Resources

About Us

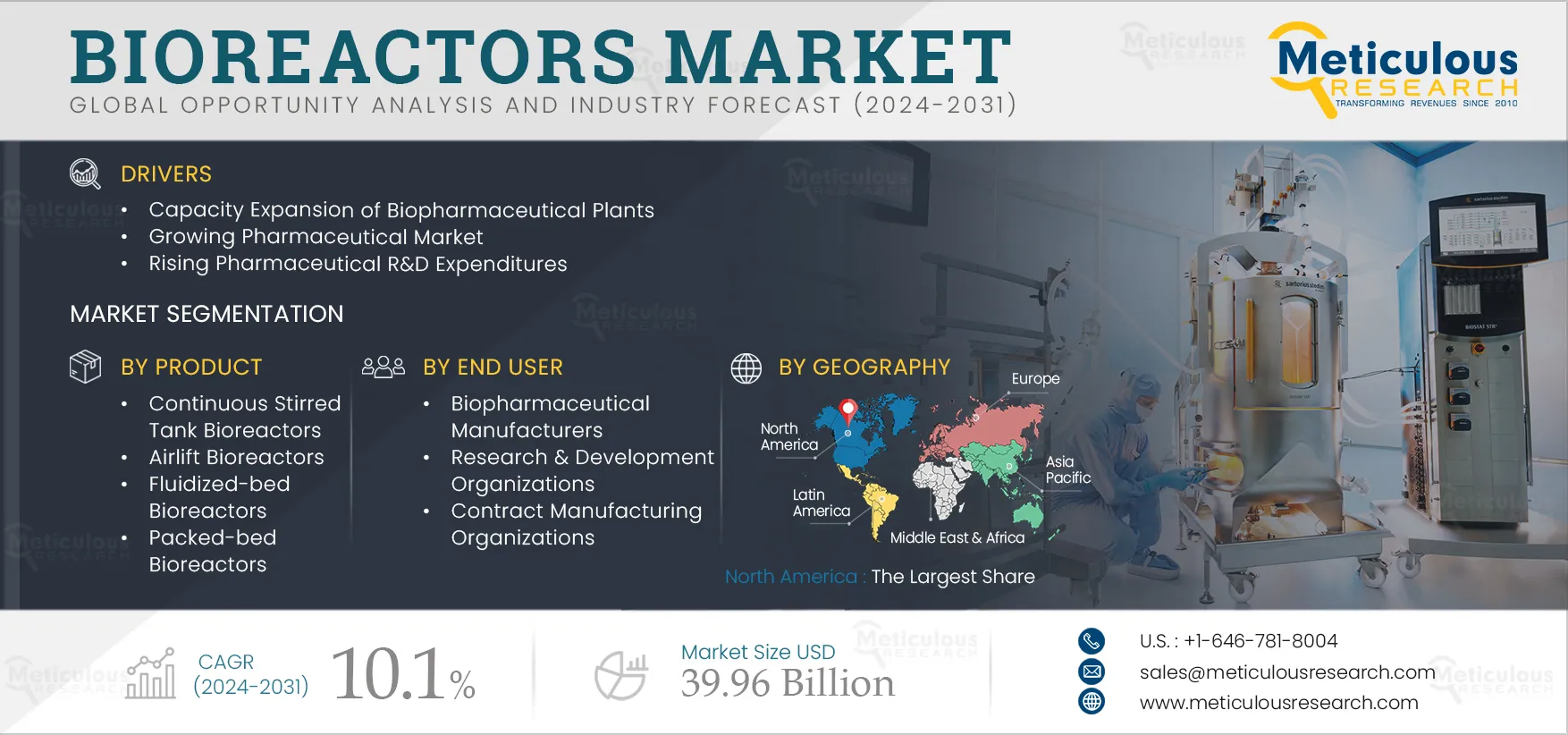

Bioreactors Market Size, Share, Forecast, & Trends Analysis by Type (Continuous Stirred Tank, Photobioreactor), Bioprocess (Batch, Continuous), Usability (Reusable, Single-use), Scale (Pilot, Industrial), Cell Type, Application, User – Global Forecast to 2032

Report ID: MRHC - 1041133 Pages: 260 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the bioreactors market can be attributed to several factors, including the capacity expansion of biopharmaceutical plants, the growing pharmaceutical market, rising pharmaceutical R&D expenditure, the rising adoption of biosimilars, and the growing adoption of single-use technologies in the pharmaceutical and biotechnology industries. Moreover, technological advancements in bioreactor technologies and the rising adoption of personalized medicines and cell & gene therapies are expected to offer growth opportunities for the players operating in this market.

The state of the global economy, drug pricing control, and stricter quality & regulatory standards are forcing pharmaceutical companies to change their approaches. Companies are focusing more on process optimization and increasing operational efficiency to keep expenses down. This has resulted in the implementation of disposable or single-use technologies across laboratory-scale and commercial-scale operations. Pharmaceutical industries are using disposable technologies to minimize the risk of handling critical process operations, reduce contamination risks, and save time. The use of single-use bioreactor technologies has positively impacted the success rates of processes by reducing the risk of losses due to contamination.

Also, the capital expenditure on building single-use plants is usually 60-70% lower than that on building stainless steel plants, and the physical footprint is 30% smaller, further saving 90% in water costs and 50-60% in energy costs. Single-use technologies allowing for lower operational costs, smaller factories, and greener processing have encouraged major pharmaceutical manufacturers to adopt them gradually.

Click here to: Get a Free Sample Copy of this report

Several pharmaceutical companies are expanding their capacities to meet the growing demand for biopharmaceutical products. For instance

In September 2022, Eppendorf AG (Germany) expanded its bioprocess site in Jülich, Germany, to increase its bioprocess solutions production capacity by up to 20%.

The global biopharmaceutical market revenue reached USD 275 billion. This revenue is expected to increase to USD 507 billion by 2024 at a CAGR of 12-14% due to the increasing number of bio-approvals, vendors’ focus on expanding biomanufacturing capacities, and government initiatives supporting bioproduction. In 2021, 5,500 new planned clinical trials have started, an increase of 14% over 2020 and 19% over 2019. The increasing focus on R&D is driving the adoption of biopharmaceutical equipment.

Government agencies around the globe are undertaking initiatives to support the growth of the biopharmaceutical market. For instance, the Chinese government has undertaken several initiatives for the development and commercialization of biosimilars. Countries like Malaysia, Indonesia, Thailand, and Taiwan have established regulatory pathways for biosimilars, increasing access to biosimilar technology. The production of biosimilars would increase the demand for bioreactors, therefore driving the growth of the market.

Traditionally, the batch and fed-batch modes have dominated the manufacturing of pharmaceuticals. However, they have some limitations, such as the requirement for additional instruments for feedback control and being costlier compared to continuous bioprocessing. In continuous bioprocessing, the process is performed at a single location without interruption, as there is a continuous flow of raw materials in and out of the bioreactor. Moreover, continuous bioprocessing produces quality end products with no variations and offers steady-state operations, reduced equipment size, streamlined process flow, and lower capital costs.

Due to the growing demand for innovative and complex therapies and growing competition in the biopharmaceuticals market, biopharmaceutical manufacturers are reconsidering their manufacturing methods (shifting from batch to continuous manufacturing). Although batch manufacturing is the most preferred manufacturing method, continuous manufacturing is being increasingly accepted in the pharmaceutical industry due to its commercial advantages. These advantages have led to investments in the implementation of continuous bioprocessing systems.

Economic development in emerging economies, progressing research in biologics, and the increasing penetration of biopharmaceuticals have created tremendous opportunities for biopharmaceutical manufacturers, boosting the demand for biopharmaceutical processing equipment and consumables. The manufacture of biologics has grown over the last five years. The industry is shifting towards Bioprocessing 4.0 (a term derived from Industry 4.0), a national strategic initiative launched by the German government in 2010. Biomanufacturing 4.0 is still in its infancy. Bioprocessing 4.0 is defined as an end-to-end connected bioprocess, where all equipment and systems in the process are connected digitally through the Industrial Internet of Things (IIoT) to run, control, and enhance processes through feedback loops, machine learning, and artificial intelligence (AI). Thus, the expanding biopharmaceuticals landscape, coupled with manufacturers’ growing interest in Bioprocessing 4.0, is creating opportunities for market growth.

Recent times have witnessed remarkable developments and advancements in bioreactor technologies and the components used for their construction. For instance, single-use bioreactors, made from different disposable materials, are cost-effective and reduce the risk of contamination. They also eliminate the need for cleaning and sterilization between batches, therefore streamlining the entire process.

Apart from this, microbioreactors are also gaining attention by using small amounts of resources. Microbioreactors are the miniaturized versions of 3D bioreactor systems that are majorly used for stem cell research. For instance, in May 2021, Beckam Coulter, Inc. (U.S.) launched the BioLector XT Microbioreactor system that enables high-throughput strain screening, cultivation parameter monitoring, and feeding strategy optimization. The integration of new technologies and systems enhances the efficiency, scalability, and productivity of the bioprocessing technique, contributing to the development of biotherapeutics, biosimilars, and other bioproducts, therefore increasing the demand for bioreactors.

Based on products, the market is segmented into continuous stirred-tank bioreactors, airlift bioreactors, fluidized-bed bioreactors, packed bed bioreactors, photobioreactors, and membrane bioreactors. In 2025, the continuous stirred-tank bioreactors segment is expected to account for the largest share of 31% of the bioreactors market. CSTR are reaction vessels in which reactants, reagents, and vessels flow in the reactor, and simultaneously output of the reaction exits the vessel. The large share of the segment is attributed to the unique ability of the vessel to handle higher reactant concentrations and more energetic reactions owing to their superior heat transfer properties in comparison to other bioreactors. Technological developments in CSTR also positively impact the market. The recent technological developments in CSTR pertain to the designs of bioreactors. Certain CSTR systems are designed to work alongside the other existing flow systems. For instance, in October 2024, Vapourtec Ltd. (U.K.) launched a CSTR that is designed for continuous process synthesis and works alongside the existing flow-chemistry systems.

Based on bioprocesses, the market is segmented into batch/fed-batch processing and continuous bioprocessing. In 2025, the batch/fed-batch segment is expected to account for the largest share of 62% of the bioreactors market. The batch/fed-batch or continuous bioprocessing is differentiated based on the feeding culture vessel. The preference for batch/fed-batch bioprocessing is higher, owing to fewer chances of contamination. The larger share of the segment is attributed to the benefits offered by batch/fed-batch bioprocessing, such as high productivity and ease in managing the bioprocesses. The duration of the batch processing is suitable for rapid experiments and speeds up the overall upstream processes, offering more productivity. Similarly, since there is no addition of nutrients or reactants in the middle of the procedure, the risk of cross-contamination is reduced and, therefore provides better traceability and control over quality.

However, the continuous bioprocessing segment is expected to register the highest CAGR of 12.40% during the forecast period of 2025–2032. Continuous bioprocessing is a process where raw materials/nutrients/reactants are continuously loaded or added to the bioreactor system. Cells are being continuously extracted and purified in a single connected system. This technique eliminates the downtime between two batches and increases the efficiency of resources and equipment. For instance, in November 2020, Merck KGaA (Germany) and Transcenta Holding (China) collaborated to implement continuous manufacturing for protein therapeutics. This collaboration brings the supplier and customer teams together to converge single-use, continuous, and digital bioprocessing technologies for further development of Trancenta’s integrated continuous bioprocessing (ICB) platform.

Based on cell types, the market is segmented into mammalian cells, bacterial cells, yeast cells, and other cell types. In 2025, the mammalian cells segment is expected to account for the largest share of the bioreactors market. Mammalian cells are used as a culture for research, clinical, and pharmaceutical applications. These cells are isolated from animal tissues and can be expanded in culture to study cell biology and disease. It is also used to produce biomolecules such as antibodies, proteins, and vaccines. The large share of the segment is attributed to factors such as the growing focus on commercial and research bioproduction, such as developing complex biomolecules, including monoclonal antibodies and therapeutic proteins and the rise in clinical research of mammalian cells, and accordingly employing them in single-use bioreactors.

Based on usability, the market is segmented into reusable bioreactors and single-use bioreactors. In 2025, the reusable bioreactors segment is expected to account for the larger share of 79% of the bioreactors market. The large share of the segment is attributed to factors such as higher demand for large-scale manufacturing, obtainability of maximum flow rates, and better capital/operating cost considerations. Furthermore, the high cost and restrictions of waste disposal support the largest share of reusable bioreactors.

However, the single-use bioreactors segment is expected to grow at the fastest CAGR of 11.40% during the forecast period. Single-use bioreactors are sustainable systems with disposable vessels that are pre-assembled and pre-sterilized with all accessories. In recent times, there has been a rapid shift from stainless steel bioreactors to single-use bioreactors, typically made from polymers or plastic. According to the American Pharmaceutical Review, single-use systems are more widely adopted in pharmaceutical manufacturing, with nearly 85% of bioprocessing using disposables, therefore driving the demand for single-use bioreactors.

Based on scales, the market is segmented into lab scale bioreactors (0.5L-10L), pilot scale bioreactors (10L-200L), and Industrial scale bioreactors. In 2025, the pilot scale bioreactors (10L-200L) segment is slated to register the highest CAGR in the market. Pilot scale bioreactors are systems that are between the capacity of 10L-200L and include multiple variations and customizations. These types of bioreactors are mostly used in the food, pharmaceutical, and cosmetics industries. The pilot scale bioreactors are used for testing and optimizing bioprocesses before the full-scale production. Growing demand for commercial bioproduction drives the applications for pilot scale bioprocessing as pilot scale bioreactors determine efficiency, scalability, and performance close to industrial settings. Pilot scale rectors are used to analyze the risk and reduce the cost for industrial production, owing to which its demand in bioprocessing is growing rapidly.

Based on automation, the market is segmented into manual/semi-automated bioreactors and automated bioreactors. In 2025, the automated bioreactors segment is expected to account for the larger share of the market. The large share of the segment is attributed to factors such as enhanced process quality, decreased errors, optimized process control, and cost savings in biopharmaceutical processing. Automated bioreactors improve quality and productivity, provide real-time monitoring, improve performance, and data-rich quality control. Automation streamlines the procedures or experiments and ensures prompt detection of deviations in the steps. The market players are launching technologically advanced automated bioreactors. For instance, in October 2022, Froilabo (U.K.) (a part of Techcomp Europe Ltd) launched fully automated lab-scale bioreactors that can be used for several applications such as academics, research, process development and optimization, scale-up, and production. These bioreactors have a novel magnetic mixer and non-welded lid that is ideal for bioprocesses that require high-grade aseptic conditions.

Based on applications, the market is segmented into commercial production and developmental, preclinical & clinical. In 2025, the commercial production segment is expected to account for the larger share of 70% of the bioreactors market. The commercial production consists of monoclonal antibodies (mAb) production, cell & gene therapy production, vaccine manufacturing, plasma fractionation, and recombinant protein production. The large share is attributed to factors such as the growing adoption of biopharmaceuticals, regulatory reforms favoring the adoption of biosimilars, and growing investments and supportive initiatives in developing gene therapies. For instance, in April 2025, the President of India launched India’s first home-grown gene therapy for cancer at the Indian Institute of Technology, Bombay (India). This treatment, known as CAR-T cell therapy, has been developed through an academic-industry collaboration of the Indian Institute of Technology (IIT), Bombay, Tata Memorial Hospital (TMH), and ImmunoACT (India).

Based on end users, the market is segmented into biopharmaceutical manufacturers, research & development organizations, and contract manufacturing organizations. In 2025, the biopharmaceutical manufacturers segment is expected to account for the largest share of the market. Biopharmaceutical companies have witnessed significant growth in recent years due to the increasing demand for biopharmaceuticals, growing incidence of chronic diseases, rising R&D expenditure by pharmaceutical & biotechnology companies, and recent launches of biologics for chronic & rare diseases. Governments of various countries are taking initiatives by making investments and providing grants & funds to biopharmaceutical companies for the manufacture and R&D of biopharmaceuticals, along with several companies that are collaborating to develop sustainable methods for biomanufacturing.

In 2025, North America is expected to account for the largest share of 34% of the bioreactors market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The largest share of the segment is primarily due to the presence of leading manufacturers, large R&D investments, support from government and regulatory authorities to promote the use of biopharmaceuticals, the presence of large biopharmaceutical companies, and expansion of manufacturing capacity by biopharmaceutical companies. For instance, in 2022, the U.S. accounted for about 45% of the global pharmaceutical market and 22% of global production. As per the International Trade Administration (ITA), the U.S. is the biggest biopharmaceutical market, comprising about a third of the global market, and is the dominant country in biopharmaceutical manufacturing and R&D.

The rise in the need for therapies for orphan and rare diseases is expected to encourage drug manufacturers to set up advanced processing facilities to help them produce medicines and generate maximum output. This also drives the demand for bioreactors in the region.

However, Asia-Pacific is slated to register the highest CAGR of 11.90% during the forecast period. This is attributed to factors such as the rising number of pharmaceutical and biopharmaceutical companies, growing patient population, increasing disposable income, and rising foreign direct investments (FDI) for pharmaceuticals and biopharmaceutical companies. For instance, the number of biopharmaceutical companies is growing steadily in China. As per data released by the Chinese president at the World Health Assembly 2020, between 2010–2020, over 140 new biotech companies have emerged in China, reaching over 500 biopharmaceutical companies active in the country. To further increase the presence of biopharmaceutical players in China, the government is emphasizing on increasing the production capacities of biopharmaceuticals in the country.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key bioreactor manufacturers operating in the bioreactors market are Thermo Fisher Scientific, Inc. (U.S.), METTLER TOLEDO (U.S.), Merck KGaA (Germany), Eppendorf AG (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Donaldson Company, Inc. (U.S.), BBI-Biotech GmbH (Germany), Infors AG (Switzerland), and Pharsol Ltd. (Slovenia).

In November 2024, The Cultivated B GmbH (Germany) announced the launch of a bioreactor control software for its AUXO bioreactors that enables a real-time, application-based, personalized user interface with added remote accessibility.

In September 2024, Getinge AB (Sweden) launched the AppliFlex ST GMP single-use bioreactor system that is designed to bridge the gap between research and clinical production in cell and gene therapy and mRNA production.

|

Particulars |

Details |

|

Number of Pages |

260 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

10.1% |

|

Market Size (Value) |

USD 39.96 Billion by 2032 |

|

Segments Covered |

By Product

By Bioprocess

By Cell Type

By Usability

By Scale

By Automation

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Ireland, Denmark, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa |

|

Bioreactor Companies |

Thermo Fisher Scientific, Inc. (U.S.), METTLER TOLEDO (U.S.), Merck KGaA (Germany), Eppendorf AG (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Donaldson Company, Inc. (U.S.), BBI-Biotech GmbH (Germany), Infors AG (Switzerland), Pharsol Ltd. (Slovenia) |

This market study covers the market sizes & forecasts of the bioreactors based on product, bioprocess, cell type, usability, scale, automation, application, end user, and geography. It also provides the value analysis of various segments and sub-segments of the global bioreactors market at country levels.

The bioreactors market is projected to reach $39.96 billion by 2032, at a CAGR of 10.1% during the forecast period.

The continuous stirred tank bioreactors segment is expected to account for the largest share of the market in 2025. Factors such as the ability of massive volume generation, easy temperature control, efficient mixing of reagents, uniform performance under steady-state conditions, and less expensive and easy construction of the system as compared to other dedicated flow systems are supporting the largest share.

Among scales, in 2025, the pilot scale bioreactors (10L-200L) segment is slated to register the highest CAGR in the market. Pilot scale bioreactors are systems that are between the capacity of 10L-200L and include multiple variations and customizations. The high CAGR is attributed to the growing demand for commercial biopharmaceuticals such as mAb and cell & gene therapies.

The growth of the bioreactors market is driven by several factors, including the capacity expansion of biopharmaceutical plants, the growing pharmaceutical market, rising pharmaceutical R&D expenditures, rising adoption of biosimilars, and growing adoption of disposable technologies in the pharmaceutical and biotechnology industries. Factors such as technological advancements in bioreactor technologies and rising adoption of personalized medicines and cell & gene therapies serve as major opportunities for the existing market players and new entrants in the bioreactors market.

The key players profiled in the bioreactors market report are Thermo Fisher Scientific, Inc. (U.S.), METTLER TOLEDO (U.S.), Merck KGaA (Germany), Eppendorf AG (Germany), Sartorius AG (Germany), Danaher Corporation (U.S.), Donaldson Company, Inc. (U.S.), BBI-Biotech GmbH (Germany), Infors AG (Switzerland), Pharsol Ltd. (Slovenia).

In 2025, countries like China, Brazil, and India are expected to offer significant growth opportunities for the vendors in this market during the analysis period. This is due to factors such as the rising number of pharmaceutical and biopharmaceutical companies, growing patient population, increasing disposable income, rising foreign direct investments (FDI) for pharmaceuticals and biopharmaceutical companies, rise in demand for services and medicines in areas of orphan and rare diseases, and support from government and regulatory authorities to promote the use of biopharmaceuticals.

Published Date: Jan-2025

Published Date: May-2023

Published Date: Dec-2022

Published Date: Jul-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates