Resources

About Us

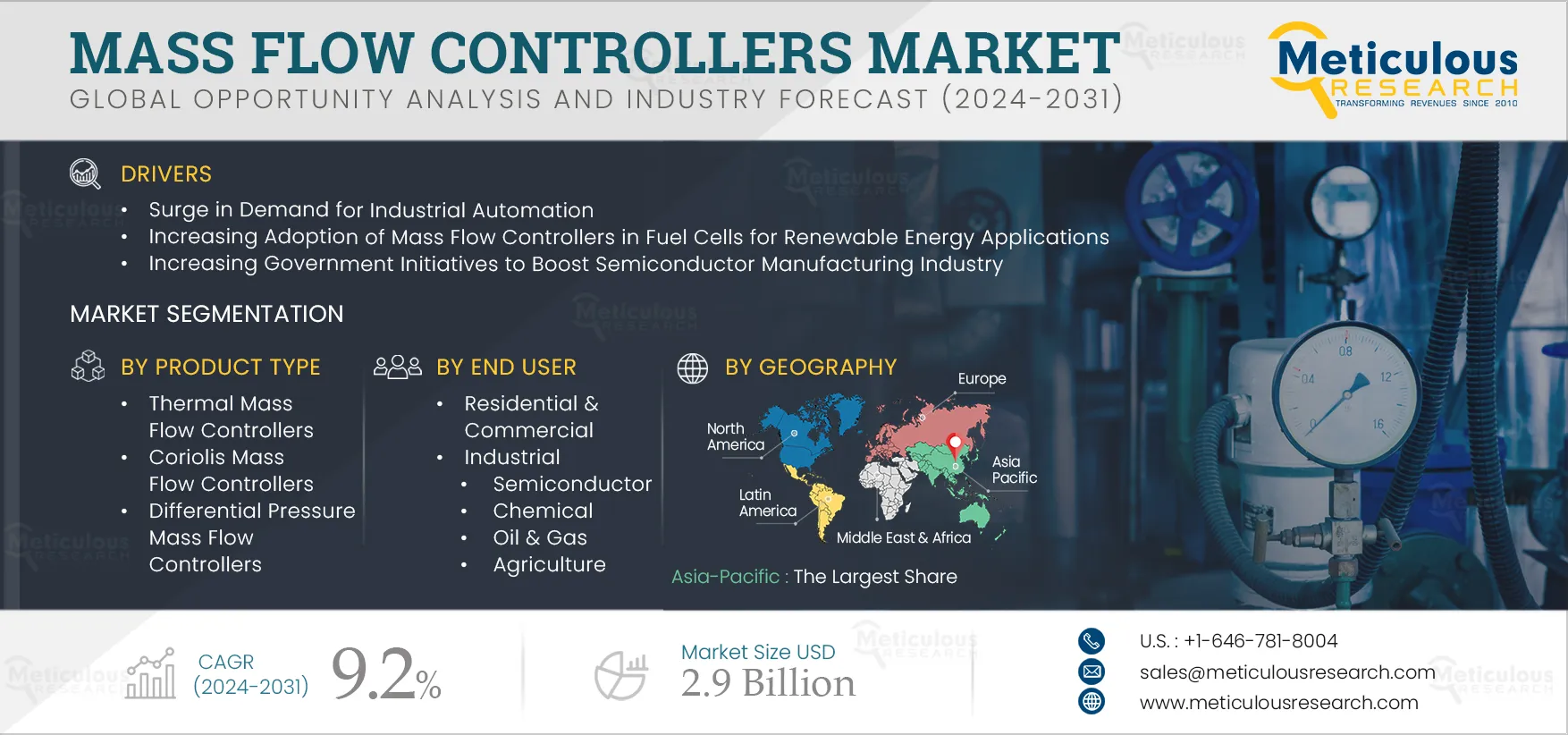

Mass Flow Controllers Market Size, Share, Forecast, & Trends Analysis by Product Type (Thermal, Coriolis, Differential Pressure), Flow Rate (Low, Medium, High), End User (Residential & Commercial, Industrial (Semiconductor, Chemical, Pharmaceutical)), and Geography - Global Forecast to 2032

Report ID: MRSE - 1041210 Pages: 250 May-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Mass Flow Controllers Market is expected to reach $2.9 billion by 2032, at a CAGR of 9.2% from 2025 to 2032. The growth of this market is attributed to the surge in demand for industrial automation, increasing adoption of mass flow controllers in fuel cells for renewable energy applications, and increasing government initiatives to boost the semiconductor manufacturing industry. Moreover, the increasing demand for mass flow controllers in pharmaceutical and medical devices industries and advancements in sensor technology are expected to offer growth opportunities for the players operating in this market.

The industrial sector is focusing on automation, machine learning, and real-time data processing to implement in the manufacturing industries. Considering the significance of automated industrialization, organizations are planning and implementing Industry 4.0 to transform their traditional manufacturing industry into a smart one with the adoption of new and advanced technologies, including IoT, artificial intelligence, robotics, cloud technology, and analytics. With increasing automation in the industrial sector, the demand for MFCs increases in manufacturing industries.

Automated processes involve precise control of gases and liquids for optimal results. MFCs are integrated into automated systems for real-time monitoring and adjustments of flow rates. This ensures that processes remain within the desired parameters. Automation systems collect data from MFCs to analyze the flow rates and process optimization over time. Also, the automation of metering and mixing processes for various chemicals relies on accurate flow control from MFCs. As automation continues to advance, the need for precise and reliable flow control solutions such as MFCs becomes more critical, further driving market growth.

Governments are promoting initiatives supporting the semiconductor industry and are investing heavily in developing a strong domestic supply chain for materials, equipment, and other resources needed for semiconductor manufacturing.

Some of the recent government initiatives are as follows:

With such developments, governments around the globe are prioritizing investments in research and development (R&D) for advanced technologies in the semiconductor manufacturing industry. This includes advancements in areas such as microfluidics, nanotechnology, and advanced materials that heavily rely on precise flow control, leading to increased demand for MFCs. Such factors support the growth of the mass flow controllers market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

The pharmaceutical and medical device industries are increasingly adopting complex processes involving precise control of gases and liquids. As these industries continue to develop advanced processes and prioritize safety and efficiency, the need for MFCs continues to grow. MFCs are used to accurately measure and control the flow of gases and liquids used in various medical processes, such as cell culture, sterilization, and drug delivery. This precise control minimizes the risk of contamination, inconsistencies, and errors. MFCs enable repeatable and consistent flow rates, ensuring the quality and efficacy of pharmaceutical products and medical devices.

Organizations are offering MFCs to control the flow of oxygen, carbon dioxide, and other critical gases for cell cultures used in biopharmaceutical production. For instance, in June 2024, Cytiva (U.S.) launched Xcellerex X-platform bioreactors with Brooks Instrument (U.S.) SLA5800 Series Biotech mass flow controllers that manage the precise flow of pure gasses such as carbon dioxide, nitrogen, air, and oxygen into bioreactor chambers. Such developments offer new opportunities for the adoption of the mass flow controllers market during the forecast period.

The rapid progress in sensor technology is mainly due to the quickly advancing development of micro/nanofabrication, manufacturing techniques, advanced materials, and increasing demand for sensitive measurement techniques. Advancements in sensor technology open doors for MFCs to be used in new and emerging applications across the industrial sector. Various sensors are used in MFCs depending on the desired level of accuracy, flow rate range, and the gas or liquid being measured. Sensors measure the differing thermal conductivity of the flowing gas.

With the advancement of sensor technology, organizations are collaborating to integrate sensor technology with mass flow controllers for various applications. For instance, in June 2021, PHIX B.V. (Netherlands) partnered with Bronkhorst High-Tech BV (Netherlands) to enable volume manufacturing of thermal mass flow sensors to integrate into mass flow meters and controllers. Such developments offer growth opportunities for the mass flow controllers market during the forecast period.

Based on product type, the global mass flow controllers market is segmented into thermal mass flow controllers, coriolis mass flow controllers, and differential pressure mass flow controllers. In 2025, the thermal mass flow controllers segment is expected to account for the largest share of above 48% of the global mass flow controllers market. The large market share of this segment is attributed to the increasing use of thermal MFCs in the chemical, semiconductor, and pharmaceutical industries, advancement in sensor technology, and increasing focus on reducing cost. Thermal MFCs offer various benefits over other MFCs, such as affordability, simple design, and compact size, allowing easier integration.

However, the pressure mass flow controllers segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the increasing demand for low differential pressure MFCs, which offer faster response and better accuracy than other MFCs, and the increasing use of differential pressure MFCs across various industries.

Based on flow rate, the global mass flow controllers market is segmented into low (0-50 slpm), medium (0-300 slpm), and high (0-1500 slpm). In 2025, the low (0-50 slpm) segment is expected to account for the largest share of above 45% of the global mass flow controllers market. The large market share of this segment is attributed to the growing trend towards more affordable thermal MFCs and increasing use of low flow rate MFCs in semiconductor manufacturing.

However, the medium (0-300 slpm) segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to the increasing emphasis on automation and centralized control systems in various industries and increasing demand for medium flow rate MFCs in chemical processing and food & beverage production applications.

Based on end user, the global mass flow controllers market is segmented into residential & commercial and industrial. In 2025, the industrial segment is expected to account for the largest share of above 80% of the global mass flow controllers market. The large market share of this segment is attributed to the increasing industrial automation, strict environmental regulations pushing industries to adopt cleaner technologies, increasing demand for low flow rate MFCs in the industrial sector, and advancements in MFC technology such as miniaturization and sensor technology. In June 2022, Sensirion AG (Switzerland) launched the SFC5500 series with four new mass flow controllers and meters for analytical, medical, and industrial applications. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

In 2025, Asia-Pacific is expected to account for the largest share of above 37% of the global mass flow controllers market. The market growth in Asia-Pacific is driven by the increasing government initiatives to boost the semiconductor manufacturing industry in the region, increasing Industry 4.0 practices, strict environmental regulations to adopt cleaner technologies, and the rising demand for cost-effective thermal MFCs in the region. China is a leader in the region for MFC adoption due to its booming manufacturing sector and government initiatives promoting technological advancements. India is rapidly expanding its manufacturing base and increasingly focusing on automation and process control, increasing the market growth. In September 2024, Brooks Instrument (U.S.) opened a new manufacturing facility for producing mass flow controllers (MFCs) in Penang, Malaysia. Moreover, this region is also projected to record the highest CAGR of above 10.5% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the mass flow controllers market are Brooks Instrument (U.S.), MKS Instruments, Inc. (U.S.), HORIBA, Ltd. (Japan), Bronkhorst High-Tech BV (Netherlands), Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (U.S.), Sensirion AG (Switzerland), Hitachi Metals, Ltd. (Japan), Teledyne Hastings Instruments (U.S.), Parker Hannifin Corp (U.S.), Alicat Scientific, Inc (U.S.), FLSmidth A/S (Denmark), Advitech Inc. (U.S.), FCON Co., Ltd. (Japan), and Azbil Corporation (Japan).

In March 2025, Brooks Instrument (U.S.) launched the GF120xHT Series high-temperature thermal mass flow controller, which precisely delivers vapor to the process chamber required in semiconductor manufacturing.

In March 2024, Sensirion AG (Switzerland) launched the SFC6000 mass flow controller for analytical instruments, semiconductor applications, and process automation.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

9.2% |

|

Market Size (Value) |

USD 2.9 Billion by 2032 |

|

Segments Covered |

By Product Type

By Flow Rate

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Brooks Instrument (U.S.), MKS Instruments, Inc. (U.S.), HORIBA, Ltd. (Japan), Bronkhorst High-Tech BV (Netherlands), Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (U.S.), Sensirion AG (Switzerland), Hitachi Metals, Ltd. (Japan), Teledyne Hastings Instruments (U.S.), Parker Hannifin Corp (U.S.), Alicat Scientific, Inc (U.S.), FLSmidth A/S (Denmark), Advitech Inc. (U.S.), FCON Co., Ltd. (Japan), and Azbil Corporation (Japan) |

The mass flow controllers market study focuses on market assessment and opportunity analysis through the sales of mass flow controllers across different regions and countries across different market segmentations. This study is also focused on competitive analysis for mass flow controllers based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The global mass flow controllers market is projected to reach $2.9 billion by 2032, at a CAGR of 9.2% during the forecast period.

In 2025, the thermal mass flow controllers segment is expected to account for the largest share of above 48% of the mass flow controllers market.

Based on end user, the industrial segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the surge in demand for industrial automation, increasing adoption of mass flow controllers in fuel cells for renewable energy applications, and increasing government initiatives to boost the semiconductor manufacturing industry. Moreover, the increasing demand for mass flow controllers in pharmaceutical and medical devices industries and advancements in sensor technology are expected to offer growth opportunities for the players operating in this market.

The key players operating in the global mass flow controllers market are Brooks Instrument (U.S.), MKS Instruments, Inc. (U.S.), HORIBA, Ltd. (Japan), Bronkhorst High-Tech BV (Netherlands), Christian Bürkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (U.S.), Sensirion AG (Switzerland), Hitachi Metals, Ltd. (Japan), Teledyne Hastings Instruments (U.S.), Parker Hannifin Corp (U.S.), Alicat Scientific, Inc (U.S.), FLSmidth A/S (Denmark), Advitech Inc. (U.S.), FCON Co., Ltd. (Japan), and Azbil Corporation (Japan).

Asia-Pacific is projected to register the highest CAGR of above 10.5% during the forecast period.

1. Market Definition & Scope

1.1. Market Definition

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation Process

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Product Type

3.3. Market Analysis, By Flow Rate

3.4. Market Analysis, By End User

3.5. Market Analysis, By Geography

3.6. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Surge in Demand for Industrial Automation

4.2.1.2. Increasing Adoption of Mass Flow Controllers in Fuel Cells for Renewable Energy Applications

4.2.1.3. Increasing Government Initiatives to Boost Semiconductor Manufacturing Industry

4.2.2. Restraints

4.2.2.1. High Initial Investment

4.2.3. Opportunities

4.2.3.1. Increasing Demand for Mass Flow Controllers in Pharmaceutical and Medical Devices Industries

4.2.3.2. Advancements in Sensor Technologies

4.2.4. Challenges

4.2.4.1. Differential Pressure Limitations with Mass Flow Controllers

4.3. Case Studies

4.4. Porter's Five Forces Analysis

5. Mass Flow Controllers Market Assessment—by Product Type

5.1. Overview

5.2. Thermal Mass Flow Controllers

5.2.1. Low (0-50 slpm)

5.2.2. Medium (0-300 slpm)

5.2.3. High (0-1500 slpm)

5.3. Coriolis Mass Flow Controllers

5.3.1. Low (0-50 slpm)

5.3.2. Medium (0-300 slpm)

5.3.3. High (0-1500 slpm)

5.4. Differential Pressure Mass Flow Controllers

5.4.1. Low (0-50 slpm)

5.4.2. Medium (0-300 slpm)

5.4.3. High (0-1500 slpm)

6. Mass Flow Controllers Market Assessment—by Flow Rate

6.1. Overview

6.2. Low (0-50 slpm)

6.3. Medium (0-300 slpm)

6.4. High (0-1500 slpm)

7. Mass Flow Controllers Market Assessment—by End User

7.1. Overview

7.2. Residential & Commercial

7.3. Industrial

7.3.1. Semiconductor

7.3.2. Chemical

7.3.3. Oil & Gas

7.3.4. Food & Beverage

7.3.5. Pharmaceutical

7.3.6. Metal & Mining

7.3.7. Water & Wastewater

7.3.8. Agriculture

7.3.9. Other Industries

8. Mass Flow Controllers Market—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. U.K.

8.3.3. France

8.3.4. Italy

8.3.5. Spain

8.3.6. Netherlands

8.3.7. Rest of Europe

8.4. Asia-Pacific

8.4.1. Japan

8.4.2. China

8.4.3. India

8.4.4. South Korea

8.4.5. Rest of Asia-Pacific

8.5. Latin America

8.5.1. Mexico

8.5.2. Brazil

8.5.3. Rest of Latin America

8.6. Middle East & Africa

8.6.1. UAE

8.6.2. Israel

8.6.3. Rest of Middle East & Africa

9. Competition Analysis

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Companies

9.5. Market Share Analysis

10. Company Profiles

10.1. Brooks Instrument

10.2. MKS Instruments, Inc.

10.3. HORIBA, Ltd.

10.4. Bronkhorst High-Tech BV

10.5. Christian Bürkert GmbH & Co. KG

10.6. Sierra Instruments, Inc.

10.7. Sensirion AG

10.8. Hitachi Metals, Ltd.

10.9. Teledyne Hastings Instruments

10.10. Parker Hannifin Corp

10.11. Alicat Scientific, Inc

10.12. FLSmidth A/S

10.13. Advitech Inc.

10.14. FCON Co., Ltd.

10.15. Azbil Corporation

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

11. Appendix

11.1. Available Customization

11.2. Related Reports

List of Tables

Table 1 Global Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 2 Global Thermal Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 3 Global Coriolis Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 4 Global Differential Pressure Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 5 Global Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 6 Global Low Rate Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 7 Global Medium Rate Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 8 Global High Rate Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 9 Global Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 10 Global Residential & Commercial Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 11 Global Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 12 Global Industrial Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 13 Global Industrial Mass Flow Controllers Market for Semiconductor, By Country/Region, 2022–2032 (USD Million)

Table 14 Global Industrial Mass Flow Controllers Market for Chemical, By Country/Region, 2022–2032 (USD Million)

Table 15 Global Industrial Mass Flow Controllers Market for Oil & Gas, By Country/Region, 2022–2032 (USD Million)

Table 16 Global Industrial Mass Flow Controllers Market for Food & Beverage, By Country/Region, 2022–2032 (USD Million)

Table 17 Global Industrial Mass Flow Controllers Market for Pharmaceutical, By Country/Region, 2022–2032 (USD Million)

Table 18 Global Industrial Mass Flow Controllers Market for Metal & Mining, By Country/Region, 2022–2032 (USD Million)

Table 19 Global Industrial Mass Flow Controllers Market for Water & Wastewater, By Country/Region, 2022–2032 (USD Million)

Table 20 Global Industrial Mass Flow Controllers Market for Agriculture, By Country/Region, 2022–2032 (USD Million)

Table 21 Global Mass Flow Controllers Market for Other Industries, By Country/Region, 2022–2032 (USD Million)

Table 22 Global Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 23 North America: Mass Flow Controllers Market, By Country, 2022–2032 (USD Million)

Table 24 North America: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 25 North America: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 26 North America: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 27 North America: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 28 U.S.: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 29 U.S.: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 30 U.S.: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 31 U.S.: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 32 Canada: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 33 Canada: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 34 Canada: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 35 Canada: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 36 Europe: Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 37 Europe: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 38 Europe: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 39 Europe: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 40 Europe: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 41 Germany: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 42 Germany: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 43 Germany: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 44 Germany: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 45 U.K.: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 46 U.K.: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 47 U.K.: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 48 U.K.: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 49 France: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 50 France: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 51 France: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 52 France: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 53 Italy: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 54 Italy: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 55 Italy: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 56 Italy: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 57 Spain: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 58 Spain: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 59 Spain: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 60 Spain: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 61 Netherlands: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 62 Netherlands: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 63 Netherlands: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 64 Netherlands: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 65 Rest of Europe: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 66 Rest of Europe: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 67 Rest of Europe: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 68 Rest of Europe: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 69 Asia-Pacific: Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 70 Asia-Pacific: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 71 Asia-Pacific: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 72 Asia-Pacific: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 73 Asia-Pacific: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 74 Japan: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 75 Japan: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 76 Japan: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 77 Japan: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 78 China: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 79 China: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 80 China: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 81 China: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 82 India: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 83 India: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 84 India: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 85 India: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 86 South Korea: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 87 South Korea: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 88 South Korea: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 89 South Korea: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 90 Rest of Asia-Pacific: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 91 Rest of Asia-Pacific: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 92 Rest of Asia-Pacific: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 93 Rest of Asia-Pacific: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 94 Latin America: Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 95 Latin America: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 96 Latin America: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 97 Latin America: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 98 Latin America: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 99 Mexico: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 100 Mexico: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 101 Mexico: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 102 Mexico: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 103 Brazil: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 104 Brazil: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 105 Brazil: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 106 Brazil: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 107 Rest of Latin America: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 108 Rest of Latin America: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 109 Rest of Latin America: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 110 Rest of Latin America: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 111 Middle East & Africa: Mass Flow Controllers Market, By Country/Region, 2022–2032 (USD Million)

Table 112 Middle East & Africa: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 113 Middle East & Africa: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 114 Middle East & Africa: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 115 Middle East & Africa: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 116 UAE: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 117 UAE: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 118 UAE: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 119 UAE: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 120 Israel: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 121 Israel: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 122 Israel: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 123 Israel: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 124 Rest of Middle East & Africa: Mass Flow Controllers Market, By Product Type, 2022–2032 (USD Million)

Table 125 Rest of Middle East & Africa: Mass Flow Controllers Market, By Flow Rate, 2022–2032 (USD Million)

Table 126 Rest of Middle East & Africa: Mass Flow Controllers Market, By End User, 2022–2032 (USD Million)

Table 127 Rest of Middle East & Africa: Industrial Mass Flow Controllers Market, By Type, 2022–2032 (USD Million)

Table 128 Recent Developments by Major Market Players (2021–2025)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Key Secondary Sources

Figure 5 Primary Research Techniques.

Figure 6 Key Executives Interviewed

Figure 7 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 8 Market Sizing and Growth Forecast Approach

Figure 9 Key Insights

Figure 10 Global Mass Flow Controllers Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 11 Global Mass Flow Controllers Market, by Flow Rate, 2025 Vs. 2032 (USD Million)

Figure 12 Global Mass Flow Controllers Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 13 Global Mass Flow Controllers Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 14 Impact Analysis: Global Mass Flow Controllers Market

Figure 15 Global Mass Flow Controllers Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 16 Global Mass Flow Controllers Market, by Flow Rate, 2025 Vs. 2032 (USD Million)

Figure 17 Global Mass Flow Controllers Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 18 Global Mass Flow Controllers Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 19 North America: Mass Flow Controllers Market Snapshot

Figure 20 Europe: Mass Flow Controllers Market Snapshot

Figure 21 Asia-Pacific: Mass Flow Controllers Market Snapshot

Figure 22 Latin America: Mass Flow Controllers Market Snapshot

Figure 23 Middle East & Africa: Mass Flow Controllers Market Snapshot

Figure 24 Growth Strategies Adopted by Leading Market Players (2021–2025)

Figure 25 Vendor Market Positioning Analysis (2022–2025)

Figure 26 Competitive Dashboard: Global Mass Flow Controllers Market

Figure 27 MKS Instruments, Inc.: Financial Overview (2022)

Figure 28 HORIBA, Ltd.: Financial Overview (2022)

Figure 29 Sensirion AG: Financial Overview (2022)

Figure 30 Hitachi Metals, Ltd.: Financial Overview (2022)

Figure 31 Parker Hannifin Corp: Financial Overview (2022)

Figure 32 Azbil Corporation: Financial Overview (2022)

Published Date: Jan-2026

Published Date: Jun-2025

Published Date: Jan-2024

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates