000-3,000 tonnes for next-generation turbines, dynamic positioning systems maintaining precise vessel positioning in deep water, jack-up legs enabling self-elevating platforms creating stable work platforms above wave action in shallow to medium depths, large deck spaces accommodating multiple turbine sets (foundations, towers, nacelles, blades), motion compensation systems allowing safe lifting operations in moderate sea states, and accommodation facilities housing 60-150+ personnel including installation crews, client representatives, and support staff. By providing stable offshore platforms for precision heavy-lift operations, these vessels enable the offshore wind industry to install increasingly large turbines in progressively deeper waters farther from shore, addressing the fundamental challenge that offshore wind components—modern turbines exceed 15 MW with rotor diameters over 240 meters and total weights exceeding 2,000 tonnes—cannot be installed using conventional marine equipment, requiring purpose-built vessels representing investments of $200-500 million each.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Offshore Wind Turbine Installation Vessels represent critical enabling infrastructure for the global offshore wind industry, addressing the fundamental engineering challenge that wind turbines installed in ocean environments—often 20-100 kilometers from shore in water depths of 20-60 meters—require specialized heavy-lift capabilities far exceeding conventional marine construction equipment. These purpose-built vessels serve as mobile offshore construction platforms, transporting turbine components weighing hundreds to thousands of tonnes, positioning precisely at installation sites, elevating themselves above wave action to create stable work platforms, and executing precision lifts placing components with millimeter accuracy despite challenging marine conditions. The vessels' capabilities directly enable or constrain offshore wind deployment—insufficient WTIV availability or capability creates bottlenecks limiting installation pace, while advanced vessels enable larger turbines in deeper waters expanding developable offshore wind resources.

Several transformative trends are reshaping the WTIV market, including the relentless scaling of offshore wind turbines from 6-8 MW in 2015 to 15-18 MW today and 20+ MW under development requiring continuously upgraded vessel capabilities, the expansion into deeper waters beyond traditional jack-up operational limits driving floating vessel and floating turbine development, the globalization of offshore wind beyond European heartland to U.S. East Coast, Asia-Pacific, and emerging markets creating demand in new regions, the emergence of Jones Act-compliant U.S. vessel construction addressing domestic content requirements, and the integration of advanced technologies including dynamic positioning, motion compensation, and digital twins optimizing installation operations. The convergence of offshore wind industry explosive growth—global capacity projected to exceed 380 GW by 2030 from 70 GW in 2023—turbine size escalation, geographic market expansion, and technology advancement has elevated WTIVs from specialized niche equipment to strategic assets commanding day rates of $150,000-300,000+ and representing multi-hundred-million-dollar investments.

Key Trends Shaping the Market:

The WTIV market is experiencing rapid evolution driven by turbine scaling requiring continuously upgraded vessel capabilities. Modern offshore wind turbines have grown from 4-6 MW with 120-meter rotor diameters in early 2010s to 15-18 MW with 240+ meter rotors today, with 20+ MW turbines under development. This relentless scaling drives WTIV requirements including crane capacities increasing from 600-800 tonnes to 1,500-3,000+ tonnes to lift heavier nacelles and foundation components, deck space expanding from 2,000-3,000 m² to 5,000+ m² accommodating larger components, leg length and depth capability increasing to support installation in deeper waters, and jacking systems and structural reinforcement handling increased vessel and cargo weights. The industry faces continuous upgrade cycle as existing vessels become undersized for next-generation turbines, driving newbuild vessel construction and creating market opportunities for shipyards and vessel operators.

Jack-up installation vessels remain dominant technology for majority of offshore wind installations, employing self-elevating platforms with retractable legs that extend to seabed, jacking the vessel hull above water creating stable elevated platform immune to wave motion. This technology suits shallow to medium water depths typically 10-65 meters covering majority of current offshore wind sites including North Sea, Baltic Sea, U.S. East Coast, and Asian shallow waters. Modern jack-up WTIVs represent engineering marvels including leg lengths exceeding 100-120 meters, lifting capacities of 1,000-3,000 tonnes, deck areas of 4,000-6,000+ m², and capabilities to operate in sea states up to significant wave heights of 1.5-2.5 meters. Leading vessels include Van Oord's Aeolus (50m depth, 1,600t crane), Jan De Nul's Voltaire (80m depth, 3,000t crane), and CSSC's newbuilds for Chinese market. The technology limitations include water depth constraints (practical maximum ~65-70m), seabed soil requirements (legs must penetrate and stabilize), and weather sensitivity during jacking operations.

Floating installation vessels are emerging technology addressing deepwater installations beyond jack-up operational limits. These vessels employ either specialized crane vessels with dynamic positioning or purpose-designed heavy-lift vessels, maintaining position through GPS-controlled thrusters rather than seabed contact. Floating vessels enable installations in water depths exceeding 60-70 meters where jack-ups become impractical, critical for projects including floating offshore wind in Pacific deep waters, fixed-bottom turbines in transitional depths 60-80 meters, and locations with challenging seabed conditions unsuitable for jack-up legs. The technology faces challenges including motion compensation requirements for safe heavy-lift operations from floating platform, weather window restrictions to acceptable sea states, and typically lower productivity than jack-ups requiring more installation time per turbine. However, for deep-water locations—increasingly important as prime shallow-water sites are utilized—floating installation capabilities are essential. Key players developing floating WTIV capabilities include Huisman, Heerema, and Asian yards constructing specialized vessels.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 3.41 Billion |

|

Revenue Forecast in 2036 |

USD 7.23 Billion |

|

Growth Rate |

CAGR of 7.8% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments Covered |

Vessel Type, Crane Capacity, Deck Space, Water Depth Capability, Application, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Netherlands, Belgium, Denmark, Norway, China, Taiwan, Japan, South Korea, Vietnam, India, Brazil, Australia |

|

Key Companies Profiled |

Van Oord, Jan De Nul Group, DEME Offshore, Fred. Olsen Windcarrier, Seajacks UK Limited, Cadeler A/S, COSCO Shipping Heavy Industry, China State Shipbuilding Corporation (CSSC), Huisman Equipment B.V., Heerema Marine Contractors, GeoSea (DEME), Sapura Energy Berhad, Pacific Orca Energy, Great Lakes Dredge & Dock, Keppel Offshore & Marine, Lamprell plc, Sembcorp Marine, Eneti Inc., Maersk Supply Service, Subsea 7 |

Crane capacity escalation represents critical WTIV specification trend. Early offshore wind installation employed cranes of 400-600 tonnes adequate for 3-4 MW turbines. Current-generation vessels feature 1,000-1,600 tonne cranes serving 12-15 MW turbines. Next-generation vessels under construction incorporate 2,000-3,000 tonne cranes anticipating 18-25 MW turbines under development. Jan De Nul's Voltaire (3,000t crane capacity) and CSSC's newbuilds (2,000-2,500t) exemplify this trend. The crane capacity requirements are driven by nacelle weights exceeding 600-800 tonnes for 15+ MW turbines, foundation components reaching 1,500+ tonnes for larger monopiles or jackets, and transition piece assemblies weighing 500-700 tonnes. The escalation creates technical challenges including crane structural design supporting extreme loads while minimizing weight, vessel stability maintaining safe operations with heavy lifts at significant heights (100+ meters), and construction costs as crane systems represent 25-35% of vessel capital expense.

Geographic market expansion is driving WTIV demand growth and fleet redeployment. Historically concentrated in European waters (North Sea, Baltic Sea, Irish Sea), offshore wind is expanding to U.S. East Coast (30+ GW planned), China (100+ GW targeted), Taiwan (15+ GW), Japan (deepwater floating projects), South Korea, Vietnam, and other markets. This geographic expansion creates opportunities and challenges including regional vessel demand supporting multiple simultaneous projects in new markets, mobilization economics as vessels transit between markets (Europe to Asia: 6-8 weeks transit), regulatory requirements including Jones Act in U.S. mandating domestic-built vessels for domestic waters creating U.S. WTIV construction industry, and local content requirements in various markets favoring regional vessel operators and construction. The globalization trend is driving WTIV fleet expansion from approximately 30-35 active vessels globally in 2020 to 50+ projected by 2027-2028 as newbuilds deliver.

Driver: Offshore Wind Capacity Growth and Installation Demand

The explosive global growth of offshore wind capacity creates fundamental demand for installation vessels, with project pipelines translating directly to vessel utilization and day rate revenues. Global offshore wind capacity exceeded 70 GW in 2023 with projections indicating 380+ GW by 2030, requiring installation of thousands of large offshore turbines annually. Each gigawatt of offshore wind capacity typically requires 50-70 turbine installations (depending on turbine size), with installation campaigns employing WTIVs for 6-18 months depending on project scale and offshore conditions. The European offshore wind pipeline exceeds 100 GW through 2030, U.S. East Coast projects exceed 30 GW, Asian markets (China, Taiwan, Japan, Korea, Vietnam) represent 150+ GW, creating sustained multi-year demand for WTIV services.

Driver: Turbine Size Escalation Requiring Fleet Upgrades

The continuous increase in offshore wind turbine size and weight creates imperative for vessel fleet modernization, as older vessels become inadequate for next-generation turbines. The industry has transitioned from 6-8 MW turbines in 2015 to 15-18 MW today, with 20+ MW turbines under development. Each turbine generation requires upgraded vessel capabilities—crane capacity, deck space, and structural strength—rendering earlier-generation vessels obsolete for latest projects. This drives newbuild vessel orders as operators compete for contracts installing next-generation turbines commanding premium day rates, creates secondary markets as older vessels serve smaller turbines or enter other markets, and necessitates continuous capital investment maintaining competitive capabilities.

Opportunity: U.S. Jones Act Vessel Construction and Market Development

The United States offshore wind market development creates unique opportunity for domestic WTIV construction driven by Jones Act cabotage law requiring vessels operating between U.S. ports be U.S.-built, owned, and crewed. With 30+ GW of East Coast offshore wind planned, the U.S. requires substantial WTIV capacity, but Jones Act compliance mandates domestic vessel construction. This has catalyzed U.S. WTIV construction including Dominion Energy's Charybdis (first U.S. Jones Act WTIV, 2023 delivery), multiple additional vessels under construction or planned by Crowley, Edison Chouest, and others, creating opportunities for U.S. shipyards including Keppel AmFELS, Philly Shipyard, and Gulf coast yards entering offshore wind vessel market. The domestic vessel construction creates premium pricing opportunities as Jones Act vessels command scarcity premiums and long-term contracts with offshore wind developers.

Opportunity: Emerging Markets and Geographic Expansion

The expansion of offshore wind into emerging markets creates opportunities for vessel operators, shipyards, and service providers. Beyond established European and Chinese markets, opportunities include Taiwan's 15+ GW offshore wind pipeline requiring substantial WTIV capacity, Japan's floating offshore wind development requiring specialized floating installation capabilities, South Korea's 12 GW offshore wind target, Vietnam's emerging offshore wind sector, India's offshore wind ambitions, and potential markets in Brazil, Australia, and other coastal nations. These emerging markets favor vessel operators establishing early presence, provide opportunities for regional shipyards constructing vessels for local markets, and create demand for both modern WTIVs and potentially older vessels acceptable for smaller turbines.

By Vessel Type:

In 2026, the Jack-Up Installation Vessels segment is estimated to hold the largest share of the overall offshore wind turbine installation vessels market, driven by suitability for water depths covering majority of current offshore wind installations (10-65 meters), proven technology with decades of operational track record in offshore oil and gas and wind sectors, large existing global fleet (30+ active WTIVs), and optimal productivity through stable elevated platforms enabling installation in various weather conditions. Jack-up vessels dominate North Sea, Baltic Sea, U.S. East Coast, and shallow Asian offshore wind markets. Leading vessels include Van Oord's Aeolus, Jan De Nul's Voltaire and Vole au Vent, DEME's Orion and Apollo, Cadeler's Wind Orca and Wind Osprey, and extensive Chinese fleet. The segment benefits from continuous technology advancement with new-generation vessels featuring 2,000-3,000 tonne cranes, 60-80 meter water depth capability, and 5,000+ m² deck space.

The Floating Installation Vessels segment is expected to witness significant growth during the forecast period, driven by deepwater offshore wind development in locations exceeding jack-up depth capabilities, floating offshore wind technology advancement requiring specialized installation approaches, and projects in deep Pacific waters off Japan, U.S. West Coast, and Mediterranean where water depths of 80-300+ meters preclude bottom-fixed foundations. Floating installation employs heavy-lift crane vessels (HLCVs) with dynamic positioning or specialized floating WTIVs maintaining position through thrusters while executing lifts. The segment faces challenges including motion compensation requirements, reduced weather windows compared to jack-ups, and lower installation rates, but is essential for deepwater locations representing substantial future offshore wind potential.

The Feeder Vessels and Tugboats segment provides component transportation supporting primary installation vessels. These vessels transport turbine components from manufacturing facilities or ports to offshore installation sites, supplying WTIVs that remain on station for extended installation campaigns. This approach optimizes WTIV utilization by minimizing transit time.

By Crane Capacity:

In 2026, the 1,000-2,000 Tonne segment is expected to witness the highest growth rate during the forecast period, representing the capacity range for current-generation large turbines (12-18 MW) and covering majority of new WTIV construction. This capacity range suits modern offshore wind projects installing 15+ MW turbines that are becoming industry standard, provides flexibility serving multiple turbine sizes within operational range, and balances capability with cost as 2,000+ tonne cranes add substantial expense. Recent and upcoming deliveries including Van Oord's Aeolus (1,600t), multiple Chinese vessels (1,200-1,600t), and U.S. Jones Act vessels (1,500t+) concentrate in this capacity range. The segment benefits from being the current sweet spot where turbine requirements and vessel economics intersect.

The >2,000 Tonne segment represents ultra-heavy-lift vessels for next-generation turbines. Jan De Nul's Voltaire (3,000t crane capacity) pioneered this segment, enabling installation of 20+ MW turbines under development. Additional vessels in this class are under construction in Asian shipyards. The segment addresses future turbine scaling but faces challenges including very high capital costs ($400-600 million per vessel), limited current turbine requirements justifying extreme capacity, and technical complexity of ultra-heavy lifts at 100+ meter heights. However, as turbine sizes progress to 20-25 MW, this segment will become essential.

The 600-1,000 Tonne segment comprises earlier-generation vessels adequate for 8-12 MW turbines. While being displaced from latest European projects by larger vessels, these WTIVs remain viable for smaller turbines, Asian markets, and repowering projects. The segment faces declining market share as turbine sizes increase but maintains relevance for certain applications and markets.

By Water Depth Capability:

In 2026, the 40-65 Meter Depth segment is estimated to dominate the overall market, representing the predominant offshore wind installation depth range for European North Sea and Baltic Sea projects, U.S. East Coast sites, and much of Asian offshore wind development. This depth range represents jack-up vessel operational sweet spot balancing water depth capability with jacking system cost and complexity, covers majority of currently developed offshore wind areas where seabed conditions and wind resources are favorable, and enables jack-up vessels to provide stable elevated platforms for installation. Leading projects in this depth range include most German North Sea developments, Dutch offshore wind zones, U.S. East Coast lease areas, and Chinese offshore wind sites. The segment benefits from large available site inventory and proven jack-up vessel capabilities.

The 65-100 Meter Depth segment addresses transitional and deeper offshore wind installations approaching jack-up operational limits or requiring floating installation vessels. Some advanced jack-up designs push depth capabilities toward 80-90 meters (Jan De Nul's Voltaire: 80m design depth), while floating installation vessels operate in this range using dynamic positioning. The segment is growing as prime shallow-water sites are developed and projects move to deeper waters, particularly in areas including deeper North Sea locations, transitional depths off U.S. East Coast, and Asian sites in deeper waters. However, the segment faces higher installation costs from challenging conditions and technology limitations.

The <40 Meter Depth segment covers nearshore offshore wind installations close to shore in relatively shallow waters. While this segment was dominant in early offshore wind (2000s-2010s), the industry trend is toward deeper, farther offshore locations accessing better wind resources and avoiding visual impacts, resulting in declining share for shallow installations. However, the segment remains relevant for specific projects and markets.

By Deck Space:

In 2026, the 4,000-6,000 m² segment is estimated to account for the largest share, representing modern WTIV deck space accommodating multiple complete turbine sets (foundations, transition pieces, towers, nacelles, blades) minimizing offshore transit frequency and maximizing installation productivity. Modern large WTIVs feature deck spaces in this range enabling transport of 3-6 complete turbine sets depending on component sizes, reducing time spent transiting to shore or feeder rendezvous points, and supporting installation campaigns of 1-2 weeks offshore before re-supply. Larger deck spaces directly improve installation economics by increasing vessel productivity and reducing overall project installation time. Leading vessels including Voltaire (6,000+ m²), Aeolus (5,382 m²), and Chinese vessels (4,000-5,000 m²) exemplify this trend.

The >6,000 m² segment represents ultra-large deck space vessels optimized for largest turbines and maximum productivity. These vessels can carry extensive component inventories enabling prolonged offshore campaigns with minimal supply trips, but face challenges including vessel size and draft potentially limiting port access and requiring specialized infrastructure. The segment is emerging with newest vessels prioritizing maximum productivity.

In 2026, Europe is estimated to account for the largest share of the global WTIV market, driven by most mature offshore wind industry with over 30 GW installed capacity and 100+ GW pipeline through 2030, extensive North Sea and Baltic Sea development with dozens of active projects, large existing WTIV fleet including major operators (Van Oord, Jan De Nul, DEME, Cadeler, Fred. Olsen Windcarrier), established maritime infrastructure and expertise in Netherlands, Belgium, Denmark, Norway, and UK, and aggressive offshore wind expansion targets under European Green Deal and national energy strategies. The Netherlands serves as European offshore wind installation hub with major vessel operators headquartered and vessels registered. The region benefits from deep maritime expertise, supportive regulatory environment, and continuous project flow supporting vessel utilization.

Asia-Pacific is expected to grow at the highest CAGR during the forecast period, driven by China's massive offshore wind capacity exceeding 50 GW installed and targeting 100+ GW by 2030, extensive domestic WTIV fleet development with Chinese shipyards (COSCO, CSSC) constructing 20+ vessels, Taiwan's 15+ GW offshore wind pipeline requiring substantial installation capacity, Japan's floating offshore wind development in deep Pacific waters, South Korea's 12 GW offshore wind targets, Vietnam's emerging sector, and government support for maritime equipment manufacturing. China dominates regional market through domestic capacity and vessel construction, while Taiwan, Japan, and Korea represent growing opportunities. The region benefits from shipyard capacity, government support, and project pipelines creating sustained demand.

North America represents rapidly growing market driven by U.S. East Coast offshore wind exceeding 30 GW planned capacity across federal lease areas from Massachusetts to North Carolina, Jones Act requirements mandating U.S.-built vessels creating domestic WTIV construction industry, first U.S. Jones Act WTIV (Dominion's Charybdis) operational with additional vessels under construction, Inflation Reduction Act incentives supporting offshore wind and vessel investment, and Canadian offshore wind potential particularly in Atlantic provinces. The region faces WTIV shortage in near-term requiring foreign-flagged vessels for some projects (with Jones Act workarounds) while domestic fleet develops, but long-term presents substantial opportunities for vessel operators and shipyards.

Major players include Van Oord (Netherlands), Jan De Nul Group (Belgium), DEME Offshore (Belgium), Fred. Olsen Windcarrier (Norway), Seajacks UK Limited (Eneti Inc.), Cadeler A/S (Denmark), COSCO Shipping Heavy Industry (China), China State Shipbuilding Corporation/CSSC (China), Huisman Equipment B.V. (Netherlands), Heerema Marine Contractors (Netherlands), GeoSea/DEME (Belgium), Sapura Energy Berhad (Malaysia), Pacific Orca Energy (U.S.), Great Lakes Dredge & Dock (U.S.), Keppel Offshore & Marine (Singapore), Lamprell plc (UAE), Sembcorp Marine (Singapore), Eneti Inc. (Monaco), Maersk Supply Service (Denmark), and Subsea 7 (UK), among others.

The offshore wind turbine installation vessels market is expected to grow from USD 3.41 billion in 2026 to USD 7.23 billion by 2036.

The offshore wind turbine installation vessels market is expected to grow at a CAGR of 7.8% from 2026 to 2036.

Major players include Van Oord, Jan De Nul Group, DEME Offshore, Fred. Olsen Windcarrier, Seajacks/Eneti, Cadeler, COSCO, CSSC, Huisman, Heerema, GeoSea, and Pacific Orca Energy, among others.

Main factors include explosive offshore wind capacity growth requiring thousands of turbine installations, turbine size escalation necessitating fleet upgrades, geographic market expansion to U.S. and Asia-Pacific, Jones Act-driven U.S. vessel construction, and deepwater/floating wind development requiring specialized vessels.

Europe is estimated to account for the largest share in 2026 due to mature offshore wind industry and extensive vessel fleet, while Asia-Pacific is expected to register the highest growth rate during 2026-2036.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Vessel Type

3.3. Market Analysis, by Crane Capacity

3.4. Market Analysis, by Deck Space

3.5. Market Analysis, by Water Depth Capability

3.6. Market Analysis, by Application

3.7. Market Analysis, by Geography

3.8. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Offshore Wind Turbine Installation Vessels Market: Impact Analysis of Market Drivers (2026–2036)

4.2.1. Offshore Wind Capacity Growth and Installation Demand

4.2.2. Turbine Size Escalation Requiring Fleet Upgrades

4.2.3. Geographic Market Expansion

4.3. Global Offshore Wind Turbine Installation Vessels Market: Impact Analysis of Market Restraints (2026–2036)

4.3.1. High Capital Investment Requirements

4.3.2. Cyclical Demand and Utilization Volatility

4.4. Global Offshore Wind Turbine Installation Vessels Market: Impact Analysis of Market Opportunities (2026–2036)

4.4.1. U.S. Jones Act Vessel Construction and Market Development

4.4.2. Emerging Markets and Geographic Expansion

4.5. Global Offshore Wind Turbine Installation Vessels Market: Impact Analysis of Market Challenges (2026–2036)

4.5.1. Weather and Seasonal Installation Windows

4.5.2. Port Infrastructure and Logistics Constraints

4.6. Global Offshore Wind Turbine Installation Vessels Market: Impact Analysis of Market Trends (2026–2036)

4.6.1. Next-Generation Vessel Design and Technology Integration

4.6.2. Alternative Installation Methods and Floating Wind

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. Offshore Wind Turbine Installation Vessel Technologies

5.1. Introduction to WTIV Design and Capabilities

5.2. Jack-Up Vessel Systems and Operations

5.3. Floating Installation Vessel Capabilities

5.4. Crane Systems and Heavy-Lift Technology

5.5. Dynamic Positioning and Motion Compensation

5.6. Jacking Systems and Leg Technology

5.7. Deck Space and Component Handling

5.8. Installation Methods and Procedures

5.9. Safety Systems and Operational Requirements

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global Offshore Wind Turbine Installation Vessels Market, by Vessel Type

7.1. Introduction

7.2. Jack-Up Installation Vessels

7.2.1. Self-Propelled Jack-Up Vessels

7.2.2. Non-Self-Propelled Jack-Up Barges

7.2.3. NG-WTIV (Next-Generation)

7.3. Floating Installation Vessels

7.3.1. Heavy-Lift Crane Vessels (HLCV)

7.3.2. Dynamic Positioned Vessels

7.3.3. Semi-Submersible Crane Vessels

7.4. Feeder Vessels

7.5. Hybrid and Specialized Vessels

8. Global Offshore Wind Turbine Installation Vessels Market, by Crane Capacity

8.1. Introduction

8.2. <600 Tonnes

8.2.1. Early-Generation Vessels

8.2.2. Small Turbine Installation

8.3. 600-1,000 Tonnes

8.3.1. Mid-Size Turbine Installations

8.3.2. Repowering Projects

8.4. 1,000-2,000 Tonnes

8.4.1. Current-Generation Large Turbines

8.4.2. 12-18 MW Turbine Installation

8.5. >2,000 Tonnes

8.5.1. Ultra-Heavy-Lift Vessels

8.5.2. Next-Generation 20+ MW Turbines

9. Global Offshore Wind Turbine Installation Vessels Market, by Deck Space

9.1. Introduction

9.2. <2,000 m²

9.3. 2,000-4,000 m²

9.4. 4,000-6,000 m²

9.4.1. Modern Standard Vessels

9.4.2. Multi-Turbine Transport Capacity

9.5. >6,000 m²

9.5.1. Ultra-Large Deck Vessels

9.5.2. Maximum Productivity Configurations

10. Global Offshore Wind Turbine Installation Vessels Market, by Water Depth Capability

10.1. Introduction

10.2. <40 Meters (Shallow Water)

10.2.1. Nearshore Installations

10.2.2. Early Offshore Wind Sites

10.3. 40-65 Meters (Standard Depth)

10.3.1. North Sea Projects

10.3.2. U.S. East Coast Sites

10.3.3. Asian Offshore Wind Zones

10.4. 65-100 Meters (Transitional/Deep Water)

10.4.1. Advanced Jack-Up Operations

10.4.2. Floating Vessel Requirements

10.5. >100 Meters (Ultra-Deep Water)

10.5.1. Floating Wind Installations

10.5.2. Pacific Deep-Water Projects

11. Global Offshore Wind Turbine Installation Vessels Market, by Application

11.1. Introduction

11.2. Foundation Installation

11.2.1. Monopile Installation

11.2.2. Jacket Foundation Installation

11.2.3. Floating Foundation Installation

11.3. Turbine Installation

11.3.1. Tower Installation

11.3.2. Nacelle Installation

11.3.3. Rotor Blade Installation

11.4. Balance of Plant Installation

11.5. Maintenance and Service Operations

11.6. Decommissioning

12. Global Offshore Wind Turbine Installation Vessels Market, by End-User

12.1. Introduction

12.2. Offshore Wind Developers

12.3. Engineering, Procurement, and Construction (EPC) Contractors

12.4. Offshore Wind Farm Operators

12.5. Vessel Operators and Contractors

12.6. Government and Utilities

13. Offshore Wind Turbine Installation Vessels Market, by Geography

13.1. Introduction

13.2. North America

13.2.1. U.S.

13.2.2. Canada

13.3. Europe

13.3.1. Netherlands

13.3.2. Germany

13.3.3. U.K.

13.3.4. Belgium

13.3.5. Denmark

13.3.6. Norway

13.3.7. France

13.3.8. Rest of Europe

13.4. Asia-Pacific

13.4.1. China

13.4.2. Taiwan

13.4.3. Japan

13.4.4. South Korea

13.4.5. Vietnam

13.4.6. India

13.4.7. Australia

13.4.8. Rest of Asia-Pacific

13.5. Latin America

13.5.1. Brazil

13.5.2. Rest of Latin America

13.6. Middle East & Africa

13.6.1. Rest of Middle East & Africa

14. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

14.1. Van Oord

14.2. Jan De Nul Group

14.3. DEME Offshore

14.4. Fred. Olsen Windcarrier

14.5. Seajacks UK Limited (Eneti Inc.)

14.6. Cadeler A/S

14.7. COSCO Shipping Heavy Industry

14.8. China State Shipbuilding Corporation (CSSC)

14.9. Huisman Equipment B.V.

14.10. Heerema Marine Contractors

14.11. GeoSea (DEME)

14.12. Sapura Energy Berhad

14.13. Pacific Orca Energy

14.14. Great Lakes Dredge & Dock

14.15. Keppel Offshore & Marine

14.16. Lamprell plc

14.17. Sembcorp Marine

14.18. Eneti Inc.

14.19. Maersk Supply Service

14.20. Subsea 7

14.21. Others

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Aug-2025

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates